The new regime: equities up, Dollar down; equities down, Dollar down.

- The US Court of International Trade ruled Trump’s ‘Liberation Day’ tariffs illegal. But tariffs will stay in place until the US government’s appeal is heard by 9 June.

- US Defence Secretary Pete Hegseth reaffirmed Washington’s commitment to its Asian allies, raising tensions with China.

- OPEC+ agreed to raise oil production for a third straight month in July, adding 411k barrels per day.

- China’s April data showed a 21% yoy drop in total cell phone exports, despite the tariff pause.

- Argentina placed USD 1bn of 2030 ARS Eurobonds, settling the coupon at 29.5%.

- Mexico’s judicial elections took place on Sunday, with a very low 13% voter turnout.

- Nationalist Karol Nawrocki defeated centrist Rafał Trzaskowski in Poland’s presidential run-off.

- Moody’s upgraded Nigeria; Ukraine and Georgia’s ratings unchanged.

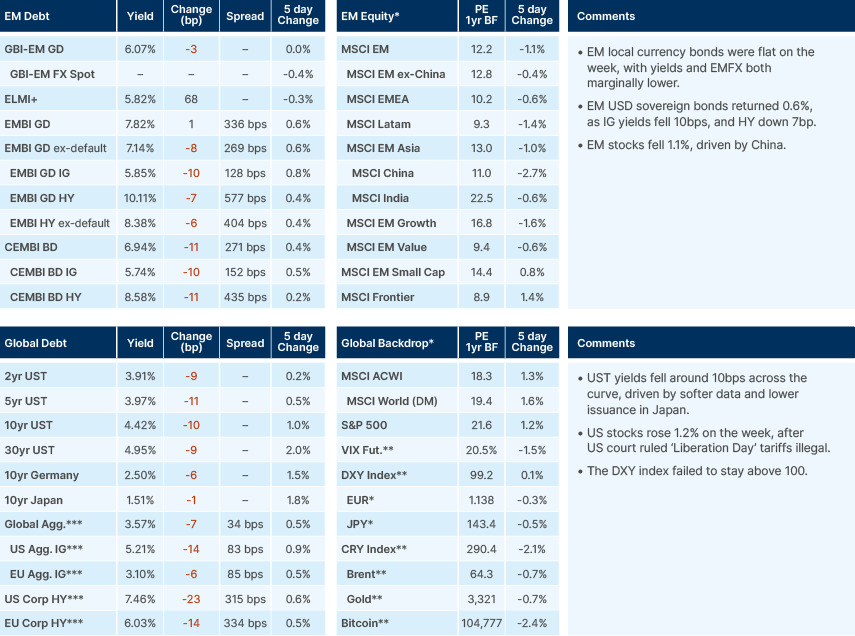

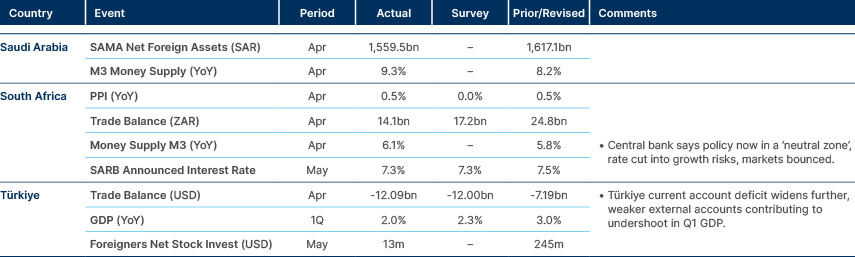

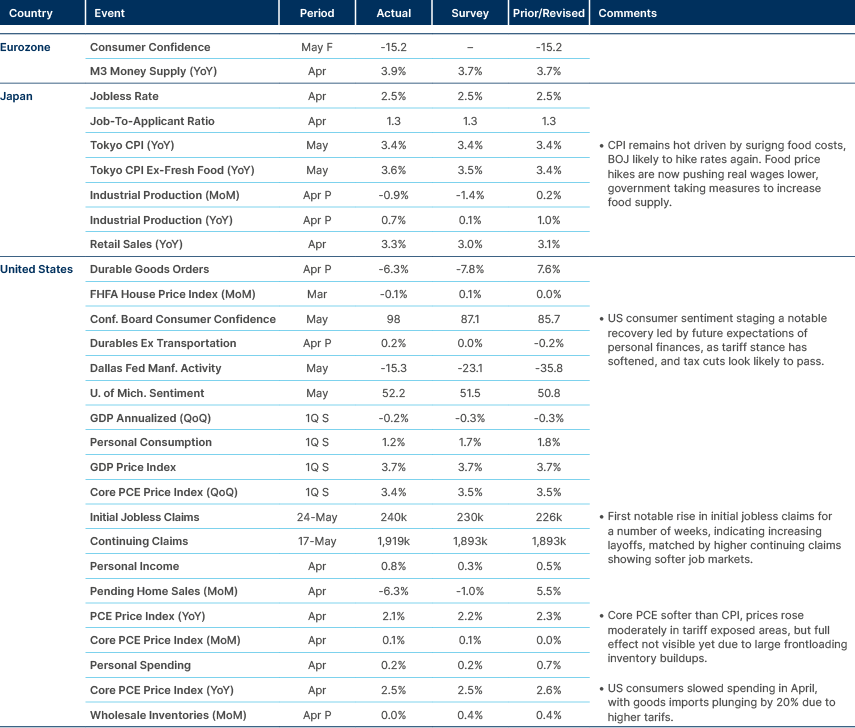

Last week performance and comments

Global Macro

A US federal trade court ruled the Trump administration’s “Liberation Day” tariffs exceeded presidential authority under the International Emergency Economic Powers Act, ordering almost all duties to be lifted within 10 days. However, the Court of Appeals paused that order until 9 June while it reviews the case. Although roughly 60% of imports would have to be untaxed under the lower court decision, Executive officials said they can quickly re-impose many levies using other statutes, preserving most of the annual tariff revenue generated by the current 15% average rate. At current levels, tariffs have already begun to bite. US goods imports dropped 20% in April month-on-month, led by a 32% slide in consumer goods.

Another US policy set to cause significant noise over the coming weeks is ‘Section 899’ of the current budget bill. The provision foresees an increase on U.S. federal income tax rates by 5-20% on US securities and investments made by non-U.S. persons or entities who pay tax in jurisdictions designated as “discriminatory foreign countries”. This includes undertaxed profits rules, digital services taxes, and diverted profits taxes, that the US considers unfair or extraterritorial.

The full scope of the bill is unclear as there are exemptions in place for tax on fixed income in the US. These will need to be clarified by the Senate. However, if approved, this would present a significant disincentive for foreign investors to deploy capital into US assets and adds to the dollar negativity currently running through markets. Last month, the Dollar Index failed to stay above 100 despite the strong recovery on global equity and credit that followed easing tariff tensions. The US administration sees a weaker dollar as key to reviving domestic manufacturing, and recent confirmation from foreign policymakers that they are discussing currencies with the US supports the thesis of a structurally weaker dollar. A persistent dollar downswing would favour gold, emerging market (EM) assets and international equities.

Speaking at the Bank of Korea conference, US Federal Reserve (Fed) Governor Christopher Waller noted that the 15% trade-weighted tariff was still his base case. He re-emphasised his more dovish outlook than the Fed median. In his view, we are very far from the 2021-22 period as the labour market is not tight, supply chains are running smoothly, monetary policy is already tight (the balance sheet is USD 2trn smaller, and the policy rate is above 4%) and there is no additional fiscal stimulus planned. Thus, the Federal Open Market Committee (FOMC) should “look through” any temporary, tariff-induced price bumps. He will favour cuts later this year if tariffs remain moderate and inflation keeps drifting toward the 2% target.

Elon Musk formally resigned from the ‘Department of Government Efficiency’ (DOGE). DOGE claimed annual efficiency savings of USD 165bn, though many figures are unverified. Confirmed measures included the dismissal of 75k federal employees, projected to save around USD 10bn annually from next year. However, critics have warned that slashing enforcement staff at the Internal Revenue Service (IRS) could reduce tax collections and offset some, if not all of those gains. Another major measure was a cut in monthly targeted foreign aid spending from USD 2.4bn to USD 1.4bn.

Nvidia’s results highlighted that artificial intelligence (AI) adoption is widespread across industries, representing a key macro trend from the current generation. The company’s revenues rose 67% in yoy terms, despite a USD 8bn hit from export controls on China. Lower margins mean net income rose by “only” 26% yoy. Bulls note that the share price surge of 343% over two years has been accompanied by a fall in the forward price-to-earnings (P/E) from 69x to 31x, while bears argue that demand for graphics processing units (GPUs) is partly reflexive and could fade if speculative buyers retrench. For now, insatiable data centre demand is holding, but margins are sliding toward their long-term average and revenue growth, though still exponential, is decelerating, leaving the stock price below its pre-earnings level. Nvidia CEO Jensen Huang cautioned that tighter US controls are accelerating Chinese rivals such as Huawei, rather than hindering them, forcing Nvidia to innovate domestically.

As concerns over global debt levels heighten, a Japanese 40-year bond issuance drew the lowest demand in 10 months, with the bid-to-cover ratio of the USD 3.5bn issue falling to 2.2. A weak 20-year government bond auction the week before had already contributed to a surge in long bond yields as part of a sell-off in developed market bonds. However, with Japan’s debt exceeding 200% of GDP, it is particularly vulnerable to rising interest costs, as the economy moves further away from deflation.

Geopolitics

At the 2025 Shangri-La Dialogue in Singapore, US Defence Secretary Pete Hegseth reaffirmed Washington’s commitment to its Asian allies, criticised Beijing for not sending a senior defence delegate, and urged regional partners to lift defence spending toward 5% of GDP in view of a possible Chinese assault on Taiwan. The US also accused China of breaching recent agreements, and China immediately counter-accused the US of breaching the same agreements.

Meanwhile, Russian and Ukrainian representatives met in Türkiye for ceasefire talks. Kyiv claims that 117 drones destroyed over 40 Russian warplanes, including long-range bombers stationed deep inside Russia. Moscow launched an unprecedented strike of 500 drones, 80% of which Ukraine says it shot down. President Volodymyr Zelenskyy said he expects the war to end by June 2026, and ruled out additional territorial concessions, while Russia continues to demand control over further parts of Donetsk, Kherson and Zaporizhzhya, in addition to the areas it already occupies.

Commodities

OPEC + will raise crude oil production for a third consecutive month in July, adding 411k barrels per day. Oil prices advanced by roughly 3% during Monday’s Asian session because the increment matched or undershot most forecasts.

US President Donald Trump ordered his tariff on steel and aluminium imports to be doubled to 50% with effect from 4 June. The European Commission announced that, failing a compromise, both its existing and additional counter-tariffs will take effect no later than 14 July.

Emerging Markets

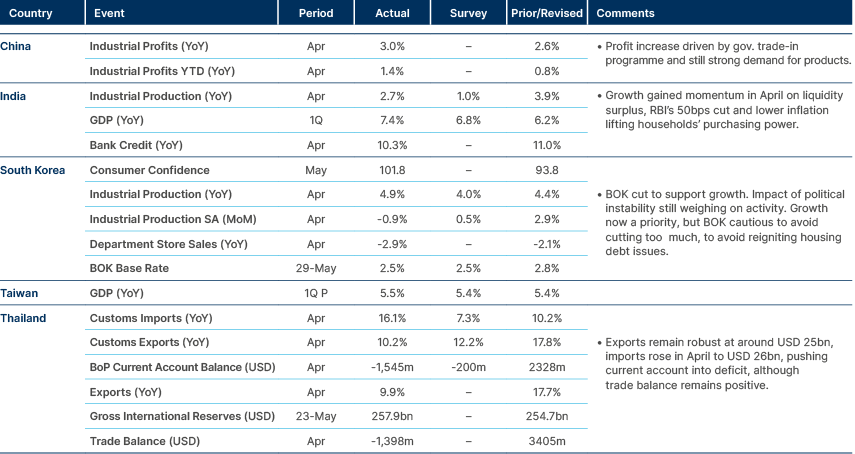

Asia

India’s GDP surprised to the upside, and April data suggests further growth ahead.

China: April’s data show a 21% yoy drop in total cell phone exports and a 70% collapse in smartphone shipments to the US, despite the partial tariff exemptions still in place. Apple intends to relocate most iPhone production to India by 2026, yet Trump’s threat to impose a 25% duty on any model assembled outside the US clouds the timing of that move.

While Vice Foreign Minister Ma Zhaoxu and US Deputy Secretary of State Christopher Landau conferred on 22 May, Beijing is hedging its bets elsewhere: it has launched an all-transaction Yuan–Rupiah settlement scheme with Indonesia and will host Chinese and EU trade ministers in early June as relations warm in the run-up to their 50th-anniversary summit.

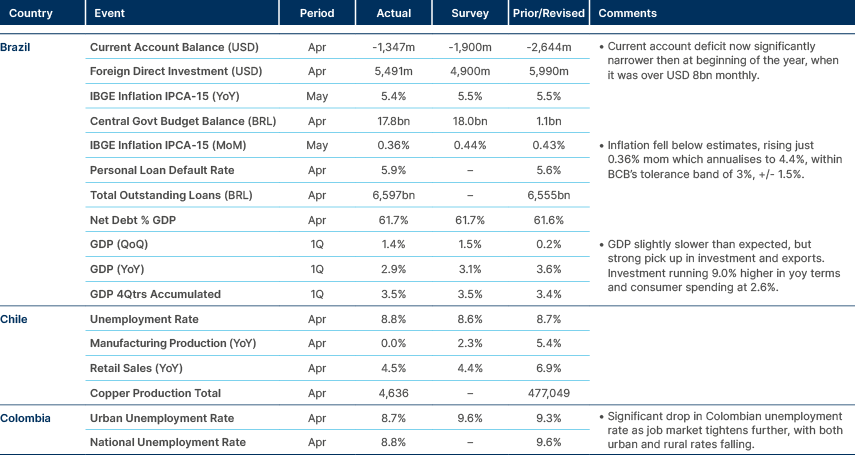

Latin America

Lower inflation and current account deficit in Brazil. Chilean IP stalled.

Argentina: The Treasury placed USD 1.0bn of its 2030 bond against demand of USD 1.7bn, settling the coupon at 29.5%, above local expectations. The deal met the authorities’ objectives, as Argentina regained market access and immediately boosted foreign exchange (FX) reserves. Although the strong real effective exchange rate would normally encourage spot-market purchases of dollars, policy makers remain of the view that they should intervene only if the currency were to breach either band of the crawling peg.

Brazil: Moody’s affirmed its credit rating at 'Ba1', but the outlook was reduced from positive to stable.

Mexico: The country’s judicial elections – where voters elect more than 2,600 judges and magistrates across federal, state, and local tribunals, as well as the Supreme Court – took place on Sunday. This represents half of the total judiciary, and, in 2027, Mexicans will vote for the other half. President Claudia Sheinbaum celebrated the election as a success, despite the mere 13% voter turnout, having said previously that even a 5% turnout would be deemed successful. The low turnout may have been influenced by opposition party calls for citizens to boycott elections they had vehemently opposed.

In other news, Banco de México’s quarterly report cut the 2025–26 growth projection by 50bps to just 0.1%. The revision confirms the near-stagnation most private forecasters already expect for next year and underscores a weaker macro backdrop.

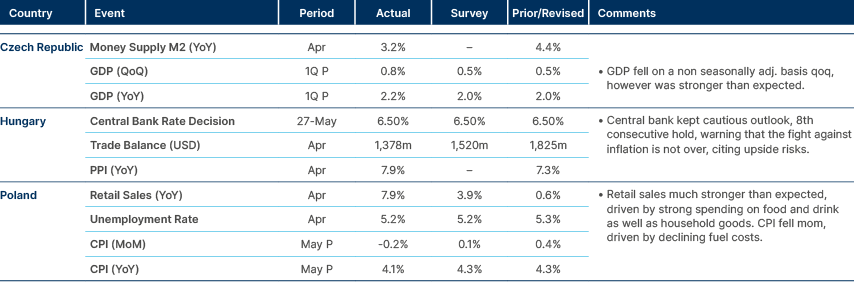

Central and Eastern Europe

Softer GDP in Czech. Lower CPI, but strong retail sales in Poland.

Georgia: Fitch reaffirmed Georgia’s sovereign rating at ‘BB’ with a negative outlook, matching Moody’s (negative outlook) and S&P (stable outlook).

Poland: Conservative historian Karol Nawrocki defeated centrist Warsaw mayor Rafal Trzaskowski in the presidential run-off, winning 50.9% of the vote to Trzaskowski’s 49.1%. Nawrocki, aged 42, is a Eurosceptic nationalist and enjoyed the backing of Donald Trump, whereas Trzaskowski was supported by former President and current Prime Minister Donald Tusk. Nawrocki’s election will have implications for the Tusk government's ability to implement its ambitious reform agenda. Beyond veto powers, the President has mandates on defence and foreign policy. The outcome was not surprising, given the narrow gap between candidates already highlighted by polls, and the price action has been muted, with a small underperformance of the Polish Zloty, which started at the end of February.

Ukraine. Moody’s affirmed Ukraine’s ‘Ca’ rating with a stable outlook. The action carries limited market relevance as attention is centred on the second round of Istanbul peace talks scheduled for Monday.

Central Asia, Middle East, and Africa

Bahrain: The 2024 fiscal deficit widened to BHD 941m (5.3% of GDP), six times the budget target, pushing public debt above 130% of GDP after heavy issuance. Hydrocarbon revenue fell 8.5% on softer prices and downtime for the Abu Sa’afa offshore oil field, offsetting stronger non-oil receipts. Debt service rose 13%, consuming one-quarter of expenditure and three-quarters of non-oil revenue and nearly eliminating the primary surplus. With USD 2.6bn in external redemptions due and reserves at USD 2.8bn, Bahrain remains dependent on Gulf Cooperation Council (GCC) support and refinery expansion is the sole material upside risk.

Nigeria: Upgraded from 'Caa1' to 'B3' by Moody's and kept the outlook stable. Moody’s rating is now in line with S&P’s 'B-' rating but still one notch below Fitch’s B.

Türkiye: Net reserves excluding swaps rose USD 8bn last week to USD 28.4bn, although daily data show a USD 1.1bn drop so far this week. Usable FX reserves for intervention (excluding gold) climbed to USD 49bn, up from USD 30bn three weeks earlier, but still below the USD 70bn held before the political crisis. After pausing the previous week, bank lending growth accelerated again to 43% (13-week moving average, annualised and FX-adjusted). Despite better reserve numbers, the TRY became a less interesting position since the beginning of the year given the lower carry and increased political risks.

Developed Markets

The US had better sentiment and consumer prices close to target, but housing market remains soft and jobless claims ticked up. Inflation surprised to the upside again in Japan.

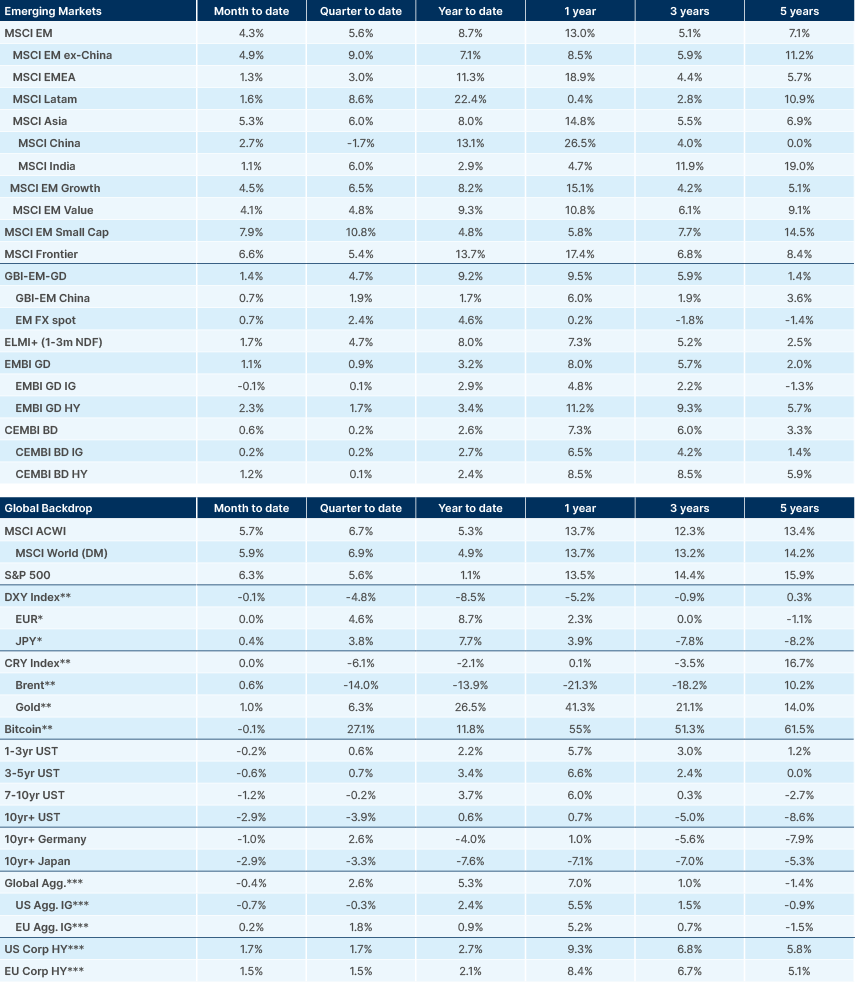

Benchmark Performance

Source and notations for all tables in this document:

Source: Bloomberg, JP Morgan, Barclays, Merrill Lynch, Chicago Board Options Exchange, Thomson Reuters, MSCI. Latest data available on publication date.

* Price only. Does not include carry. ** Global Indices from Bloomberg. Price to Earnings: 12m blended-forward

Index Definitions:

VIX Index = Chicago Board Options Exchange SPX Volatility Index. DXY Index = The Dollar Index. CRY Index = Thomson Reuters/CoreCommodity CRM Commodity Index.

Figures for more than one year are annualised other than in the case of currencies, commodities and the VIX, DXY and CRY which are shown as percentage change.