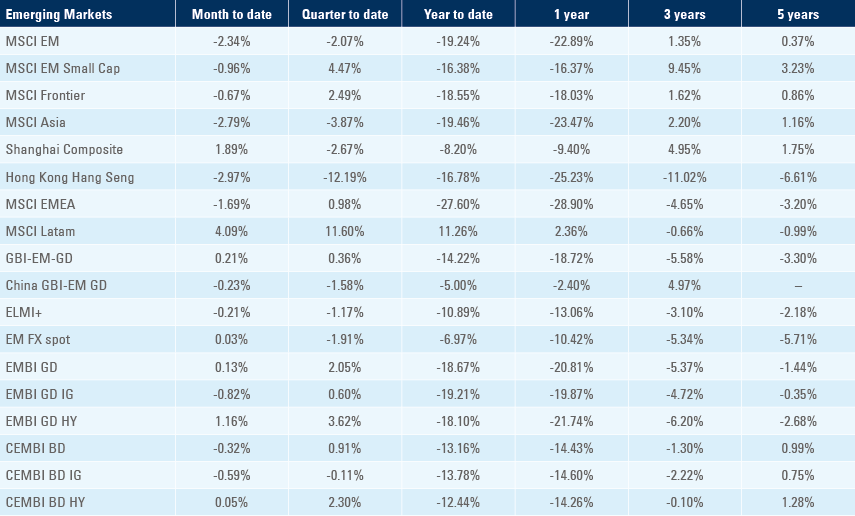

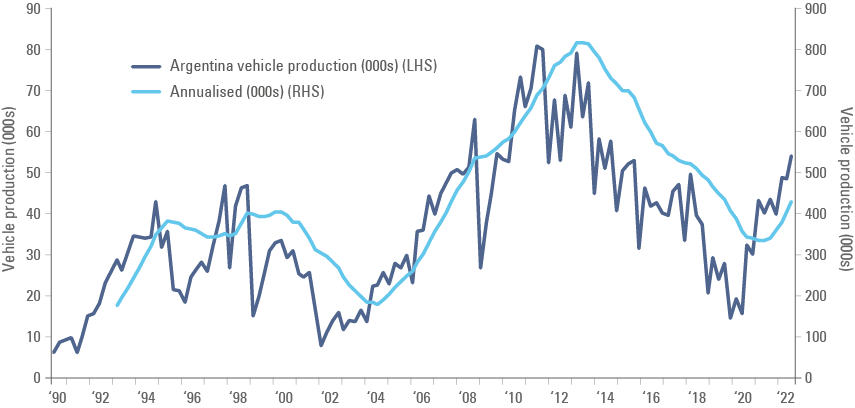

The Ukrainian army regained a large territory in the Northeast as the Russian army fled direct confrontation. Argentina’s exporters increased sales of soybeans. Car production improved in Mexico, Brazil, and Argentina. China aggregate financing was better than expected but inflation remained subdued due to weak economic activity. Chile hiked 100bps and Mexican economic data surprised to the upside.

Geopolitics

Ukraine undertook an impressive counterattack in the north, retaking the strategically important region of Kharkiv Oblast as the Russian army fled. The Russian army had thin lines of defence as it concentrated in gaining territory in the South. However, Ukraine is also counterattacking from the South, taking important territory around Kherson. Low Russian morale and countless mistakes by the army allowed for a re-equipped Ukrainian army to strike back. The map showing the progress made by the Ukrainian army since the 30 March shows the extent of the progress made by the Ukrainians.1

Military analysts are saying the recent developments suggests the Russian military is on the brink of collapsing. The presage for a Russian defeat could also be a fatal blow to the regime of Russian President Vladimir Putin, considering the fade faced by the Romanovs following the Russia defeat in the war against Japan in 1905. Whilst this is a plausible scenario, one must be cautious, particularly about the possibility of a collapse in the Russian regime. First it is worthwhile remembering that Russia lost the war to Japan 12-years before the revolution.

Not only is Russia on its backfoot, but there is a suggestion that Putin is unaware of the real situation. The leader of the Chechen military command Ramzan Kadyrov posted on telegram “Mistakes were made” and “If today or tomorrow changes are not made to the strategy of the special military operation, I will be forced to contact the leadership of the Defence Ministry and the leadership of the country and explain the real situation on the ground.” If Putin thinks he is losing the war, he will have two options:

- Escalate further using heavy artillery on civilian areas, or even weapons of mass destruction. Putin said Russia would use nuclear weapons if a threat to the country’s sovereignty is likely.

- Try to organise a hasty peace deal.

The first scenario would reduce the likelihood of a solution to the energy and food crisis before the winter and is likely to lead Western countries to increase the breadth and reach of sanctions on Russia. Russia would retaliate blocking grains exports from Ukraine. Commodity prices have been declining since May would accelerate, threatening the current disinflationary trend and increasing financial stability risks across the world.

The second scenario would lead to the opposite effect. A cease-fire and peace agreement would likely coincide with the normalisation of the flow of commodities from Ukraine and some improvement from Russia as well. Commodity prices could fall hard considering demand for commodities has been declining in 2022 due to elevated prices alongside the ongoing global economic slowdown.

Sadly, we consider the cease fire an unlikely scenario. Ukrainian President Volodymyr Zelensky remains committed to recover the entire Ukrainian territory, including Crimea, recently targeted by Ukrainian forces. After 200-days of war, a cease-fire giving Ukrainian territory would not be popular, both in Ukraine and abroad. It is hard to believe Russia is ready to allow Ukraine regain Crimea alongside its strategic military base on the Black Sea and a defeat in Donbass would be humiliating for Russia.

Last week the World Bank estimated the costs to rebuild Ukraine could reach USD 349bn. Whist this is a sizeable number for Ukraine itself, it is close to the USD 300bn of Russian foreign exchange (FX) reserves frozen by the US and Europe. There is a strong likelihood that the Russian FX reserves will be used to reconstruct a country they have destroyed themselves.

In other news, China’s President Xi Jinping confirmed his presence in the Shanghai Cooperation Organisation meeting in Samarkand, Uzbekistan from 14-16 Sept. It will be the Xi Jinping first trip abroad since the beginning of the covid-19 pandemic.2 Important Eurasian heads of state will be present in the forum, including Russia’s Putin, India’s Modi and Turkey’s Erdogan.

Emerging markets

Argentina: Argentina’s farmers are selling soybeans at a record pace after the economy minister Sergio Massa allowed them to sell USD at 200 Pesos, only 30% lower than the parallel FX rate at 282, and significantly above the official FX rate of 140. In total 3.66 million metric tons of soy were sold over the last week since the weaker exchange was in place, which is close to 1% of the total global production. Vehicle production and exports rose by 10k to 54k and 32k respectively in August, the highest level reaching the highest level of production since 2014 and the highest level of export since 2013. The last 12-months production rose to 429k units from 333k at the lowest level in June 2021 as per Figure 1. The yoy rate of industrial production slowed to 5.1% in July from 6.9% in June.

Figure 1: Argentina Vehicle production

China: Aggregate financing rose to RMB 2.43trn in August from RMB 0.76trn in July as new loans recovered to RMB 1.25tn from RMB 0.68trn over the same period, both converging to the average of the last 5-years over the same month. The yoy rate of CPI inflation dropped by 20bps to 2.5%, PPI inflation dropped 190bps to 2.3% and core CPI was unchanged at 0.8% in August, both significantly lower than consensus mostly due to lower gasoline and diesel prices. The trade surplus narrowed to USD 79.4bn in August from USD 101.3bn in July as the yoy rate of export and import growth slowed to 7.1% (from 18.0%) and 0.3% (from 2.3%) respectively.

Chile: The Central Bank of Chile hiked its policy rate by 100bps to 10.75%, 25bps more than consensus, as CPI inflation rose another 1.2% mom in August (1.0% consensus), bringing the yoy rate 100bps higher to 14.1%, albeit nominal wage growth slowed 20bps to 9.8% yoy in July. The trade balance moved to a USD 990m deficit in August from a USD 76m surplus in July as imports rose by USD 1bn to USD 8.8bn and exports were down USD 0.1bn to USD 7.8bn. In political news, President Gabriel Boric reshuffled his cabinet after the population rejected the constitution drafted by the Constitutional Assembly.

Mexico: A total of 157.4k formal jobs were created in August, up from 10.7k in July. Vehicle production rose to 317k units in August from 260k in July, now above the average production for the month over the last 10-years and exports increased by 39k to 249k over the same period. CPI and core CPI inflation rose by 0.7% mom and 0.8% respectively in August, bringing the yoy rates to 8.7% and 8.1%, both in line with consensus. The yoy rate of nominal wages dropped to 5.0% in August from 9.4% in July. Manufacturing and industrial production rose by a yoy rate of 5.1% (unchanged) and 2.6% (down from 3.7%) respectively.

Snippets

- Brazil: CPI inflation dropped 0.4% mom in August after -0.7% decline in July, allowing the yoy rate to decline by 140bps to 8.7%. Vehicle production rose 19k to 238k in August and exports increased 5k to 47k over the same period. The Services PMI declined 1.9 points to 53.9. The Independence Day saw peaceful pro-Bolsonaro demonstrations, adding a boost to the incumbent in the race.

- Colombia: CPI inflation rose 1.0% mom in August from 0.8% in July, 40bps above consensus, taking the yoy rate up 60bps to 10.8% as core CPI rose 0.8% mom taking the yoy rate to 7.8% over the same period.

- Czechia: CPI inflation rose 0.4% mom (half the consensus) taking the yoy rate down 30bps to 17.2%. The yoy rate of industrial output declined 1.9% in July after rising 2.7% yoy in June as construction output and retail sales ex-auto also declined in yoy terms in July. The average monthly wages dropped 9.8% yoy in real terms on Q2 2022 from -3.5% yoy on Q1 2022

- Egypt: CPI inflation rose 0.9% mom in August taking the yoy rate 100bps higher to 14.6%. Foreign exchange reserves were unchanged at USD 33.1bn in August, but currency and deposit declined by USD 2.6bn as official reserve assets rose by USD 2.9bn, suggesting outflows were compensated by Gulf countries deposits.

- Hungary: The yoy rate of retail sales dropped 20bps to 4.3% in July and industrial production rose 180bps to 6.6% over the same period. CPI inflation increased another 1.8% mom in August after 2.3% in July taking the yoy rate to 15.6%, the highest rate in 25-years. The trade deficit widened to EUR 1.15bn in July from EUR 0.41bn in June, the worst monthly result in 30-years.

- India: The Service PMI rose 1.7 points to 57.2.

- Malaysia: Bank Negara Malaysia hiked its policy rate by 25bps to 2.5%. The yoy rate of industrial production increased by 40bps to 12.5%

- Poland: The National Bank of Poland hiked its policy rate by 25bps to 6.75%, in line with consensus.

- Peru: The Central Bank of Peru hiked its policy rate by 25bps to 6.75%, less than the 50bps consensus.

- Philippines: The yoy rate of CPI inflation slowed 10bps to 6.3% in August. The trade deficit was unchanged at USD 5.9bn in July as both exports and imports declined.

- Romania: Both the qoq and yoy rates of GDP growth were unchanged at 2.1% and 5.3% respectively in Q2 2022 and retail sales rose 0.2% mom in July from -2.0% in June. CPI inflation rose 0.6% mom (0.3% consensus) taking the yoy rate to 15.3% (15.2% consensus) and 15.0% prior.

- South Africa: The current account moved to a USD 87bn deficit (1.3% of GDP) in Q2 2022 from a USD 157bn surplus (2.4% surplus) in Q1 2022 as imports of consumption goods and dividend remittances from South African companies increased.

- South Korea: The current account surplus narrowed to USD 1.1bn in July from USD 5.6bn in June as the trade balance moved to a USD 1.2bn deficit form a USD 3.6bn surplus over the same period.

- Taiwan: The yoy rate of CPI inflation declined to 2.7% in August from 3.4% in July as core CPI was unchanged at 2.7% and WPI declined to 11.5% from 13.1%. The trade surplus narrowed to USD 3.0bn in August from USD 5.0bn in July as both exports and imports declined sharply.

- Thailand: The yoy rate of CPI inflation rose by 30bps to 7.9% in August, but core CPI rose by only 20bps to 3.2% over the same period.

- Turkey: CPI inflation rose 1.5% mom in August after 2.5% in July, lifting the yoy rate by 80bps to 80.2% over the same period. PPI inflation rose by 2.4% mom from 5.2% mom in July as the yoy rate slowed 110bps to 143.8% (not a typo).

Developed markets

United States: The Federal Reserve Governor Jerome Powell’s remarks suggests he is inclined to hike the Fed Fund rates by another 75bps on its next meeting on 21 September, a message corroborated (or at least not refuted) by other members in the Federal Market Open Committee (FOMC) when speaking last week. In economic news, the trade deficit narrowed to USD 70.6bn in July from USD 80.9bn in June. Initial jobless claims declined to 222k in the week of 3 September from 228k in the previous week. The net worth of household and non-profit organisations declined by USD 6.1trn in Q2 2022 to USD 143.8trn (578% of GDP), a similar quarterly loss to Q1-2020, albeit total net worth remains USD 27trn (110% of GDP) above pre-pandemic levels. The decline in net worth was due to lower equity valuations as real estate assets still increased in price.

Europe: The European Central Bank (ECB) hiked its policy rates by 75bps, taking the deposit rate to 0.75%, the refinancing rate to 1.25% and the marginal lending rate to 1.5%, in line with consensus, but slightly more than priced by the overnight interest swap (OIS) market was pricing. Governor Christine Lagarde pledged to hike policy rates further and ECB board members did not rule out further 75bps increases. The more hawkish tone lifted 2-year OIS to 2.27% from 2.08% one week ago and -0.47% one year ago. In economic news, retail sales rose 0.3% mom in July after dropping 1.0% in June, but Q2 2022 final GDP was revised to 0.8% qoq (from 0.6%).

United Kingdom: It was a weekend of mourning for the Anglo-Saxon world. Queen Elizabeth II passed away after more than 70 years on the throne of England. Crowds travelled to London to pay tribute to the beloved Queen who oversaw the country during the mandate of fifteen prime ministers. The throne now belongs to King Charles III. The King plays a ceremonial role but is an important part of the mission of keeping coherence within the UK as well as protecting and projecting the country’s significant soft powers. In other news, Prime Minister Liz Truss announced energy bills for the typical household would be capped at GBP 2,500 per year for the next two years. The cost of implemented the cap as well as the support for small businesses and utility companies is estimated cost at GBP 150bn to GBP 200bn. The massive fiscal package is larger than the covid-19 furlough scheme and will add pressure on local rates and the Bank of England.

Australia: The Reserve Bank of Australia hiked its policy rate by 50bps to 2.35%, in line with consensus. GDP growth rose to 0.9% qoq in Q2 2022 from 0.7% qoq in Q1 2022, lifting the yoy rate by 30bps to 3.6%.

Canada: The Bank of Canada hiked its policy rate by 75bps to 3.25%, in line with consensus. The economy lost 39.7k jobs in August, against a consensus of 15k jobs increase lifting the unemployment rate by 40bps to 5.4%.