Global central banks delivered a hawkish tone, but market moves were mostly related to positioning. United States (US) Secretary of State Anthony Blinken cancelled a visit to China over espionage accusations. The Brazilian Central Bank kept its policy rate at 13.75% but unveiled a hawkish statement against intense political pressure. India threads the needle after unveiling in our opinion, a growth-friendly and fiscally sound budget. Growth in Indonesia and Thailand surprised to the upside while inflation surprised to the downside.

Global macro

Central banks kept the course, with the US Federal Reserve (Fed) hiking its key policy rate by 25 basis points, taking its benchmark rate to a range of 4.5%-4.75%, while the European Central Bank (ECB) and Bank of England (BOE) hiked their policy rates by 50bps to 2.5% and 4.0%, all in line with expectations. Accompanying statements were more hawkish than expected as the Fed kept up its mention of “ongoing hikes” necessary to bring inflation under control, while the ECB pre-committed to another 50bps hike in March. But Fed Chair Jay Powell gave a much more dovish performance when answering questions at the press conference, crucially, not minding the strong easing of financial conditions since December (he answered saying financial conditions had tightened considerably, which is factually incorrect). Powell also said he was feeling good about inflation declining (even as he highlighted the Fed had higher inflation estimates than sell-side research).1 Likewise, despite ECB President Christine Lagarde’s attempt to keep a more hawkish tone, yields on European bonds rallied dramatically after the meeting, suggesting markets expect the ECB to be nearly done with hiking cycles as well. Historically, bond yields start rallying after inflation peaks and the rally accelerates one meeting before the last hike. Will central banks deliver their last hikes in March as the market is pricing? Perhaps. But as policymakers highlighted, they all remain data-dependent, which means economic data will be more important than central banks’ communications.

Overall, US earnings announcements were soft, with large bellwether companies showing a strong decline in year-on-year (yoy) revenue growth suggesting an earnings recession trend is well underway.

Economic data, however, was stronger than expected, with inflation surprising to the upside across many European countries, and with non-farm payroll data showing 517k new jobs were created in the US in January, contrasting with other surveys, such as the Challenger Job Cut and the Quit rates ,which suggest the labour market maybe peaking (more in the United States section).

The price action until Thursday was consistent with January's prevailing trends, with yields on government bonds declining, driving a general stock market rally and with 2022’s underperforming sectors (consumer discretionary, non-profitable tech) outperforming and with its winners (energy) disappointing. This price action stalled after the much stronger-than-expected labour market data on Friday. Yields on US government bonds moved sharply higher following the non-farm payrolls report, bringing the Dollar higher and stocks trimmed some of the rally.

There were three factors leading to the interest in global rates: growth moderating, inflation falling and labour markets moving towards equilibrium. The third assumption was severely challenged last week, calling into question whether the disinflationary trend experienced from October 2022 to January 2023 will remain in place. An ongoing slowdown on inflation will allow central banks to stop hiking in March, which could give more legs to the price action prevailing since October, despite the stretched valuations on Developed Market (DM) bonds and US stocks.

However, should inflation re-accelerate – breaking the declining trend from October to January –, bond price volatility could increase again with central banks forced to hike policy rates and keep rates higher beyond currently priced, driving stock market volatility higher and prices lower. This scenario is perhaps the most likely to play out from a market perspective, considering the current positioning across asset classes. Investors turned from ‘long Dollar’ in October to ‘very short Dollar’ today. Precious and industrial metals are somewhat anticipating a surprising rebound/stickiness in inflation, but energy markets are not, allowing consensus in rates to remain firmly anchored to long bonds despite the strong total returns and positioning. Similarly, stocks positioning (both physical and via options) has moved from oversold to overbought. In short, greed is back!2 Will it last? The key seems to be dependent on inflation.

This week, several Fed board members have the opportunity to share their views, including Jay Powell’s Q&A at the Economic Club, where he will certainly be probed on the ‘financial conditions’ gaffe. The strong economic data will give ammunition for them to forcefully push back against rate cuts in 2023 as well.

Geopolitics

US Secretary of State Antony Blinken cancelled a visit to Beijing after the US spotted and then downed a Chinese balloon flying over US territory. The balloon stirred local politics after flying from Alaska to Canada before re-entering US airspace and flying over a military base in Montana. Initially, the US Air Force only surveilled the balloon, but then shot it down after intense public pressure led by the hawkish Republican party members, just as the balloon left the US airspace.

The incidence says much about the current China-US relationship. Not shooting down the balloon and using it for leverage could make sense from a pragmatic perspective, if you assume the balloon did not manage to capture any significant information. However, regardless of the facts, the US administration had to account for public opinion, which has long framed China as an aggressive state.

Emerging Markets

Brazil: The Central Bank of Brazil kept its policy rate unchanged at 13.75%, but the statement was hawkish, at the margin, as inflation expectations kept on rising because of the ongoing attacks by President Lula over central bank autonomy and the idea of increasing the current inflation target rate to allow for higher gross domestic product (GDP) growth. In economic news, January’s S&P Global Purchasing Managers Index (PMI) Manufacturing survey rose 3.3 points to 47.5 as Services PMI declined 0.3 to 50.7. Industrial production was unchanged in December after declining 0.1% month-on-month (mom) in November, in line with expectations, while producer price index (PPI) inflation declined to 0.2% mom in January from 0.45% in December, allowing the yoy rate to drop by 170bps to 3.8% over the same period. Net debt to GDP rose 0.5% to 57.5% in December as the primary budget deficit improved to BRL 11.8bn (from 20.1bn) but the nominal deficit deteriorated to BRL 70.8bn from BRL 70.4bn (BRL 63.5bn expected). The trade surplus declined to USD 2.7bn in January from USD 4.8bn in December, as exports dropped by USD 3.5bn to USD 23.1bn and imports slowed by USD 1.4bn to USD 20.4bn over the same period.

India: The fiscal year 2024 budget did a fine job balancing between (1) fiscal consolidation, (2) a more attractive new personal income tax regime and (3) continued higher capital expenditure. Despite higher public investments, gross borrowing was maintained at a comfortable level, which should keep interest rates in check. Manufacturing PMI declined 2.4 points to 55.4 while the service sector PMI was down 1.3 points to 57.2 in January, taking the composite down by 1.9 points to 57.5, a still elevated reading, despite the softness at the margin.

Indonesia: The S&P Manufacturing PMI rose 0.4 points to 51.3 in January. Consumer price index (CPI) inflation dropped to 0.3% mom in January from 0.7% mom in December, 15bps below consensus, bringing the yoy rate down 20bps to 5.3% as core CPI dropped 10bps to 3.3% yoy. Real GDP grew by 5.3% in 2022, significantly better than 3.7% in 2021 as the yoy rate of Q4 real GDP growth came in 10bps better than expected at 5.0%.

Thailand: The S&P Manufacturing PMI rose two points to 54.5 and business sentiment increased 1.4 points to 49.8, supporting the Bank of Thailand’s more cautious stance on inflation as the economy reopens. However, the yoy rate of CPI inflation declined by 90bps to 5.0% and core CPI moderated by 20bps to 3.0%, bringing the core measure in line with the 1%-3% inflation target band. The current account moved to a USD 1.1bn surplus in December from a USD 0.4bn deficit in November, and the trade surplus rose to USD 0.96bn in December after USD 0.54bn in November.

Snippets

- Argentina: Wages rose by 6.7% mom in November 2022 after 5.1% mom in October. Vehicle production dropped to 27.2k in January from 37.1k in December, as domestic sales declined by 11.5k to 22.1k. Exports dropped 11k to 11.4k over the same period. Tax revenue was virtually unchanged at ARS 2.3trn in January.

- China: S&P Manufacturing PMI rose 3.1 points to 50.1 and the Service PMI surged 13 points to 54.4, taking the overall composite PMI more than ten points higher to 52.9. The official Caixin Manufacturing PMI rose only 0.2 to 49.2 and Service PMI improved five points to 52.9 as the composite PMI rose three points to 51.1.

- Chile: Copper production rose to 498k tons in December from 459k in November, bringing production close to the average over the last ten years in seasonally-adjusted terms. The yoy rate of industrial production improved to -1.0% in December from -5.0% yoy in November, as manufacturing increased to -4.1% from -7.8% yoy over the same period. Retail sales contraction also decelerated to -11.1% yoy in December from -15.2% yoy in November.

- Colombia: The urban unemployment rate rose by 170bps to 10.8% in December as the national unemployment rate rose 80bps to 10.3% over the same period, both significantly above consensus. CPI inflation rose to 1.8% mom in January from 1.3% mom in December and core CPI increased to 1.6% mom from 0.9%, taking the yoy rate or headline inflation up 15bps to rose to 13.25%, broadly in line with consensus. The Davidienda Manufacturing PMI declined 2.6 points to 48.5.

- Czechia: The Czech National Bank kept its policy rate unchanged at 7.0%, in line with consensus. The yoy rate of real GDP growth slowed to 0.4% in Q4 2022 from 1.5% in Q3 2022, 20bps above consensus. The S&P Manufacturing PMI increased 2.0 points to 44.6.

- Egypt: The Central Bank of Egypt kept its deposit and lending policy rates unchanged at 16.25% and 17.25% respectively, against consensus of a 100bps hike. The S&P Manufacturing PMI declined another 1.7 points to 45.5 in January.

- Hungary: The S&P Manufacturing PMI dropped 4.3 points to 55.0 (previous month was revised to 59.3 from 63.1), significantly below consensus. The survey remained at odds with other activity gauges. For example, the GKI-Erste economic sentiment was unchanged at -20.5 in January as business and consumer confidence remained depressed at -7.8 and -56.6 respectively. PPI inflation dropped another 0.1% mom in December after declining 0.8% mom in November, taking the yoy rate down 210bps to 34.9%.

- Malaysia: The S&P Manufacturing PMI declined 1.3 points to 46.5 in January.

- Mexico: The yoy rate of real GDP growth slowed to 3.5% in Q4 2022 from 4.3% in Q3 2022, 10bps better than consensus. Remittances rose to USD 5.3bn in December from USD 4.8bn in November, but the S&P Manufacturing PMI declined 2.4 points to 48.9 in January. Domestic vehicle sales dropped to 94.4k in January from 123.4k in December, broadly in line with seasonal patterns.

- Nigeria: The S&P Stanbic IBTC Manufacturing PMI declined 1.1 points to 53.5 in January.

- Poland: Real GDP growth slowed to 4.9% in 2022, from 6.8% in 2021 (revised from 5.7%) and the S&P Manufacturing PMI rose 1.9 points to 47.5 in January.

- Peru: CPI inflation dropped to 0.2% mom in January from 0.8% mom in December, but the yoy rate rose by 20bps to 8.7%, still 30bps below consensus.

- Philippines: The S&P Manufacturing PMI rose 0.4 points to 53.5 in January.

- Russia: The S&P Manufacturing PMI declined 0.4 points to 52.6 while the service PMI rose 2.8 points to 48.7, bringing the composite PMI up 1.7 points to 49.7.

- South Africa: The Absa Manufacturing PMI was unchanged at 53.0, almost one point better than consensus. Electricity consumption and production dropped 8% in yoy terms as Eskom loadshedding continued. Behind the scenes, there are massive amounts of investments in renewable energy which can drive the next cycle in South Africa, particularly if the outlook for precious and industrial metals remains buoyed by diversification from reserve managers and energy transition, respectively.

- South Korea: CPI inflation rose 0.8% mom in January from 0.2% mom in December as the yoy rate rose by 20bps to 5.2% and core CPI rose by the same magnitude to 5.0% yoy. January exports dropped 16.6% in yoy terms after a 9.6% yoy decline in December, while imports declined by 2.6% yoy (unchanged).

- Taiwan: The S&P Manufacturing PMI declined 0.3 to 44.3. Exports orders declined by 23.2% yoy in December, a similar level to November and the yoy rate of industrial production dropped 7.9%, accelerating the decline from 5.6% in November.

- Turkey: The S&P Manufacturing PMI rose two points to 50.1 in January. The trade deficit widened to USD 9.7bn in December from USD 8.8bn in November, while CPI inflation rose to 6.7% mom in January from 1.2% mom in December, allowing the yoy rate to decline by 660bps to a very elevated 57.7%. Core CPI rose by 110bps to 53.0% over the same period.

- Vietnam: The yoy rate of CPI inflation rose 35bps to 4.9% in January, 10bps ahead of consensus. Industrial production declined by 8.0% in yoy terms in January, but retail sales rose by 20% yoy (from 17.1% in December) and the trade surplus rose to USD 3.6bn from USD 0.5bn over the same period, significantly better than the seasonal pattern. The S&P Manufacturing PMI rose one point to 47.4.

Developed Markets

United States: Economic data surprised to the upside. On Monday, the Dallas Fed Manufacturing Activity survey rose to -8.4 in January, from -20.0 in December. On Tuesday, the Employment Cost Index declined to 1.0% qoq in Q4 2022 from 1.2% in Q3, 1.3% in Q2 and 1.4% in Q1 2022. Annualised wage inflation declining from 5.6% to 4.0% in three quarters emboldened the view from rates traders that inflation was indeed peaking, as the Chicago PMI remained soft, declining 0.8 points to 44.3. As was the Conference Board’s Consumer Confidence Index, which declined 1.9 points to 107.1. On Wednesday, the ISM Manufacturing PMI slowed one point to 47.4, but prices paid rose 5.1 points to 44.5 and new orders dropped 2.6 points to 42.5. Job openings rose to 11m in December from 10.4m in November. Vehicle sales rose to 15.7m in January from 13.3m in December, but 4.5% below the average of the last ten years. On Thursday, the Challenger Job Cut Announcements rose sharply to 103k in January from 43.6k in December, further emboldening hopes of a continuous disinflation hitting the labour market. Unit labour costs declined to 1.1% qoq in Q4 2022 from 2.0% in Q3 2022, as productivity rose to 3.0% qoq in Q4 2022 from -5.9% at the lowest levels in Q1 2022. However, these figures are misleading as productivity remains lower than September 2020 and unit labour cost rose by 11.4% over the same period. Initial jobless claims declined by 3k to 183k in the week ending 28 January, as continuing claims declined by 10k to 1,655k in the previous week. Factory orders rose 1.8% mom in December after declining 1.9% mom in November, but remained stagnant since June 2022, whereas durable good orders rose 5.6% mom and are now 4.8% above June 2022 levels.

On Friday, the non-farm payroll report shocked everyone as 517k new jobs were created in January after 260k in December (revised from 233k),the biggest upside surprise in 25 years. The unemployment rate declined 20bps to 3.4%, but average hourly earnings slowed to 0.3% mom from 0.4% mom in December, bringing the yoy rate down 40bps to 4.4%. The most fitting narrative for the big divergence between labour market indicators seems to be quit rates, which have peaked and the sharp increase in Challenger Job Cut to non-farm payrolls appears related to the post-pandemic recovery. Several low value-add service industries such as hospitality, restaurants and bus/truck drivers, remained understaffed after significant layoffs while generous cash transfers are allowing people to seek other careers. At the same time, the large technology companies that over-hired during the pandemic, and have been recently punished with lower stock prices, are laying-off employees. This would explain the softness in average labour costs, despite the very strong labour market. In terms of aggregate income, this distribution would favour more spending on staples than discretionary items and should NOT generate as much spending as 2021/22 and, at the margin, is recessionary/dis-inflationary. The danger is that policymakers zoom in on the very large payroll number and decide to hike policy rates by more than the market expected before last Friday. After all, the labour market is easing (confirmed by the key leading indicators quit rates and Challenger job cuts) but remains at the tightest level since the Covid-19 shock.

Another divergence to monitor is the gap between the S&P Services PMI, which was flat at 46.8 in January and the ISM Services PMI, which rose 5.5bps to 55.2, driven by new orders, which rose 15 points to 60.4! The ISM report is known to have a higher concentration of large companies.

Europe: The yoy rate of real GDP growth slowed to 1.9% in Q4 2022 from 2.3% in Q3, 20bps better than consensus as the unemployment rate was unchanged at 6.6%. CPI posted the second consecutive 0.4% mom deflation in January, according to preliminary data, bringing the yoy rate down 70bps to 8.5%, but core CPI inflation remained unchanged at 5.2% yoy. PPI inflation rose 1.1% mom in December after declining 1.0% in November, as the yoy rate dropped 240bps to 24.6%. The data is likely to be revised as Germany’s CPI wasn’t released due to a change in methodology. The Euro-area Economic Confidence survey improved to 99.9 in January from 97.1 in December (revised from 95.8), almost three points better than consensus.

United Kingdom: House prices fell by 0.6% mom in January, the fourth consecutive month of decline.

1. See https://www.bloomberg.com/news/articles/2023-02-01/powell-holds-fire-on-markets-breaking-loose-from-fed-control

2. See https://edition.cnn.com/markets/fear-and-greed#:~:text=The%20Fear%20%26%20Greed%20Index%20is,to%20have%20the%20opposite%20effect.

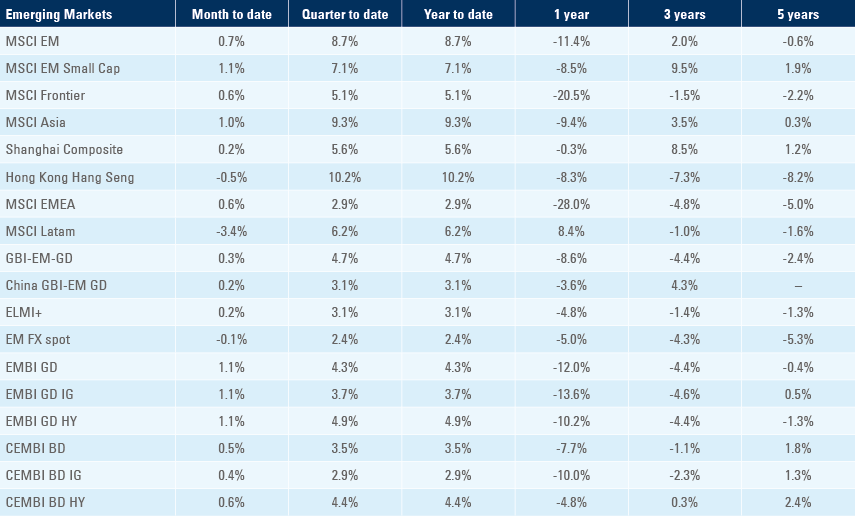

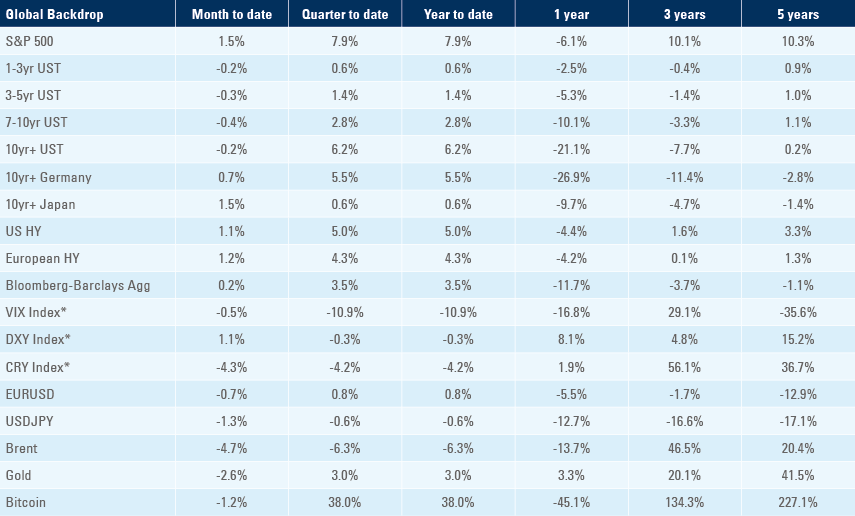

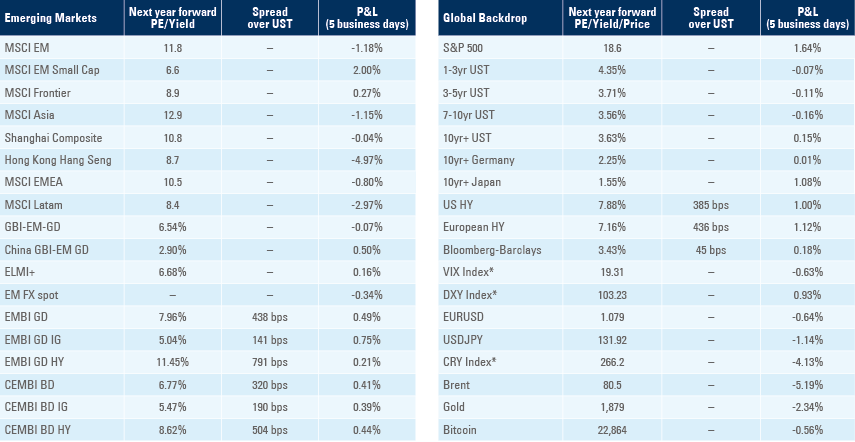

Benchmark performance