A hawkish dot-plot brought US interest rates higher, but risks are increasing. Disputes over Ukrainian grain exports increased tensions in Eastern Europe. JP Morgan announced it will include India in its Emerging Market (EM) Government bond index, positive for Indian bonds. The Brazilian Central Bank cut policy rates by another 50bps as the government increased it parliamentary majority following a small cabinet reshuffle.

Global Macro

The expected hawkish pause from the US Federal Reserve (Fed) brought rates higher, mostly due to higher median dot-plot. Fed Chair Jerome Powell’s acknowledgement that the neutral rate may be above the long-run rate (higher for longer) weighed on stocks.

However, Fed conviction is low, reflected in the highest dispersion for September’s dot-plot chart since 2014. The implied policy direction on the median dot-plot would bring real policy rates to the most restrictive levels since the early 1980s over the next months as the core Personal Consumption Expenditures (PCE) price index is likely to keep declining. Powell linking restrictive policy to real rate suggests the dot-plot implied path will turn too restrictive over the next quarters: “We understand that it’s a real rate that will matter and needs to be sufficiently restricted”.

Consensus remains for GDP growth to keep elevated, but there have been several emerging risks. Flash Manufacturing purchasing manager indices (PMIs) have remained in negative territory. There is an increasing risk of a US government shutdown – betting markets currently have 69% odds – and even if the fallout from this may be temporary, it is nevertheless negative. A government shutdown may even impact the statistics bureau ahead of the November meeting of the Federal Open Market Committee (FOMC). The United Auto Workers union (UAW) strikes have continued, with the Writers Guild of America having seemingly reached a deal after 146 days of strikes. Beyond this, the US federal deficit, based on current law, is set to shrink on a year over year basis over the coming 12 months, all while the risks to the banking system are rising again, with Treasury holdings creating unrealised losses. Money market fund assets under management (AuM) have reached a record high at USD 6.05trn (+USD1trn in last 12 months). Defaults are increasing: credit card +0.8% to 1.2%; autos +5% to 7.3%; high yield (HY) +1.6% to 3.2%, with student loan repayments returning in October likely to add further pressure to this. This myriad of factors demonstrates the evolving situation behind US GDP outlook.

On the other hand, the Bank of Japan (BOJ) continues to insist on making a policy mistake. De-anchoring inflation expectations in the third largest economy in the world does not bode well for inflation, in our view.

Geopolitics: Tensions between Poland and Ukraine escalated due to disputes over Ukrainian grain imports, following the European Commission’s move to allow their sale across the bloc. Following the initial invasion, the European Union (EU) temporarily banned imports of grains into five countries (Bulgaria, Hungary, Poland, Romania, and Slovakia) to protect local markets as Ukrainian grain was now exported overland given the closure of Black Sea shipping lanes. When this exemption expired on 15 September, the EU chose not to renew the scheme, pushing Poland (in addition to Hungary and Slovakia) to impose their own unilateral bans – which Ukraine responded to by filing a lawsuit against the countries at the World Trade Organization (WTO).

Following these developments, Polish Prime Minister Mateusz Morawiecki announced it would no longer supply Kyiv with weapons, suggesting Poland would focus on arming themselves instead. This shift in tone comes ahead of the Polish parliamentary elections on 15 October, where hopes of forming a government may come down to the far-right Confederation Party (Konf) breaking the longstanding duopoly between the incumbent Law and Justice Party (PiS) of President Andrzej Duda and Morawiecki and the opposition Civic Coalition Party (KO), led by former President Donald Tusk. A poll of polls by Politico has the PiS with 38% of vote intentions and the KO with 29%, while the Konf has 10% of the votes and is tied with the far-left Lewica and the centrist and conservatives Third Way Party.1

Emerging Markets

EM Asia

China: The People’s Bank of China kept its one and five-year loan prime rates unchanged at 3.45% and 4.20%, in line with consensus. Chinese stocks outperformed after headlines that China may ease foreign limits and after US Treasury Secretary Janet Yellen said it was launching working groups to establish a durable channel of communication with China.

India: JP Morgan announced the inclusion of Indian government bonds to its flagship local currency benchmark the Global Bond Index Emerging Markets – Global Diversified (GBI EM GD). The country will have a 10% weight after a 10-month staggered inclusion starting in June 2024, allowing plenty of time for the local market to absorb the inflow.

The announcement is most welcome. The inclusion of India will improve the quality and representativity of EM in the index as well as correct a historical anomaly. India is the third largest economy in the world (on a purchasing power parity basis) and the second largest EM economy behind China. The Indian government bond market is attractive on account of its rapid GDP growth rate, economic development, and investment grade rating. The gross yield is around 7.2%, above the current GBI-EM GD yield of 6.7%.

Investors have been clamouring for years for India to be part of the local currency bond index, and the authorities have been preparing for inclusion in the major indices, notably via the introduction of the ‘Fully Accessible Route’ (FAR) bonds in March 2020. This created a class of INR securities fully open to foreign investors, which represent around one-fifth of the stock of local bonds.

The index inclusion will have a positive impact on India’s local bond market, in our view, since funds with an estimated USD 240bn to USD 320bn of assets under management follow the GBI-EM GD. Some investors are already positioned to some extent, but we expect that more could ‘front-run’ the inclusion as passive investors are likely to purchase the bonds. The impact would be compounded if the more widely used Bloomberg Global Aggregate index family were to take a leaf out of JP Morgan’s book and include INR securities into the Global Agg index. Fundamentally, the inclusion should lower government funding costs, which lower the cost of credit through the capital markets and the banking channels. It could also help boost economic activity and help make local equities more attractive.

The inclusion of a large country at the maximum 10% weight will ‘crowd out’ other constituents that have weightings below the maximum threshold. Thailand, South Africa, and Poland are expected to have lower weight in the index, but these countries have large liquid domestic government bond markets to absorb any bonds sold by foreign investors. There is a small number of candidates for future inclusion from under-represented regions, such as Kazakhstan in Central Asia and Saudi Arabia in the Gulf.

In other news, diplomatic tensions between India and Canada continue to deteriorate following Canadian Prime Minister Justin Trudeau’s allegations that the Indian government was involved in the extrajudicial killing of Hardeep Singh Nijjar, a Canadian citizen who was gunned outside his home in British Colombia in June. The Indian government previously designated Nijjar a terrorist, given his links to the Khalistani separatist movement. The fallout from which has continued following discussions between the two countries’ leaders at the sidelines of the G20; the Indian government subsequently accused Canada of “promoting secessionism and inciting violence against Indian diplomats”, while the Canadian statement suggested Trudeau “raised the importance of respect for the rule of law, democratic principles, and national sovereignty”. Since then, a flurry of diplomatic moves has been made by each side, including the Canadian Trade Minister cancelling a planned visit to India in October, the two nations pausing their free trade agreement discussions, and India suspending visas for Canadian citizens (following a travel adviser for Indian citizens visiting Canada). The event has deep political implications in both countries, with Sikh populations paying a significant, yet very different role in each. Canada is home to the largest population of Sikhs outside India and they play an important role in Canadian politics (neither party would want to undermine their support ahead of the 2025 elections). In India, the Khalistan movement (which seeks to establish an independent Sikh state in Punjab) has a troubled history. Following Operation Blue Star in 1984, Sikh separatist and central government tensions were escalated to the point of the assassination of then Prime Minister Indira Ghandi by her Sikh bodyguards.

Indonesia: Bank Indonesia kept its seven-day reverse repo rate unchanged at 5.75%, in line with consensus.

Malaysia: CPI inflation was unchanged at a yoy rate of 2.0% in August, in line with consensus. The trade surplus was unchanged at MYR 17.3trn in August, in line with consensus.

Philippines: The BSP held the overnight borrowing rate at 6.25%, in line with expectations and unchanged from the previous meeting.

South Korea: Exports rose by 9.8% yoy in the first 20 days of September from -16.5% yoy over the first 20 days in August.

Taiwan: The CBC interest rate was held at 1.875%, in line with consensus. Export orders dropped by 15.7% yoy in August after -12.0% yoy in July. The unemployment rate was unchanged at 3.4% in August.

Latin America

Argentina: The yoy rate of real GDP growth collapsed to -4.9% in Q2 2023, 10bps below consensus, down from 1.4% yoy in Q1 2023 as the unemployment rate declined 70bps to 6.2% over the same period. The trade deficit increased to USD 1.0bn in August from USD 0.7bn in July.

Brazil: The Brazilian Central Bank cut its policy rate by another 50bps to 12.75%, in line with consensus. In political news, the government reshuffled its ministerial cabinet, resulting in an increased political base with 349 deputies and 58 senators (from 284 and 50), thus above the threshold required for a constitutional majority (308 and 49 respectively) as two relevant centrist parties were brought into the government. Progressive lawmaker André Fufuca replaced Ana Moser as Sports Minister, while Republican lawmaker Sílvio Costa Filho now heads the Ports and Airports office, replacing Marcio Franca of the Brazilian Socialist Party (PSB). Franca will be transferred to a newly-created Ministry of Small Enterprises.2 Although not guaranteeing the proposed tax reforms, it does push the legislative needle in the right direction.

Chile: The National Treasury revealed new details of spending on Chile’s care system, universal nursery, and university application test. The Executive detailed the four priorities: pensions, health, citizen security and social protection, which together involve resources of USD 8bn, equivalent to 2.7% of GDP.

Colombia: The trade balance for July was USD -600.2m, below the expectation of USD -555.0m, up from the July figure of USD -766.1m.

Mexico: Retail sales declined by 80bps to a yoy rate of 5.1% in July, 20bps above consensus. The yoy rate of CPI inflation declined by 15bps to 4.4% in the first 15 days of September versus the same period in August, as core CPI declined by 20bps to 5.8% over the same period. The faster decline in inflation suggests that the central bank can start easing monetary policy ahead of the Fed. The fact that most central banks that have led the hiking cycle are in easing mode possibly suggests Developed Market (DM) central banks are already in over-tightening mode. Thoughtful central banks will not get caught in group-thinking and will take monetary policy decisions that are relevant to local economic dynamics on a forward-looking basis.

Central and Eastern Europe

Poland: The yoy rate of core CPI inflation declined by 60bps to 10.0% in August, 10bps below expectations as producer price index (PPI) inflation dropped by 90bps to -2.8% yoy over the same period. Retail sales rose by 100bps to a yoy rate of 3.1% in August, 150bps above consensus.

Central Asia, Middle East, and Africa

Egypt: The central bank kept its policy rate unchanged at 19.25%, in line with consensus.

Morocco: The International Monetary Fund reached an agreement to lend USD 1.3bn under the Resilience and Sustainability Trust to support Morocco following its devastating earthquake.

Nigeria: President Tinubu nominated Yemi Cardoso as the next Governor of the Central Bank of Nigeria. Cardoso is a respected economist who should restore the credibility and technocracy lost during Godwin Emefiele’s mandate. Cardoso is due to be confirmed by the Senate next week. As in Türkiye, policy normalisation is likely to be gradual.

Saudi Arabia: The Saudi government borrowed USD 11bn in a 10-year syndicated loan at the Secured Overnight Financing Rate (SOFR) +100bps. The loan is likely frontload next year’s financing and allows the country to gain flexibility in a few ways, including higher investment, lower issuance in local currency markets, and/or building a buffer to keep oil production at lower levels for longer.

South Africa: The yoy rate of CPI and core CPI inflation rose 10bps to 4.8% in August, in line with consensus. The South Africa Reserve Bank maintained its policy rate at 8.25%, also in line with expectations.

Türkiye: The one-week repo rate was increased by 5.0% to 30.0%, in line with consensus. The central bank signalled further hikes going forward, acknowledging the upside risks caused by higher oil prices and inflation expectations.

Developed Markets

United States: The Federal Open Markets Committee (FOMC) left its policy rates unchanged at a 5.25% to 5.5%, in line with consensus, but kept the window open for further tightening, should conditions warrant it. US Treasury yields rose across the curve following the press conference where Chair Jerome Powell acknowledged that it is “certainly plausible that the neutral rate is slightly higher than the long-run rate”. The updated Fed dot-plot, representing the official projections of various members on where short-term interest rates will be, showed 12/19 participants expect another hike in 2023. The ‘higher for longer’ narrative has turned the base case among FOMC members, as the 2024 and 2025 median projections rose by 50bps compared to June. The median projection for GDP growth in 2023 rose to 2.1% last week from 1.0% in June, and 1.5% in 2024 (from 1.1% in June). Two-year Treasuries went from 5.05% to 5.19% following the decision, before finishing the week at 5.12%.

In economic news, the housing market continued to deteriorate as existing home sales declined to 4.04m in August from 4.07m prior, housing starts dropped by 164k to 1.28m in August, 156k below expectations, but building permits data rose by 100k to 1.54m, 103k above consensus over the same period. Initial jobless claims dropped 20k to 201k on the week ending 16 September, 24k lower than consensus. The Philadelphia Fed Business Outlook survey for September was -13.5, below the expected -1.0, and down from the August figure of 12.0. The current account deficit was broadly unchanged at USD 212bn in Q2 2023, slightly better than consensus. The S&P Global Flash Composite PMI declined 0.1 to 50.1 in September as manufacturing PMI increased to 48.9 from 47.9 and services PMI declined 0.3 to 50.2, the lowest reading since January 2023. The Philadelphia Fed Business Outlook plunged to -13.5 in September from 12.0 in August.

Ford Motor Company agreed with the UAW on a 25% pay increase over three years (c. 8.3%/year), plus bonuses, improved retirement benefits, and measures to protect employees on retooling factories for electric vehicles. General Motors and Stellantis are now under pressure to agree a similar deal.

In political news, the odds of a government shutdown increased to 69% in betting markets after the Leader of the House Kevin McCarthy suffered a defeat and allowed Congressmen to go home for a long weekend. Bloomberg Economics’ Anna Wong reported a one-month long shutdown could temporarily bring the US unemployment rate to 4.0% in October.

Eurozone: CPI inflation was revised lower by 10bps to 5.2% yoy. The Eurozone composite PMI rose 0.4 to 47.1 as the manufacturing PMI declined 0.1 to 43.4 and services PMI rose 0.5 to 48.4. The German manufacturing PMI rose 0.7 to 39.8, remaining at very depressed levels as the services PMI increased 2.5 points to 49.8. The current account surplus declined to EUR 20.9bn in July from EUR 35.8bn in June.

United Kingdom: CPI inflation for August declined by 10bps to a yoy rate of 6.7%, 30bps below consensus as core CPI dropped 70bps to 6.2% yoy, 60bps below consensus, the lowest level in 18 months, but still above both the US and Eurozone, despite the Bank of England (BOE) starting its hiking cycle before the Fed or the European Central Bank. The BOE’s Monetary Policy Committee (MPC) held the policy rate at 5.25%, while consensus expectations had a 25bps hike. The split decision had four out of nine MPC members voting for a hike, and ended 14 consecutive hikes since December 2021. Governor Andrew Bailey voted to keep the policy rate unchanged, breaking the tie. At the same time, the BoE announced an increase in the pace of quantitative tightening, aiming to decrease its gilts portfolio by GBP 100bn over the next year, down to GBP 658bn. Some analysts believe the stock of securities in central banks’ balance sheets is a key element boosting liquidity in the system, thus postponing the impact of higher policy rates in the economy.

Japan:The BOJ kept its policy rate unchanged at -0.10%, in line with consensus. Following the announcement, Governor Kazuo Euda said it will be continuing “under the current framework”, suggesting a policy pivot is not imminent. The BOJ is making a policy mistake, in our view. Keeping the economy overstimulated, despite rising oil prices which forces the government to increase subsidies, is likely to de-anchor inflation expectations and does not bode well for global inflation. CPI inflation declined by 10bps to a yoy rate of 3.2% in August, 20bps above consensus as CPI ex-fresh food and energy was unchanged at 4.3% yoy.

1. See – https://en.wikipedia.org/wiki/Third_Way_(Poland)

2. See – https://rsch.baml.com/report?q=0v4OHWtHv9pCYNeD00HeWw__&e=gustavo.medeiros%40ashmoregroup.com&h=TB-yZQ

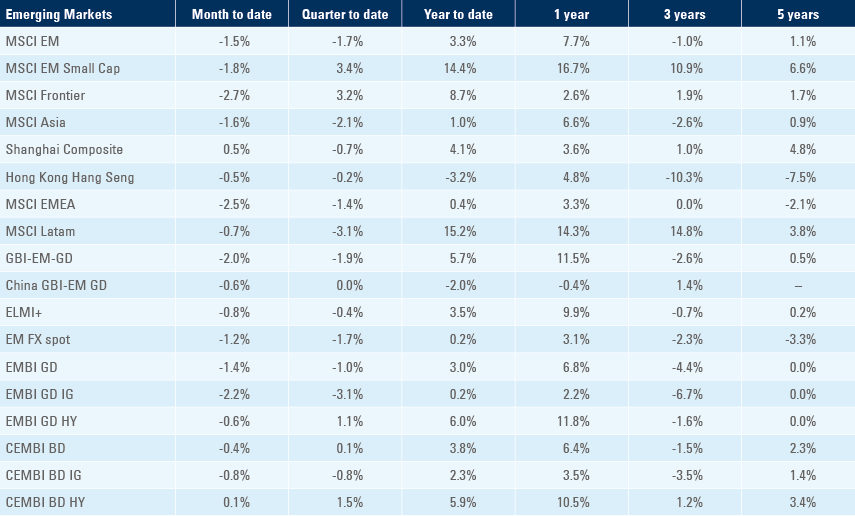

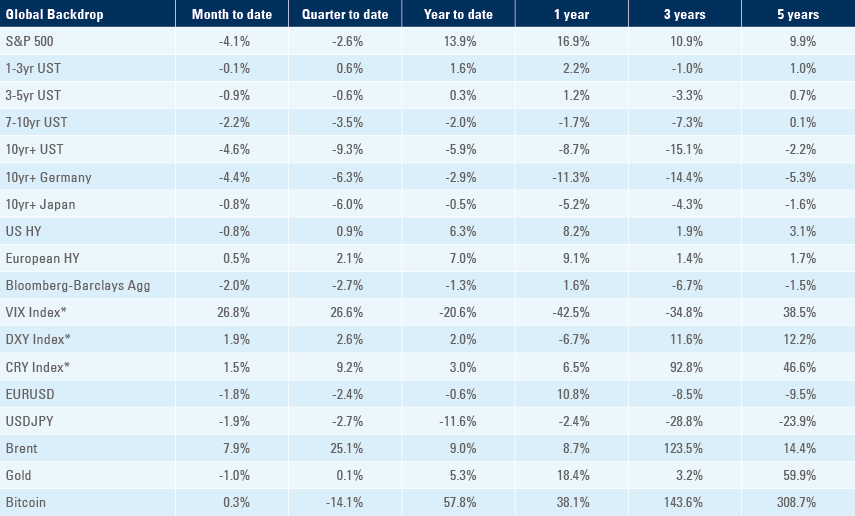

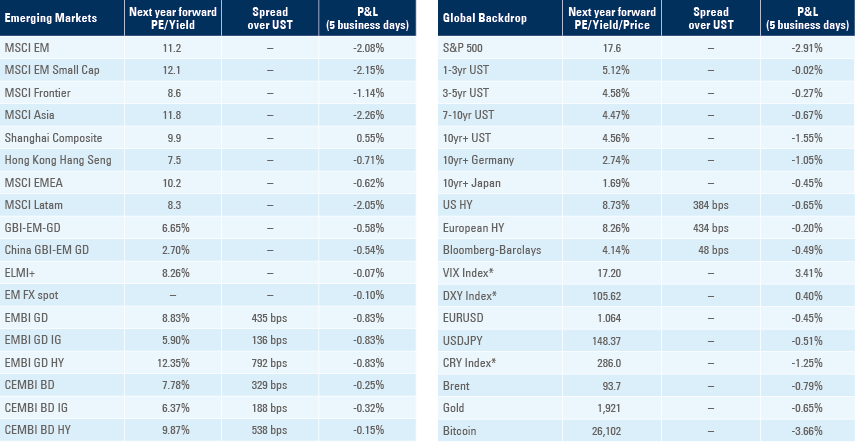

Benchmark performance