- Trump blinked first and delayed his “reciprocal” tariffs for 90 days, except for China.

- The dollar index moved to its lowest in six months, as the US 10y moved 50bps higher.

- Oil prices fell to levels not seen since COVID, with the curve shifting into contango.

- Volodymyr Zelenskyy said last Friday that Chinese soldiers were fighting in Ukraine.

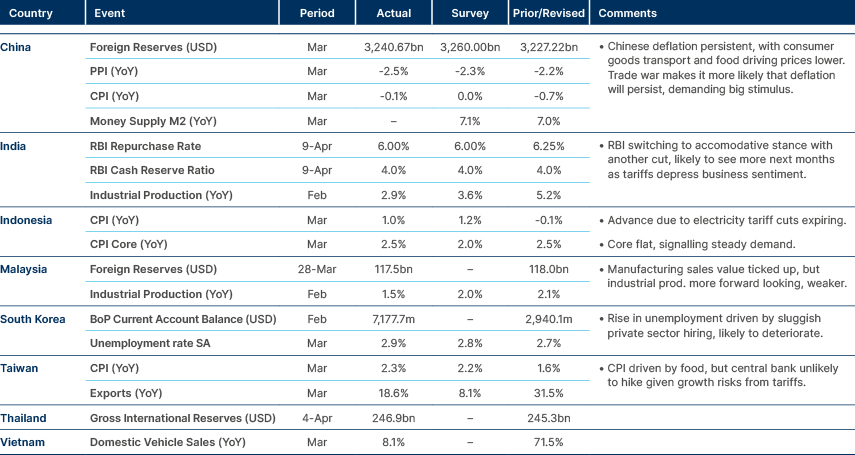

- India’s central bank cut rates and switched to an accommodative stance. Philippines also cut.

- The IMF announced a 48-month EFF programme for Argentina.

- President Noboa won the Ecuador election by a wide margin, leading to a strong bond rally.

- S&P and Fitch maintained Egypt’s B credit ratings, with a ‘stable’ outlook.

- The future of South Africa’s GNU remains uncertain.

- Türkiye’s Finance Minister highlighted economic resilience due to strong domestic demand.

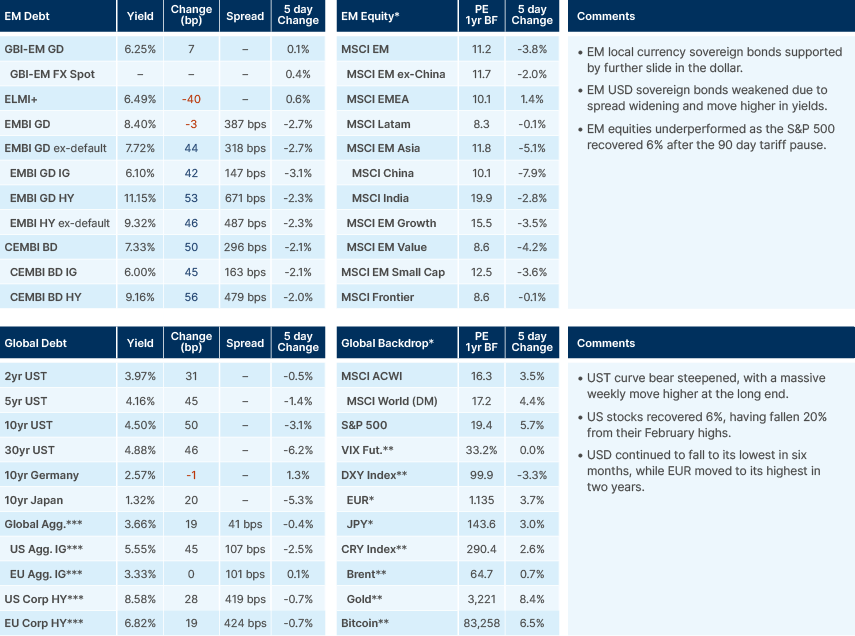

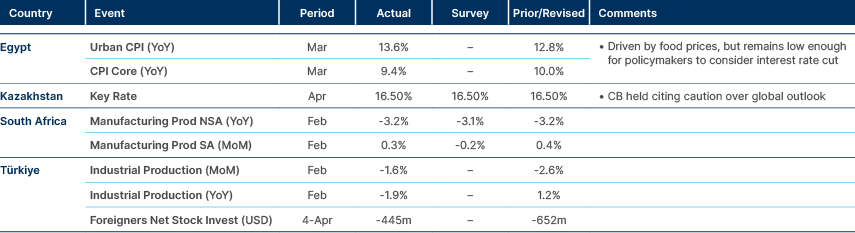

Last week performance and comments

Global Macro

In a three-way game of chicken between US President Donald Trump, US Federal Reserve (Fed) Chair Jerome Powell, and Chinese Premier Xi Jinping, Trump was first to blink, announcing a 90-day pause on “reciprocal” tariffs on the day of their implementation, to allow for more “negotiations.” Trump singled out China, however, raising the tariff against it to 145% given it had retaliated. Since then, there has been news that consumer electronics, including Chinese-made, would also be exempt from tariffs. This covers almost USD 390bn of US imports and more than USD 101bn from China, however, the move has been played down so far by Trump as a procedural step.

Trump’s U-turn was probably influenced by various factors, including the sharp sell off in the S&P 500, and a typically clear-headed interview from JPMorgan’s Jamie Dimon, who pointed to the strong likelihood of recession if the tariffs were not moderated. However, it seems the biggest pressure point for Trump was the total breakdown of correlation between US stocks and US Treasury (UST) yields. As US stocks plunged, the 10-year UST spiked aggressively in its biggest weekly move in over two decades, jumping over half a percentage point to around 4.5% between Monday and Wednesday. The economic consequences of these incredibly high tariffs began to make bond investors, as Trump rightly pointed out, “a little queasy”. We have consistently pointed out that inflation and bond vigilantes would be major constraints for Trump should he choose to go down a more extreme policy path. Trump won last November’s election on an anti-inflation mandate; he hates high yields as a leveraged-real estate mogul and is aware of the need for the US to roll over around USD 9trn of debt this year.

What was behind this unprecedented move in Treasury yields? Technical reasons were important, with many investors probably needing to raise cash via bonds to meet margin calls on risky assets, or to de-lever altogether. The unwind of very large ‘basis trades’ – Hold Treasury notes and then short interest rate futures contracts, taking advantage of the arbitrage – also caused meaningful selling pressure. But the macroeconomic reasoning behind higher yields and curve steepening, despite a greater recession risk, is also quite logical, given the inflationary impact of import taxes, the fact that budget deficits almost always widen in recessions and that the Fed is reluctant to act too soon.

The USD selling off despite the widening UST-Bunds yield differential is very significant and points to wider US asset liquidation. The trade-weighted dollar index has now fallen to a six-month low, while the euro has risen to its strongest level in three years. Emerging market foreign exchange (EMFX) is up 2% against the dollar year-to-date (YTD). Higher-yielding EM currencies have struggled in the risk-off environment, but as the weaker dollar trend continues to play out, we would expect the move lower in USD-EM currency pairs to broaden. Longer term, the simple dynamics of having a smaller current account deficit with the rest of the world typically suggests the capital account surplus is likely to also shrink, structurally reducing demand for dollar assets, primarily treasuries. Foreigners currently own 33% of the UST market, so this may play out for a long time. In Asia, the risk of some competitive devaluation against the RMB remains elevated while China/US trade war tensions persist.

Now we have a clearer idea of Trump’s pressure point, the next questions are: where is Xi Jinping’s, and where is the Fed’s? Game theorists are saying the best way to look at this current scenario, is ‘bullies in a schoolyard.’ If you are the bullied child, or his friend, the best way to play this game is to stand firm. In this scenario, everyone is hurt, but in the end the bully loses the most. Although simplistic, we think this is a reasonable framework, as the US turning heavily protectionist will be more damaging to its own economy than to others, unless it makes significant tariff concessions to bring the average tariff rate back under 15%. Xi Jinping’s put, in our view, is further away than Trump’s, given his relatively low concern for short-term popularity. A strong decline in consumer and business confidence would get his attention, however, given domestic demand and investment in China is already very soft, with the economy in deflation. The Fed has indicated a willingness to intervene if its threshold is reached. We think this will probably happen when something ‘breaks,’ for example, US investment grade spreads widening to 6.5% or higher, or the S&P 500 falling below 4800. This would be the level to begin to add to higher beta positions, should policy panic lead to a shorter, shallower downturn.

Commodities

Oil prices fell to levels not seen since COVID, down 12% since ‘Liberation Day’. The oil curve switched back to contango for the first time since COVID, a sign of significant oversupply in the short term. Markets are facing the twin threats of falling demand and supply hikes from OPEC producers.

Geopolitics

Ukraine President Volodymyr Zelenskyy said last Friday that Chinese soldiers were fighting in Ukraine. "We have information that at least several hundred Chinese nationals are fighting as part of Russia's occupation forces", Zelenskyy told military chiefs of allied countries in Brussels. "Russia is clearly trying to prolong the war – even by using Chinese lives," he added.

Emerging Markets

Asia

Philippines: The Monetary Board of the Philippines central bank (BSP) cut its target Reverse Repurchase (RRP) Rate by 25 basis points (bps) to 5.50%, citing improved inflation forecasts and downside risks to growth. Inflation projections for 2025 and 2026 were lowered to 2.3% and 3.3%, respectively. The BSP is shifting to a more accommodative stance, supported by manageable inflation and global economic challenges. Governor Eli Remolona indicated more 25bps cuts are expected in 2025, with the easing cycle likely concluding within the year.

South Korea: President Trump told reporters at the White House he plans to include defence cost-sharing as part of broader "package" of deals with individual countries. While he acknowledged that the issue is technically separate from trade, he argued it made sense to link them. He pointed to South Korea as an example of a country benefiting from US military protection without contributing enough financially. In 2019, during his previous term, Trump demanded South Korea increase its defence payments fivefold to USD 5bn annually, a proposal South Korea rejected. Trump left office in 2021 without finalising a new agreement. Joe Biden later signed two cost-sharing deals with South Korea, raising payments by 13.9% in 2021 and 8.3% in 2026. To avoid another dispute under Trump’s renewed presidency, a new deal was signed in late 2024, covering the years 2026 through 2030.

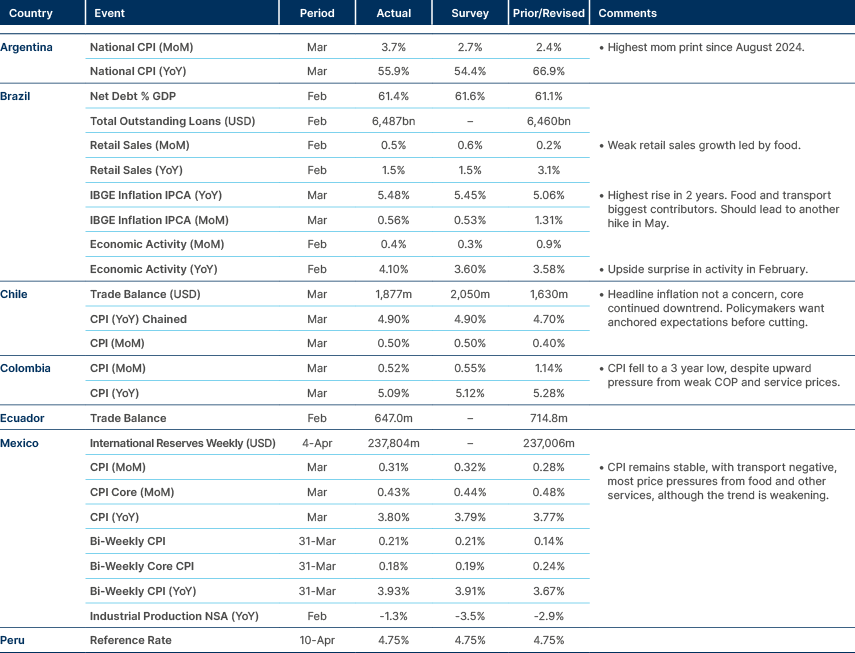

Latin America

Higher inflation in Argentina and Brazil, lower in Colombia, stable in Mexico.

Argentina: The International Monetary Fund (IMF) announced a 48-month programme for Argentina, totalling USD 20bn in disbursements. As part of the programme, most FX controls were lifted for new flows, and the exchange rate regime has advanced to wide currency bands. The government expects to secure USD 23bn in new FX financing in 2025, with the IMF accounting for USD 15bn of that amount. The IMF capital repayments will be spread over 10 years with a grace period of 4.5 years. Disbursements will be structured as follows: USD 12bn immediately, USD 2bn in 60 days, and USD 1bn by the end of 2025.

Additionally, the World Bank and the Inter-American Development Bank (IDB) have committed to multi-year financing plans totalling USD 12bn and USD 10bn, respectively. In 2025, disbursements from these institutions will amount to USD 6.1bn, broken down as USD 1.5bn now, USD 2.1bn in 60 days, and USD 2.5bn by year end. The FX regime is shifting from a fixed crawling peg to a floating band. This new band will initially range from 1,000 to 1,400, a range that falls between the official and parallel market exchange rates. The limits of this band will adjust by 1% month-on-month, with the ceiling increasing and the floor decreasing at the same rate.

Capital controls have been relaxed significantly. All FX market restrictions for individuals have been lifted, including the surtax on US dollar purchases. Individuals are now permitted to arbitrage between official and parallel rates, which is expected to narrow the gap between them. Goods imports can now be paid for upon customs registration, eliminating the previous 30-day waiting period. Capital imports can be paid with 30% in advance, 50% upon shipment, and 20% upon customs registration. Service imports can be paid from the start of service provision, as opposed to the previous 30-day delay. For service imports within related companies, payment is allowed 90 days after provision instead of 180 days. Juridical persons are now granted FX market access to settle financial obligations accrued from the start of 2025. They can also use the FX market to pay dividends to non-resident shareholders on balances accumulated from 1 January 2025. To address restrictions on FX stocks, the central bank (BCRA) will issue a new series of US dollar bonds, which companies can subscribe to using Argentine pesos. These bonds are likely to help firms cover FX obligations, including undistributed dividends and debt accrued before 2024.

Ecuador: Sitting President Daniel Noboa won the election in the run-off round, meaning he will serve a full four-year term. He has been in power since November 2023 after winning a snap election. The victory was decisive, with 56% of voters voting for Noboa. Noboa will continue his war on drugs policies, which have characterised his presidency thus far. Governing from a centre-right stance, Noboa is seen as market-friendly and likely to implement structural reforms to boost growth. Already he has pushed through unpopular but important measures such as raising VAT and phasing out gasoline subsidies, policies which allowed a $4billion deal with the IMF to be signed at the end of 2024.

Sovereign bonds jumped around 17 cents on the dollar on Monday, leading EM gains after the bonds had performed very poorly so far this year due to Noboa’s left-wing opponent Luisa Gonzalez rising in the polls. Noboa now has a strong mandate and can control congress, although may still struggle to boost economic growth in the short-term. The IMF forecasts Ecuador to grow 1.2% this year, the slowest in South America. The nation has struggled from dry spells recently, given it relies on hydroelectric power for 70% of electricity.

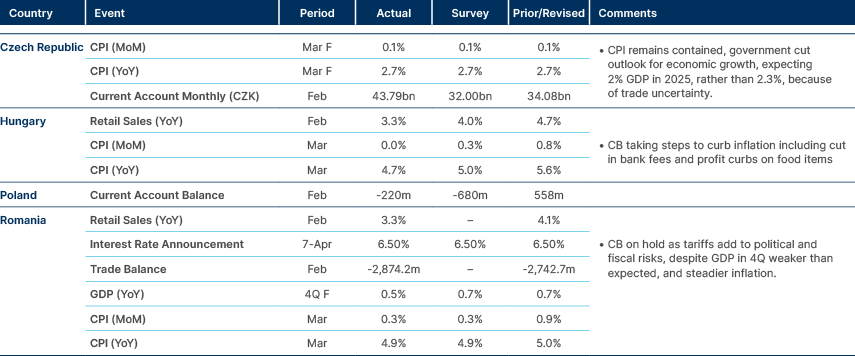

Central and Eastern Europe

Hungary takes measures to curb inflation.

Central Asia, Middle East, and Africa

Egypt’s core CPI below 10%.

Egypt: Fitch Ratings affirmed Egypt’s sovereign credit rating at 'B' with a stable outlook. Meanwhile, S&P Global Ratings affirmed its B-/B credit rating but revised Egypt’s outlook to stable. Egypt continues to carry one of the highest interest-to-government revenue burdens among sovereigns. Fuel prices have risen for the first time in 2025, as part of Egypt’s commitment to the IMF to reach cost-recovery pricing by the end of the year. Petrol prices increased by approximately 13% on average, while diesel prices rose more sharply by 15%, now priced at EGP 15.5 per litre (around USD 0.30). Liquefied petroleum gas (LPG) saw the largest increase, with prices jumping by 33%.

Among the fuel types, the increase in diesel prices is expected to have the most significant impact on consumer prices due to its widespread use across the country. These hikes are likely to exert upward pressure on inflation, alongside ongoing currency depreciation. However, Egyptian authorities have already made notable progress in reducing inflation.

South Africa: In South Africa, the Democratic Alliance (DA) has not yet decided whether it will remain part of the Government of National Unity (GNU). The African National Congress (ANC) insists the DA must justify its continued participation if it does not support the national budget. The uncertainty surrounding the DA’s position has already led to the indefinite cancellation of a scheduled cabinet meeting. DA Chair Helen Zille warned that removing DA ministers from their posts would signal the end of the GNU. However, the ANC maintains the GNU can continue even without the DA’s participation. While a political split remains possible, the DA is viewed as having more to lose by withdrawing from the coalition. Regardless of the outcome, the ongoing standoff has negatively affected business sentiment and could impede South Africa’s economic recovery.

Türkiye: The economy has shown resilience amid rising global protectionism, largely due to its reliance on domestic demand rather than exports, Finance Minister Mehmet Simsek said at the 4th Agriculture and Forestry Council. He noted that Turkish exports are concentrated in nearby and friendly regions, offering some protection from escalating trade barriers. Simsek downplayed the impact of recent market volatility and the lira’s depreciation following the detention of Istanbul Metropolitan Municipality Mayor Ekram Imamoglu, expecting only marginal inflationary effects in the short term and disinflationary support over the medium term. Inflation control remains the government's top priority, backed by disciplined fiscal policies and budget savings. While emphasising the need for economic rebalancing to avoid overheating, Simsek reaffirmed the government’s commitment to investing in housing, food, and renewable energy to drive growth and job creation. He also stressed the importance of adequate FX reserves and anticipated reduced energy import dependence through upcoming domestic energy projects.

Developed Markets

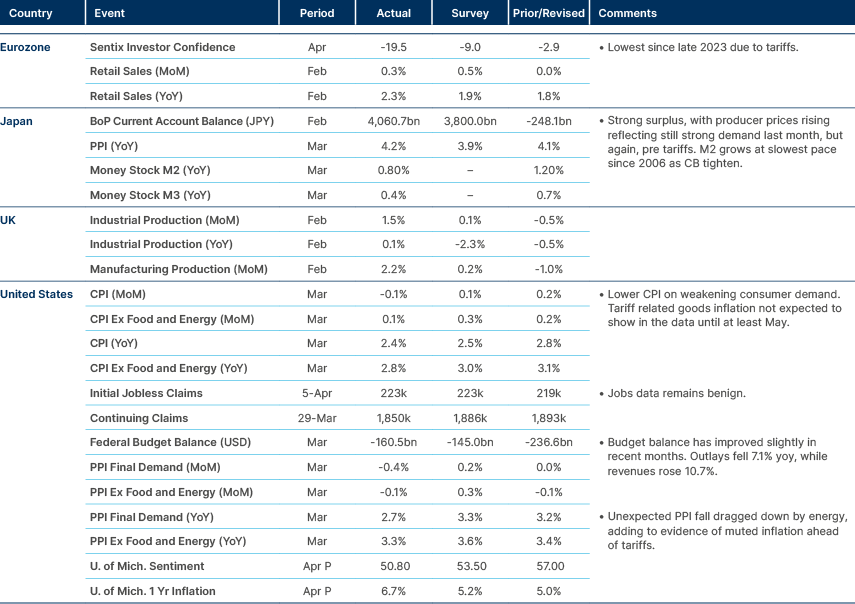

Weaker data in US remains as CPI points to weaker consumer spending.

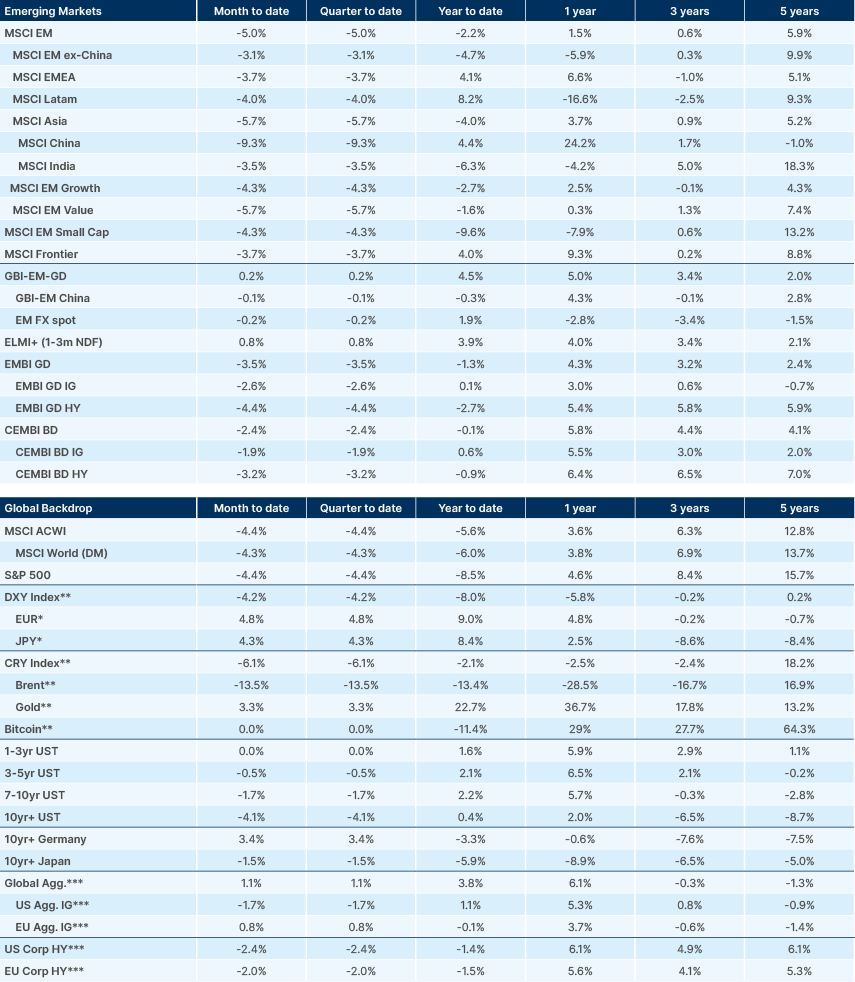

Benchmark Performance

Source and notations for all tables in this document:

Source: Bloomberg, JP Morgan, Barclays, Merrill Lynch, Chicago Board Options Exchange, Thomson Reuters, MSCI. Latest data available on publication date.

* Price only. Does not include carry. ** Global Indices from Bloomberg. Price to Earnings: 12m blended-forward

Index Definitions:

VIX Index = Chicago Board Options Exchange SPX Volatility Index. DXY Index = The Dollar Index. CRY Index = Thomson Reuters/CoreCommodity CRM Commodity Index.

Figures for more than one year are annualised other than in the case of currencies, commodities and the VIX, DXY and CRY which are shown as percentage change.