A good holiday period for Emerging Markets, behind the fog of China’s Covid wave

A better year-end for EM manufacturing Purchasing Managers’ Indices (PMIs), except for China, where the experience of ‘living with Covid’ appears to be creating an incredible amount of pain, and noise. Looking through the near-term confusion, the change in policy could lead to the sort of boom in household demand that countries such as the US experienced, which will boost nominal growth but could present new challenges for policymakers. It feels like 2002 all over again in Latam, where Argentina gets money from the International Monetary Fund (IMF) and Lula is sworn in as Brazil’s president. Elsewhere, Venezuela moves further towards normalisation as the weird and wonderful experience of Juan Guaido’s interim government comes to an end. Finally, Turkey’s president Erdogan tries to buy his way into another term, at one of this year’s rare general elections in June.

Week ahead

In global macro, the market will be monitoring USD/JPY and the impact of the Bank of Japan (BoJ) decision to widen its target yield band. In the US, the JOLTS data and ISM manufacturing survey are due on Wednesday. The US Treasury issuance programme on Thursday, and US payrolls for December on Friday will be followed closely. In EM, the main events this week after the release of central European PMIs and Turkey inflation will be Poland’s Monetary Policy Council’s decision on Wednesday, and Colombia’s consumer price inflation (CPI) and Brazil’s industrial production (IP) on Thursday.

Emerging Markets

The few December manufacturing PMIs released since the turn of the year paint a relatively positive picture: all but two of eight countries (Colombia, Brazil, Czechia, Hungary, Poland, India, Indonesia and China) posted an uptick in manufacturing PMI compared with November. The average increase was two points, lifted notably by Hungary (up 7.1 points to 63.1) and Colombia (up 3.8 points to 51.1). The outliers were Brazil (-0.1 to 44.2) and China (-1.0 to 47.0), which we discuss in more detail below.

China: We start with China, where some of the most impressive changes are happening, on a global scale. On 26 December, the State Council downgraded Covid-19 from Class A to Class B, meaning its focus had shifted “from infection prevention to medical treatment” and that measures such as quarantining, tracking of close contacts and mandatory mass testing would be scrapped, effective 8 January. The new plan also lifts most cross-border restrictions, and travellers can fly into China with no quarantine requirements, provided a negative Covid test result is produced within 48 hours of departure.

The end of zero-Covid policies since the policy U-turn announced on 7 December has led to sweeping Covid infections across the country, possibly running into the hundreds of millions according to a Bloomberg article. In late December, the health authorities announced infections had peaked in Beijing and Guangzhou, notably, but China’s chief epidemiologist at its Centre for Disease Control and Prevention projected it could face three waves of infection between now and March, with the second wave corresponding to the Chinese New Year in late January. Metro passenger trips in 15 major cities (including Beijing, Shanghai, Guangzhou, Shenzhen, Chengdu, etc) have already fallen -47.0% y-o-y between 1-27 December, from -29% in November. Urban traffic congestion data also indicates a drop in mobility, but intercity travel has rebounded due to the lifting of restrictions.

For all the medium-term benefits of this policy shift, progress is not immediate. President Xi acknowledged in his New Year’s address that “tough challenges remain.” The apparent enormous and opaque (no official numbers are released) rise in Covid cases has hit economic activity and confidence: the official manufacturing PMI dipped to 47.0 in December (consensus: 47.8) from 48.0 in November, its lowest level since Q1 2020, and the non-manufacturing PMI plunged to 41.6 from 46.7 (consensus: 46.0), below the level reached in April after Shanghai was placed in lockdown. The Caixin Manufacturing PMI fell from 49.4 in November to 49.0 in December, and delivery times lengthened for the sixth consecutive month.

Looking forward, economists will be at pains to try to understand the enormous ripple effects that the decision to ‘live with Covid’ will have on China’s external and internal balances. The first immediate impact, which is already at work, is the restart of inbound and outbound tourism flows. Outbound Chinese tourism spend totalled USD 255bn in 2019 before the pandemic, and renewed travel could finally tame the inexorable rise in China’s current account surplus, which was just revised to a record surplus of USD 144 bn in Q4 2022. Thailand and Japan are the main beneficiaries outside of Hong Kong and Macau.

The second effect, potentially of even greater significance, is the explosion in consumer spending that can follow a long period of restraint. China’s household domestic CNY deposits have increased by CNY 15-20 trillion over the previous decade’s trend line since January 2020, which is an enormous amount at 12-15% of GDP. This is commensurate with the USD 3 trillion bump in US households’ bank deposits between 2020 and end-2021. The impact in terms of spending behaviour and inflation dynamics could be quite spectacular, especially in the domestic services sector.

Argentina: On 22 December, four days after triumph at the FIFA World Cup in Qatar, the IMF completed its third review of Argentina’s Extended Agreement (EA) and allowed for the disbursement of c. USD 6.0bn. This will help replenish the country’s foreign exchange (FX) reserves, which have come under pressure again in recent months, prompting the executive to re-introduce a targeted exchange rate for soybean exporters that allowed Argentina’s central bank to purchase USD 700m in the first week of December.

Argentina's trade balance posted a surplus of USD 1.3bn in November, according to the National Institute of Statistics and Censuses (Indec), the third consecutive monthly surplus. Exports reached USD 7.1bn, up 14.5% in yoy terms. Imports totalled USD 5.8bn, down 0.3% yoy. Over the first 11 months of the year, the trade balance recorded a surplus of USD 5.8bn, around one-third of the 2021 surplus of USD 14.4bn for the same period.

With regards to the fiscal accounts, the IMF had encouraging things to say: “Fiscal targets were met (primary deficit of 1.3% GDP over Q1-Q3) on account of strong expenditure controls and cash management, as well as higher export duties from the FX incentive scheme”. Most analysts expect Argentina can meet the 2.5% primary deficit target agreed for 2022, but the 1.9% primary deficit target agreed with the IMF and budgeted for 2023 depends mainly on a 0.6% of GDP reduction in subsidies that could prove challenging in an election year.

Brazil: President Lula took office on 1 January. In his initial speech after the swearing-in ceremony, he criticised the federal spending cap and said he was signing measures to allow state-owned enterprises to resume their role in boosting economic development: “Public banks, particularly the BNDES, as well as companies that lead growth and innovation such as Petrobras will have a key role in this new cycle”.

Lula had spent the previous week making appointments to his 37-strong cabinet. His Vice-President Geraldo Alckmin was appointed as Minister of Development, Industry and Commerce. The Senator and presidential candidate Simone Tebet, leader of the large, centrist Brazilian Democratic Movement party of former President Temer, was given the job of Planning Minister. She will have a seat in the National Monetary Council (coordination body for the macroeconomic policy of the federal government, setting the Central Bank’s inflation target and formulating the currency and credit policy) and the same voting rights as Finance Minister Haddad and the Central Bank Governor. The Minister of Finance announced the members of his own economic team, including Guilherme Mello as Secretary of Economic Policy.

Mexico: Manufacturing PMI was up to 51.3 in December from 50.6 in November. The unemployment rate fell to 2.85% in November, down from 3.3% in the same month last year, levels not seen since before the pandemic. November remittances came in at USD 4.8bn, modestly below the record of USD 5.36bn recorded in October.

Venezuela: Venezuela's opposition parties overwhelmingly voted last Thursday to terminate the Juan Guaido-led interim administration. Three of the four main opposition organisations, including the political formations of leaders such as Henrique Capriles (Primero Justicia), Gustavo Duque and Julio Borges withdrew their support for Guaido’s interim government, with only Guaido's own Popular Will party opposed to the move. This signals many of the opposition party leaders’ intention to participate, and possibly run, in the presidential election due to be held possibly in 2024.

Venezuela’s economy expanded for a fifth straight quarter in Q3 2022, according to the central bank, led by a rebound in the oil sector. Gross domestic product (GDP) advanced 13.2% in Q3 over the same period a year ago, down from the 17.5% and 23.3% yoy jumps recorded in Q1 and Q2, respectively. Output growth recorded by the oil sector over the nine months to September was 257% over the prior year.

The first US oil export cargo to Venezuela in four years is expected to arrive next week, according to ship-tracking data compiled by Bloomberg. Heavy naphtha is used to reduce viscosity of Venezuelan crude oil, enabling it to flow in pipelines. This comes shortly after Chevron resumed production and exports of crude oil from Venezuela. US oil refiner Citgo Petroleum, owned by PDVSA, is on track to make a USD 2.5bn profit this year, according to the company’s board.

South Korea: December headline inflation was unchanged from November at 5.0% yoy (0.2% mom), and core inflation (ex-food and oil) also remained steady at 4.8% yoy for the third month. IP data for November stabilised after a poor outturn in October, with overall IP up 0.1% mom, but only up 0.6% yoy (from 2.7% yoy in October). Weakness is particularly acute in the semiconductor sector (-15% yoy). Overall, industrial goods inventories relative to shipments have built up to record levels not seen since 1998. After a dismal start to the month, the trade deficit for December came in lower than the November deficit at USD 4.7bn vs. USD 7.0bn the previous month. Exports did slightly better, and dropped by 9% over the previous year, against a 14% drop in November.

Croatia: On New Year’s Day, Croatia joined the Eurozone as its 26th member, and was admitted into the Schengen Area. Two other candidate countries, Romania and Bulgaria, were denied membership, however.

South Africa: President Ramaphosa survived the “Farmgate” scandal and was re-elected as leader of the ruling ANC party, gaining 2,476 votes (56% of the votes cast) for the position of party president at its elective conference, against 1,897 for former health minister Zweli Mkhize. Ramaphosa's victory paves the way for him to land a second term as South African president if the ANC wins the next general elections, due in 2024. Although four of Ramaphosa’s allies were also elected to the top seven positions in the party leadership, they won by relatively slim margins against opposition adversaries.

The elective conference took place against a backdrop of rolling energy blackouts that extended over Christmas and New Year, owing to ongoing operational and financial problems at Eskom, which supplies more than 90% of the country’s electricity. In a recent financial update, company CEO de Ruyter announced that the 2023 FY results (to March 2023) are expected to show a rise back up to ZAR 20bn (c. USD 1.2bn), from ZAR 12.3bn in the FY 2022.

Turkey: Turkey’s December trade deficit widened 52% over the previous year to USD 10.4 bn. Exports rose 3.1% from a year earlier to USD 22.9 bn. Imports jumped 14.6% to USD 33.3 bn. On a full year basis, Turkey’s trade deficit widened 138.4% from the previous year to USD 110.2 bn in 2022, with exports rising 12.9% to USD 254.2 bn and imports jumping 34.3% to USD 364.4 bn.

The yoy inflation rate fell to a nine-month low of 64.3% in December (consensus 66.5%) from 84.4% in November, due to favourable base effects. Producer price index (PPI) inflation also fell sharply to 97.7% yoy from 136.0% in November.

In a bid to bolster his chances of victory at this year’s general election, expected in early June, President Erdogan ordered a 55% increase in the net minimum wage from TRY 5500 to TRY 8500. This brings the real terms increase to c. 20% over two years, based on official CPI data, which may be under-estimating actual price inflation. This will not help with either the external imbalance or with domestic inflation dynamics. The Central Bank of Turkey (CBRT) left the one-week repo rate at 9% at its 29 December meeting, but the transmission of monetary policy is weak in view of other policies such as ‘lira-isation’, and the minimum wage policy mentioned above. On that note, the CBRT said it intends to lift the share of lira deposits in overall banking system deposits to 60% over the next six months, from the current 53%.

Developed Markets

United States: Apart from a greater than expected slowdown in existing home sales for November (-7.7% mom), US economic data was generally positive in the closing days of 2022. Confidence survey data was better sequentially in December, albeit at still low levels: the Conference Board consumer confidence index came in at 108.3 in December, up from 100 in November, and the University of Michigan (UMich) sentiment index was up 0.6 to 59.7, still a very low level historically. We received further indication that inflation pressure is subsiding: the personal-consumption expenditures (PCE) deflator and core PCE deflators came in at 0.1% and 0.2% mom in November. The UMich one-year inflation expectation survey also came down to 4.4% from 4.6%. Nominal personal income in November was stronger than consensus at 0.4% mom. The US Bureau of Economic Analysis (BEA) revised its estimate of Q3 real GDP growth up from 2.9% to 3.2% (seasonally-adjusted annual rate), with upward revisions to both final sales and domestic final sales.

Europe: The November PPI inflation releases from Germany and France both came in lower than expected, and lower than October, at 28.2% (vs. 34.5% prior) and 21.5% (vs. 24.7% prior) respectively. Germany’s IFO Institute’s current assessment and future expectations survey results rebounded from their lows after more than two quarters of decline.

Japan: In a surprising change in policy, on 20 December the BoJ decided to expand its target range for the ten-year Japanese Government Bond (JGB) yield to +/-50 basis points (bps) (around 0%) from+/- 25bps. The BoJ stressed this tweak in its famous yield curve control (YCC) policy was designed to facilitate the transmission of monetary easing effects, and was not a tightening in monetary policy stance. However, the market has been sceptical of this view. The ten-year JGB bond yield jumped by 25bps to 50bps on the day following the announcement, and the JPY strengthened to 130 vs the USD, a sizeable move from the 150 level at which the BoJ intervened in October. The change in monetary policy carries particular significance ahead of the retirement of long-time BoJ governor Kuroda in April. Kuroda is the main architect of the BoJ’s ultra-loose monetary policy, and with Japanese inflation rising, and with the BoJ the last remaining ‘dove’ among global central banks, many investors believe his successor will be forced to make policy readjustments.

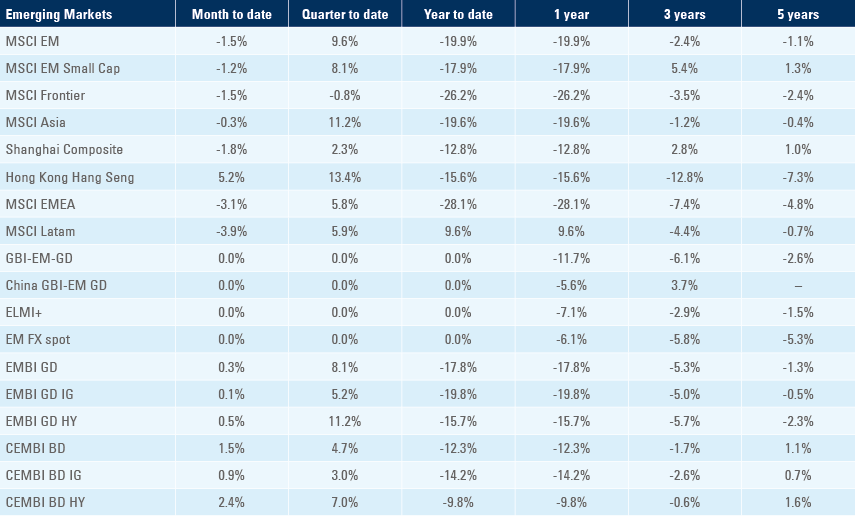

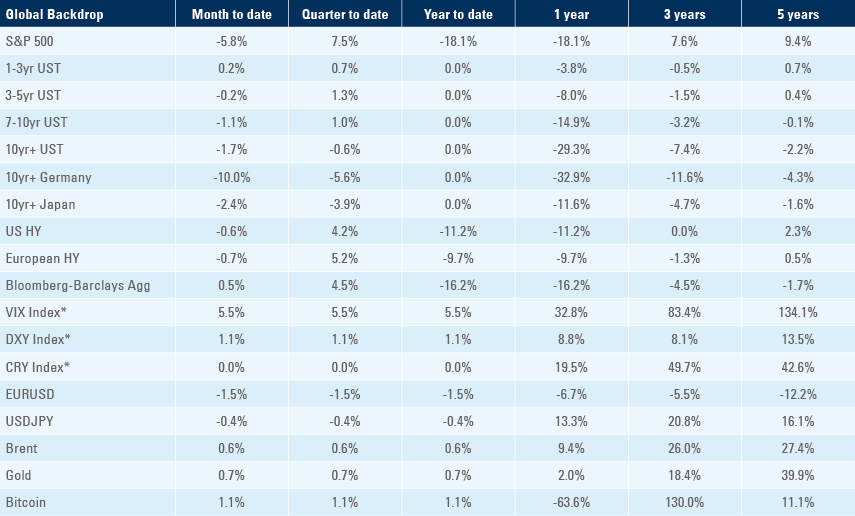

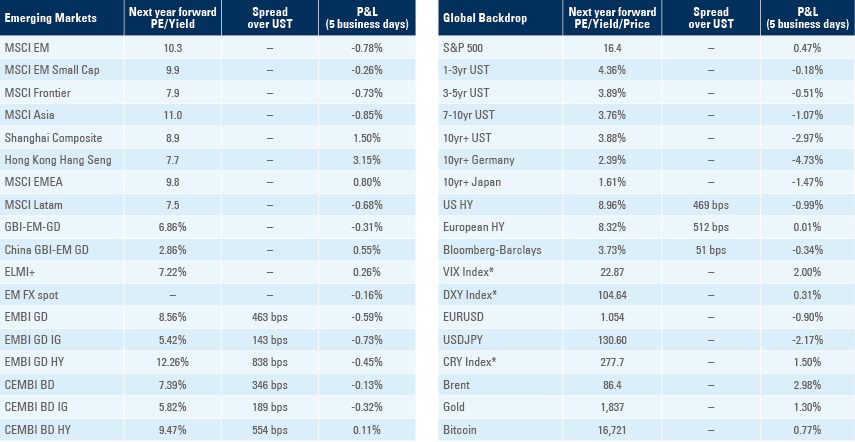

Benchmark performance