The energy transition debate is maturing. The Paris Agreement’s goal of limiting the increase in the global average temperature to 2.0°C, ideally 1.5°C, above pre-industrial levels is imperative to avoid a challenging climate situation. However, the recent increase in energy consumption resulting from fast post-pandemic GDP growth makes it clear that fossil fuels will play an important role during the required energy transition. Furthermore, the backlash against climate change measures from communities dependent on traditional sources of energy is real and a lesson to the future. Governments and investors should avoid the polarising aspect of the discussion and focus on pragmatic solutions.

A 'Just Transition' must consider the needs of different countries, communities and individuals affected to avoid a backlash against renewable energy. Emerging and Frontier Markets (EM and FM) require capital and technology to ramp up renewable generation, transmission, and distribution investments. Several deep-pocketed institutions stand ready to be part of the solution, but many investment vehicles focusing on environmental, social and governance (ESG) matters tend to be led by a score system that punishes countries on their absolute levels of emissions, environmental practices, and governance policies. These scores have a strong correlation with GDP per capita, likely implying poor countries get a bad score and vice versa. The only approach, in our view, that would allow EM and FM countries to benefit from capital access is to focus on the first derivative: Instead of punishing countries that are not fully aligned to the goals of the Paris Agreement, investors should reward countries that are starting to become part of the solution.

Furthermore, international financial institutions (IFIs), such as the International Monetary Fund (IMF), must acknowledge that there is no energy transition for countries with high indebtedness. Dealing with the large stock of debt accumulated by FM while requesting tighter governance and environmental rules is the first step to deal with the problem. Transactions that focus on achieving both debt sustainability and support environmental protection and lower emissions should be encouraged, in our view, even if they don’t come with blue or green labels.

Energy transition

The definition of ‘transition’ is a change or shift from one state to another. Sudden transitions in political power are often traumatic. Some generate larger unintended consequences than orderly power changes. When it comes to the energy matrix, we believe the trade-off is clear: an accelerated transition is only possible if we slow the pace of global GDP growth (and economic development) or if we accelerate investments in renewable energy.

More investment towards renewable energy is positive for growth. Albeit that is not the path of least resistance, the public support for the energy transition (including central banks) is attracting more capital to the space. This should be celebrated.

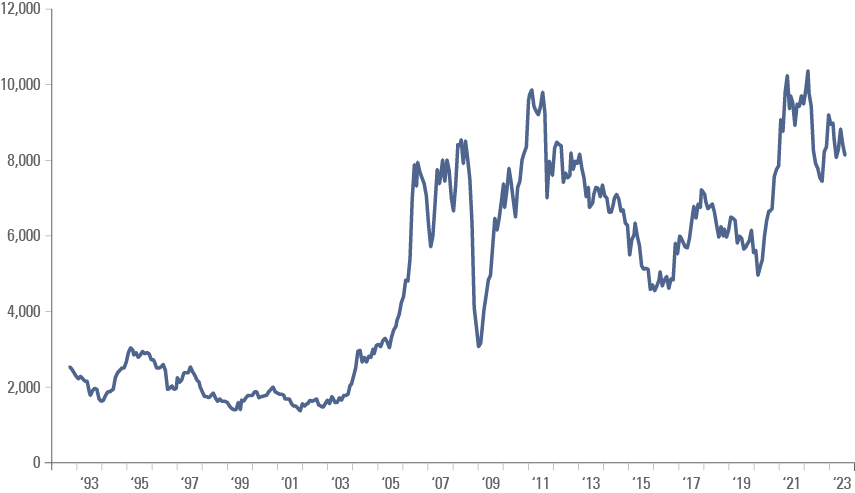

However, most economies are running at full capacity after the very large post-pandemic economic stimulus. The commodities needed to transform energy generation, transmission and distribution systems are scarce. For example, copper prices remain close to their highest levels in two decades (Fig. 1) despite the slowdown in the Chinese economy. China is responsible for more than half the copper consumption in the world and the last three bull markets were associated with an expansion in Chinese construction. This time, the boom in electric vehicle (EV) production and infrastructure investments for renewable energy is more than compensating for the real estate slowdown over the last 18 months.

Fig 1: Copper Futures: CMX (USD/lb) and LME (USD/Mt)

The lost art of compromise

The tension between climate change denialists and catastrophists is real. The first group claims climate change is not happening. The latter group extrapolate trends and point to worst case scenarios everywhere. The polarisation is unhelpful in achieving consensus. The only way of addressing the problem is finding a thoughtful middle ground that acknowledges a few realities, we believe:

- The current pace of transition is too slow and insufficient.

- The current generation maybe the last one able to mitigate the impact of greenhouse gas (GHG) emissions on the climate.

- Low-cost large fossil fuel producers have no incentive to abandon their assets. They should not be excluded from investment portfolios. Instead, investors should engage with these institutions to make them part of the solution.

- Developing a renewable energy system will temporarily increase demand for fossil fuels and mining.

More capital needs to be mobilised to accelerate the pace. Wealthy individuals (top 1%) are responsible for 150x more emissions than poor ones (bottom 50%). The first group has capital and ability to mobilise networks, the latter is dependent on it. A global solution demands capital to be allocated from rich Developed Markets (DM) to poor EM and FM. But the root concept of a Just Transition is much broader than capital availability. A poll by Fidelity showed only 43% of investors knew what Just Transition meant, a key concept that needs to be properly understood.1

Just transition

According to the COP-27 language: A Just Transition means transforming the economy and economic system in a way that is as fair and inclusive as possible to everyone concerned, creating decent work opportunities, and leaving no one behind.

A Just Transition will aim to maximise the social and economic opportunities of climate action, while carefully managing and minimising any challenges through effective social dialogue among all groups impacted, and hold respect for fundamental labour principles and rights, all the while recognising the different countries needs and stages of development.

In our view, the Just Transition concept is a rare example where the theory is simpler than the practice. In practice, hard questions need to be answered. How will a community dependent on a mine/steel mill survive post transition? How to balance families’ need to improve their lives by exploiting native tropical forests with preservation? How to capacitate workers in fossil fuel industries to work for renewable energy companies? Perhaps most challengingly, how to allocate capital in a fair manner to avoid the same problems and discontent generated by globalisation?

Why is it important?

A transition managed without due consideration of the people it affects could have negative consequences such as social unrest, increased unemployment, and a reduction in living standards. There is also the risk of backlash if the transition happens too fast. For example: the Yellow Vest protests in France, where Macron’s introduction of green tax fuel in January 2018, sparked unrest among the rural working class who said the cost of living was rising at a rate their incomes couldn’t keep up with. The recent U-turn on the UK’s pledge to end the sale of internal combustion engine vehicles is another example.

How is this relevant to EM?

EM and FM countries faces several challenges when it comes to the energy transition.

In many FM countries, the first problem is energy availability itself. Without energy, there is no economic development or progress. Moreover, many EM countries are reliant on fossil fuel energy sources. An abrupt phase-out of fossil fuels without trustworthy renewable alternatives or support to the populations’ social realities would be cruel or impossible. Impossible because no family leader or government accountable to its population will opt to impoverish its people in the name of a ‘greater good’. Without capital and technology for renewable investment, EM countries will be left with no alternatives but to boost fossil fuel consumption.

It is a fact that the fallout from climate change is asymmetric, implying the least prepared countries will face the greatest consequences. More likely than not, these will be in FM. Across 2022 and 2023 alone we have seen a plethora of tragic examples of the fallout of climate change: Pakistan floods killed an estimated 1,739 people, wildfires ravaged Pacific islands such as Hawaii, and tropical Storm Ana hit across Africa. The earthquakes in Türkiye and Morocco, albeit not attributed to climate change, are also reminders of how EM countries are less prepared to extreme natural, as well as man-made, events.

Lastly, FM and EM poverty levels are high, as are socio-economic inequalities. This increases the urgency of providing capital for poorer countries to implement their energy transition policies in a manner that would reduce social inequality. It also means working as a partner to advocate for a fairer transition that respects the social and economic realities of each region.

The ideal path is bringing together as many EM and FM countries as possible to increase their access to energy while reducing their reliance on fossil fuel.

Why is this relevant to investors?

Financial institutions play a huge role in the allocation of capital and funding of a Just Transition. Allocating capital fairly is an important element, but the key bottleneck to energy transition is the lack of capital, particularly within EM countries. We believe the problem is compounded by the fact that many investors have adopted exclusion lists based on scorecards that punishes countries and companies e.g. responsible for high GHG emissions and benefits countries and companies with low emissions.

Empirical evidence shows there is a significant correlation between ESG scores and sovereign credit ratings. A 2020 World Bank paper demonstrated that “about 90% of a country sovereign ESG score is explained by the country’s level of development”.2] Several EM countries carry low credit ratings and therefore low ESG scores, so asset managers with ESG mandates have a bias to allocate capital away from EM. This exacerbates a dynamic whereby those nations which already have the greater income, also have a greater starting point for the energy transition – creating a cycle where strong ESG performance leads to further ESG funding, and so forth. This consequently restricts the ability of poorer countries, typically in EM, from accessing funds in the same way, ultimately as a reflection of their national income.

ESG scores are a measure of risk. EM countries have taken steps towards sustainability that are not fully reflected in such ESG scores. For example, Brazil earned a bad environmental reputation due to actions from the previous government. Nevertheless, the country has the capacity to generate more than 85% of its electricity through renewables.

In our opinion, in order to correct such injustices, investors should focus on allocating capital to countries that are taking incremental steps towards becoming part of the solution. Countries with the worst environmental, social, and governance risk scores, but that are taking important and decisive steps in the right direction, should be rewarded more than countries with a high-risk score, but that are not contributing towards the solution.

Ultimately, we consider that the more capital that is mobilised for EM to assist in the climate transition, the greater the benefit for all parties as the most vulnerable countries are assisted, while avoiding the damaging consequences of a forced demobilisation of existing fossil fuel facilities.

A good example of poor scoring clashing with the energy transition is the largest solar photovoltaics (PV) producer in the world:

Sovereign case study

Indonesian EV Paradox

The Indonesian economy still depends on coal across large parts of its vast scattered territory. Indonesia’s starting point and willingness to be part of the solution explains the USD20bn aid package from the US, Japan, and other wealthy nations in the Just Energy Transition Partnership (JEPT). The initiative focuses on empowering countries with capital (a mix of grants and capital) to be deployed according to their own needs. The JEPT initial deal was a USD 8.5bn package to help South Africa reduce its coal dependency.

It is also clear that fossil fuels, in some circumstances, act as a conditional cornerstone to unlocking green energy. Indonesia ranks among the largest suppliers of nickel, which is critical in the production of EV batteries and hence vital for any clean energy ambitions. Yet many of the vital nickel mines are in remote areas that are not connected to the country’s grid and can only be explored today by increasing energy consumption from local coal plants. This appears to be a contradiction in itself, highlighting the complexity of the transition effort. Curbing short-term fossil fuel emissions from Indonesia would reduce the availability (or increase the cost) of a crucial resource needed for energy transition.

Equity case study

Solar Glass Manufacturer

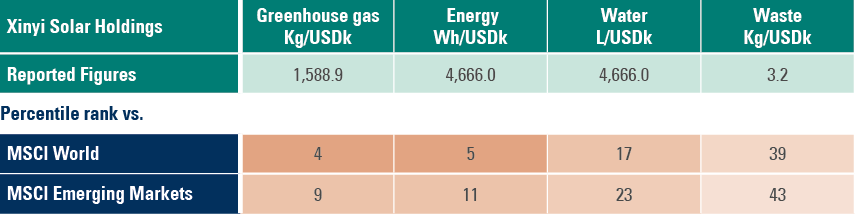

Xinyi Solar, the largest global producer of solar PV, emits c. 2m tonnes of GHG emissions (direct based on tonnes of CO2 equivalent or 1,600kg per USDk revenue). Their carbon intensity ranks in the bottom decile compared to global materials companies. The company also performs poorly across water usage and to some extent waste, given the challenges associated with recycling the modules.

Fig. 2: Global cross industry comparison

However, there are currently limited alternatives to this glass which indirectly enables approximately one third of global solar capacity, a critical tool in global climate action. While the poor carbon intensity should see the company penalised in an ESG score, and be a driver for engagement to improve, the overall ESG evaluation of the company should recognise its positive associated contribution to the energy transition. This is the case in Ashmore’s internal ESG scoring as illustrated by the case study from Challenge 4 of our latest paper on “The reality of ESG integration in EM equities”.3

Level the playing field

There are several other elements necessary to contextualise the role of EM countries, including:

- Evaluating emissions per capita rather than absolute emissions. For example, Fig. 1 of a former piece on the subject illustrates how India, the third-largest polluting country in absolute terms, has the same emission per capital pattern of sub-Saharan Africa.4

- Measuring emissions on a consumption basis. A large portion of European and US emission reduction has been achieved in the process of diversifying production away to EM countries (particularly China, and increasingly Vietnam, Bangladesh, and India). This issue is also addressed in Figs 1, 2, and 3 of the piece at the footnote.

- Acknowledging the fact that most historic pollution and environmental damage was done by DM (not EM). A report by Bloomberg New Energy Finance (BNEF) illustrates the historical emissions by country.5

- Acknowledging a nations’ rightful desire to develop living standards and create opportunities for its citizens.

Total investments

The BNEF 2022 outlook envisages two scenarios for 2050. The ‘Economic Transition Scenario’ considers the energy transition likely to take place purely due to economic reasons such as lower generation costs in renewable energy. In this scenario, BNEF estimates “emissions have fallen 29% but unabated coal, oil and gas keeps a trajectory consistent with 2.6°C of global warming, with a 67% confidence interval.” In other words, the economic transition is welcome, but insufficient. Therefore, BNEF also considers a ‘Net Zero Scenario’ consistent with the Paris Agreement’s temperature targets.

The Economic Transition scenario comprises USD 119.5trn of investments across industries until 2050 (USD 4.1trn per year) and the Net Zero Scenario would require USD 195.7tn (USD 6.7trn per year). About half of the investment in both scenarios will come from EV sales, an industry that is outperforming expectations from five years ago, thanks to China.6 Areas that need more capital mobilisation are energy grid (11% of total) low-carbon power (18%) and carbon capture and storage (5%). There is no question that more public and private sector engagement will be needed for the less commercially-intensive industries.

A holistic approach

Another important element, we note, is that no energy transition plan will succeed without considering the significant challenges faced by FM economies today. In a recent piece, Martin Wolf highlights that the G-20 main issues are threefold: its divisions (absence of China and Russia); hypocrisy (about climate change); and overload (trying to address too many problems).

The key, when it comes to climate, is to improve Governance and clean up the balance sheets of FM economies. There is no energy transition for countries at high risk of debt distress or in a default on their obligations.

At the same time, it would be pointless to allocate, say, USD 10trn of funding for renewable energy in FM if a large share is squandered by corruption. Any capital commitment for FM must come with governance improvement conditionalities, such as the approval of procurement rules in national parliaments. Countries will need incentives to implement tough governance rules that in many places will go against their own elites. The biggest incentive for countries adopting procurement and governance rules should be debt relief, in our view.

Furthermore, whenever possible, the project implementation should be executed by arms-length capable organisations, preferably local private sector companies and non-government organisations, and supervised by the donors.

Don’t just Let thEM Eat Cake… Finance it as well!

The G-20 hypocrisy can be compared to Marie Antoinette’s apocryphal response to “the people don’t have bread” at the beginning of the French Revolution. Some may say that even DM countries don’t have money considering their political inability to adjust the post-pandemic fiscal deficits and high level of interest rates. But there are creative ways to mobilise capital.

The model of infrastructure investment in Colombia, where the private sector raises capital from large pension funds, insurance companies, banks, and families to invest in infrastructure at arms-length is a good example. The Colombian model allows the private sector to invest in the most efficient infrastructure projects available while also achieving a handsome profit in their investments. There appears to be no reason this cannot be replicated for renewable energy, transmission, and distribution projects.

Providing tax benefits for long-term investment (both for investors and the company executing the project) is also necessary. For example, the UK has the Enterprise Investment Scheme where investors get a 30% tax rebate on investments in British small businesses and start-ups and can also claim loss relief on those companies that fail. Something similar on a global scale could be beneficial to attract private capital to peruse projects that will maximise impact. Projects could receive a larger tax rebate (or perhaps emission credits to be exchanged in the emission trading schemes) on projects with the highest impact by capital allocated. Companies certifying projects should be rewarded for accuracy and risk losing the certification on any evidence of fraud.

The advantage of using tax rebates is that the cost for the governments from ‘donor countries’ would have the cost of the initiative spread over a long period. The amount of tax rebates can be capped in a way that doesn’t affect the fiscal sustainability of the government, but central banks could contribute, providing concessional funding for banks to channel to investors to leverage the schemes.

Financing structures

EM has been centre stage when establishing how this financing can be done, epitomising one of the central themes of this piece: that investors and sovereigns should be drawing on their aligned interests and sharing burdens.

Uruguay

Uruguay exemplifies this innovative approach, developing a unique framework which aligns interests between the sovereign and their private sector investors in a manner which pushes the country closer to targets set out in the Paris Agreement. Its sovereign sustainability-linked bonds (SSLBs) aim to keep the government accountable for environmental policies through providing greater financing optionality via step-up and step-down features tied to environmental key performance indicators (KPIs). KPI-1 requires a reduction of 50% for ‘aggregate gross GHG emissions’ by 2025, and KPI-2 requires a maintenance of the ‘Native Forest Area’ when compared to 2012. The bonds spread over US Treasuries can widen or tighten by up to 30bps depending on whether the government meets these objectives. This represents a model that we consider could be adopted by other EM countries when accessing the market.

Gabon

Another excellent transaction that can be replicated, in our view, is the ‘debt for nature’ (DFN) swap issued by Gabon. A new bond was issued, backed by a USD 500m political risk insurance policy from the US International Development Finance Corporation (DFC), resulting in an ‘AA’ credit rating, compared to the sovereigns ‘C’ to ‘B-’ score. The transaction involved using part of the use of proceeds to buy back existing debt at a discount to par, leading to significant savings.

Further savings are achieved through the life of the bond as the coupon on the guaranteed bond is significantly lower than the Eurobond (6.10% vs 7.0% on the tendered bonds). The USD 4.5m savings achieved will support Gabon’s biodiversity via direct investments into sustainable ocean-focused projects. Projects includes supporting marine protection, advancing sustainable fisheries, and strengthening the nation’s climate resilience.

The bond was subsequently criticised for mislabelling and not dedicating the entire use of proceeds to environment conservation. Nevertheless, the transaction achieved two objectives that are connected. It lowered Gabon’s debt burden by lengthening its maturity profile while achieving a discount over the amount owed and created space in the budget for crucial biodiversity projects. It also did so without any direct contributions from the US government. The US has just insured (guaranteed) the payments. The bond is likely to have ‘de facto’ seniority like an IMF loan for all intends and purposes, therefore minimising the risk for the US government.

A step to the right direction

Globally, countries and corporations are working towards environmental and social programmes that needs funding. More capital allocated to EM-dedicated ESG funds will likely ensure an increasing demand for such structures and directly support the energy transition efforts. Despite their unique characteristics, and differing approaches, both the Uruguay and Gabon examples demonstrate that there is a role for investors and the private sector in supporting a country’s environmental effort that goes beyond the unjust negative screening approaches that this piece has highlighted.

Summary and conclusion

There is no Just Transition without considering the individual, community, and country-specific circumstances. Instead of rewarding countries that have high ESG scores, investors should allocate capital based on the policy changes, rewarding countries that move in the right directions. A few years ago, it would have been hard to build an EM debt portfolio incorporating ESG concerns in a pragmatic and thoughtful manner, but this is changing fast. Several innovative financing structures in the sovereign space allow countries to both reduce their debt burden and start becoming part of the solution, in our view. Sovereigns are working on debt structures that incorporate energy transition goals.

The author thanks the contributions from Iselin Lummis, Olivia Shaul and Iylana James.

1. See: https://www.fnlondon.com/articles/fidelity-investors-lack-awareness-of-just-transition-esg-20230912?mod=topic_asset-management

2. See: https://documents1.worldbank.org/curated/en/842671621238316887/pdf/Demystifying-Sovereign-ESG.pdf

3. See: 'The reality of ESG integration in Emerging Markets equity' - The Emerging View, 5 August 2022

4. See: 'Seven policy proposals to meet the Paris Agreement objectives' - The Emerging View, 13 April 2021

5. See: https://www.bnef.com/insights/30197/view

6. See: '“Beep-beep!” China’s auto industry leapfrogged the West' - Weekly Investor Research, 18 September 2023