- Risk-off moves deepened, with the re-expansion of US liquidity and bond yields key catalysts for recovery. NVIDIA’s earnings helped the AI narrative to remain intact.

- Ukraine and EU worked on a counterproposal to the 28-point US peace plan for Russia/Ukraine.

- South Korea released details of US investment pledges and tariff deal.

- Malaysian exports hit record high, driven by semiconductor volumes and prices.

- US tariffs removed on key Brazilian agricultural products.

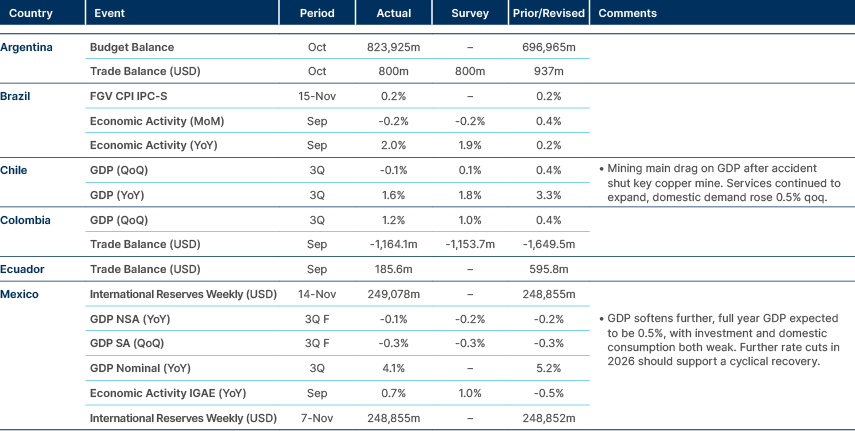

- Mexico’s GDP growth running below 0%, but improvements ahead.

- Positive meeting between Trump and Saudi Arabia’s Mohamed Bin Salam strengthens the strategic partnership.

- S&P upgraded Uzbekistan to ‘BB’, Zambia to ‘CCC+’ and Kuwait to ‘AA-’

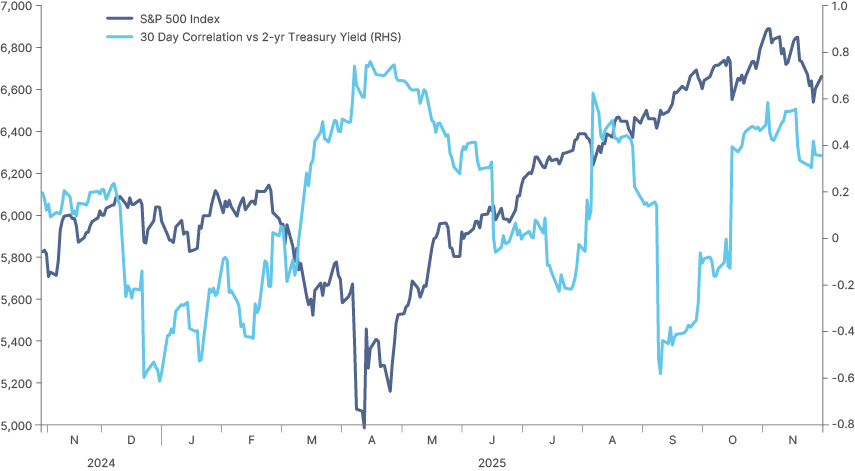

Last week performance and comments

Global Macro

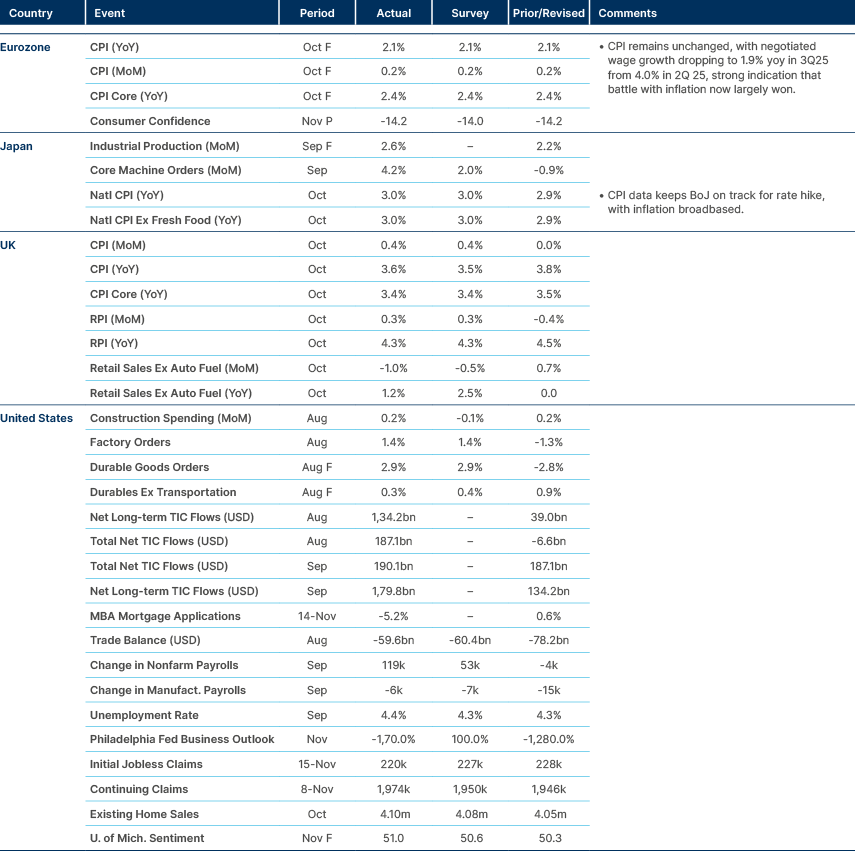

Risk sentiment deteriorated last week as the US tech-led selloff broadened. The S&P 500 fell nearly 3% over four sessions, with over 60% of constituents down on Wednesday as the VIX spiked. Emerging markets (EM) underperformed, led by China’s 5.5% drop, and speculative assets were hit hardest: Bitcoin fell much further, trading below USD 85k, nearly two standard deviations below its 250-day moving average. This erased year-to-date (YTD) gains. NVIDIA’s strong earnings (earnings per share +56% yoy, and revenue +65% yoy) steadied sentiment, although volatility remained elevated, with market pricing of a potential US Federal Reserve (Fed) December rate cut swinging around amidst undecisive economic data and mixed signals from different Federal Reserve members. Price action stabilised into Friday and in Asia trading this morning, but conviction remains low, and the recovery so far looks hesitant.

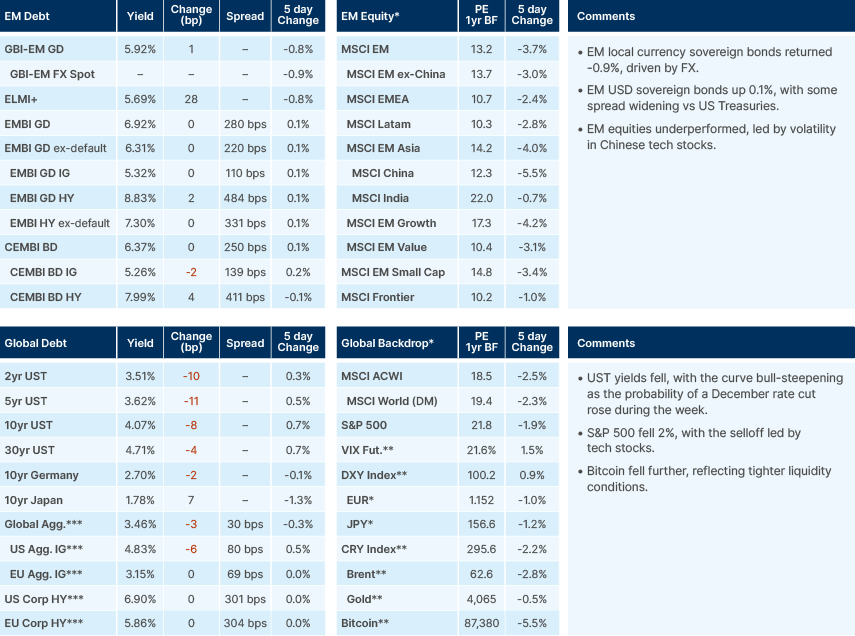

In our view, the disproportionately large move in crypto last week relative to tech stocks is a clear signal that tight liquidity has been the dominant driver of market volatility. US M2 is at record highs, yet marginal liquidity has tightened sharply in recent weeks due to quantitative tightening (QT), elevated US Treasury issuance and a depleted reverse repo (RRP) buffer. Bank reserves have been drained, with trading priced off the Secured Overnight Financing Rate (SOFR) above the top of the target range, an indicator of tight liquidity in overnight funding markets. Despite increased noise of an ‘AI bubble’, fundamentals remain intact. Capex for large language models (LLMs) is still backed by strong earnings and very strong cashflow, and hyperscalers continue to signal robust investment pipelines. Perhaps the most telling signal is that NVIDIA’s share price is unchanged over two weeks despite fear spiking, underscoring that nerves around AI capex appear driven more by sentiment than data.

Fig 1: SOFR vs Fed Funds Rate Spread

The outlook for US liquidity into the end of the year looks supportive. The Treasury General Account (TGA) remains high at around USD 940bn after the government shutdown but will begin to run down from early December. Simultaneously, Fed QT ends on 1 December, with the Fed shifting reinvestments into T-bills. This combination should inject liquidity back into the system, but the transmission depends on the behaviour of the long end of the Treasury curve. A renewed bear steepening would risk another risk asset flush, particularly across crypto and high-beta equities.

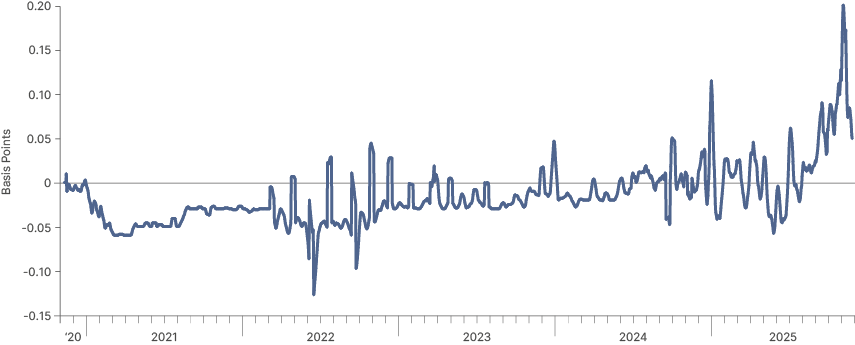

Fig 2: US stocks correlation with yields firmly positive into year end

Communication from Fed officials softened meaningfully late last week. New York Fed President John Williams signalled room for “near-term” cuts, driving odds of a December cut to nearly 70%. This helped yields move lower, with the 2-year Treasury yield falling from 3.6% to 3.5% between Wednesday and Thursday. Boston Fed President Susan Collins then pulled the rhetoric back slightly, noting she has not yet decided and sees “upside risks to inflation.” She also acknowledged clear labour-market cooling and rising unemployment for younger college-educated workers. St. Louis Fed President Alberto Musalem and Atlanta’s Raphael Bostic remain cautious, though neither dismissed further easing if data weakens. The broader takeaway is a shift toward an insurance cut narrative, with several members indicating they would respond quickly if labour softens further. If the Federal Open Market Committee holds rates in December, a cut in January is highly likely. Markets now expect roughly three cuts over the next six months.

On jobs data, September’s headline payrolls surprised to the upside (+119k vs +51k expected), but the details were weaker: net revisions of -33k, rising unemployment to 4.44% (partly participation-driven), and the highest October layoff count since 2003. The three-month payroll average was only +62k, consistent with rapidly decelerating employment momentum. U-6 underemployment fell, but this reflects part-time shifts more than strength. No more up to date payroll data will be released before the December FOMC, leaving the Fed reliant on patchy indicators.

The UK Budget poses a risk to global bond yields this week. Chancellor Rachel Reeves faces a GBP 30bn fiscal gap, with borrowing already running above forecast. Retail sales fell 1.1% month-on-month in October and business activity continues to slow. Likely tax rises will focus on higher income households and indirect measures, while broader income tax hikes look politically unworkable. With growth weakening and gilt markets sensitive to fiscal discipline, the Budget will need to outline a credible debt path to avoid renewed pressure at the long end.

EMs mostly traded with low beta to the selloff, suggesting positioning is lighter and technicals cleaner. That creates scope for EM to ‘catch a bid’ into yearend if liquidity turns supportive and the Fed signals or delivers a near-term cut. With limited EM-specific catalysts on December’s horizon, the macro backdrop, including Fed cuts, the end of QT and a drawdown in the TGA, is likely to be the key driver of returns in December. This should all be supportive provided the long end remains orderly.

Geopolitics

Trump’s 28-point draft peace plan remains the reference point in peace talks, proposing that Ukraine formally cedes Crimea, Luhansk and Donetsk, accepts limits on its military and NATO ambitions, and allow the phased lifting of sanctions and Russia’s gradual reintegration into the global economy. Kyiv and most European capitals still view this as far beyond what is politically acceptable. After backlash from Ukraine and European Union (EU) leaders, President Donald Trump stressed the document is “not the final offer” and hinted the Thursday deadline could be flexible. However, Washington is clearly signalling that continued US support is conditional on engagement with the framework.

Markets increasingly see the potential scaling-back of US intelligence and targeting support as a key pressure point on Kyiv, even if this has not yet been formalised as a public ultimatum. Ukraine and its European partners began preparing a counterproposal that would discuss territorial issues only once fighting has stopped along the current line of contact. They are pushing for NATO-style US security guarantees, the use of frozen Russian assets for reconstruction and compensation, and a phased, conditional easing of sanctions only if Moscow complies with any deal. Ceding currently unoccupied territory in the east remains a red line. European leaders are trying to insert themselves more firmly into the process after being largely sidelined by the initial US–Russia channel, warning that a settlement that rewards aggression would damage Europe’s security architecture and political cohesion. For now, the gap between the US draft and the Ukrainian/EU counter-position is wide, suggesting a prolonged and noisy negotiation phase rather than an imminent deal.

Emerging Markets

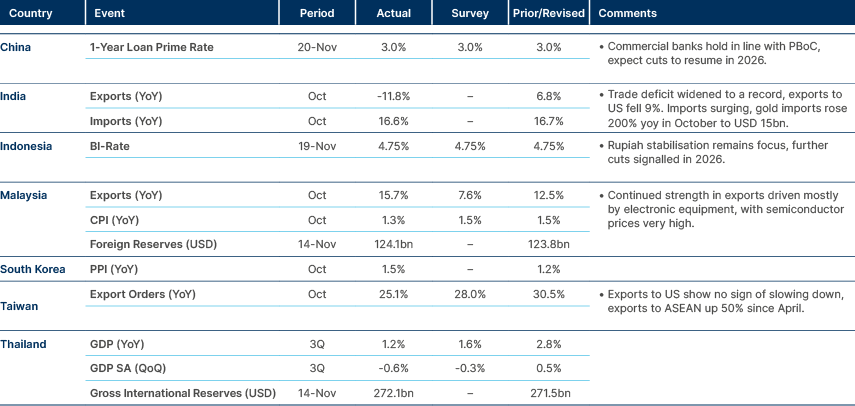

Asia

South Korea: The government will submit a special law by next week to formalise the USD 200bn capex pledged to the US, a prerequisite for Washington to cut tariffs on Korean autos to 15% and apply the lower rate retroactively from 1 November.

Officials say deepening US cooperation should strengthen Korea’s position vs fast-catching-up Chinese competitors in semiconductors, shipbuilding and other advanced industries. Bank of Korea Governor Rhee Chang-yong said the tariff deal “significantly” reduces uncertainty and that US-Korea joint ventures combining US science with Korean manufacturing could be very positive. He was also upbeat on AI-linked demand, hinting at a shift to a more neutral monetary stance. A separate industry survey suggests China could overtake Korea by 2030 in five key sectors (semiconductors, electronics, automobiles, shipbuilding and batteries) reinforcing the authorities’ push for alliances with the US while defending Korea’s remaining advantages in areas like shipbuilding and batteries.

Kazakhstan: An International Monetary Fund (IMF) mission urged a more restrictive macro policy mix to contain inflation, including tighter fiscal and quasi-fiscal policies, and better liquidity management, in support of ongoing tight monetary policy. The fund recommended coordinated issuance of short-term NBK notes and Treasury bills, a medium-term public-debt limit and closer monitoring of state-owned enterprises. The IMF expects GDP growth above 6% in 2025 on strong oil output and domestic demand, moderating to 4.5% in 2026 as oil production and consumer credit growth cool. External shocks to oil prices and exports remain the main downside risks.

Malaysia: Exports rose 15.7% year-on year (yoy) in October to a record MYR 148bn, led by a 26.5% rise in electronics, while other exports rose 5.6% yoy driven by metals, optical equipment and palm oil. Imports also reached a new high, up 11.2% yoy to MYR 129bn, largely due to capital goods purchases by the electronics sector, signalling ongoing investment in production capacity.

The trade surplus widened nearly 60% yoy to MYR 19bn and is up 19% YTD, on resilient demand from Singapore, the EU and North Asia, although exports to the US have softened. Looking ahead, easing global trade tensions and Malaysia’s partial exemption from US tariffs is supportive, but the risk of steeper US duties on semiconductors remains a key downside.

Thailand: Finance Minister and Deputy Prime Minister Ekniti Nitithanprapas said the government will keep implementing its economic agenda even if Prime Minister Anutin Charnvirakul dissolves the lower house on 12 December in response to a no-confidence motion. Authorities intend to press ahead with planned measures through year-end, prioritising competitiveness via support for local firms, new market access through foreign trade agreements and bilateral deals, and faster project approvals under the ‘Thailand Fast Pass’ initiative. Trade talks with the US are likely to continue, although any agreement would need to wait for a post-election government as a caretaker administration cannot sign binding treaties.

Uzbekistan: S&P upgraded Uzbekistan to ‘BB’, in line with Fitch. Analysts cited stronger economic policymaking, and ongoing energy and tariff reforms, along with infrastructure investment which should support long-term growth potential.

Latin America

Argentina: Central Bank of Argentina (BCRA) President Santiago Bausili reiterated that its policy focus is disinflation and growth rather than rapid reserve accumulation, arguing that build-up should be a by-product of rising money demand as the economy re-monetises. Bausili posits that forcing a current account surplus via an undervalued exchange rate would depress activity in a relatively closed, import-dependent economy and deter investment. The administration therefore favours a strong real FX rate to anchor inflation and will buy USD opportunistically, leaving Argentina more reliant on market access to rebuild reserves.

Brazil: The US removed the additional 40% tariff on a subset of Brazilian agricultural exports, including coffee, beef and some fruits, partially restoring pre-April duty levels for products that also benefit from reciprocal Brazilian tariff reversals. Washington framed the move as recognition of “initial progress” in bilateral talks after Trump’s October call with President Lula. The decision eases pressure on key farm sectors that had seen exports to the US fall sharply in recent months. Lula is likely to capitalise politically on the outcome, having resisted US pressure while securing concessions. The change suggests former-president Jair Bolsonaro’s legal troubles are no longer a significant factor in the bilateral relationship. Bolsonaro went to jail after trying to break the electronic ankle monitor from his house arrest on a day that one of his sons organised protests.

Chile: National Libertarian Party leader Johannes Kaiser, who won nearly 14% in the first round, gave “unconditional” backing to Republican candidate José Kast in the presidential runoff. Kaiser pledged active campaigning for Kast without seeking pre-election posts or policy concessions, reinforcing a united right-wing front. By contrast, Communist Party candidate Jeannette Jara appears isolated, having criticised the current government and struggled to mobilise the broader left, leaving Kast as the clear favourite heading into the second round.

Mexico: Moody’s warned that weak investment and industrial output are weighing on growth and expects GDP to expand only about 0.5% in 2025, with severe downside risk from the upcoming USMCA review. The ratings agency flagged that recent institutional reforms, especially in the judiciary, are undermining investor confidence and could complicate what it anticipates will be a contentious trade agreement renegotiation. Public debt is projected to increase by roughly 5% of GDP to c. 50% by 2027, despite planned deficit reduction via austerity. Further fiscal slippage could eventually trigger a downgrade. Separately, Donald Trump said he is open to military action against drug traffickers in Mexico, but would seek US Congressional approval, keeping bilateral security and sovereignty tensions in focus even as Mexican President Claudia Sheinbaum pledges tougher joint action on cartels and migration.

Central Eastern Europe

Ukraine: President Volodymyr Zelenskyy said the US peace plan presents a choice between “losing dignity or a key partner”, signalling deep unease but avoiding a rejection while he consults Washington and EU leaders. Trump set a 27 November deadline and threatened to halt intelligence sharing and weapons deliveries if Kyiv does not accept, raising the risk of a rift with its main security partner.

In parallel, early IMF discussions on a new programme point to only USD 8bn over four years, well below official expectations, with tough prior actions on budget deficit targets and tax loopholes, reflecting damaged trust after recent corruption scandals. The European Commission is exploring large-scale grant or loan packages for 2026-27, but Ukraine’s external financing gap remains large and dependent on restoring confidence.

Middle East & North Africa

Oman: Investment in special economic zones, free zones and industrial cities has reached about USD 57bn, with USD 2.7bn added in H1 2025 across 138 mainly industrial projects. Employment in these zones has risen to c. 80k, around 39% of them Omani nationals. Duqm’s special economic zone remains the flagship, with cumulative investment rising from roughly USD 9.4bn in 2023 to over USD 16bn by late-2025, supported by a unified legal framework that standardises incentives and rules across all zones.

Saudi Arabia: During a high-profile US visit, Crown Prince Mohammed bin Salman (MBS) signed a strategic defence pact, a civil nuclear cooperation declaration and a critical-minerals framework. He also announced plans to raise Saudi investment to USD 1trn over four years from a previously pledged USD 600bn.

Washington designated Saudi Arabia a “major non-NATO ally”, opening access to more advanced military equipment, including F-35s and tanks. The deals may face Congressional pushback given Riyadh’s China ties. Nuclear and minerals agreements commit Saudi to prioritising US firms for future projects and to non-proliferation standards, while the Saudi Public Investment Fund’s AI subsidiary has reportedly secured access to advanced AI chips, underpinning the Kingdom’s technology push. Riyadh reiterated interest in joining the Abraham Accords, but insists on a clear pathway to a two-state solution, keeping some conditionality around further normalisation with Israel.

Ivory Coast: S&P affirmed the sovereign at ‘BB’ with a stable outlook, citing robust 6–7% medium-term growth, improving business conditions and strong donor support. Twin deficits are expected to narrow. The current account deficit should decline to c. 1% of GDP in 2025 on higher cocoa and gold prices as the fiscal deficit moves towards the 3% target. Key constraints remain relatively low-income levels and large external and fiscal financing needs, but membership of the West African Economic and Monetary Union provides a credible policy anchor and limits currency risk

Kuwait: S&P upgraded Kuwait to ‘AA-’, bringing its rating in line with that of Fitch. The upgrade was down to strong and stable public and external balances, and ongoing reform momentum mitigating risks around reliance on hydrocarbons.

Nigeria: At least 145 people were kidnapped across the states of Kebbi, Niger and Zamfara in four days, including 25 girls seized from a secondary school, in a renewed surge in mass abductions. The federal government has ordered security forces to rescue hostages and reinforced deployments, but analysts are split on drivers of the spike, pointing to both pre-election political dynamics ahead of 2027 and overstretched security agencies.

Nigerian capital Abuja is seeking deeper cooperation with regional bodies and joint task forces, yet persistent kidnapping for ransom continues to undermine stability and investor confidence.

Developed Markets

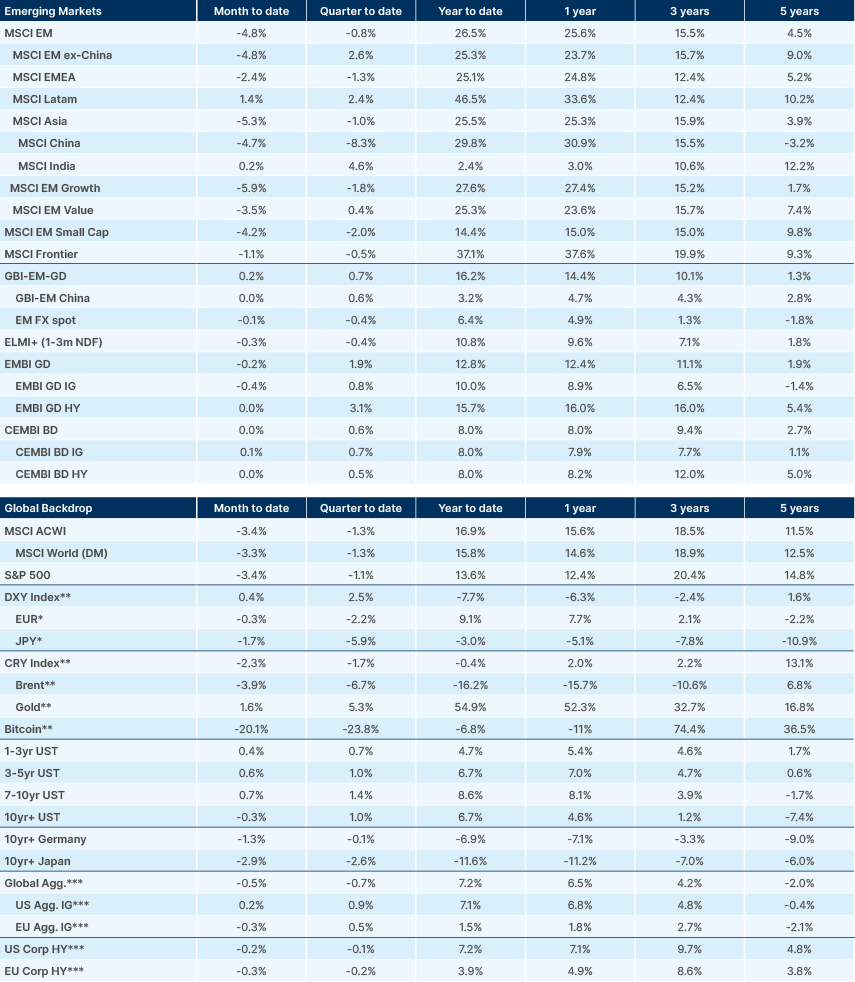

Benchmark Performance

Source and notations for all tables in this document:

Source: Bloomberg, JP Morgan, Barclays, Merrill Lynch, Chicago Board Options Exchange, Thomson Reuters, MSCI. Latest data available on publication date.

* Price only. Does not include carry. ** Global Indices from Bloomberg. Price to Earnings: 12m blended-forward

Index Definitions:

VIX Index = Chicago Board Options Exchange SPX Volatility Index. DXY Index = The Dollar Index. CRY Index = Thomson Reuters/CoreCommodity CRM Commodity Index.

Figures for more than one year are annualised other than in the case of currencies, commodities and the VIX, DXY and CRY which are shown as percentage change.