Taiwan: incumbent party wins election, but loses majority in Congress

Taiwan's Vice-President Lai Ching-te was elected President although the Democratic Progressive Party (DPP) lost its Congress majority. Houthi disruptions in the Red Sea caused a spike in shipping costs. Despite an upside US consumer price index (CPI) inflation surprise at the start of last week, lower producer price index (PPI) inflation readings on Friday pushed the odds of a 25 basis points (bps) rate cut in March to 80%, with two-year bonds dropping 25bps. China kept its one-year medium term policy rate unchanged. Thailand consumer confidence increased to the highest level in four-years. The International Monetary Fund (IMF) agreed a USD 4.7bn loan to Argentina. Ecuador was placed under a state of emergency for 60 days. Two members of parliament were arrested in Poland.

Global Macro

Geopolitics

Taiwan

The current Vice-President Lai Ching-te (DPP) was elected President of Taiwan, in line with expectations, with 40.1% of valid votes against 33.5% of Kuomintang’s (KMT) Hou Yu-ih, while Ko Wen-je (TPP) gathered 26.5% of votes – a solid challenge to the two-party system. Despite the convincing victory, the incumbent party lost its majority in Congress as the opposition KMT gained 14 seats and now has 52 votes (46%), or 54 (47.8%) when added to two posts won by independent parties tied to the KMT. The DPP lost 10 chairs and now has 51 (45.1%) and the challenger TPP gained three, holding eight in total (7.1%) giving them a strong position to shape future policies. The victory represents continuation of the regime most unfriendly to Beijing, but the opposition grabbing most seats in parliament increases the chances of more moderate policies getting approved. The TPP candidate view that a free trade and service sector policy with China should be pursued could motivate closer links with Beijing, which lowers the risk of an escalation in the Taiwan Strait. There were no escalatory remarks from either China or Taiwan over the weekend.

US and China Military Talks

Days before Taiwan's general election, United States (US) and Chinese military officials held their first formal talks since 2021, the Pentagon said. These 'Defence Policy Coordination Talks' were led by Michael Chase, Deputy Assistant Secretary of Defence for China policy, and Major General Song Yanchao, Deputy Director of China's Central Military Commission office. Chase stressed the importance of these communications “to prevent competition from veering into conflict”, raising concerns over China harassing Philippine vessels in the South China Sea.

Red Sea Conflict

The number of container ships at the mouth of the Red Sea declined 90% in the first week of January compared to the start of 2023. According to the IMF, shipping volumes in the Bab el-Mandeb Strait have fallen by more than 50% since the end of November. As a result, ships diverting to travel around the Cape of Good Hope, as opposed to going through the Suez Canal, were double that of December. Rerouting around Africa adds between two and three weeks to the journey to Northern Europe, driving up fuel prices for ship owners, as African ports where ships now must dock do not possess the infrastructure to handle such high volumes. Around 40% of European and Asian trade passes through the Suez Canal, so Europe will likely feel the impact of these disruptions most keenly. Container freight costs from Asia to Europe have already risen sharply.

In the second week of the year, conflict in the maritime zone intensified. On Tuesday evening, Houthi rebels launched their largest attack on ships so far, with the US and UK shooting down 18 drones, two anti-ship cruise missiles, and one ballistic missile. A day later, an oil tanker seized by the US for carrying illicit Iranian oil was recaptured by Iran. Oil prices in London rose as much as 2% on the news. On Wednesday night, in what North Atlantic Treaty Organisation (NATO) called a 'defensive' strike, UK and US fighter jets hit 16 Houthi targets within Yemen. UK Prime Minister Rishi Sunak called the strikes “limited, necessary, and proportionate”, purely intended to restore order in the Red Sea shipping lanes. However, some in the Arab world do not see it this way. Iran's Foreign Ministry released a statement these attacks were part of an effort “to extend the full support of the US and UK for the war crimes of the Zionist regime in Gaza”. Even President Erdogan of Türkiye condemned the strikes in incendiary fashion, saying the US/UK were “trying to turn the Red Sea into a sea of blood” and highlighting a “disproportionate use of force…like that of Israel in Gaza”. Necessary or not, direct conflict with the Houthis, a major Iranian ally draws the US and UK closer to confrontation in Iran.

Global Rates

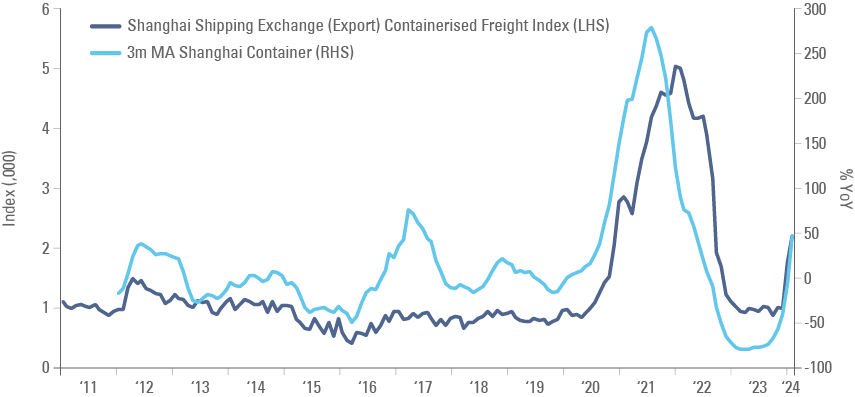

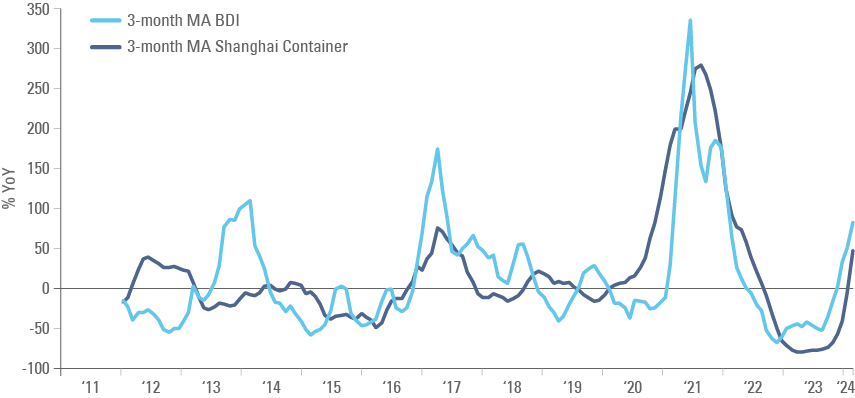

The US consumer price index (CPI) of inflation surprised to the upside, but lower medical, financial, and nonprofit service readings on the producer price index PPI kept the forecast for Core PCE inflation to decline below 3.0% in December. The odds of a 25bps policy rate cut in March rose to 80% as 2-year bonds dropped by 24bps to 4.14%, but the yield curve steepened as 10-year bonds declined 11bps to 3.94%. Nevertheless, higher shipping costs and a potential additional fiscal stimulus bill may add further inflationary pressures. The container freight costs from Shanghai surged 149% since September (114% year-on-year (yoy), a shock comparable to the 492% increase from April 2020 to December 2021 as per Fig 1. The problem is related to container ships avoiding the Red Sea routes only. The Baltic Dry Index, a more volatile index which measures costs of containers and bulk commodities declined to 1,460 points (pts) last week after reaching 2,937pts on 30 November 2023, but remains 49% above its low of 977pts in 31 May 2023. An IMF study suggests that a 22% increase in shipping rates lifts US CPI by 15bps.1

Fig 1: Shanghai (Export) Containerised Freight Index

Fig 2: Baltic Dry Index and Shanghai Container (%YoY of 3m Moving Average)

Bumper EM Debt Issuance

The first two weeks of 2024 saw record bond issuance from Emerging Market (EM) governments and corporates, in a rush to lock-in a recent drop in borrowing costs. Saudi Arabia has already funded nearly half of its forecasted fiscal deficit this year, with a bond sale drawing USD 30bn worth of demand. Mexico's UDS 7.5bn bond sale, its largest ever, drew USD 21bn worth of demand, demonstrating favourable investor sentiment for investment grade (IG) bonds with sound fundamentals. However, for lower-rated countries, the higher 'risk-free' rates being offered by the US, and bumper supply from IG debtors, will make market access at single-digit rates difficult. With this backdrop, it is likely that 'junk' rated countries with looming maturities, such as Kenya and Egypt, should continue to look to the IMF and development banks to refinance loans, rather than locking themselves into large new tranches of unsustainable interest payments.

Emerging Markets

EM Asia

China: The People’s Bank of China (PBOC) kept its one-year medium-term lending facility rate unchanged at 2.50%, against a consensus for a 10bps cut. Foreign reserves increased to USD 3,238bn in December, from USD 3,172bn prior. Consumer price deflation moderated to -0.3% in December, after -0.5% in November. PPI inflation contracted 2.7% yoy in December, in line with expectations. Exports increased 2.3% yoy in December, above consensus for a 1.5% rise. Imports rose 0.2% yoy, up from -0.6% in November, slightly better than consensus.

India: Industrial production slowed to 2.4% yoy in November (3.5% consensus), down from 11.6% yoy in October. CPI inflation ticked up to 5.7% yoy in December, from 5.6% prior.

Indonesia: Foreign reserves increased to USD 146bn in December, from USD 138bn prior.

Malaysia: Foreign reserves increased to USD 113.5bn in December, from USD 112.8bn prior.

Vietnam: Domestic vehicle sales rose 20% yoy in December, up from -15.2% yoy in November.

South Korea: The current account balance fell from USD 6.8bn in October to USD 4.1bn in November. The unemployment rate rose by 50bps to 3.3% in December (consensus 2.9%). The Bank of Korea kept its policy rate at 3.5% in January, in line with market expectations.

Taiwan: Exports rose 11.8% in December yoy, up from November’s 3.8%, above 5.6% consensus. Imports fell 6.5% yoy, up from -14.8% over the same period.

Thailand: The Consumer Confidence index rose 1.1pts to 62 in December. Consumers haven’t felt so positive in nearly four years, as increased tourism, and a controversial government digital wallet handout programme, boosted sentiment. The government plans to transfer 10k Baht (GBP 380) to 50 million people to spend within six months. Some say the Thai economy is not in such dire straits as to warrant such stimulus. Foreign reserves decreased slightly, by USD 2.0bn to USD 222.5bn as of 05 January.

Latin America

Argentina: The IMF reached a staff-level agreement to lend USD 4.7bn to Argentina. This allows President Milei and his cabinet to service upcoming debt payments, as they pursue major reforms. In a press release announcing the agreement, the IMF shared some amended programme targets, which includes a primary surplus of 2.0% in 2024, a build-up of reserves of around USD 10.0bn, and the elimination of monetary financing from the central bank to the Treasury. The IMF added that Milei's “ambitious stabilization plan” is expected to boost net foreign reserves to USD 10.0bn by the end of the year, with USD 2.7bn already accumulated in December. In economic news, industrial production fell by a yoy rate of 4.9% in November, down from -0.8% in October and below consensus -2.0%. CPI inflation surged to 25.5% month-on-month (mom) (211% yoy) in December from 12.8% prior (161% yoy), but came in below consensus at 30.0% (222% yoy).

Chile: The yoy rate of CPI inflation declined to 3.9% in December, from 4.8% in November (consensus 4.5%) as prices declined by 0.5% in mom terms (-0.1% consensus) down from +0.7% in November. The trade surplus rose by 0.4bn to USD 1.7bn in December as copper exports increased by USD 0.2bn to USD 4.2bn.

Brazil: The yoy rate of CPI inflation declined by 10bps to 4.6% yoy in December, falling within the 3.25% +/- 1.5% target band for 2023. The inflation target will decline to 3.0% +/- 1.5% in 2024. Inflation rose in sequential terms to 0.6% mom from 0.3% mom in November, led by food prices as the three-month moving average of core CPI declined to 3.3% yoy in December from 3.5% yoy in November. Analysts expect the Selic rate to decline from the current 11.75% to 9.25% at the end of 2024 (7.0% to 10.0% range). The key factor determining the year-end rate will be the evolution of the fiscal deficits.

Colombia: CPI inflation rose 9.3% in December yoy, 15bps lower than consensus from 10.2% in November as prices were unchanged in sequential terms at 0.5% mom, 10bps below expected. The consumer confidence index rose from -20.9 to -17.3 in December.

Ecuador: A 60-day state of emergency was declared in Ecuador , as one of the country's most notorious drug bosses escaped from a facility in Guayaquil. During this period, the military will be entitled to enter prisons, as President Noboa cracks down on gangs who have “infiltrated” the prison system. On Wednesday, Noboa said the US ambassador had offered an “assistance package” to help contain the terror campaign by drug traffickers.

Mexico: The yoy rate of CPI inflation rose by 40bps to 4.7% in December, 10bps higher than consensus, while core CPI declined by 20bps to 5.1% yoy over the same period. Industrial production declined to a yoy rate of 2.8% in November from 5.6% in October, 200bps below consensus.

Peru: The central bank cut its policy rate by 25bp to 6.5%, in line with consensus.

Central and Eastern Europe

Czechia: The yoy rate of CPI inflation fell by 40bps to 6.9%, (consensus 7.3%) in December as prices dropped 0.4% in mom terms after +0.1% in November. The current account surplus rose to EUR 1.8bn in November, the best monthly result on record.

Hungary: Industrial production declined by a yoy rate of 5.6% in November, from -2.8% in October. The budget deficit reached EUR 4.6bn, from 4.1bn in November. The yoy rate of CPI inflation plunged to 5.5% in December, from 7.9% prior (5.9% consensus).

Poland: The arrest of two MPs from the Law and Justice Party (PiS) last week highlights the polarisation in Polish politics amidst the power struggle between President Andrzej Duda aligned with the conservative PiS party, and the liberal coalition led by Prime Minister Donald Tusk. Police entered the country's presidential palace on Tuesday, where the pair were hiding under the protection of Duda, after being sentenced for abuse of power. The event lead to increased speculation that President Duda, who has legislative veto power, may try to block the government's budget as a reason to call snap elections, giving the PiS a chance to re-gain the majority in Congress. However, the extremity of this move makes the outcome unlikely. A more realistic scenario is the government operates on its draft budget throughout the year. The central bank kept its policy rate unchanged in January, at 5.75%. The current account surplus declined to EUR 1.3bn in November from EUR 2.1bn as the trade surplus decreased to EUR 230m, from EUR 1.3bn in October.

Romania: Retail sales In November rose 3.3% yoy, up from 1.7% in October. The trade deficit for November decreased from RON 2.8bn to RON 2.4bn. CPI inflation slowed slightly to 6.6% yoy in December, down from 6.7% the month before.

Russia: Gold and foreign exchange (FX) reserves increased slightly, from USD 593bn to USD 598bn.

Ukraine: The yoy rate of CPI inflation was unchanged at 5.1% yoy in December, 10bps faster than expected. UK Prime Minister Rishi Sunak met President Volodymyr Zelensky in Kyiv, signing a new agreement supporting Ukraine's long-term security. Officials said the package will provide Ukraine with long-range missiles, air defence and artillery shells, with some GBP 200m spent on drones.2

Central Asia, Middle East, and Africa

Egypt: Urban CPI inflation slowed to 33.7% yoy in December, from 34.6% in November.

Saudi Arabia: The yoy rate of industrial production decreased by 11.2% in November, from -12.3% prior. Aramco sharply lowered its crude selling prices to all regions in February. Following the price cut, Arab Light imported to the Mediterranean will only cost 40 cents more per barrel than ICE Brent, while the premium for Northwest Europe is at an 11-month low.

South Africa: Net reserves increased in December, from USD 56.3bn to USD 56.9bn. The manufacturing purchasing managers’ index (PMI) in December rose from 48.2pts to 50.9pts. Manufacturing production grew 1.9% yoy in November, a 20bps decline from November yoy growth, but a 40bps better than consensus. Manufacturing production growth turned positive, increasing 0.8% mom in November after -0.2% mom in October.

Türkiye: The unemployment rate rose to 9.0% in December, from 8.6% prior. Industrial production growth slowed to 0.2% in yoy terms in November, from 1.3% in October. The current account moved to a USD 2.7bn deficit in November, after a small surplus in October.

Developed Markets

United States: US CPI inflation data tempered expectations that the US Federal Reserve (Fed) will cut rates in March, ticking up 30bps to 3.4% in December, from 3.1% the month before, a 20bps beat on consensus. In mom terms, prices increased 0.3%, up from 0.1% in November, a 10bps upside surprise. While core CPI inflation cooled slightly less than expected, it nonetheless edged lower to 3.9%, from 4.0% in November. The mom core rate, a key measure of underlying inflationary pressures, remained unchanged at 0.3%. Due to the frequent noise in headline inflation numbers from food, energy, and supply chain disruptions, Fed Chair Jerome Powell and other policymakers have repeatedly highlighted the core figure as a key focus. The weekly jobless claims data was also hot at 202k (210k consensus), but the market reaction was muted. Two-year US Treasury yields settled at just 4bps higher than before the CPI print, and S&P 500 futures moved just 20bps lower. Still, with core inflation nearly double the Fed's target rate, the current odds-on probability of a March cut will likely begin to be priced out if the January CPI reading surprises to the upside once more.

Friday's data release showed that PPI inflation declined for a third month in a row. Prices paid to producers for goods decreased 0.4% in December, with nearly 60% of that reflecting cheaper energy. However, due to the ongoing disruptions in the Red Sea shipping channels, there are no assurances that this trend will continue. Stripping out food and energy, prices rose 0.2% in December, in line with expectations. The lower PPI led several banks to revise their core PCE December preview, with former Fed inflation analyst (UBS’ Alan Detmeister) revising his projection to 0.2% mom and 2.9% yoy in December due to lower wholesale prices for medical services, financial services, and non-profit services.

In other news, the fiscal deficit increased significantly more than expected, reaching USD 129bn in December, from USD 85bn in November, bringing the 2023 fiscal deficit to 6.5% of gross domestic product (GDP) up from 5.4% in December 2022 and 4.2% in June 2022. Consumer credit surged to USD 23.7bn in November, up from USD 5.8bn prior, significantly higher than consensus at USD 8.5bn, but remaining at lower levels than 2022. The trade deficit for November was unchanged at USD 63.0bn, in line with expectations.

Eurozone: Early in the week, European Central Bank (ECB) governing council member Mario Centeno hinted at the possibility of a first interest rate cut as early as March or April. In an interview to Econostream Media, the Bank of Portugal Governor remarked: “I don’t think we have to wait until May to make decisions. I don’t see any sign that second-round effects on wages have materialized or will materialize or that wages will put additional pressure on prices”. The comment did not materially move yields. Later in the week, ECB Vice-President Luis de Guindos warned that a recent pick-up in inflation is expected to persist in the coming months. He also added that soft indicators pointed to an economic contraction in December, confirming “the possibility of a technical recession in the second half of 2024 and weak prospects or the near-term”.

Japan: Tokyo CPI inflation slowed to a yoy rate of 2.4% in December, from 2.7% yoy in November, (+2.5% consensus). The current account balance fell from JPY 2.5tn in October to JPY 1.9tn in November (JPY 2.43tn expected).

United Kingdom: Rishi Sunak moved to hold two UK parliamentary by-elections in mid-February. Sunak has lost four Conservative seats in by-elections since becoming Prime Minister in October 2022. By triggering the votes quickly, Sunak will presumably hope possible Tory defeats can be quickly forgotten by the electorate, before Jeremy Hunt's Budget on 06 March, which will likely be a key pre-election event.

1. See – https://www.imf.org/-/media/Files/Publications/WP/2022/English/wpiea2022061-print-pdf.ashx

2. See – https://neo.ubs.com/shared/d23XwGrXkdSxgYI

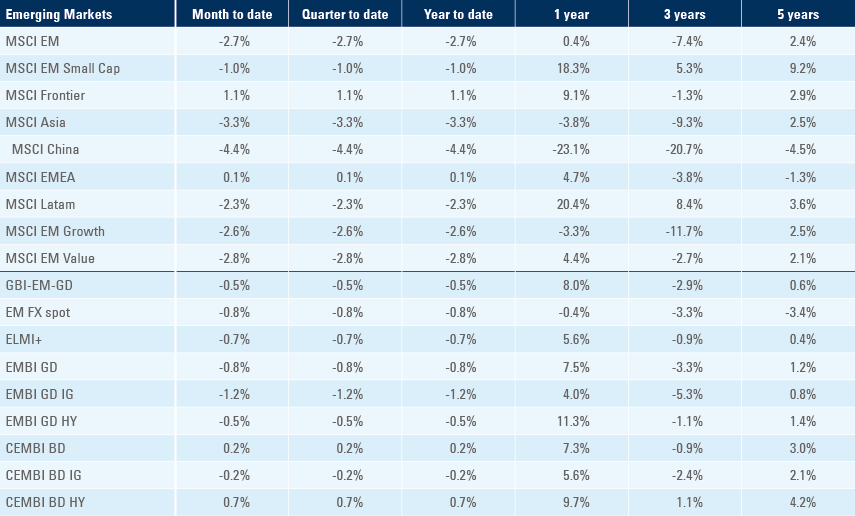

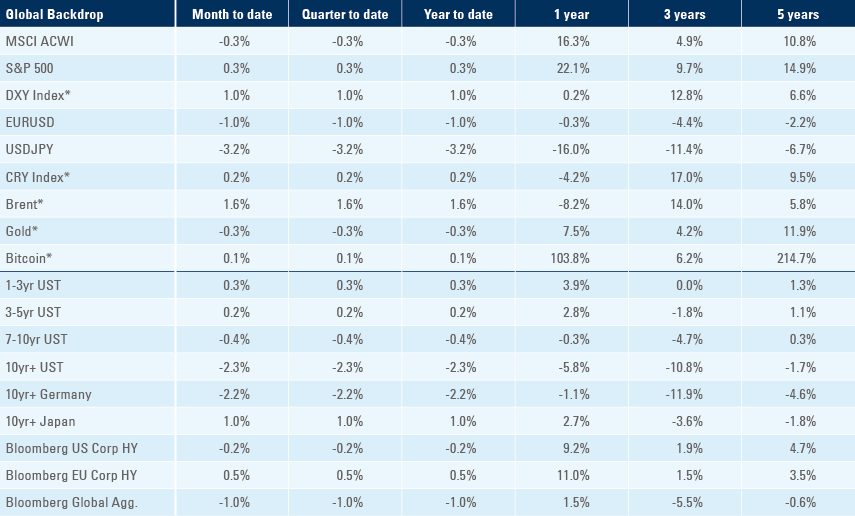

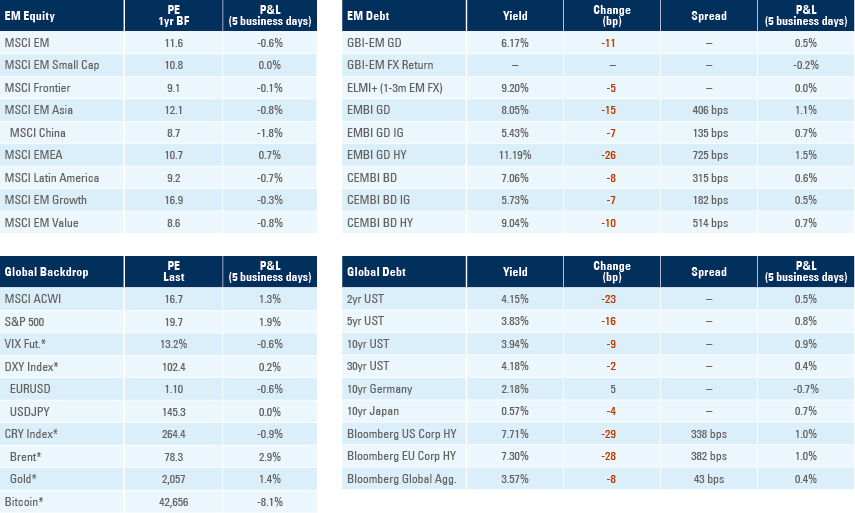

Benchmark performance