Brazil’s Lower House of Congress approves key structural reforms. The Thai parliament reconvenes this week.

US Treasury Secretary Janet Yellen met with her Chinese counterpart, and sounded more constructive on economic relations. Ratings agency S&P kept Indonesia’s credit rating unchanged at BBB, even though it deserves an upgrade, in our view. The Thai parliament named a House Speaker and will vote for Prime Minister this week. The Brazilian Lower House of Congress approved a key domestic tax reform. Polls suggest Ecuador’s market-friendly presidential candidate is in second place ahead of August’s snap elections. Mexican foreign exchange (FX) remittances printed at an all-time high. Venezuela’s opposition leader Maria Corina Machado was banned from running for President as state-owned oil company Petroleos de Venezuela (PDVSA) raised diesel prices for the industrial sector, albeit with significant subsidies still in place.

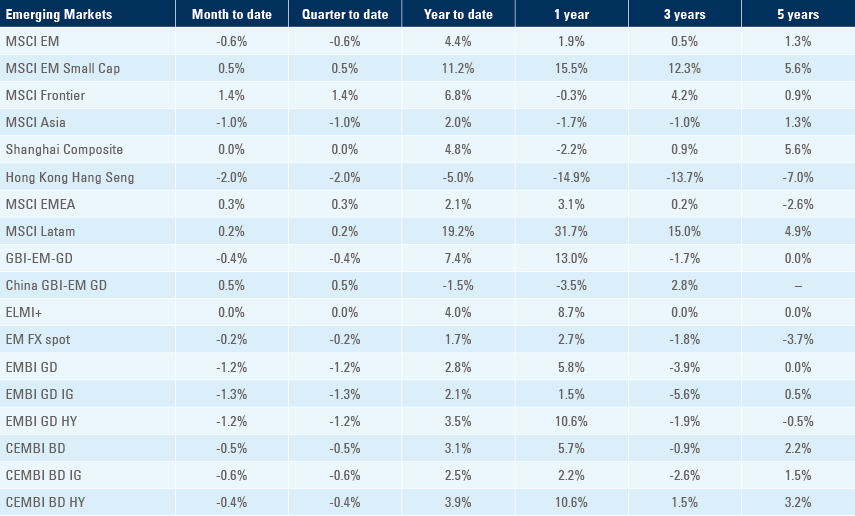

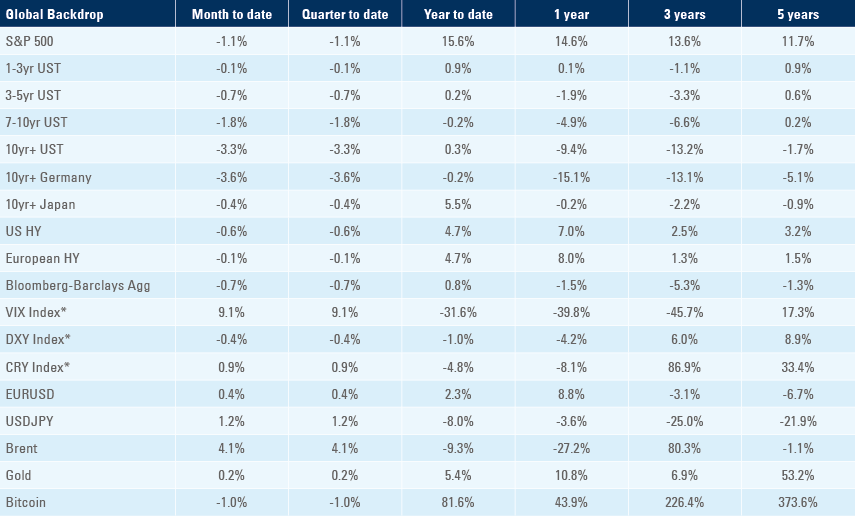

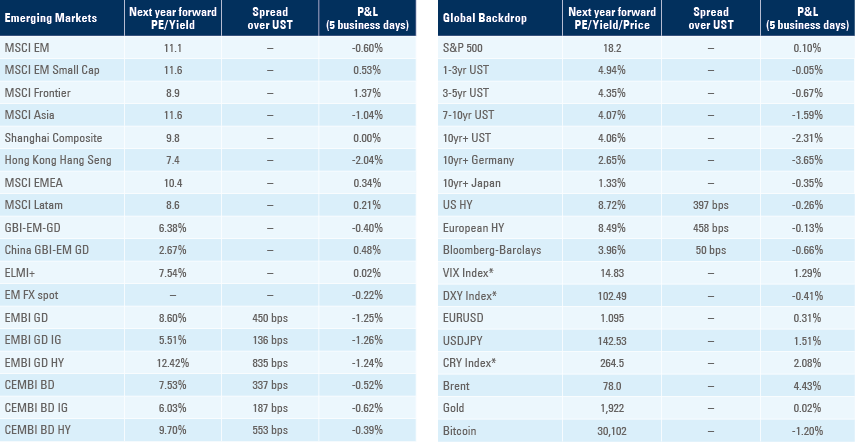

Emerging Markets

EM Asia

China: China retaliated against sanctions imposed on its semiconductor sales by limiting the export of metals used in chip production. This reprisal came one day after US Treasury Secretary Janet Yellen announced her trip to China, which took place last weekend. The meetings had a conciliatory tone; Yellen’s main message was that trade restrictions imposed by the US are “highly targeted” on national security concerns and should have low impact on business, and that the US remains open to cooperation in all other areas. It is worth noting that the pragmatically pro-business Yellen would most likely prefer to have no trade restrictions at all with China. It will be interesting to see whether this pragmatism gains traction in the coming months, especially if the US economy slows down ahead of presidential elections in November 2024. There is no expectation of an overtly friendly approach to China, as this would be extremely unpopular and counterproductive for any campaign. Nevertheless, more covert “behind closed doors” diplomatic negotiations could prove just as effective to boosting economic relationships between the countries. In economic news, the Caixin Services Purchasing Managers’ Index (PMI) declined by 3.2 points to 53.9 in June, below consensus at 56.2, taking the composite PMI down 3.1 points to 52.5. Inflation disappointed as the year-on-year (yoy) rate measured by the consumer prices index (CPI) dropped 20 basis points (bps) to 0.0% in June (consensus +0.2% yoy) and producer price inflation (PPI) dropped 80bps to -5.4% yoy (consensus -5.0%).

India: Services sector PMI declined by 2.7 points to 58.5 in June, bringing the composite PMI down 2.2 point to 59.4 over the same period.

Indonesia: Ratings agency S&P confirmed Indonesia’s credit rating at BBB with a stable outlook. Some local investors were hoping for an upgrade given Indonesia’s strong fiscal and monetary policy management during the Covid-19 crisis and the apparent extremely favourable credit profile as Indonesia has the lowest debt/GDP (when adding Sovereign, Corporate and Household) across the largest economies in the world, according to the Bank of International Settlement. However, there have been some discrepancies on how Indonesia accounts for tax to gross domestic product (GDP) ratios (some finance ministry technocrats estimate the tax ratio should be closer to 12.5% instead of 10%). Indonesia has a target of achieving tax ratio at 14%. Changing the classification could be a step to accelerate the well-deserved upgrade.

Malaysia: Malaysia’s central bank, Bank Negara Malaysia (BNM), kept its overnight policy rate at 3.0%, in line with consensus. The BNM statement said its monetary policy stance “is slightly accommodative and remains supportive of the economy”.1 Its stance is being held against a backdrop of weakening external demand, which is already straining the manufacturing sector. Malaysia’s industrial output shrank for the first time in nearly two years in April, alongside the third consecutive month of contraction in exports in May. As in other countries, manufacturing weakness has been compensated by a strong domestic economy, buoyed by the recovery of its tourism sector and a tight labour market.

South Korea: CPI inflation was unchanged in June after rising 0.3% month-on-month (mom) in May, while the yoy rate declined 60bps to 2.7% (below consensus at 2.8%). Core CPI inflation dropped by 20bps to 4.1% yoy over the same period.

Taiwan: The yoy rate of CPI inflation declined from 2.0% yoy in May to 1.8% in June, broadly in line with consensus. Core CPI was unchanged at 2.6% yoy.

Thailand: Parliament reconvened, and former deputy prime Minister Wan Muhamad Noor Matha (Wan Noor) of the Prachachat Party was appointed House Speaker unopposed. The Prachachat Party is in coalition with the two largest parties in Congress (Move Forward and Pheu Thai Party), and Wan Noor is viewed as a moderate capable of bridging the aggressive reforms proposed by Move Forward.2 The first vote for Prime Minister will take place on the 13 July. A simple majority of both houses combined (500 Congress seats and 250 Senate seats) is needed to elect the Prime Minister. The Move Forward and Pheu Thai Party coalition has a large majority in the Congress, but the Senate is a non-partisan group that was appointed by the Royal Thai Military, which has been against the reforms. The three main scenarios in terms of outcome, in our view are:

- Pita Limjaroenrat, the leader of the Move Forward Party, is installed as Prime Minister despite being under investigation for owning shares in media company iTV.3

- The second-biggest party propose a Prime Minister but Move Forward remains part of the coalition.

- The Pheu Thai Party breaks its coalition with the Move Forward Party and tries to form a coalition with the Junta (presenting a higher risk of protest/violence).

Thailand’s King Maha Vajiralongkorn stroke a conciliatory tone, saying Congress needed to hear the voice of the people. Alongside with the more moderate House Speaker, we appear to be moving towards the first two scenarios, which would be positive for Thai investment assets. However, as expected, Senate leadership has gone quiet, keeping all scenarios in play.

In economic news, CPI inflation rose by 0.6% mom in June after declining 0.7% mom in May, but the yoy rate was down 30bps to 0.2% (consensus 0.0%) due to base effects. Core CPI was down by 30bps to 1.3% (consensus 1.4%). The business sentiment index rose by 1.3 points to 51.0.

Latin America

Argentina: Domestic vehicle sales rose to 44.1k in June from 38.6k in May. Vehicle production was stable at 53.5k and exports declined by 7k to 23.3k.

Brazil: The Lower House approved a historic tax reform that simplifies the corporate tax regime by unifying five state and federal taxes into a dual value-added tax (VAT) system (one for the federal government and another for the states). The system is not perfect, with lots of tax benefits still being given to different sectors. Treasury Secretary Bernard Appy believes a 25% VAT rate (OECD average 19.2%) will be necessary to keep tax rates unchanged, as several sector-specific tax exemptions were necessary to approve the constitutional amendment. For example, the Manaus free trade zone (ZFM) in the Amazon will retain its tax-free status. Several sectors will pay only 40% of the standard rate (education, healthcare, medicines, public transport, food, personal hygiene, cultural activities, hospitality services and restaurants), and several other sectors will be exempt (such as basic foodstuffs and rural producer suppliers). Brazil’s tax regime for individual taxpayers will change gradually from 2026 to 2035. Two special funds were also created: a BRL 40bn fund to reduce regional inequalities and a BRL 32bn fund to replace state fiscal benefit policies. There were new taxes created for jets, yachts, and boats, as well as a progressive inheritance tax and an update on the tax basis for municipal property taxes. Congress approved the constitutional amendment in two votes, which means the reform now goes to the Senate where a supermajority is needed.

The Lower House also unwound a regulatory measure enacted by former President Jair Bolsonaro relating to the Administrative Council for Fiscal Resources (CARF), an independent council for judging tax disputes. Currently, if the council has a split vote, the case is won by the taxpayer. If approved, the reform will give the advantage back to the government in split vote cases. Brazil’s tax complexity leads to an above-average number of disputes.

In economic news, the manufacturing sector PMI declined by 0.5 points to 46.6 and the service sector PMI was down 0.8 points to 53.3. Brazil’s trade surplus declined marginally to USD 10.6bn in June but remained at the highest level in ten years as exports declined by USD 3bn to USD 30.0bn and imports declined by USD 2bn to USD 19.5bn. Industrial production rose 0.3% mom in May after declining 0.6% mom in the previous month, while the yoy rate rose from -2.7% to +1.9% (consensus +1.3%) over the same period. Vehicle sales rose to 189.5k in June from 176.5k in May.

Chile: The economic activity proxy declined 0.5% mom in May after -0.1% mom in April, while the yoy rate declined to -2.0% from -1.1% over the same period, slightly below consensus at -1.7%.

Colombia: The Davivienda PMI was unchanged at 49.8 in June.

Ecuador: A poll ran by Comunicaliza from 6 July for snap National Assembly elections scheduled for 20 August show the market-friendly Former Vice President Otto Sonnenholzner stand in second place with 12.8% of vote intentions but is increasing his lead over indigenous activist candidate Yaku Perez with 10.3% of vote intentions. This is relevant because support for the current front-runner, Correista candidate Luisa Gonźalez, remains capped at 27%, so whoever goes through to the second round of voting has a good chance of winning the election.

Mexico: Manufacturing sector PMI improved 0.4 points to 50.9 in June. FX remittances rose to USD 5.7bn in May from USD 5.0bn in April, the highest number in the series. With most Mexican remittances coming from US service sector employees the record number corroborates the strength of the US economy. As an economic indicator, this probably provides the cleanest picture for the US job market, considering the challenges in reading US labour market surveys. Domestic vehicle sales rose to 113.5k in June from 106.8k in May, while vehicle exports rose 7k to 286k, the highest level since December 2020. The yoy rate of gross fixed investment slowed to 6.1% in April from 9.0% yoy in March, slightly lower than consensus.

Venezuela: At the Mercosur Summit in Argentina, the presidents of Paraguay and Uruguay condemned the ban imposed on opposition candidate María Corina Machado from running for public office. Uruguay’s President Luis Lacalle Pou said “Venezuela is not going to transit towards a healthy democracy if a candidate with enormous potential like María Corina Machado is disqualified for political reasons and not legal ones”. Lacalle also called on the bloc to use its voice to help Venezuela achieve a full democracy. The United Nations issued a report on the human rights situation in Venezuela urging it to take actions to create an environment that guarantees the full exercise of economic, social, as well as human rights. Administrative bans reportedly imposed by the Office of the Comptroller were also noted in the report. This week, the opposition candidates hold a primary debate. In economic news, the government raised diesel prices for the industrial sector from an equivalent of USD 0.00 to USD 0.32 per litre, in line with the production and operational costs of USD 0.31 per litre reported by the nationalised oil company PDVSA, although it is difficult to verify the accuracy and veracity of PDVSA reports. Gasoline prices were increased three years ago, but hyperinflation brought it back to highly subsidised levels of circa USD 0.02 per litre.5 Dollar prices for diesel had dropped to zero due to hyperinflation, which affected the supply to the industrial sector, generating black market and additional bottlenecks in the local economy, feeding back to more hyperinflation. However, the diesel subsidy was kept for health and public transportation systems.

Central and Eastern Europe

Hungary: Retail sales and industrial output continued to contract in June. The yoy rate of industrial production dropped to -4.6% from -5.8% yoy in May (in seasonally, working day adjusted terms), and retail sales declined by -12.3% yoy from -12.7% yoy.

Romania: PPI inflation dropped by 2.1% mom in May after declining 3.5% in April, bringing the yoy rate down by 390bps to 7.7%. The central bank kept its policy rate unchanged at 7.0%, in line with consensus. Retail sales rose to 2.7% mom in May from a revised -0.5% mom in April as the yoy rate rose to 2.7% from -0.5% yoy over the same period, rebounding from one standard deviation below the average over the last ten years (7.5% yoy), but remaining at depressed levels.

Central Asia, Middle East, and Africa

Saudi Arabia: The S&P Global Whole economy PMI rose 1.1 points to 59.6 in June.

South Africa: Vehicle sales rose to 46.8k in June from 43.0k in May, the highest level since 2014.

Turkey: CPI inflation rose by 3.9% mom in June after being unchanged in May, while the yoy rate dropped 130bps to 38.2% due to base effects (consensus 38.9%). Core inflation rose 70bps to 47.3% over the same period. PPI inflation rose 6.5% mom in June after 0.7% mom in May and the yoy rate was down only 40bps to 40.4%.

Developed Markets

United States: The Institute for Supply Management (ISM) manufacturing index dropped 0.9 points to 46.0 (47.2 consensus) in June. The underlying numbers suggested the manufacturing sector is struggling, with current production down to 46.7 from 51.1, while prices paid plunged to 41.8 (from 44.2 prior and 53.2 in April).

The labour market was stronger than expected, but there were mixed signs from different surveys. These surveys have always been known for their apparently unpredictability, and part of the reason is that only around 40% of companies answer the survey. Paul Donovan, Chief Economist from UBS Wealth Management, said most mainstream companies do not bother with the surveys, so only the “weird” companies answer, making them “weird” surveys. Also, the labour market data has severe distortions from the pandemic and new technology which does not get captured in the data.

With all that in mind, last Friday, non-farm payrolls increased by 209k, slightly below consensus at 230k and below 306k in May (revised from 339k). The unemployment rate fell to 3.6%, as expected. The US Job Openings and Labour Turnover Survey (JOLTS) was softer in May with 9.8m job openings versus an estimated 9.9m and 10.3m prior. Morgan Stanley highlighted data from LinkUp (highly correlated with JOLTS) suggesting job openings should be weaker than reported by the JOLTS survey and eventually job openings will decline to 8.0m, below the pre-pandemic trend line.

Initial jobless claims for the week ending 1 July increased by 9k to 248k, slightly above consensus, but continuing claims declined to 1.72m in the prior week, below consensus at 1.74m. Other aspects of the jobs market were much stronger than expected. The ADP report showed US companies added 497k jobs in June – a much larger number than the Bureau of Labour Statistics (BLS) survey and the largest increase for this measure in over a year. The ADP data was released when US Treasury yields were under pressure by higher yields on UK and European bonds (UK inflation remained surprising buoyant) and led to a sharp sell-off in US Treasury yields. Nevertheless, economists have traditionally focused more on what is considered to be the better quality BLS survey. Every now and then investors forget ADP is not a good signal for the BLS and trade frantically.

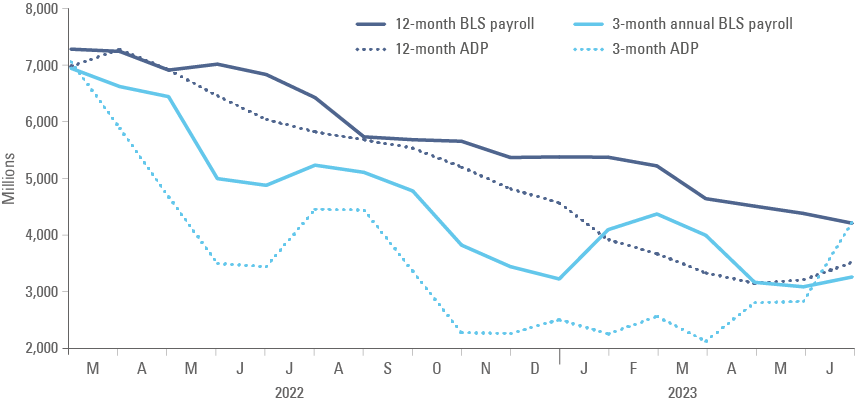

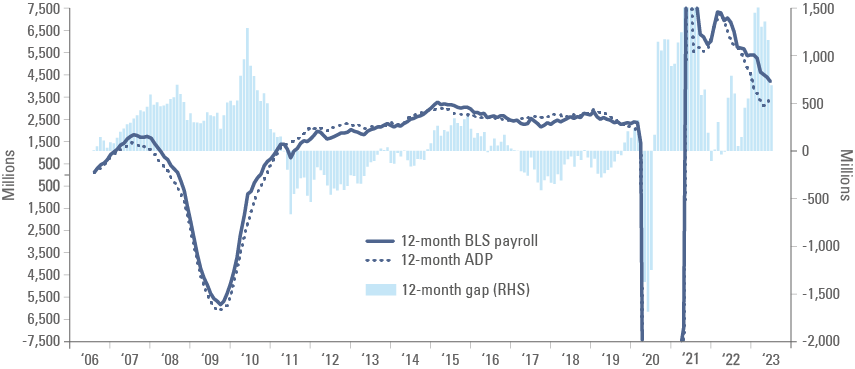

The unusual difference between the ADP and the BLS numbers could be simply due to mean reversion of the signals captured by the different surveys. ADP had much lower numbers than the BLS over the last 12 months as illustrated by Figure. 1. Over the longer term, these divergences tend to mean-revert, at least to some extent, as illustrated by Figure 2. The second chart also shows a similar dispersion between the BLS and ADP data in the post-2008 period but appears more persistent this time. Therefore, the historical data suggests ADP data should trend higher than BLS over the coming months, as the divergence is too elevated for historical standards.

Fig 1: 12-month and 3-month annualised cumulative ADP and Payroll data

Fig 2: 12-month annualised cumulative ADP and Payroll since 2006

One consistent theme across both reports is that the service sector is driving the push. Out of the increase in payrolls, it was education and health services (+73k), construction (+23k), professional and business services (+21k) and leisure and hospitality (+21k) that drove the increase, and most of these are service based. In the ADP report, it was leisure and hospitality leading the gains.

Indeed, the just-released US ISM Services index also showed an expansion (an increase from 50.3 to 53.9) in the service sector for June, with 15 out of 18 surveyed industries reporting growth. This included accommodation and food services, arts, entertainment, and recreation. The strong service sector and job market data suggests the US Federal Reserve (Fed) is likely hike policy rates by 25bps to 5.5% on 26 July (with 90% chance of a 25bps hike to 5.5%).

Aside from the jobs market, the MBA Mortgage Applications index fell 4.4% in the week ending 30 June. This was the first week mortgage applications fell since the beginning of June. Finally, the US trade deficit narrowed more than economists expected to USD 68.9bn May, from USD 74.4bn in April.

Eurozone: The Eurozone manufacturing PMI fell to 43.4 in June (below the preliminary estimate of 43.6), down from 44.8 in May, while services sector PMI fell for the second month running, down from 55.1 in May to 52.0. This meant the composite PMI for June was revised down to 49.9 from a preliminary estimate of 50.3. PPI inflation dropped 1.9% mom in May after -3.2% mom in April bringing the yoy rate to a 1.5% deflation from +0.9% in over the same period (consensus -1.3%)

Australia: Australia’s trade balance rose to AUD 11.8bn from AUD 10.5bn in May, surpassing economists' expectations.

Commodities: US crude oil stocks fell by more than expected due to strong refining demand, while gasoline inventories also fell after an increase in driving last week, according to the Energy Information Administration (EIA). Crude inventories fell by 1.5 million barrels in the last week, while US gasoline inventories fell by 2.5 million barrels. Although the fall was expected by seasonal patterns, the record temperatures set this summer suggests energy demand will remain strong. Last week, Saudi Arabia announced the oil production cut of 1m barrels per day will be extended for another month in August. This is intended to rebalance an oversupplied market in the short-term, due to robust growth of non-OPEC supply and softer than expected demand from China.

The author thanks the contributions from Igor Yamamoto, Jake Ward, Joe O’Shea and Olivia Shaul.

1. See: https://www.bnm.gov.my/-/monetary-policy-statement-06072023

2. See: EM elections: good result in Thailand, poor results in Türkiye

3. See: https://www.bangkokpost.com/thailand/politics/2585541/pita-has-sold-itv-shares

4. See: https://www.bloomberglinea.com/english/what-is-the-real-price-of-gasoline-in-venezuela/ and https://tradingeconomics.com/venezuela/gasoline-prices

Benchmark performance