- Israel attacked Iran, targeting its nuclear facilities, scientists, and military.

- Oil prices went up. This should have been positive for the dollar…but wasn’t.

- US willing to remove some key trade restrictions for access to Chinese rare earth minerals.

- Inflows of USD 3.8bn to EM debt last week (BAML estimate) was fourth largest ever.

- Chinese retail sales buoyant, trade surplus remains solid despite lower US exports.

- South Korea exports already 15% higher than last June.

- Colombian government suspended fiscal rule (max. 7% deficit) for three years.

- Dovish Mexican central bank signalled 50bps cut this month.

- World Bank approved USD1.5bn loan to South Africa.

- IMF agreed USD1bn loan increase to Ecuador.

- Turkish opposition party gained support, leading recent polls with 31.2%.

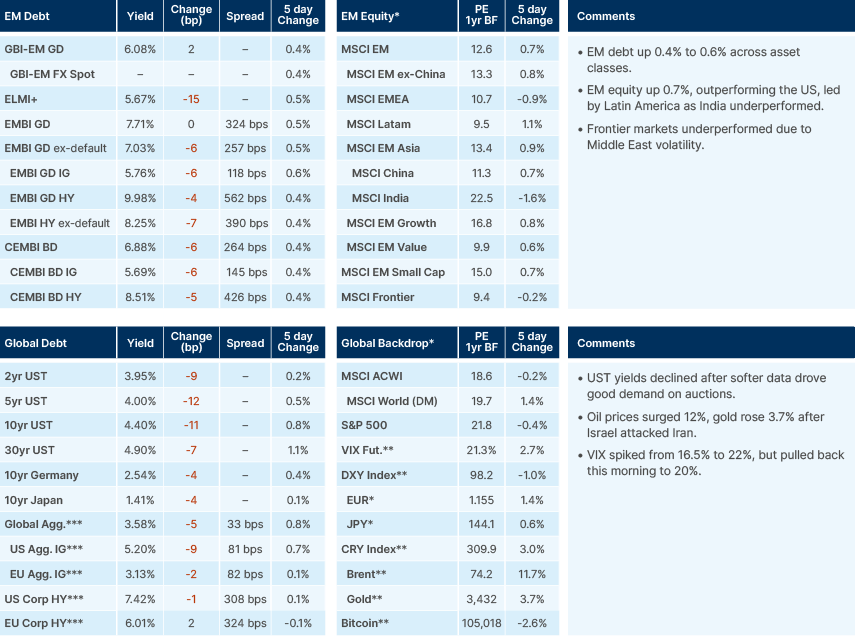

Last week performance and comments

Global Macro

Geopolitics

The rumours of air strikes by Israel against Iran were proven correct. Tel Aviv launched a barrage of at least 300 missiles and drones targeting Iranian nuclear facilities and military infrastructure as well as Iranian scientists and top military. As in the Israeli attacks on Hezbollah, technology and intelligence were successfully deployed. Ali Shamkhani, a close confidant to Supreme Leader Ali Khamenei and former navy commander and secretary of the Supreme National Council, who was overseeing the nuclear talks with the US, was also killed. Reports that the US blocked Israel from killing Khamenei are part of fog of war (and was implicitly denied by Israel’s Prime Minister Benjamin Netanyahu on Fox News).

The timing of the attack was likely motivated by Israel’s superior strategic position after “dealing with” Hamas, Hezbollah, and having significantly damaged Iran’s defence capabilities last year. Regime changes in Syria and Lebanon not only eliminated threats but allowed for strategic depth with aircraft refuelling over Syrian territory possible.

The key explicit reasons for the Israeli attack were stopping Iran from acquiring nuclear weapons technology and its reported build-up of long-range missiles. Implicitly, Israel is going for regime change (“could be the result of actions” according to Netanyahu) as the magnitude and sophistication of the attack has cornered the Iranian regime, leaving it with no good options to respond or retaliate.

A nuclear deal is clearly off the table, after Trump walked away from the first nuclear deal and Israel killing a key interlocutor for a second one. There were mixed reports on whether the US knew about or approved the attack. The removal of personnel across embassies, including in Baghdad, suggested the US was aware. Nevertheless, the mixed statements from key US leadership following the attack suggests the magnitude and strategic depth of the operation was unclear to the US. While the attack led to an oil price move that was undesirable for US President Donald Trump, Israel may have calculated the US would still support the Jewish state.

All Arab countries, including the UAE, Saudi Arabia, Qatar, and Türkiye denounced the attacks.

The situation remains fluid, but the most relevant risks seem to be Iran doing something desperate. What can it do to increase bargaining power? In our opinion, the most consequential impact on oil prices would come if Iran tried to close the Strait of Hormuz. Nevertheless, this is a very complex task as the Strait is 55-95km wide and most of it is in Oman, not in Iran. Israeli air superiority and the presence of NATO warships in the canal suggests closing the Strait would be short lived.

The muted reaction across asset prices suggests market participants only care in the short term about the disruption to energy supplies or shipping lanes. It has become well known that geopolitical shocks leading to a short-term increase in volatility should be “faded” most of the time. Hence, medium-term risks (including large immigration flows from Iran), and long-term unknown risks have not been reflected in asset prices. Equity investors are also quick to notice that defence spending overrides budgetary constraints and are unwilling to sell assets unless there is a clear disruption to their investment thesis.

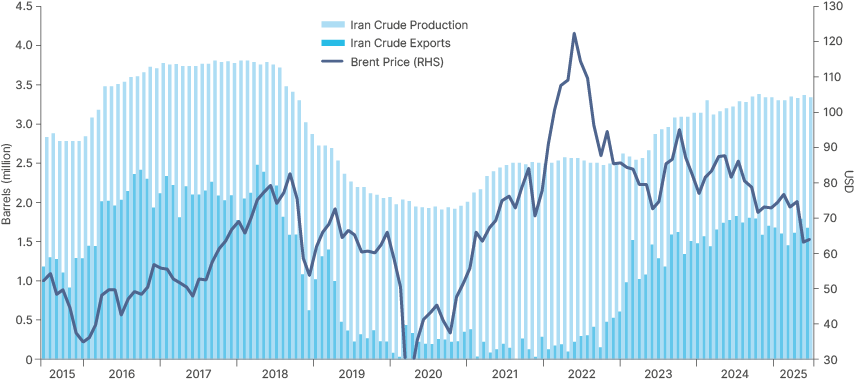

Nevertheless, many questions remain. Does Iran already have a nuclear bomb? Will it test or deploy them for deterrence? Will the US get involved if Iran escalates the conflict regionally (including using Houthi proxies)? Will the US tighten oil sanctions to stop even China importing Iran’s oil? If yes, will OPEC+ increase production and can it replace the 1.6m barrels that Iran exports daily today (Fig. 1)? Will the Iranian people rise against the regime? When? In the absence of regime change and US involvement, can Israel destroy Iran’s nuclear enrichment facilities like Fordow? How long before Iran can acquire nuclear weapons? Does Israel have a game plan for the aftermath across (regime change scenarios?

The Dollar

A higher oil price is good for US terms of trade, even if undesirable for the Trump administration as it would stoke inflation at a time when tariffs are biting (late June). Higher oil prices are not good for Europe and Asia. Against this background, the technical position was getting relatively heavy in a few corners of the market ahead of the attack. In currency markets, the dollar was oversold as speculators added short dollar positions betting on a continuous reallocation of capital away from the US. Given the dollar did not manage to rally against this background is very negative for the greenback.

Deutsche Bank noted that pension funds and insurers are still running near historical lows in foreign exchange (FX) hedge ratios. If these ratios begin to rise, it could further weigh on the dollar. BNP Paribas reported that asset allocators in the Eurozone have started reducing dollar allocations, a trend it says is far from complete. The breakdown in correlations between risk assets and the dollar, rate differentials and the dollar, and now oil prices and the dollar, demonstrates that the USD is no longer just reacting to economic data, commodity prices, or rate expectations, but is entering a new macro regime where unhedged USD assets are quickly losing their appeal.

Commodities

Oil prices spiked 12% last week and are now 15% higher month-to-date, given the now very elevated risk to supply disruptions as conflict between Israel and Iran escalates. Deutsche Bank analysts estimate oil prices at current levels (USD74) indicate the market is pricing a 50% reduction in Iranian oil output. Iran produces 1.6 million barrels per day of oil but also has the potential to disrupt shipping through the Strait of Hormuz, where around one-third of the global oil and natural gas supply passes through daily. The US implementing further sanctions against Iran could also disrupt supply. However, the current peak of the oil spike at USD78-70 is relatively benign.

Some analysts estimate that oil could spike to above USD120 if the Strait of Hormuz was closed, but the risk of this is still considered to be relatively contained. It would be a very difficult operation to carry out and would raise the risk of direct US involvement. The oil market may also, in our view, be discounting a benign outcome where the conflict leads to a regime change in Iran, which in turn leads to a de-escalation of tensions in the Middle East, and a lower geopolitical risk premium. The appetite for the US to implement further sanctions on Iran is also likely low, given the Trump administration’s strong wish for low oil prices, and the fact that Iran exports most of its oil to China, with which the US has ongoing trade negotiations. Furthermore, building oil inventories in recent weeks suggests the physical market is now in a surplus, which provides some cushion from the impact of potential supply disruptions.

Fig 1: Iranian Crude production/exports vs Brent Prices

The European Central Bank (ECB) showed that gold at current levels is now 20% of global FX reserves, overtaking the euro, at 18%.

Emerging Markets

Asia

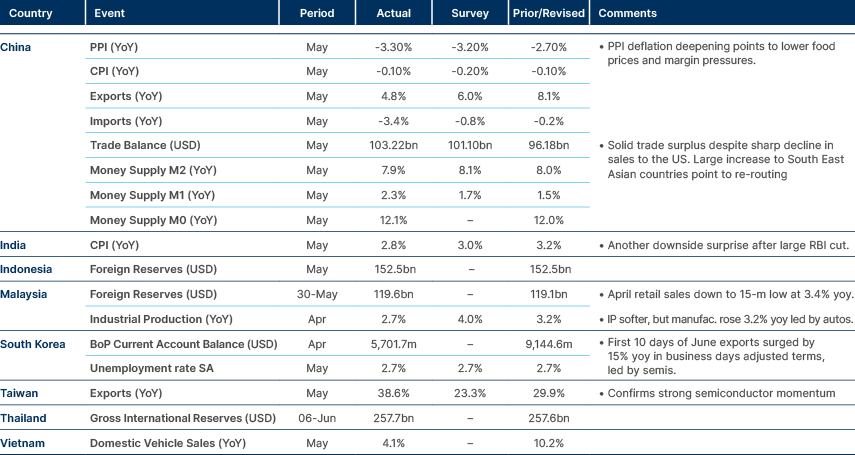

Deflationary pressures remain across Asia, despite solid tech exports and China retail sales.

China: China’s May retail sales were boosted to 6.4% year-over-year by an earlier-than-usual ‘online shopping festival’, which pulled some demand forward from June to May. Service sector sales were more stable. Infrastructure investment and industrial production were broadly in line with expectations, but housing data disappointed. Deutsche Bank’s high-frequency data points to resilience in services and consumption. Investment is expected to rebound on fiscal support, while industrial production may soften The property sector shows renewed weakness, though the government's idle land buyback scheme has accelerated. Exports to the US are set to rebound in June as tariffs have stabilised, for now.

Pakistan: The 2025–26 budget targets a 2.4% primary surplus of GDP, above both last year’s 2.2% and the International Monetary Fund (IMF’s) forecast of 1.6%. The overall deficit (primary spending balance plus interest costs) is projected to shrink to 3.9% of GDP, helped by a 1.5% drop in interest costs, while revenues are expected to remain largely flat. The budget emphasises revenue mobilisation and spending cuts, including a 14% cut in subsidies, while increasing defence spending by 16.9%.

Philippines: Vice President Sara Duterte is facing an impeachment trial in the Senate. Net foreign direct investment (FDI) inflows contracted 27.8% year-on-year (y/y) in March.

South Korea: Exports rose 15.0% y/y in early June, driven by semiconductors. Strong corporate profitability boosted April tax revenues by 20.1%. President Lee Jae-myung is pushing a pro-business agenda, including deregulation and a dividend tax cut. The Bank of Korea signalled a cautious easing path, warning against over-reliance on stimulus amid a growth slowdown.

Sri Lanka: Electricity tariffs were raised by 15% to meet IMF cost-recovery requirements, which are essential to unlocking the next loan tranche.

Taiwan: May exports surged 38.6% y/y, up from 29.9% in April and far above the 23.3% consensus. The trade surplus hit USD 12.6bn as imports rose 25.0%. Technology exports soared 60.6% y/y, while non-tech export growth slowed to 0.4%. US-bound exports jumped 87.4% y/y, ASEAN-bound 52.3%. Export growth was driven by frontloaded orders during the tariff reprieve and concerns over further tech restrictions on China. The recent TWD appreciation may begin to weigh on non-tech exports.

Latin America

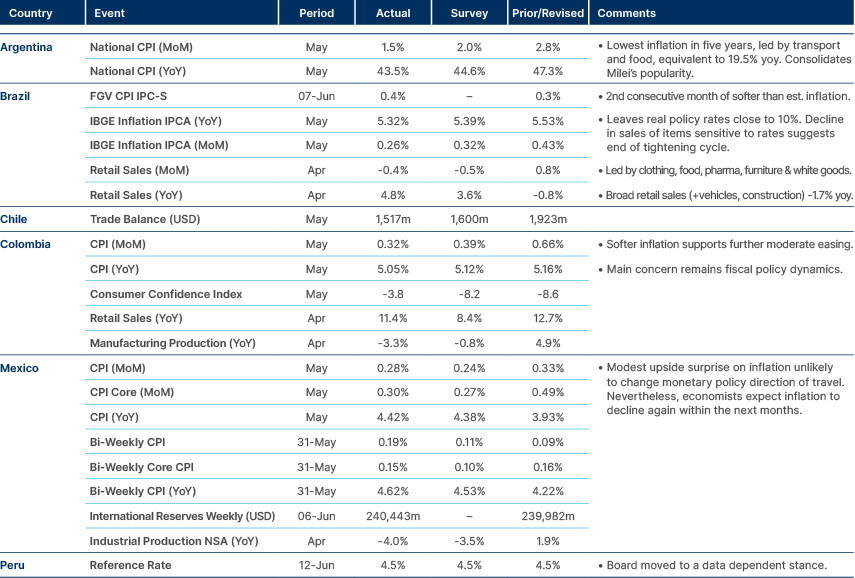

Softer inflation in Argentina, Brazil, and Colombia. Temporarily higher in Mexico.

Argentina: Core inflation in May eased to 2.2% month-on-month (m/m) from 3.2% in the prior two months. Regulated prices rose 1.3%, seasonal goods prices fell 2.7%, and key items like transport (+0.4%) and food (+0.5%) showed subdued price gains. Housing rose 2.4%. The Supreme Court upheld Cristina Kirchner’s six-year prison sentence and lifetime political ban; she has requested house arrest. The government is offering ARS bonds to offshore investors to boost FX reserves, while removing minimum stay periods for non-residents buying six-month+ Treasury notes in primary auctions. The IMF is expected to approve a USD 2bn disbursement despite missed targets.

Brazil: Revenue boosting measures proposed by the government are seen as inadequate to meet fiscal targets, increasing friction between the executive branch and Congress, which is blocking any tax hikes, and pushing for spending cuts. The 2025 harvest forecast was revised up to a record 13.6% annual growth. Former President Jair Bolsonaro adopted a more conciliatory tone during his first Supreme Court hearing related to the alleged 2022 coup plot.

Colombia: The government suspended the fiscal rule for three years, allowing the 2025 deficit to exceed 7% of GDP, raising the risk of a credit rating downgrade. President Gustavo Petro escalated political tensions, threatening to call a Constituent Assembly if Congress blocks his reform agenda. Security risks are rising after a wave of deadly terrorist attacks by FARC dissidents in the southwest.

Ecuador: IMF staff agreed to increase financial assistance by USD 1bn. Further multilateral support is expected once the IMF board gives formal approval.

Mexico: Dovish Banxico board members are leaning toward a 50 basis points (bps) rate cut on 26 June, despite a higher May inflation print and dissent from hawkish members. Governor Victoria Rodríguez and members Galia Borja Gómez and José García are seen as backing the move. Deputy Governor Jonathan Heath opposes the cut, warning of the absence of a clear disinflation trend at this stage, and doubts convergence to the 3.0% consumer price index (CPI) inflation target by Q3 2026. Heath may be the lone dissent in a 4-1 vote. The government is close to a deal with the US on a volume-based exemption from the 50% tariff on Mexican steel. However, tensions remain over US demands to prosecute cartel-linked politicians, which Mexico denies.

Panama: President José Raúl Mulino ordered security forces to lift road blockades by striking banana workers in Bocas del Toro after a legislative agreement was reached with union leaders.

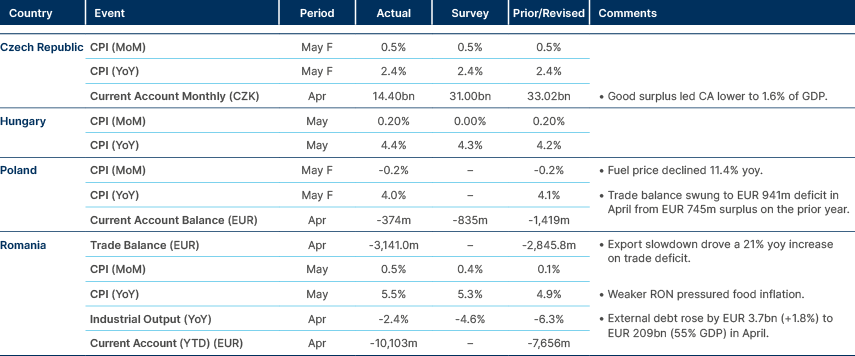

Central and Eastern Europe

Romania data points to severe challenges ahead

Czech Republic: The main opposition party triggered a no-confidence vote against the government, but the ruling coalition is expected to survive the motion.

Poland: A member of the central bank's monetary policy committee signalled the likely start of an easing cycle, suggesting a 25bps rate cut in July or September, as inflation has surprised to the downside in recent readings.

Romania: Inflation accelerated to 5.45% y/y in May, above expectations, which will likely keep the central bank on hold. Governor Mugur Isărescu has warned on rising debt sustainability risks. Gross external debt rose 1.8% m/m in April, driven by public sector borrowing.

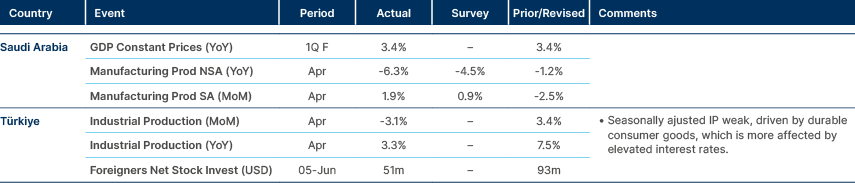

Central Asia, Middle East, and Africa

Türkiye’s softer activity shows tight policy bite.

Egypt: Remittances surged 55% y/y to a record USD 3.4bn in March following the March FX liberalisation. Foreign holdings of Egyptian T-bills climbed to USD 38.5bn by end-March.

Kenya: The central bank cut the benchmark rate to 9.75%, slightly above the consensus estimate of 9.50%.

Morocco: Q1 manufacturing output rose 3.2% y/y, led by autos (+12.7%) and mining (+10.8%).

Nigeria: A proposed USD 5bn oil-backed loan from Saudi Aramco faces hurdles after crude prices fell, raising repayment concerns. The Q1 trade surplus reached NGN 5.2trn amid lower imports and stronger exports, but oil dependence remains high. President Bola Tinubu is consolidating political power as opposition defections continue.

Saudi Arabia: India has launched construction of a USD 5.5bn, 1,700km undersea power cable to Saudi Arabia, strengthening bilateral energy ties.

South Africa: The World Bank approved a USD 1.5bn budget support loan to help address the energy and logistics infrastructure crisis. Moody’s affirmed the Ba2 credit rating, but expects only modest reform progress in the medium term amid political and structural challenges.

Türkiye: Finance Minister Mehmet Şimşek celebrated the smooth unwinding of the FX-protected deposit (KKM) scheme. Opposition party CHP is leading the polls at 31.2%, as dissatisfaction with the government's moves against Istanbul municipality grows. Türkiye secured a USD 10bn defence export deal with Indonesia for 48 Kaan fighter jets.

United Arab Emirates: Abu Dhabi’s luxury real estate market continues to boom, with USD 1.7bn in sales through April driven by branded residence demand.

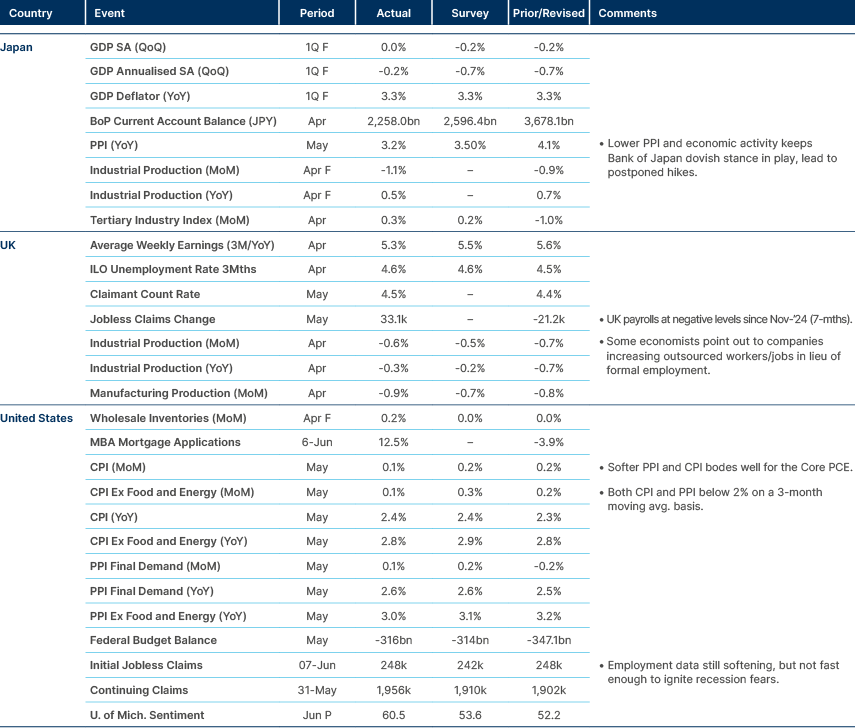

Developed Markets

Softer data in the US

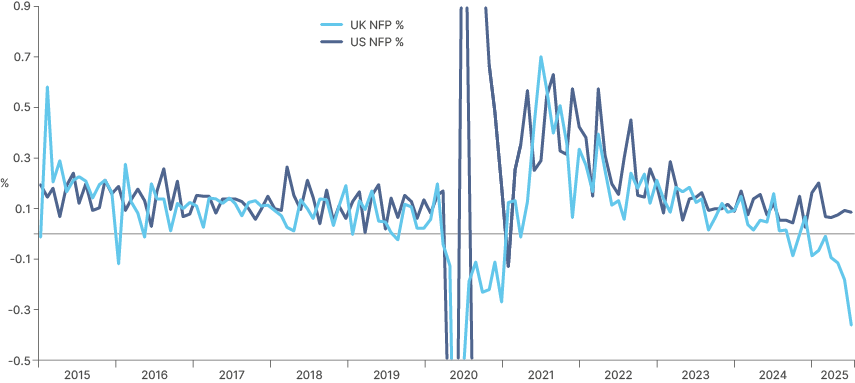

United Kingdom: Payrolls fell by 109k vs. -22k expected, with the prior month revised to -55k. Since October, total job losses amount to 276k (~1% of the workforce). Economists cited tax hikes and non-dom changes as drivers. The historical correlation with US payrolls suggests this trend should be watched closely.

Fig 2: Payrolls as % or active labour force: US vs. UK

United States: Trump again criticised US Federal Reserve (Fed) Chair Jerome Powell, fuelling speculation about his successor. Fed Governor Adriana Kugler will leave in January 2026, and Powell’s term ends in May 2026. Possible replacements include Kevin Warsh, Kevin Hassett, Chris Waller, and Scott Bessent. Markets may react with further curve steepening on expectations of a more dovish successor.

Japan: Confusion arose after Reuters reported the government might buy back super-long Japanese Government Bonds (JGBs), later denied. Volatility in JGBs is currently high, with rising yields and weak auction demand. 30-year and 40-year JGBs have hit decade highs as life insurers and banks pull back and the Bank of Japan (BOJ) tapers purchases. Japan’s Finance Minister Katsunobu Kato will consult with bond market participants on 20 and 23 June, after the next BOJ meeting, to align any debt management strategy with investor expectations. Limited buybacks could begin in July, but regular or large-scale operations would need extra budget approval. Domestic investors still prefer JGBs over foreign bonds, while USD-hedged yields on 30-year JGBs at 7.0% are now at attractive levels for foreign investors.

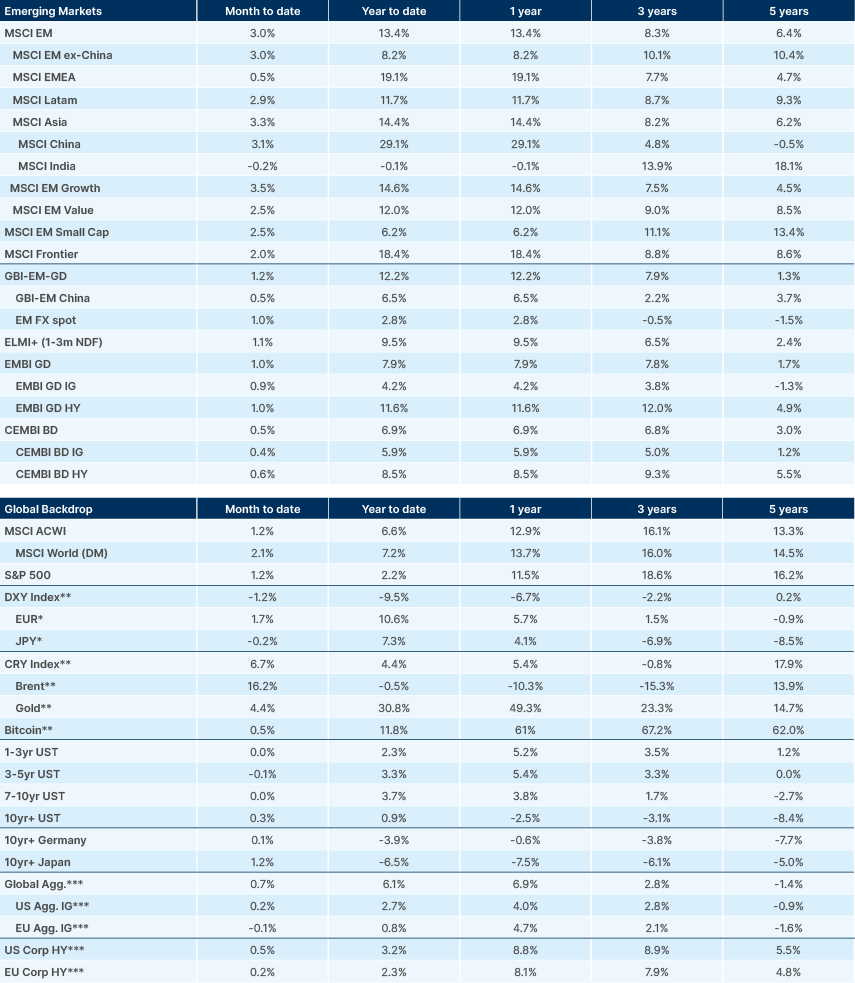

Benchmark Performance

Source and notations for all tables in this document:

Source: Bloomberg, JP Morgan, Barclays, Merrill Lynch, Chicago Board Options Exchange, Thomson Reuters, MSCI. Latest data available on publication date.

* Price only. Does not include carry. ** Global Indices from Bloomberg. Price to Earnings: 12m blended-forward

Index Definitions:

VIX Index = Chicago Board Options Exchange SPX Volatility Index. DXY Index = The Dollar Index. CRY Index = Thomson Reuters/CoreCommodity CRM Commodity Index.

Figures for more than one year are annualised other than in the case of currencies, commodities and the VIX, DXY and CRY which are shown as percentage change.