The 18th G20 Summit was held in New Delhi. India used its presidency to become a conduit for greater cooperation between the West and the “Global South”. Poland cut its policy rate by 75bps to 6.0%. South Korean inflation surprised to the upside at 3.4% yoy, up from 2.3% in July. Chile continued its cutting cycle, although it slowed the pace to 75bps, to 9.5%. Mexico proposed a larger fiscal deficit primarily to support the state-owned oil company Pemex.

Geopolitics

The 18th Summit of the G20 held in New Delhi on 09-10 September provided another platform for Prime Minister Narendra Modi to position India at the centre stage.1 Modi continued to promote the voice of the “Global South” following the BRICs meeting held at the end of August. Given India’s closeness to many Western economies, its positioning acts as a counterbalance to Chinese influence through initiatives such as the Belt and Road Initiative and China’s position of a large trading partner across most Emerging Market (EM) countries.

The most notable win of India’s presidency was the inclusion of the African Union (representing 55 countries across the continent) to the group. Xi Jinping’s absence from the summit was probably an attempt to hollow out the organisation, which has been in practice dominated by the G-7 nations and failed to advance any issue relevant to the developing world. Instead of going to New Delhi, Xi Jinping received the presidents of Venezuela and Zambia last weekend.

During the summit, the US pitched for the World Bank loan capacity to be increased by USD 25bn, with the potential for it to increase to USD 100bn, should other countries get behind the suggestion. However, nothing effective was announced to make these loans available, and even if it will become a reality, this is not enough to improve the debt and economic situation as well as energy transition needs of several Frontier Market economies.

Global Macro

The risk premium on US stocks reached levels not previously seen since the 2008 Great Financial Crisis, having only been lower twice over the last 100 years (the dot-com bubble c.2000, and the Great Depression), according to data from UBS.

The high valuation levels contrast with a challenging macro environment on a forward-looking basis. US consumers have started to suffer again from negative real income growth as both inflation and energy prices have increased sequentially (not in yoy terms). If inflation and oil prices keep increasing, consumer spending will be directly impacted. This will be exacerbated by the resumption of student loan repayments, impacting more than 40m individuals.2 Bank lending standards have also continued to tighten, and higher US Treasury interest rates will add pressure on the weaker links in the credit space, including small banks, commercial real estate, and residential real estate in many countries (i.e., Scandinavia, Australia, Canada).

In commodity news, Brent oil prices consolidated above USD 90 per barrel following commitments from Saudi Arabia and Russia to further production cuts, earlier in the week, keeping price levels to a 10-month high.

Emerging Markets

EM Asia

China: Aggregate financing rose to RMB 3.1trn in August from RMB 0.5trn in July, as new loans increased by RMB 1.1trn to RMB 1.4trn over the same period, both above consensus expectations. The S&P Global Caixin Purchasing Managers’ Index (PMI) declined to 51.8 in August from 54.1 in July, significantly below consensus at 53.5. The trade surplus narrowed to USD 68.4bn in August from USD 80.6bn in July as exports declined by a yoy rate of 8.8% in August, 20 basis points (bps) above expectations, and higher than -14.5% yoy in July while imports declined by -7.3% yoy, 170bps higher than consensus, from -12.4% in July.

India: The Services PMI declined 2.2 points to 60.1 in August.

Malaysia: Bank Negara Malaysia kept its policy rate unchanged at 3.0%, in line with consensus.

Philippines: The yoy rate of consumer price index (CPI) inflation rose to 5.3% in August from 4.7% in July. Exports declined by -1.2% in yoy terms in July, below consensus expectations of +3.0%.

South Korea: The yoy rate of CPI inflation rose to 3.4% in August from 2.3% in July, above consensus at 2.9% yoy, but CPI ex-food and energy was unchanged at 3.3% over the same period.

Taiwan: The yoy rate of CPI inflation rose by 60bps to 2.5% in August, but core CPI was down 10bps to 2.6%.

Thailand: CPI inflation rose by 50bps to 0.9% in August, 30bps above consensus, while core CPI declined 10bps to 0.8%, in line with consensus. Foreign exchange (FX) reserves increased by USD 1.9bn to USD 217.1bn in September.

Latin America

Argentina: Vehicle production rose by 14k in August to 63.5k, the highest level over the last decade, as domestic sales and exports were unchanged at 30.3k and 28.9k respectively. Industrial production declined by a yoy rate of 3.9% in July after -2.4% yoy in June.

Brazil: The S&P Global services PMI rose 0.4 to 50.6 in August. Vehicle production rose by 44k to 227k in August, close to the average over the last decade, as exports rose by 4k to 34.5k and domestic sales declined by 18k to 207.7k. Industrial production declined 0.6% mom in July as the yoy rate contracted by 1.1% from +0.2% yoy in June.

Chile: The central bank cut its policy rate by 75bps to 9.5%, slowing down the pace of easing following the 100bps cut in the previous month. Headline inflation is expected to converge to the 3.0% target in Q4 2024. CPI inflation dropped faster than expected (to 0.1% mom) in August from 0.4% in July as the yoy rate declined by 120bps to 5.3%. Core CPI declined by 0.1% mom and the yoy rate was down 110bps to 7.4% over the same period. Total vehicle sales increased by 5k to 28.3k in August. The trade surplus narrowed to USD 586m in August from USD 814m in July, below consensus at USD 1.0bn as imports rose faster than exports.

Colombia: CPI inflation rose by 0.7% mom in August from 0.5% in July as the yoy rate declined by only 35bps to 11.4%, 20bps above consensus, and core CPI declined by 25bps to 11.2%, 10bps above expected.

Mexico: The 2024 draft budget featured the widest fiscal deficit of this administration, with the primary deficit at 1.2% of GDP and the nominal deficit at 4.9% GDP, a significant deterioration from the 0.1% primary surplus (3.3% GDP deficit) in 2023. Higher spending and lower revenues are primarily related to support to the state oil company Pemex, which will receive an MXN 145bn (USD 8.5bn) of capital injection and lower royalties equivalent to USD 3.1bn, which still support debt payments. The debt/GDP ratio is forecasted to increase from 46.5% to 49.0%, according to Morgan Stanley, bringing the sustainability of the policies (or debt metrics) into question.

In economic news, gross fixed investment rose by 28.8% in yoy terms in June from 25.2% in May and only 13.0% yoy in April, reaching the highest levels since 1998, once excluding the 2021 rebound following the Covid-19 pandemic. Domestic vehicle sales rose by 3k to 113.9k in August. CPI inflation rose to 0.6% mom in August from 0.5% in July, but the yoy rate declined by 15bps to 4.6%, in line with consensus, and core CPI declined by 50bps to 6.1% yoy.

In other news, Reuters reported the Biden administration is looking to escalate the energy dispute with Mexico, asking US companies to prepare affidavits on the Southern neighbour policies. The USMCA free trade agreement provides checks and balances against populist reforms that are negative for investing in the country.

Central and Eastern Europe

Czechia: The yoy rate of industrial output declined by 400bps to -2.9% in July, significantly below the consensus at +0.6%.

Hungary: The yoy rate of CPI inflation declined by 120bps to 16.4%, 10bps above consensus expectations. Industrial Production WDA was -2.5% yoy for July, 3.9% higher than expectations, up from -6.1% in June.

Poland: The National Bank of Poland cut its policy rate by 75bps to 6.0%. None of the 36 analysts surveyed by Bloomberg expected a larger cut than 25bps: 20 expected a 25bps cut and 16 expected no change.

Romania: Defence Minister Angel Tilvar confirmed that parts of a Russian drone fell on Romania's soil after a strike against a Ukrainian port on the Danube River, a report initially denied by Bucharest. In economic news, the producer price index (PPI) dropped by 0.9% in yoy terms in July after rising by 3.7% yoy in June and retail sales declined by 80bps to 1.2% yoy over the same period. Preliminary GDP growth yoy for Q2 was 1.1%, in line with expectations and the previous quarter’s figure.

Central Asia, Middle East, and Africa

Morocco: The Atlas Mountain region was hit by the worst earthquake in a century, resulting in thousands of deaths and leaving an even larger number of people potentially homeless. The earthquake will be a test for United Nations (UN) institutions such as the World Bank. Morocco is a poster child of economic development in North Africa, with a solid growth model backed by sound fiscal and macroeconomic policies. However, inequality has remained very elevated, meaning a large share of the population affected by the natural disaster have little safety net.

Saudi Arabia: The S&P Global PMI declined 1.1 points to 56.6, remaining at elevated levels.

South Africa: Economic activity surprised to the upside. GDP growth increased by 0.6% in Q2 2023 from 0.4% in Q1 2023 as the yoy rate of growth rose by 140bps to 1.6% over the same period, 40bps above consensus. The S&P Global Services PMI rose 2.8 points (pts) to 51.0pts in August. The current account deficit declined to -2.3% for Q2 2023 from -0.9% in Q1 2023, in line with consensus.

Türkiye: President Recep Tayyip Erdogan said tight monetary policy will help to bring inflation down, a reversal of his long-standing narrative that high interest rates cause high inflation. PPI inflation rose 5.9% mom in August from 8.2% in July, but the yoy rate increased by 490bps to 49.4% over the same period.

Developed Markets

United States:The ISM Services survey rose to 54.5pts in August from 52.7pts in July, significantly above consensus at 52.5pts. Prices paid rose by 2.1pts to 58.9pts, employment increased by 4.0pts to 54.7pts and new orders went up by 2.pts to 57.5pts. The survey contrasted with the S&P Global Services PMI which declined 0.5pts to 50.5pts. Seasoned market participants follow the former, longer standing survey closer, but the later has a broader representation (more small and medium companies) of the economy. Mortgage applications dropped to the lowest level since 1997. Initial jobless claims reported declined by 13k to 216k on the week of 02 September, 17k lower than expectations, and continuing claims were down by 40k to 1679k in the previous week, also 40k below consensus.

Several members of the US Federal Reserve (Fed) were on record last week in favour of keeping the overall “data dependent” stance. Governor Christopher Waller said policymakers can afford to “proceed carefully” with interest rate increases, adding “there is nothing that is saying we need to do anything imminent”. John Williams, President and CEO of the New York Fed, said in an interview to Bloomberg: “We’ve got policy in a good place, but we’re going to need to continue to be data dependent.” The context for this is important. Williams has continued to advocate that the implied neutral interest rate (a concept called R*) has remained relatively low (below 1%), which implies the Fed policy is at quite restrictive levels. This is a concept that Fed Chair Jerome Powell seems to favour and implies the Fed would have some room to lower policy rates in the event of a “soft landing”, something that is reflected in the front end of the US Treasury yield curve today.

In political news, a poll by the Wall Street Journal showed most voters have unfavourable views of President Joe Biden, saying he is “too old” to run for re-election.

Eurozone: Retail sales declined by 0.2% mom in July after rising 0.2% mom in June (revised from -0.3%) as the yoy rate was unchanged at -1.0%. The final GDP figure for Q2 2023 was 0.5% yoy, 10bps below the prior number. The European Central Bank (ECB) will meet this week with the overnight interest rate swap market pricing less than 50% odds of a 25bps interest rate increase. The ECB must balance the various inflation rates across Europe and the fact that overall European Union core CPI inflation actually increased marginally last month and remains around 5.0%. Moreover, most loans from European companies and individuals have a much shorter-term nature than in the US, where investment grade companies access capital via 10 and 30-year bond deals and mortgages are also 30-years. This means that the transmission channel is much faster in Europe than in the US, explaining why, despite having higher inflation and lower policy rate than the US, the ECB is already under pressure to pause its tightening cycle. This is particularly apparent after Poland opted for a 75bps cut last week, which implies the central bank is worried about the impact of its tight monetary policy stance in future economic activity.

1. See – ‘India takes centre stage’, The Emerging View, 30 June 2023

2. See: https://www.theguardian.com/money/2023/jul/10/us-student-loans-restart-payments#:~:text=Who%20will%20be%20affected%20by,restarting%20payments%20in%20the%20fall

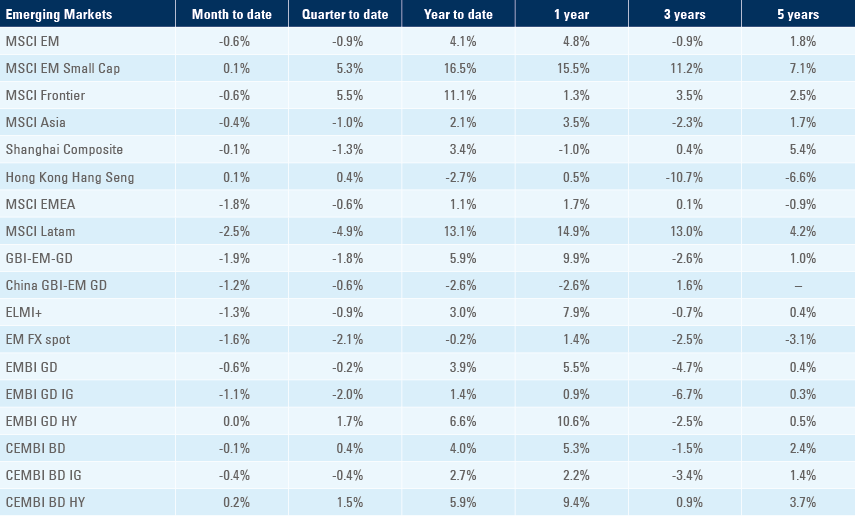

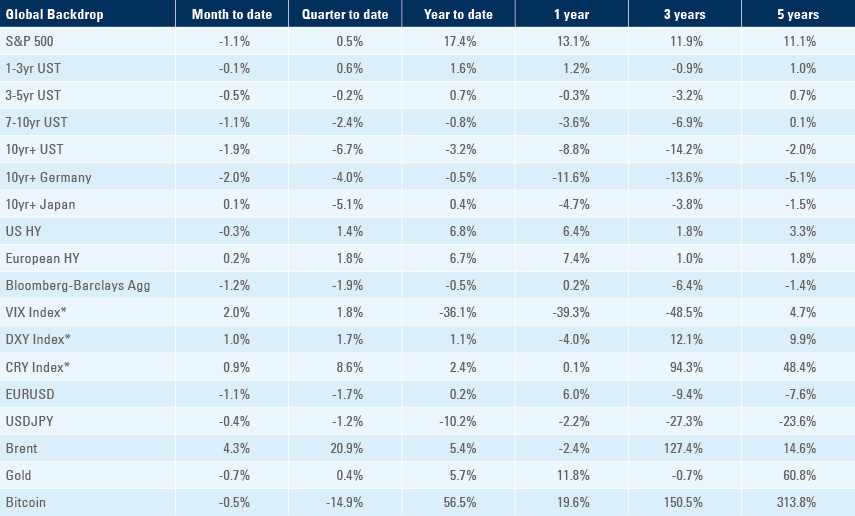

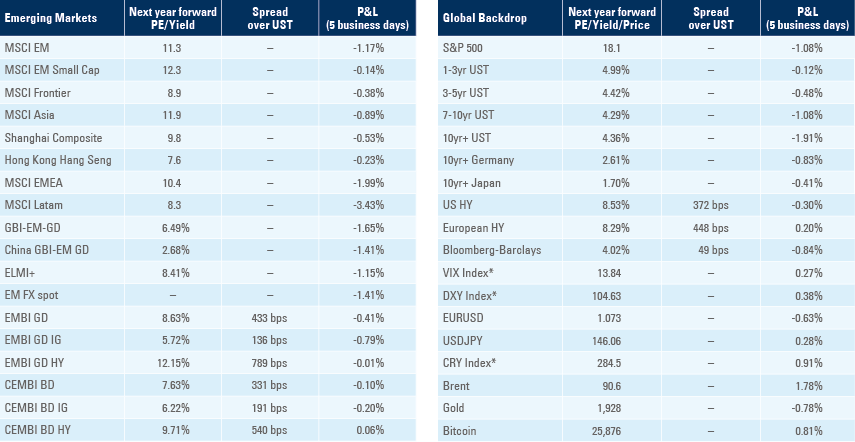

Benchmark performance