Positioning driving price action ahead of Trump’s inauguration

- EM assets performed well post benign US core CPI data

- US Treasury appointee Bessent pledged fiscal rectitude via expenditure cuts and marginal revenues via tariffs

- Trump held a cordial call with Xi Jinping prior to inauguration. Ceasefire in Gaza agreed

- Indonesia cut policy rates by 25bps, South Korea kept rates unchanged

- TSMC announced record profits and capex

- Argentina to lower pace of FX depreciation after achieving first surplus in 14 years

- Türkiye macro turnaround story remains intact.

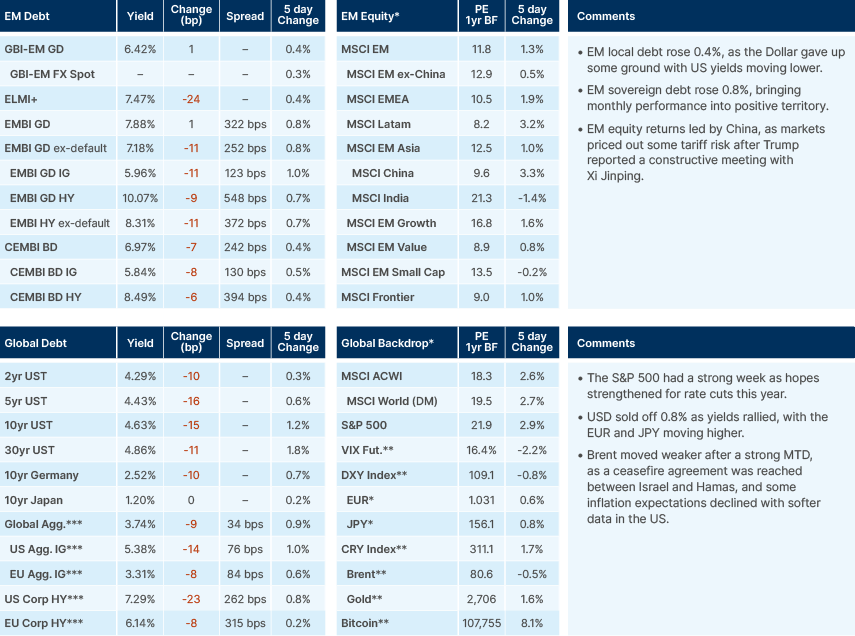

Last week performance and comments

Global Macro

A 10 basis points (bps) downside surprise in US core consumer price index (CPI) inflation led to a significant reversal of the bond and equity markets sell-off from the prior two weeks. Core CPI inflation declined to 0.2%, with 0.3% expected. Federal Reserve (Fed) Governor Christopher Waller suggested the potential for multiple rate cuts in 2025 remains if inflation continues to ease as he expects. The overnight interest swap market repriced a 50% chance of a second 25bps cut in 2025, having completely priced this out before the lower inflation reading. The large moves on rates on small fundamental changes shows how investor positioning matters for short term price action.

A day before Scott Bessent’s hearing for the Treasury Secretary position, Janet Yellen warned that extending Donald Trump’s 2017 Tax Cuts and Jobs Act (TCJA) could roil markets and worsen an already challenging US fiscal outlook. However, Bessent pledged fiscal rectitude, even with the tax cuts fully renewed. In his view, the US doesn’t have a revenues problem with revenues-to-gross domestic product (GDP) at 17.5% of GDP, which is close to historical levels. It is expenditures that are elevated and must be curtailed. Bessent also said tariffs, if gradually implemented, can be a source of additional revenues, without being inflationary. This is only possible on targeted and sensible tariff rates, in our view.

Both Trump, in his first administration, and Joe Biden ran a primary deficit of 5% of GDP per year versus Barack Obama’s 4.4%. Ex-pandemic and crisis years, the primary deficit rose progressively in the last three administrations on average (Obama 1.8%, Trump 2.4%, Biden 3.3%). The path of deficits is favourable considering the primary deficit already improved in 2024 to 2.9% from 3.7% in 2023. Therefore, a small consolidation, potentially coming from tariffs (higher revenues), trimming the Inflation Reduction Act (IRA), growth buoyancy, and efficiency (aka DOGE) may allow the Fed to cut rates, lowering the US interest burden.

This week, global assets will oscillate according to President Trump’s first measures following his inauguration today, when US markets are closed. Market participants remain sanguine in assets that should benefit from Trump’s deregulation – like crypto – but have also been adding exposure to US companies that are sensitive to tariffs. We remain of the view that a positive path for US assets depends on the announcement and implementation of thoughtful policies – a narrow path considering the willingness of the administration to fully renew the TCJA.

Geopolitics

US/China

Trump and Xi Jinping held a call on Friday. Trump posted on social media that it was a very constructive conversation, which may set the tone for relations in the early days of the new administration. They discussed trade, TikTok and fentanyl, according to Trump. TikTok started restoring its US service after Trump said he would temporarily halt the Supreme Court enforcement of the ban.

Israel/Hamas

Israel agreed on a six-week ceasefire with Hamas. Hamas agreed to release 33 hostages and Israel is to release 1,000 Palestinian prisoners and withdraw from populated areas.

Russia/Ukraine

The Trump team is reportedly considering two main approaches to negotiating with Russia. One set of policy recommendations, assuming the incoming administration believes a resolution to the Ukraine war is within reach, involves offering good-faith measures to benefit sanctioned Russian oil producers. This could help in securing a peace deal, according to anonymous sources familiar with the discussions. Alternatively, the administration could build on the existing sanctions, further ramping up pressure to increase leverage. Trump aides are also pushing for Ukraine to lower its conscription age from 26 to 18 ahead of ceasefire negotiations, which are expected to begin after Trump’s inauguration.

Commodities

Chinese crude oil imports fell 2% to 553m tons in 2024, the third decline of the decade, due to the country’s energy transition and weaker domestic demand. Outside of the 2021 and 2022 pandemic years, this is the first recorded decline for a country that has driven nearly 50% of global oil demand growth since 2000.

Trump is set to declare a “national energy emergency” to unlock new executive powers as part of his plan to “drill baby drill”, build more fossil fuel power plants and reverse Biden’s actions to combat climate change, which have included recently banning further offshore oil exploration across the entire Atlantic coast and eastern Gulf of Mexico, as well as the Pacific coast of California Oregon, Washington and some Alaskan waters.

Emerging Markets

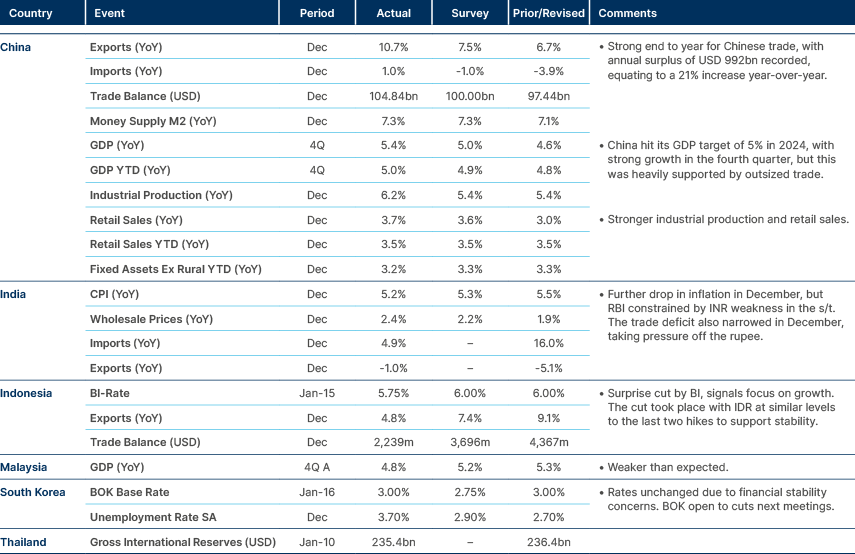

Asia

Stronger data in China. Bank Indonesia surprise cut, Bank of Korea (BOK) rates unchanged. India CPI lower, but INR weaker.

Indonesia

Bank Indonesia’s 25bps cut came as a surprise, with unanimous expectations for another hold, given the central bank hiked policy rates twice since Q4 2023 to support IDR financial stability concerns. The rupiah lost nearly 2% against the dollar in the past month, despite consistent central bank intervention. After the cut, the rupiah depreciated 0.4%, but Indonesian stocks rose 1.4%. Governor Perry Warjiyo said: “we have changed our stance, which is pro-stability and growth”.

South Korea

The BOK held policy rates against consensus for a cut due to KRW volatility. All six members stand ready to cut again over the next three months, depending on conditions.

Taiwan

Taiwan Semiconductor Manufacturing Corporation (TSMC) net profit rose 57% to TWD 375bn, ahead of TWD 371bn consensus forecasts. TSMC sees Q1-25 sales between USD 25bn and USD 25.8bn; ahead of consensus at USD 24.4bn. Capital expenditure is to increase to USD 38-42bn against an estimate of USD 35.2bn. Most of this capex will remain in Taiwan, where TSMC maintains all of its manufacturing capacity for the most advanced chips.

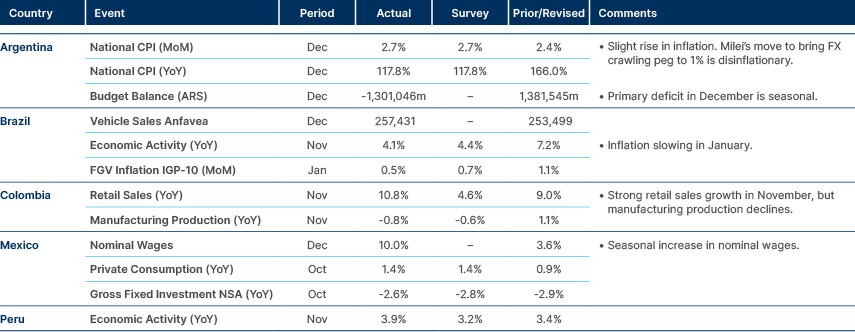

Latin America

Milei moving to a tighter ARS crawling peg

Argentina

From February, the central bank will slow the peso’s crawling peg to 1% per month from 2% currently. The crawling peg acts effectively as a floor to inflation in tradeable goods. With the peso now depreciating more slowly, inflation is likely to fall even further. Some economists criticised the measure, worried that the currency is already overvalued with large outflows to tourism in December as a justification. In our view, this is narrow minded. If you go to Buenos Aires in December, you’ll see locals ‘never’ spend their holidays there and the devaluation of the BRL made it cheap for Argentinians to travel to Brazil for the first time in decades. The current account is likely to remain in surplus overall and the currency stability will support investments. The main concern about the currency was the possibility of the International Monetary Fund (IMF) requiring a large devaluation to increase its loans to Argentina. However, local newspaper La Nacion reported the IMF Chair Kristalina Georgieva met Javier Milei at Davos, and reported her intention to work “quickly” to close a new programme. This statement came after the Central Bank of Argentina narrowed its crawling peg and there was no mention of foreign exchange (FX) policy in the statement.

Brazil

Vehicle production rose by 9.7% in 2024 to 2.5m units, reclaiming Brazil’s spot as the world’s eighth-largest manufacturer, surpassing Spain, according to the Brazilian Association of Automotive Vehicle Manufacturers (ANFAVEA). Domestic vehicle sales reached 2.63m, making Brazil the sixth-largest global market. Sports utility vehicles (SUVs) led sales with a 19.4% increase, while pickups and trucks also saw double-digit growth. This shows the strength of the economy was partially related to wealth effects from higher commodity prices and agriculture and energy production levels.

However, vehicle financing fell to 44% of the market despite increased credit issuance. Exports declined 1.3% to 398,500 units, with revenue slightly down at USD 10.9bn, offset partially by demand from Argentina. Employment in the automotive sector grew 8.3% to 107,000, the largest increase since 2007.

Colombia

President Gustavo Petro appointed Laura Moisa and Cesar Giraldo, two academics, as monetary policy committee directors to the central bank. Local investors are worried about the government’s influence on the constitutionally independent monetary authority now that most directors were appointed by the current administration. Finance Minister Diego Guevara, who voted for deeper cuts in the previous monetary policy committee, formerly said that the new appointees would have profiles that align with the government’s vision.

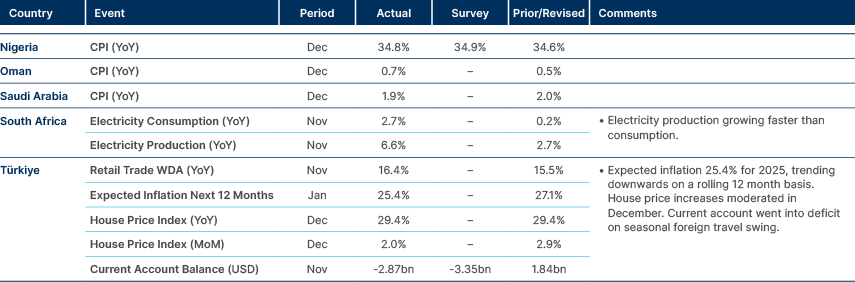

Central Asia, Middle East, and Africa

Lebanon

Nawaf Salam, President of the International Court of Justice, was elected as Prime Minister. Two-thirds of the 128 members of parliament voted for Salam. His appointment dealt another blow to Hezbollah, which ended up nominating no candidate for the position. The full cabinet is set to be announced by the end of this week.

Türkiye

Consensus expectations for inflation 12-months ahead declined to 25.4% in January from 27.1% in December. Consensus remains slightly above the centre of the target of 21% in 2025. Still, this leaves ex-ante one-year real interest rates at close to 15%, the highest level across emerging and frontier markets. The elevated real interest rates explain why the central bank has room to cut policy rates without de-anchoring the TRY. In fact, after losing some USD 2bn of FX reserves in December due to seasonal outflows, the central bank has accumulated close to USD 4bn in the first two weeks of January. The current account deficit improved from USD 40bn in 2023 to USD 7bn in 2024, reflecting tight monetary policy. The main issue in the current account remains the c. USD 20bn outflows from errors and omissions, largely due to purchase of gold and cryptocurrencies, as capital controls proves ineffective. Nevertheless, we agree with the central bank that a more stable TRY and positive real interest rates at sustainable levels will keep capital outflows constrained overall.

Developed Markets

United States

The largest US banks have reported very good Q4 earnings and have given positive guidance due to the anticipation of deregulation under Trump.

Benchmark performance

Source and notations for all tables in this document:

Source: Bloomberg, JP Morgan, Barclays, Merrill Lynch, Chicago Board Options Exchange, Thomson Reuters, MSCI. Latest data available on publication date.

* Price only. Does not include carry. ** Global Indices from Bloomberg. Price to Earnings: 12m blended-forward

Index Definitions:

VIX Index = Chicago Board Options Exchange SPX Volatility Index. DXY Index = The Dollar Index. CRY Index = Thomson Reuters/CoreCommodity CRM Commodity Index.

Figures for more than one year are annualised other than in the case of currencies, commodities and the VIX, DXY and CRY which are shown as percentage change.