The Fed delays the easing cycle while EM central banks press on

Chile, Brazil, Colombia, Hungary, and Ghana cut their policy rates. Egypt hiked by 200 basis points (bps), moving to an orthodox policy stance favoured by the International Monetary Fund (IMF) as it stepped up its conversations to receive a fresh loan package from the multilateral. The Governor of the Central Bank of Türkiye resigned for personal reasons, with an orthodox replacement appointed. In Asia, Chinese regulators mulled further steps to stabilise the equity market. India’s budget deficit was more frugal than expected. Semiconductor exports supported trade and gross domestic product (GDP) data in both South Korea and Taiwan. In global macro matters, interest rate volatility remained elevated as US Treasury (UST) yields declined following a return of US regional banking sector woes, but then rose after more hawkish language from the Federal Open Market Committee (FOMC) and a strong payrolls report. Global manufacturing purchasing manager indices (PMIs) improved with most Emerging Market (EM) countries accelerating. Israel reportedly negotiated a ceasefire with Hamas, but Houthi rebels continued to disrupt Red Sea shipping, despite US involvement.

Global Macro

Global Rates

On Wednesday, the FOMC gave no indication that it was in a hurry to reduce rates, stating “it does not expect it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving sustainably towards 2%”.' Fed Chair Jerome Powell added it was “not likely” committee members would reach this level of confidence by March. Powell largely repeated that view in a televised interview for ‘60 Minutes’.1 The more prudent tone has not changed the market’s assessment that the next move is likely to be cutting rates, and this is expected to start towards the end of Q2 2024 rather than March. Importantly, the Fed has a powerful tool to backstop financial stress, should any take place. This reticence over rate cuts was vindicated on Friday, as the non-farm payrolls number soared past expectations. The US added 353k jobs in January, with large revisions to the prior months and with the unemployment rate steady at 3.7% against estimations of a 20bps increase. Wages also grew far more than anticipated, jumping 0.6% mom, twice as much as the estimate and up 4.5% yoy, well above the 4.1% forecast. Underneath the headline the report seemed to be softer. First, the strong job number increase was led by part-time workers. A total of 5.8m jobs were created since May 2022, but full-time employment was up only 457k (less than 10% of total). Furthermore, average weekly hours dropped 0.2 to 34.1 hours (down from 34.6 in May 2022). In a workforce of 160 million, companies would need 2.3 million additional workers to compensate for the drop in hours worked since May 2022 to keep total man-hours unchanged. Furthermore, government, education and healthcare were the largest sources of job gains over the last 12 months.

US Banks

Markets were reminded that the banking sector stress that sent three regional banks under in 2023 was far from over, as New York Community Bancorp (NYCB) slashed its dividend and reported a quarterly loss in Q4. It also set aside millions in provisions for future losses. NYCB, which last year purchased the collapsed Signature Bank, saw its stock fall 37% on Wednesday and 11% on Thursday, pulling the wider sector’s share prices lower. While NYCB's problems are largely unique to its balance sheet, its poor earnings underscored regional lenders’ ongoing sensitivity to high Fed rates which keep pressure on fragile commercial real estate loan (CRE) portfolios. The inverted yield curve caused by above-trend real rates also keeps pressure on lending margins. Friday's large beat on non-farm payrolls, raised the likelihood of further problems for regional banks, as markets priced out the probability of a rate cut in March.

Leading Indicators: Global Purchasing Manager’s Index (PMIs)

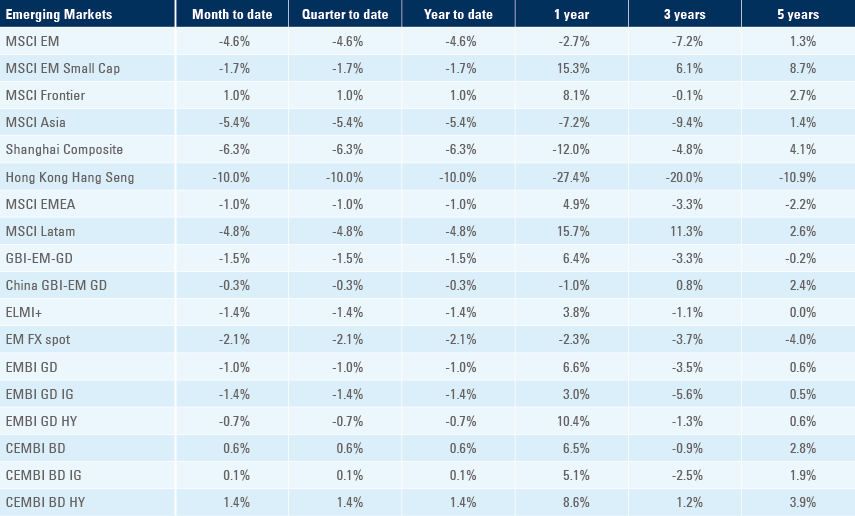

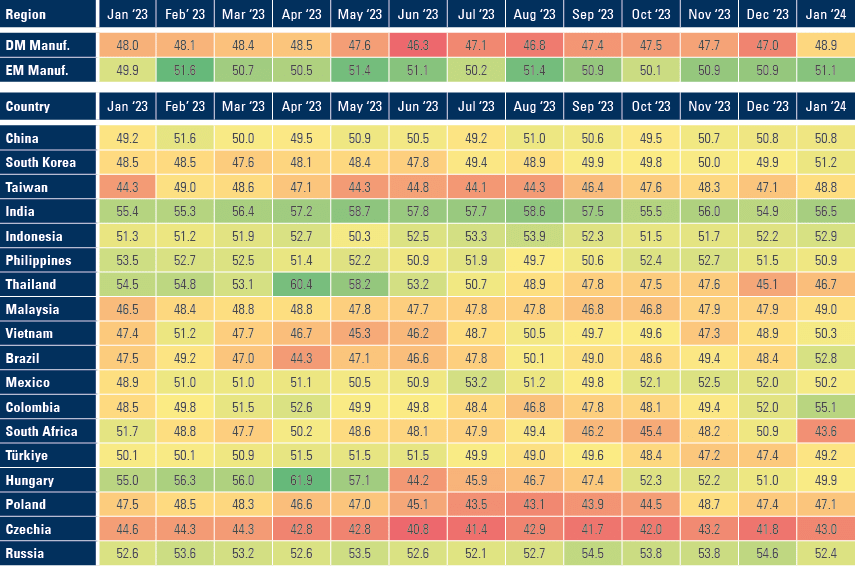

The Manufacturing PMIs recovered in January with Developed Markets (DM) up 1.9 points to 48.9 (-1.1 z-score) and EM inching 0.2 points higher to 51.1 (+0.5 z-score), as per Fig. 1.2 The US ISM Manufacturing rose by 2.0 to 49.1 and the new orders to inventory ratio moved to 1.14 from 1.07 previously. The increase in Taiwan and Korean exports from Q4 2023 and early 2024 data, as well as the increase in the new orders/inventory ratios, suggests further manufacturing strength over the coming months.

Within EM, the manufacturing PMI rose in 11 out of the 17 countries surveyed by S&P Global. The main increases were registered in Brazil, Colombia, and Türkiye (+4.4 to 52.8; +3.1 to 55.1 and +1.8 to 55.1, respectively). China’s PMI was unchanged at 50.8, holding the EM index down. The largest drops were observed in South Africa, Russia, and Mexico (-7.3 to 43.6; -2.2 to 52.4 and -1.8 to 50.2, respectively). The PMIs corroborate our expectation that EM ex-China will lead economic performance in 2024 as the Chinese economy slows down marginally.

Fig. 1: Manufacturing PMIs: DM, EM, and EM countries

January Performance

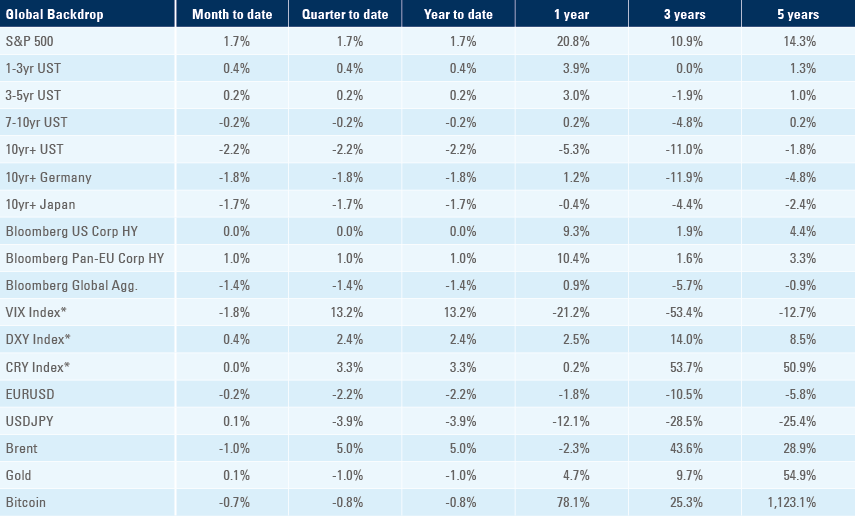

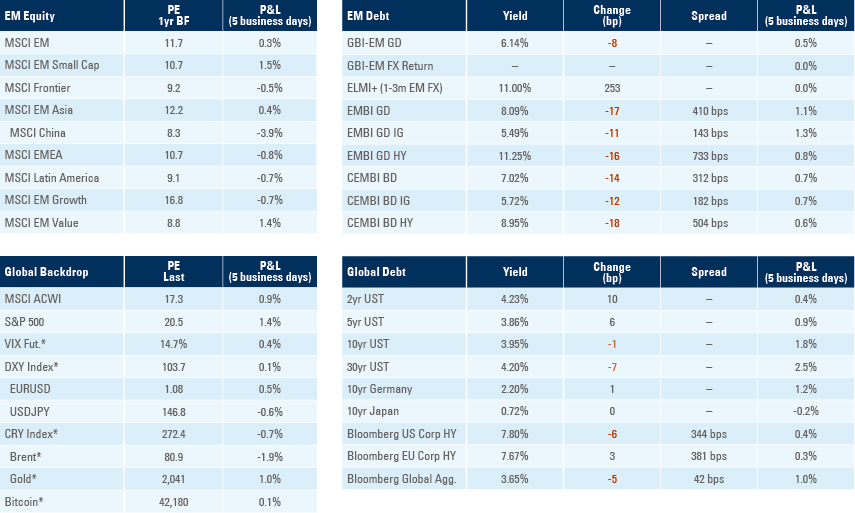

January saw consolidation of some of the gains made in December's rally across most asset classes. EM were poor due to mean reversion and US outperformance amidst a very narrow leadership. The NASDAQ and SP500 were up 5.5% and 3.5%, respectively. The S&P500 returns were driven by multiple expansions as earnings estimates declined marginally during the month. The dollar rose 1.9%, amidst robust employment, GDP data and inflows into US stocks. The yield on 10-year USTs increased by 4bps to 3.91%, but hit 4.20% on 19 January before rallying back on worries of regional banks.

The MSCI EM index returned -4.6%, primarily driven by continued weakness from China. The Hong Kong Hang Seng plunged 10%, despite a 5% relief rally towards month-end, after policy intervention measures were announced. Latin American equities declined 4.9%, paring gains after a strong rally in Q4 2023. The MSCI Frontier index was the one bright spot, rallying 1.0%.

Local currency bonds declined 1.4%, driven by a 2.1% drop in EM currencies. In external debt, investment grade (IG) underperformed, down 1.4% as the market pared back expectations for Fed Fund rate cuts over the course of the month, with high yield (HY) down 0.7%. EM corporate debt delivered marginally positive returns, driven by HY (+1.4%) as IG rose 0.1%. A recovery on some Chinese real estate names, less sensitivity to US rates, and robust demand for credit all proved supportive for the asset class. Oil rose 6.1% as the US intervened in Yemen, trying to normalise the Red Sea trade route.

Geopolitics

North Korea launched several missiles in January and adopted a more aggressive rhetoric with Kim Jong Un saying he has “no intention of avoiding” a war with South Korea. Reports suggested discontent over a train crash incident amidst an economic malaise and a reported shortage of basic goods.

The flows of ships navigating the Red Sea remained depressed despite the US launching two strikes on Houthi targets in Yemen, as it considered a response to a deadly attack on US forces in Jordan. Last week, two Maersk ships were attacked despite being convoyed by the US Navy.3 Supply chain disruptions and/or higher oil prices due to geopolitical risks could lead to an increase in inflation when all analysts expect Fed cuts as inflation remains low after a steep decline over the last year. A Ukrainian drone strike reportedly hit a pipeline at Russia’s fourth-largest oil refinery, owned by Lukoil, although Lukoil later said the refinery was operating normally.

There were reports that Israel sent a deal to the Hamas involving a 30 to 45-day ceasefire, which would include the releases of hostages. Hamas is expected to try to negotiate. There is some suggestion that both parties would like the ceasefire to coincide with Ramadan (11 March to 8 April).

Persistent geopolitical tensions and weakness in China’s economy drove demand for gold, according to a report from the World Gold Council. Despite the decline in global inflation, the prospect of lower Fed Fund rates, further central bank purchases, and ongoing geopolitical tensions are expected to keep the demand for the precious metal elevated in 2024.

Emerging Markets

EM Asia

China: This morning, China’s securities regulator said it will take steps to prevent risks stemming from share pledges, saying it would guide more medium and long-term funds into the market and crack down on illegal activities including “malicious short selling and insider trading”. Chinese equities remain under pressure partially for technical reasons. Retail investors in China and other countries purchased structured products that essentially sold put options on CSI 500 and CSI 1000 indices to enhance returns. Dealers who are long put options need to buy the indices to hedge their exposure to the underlying asset (delta) and are forced to sell in a down market. In our view, the risk is that the negative sentiment in the stock market feeds back to the economy, hence, regulators are likely to take a more proactive stance. The official manufacturing PMI rose from 49.0 to 49.2, while the non-manufacturing PMI rose from 50.4 to 50.7, in line with expectations.

India: India's fiscal deficit fell to INR 757bn (c. USD 9.1bn) in January, from INR 1,029bn (USD 12.4bn) the month prior, lower than the seasonally-adjusted deficit over the last 10 years. Narendra Modi's government presented the final budget for the 2025 fiscal year (1 April 2024 to 30 March 2025) before India heads into a general election between March and May. The FY 2025 fiscal deficit target was set at 5.1%, lower than market expectations of around 5.4% and the current year at 5.9%. Capex remains elevated at 3.4% of GDP, but growth is expected to slow from 28% to 17% yoy in FY 2024, and revenue growth is predicted to increase from 2.5% in FY 2024 to 3.2% in FY 2025. This consolidation is likely to help India's case for a higher sovereign credit rating in the coming months and improve the allure of the nation's bonds before they are included in global indexes in June.

South Korea: Exports rose 18% yoy in January from 5.1% in December, driven by strong exports to China, healthy automotive export growth (+24.0%), and a 56% increase in semiconductor exports yoy (+21.0% last month). Consumer price index (CPI) inflation ticked up 0.4% mom in January, as expected, with prices 2.8% higher yoy, from +3.2% in December. While this is the third straight month of cooling inflation, the central bank will likely need to see numbers closer to its 2.0% target before it considers reversing monetary policy.

Thailand: Thai exports rose 3.0% yoy in December, from 3.9% prior. Imports fell 1.7%, having risen 9.5% prior. The drop in imports tipped the trade balance into a USD 2.4bn surplus, following a USD 159m deficit in November.

Taiwan: Real GDP rose by a yoy rate of 5.1% in Q4 2023, from 2.3% in Q3 2023, 100bp above expected. This was the fastest quarterly growth rate recorded in two years, as global demand for semiconductors helped drive a healthy recovery.

Vietnam: CPI inflation rose 3.4% yoy in January, 20bps less than the month prior (3.3% est.). Imports rose 33.3% yoy, from +12.0% the prior month (vs. 30.5% est.), while exports rose 42.0% yoy, from 13.0%, (30.5% est.).

Latin America

Argentina: Government tax revenue increased from USD 5.9bn in December 2023 to USD 7.7bn in January.

Brazil: The central bank cut its policy rate by 50bps to 11.25%, in line with consensus. Producer price index (PPI) inflation rose just 0.1% mom, from 0.7% in December (0.3% consensus). This measure is weighted 60% towards producer prices, which fell 10bps on the month.

Chile: The central bank cut its policy rate by 100bps to 7.25%, in line with consensus. Chile remains the most aggressive central bank in Latin America as inflation plunged to 3.9% yoy in December 2023, from 14.1% in August 2022. The unemployment rate fell from 8.7% to 8.5 % in December, 10bps more than expected based on a three-month moving average. Copper production rose from 445k to 496k metric tonnes in December amid ongoing worries about lower output.

Colombia: The overnight lending rate was cut by 25bps to 12.75%, 25bps less than expected. While opting for a smaller rate cut, the post-meeting statements were dovish, as Governor Leonardo Villar acknowledged that two consecutive cuts were consistent with the onset of a longer-term easing cycle. The unemployment rate rose from 9% in November 2023 to 10% in December 2023, as the labour market continued to loosen.

Ecuador: Preliminary data for CPI inflation in January showed prices dropped by 0.4% mom (+3.3% yoy), in line with expectations, having increased 0.2% in December. The unemployment rate for December was unchanged at 6.4%, in line with consensus.

Central and Eastern Europe

Czechia: Real GDP growth rose by 0.2% qoq in Q4 2023, as expected, having contracted 0.6% qoq in the previous quarter. In yoy terms, real GDP contracted 0.2% in Q4 2023 from -0.8% in the third quarter of 2023.

Poland: Annual real GDP growth dropped to 0.2% in 2023, 30bps less than expected, and a significant decline from 5.3% recorded in 2022.

Hungary: The central bank cut rates by 75bps to 10.00%, 25bps less than expected.

Central Asia, Middle East, and Africa

Egypt: Egypt hiked its deposit and lending rates by 200bps to 21.25% and 22.25%, respectively. This, the first hike since August 2023, was not expected by most economists. The decision suggests Egypt is starting to follow the IMF’s prescription to tighten monetary and fiscal policies, as well as moving to a more flexible foreign exchange regime, before disbursing loans. Talks are underway in Cairo to increase its current USD 3bn IMF loan as part of a wider package that could exceed USD 10bn when including support from the World Bank.

Ghana: The Bank of Ghana cut its benchmark interest rate by 100bps to 29.0%. This was the first monetary policy rate cut by an African central bank so far this year and the first in Ghana since 2021, as the central bank looks to support the economy while the disinflationary process takes hold. Annual inflation softened to a 21-month low in December at 23.2%, from 26.4% a month prior.

Nigeria: Private sector credit rose 49.8% yoy in January, from 43.8% in December. Nevertheless, most of the expansion is explained by the local currency depreciation. As most of the consumer goods in Nigeria are imported, the large 49.4% depreciation in the Naira leads to higher working capital requirements in Naira terms. In Dollar terms, credit contracted by 25% yoy, reflecting how liquidity in the system, remains relatively tight.

Saudi Arabia: The Minister of Finance asked Saudi Aramco to keep oil capacity at 12m barrels of oil per day (bpd) until 2027, instead of increasing production to 13m bpd in the company’s previous strategic plan. The announcement led to a sell-off in global oil service companies, raising fears of ‘peak oil’. At the same time, Bloomberg reported Saudi Arabia is considering a follow-on share offering of Saudi Aramco, considering raising SAR 40bn (USD 10bn) as early as February.

South Africa: The trade surplus for December fell from ZAR 20.6bn to ZAR 14.0bn.

Türkiye: The resignation of the Central Bank of Türkiye’s Governor Hafize Gaye Erkan resulted in Deputy Governor Fatih Karahan taking her place. The incident raised fears of another U-turn in central bank monetary policy, like after the departure of Naci Ağbal in March 2021. However, Erkan seems to have departed for personal reasons. The new Governor has a strong background, with a PhD in Economics from the University of Pennsylvania and after working at the New York Fed for a decade. In other news, tourist arrivals were up 3.5% yoy in December 2023, following a 1.0% decline in November. CPI inflation rose to 6.7% mom in January (64.9% yoy) to 2.9% mom in December (64.8% yoy), slightly above consensus.

Developed Markets

United States: Initial jobless claims rose from 215k to 224k, faster than the +212k expected. While weekly claims are volatile, the four-week moving average increased to 208k, the highest since November 2023. As inflation slowly subsides, and economic data stays broadly strong, consumer confidence surveys have continued to rise. The Conference Board survey rose from 108 to 114.8 in January, in line with expectations. This suggests consumers’ ‘future expectations’ are now moving further away from a recession scenario.

Eurozone: GDP growth was stagnant in qoq terms at the end of 2023, having contracted -0.1% the quarter prior. In yoy terms, GDP growth rose a lacklustre 0.1%, in line with expectations.

Japan: The unemployment rate fell from 2.5% to 2.4% (no change was expected). The Bank of Japan will be watching the labour market closely, as it seeks evidence of a virtuous cycle of rising wages and demand-led price gains.

United Kingdom: UK mortgage approvals rose from 49.3k to 50.5k in January. A higher number was expected, but this nevertheless may indicate a turning point in the housing market, as lower interest rates began to invite more demand. House prices rose 0.7% mom, 60bps higher than expected. The Bank of England maintained its bank rate at 5.25%, as expected.

1. See – https://www.cbsnews.com/news/full-transcript-fed-chair-jerome-powell-60-minutes-interview-economy

2. See – Z-Score: Standard deviations around the mean since inception of the indices in 2012.

3. See – https://www.tradewindsnews.com/containers/maersk-ships-in-us-navy-convoy-forced-to-retreat-under-houthi-missile-attack/2-1-1588303

Benchmark performance