Romania and Uruguay voted for change last weekend. The fact that both these countries have very different historical backgrounds and economic situations confirms the overarching anti-incumbency bias faced by most politicians today. Uruguay saw another healthy alternance of power with the centre-left party elected due to cost-of-living concerns. Romania’s first round of presidential election brought a pro-Russian independent candidate surprisingly to the run-off, a more unexpected and worrisome protest vote. Elsewhere, Brazil’s former President Bolsonaro was indicted for crimes against Democracy. Argentina’s Finance Minister mentioned the country is negotiating a new programme with the IMF. India’s state elections consolidated the BJP solid position despite a fresh high-profile corruption scandal. In Senegal, the president’s party secured a solid majority in parliament, which is supportive of its ambitious fiscal consolidation plans. In the US, President Trump appointed Scott Bessent, a market-friendly orthodox hedge fund manager, for Treasury Secretary.

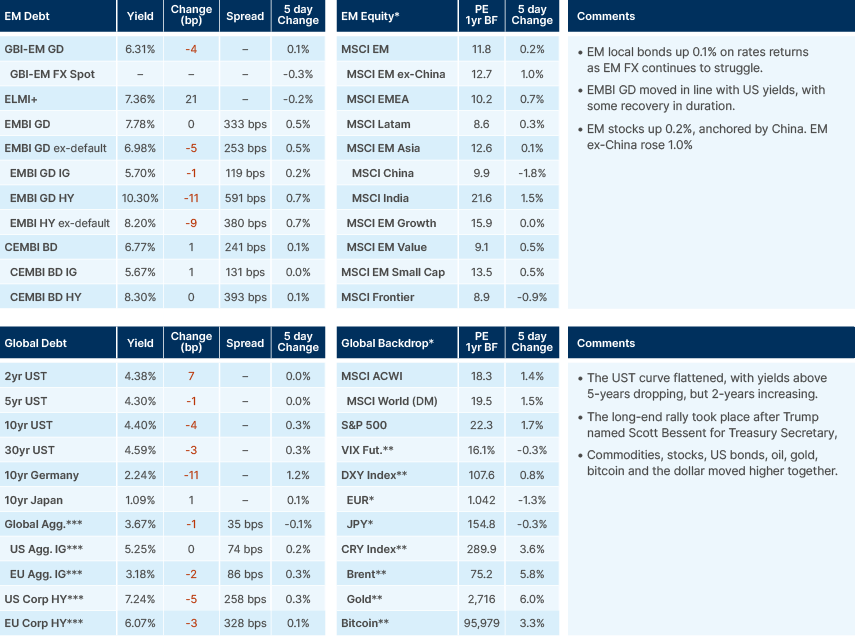

Last week performance and comments

Global Macro

Donald Trump has named Scott Bessent Treasury Secretary, a market friendly and somewhat relieving choice for such a pivotal role. Bessent has already been vocal with markets about his policy preferences. These include introducing a "333" policy framework aimed at increasing oil production by 3 million barrels per day, raising real GDP growth to 3% (driven by deregulation and significant productivity improvements), and cutting the fiscal deficit to 3% by 2028 through lower expenditure as percentage of GDP. Tariffs are expected to be a critical tool for achieving goals related to national security, trade reciprocity (such as addressing EU agriculture tariffs), and stronger currencies from countries with a large surplus against the US. These ideas align closely with former trade representative Robert Lighthizer’s focus on reciprocity, national security, and currency policies.

Other cabinet appointments sine last week include Pam Bondi as Attorney General after Matt Gaetz withdrew, Brooke Rollins as Agriculture Secretary, Doug Burgum for Interior, Lori Chavez-DeRemer for Labor, and Linda McMahon for Education. Questions remain regarding the qualification of many appointees to take such high office. But in each case, what appointees lack in experience, they make up in loyalty to Trump and alignment with his values. All nominees will have to be approved by the Senate, likely after the inauguration of the new Senate on 20 January, but some names may be voted by current Congress. Like in the first mandate, Trump has access to quite a deep bench with more mainstream policy makers to work with. He is likely to tap into those, should the current loyal appointees face any political challenges in the approval process or afterwards when running their portfolios.

Market Outlook Post-Bessent Appointment

Markets appear poised for a "Santa rally" as U.S. stocks stabilised following recent consolidation, driven in part by speculation that Trump is keen on supporting positive price action. Supporting equities and risk assets in general was the improvement on U.S. Treasuries, as the 10-year yield declined to 4.33% after testing 4.5%, a move that may have more legs into year-end, in our view. Emerging markets (EM) equities, which have lagged during Trump’s rise in the polls, may join this rally and could potentially outperform given lower valuations. The main headwind for EM equities has been the threat of tariffs, which may not emerge before inauguration date. EM could also benefit from the announcement of a more thoughtful approach to trade by the current administration, but that’s likely to materialise only at a later stage.1

In the foreign exchange (FX) market, the DXY Dollar index is nearing the upper boundary of its two-year range at 107. The Yen may strengthen into year-end as US Treasury yields decline, particularly if the Bank of Japan (BOJ) hikes in December. The Euro may initially rebound to 1.06–1.07. Emerging market currencies are also seeing a shallow bounce, particularly in Asia, with further gains likely if UST yields fall and the DXY softens.

Global Rates and Central Bank Policies

Markets price a 40% chance of a 25-basis point rate cut by the US Fed in December based on the overnight index swap (OIS) market, or a 55% odds based on future contracts. Longer-term expectations suggest only two cuts by mid-2026 and three by January 2026. Tariffs and reflation fears have driven inflation expectations higher, with the two-year break-even rate reaching 2.66%.

The Bank of Japan (BOJ) is seen as having a 60% probability of a 25-basis point hike in December. Governor Kazuo Ueda has maintained that it is too early to predict the outcome, citing a need to analyse more data. Meanwhile, the European Central Bank (ECB) is expected to reduce its deposit rate by 101 basis points across the next three meetings. The Eurozone is grappling with weak economic data resulting from structural challenges and uncertainties in the US trade policy front. Bosch’s announcement of 5,500 job cuts in Germany highlights challenges in the automotive sector, with overcapacity being a significant issue. Balance sheet risks are also on the fore as France politics (see DM) remain a key impediment to fiscal consolidation in Europe’s second largest economy. ECB policymaker François Villeroy has emphasised a cautious, pragmatic approach to monetary easing, noting that recent wage growth reflects lagged effects of past negotiations, particularly in Germany. As a result of diverging fundamentals and rates, the euro recently fell to 1.033 before bouncing to 1.047.

Geopolitics

U.S. Actions in Ukraine, Venezuela, and India

The US continues to escalate its involvement in global geopolitics. Secretary of State Antony Blinken authorized Ukraine’s use of surface-to-air missiles offensively, marking a significant policy shift and recognised Edmundo Gonzales as Venezuela’s president-elect tightening sanctions on Nicolás Maduro's regime. US prosecutors indicted Indian businessman Gautam Adani and other related parts on charges of bribery to secure renewable energy contracts, potentially complicating the relationship with India.

These escalatory late moves from the Biden’s administration seem to be further complicating the geopolitical task of Donald Trump’s government. However, National Security Advisor appointee Mike Waltz said that the incoming administration is ‘on the same page’ on adversaries. Waltz declared, “We are hand in glove. We are one team with the United States in this transition.”

Ukraine and Russia: Heightened Tensions

The G-20’s latest document used softer language on Ukraine than the U.S. and European allies had hoped for reflecting fractures in international consensus. The document avoided directly condemning Russia, instead calling for "a comprehensive, just and durable peace in Ukraine" without attributing blame. Russia escalated tensions by firing an intercontinental ballistic missile (ICBM) capable of carrying nuclear warheads to Europe. Russian President Vladimir Putin dismissed the impact of Western-supplied weapons like ATACMS and Storm Shadow missiles on the Ukraine conflict and criticised the U.S. for withdrawing from missile treaties, framing it as a strategic error.

Legal Actions Against Israeli Leadership

The International Criminal Court (ICC) issued arrest warrants for Israeli Prime Minister Benjamin Netanyahu and Defence Minister Yoav Gallant. Both leaders face potential arrest if they travel to any of the 124 countries recognizing ICC jurisdiction, including major Western and regional powers such as the United Kingdom, Australia, Brazil, and Mexico. The implications for Israeli diplomacy are significant.

Commodities

China’s oil demand is expected to decline by 2% this year, according to CNPC, with consumption of key fuels like gasoline, diesel, and jet fuel projected to fall to 390 million tons. This drop is attributed to the increasing adoption of electric vehicles (EVs) and LNG-powered trucks, which have displaced approximately 50 million tons of traditional fuel demand.

In Europe, natural gas futures surged to a one-year high of €48.3/MWh, marking the largest monthly gain in over a year. The spike underscores growing energy security concerns as winter approaches, coupled with limited supplies and geopolitical uncertainty.

Nevertheless, commodity prices bounced from the lows due to higher geopolitical uncertainty after Ukraine deployed NATO weapons against Russia, who retaliated using advanced weapons.

Emerging Markets

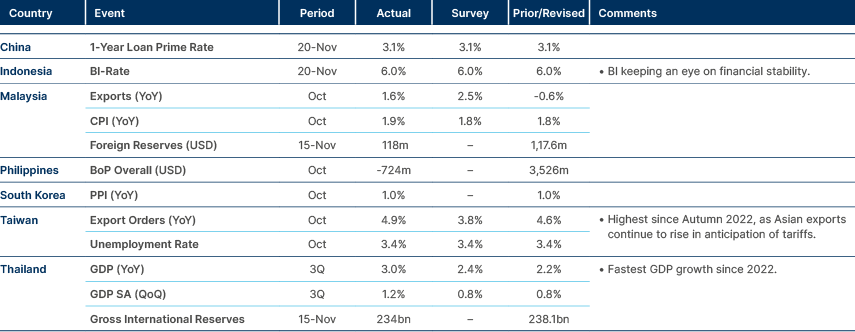

Asia

Export data strengthened further

India

In state elections last week, the BJP-led coalition won a convincing victory to retain Maharashtra (ahead in 228 of 288 seats). This state houses the financial capital, Mumbai, and represents over 10% of GDP. The opposition coalition retained the smaller state of Jharkhand. Modi reacted on social media company ‘X’; “Development wins! Good governance wins! United we will soar even higher!”.

The incumbent parties in both states – BJP+ allies in Maharashtra and JMM-Congress in Jharkhand announced cash transfer scheme for lower income woman before the elections. This has been a growing trend across states where the parties are attempting to gain female voters. This scheme is expected to cost upwards of 0.6% of GDP for Maharashtra and upwards of 1.0% for Jharkhand. This could result in government expenditure on infrastructure, which has been important to India’s growth, to decline in the future as more states will likely follow this script.

Gautam Adani and other Adani executives were indicted by US prosecutors for taking bribes on public contracts to gain renewable energy programs. This may have macro implications. Corruption scandals usually hit governments approval. But the impact is more levant when the population is more financially sensitive. When the Odebrecht scandal hit Brazil (and Latin America), the region was going through a severe slowdown and a balance of payment adjustment that hit people’s purchasing power. It had a very different impact on the Brazilian government than the Petrobras scandal that hit the Labour Party administration during Lula’s very first mandate when people’s purchasing power was increasing. The Adani scandal is taking place when Indian growth is solid, causing a smaller impact than feared on the government’s popularity.

However, all this may lead to a slowdown in credit for infrastructure construction (certainly for Adani, which has been the biggest player) which will lead to a softening of the stellar macro conditions so far. On the micro side, bribery charges mean Adani may struggle to tap bond markets and raise new funds from banks, despite their strong asset base. The companies' ability to tap alternative funding sources is key, as one of the downgrade triggers for Adani companies' ratings occurs if there's a material adverse effect in the ability to roll the debt from regulatory investigations or developments at the sponsor level or other group entities. This would be more important for the more levered entities with less valuable assets.

South Korea

Export orders in the 20 first days of November rose by 5% yoy on a business day adjusted basis, from c -1% in October. This is expansion came despite the higher base as exports were already rising in Q4-2023. Semiconductor exports rose nearly 50% yoy. Nvidia earnings growth remains unabated, enough to drive further demand for semiconductor supply chain.

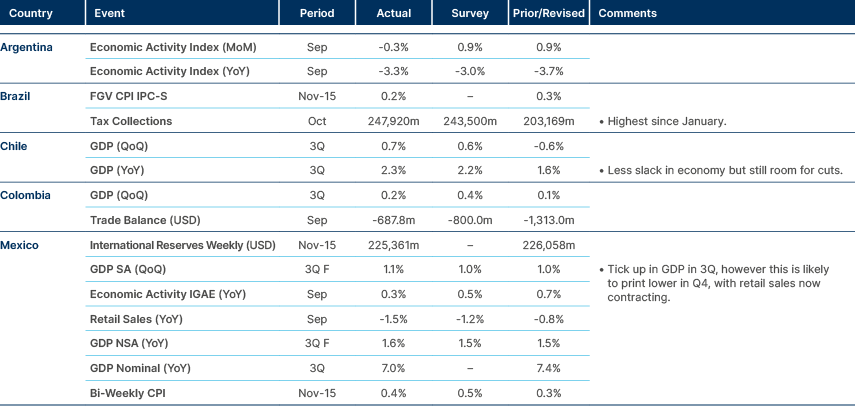

Latin America

Strong tax collection in Brazil.

Argentina

In an interview, Luis `Toto` Caputo revealed that Argentina is planning to remove capital controls in 2025. Argentina still has a backlog of imports and relatively small foreign exchange reserve basis. To liberalise capital flows the country is negotiating a new agreement with the International Monetary Fund (IMF), which includes securing additional funds. According to Caputo, the ongoing discussion centres around the quantity of money to be provided. Despite persistent political drama, Argentina continues to make progress on fiscal consolidation and achieved a budget surplus in the first 10-months of the year. Notably, wages are now growing faster than inflation, as month-on-month inflation has declined to an annualized rate of 42%, a significant drop from its peak of approximately 280%. This improvement not only boosts Javier Milei’s popularity but also signals a potential rightward shift in political sentiment across Latin America.

Brazil

The Federal Police have released a report accusing 37 individuals, including former President Jair Bolsonaro and several top military officials such as Braga Netto, Augusto Heleno, and Paulo Sérgio Nogueira de Oliveira, of plotting to undermine democracy by attempting to keep Bolsonaro in power after his electoral loss to Luiz Inácio Lula da Silva in 2022. This development likely eliminates Bolsonaro’s prospects for a 2026 political comeback.

However, Lula stands to benefit from this only if he can implement sound fiscal policies to re-anchor the Brazilian real (BRL), lower real interest rates, and support economic growth and citizens’ purchasing power. Without such policies, the report is likely to exacerbate political polarization. In this context, São Paulo Governor Tarcísio de Freitas may emerge as a beneficiary of the political fallout. A potential Bolsonaro return under these circumstances would spell trouble for the nation’s democratic stability. The alternative, a return of Bolsonaro in 2026, is not impossible, but much harder to envisage given the Supreme Court indictment is much harder to overrule than Lula’s indictment which took place in the lower court levels.

Uruguay

Uruguay has shifted toward the centre-left as Yamandú Orsi emerged victorious in the presidential runoff election, securing 49.8% of the vote against conservative candidate Álvaro Delgado, who garnered 45.9%. The incumbent President, Luis Lacalle Pou, was ineligible to run due to term limits. High living costs, inequality, and rising violent crime remain top concerns for Uruguayans.

While Orsi has pledged a "modern left" approach focused on addressing inequality and strengthening social safety nets, his Broad Front party’s policies are not drastically different from the outgoing administration. Delgado’s campaign emphasized continuity of business-friendly policies. The election highlighted Uruguay's political civility, standing in stark contrast to the polarised contests seen elsewhere in the region.

The more important event was the fact that Uruguayans had rejected two constitutional proposals together with the first round of elections on the 27 October: one to reform pensions and another to permit nighttime home searches by police. The cautious approach reflects the electorate's reluctance toward sweeping changes.

Central and Eastern Europe

Inflation in Poland slowly declining, another Hungarian hold.

Romania

Preliminary results from Romania’s presidential election show a surprising lead for independent pro-Russia candidate Călin Georgescu, who garnered 22.9% of the vote. Reformist candidate Elena Lasconi made to the run-off with 19.2%, the same percentage of votes received by Prime Minister Marcel Ciolacu who was less than 1,000 votes behind Elena in the third position. Far-right leader George Simion captured 13.9%. Voter turnout stood at 52.6%.

Georgescu’s campaign, heavily focused on TikTok, emphasised national sovereignty, environmental policies, and economic independence. He criticized Romania’s alignment with the EU and NATO, including the missile defence system in Romania, appealing to voters disillusioned with traditional parties. Lasconi, the newly elected leader of the Save Romania Union (USR), campaigned on strengthening democracy, improving healthcare and education, and ensuring Romania’s continued NATO and EU membership. She has called for unity among right-leaning parties to counteract the dominance of traditional political forces and promised a citizen-focused, predictable government.

Lasconi is expected to have an advantage in the second round on December 8, as centrist voters are likely to coalesce around her candidacy. While the Romanian president’s powers are limited, especially in domestic affairs, the position holds significant influence in foreign policy, making the runoff particularly relevant for Romania’s international alignment. Parliamentary elections are scheduled for December 1, further shaping the nation’s political future.

The election results raise concerns for Romania’s already fragile credit position, as the country faces a significant twin deficit. The combined current account and fiscal deficit is projected to reach 15% of GDP in 2024, with slight improvement to 12.5% in 2025. Specifically, the 2024 current account deficit is estimated at c. 7.0% of GDP and the fiscal deficit at c. 8.0%, declining to 6.6% and 5.8%, respectively, by 2025. These challenges underscore the importance of fiscal and economic stability amid shifting political dynamics.

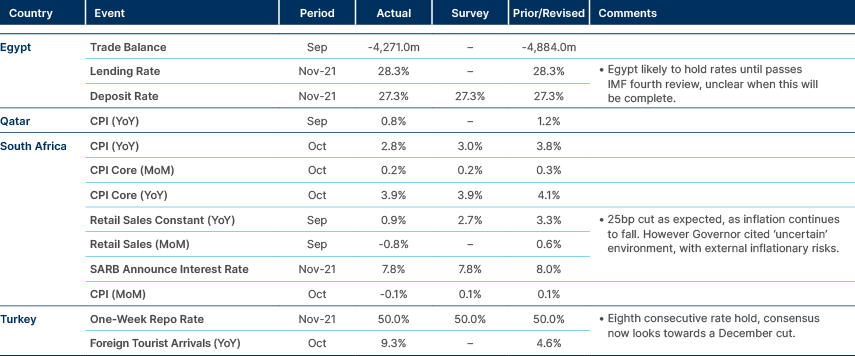

Central Asia, Middle East, and Africa

Egypt and Turkey hold, South Africa cut again.

Saudi Arabia

Moody's has upgraded Saudi Arabia's credit rating to Aa3 with a Stable outlook (from A1/Positive), citing sustained progress in economic diversification. The upgrade reflects Moody's confidence in the kingdom's reduced reliance on oil markets and resilience to the long-term carbon transition. Non-hydrocarbon revenues now account for 30-40% of total government revenue and nearly 20% of non-oil GDP—high compared to GCC peers—and are projected to grow further. Moody’s anticipates fiscal deficits of 2-3% of GDP in the coming years, based on an oil price assumption of $70-75/bbl and the unwinding of production cuts from 2025. The government's recalibration of diversification priorities and fiscal planning is expected to support sustainable non-oil economic growth while preserving the sovereign balance sheet's strength.

Senegal

President Bassirou Faye and his Pastef party have secured a commanding majority in the National Assembly, winning 130 out of 165 seats according to preliminary results. This victory provides a strong platform to push forward the government’s reform agenda, which includes ambitious plans to reduce the budget deficit from its current 10% of GDP to 3% by 2029. The strategy centres on broadening the tax base to better include the informal economy and implementing measures to control the public sector wage bill.

The International Monetary Fund (IMF) is set to review audit findings in January that previously uncovered underreported fiscal deficits and debt levels. These revelations led to a suspension of Senegal's loan program with the Fund. It is anticipated that both sides will agree on stringent corrective actions to restore fiscal balance and enable the continuation of IMF financial assistance, critical to supporting Senegal’s economic reform goals.

Developed Markets

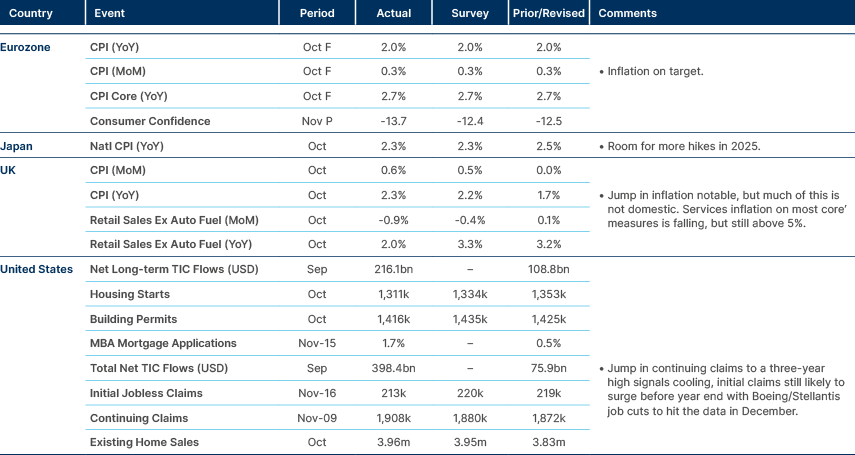

On target inflation in EU, UK prices higher, US continuing claims at 3-yr high.

France

Beyond the expected opposition from the left-centre NFP alliance, Marine Le Pen repeated her threat to vote against the minority government's 2025 budget and back a motion that could result in a vote of no confidence for French PM Michel Barnier. Marine Le Pen reminded the PM of the National Rally's 'red lines,' such as dropping plans to increase electricity tax and delaying of pension increases to account for inflation. These are violations of the commitment she has made to preserve French purchasing power.

A rejected budget and subsequent no-confidence vote leading to Prime Minister Barnier's resignation would necessitate the appointment of a new Prime Minister by President Macron. Given constitutional timelines, the new government might lack sufficient time to present a full budget before 2025. In this circumstance, constitutional provisions (Article 47) and the LOLF (Article 45) allow for parliamentary approval of a special law authorizing tax collection pending a new budget's approval.

Benchmark performance

Source and notations for all tables in this document:

Source: Bloomberg, JP Morgan, Barclays, Merrill Lynch, Chicago Board Options Exchange, Thomson Reuters, MSCI. Latest data available on publication date.

* Price only. Does not include carry. ** Global Indices from Bloomberg. Price to Earnings: 12m blended-forward

Index Definitions:

VIX Index = Chicago Board Options Exchange SPX Volatility Index. DXY Index = The Dollar Index. CRY Index = Thomson Reuters/CoreCommodity CRM Commodity Index.

Figures for more than one year are annualised other than in the case of currencies, commodities and the VIX, DXY and CRY which are shown as percentage change.

1. See – “Trump 2.0: Implications for Emerging Markets”, Market Commentary, 12 November 2024.