Israel reportedly suffered minimal damages from the telegraphed air strike from Iran. While the attack has raised the stakes in the Middle East, Iran signalled a willingness to de-escalate, a stance favoured by the United States (US). Higher-than-expected inflation in the US brought rates higher before fears of geopolitical escalation prior to the weekend. Consumer price index (CPI) inflation declined in China, and the Philippines kept its policy rate unchanged. In South Korea, the opposition increased its position in parliament. Inflation surprised to the downside across Brazil, Chile, and Mexico. In South Africa, a poll showed support for the incumbent African National Congress (ANC) party, below 40% for the first time since 1994.

Global Macro

Geopolitics

Iran launched an unprecedented attack on Israel on 13 April, with over 300 missiles and drones launched from Iran, Yemen, Iraq, and Lebanon. The attack was a retaliation for the killing of Iran’s top soldier, Brigadier General Mohammad Reza Zahedi, and other commanders of the Revolutionary Guard at the Iranian Consulate in Damascus on 1 April.

The direct response has raised the risk of a direct confrontation in the future. But there was reportedly minimal damage in Israel as the attack was well-telegraphed and reportedly communicated to the US in advance to avoid major damage. Hence, the retaliation apparently had the intent of de-escalating, rather than opening the first chapter of a regional war, as Iran said: “The matter can be deemed concluded” after the attack. The US also wants to see restraint as President Joe Biden reportedly told Israeli Prime Minister Benjamin Netanyahu that the US won’t support an Israeli counterattack.

Despite the short-term relief, the risks of a direct Israeli strike on Iran remain in place. Israel hardliners will see Iran’s attack as a major threat and push for an attack on Iranian nuclear facilities. However, Israel may wait to consolidate frontlines in Gaza/Lebanon before its next move. It is also not clear whether Israel has the capability to inflict serious damage on Iran’s nuclear programme.1 Oil prices would likely be exposed to logistical disruptions in the Strait of Hormuz and a tightening of US/European Union (EU) sanctions on Iran could also lead to lower oil supply in an otherwise balanced market.

The attack increased the odds of the US approving aid to Israel, in our view. There are also higher odds of more releases of strategic petroleum reserves, which, albeit half depleted, remain at elevated levels at 365m barrels of oil. Not only will higher gasoline prices during the summer and autumn driving season pose a re-election risk for Biden, but higher oil prices will benefit Russia.

In Europe, EU Chief Diplomat Josep Borrell said: “A high-intensity, conventional war in Europe is no longer a fantasy” and that “we need a new intergovernmental financing vehicle… comparable to the one that we created during the [eurozone] financial crisis” to deal with this heightened risk.2 Strikes between Russia and Ukraine have continued and there were unconfirmed reports that Ukrainian military intelligence was responsible for an attack on a Russian naval missile carrier in the Baltic Sea. On 11 April, Russian missiles hit Ukraine’s power system and gas storage.

Türkiye opted to restrict exports to Israel amidst increasing domestic pressure to cut trade ties. Shipments of 54 items have been banned until a ceasefire is agreed. As a response, Israel’s Foreign Minister Israel Katz threatened to block the import of other Turkish products, also appealing to the US to stop investing in Türkiye.

In Asia, at a meeting in Beijing, Chinese Foreign Minister Wang Yi and Russian counterpart Sergei Lavrov reinforced that the two countries will work together against “hegemonism” and will maintain “industrial supply chain stability”. Lavrov also backed China’s peace plan for Ukraine. Meanwhile, a trilateral summit between the US, Japan and the Philippines upgraded their alliance to involve joint military patrols and training to counter China in the South China Sea. The summit came shortly after Chinese Coast Guard ships fired water cannons at a civilian Filipino boat last month. The alliance also has an economic element with plans of port, rail and semiconductor supply chain projects set to commence in the Luzon area of the Philippines.3

US inflation and FOMC minutes

A stronger-than-expected US CPI inflation print added to expectations of a delayed first rate cut by the US Federal Reserve (Fed). Headline inflation increased 0.4% mom in March and core CPI showed no deceleration from February, rising 0.4% mom and 3.8% yoy. Stronger headline CPI came on the back of gasoline prices rising 1.6% mom (1.0% yoy) and electricity by 0.9% mom (5.0% yoy). This has lowered confidence of inflation moving towards the 2% target, with expectations of the first rate cut shifting from June to either July or September.

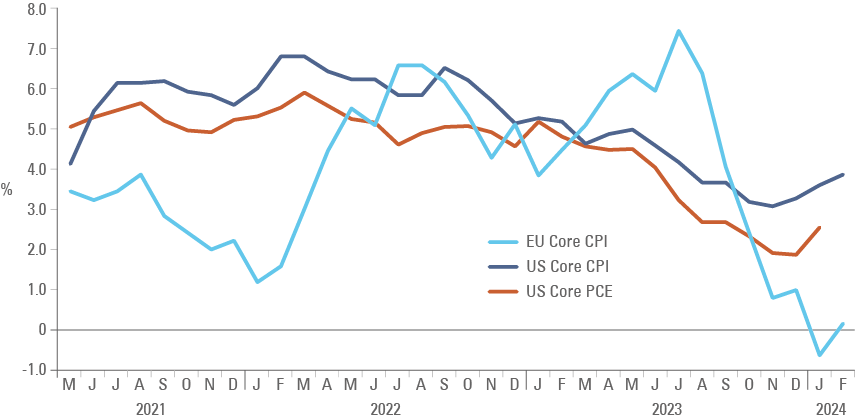

Post-CPI, a ‘back-of-the-envelope’ scenario analysis is consistent with 10% odds of 50bps hikes, 40% odds of 150bps cuts (hard landing) and 50% odds of no cuts. However, the Fed’s policy stance remains marginally dovish, with Chair Jerome Powell still favouring cuts and Waller moderating his tone on cuts after the inflation and employment data releases. The minutes of the Federal Open Market Committee (FOMC) stated policymakers “generally favoured” slowing the pace of quantitative tightening by shrinking the central bank’s portfolio of US Treasuries (USTs) by a half (from USD 60bn to USD 30bn) but keeping up the run-off of mortgage-backed securities (MBS) at up to USD 35bn per month and “the vast majority of participants thus judged it would be prudent to begin the pace of runoff fairly soon”.4 In Europe, the European Central Bank (ECB) signalled that cooling inflation will allow rate cuts in June. ECB President Christine Lagarde stated: "The nature of inflation in Europe is different", as illustrated in Fig 1.

Fig 1: US Core CPI and PCE vs. EU CPI (6m moving average)

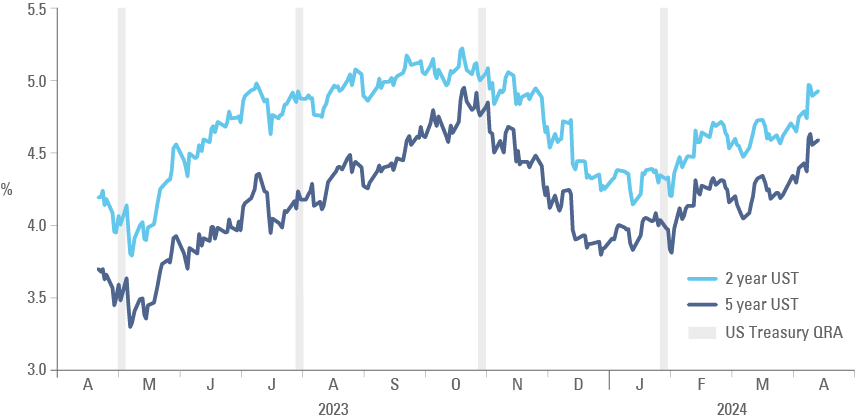

There seems to be a policy tug-of-war in Washington. The Fed needs credit spreads higher, and stocks lower, for financial conditions to tighten via the wealth effect to bring inflation down. However, with some modest QT tapering announced and no room for cutting rates, the Treasury issuance policy remains the marginal setter of monetary policy. Fig. 2 suggests this has been the case for a while. Treasury Secretary Janet Yellen may be alarmed if higher rates bring asset prices down too much as we approach the election. In Q4 2023, rates peaked two weeks ahead of the 30 October quarterly refinance announcement (QRA), which may also be the case ahead of the next QRA on 1 May.

Fig. 2: US Treasury Yields and QRAs

Higher interest rates will also impact the weak links in the economy. The lower part of the population is struggling as credit card borrowing has been rising, full-time employment has declined while part-time employment has risen and small businesses are hiring less. Higher rates would also impact commercial real estate. Hence, we may be very close to a top in front-end rates, as real interest rates remain elevated, leaving more downside than upside in US rates, particularly in the two to seven-year segment. Equities should remain in corrective mode in the short term. The duration and intensity of the drawdown will depend less on Powell and more on Yellen, in our view.

Leading Indicators

The OECD leading indicator for G-20 economies increased by 0.2 to 100.5 in March, confirming the global economic manufacturing increased further into expansion territory. Last week, the Citibank Surprise index increased by three points to 30 in China and by 17 points to 32 in the Emerging Markets (EM) fixed weights index, which lowers China’s importance.

Emerging Markets

EM Asia

China: Fitch revised its outlook on China from ‘stable’ to ‘negative’ and affirmed its ‘A+’ rating. The outlook reflects increasing risks to China’s public finances due to uncertainty in its transition away from property-reliant growth. Fiscal buffers have also weakened due to wide fiscal deficits and government debt. CPI inflation declined to 0.1% yoy in March from 0.7% yoy in February, below consensus at 0.4%. This was driven by food prices falling at a faster pace of -2.7% yoy compared with the -0.9% decline in the prior month. Core CPI slowed to 0.6% yoy from 1.2% over the same period due to a lower contribution from services prices. The trade balance stood at a surplus of USD 58.6bn in March from USD 39.7bn in February, but less than expectations of USD 69.1bn. Exports shrank 7.5% yoy to USD 279.7bn, while imports fell 1.0% yoy to USD 221.1bn. This has created less optimism that sales would offset weak demand domestically.

India: Industrial production rose by 5.7% in February from 4.1% in January, while CPI inflation declined 20bps to 4.9% in March, both broadly in line with consensus.

Malaysia: Industrial production increased by 3.1% yoy in February, above consensus at 1.8%, but slowing from 4.3% in January. Manufacturing and electricity led the increase while mining slowed.

Philippines: The Bangko Sentral ng Pilipinas (BSP) kept its policy rate unchanged at 6.5% at its 8 April meeting, in line with consensus. The trade deficit moved to USD 3.6bn in February from USD 4.2bn in January, mainly due to imports decreasing by USD 0.8bn. The unemployment rate decreased to 3.5% in February from 4.5% in January, a much sharper decline than the 20bps seasonal average.

South Korea: The opposition bloc Democratic Party of Korea (DPK) maintained its parliamentary majority, securing 187 seats in the 300-seat parliament in last week’s elections. The People Power Party (PPP) bloc supporting President Yoon Suk Yeol’s market-friendly legislation – including union curbs, tax cuts, pension reform and the Value-Up programme – shrunk from 40% to 37%. Nevertheless, several elements of the Value-Up programme are likely to remain in place, in our view, providing a supportive backdrop to Korean stocks. President Yoon is more likely to focus on foreign policy such as alignment with the US, détente with Japan, and adopting a more hawkish stance against North Korea and China. Furthermore, renewables are set to benefit, and the development of nuclear power plants to be hindered due to DPK’s pledge to triple renewable capacity to 100GW by 2030. In other news, the unemployment rate came in line with consensus at 2.8% in March, up from 2.6% in February while the Bank of Korea kept its policy rate unchanged at 3.5% as expected.

Taiwan: The trade balance increased to USD 8.7bn in March from USD 7.9bn in February, as exports increased by USD 10.4bn to USD 41.9bn and imports rose by USD 10.0bn to USD 33.1bn. CPI inflation declined to 2.1% yoy in March from 3.1% in February, below consensus at 2.5%. Producer prices rose to 0.3% in yoy terms in March, from 0.1% yoy in February and core CPI slowed to 2.1% yoy from 2.9% yoy.

Thailand: The Bank of Thailand left interest rates unchanged at 2.5% on 10 April, in line with consensus.

Vietnam: Domestic vehicle sales declined at a yoy rate of 8.1% in March, a significant improve from -51.2% yoy in February.

Latin America

Argentina: The central bank cut its main interest rate to 70% from 80% on 11 April. CPI inflation slowed to 11.0% mom (288% yoy) in March from 13.2% (292%) in February, below consensus at 12.1% mom.

Brazil: CPI inflation increased 0.2% mom (3.9% yoy) in March from 0.8% mom (4.5% yoy) in February, 10bps below consensus. Inflation is now 60bps below the upper end of the tolerance band for the 3.0% target. The main downward pressure came from transportation, industrial, and food prices. However, inflation in core services remains relatively high. Retail sales increased by 8.2% yoy in February from 4.0% in January, significantly above consensus of 3.5% yoy.

Colombia: The consumer confidence index reached -13.0 in March from -9.4 prior and below the -9.8 estimate. Colombia’s government is still struggling to approve any measures in Congress. Last week, Senators voted to shelve the government’s health care bill.

Chile: CPI inflation slowed to 3.7% yoy from 4.5% prior, and below consensus at 3.9%. This was the first downward surprise of the year, after strong prints in January and February. Education and Housing contributed the most to headline CPI, adding 23bps and 14bps, while food detracted -20bps. Core services inflation remained higher (0.7% mom) than core goods (0.3%). The trade surplus widened to USD 1.8bn in March from USD 1.5bn in February.

Ecuador: The trade surplus widened to USD 0.7bn in February from USD 0.4bn in January, as exports rose to USD 2.7bn from USD 2.6bn and imports fell by USD 0.2bn to USD 2.0bn.

El Salvador: The country issued a USD 1bn 2030 Eurobond (five-year weighted average life) at 12% yield. The country’s bonds have rallied 215% since July 2022, as Nayib Bukele’s government carried out two bond buybacks, refinanced local, short-term paper and orchestrated an exchange of pension debt.

Mexico: CPI inflation increased by 0.3% mom (4.4% yoy) in March from 0.1% mom (4.4% yoy) in February. Core CPI increased by 0.4% mom in March from 0.5% in February, 10bps below consensus. CPI decreased by -0.03% mom in the second half of March from an increase of 0.27% mom in the first half period. Same-store sales increased 7.9% yoy in March from 9.2% in February. Industrial production decreased by 0.1% mom in March from + 0.2% in February.

Peru: The central bank cut its policy rate from 6.25% to 6.0% on 11 April (consensus unchanged).

Central and Eastern Europe

Czechia: The trade Balance was CZK 34.6bn in February, a significant increase from CZK 3.7bn in January and estimates of CZK 8.9bn. Consumer prices rose 0.1% mom in March after 0.3% in February, in line with expectations. Prices increased at a maintained rate of 2.0% from the previous month. The current account deficit was CZK 39.2bn in February from CZK 6.9bn in January.

Hungary: The budget deficit widened to HUF 2.3trn in March year-to-date, putting additional pressure to rein in spending before local elections. Economy Minister Márton Nagy told reporters that the government plans to delay some investments. The cabinet targets a shortfall of 4.5% of GDP, from 2.9% of GDP originally for this year, led by higher interest payments. Inflation declined to 3.6% yoy in March from 3.7% in February, 10bps below consensus. The National Bank of Hungary flagged it will slow interest rate cuts to maintain positive real interest rates to anchor the currency.

Poland: The current account surplus declined to EUR 0.5bn in February vs. EUR 0.9bn est. and EUR 1.2bn prior.

Romania: The trade deficit stood at EUR 2.2bn in February from EUR 2.0bn in January. Exports increased by EUR 0.9bn to EUR 8.0bn, while imports rose by EUR 1.1bn to EUR 10.1bn. CPI inflation slowed for a second month to 0.4% mom in March from 0.8% mom in February, bringing the yoy rate down by 60bps to 6.6%.

Central Asia, Middle East, and Africa

Egypt: Urban CPI inflation slowed to 33.3% yoy in March from 35.7% yoy.

South Africa: The Electoral Court restored the candidacy of former president Jacob Zuma on 9 April, overturning an objection made by the Election Commission on 28 March. The latest Social Research Foundation poll shows support for the ANC has decreased to the lowest on record, to 37% from 57.5% in the 2019 elections as Zuma’s uMkhonto we Sizwe (MK) Party received 13% of vote intentions, displacing the Economic Freedom Fighters to become the second-largest opposition party. The centre-right Democratic Alliance Party has 25% of vote intentions. In economic news, net reserves increased to USD 57.5bn in March from USD 56.7bn in February. Mining production increased significantly by 9.9% yoy (5.0% mom) in February from -2.8% yoy (-0.4% mom) in January as gold production improved to -3.6% yoy in February from -12.7% in January. Manufacturing production decreased to -0.3% mom in February, lower than consensus at 0.7%.

Turkey: Industrial production increased by 3.2% mom (11.5% yoy) in February from 0.3% mom (1.3% yoy) in January. This was significantly below estimates of 8.1%.

Developed Markets

United States: The National Federation of Independent Businesses Small Business Optimism Index declined from 89.4 in February to 88.5 in March, below estimates of 89.9, the seventh decline in the last eight months. A quarter of small business owners said inflation was their biggest problem while 18% cited quality of labour as their biggest problem. The rate on 30-year fixed-rate mortgages rose 10bps to 7.01% in the week ended 5 April. Initial jobless claims slowed to 211k for the week ended 6 April from 222k prior and below estimates of 215k. However, continuing claims increased to 1817k in the week ended 30 March from 1789k prior and above estimates of 1802k.

Europe: The ECB left rates unchanged with an accompanying statement that cooling inflation would probably allow rate cuts: “If the Governing Council’s updated assessment of the inflation outlook, the dynamics of underlying inflation and the strength of monetary policy transmission were to further increase its confidence that inflation is converging to the target in a sustained manner, it would be appropriate to reduce the current level of monetary policy restriction.” The ECB re-affirmed that its policy remains data-dependent, not committing to a particular rate path. The ECB’s Main Refinancing rate was maintained at 4.5%, the Marginal Lending Facility at 4.75% and the Deposit Facility rate at 4.0%, all in line with consensus.

Japan: Labour cash earnings increased to 1.8% yoy in February from 1.5% in January, in line with consensus. Real cash earnings fell to -1.3% yoy in February from -0.6% in January, still above estimates of -1.4%. The current account surplus rose to JPY 2.6trn in February from JPY 457bn in January, slightly below consensus. Industrial production declined 0.6% mom (-3.9% yoy) in February from -0.1% mom (-3.4% yoy) in January.

1. See – https://www.wsj.com/livecoverage/israel-iran-strikes-live-coverage/card/israeli-hit-on-iranian-nuclear-facilities-seen-as-unlikely-for-now-jq336GBNOF0phHVH1oF9

2. See – https://www.ft.com/content/0c0482f3-ee5f-42f8-9469-7f82c4ad4c17

3. See – https://blinks.bloomberg.com/news/stories/SBQCOXT0AFB4

4. See – https://www.reuters.com/markets/us/fed-officials-preparing-slow-pace-balance-sheet-runoff-2024-04-10

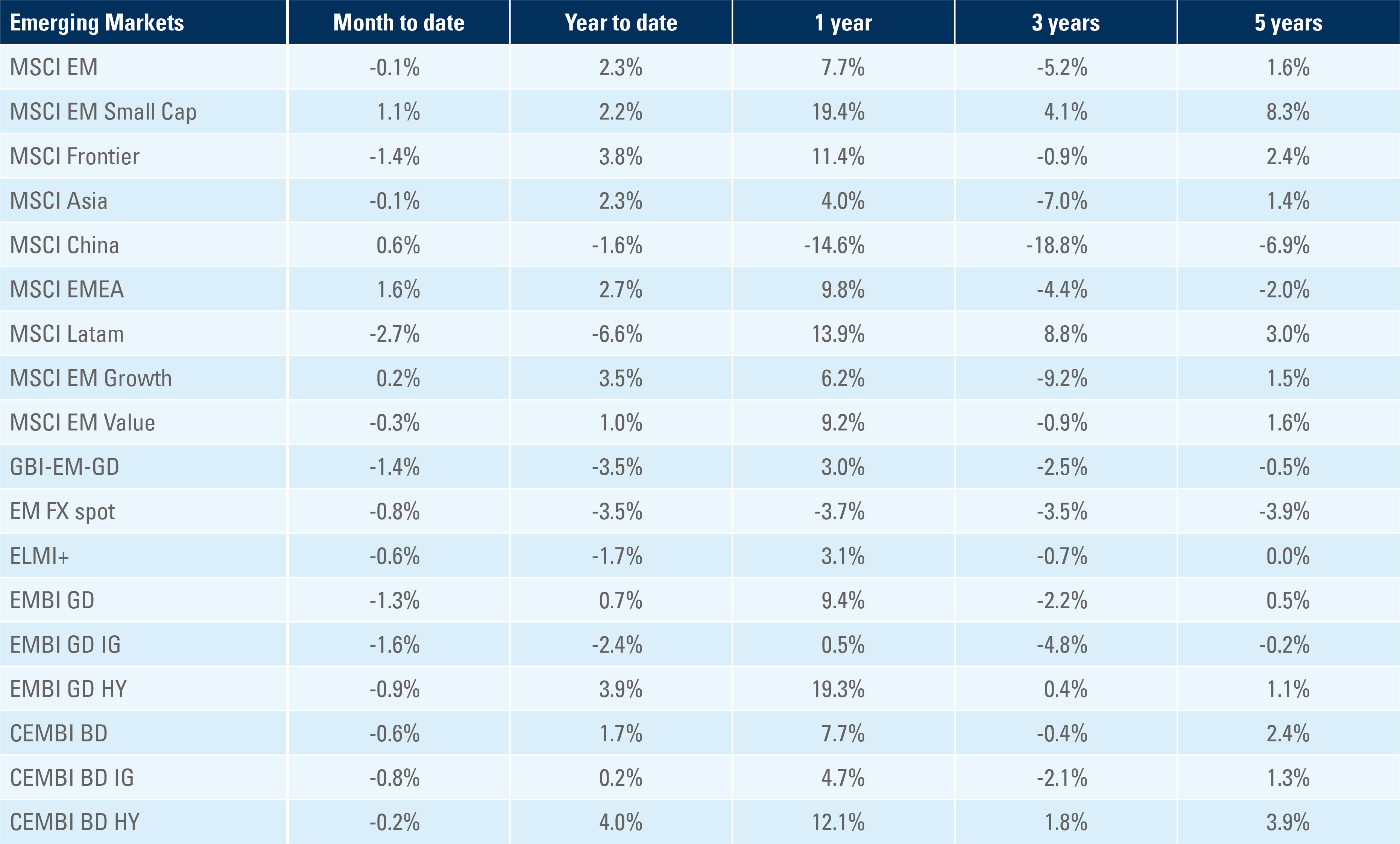

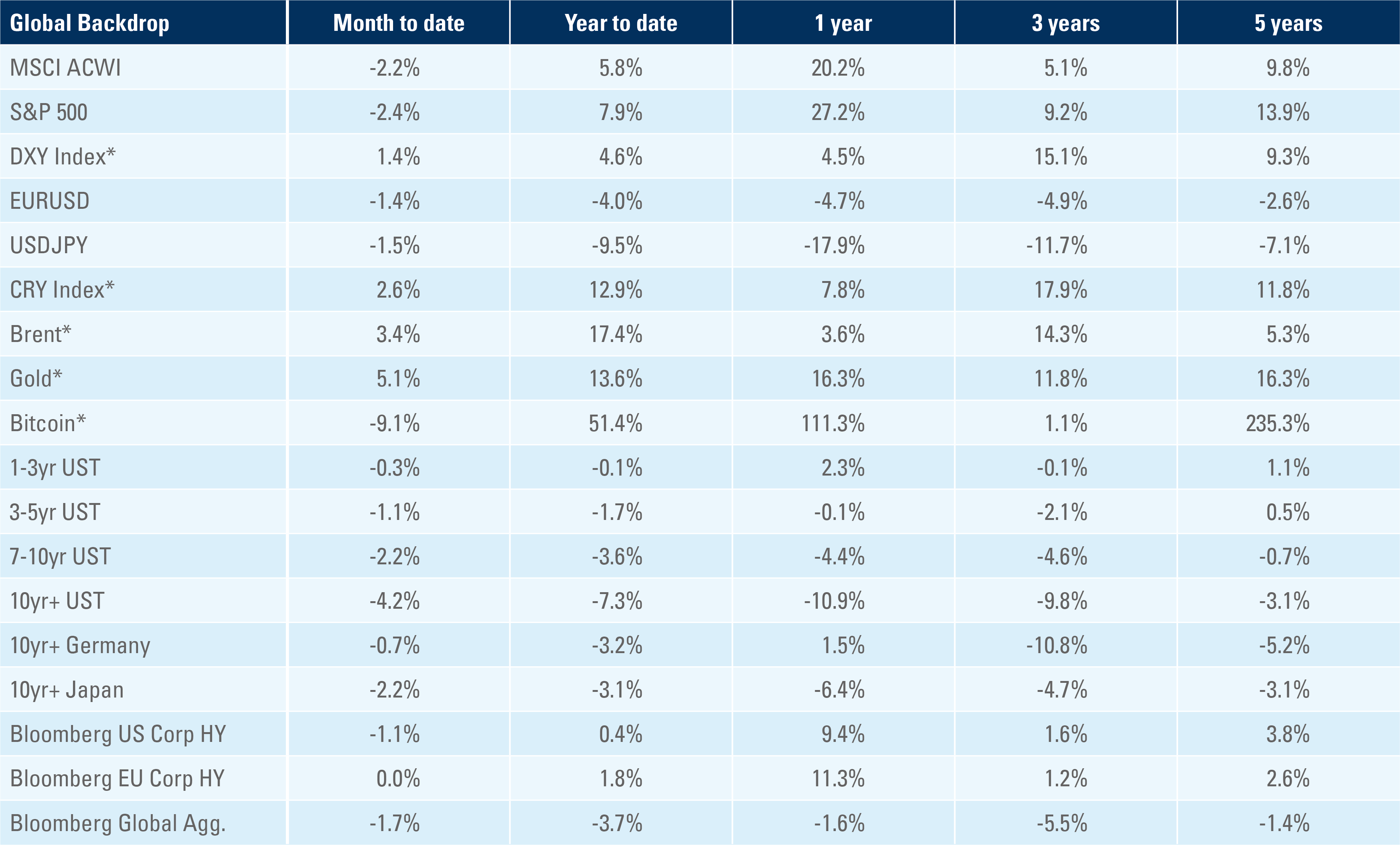

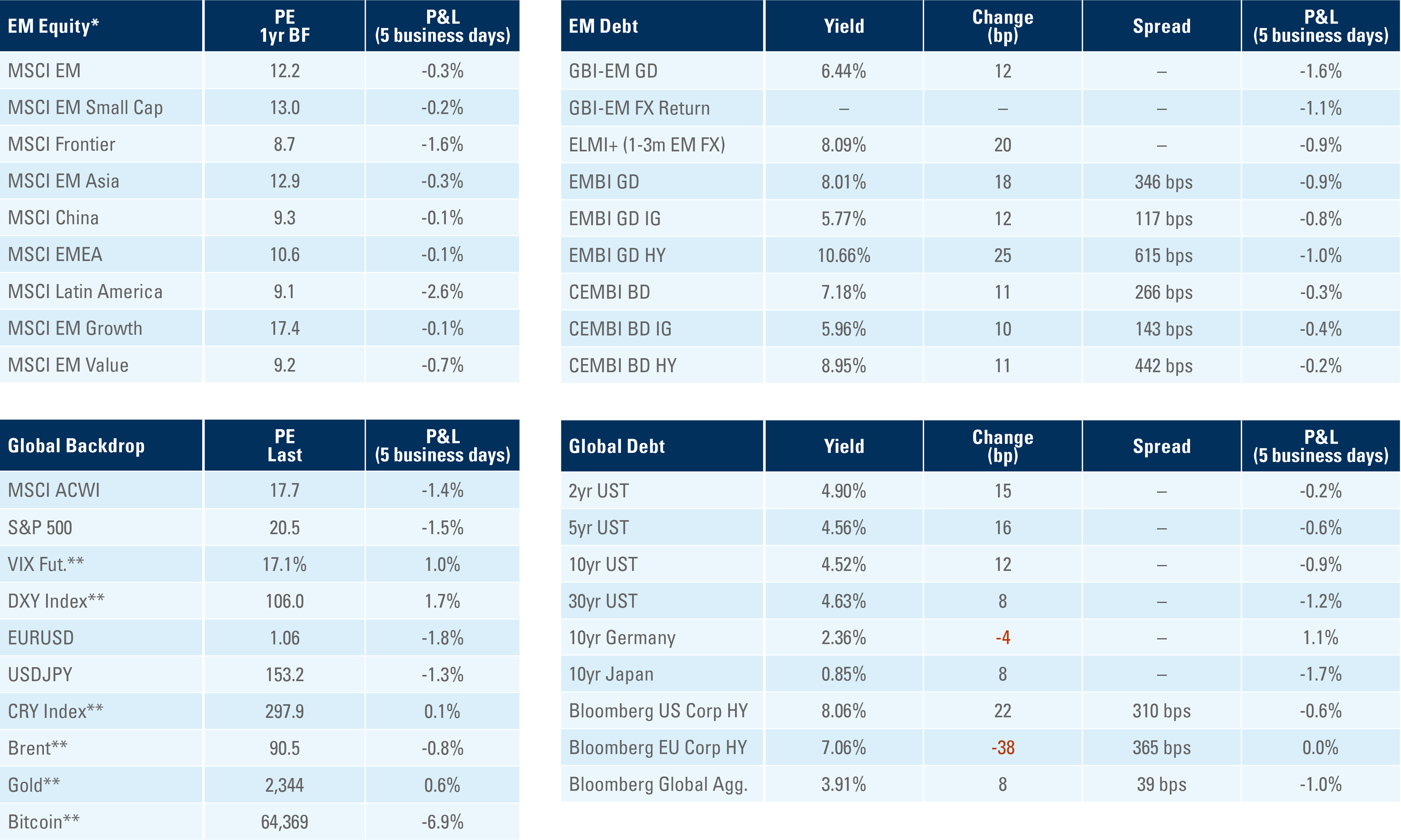

Benchmark performance