- Sharp increase in yields post strong labour market report and increase in oil prices.

- Chinese stocks outperform again ahead of end of Golden Week holiday.

- Iran missile strikes against Israel targeted civilian areas, further escalating the regional conflict.

- Soft manufacturing more than compensated by stronger service sector across G20.

- Brazil, Mongolia, and Serbia upgraded, Senegal downgraded last week.

- Ghana reached agreement on debt restructuring with 98% of creditors.

- EU announced tariffs of up to 45% on China’s electric vehicles.

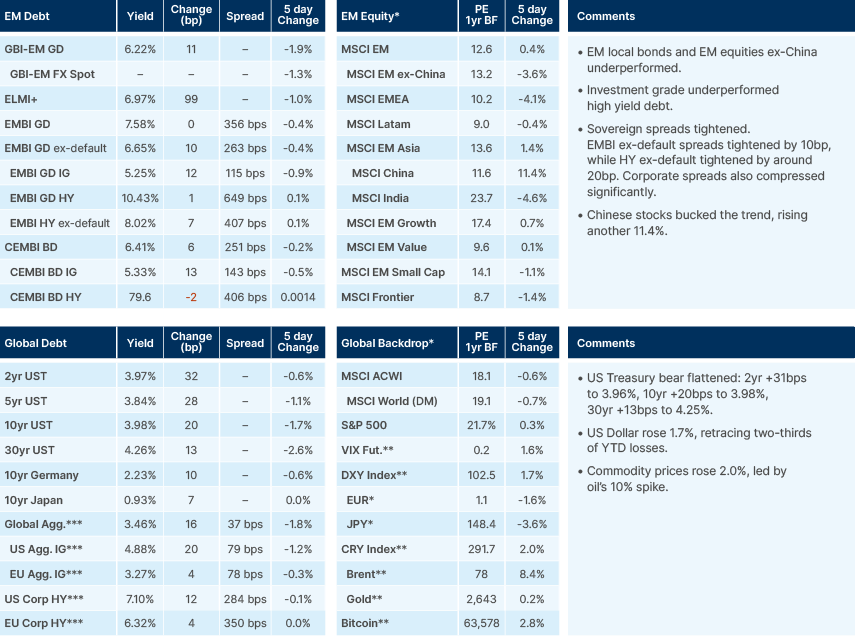

Last week performance and comments

Global Macro

September’s US non-farm payrolls report exceeded expectations, with employers adding 254,000 jobs, reflecting strong labour market momentum. This robust data led US Treasury yields sharply higher, as markets anticipated fewer rate cuts from the Federal Reserve (Fed). US stocks remained relatively stable, as reduced expectations for a 50 basis points (bps) rate cut in November were offset by optimism about the job market and the economy.

Oil prices surged following Iran's attack on Israel. Chinese stocks extended their policy driven rally. These developments have led to speculation that the market could be entering the early stages of a broader reflation in the final quarter of 2024 or the first quarter of 2025. In global monetary policy, September marked the fourth-largest month in the number of central bank rate cuts since 2001, signalling a shift toward more accommodative stances in various regions.

Geopolitics

Iran retaliated against the killing of Hezbollah’s leader Nasrallah in Beirut by firing hundreds of missiles, including ballistic warheads, at targets across Israel. According to Israeli sources, the strikes targeted both civilian and military infrastructure. Unlike the events in April, the Iranians did not give any warning to either Israel or the United States before launching this attack.

Despite the large-scale missile barrage, US and Israeli intelligence detected the plans in time to move Israeli civilians into bunkers, preventing any casualties. US President Joe Biden described the attack as “ineffective", although its nature suggests a higher likelihood of a strong Israeli response this time, potentially with direct strikes on Iranian targets. The US has signalled it will not prevent Israel from taking such actions.

Throughout the week, Israel increased its bombardment of targets in Beirut and launched targeted raids on Hezbollah infrastructure in southern Lebanon. This marks the first time Israeli ground forces have been deployed in Lebanon since 2006. President Biden also referenced ongoing discussions between US and Israeli military officials regarding potential strikes on Iranian oil infrastructure, indicating tensions could escalate even further, and leading to a second sharp increase in oil prices.

Commodities

Brent crude surged by 10% last week, nearing USD 79 per barrel, fuelled by escalating tensions in the Middle East, and in particular, comments from Biden that Israel is considering attacks on Iranian oil infrastructure. The stock market rebound from fresh stimulus measures in China supported the rally, as investors began to anticipate a pickup in demand from the world's second-largest economy, while solid US jobs data on Friday prompted traders to increasingly rule out the likelihood of a near-term economic downturn in the US, extending the oil market's upward momentum into the weekend.

Leading Indicators

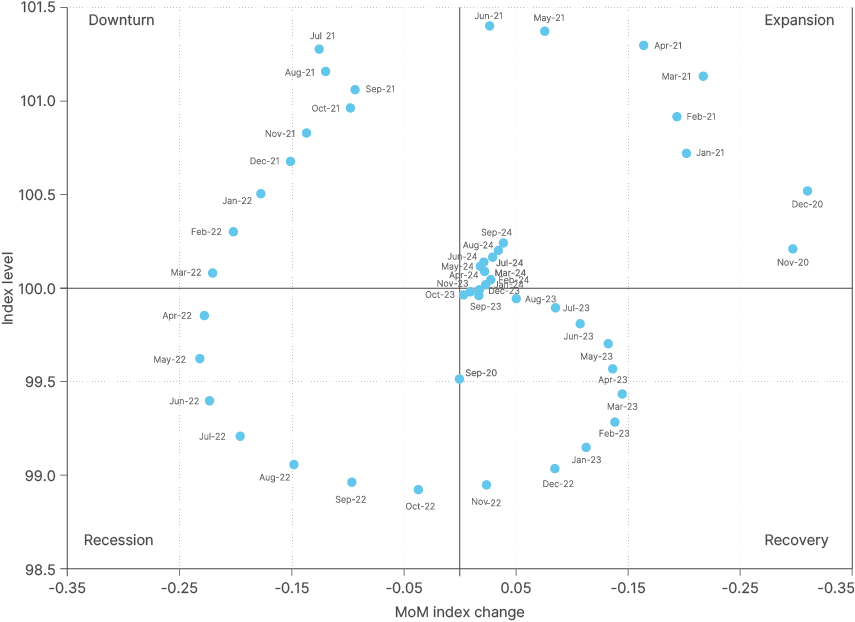

The G20 OECD leading indicator, comprising both services and manufacturing sectors, moved further into expansion territory in September. The positive surprise came after revisions to Q2 data led to a sharp negative surprise in economic activity until June. Since then, economic activity has recovered.

Fig 1: OECD G-20 leading indicator

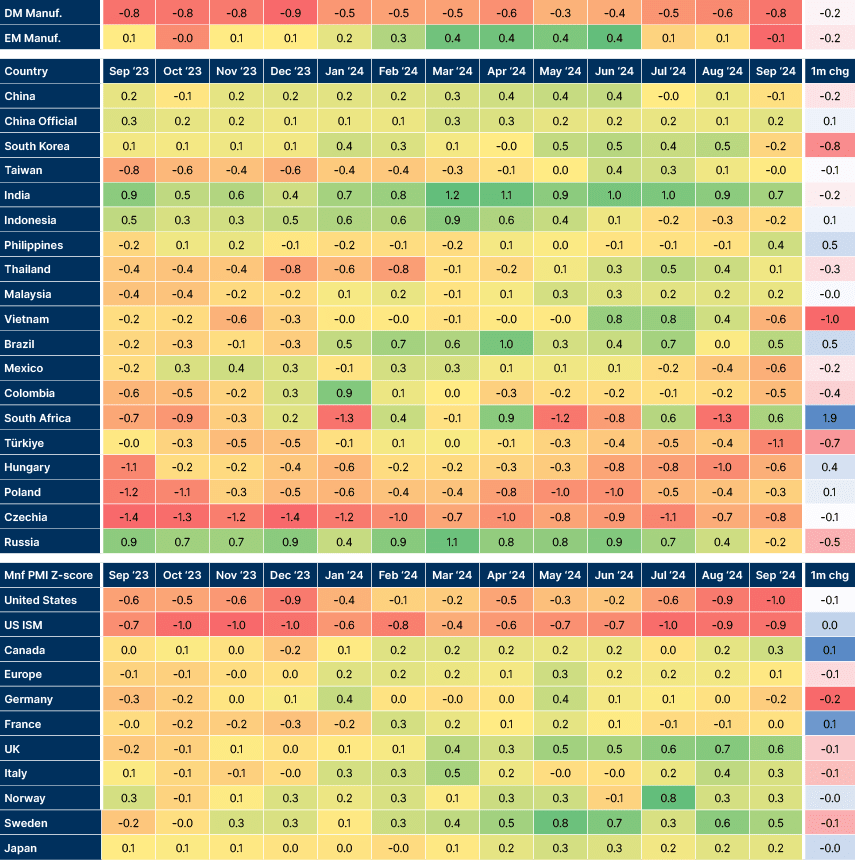

The Manufacturing Purchasing Manager’s Index (PMI) receded further in Developed Markets (DM) and declined below 50 in Emerging Markets (EM), driven by declines in South Korea, Vietnam and Türkiye.

Fig 2: Global Manufacturing PMI data

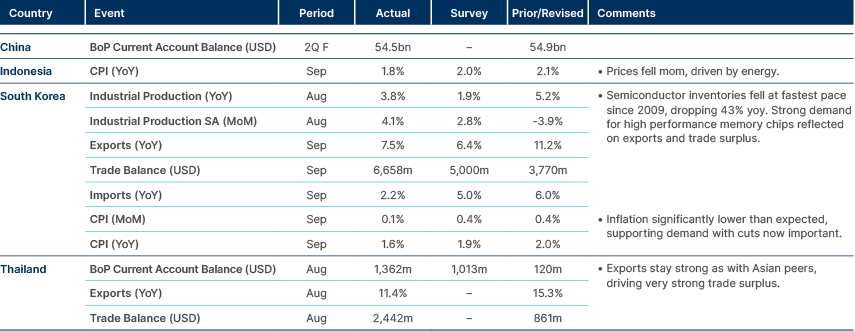

Emerging Markets

Asia

Tech exports still a strong point across the region.

China

The Hang Seng China Enterprises Index (HSCEI) has risen 37% year-to-date, making it the best-performing market in the world in 2024. Chinese assets have surged on the back of a classic ‘3Ps’ combination: bearish positioning, as China reached a 50-year low compared to US stocks; bearish profit expectations, with fears of a deflationary hard landing; and a major policy shock, with a USD 560bn fiscal and monetary stimulus announced, accounting for over 3% of gross domestic product (GDP). While large investors remain sceptical due to US-China relations, and China's traditional aversion to economic booms, structural bears are likely to be forced back into the market. This shift will be driven by a rise in China’s bond yields from a 2% floor and a recovery in house prices, currently down 6% yoy, mirroring past post-stimulus recoveries in 2008, 2016, and 2020.

On Tuesday, China’s chief economic planner, the National Development and Reform Commission (NDRC), will discuss policies to raise economic growth. Traders are closely watching additional policy measures, after the government announced rate cuts, banking liquidity support and stock market support just before last week’s national holiday. Expectations are that Beijing will expand public spending as part of this week’s package to stimulate demand. The country has the space to increase fiscal spending to around 10 trillion yuan (USD 1.4tn) according to economists. This is very unlikely to be announced at one time however, and most analysts expect a fiscal package of 2-3 trillion yuan to be announced at Tuesday’s NDRC.

India

Between April and August, India's central government fiscal deficit fell 32% yoy. This improvement was fuelled by better revenue collection and lower capital spending during the election period. Total receipts rose 18% compared to the previous year, with personal income tax revenues up 25%. In other news, Hyundai is reportedly seeking a USD 19bn valuation for its India unit in what would be India's largest-ever IPO.

Mongolia

S&P upgraded Mongolia's credit rating to B+, reflecting improving economic conditions. This brings it in line with Fitch’s upgrade in September.

Thailand

The current account surplus increased by 71% year-on-year in August, reaching USD 1.4bn. Exports rose 11% to USD 26bn. From January to August, the current account surplus expanded sixfold yoy to USD 4.7bn, primarily driven by a shrinking deficit in the net services balance. However, a stronger baht could weigh on both manufacturing exports and tourism inflows going forward.

Latin America

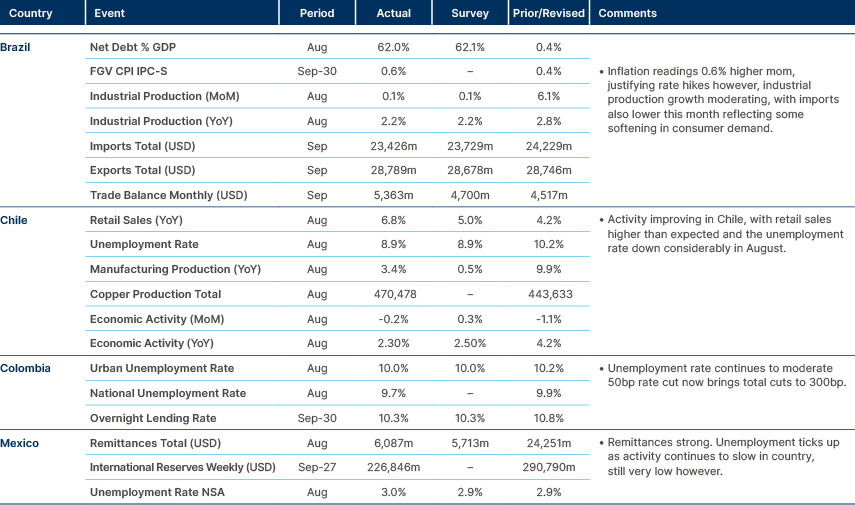

Lower unemployment in Chile and Colombia, higher in Mexico.

Brazil

Municipal elections for mayors and city assemblies took place yesterday as Brazilians elected 5,518 mayors, while in another 51 cities no candidate received more than 50% of votes and will have a run-off in three weeks. Centre-right parties won most votes. Candidates supported by former president Jair Bolsonaro won four elections across the country’s 27 state capitals and 14 others will face a run-off. On the other hand, only two candidates supported by President Luiz Inácio Lula da Silva (Lula) won in the first round and only four will face the run-off. The biggest winner was the Governor of the Sao Paulo state Tarcísio de Freitas. He supported incumbent Ricardo Nunes in the race for Mayor of Sao Paulo city, who will face a run-off against Guilherme Boulos, supported by Lula. Pablo Marcal, the candidate supported by Bolsonaro, did not qualify for the run-off.

Finance Minister Fernando Haddad emphasised that adhering to Brazil’s fiscal framework is crucial for aiding the central bank in lowering interest rates. Haddad noted that if Congress had approved all proposed measures, such as ending payroll tax exemptions, the government could achieve its zero-deficit target this year. While Haddad remains the main advocate for fiscal adjustment within the government, President Lula's reluctance toward strict austerity measures raises concerns about the future of fiscal policy. Moody's recently upgraded Brazil’s credit rating to one notch below investment grade, citing better economic growth prospects that could further enhance the country's credit profile if fiscal targets are met.

Colombia

The Central Bank board reappointed Governor Leonardo Villar for his second four-year term. This will reassure investors for whom the potential for political interference in monetary policy had become a concern. Villar has resisted pressure from the President and Finance Ministry in the past to cut interest rates faster.

Mexico

President Andrés Manuel López Obrador (AMLO) left office with a strong approval rating of 68%, according to a poll by El Financiero. This high approval contrasts with lower ratings on individual social and economic issues, underscoring AMLO’s enduring influence over the incoming Claudia Sheinbaum administration.

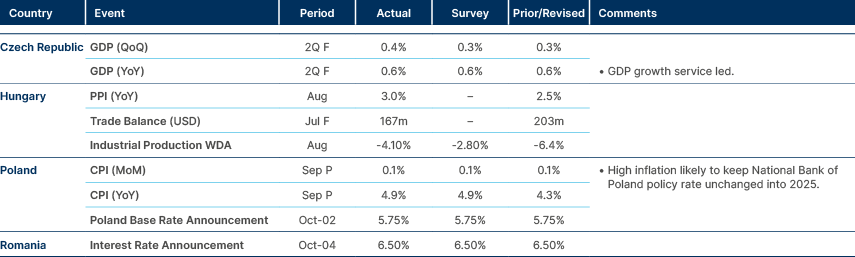

Central and Eastern Europe

Poland and Romania hold rates.

Czechia

The Czech Fiscal Council, an independent body overseeing the country’s budget and fiscal policy, raised concerns about a potential deviation from the fiscal target of CZK 28.5-30.5bn (0.3-0.4% of GDP) in 2025. According to the Council's latest budget report, several revenue projections seem overly optimistic, including proceeds from carbon emission allowance sales, which could fall short by CZK 10bn, and lower-than-expected dividend payouts from state-owned companies, which may result in a shortfall of CZK 5bn. The government is also counting on savings from renewable energy subsidies, though the legislation for this has yet to be passed, and pension spending could exceed the planned budget by CZK 5-7bn.

Serbia

The rating agency S&P upgraded the sovereign rating to BBB-, granting the country its first investment grade rating. “The upgrade reflects Serbia’s improved economic resilience against shocks on the back of strong macroeconomic management, which we expect to persist in the coming years,” S&P said. Resilient domestic demand, bigger fiscal and external buffers and International Monetary Fund (IMF)-led fiscal and monetary policy derisks Serbia’s credit from ongoing weakness in the eurozone.

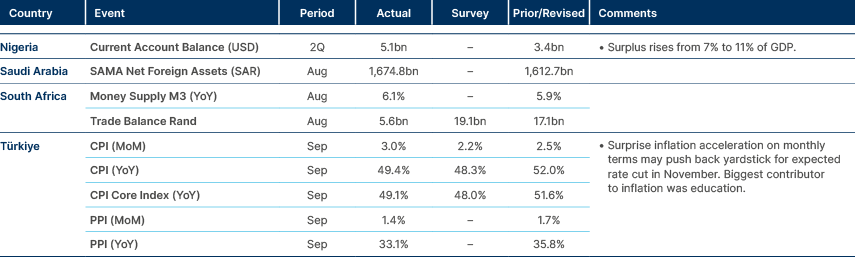

Central Asia, Middle East, and Africa

Inflation accelerates in Turkey, may push back rate cut.

Ghana

Ghana received the approval of more than 90% of bondholders to restructure and exchange USD 13bn of international debt, it said on Thursday, clearing the last hurdle in its protracted debt rework. Finance Minister Mohammed Amin Adam announced that by the final deadline in September, 98% of bondholders had agreed to a 37% haircut on the USD 13bn eurobond. This is the biggest haircut in the history of African debt and a crucial step in Ghana’s broader economic recovery efforts after its December 2022 default.

Senegal

Moody’s downgraded the sovereign rating to B1 from Ba3 and kept a negative outlook. The main reasons cited were weaker fiscal and debt positions than expected, after an audit ordered by the new president revealed the 2023 budget deficit was over 10% of GDP, compared to the 5% figure reported by previous government. The country is in talks now with the IMF for corrective measures.

Türkiye

Türkiye's macroeconomic indicators are aligning with projected goals, signalling a positive outlook for the country's economy, according to Central Bank Governor Fatih Karahan. In a presentation to the Plan and Budget Commission in Parliament, Karahan noted that tight monetary policy is helping to rebalance domestic demand, with the output gap expected to turn negative in the coming months—a key factor in achieving disinflation. The Central Bank anticipates monetary tightening will continue to improve the current account balance. Monthly inflation in services is beginning to decline, although it remains a challenging area. Meanwhile, the Ministry of Treasury and Finance plans to borrow TRY 510bn from the local market between October and December to meet a domestic debt service requirement of TRY 329.4bn. Borrowing targets for October were revised downward, while November's target saw a significant increase.

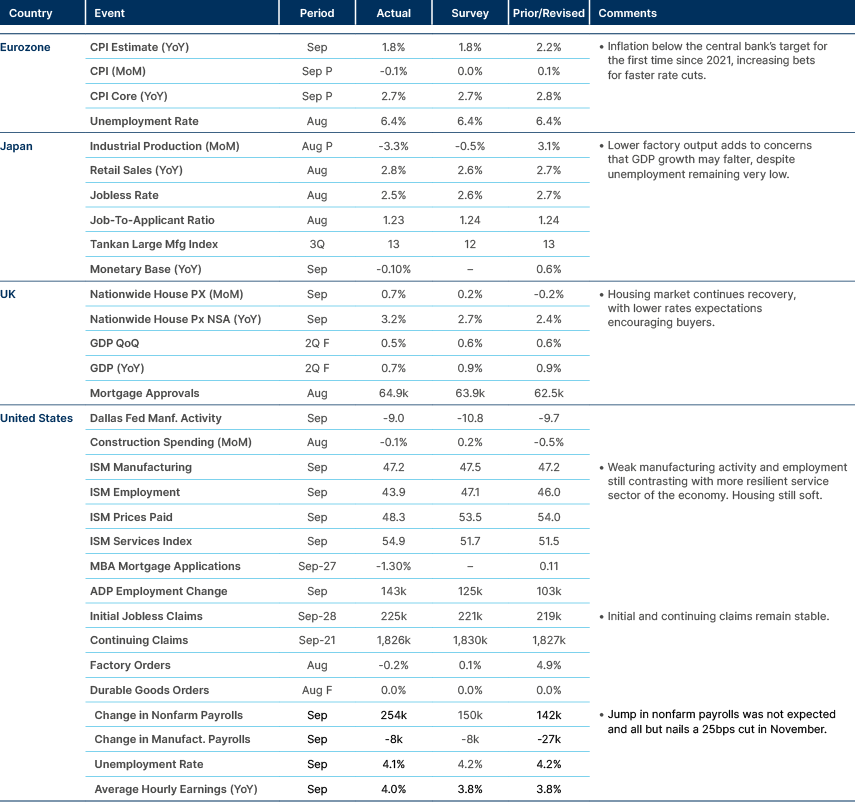

Developed Markets

Inflation below target in EU, jobs growth spikes in US.

European Union

The EU announced tariffs of up to 45% on Chinese electric vehicles (EVs). The levies varied according to the degree of subsidy received from the government, ranging from 8% for Tesla to 35% for SAIC. China's Commerce Ministry strongly opposed the tariffs, calling them "unfair, non-compliant, and unreasonable" and asserting that they violate World Trade Organization rules, though no specific countermeasures have been announced yet. Retaliation is expected, as BMW and Volkswagen condemned the tariffs, describing the EU’s move as a "fatal signal for the European automotive industry." EU carmakers still have large sales in China and have been forging alliances with Chinese peers to improve their competitiveness, both in Europe and in China.

United States

Recent developments have brought relief to concerns over the economic impact of potential port strikes in the US. After tense negotiations, the strike involving 47,000 port workers across major US ports was called off following a deal between union representatives and employers. Workers had been pushing for significant pay increases, with demands for a 10% annual raise over the next six years. The ports affected handle about 25% of US goods imports and 27% of exports, representing approximately 2.8% and 1.9% of US GDP, respectively. Economists had warned the strikes could have resulted in weekly economic losses of around USD 4.5bn and exacerbated supply chain disruptions, driving up inflation, particularly in food prices. With the strike averted, concerns over prolonged economic disruption have eased after the International Longshoremen’s Association agreed on a 62% wage increase over six years.

Japan

The yen weakened after Japan elected a more dovish Prime Minister, Shigeru Ishiba. Traders ‘forgot’ that monetary policy is decided by the Bank of Japan and unwound expectations of another interest rate hike in the near future. Prime Minister Ishiba stated he does not believe the current economic environment warrants additional rate increases. This more lenient stance on monetary policy has led to renewed momentum in the yen carry trade, which could potentially provide an upside for Japanese stocks.

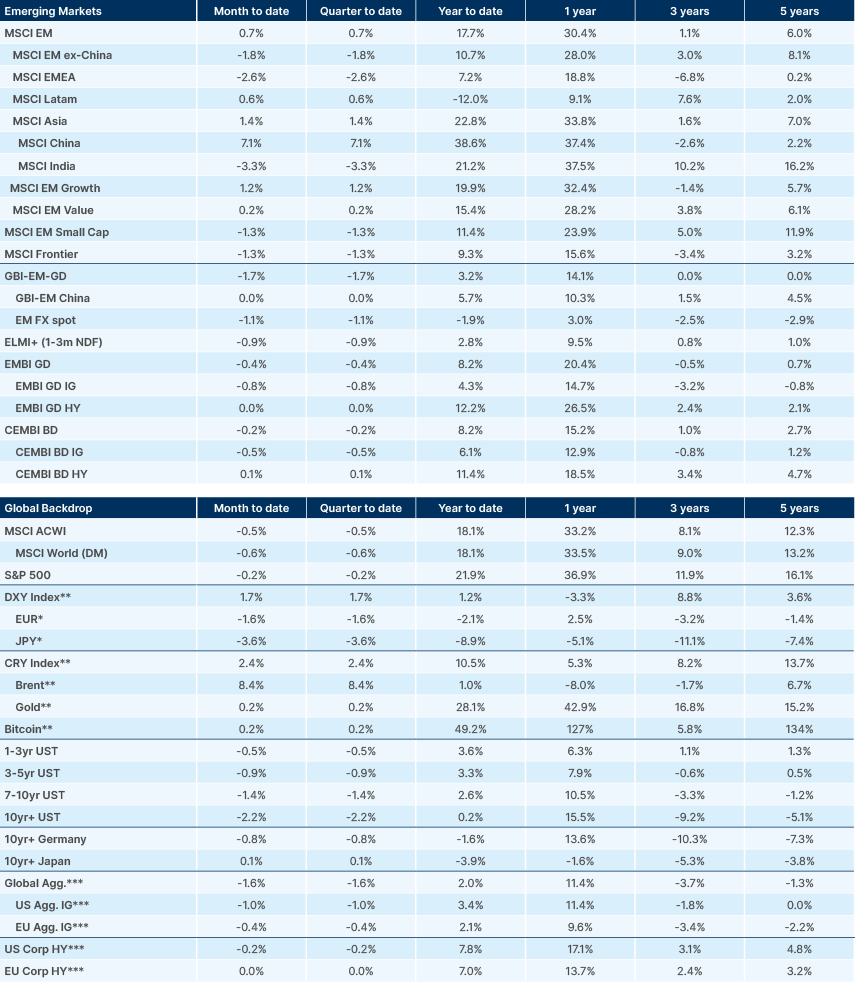

Benchmark performance

Source and notations for all tables in this document:

Source: Bloomberg, JP Morgan, Barclays, Merrill Lynch, Chicago Board Options Exchange, Thomson Reuters, MSCI. Latest data available on publication date.

* Price only. Does not include carry. ** Global Indices from Bloomberg. Price to Earnings: 12m blended-forward

Index Definitions:

VIX Index = Chicago Board Options Exchange SPX Volatility Index. DXY Index = The Dollar Index. CRY Index = Thomson Reuters/CoreCommodity CRM Commodity Index.

Figures for more than one year are annualised other than in the case of currencies, commodities and the VIX, DXY and CRY which are shown as percentage change.