The year-end rally continued to be very strong with US Treasuries this November recording their strongest monthly performance since 1985. Elsewhere, however, sources of political risk persist. Oil continued to sell off following the OPEC announcement to deepen and extend production cuts into Q1 2024. India’s incumbent BJP party won three out of four key states, further strengthening Prime Minister Narendra Modi’s re-election standing. In Pakistan, corruption charges against former President Nawaz Sharif were overturned by Islamabad’s High Court, boosting chances of his re-election in February 2024. Sri Lanka is back on track to securing a USD 780m disbursement of multilateral recovery funds, after striking a deal with its committee of official creditors to restructure around USD 5.9bn of debt. Venezuela’s Maduro administration announced that barred candidates can appeal their cases in court until 15 December, potentially paving the way for María Corina Machado, winner of the primary elections in October, to run for office.

Global Macro

In November, US Treasuries recorded their strongest calendar month performance since 1985, as markets priced in higher odds of early policy rate cuts. Interest rate futures currently imply a 25bp cut in the Federal Funds rate as early as next May, compared to Q3 2024 in October. Yields on 10-yr US Treasures (USTs) dropped from close to 5% in October to 4.20% last week. The move was prompted by dovish comments from several of Federal Reserve (Fed) board members, including noted hawk Christopher Waller, who was confident the Fed would bring inflation back to within target in 2024. Weaker activity data and lower increase in long-dated USTs were important factors for the strong rally on bonds. The market does not view the Fed’s 14 December Federal Open Market Committee meeting as a live meeting (no change in policy expected), but the written statement and Q&A may bring insights into the 2024 policy path.

The Organisation of the Petroleum Exporting Countries (OPEC+) further extended its voluntary cuts in oil production to Q1 2024 and increased the cuts to 2.2m barrels per day (b/d). Saudi Arabia agreed to extend its voluntary cut of 1m b/d through Q1 2024, and Russia committed to increasing its cuts to 500k from 300k b/d. Iraq, United Arab Emirates, Kuwait, Kazakhstan, Algeria and Oman also contributed to cuts.1 Any further voluntary cuts above 2.2m b/d would be decided and announced by the respective members. Angola rejected the OPEC+ quota and decided to maintain its existing level of production at 1.18m b/d, above OPEC’s set quota of 1.11m b/d. After a brief rally ahead of the announcement, the Brent first future contract slipped by 0.3% to trade at USD 82.8 per barrel on Thursday. The Friday decline to USD 79.6 was in part related to the first future roll from January to February 2024. In other news, Brazil announced it would join OPEC+ next year as part of the “OPEC+ alliance charter”, meaning Brazil would not commit to any production cuts within the group.

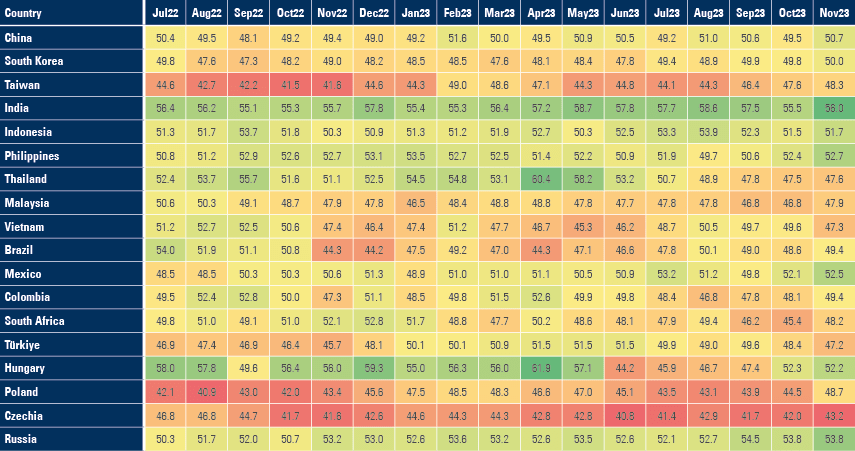

Purchasing Managers’ Indices (PMI)

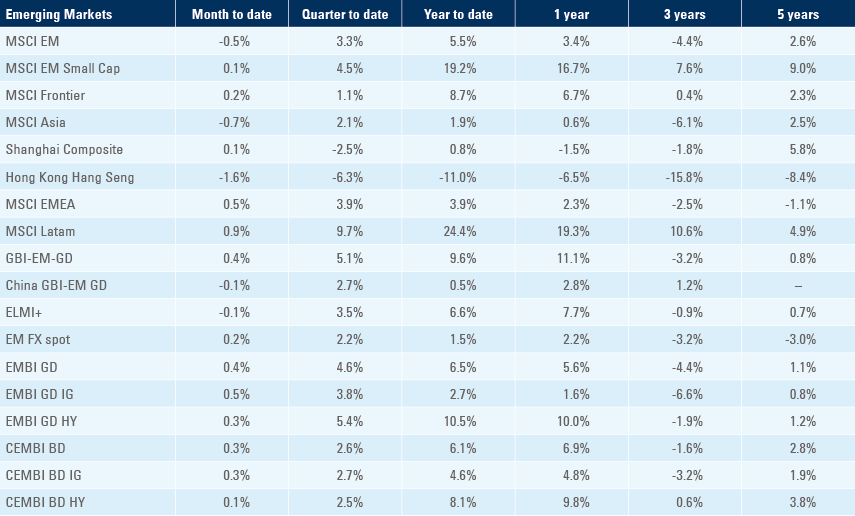

The manufacturing PMIs increased across all Emerging Market (EM) Asian countries, except for Vietnam (Fig 1). In China, the official manufacturing PMI covering mostly large and state-owned companies was broadly unchanged at 49.4 in November, in contrast with the Caixin manufacturing PMI, a survey that includes small and medium-sized enterprises, which showed a notable improvement in November to 50.7, up from 49.5.

The manufacturing PMI improved but remained at contractionary levels in Brazil, Colombia, Poland, Czechia, and South Africa. In Mexico, Russia, and Hungary, the PMI strengthened further into the expansionary zone. The manufacturing PMI declined deeper into contraction in Türkiye and Nigeria.

Fig. 1: EM Manufacturing PMIs

Greenwashing and ESG Investing

The Financial Conduct Authority (FCA) announced the implementation of its disclosure regulation on Tuesday that would enhance its oversight over the labelling of ‘green’ funds by asset managers. To be enforced from December 2025 onwards, funds will be required to choose from one of four pre-determined labels and show that it meets the criteria and applies to at least 70% of the managed assets. Furthermore, funds actively marketed as ‘sustainable’ must now be accompanied by a published evidenced-based summary of their stewardship strategy in accordance with an independently assessed standard, e.g., alignment with a greenhouse gas target, or an official taxonomy. From May 2024 onwards, all FCA-regulated companies will also be subject to anti-greenwashing regulations ensuring that all marketing of financial products be ‘correct, clear, complete, and fair’.2 The move strengthens the oversight over greenwashing, improving the integrity of ‘green’ investments, and preventing a market being created out of virtue rather than one driving meaningful change.

Emerging Markets

EM Asia

China: China added an additional six countries to its 15-day visa-free programme on a trial basis, effective 1 December, 2023 to 30 November, 2024. As part of its policy to open up further, the visa-programme now applies to visiting nationals from France, Germany, Italy, Malaysia, the Netherlands, and Spain.

India: Prime Minister Narendra Modi’s Bharatiya Janata Party (BJP) won three of the four key state elections on Sunday, winning Madhya Pradesh, Rajasthan, and Chhattisgarh, while the main opposition party, the Indian National Congress, took control of Telangana. The outcome of these state elections has been crucial for cementing the BJP’s political dominance in the country, particularly now they amass the most support in the ‘Hindi Heartlands’ of the north and central regions of the country.3 The results are a further boost for Modi as he sits on the brink of a third term. According to the latest nationwide polls by India Today Magazine, 52% of respondents believe Modi should continue to lead the country.4 In data, Q3 2023 GDP growth was 7.6% yoy, 20bps lower than 2Q 2023 and 1.0% above consensus expectations.

Indonesia: The yoy rate of consumer price index (CPI) inflation rose 2.9% in November, 30bps higher than in October, and 20bps ahead of expectations. On a mom basis, CPI inflation was 0.4%, up from 0.2% in the October. The yoy growth in core CPI inflation, however, was broadly unchanged in the month.

Pakistan: Corruption charges against former President Nawaz Sharif were overturned by Islamabad’s High Court. Sharif, who served three times as Prime Minister in the past, returned from self-imposed exile in October to stage his political comeback. Sharif’s eligibility to run for office still depends on the dismissal of another graft charge, with a hearing scheduled for 7 December. The dismissal of the charges indicate he may have secured the army’s support and boosted his chances of re-gaining power at next February’s general elections. In the same week, former President Imran Khan announced he would be stepping down as Chairman of the Tehreek-e-Insaf Party. Khan’s standing down from the intra-party elections is likely to be motivated by possible disqualification due to his conviction on corruption charges.

Sri Lanka: The nation has reportedly struck a deal to restructure around USD 5.9 billion of debt, with its committee of official creditors – including India, and the Paris Club. Specific details on the terms of the deal have yet to be made public, but it will not involve a haircut and will employ maturity extensions and coupon rate reductions on the bonds in question. The agreement is a positive step towards Sri Lanka continuing to access multilateral recovery funds totalling USD 780m, including a USD 330m pay-out from the International Monetary Fund (IMF) under its programme, following an initial failed review in September. Thus far, Sri Lanka has also successfully restructured USD 10bn of local debt. The next step will be to finalise agreements with remaining official bilateral creditors to continue the restructuring of its outstanding claims.

South Korea: The Bank of Korea kept the base rate unchanged at 3.5% at its November meeting. In economic data, consumer confidence declined by 0.9 points in November to 97.2. Industrial production declined by 4.5% mom in October, after +3.5% in September, and the yoy rate declined to 1.1% from 2.9% yoy in September (consensus expectations 4.5%). The trade surplus more than doubled in November to USD 3.8bn, from USD 1.6bn in October, significantly ahead of expectations of USD 1.0bn. Exports rose by 7.8% yoy, 1.7% higher than the month prior, and 2.8% above expectations. Imports declined by 11.6% yoy, from -9.7% yoy in October, (-8.6% yoy consensus). The trade surplus was boosted by a 12.9% yoy increase in semiconductors exports, the first positive yoy rate in 16 months.

Taiwan: GDP growth was unchanged at 2.3% in Q3 2023, broadly in line with expectations.

Thailand: The trade surplus declined to USD 1.3bn, down from USD 3.8bn in September. Exports grew by 7.0% on a yoy basis in October, higher than 1.0% yoy growth in September but imports rose to +10.5% yoy from -7.9% yoy in September. The current account surplus declined to USD 670m in October from USD 3,400m in September. The Bank of Thailand kept its policy rate unchanged at 2.5%. The manufacturing index declined by 4.3% yoy in October, up from -6.3% in September, below consensus at -1.6% yoy.

Vietnam: Vietnam’s parliament voted to raise the corporate tax rate to 15%, which should impact an estimated 122 multinational companies, generating an additional VND 14.6tn (USD 603m) in state revenue, c. 0.2% of GDP. This will come into force in January of 2024 and brings Vietnam in line with the global minimum tax rate agreed at the OECD in 2021. Before the bill, large international companies were allowed to pay much lower taxes (around 5% in some cases).

In economic data, the yoy rate of CPI inflation decreased by 10ps to 3.5% in November. Industrial production increased by 5.8% yoy in November, from 4.1% yoy growth in October. Retail sales rose 10.1% yoy in November, 3.0% above the prior month. The trade balance shrank to USD 1.3bn from USD 3.0bn in October.

Latin America

Bolivia: The government intends to borrow USD 2.4bn in external financing as part of its socioeconomic and development projects. Any sustainable or environment-related bond issue would have to be guaranteed by a multilateral as Bolivia has no access to international capital markets. Bolivia is rated CCC+ and currently has USD 1.85bn external debt outstanding trading at distressed levels (the USD 1bn 2028 bond trades below USD 50c). As a result of external and fiscal imbalances, debt-to-GDP rose from 36% in 2013 to 83% in 2023 and foreign exchange (FX) reserves declined from USD 13.6bn in November 2014 to USD 0.3bn April 2023. The currency has been pegged to the dollar since April 2008. Any debt-for-nature swap that doesn’t feature economic reforms would be unsustainable and further deteriorate the country’s macro imbalances.

Brazil: The central government primary budget surplus increased by BRL 6.8bn to BRL 18.3bn in October, vs. BRL 15.5bn expected. The yoy rate of CPI inflation increased by 4.8% in November, 20bps lower than in October, broadly in line with consensus. The national unemployment rate in October was 7.6%, 10bps lower than September, in line with estimates. Industrial production grew by 1.2% yoy in October, 60bps higher than in the month prior, but 80bps lower than consensus expectations.

Chile: The unemployment rate remained unchanged in October at 8.9%, in line with expectations. Manufacturing production increased by 9.5% yoy in October, up from -1.1% yoy in September, and ahead of expectations of a modest rebound to 2.6% yoy. Industrial production increased by 1.1% mom, 40bps lower than September and 40bps above expectations. Commercial activity declined by 0.9% yoy in October, up from a 3.7% yoy decline in the month prior. Economic activity in the country grew by 0.3% yoy in October, unchanged from the month prior, 10bps below expected.

Colombia: The national unemployment rate declined by 10bps in October to 9.2%.

Mexico: The trade deficit declined to USD 252m in October, from USD 1,480m in September, a better number than consensus. The unemployment rate declined by 10bps to 2.8%.

Panama: The Supreme Court ruled unanimously that the mine contract signed with First Quantum Minerals, was “unconstitutional”. The ruling comes after the protests that ensued after the contract was initially revised in October 2023. President Laurentino Cortizo said the government would commence the transition process to shut down the mine in an orderly fashion. The decision weakens the country’s reputation for legal stability and doesn’t bode well for future investments in Panama. Nevertheless, it has been welcomed by environmentalists given the threats to freshwater supplies and biodiversity in the area that they argue the mine has posed.

Venezuela: Hours before the 30 November deadline set by the United States (US) for Maduro’s administration to demonstrate progress towards ‘free and fair’ elections, the government announced that barred candidates can appeal their cases in court until 15 December. As it stands, María Corina Machado is still banned from running for office in the presidential elections next year, despite winning the self-funded opposition primaries by a landslide. The government’s position, which calls into question the integrity of the primaries, poses a threat to the continued relaxation of sanctions on the oil and gas sector by the US.5

Meanwhile, the Venezuelan government held a referendum on the status of Essequibo, a 160,000 square kilometre region of Guyana. The vote, held on Sunday, revealed that 95% of voters approved of Venezuela’s claim over the territory. While the territory itself is governed by Guyana, the international waters demarcation, where significant oil deposits lie, is disputed by Venezuela. Oil production has increased significantly in Guyana and is likely to increase further, led by large investments from international oil companies, most notably Exxon. As reported by the FT, Francisco Monaldi, a Latin America energy expert at Rice University in Houston, said: “So far Exxon’s wells and discoveries are in the area north of Guyana’s undisputed land territory, but the awarded oil blocks do go into the disputed waters”. Some claim that the referendum is a political move by Maduro to boost his ratings ahead next year’s elections. Several polls show Maduro’s approval ratings at around 20% after a decade where low growth and macro instability have led to a humanitarian crisis.6

Central and Eastern Europe

Czechia: GDP growth declined by 0.7% in yoy terms in Q3 2023, 10bps lower than in the second quarter. On a quarterly basis, this represented a further contraction by 0.5% in Q3, from -0.3% in Q2.

Hungary: Economic sentiment rose by 1.6 points to -15.4; business confidence grew by 2.6 points to -7.9; and consumer confidence declined by 1.1 points to -36.7. The producer price index (PPI) of inflation declined by 6.6% in yoy terms in October, from -2.5% yoy in September.

Poland: The yoy rate of CPI inflation declined by 10bps to 6.5% in November. In sequential terms, inflation rose 0.7% mom in November, in line with expectations, and 40bps higher than October.

Russia: Industrial production rose by a yoy rate of 5.3% yoy in October, 30bps less than September. The yoy rate of retail sales rose by 50bps to 12.7%, 1.0% above consensus. The unemployment declined by 10bps to 2.9% in October.

Central Asia, Middle East, and Africa

South Africa: The trade balance deteriorated by ZAR 24.7bn in October moving to a ZAR 12.7bn deficit, whereas a surplus of ZAR 8.1bn was expected. The yoy rate of PPI inflation rose by 70bps to 5.8% in October, in line with consensus. In sequential terms, PPI rose 1.0% mom, down from 1.5% mom in September, 10bps below Bloomberg median forecasts.

Türkiye: Economic confidence declined by 1.2 points to 95.3 in November. The trade deficit widened by USD 1.5bn to USD 6.5bn in October, attributed to an increase in exports of cereals, precious stones, and metals. The yoy rate of real GDP growth increased by 5.9% 3Q 2023, from 3.9% yoy Q2 2023, 60bps above consensus. On Friday, S&P Ratings revised Türkiye’s outlook to positive from stable and maintained its rating at ‘B’. The revision was motivated by Turkish policymaker’s progress in stabilising macroeconomic conditions with orthodox policies.

Developed Markets

Eurozone: Consumer confidence remained unchanged at -16.9 in November. Core CPI inflation declined 60bps to 3.6% yoy in November, 30bps below consensus. On a mom basis, core CPI dropped 0.5% mom, from +0.1% in October. The unemployment rate was unchanged at 6.5% in October.

Japan: The yoy rate of retail sales declined by 200bps to 4.2% in October, 1.8% lower than consensus. In mom terms, retail sales dropped 1.6%, down from +0.4% mom in September. Industrial production grew by 0.9% in yoy terms in October, from a 4.4% yoy decline in September. The unemployment rate declined by 10bps to 2.5% in October.

United States: The annualised rate of qoq real GDP growth was revised higher by 20bps to 5.2%, 30bps higher than in Q2. The core personal consumption expenditures (PCE) GDP deflator declined by 20bps to 3.5% yoy in October, in line with expectations. Personal consumption was revised 40bps lower to 3.6% (qoq annualised). Initial jobless claims registered 218k in the week, 7k above the prior week and continuing claims rose by 86k to 1927k, 62k higher than forecast. The ISM manufacturing remained unchanged at 46.7 in November, 1.1 points lower than consensus as new orders rose by 2.8 points to 48.3, but employment declined by 1.0 to 45.8 and prices paid rose by 4.8 to 49.9. Personal income and spending slowed to a yoy rate of growth of 0.2% in October.

United Kingdom: The yoy rate of consumer credit rose by 10bps to 8.1% in October.

1. See – https://www.opec.org/opec_web/en/press_room/7267.htm#:~:text=The%20OPEC%20Secretariat%20noted%20the,and%20balance%20of%20oil%20markets

2. See – https://www.ft.com/content/5d98ca53-7572-4886-a1d6-b86eb5040924

3. See – State poll results: Key wins boost Indian PM Modi's re-election bid - BBC News

4. See – Mood of the Nation: 52% want PM Modi to continue to lead India - India Today

5. See – ‘Yields lower, stocks higher… For longer?', Weekly Investor Research, 6 November 2023.

6. See – https://www.ft.com/content/a0ec9710-aa52-416b-ac79-8ada5cdab229

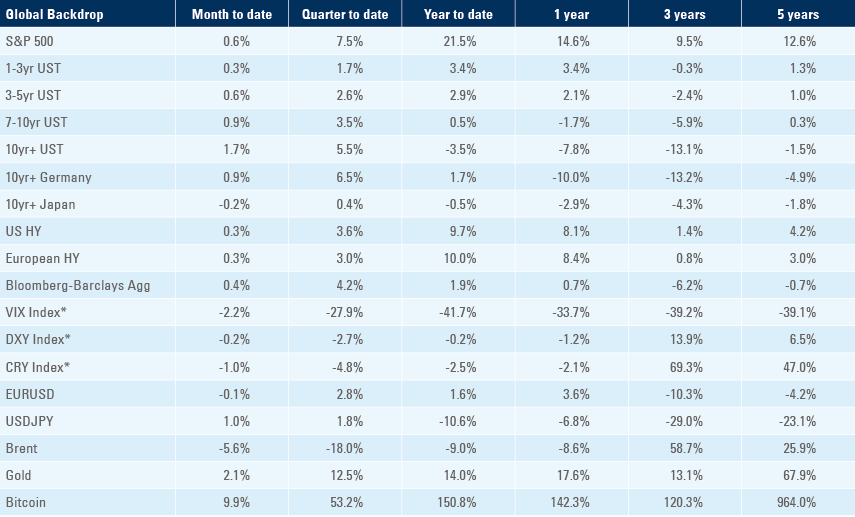

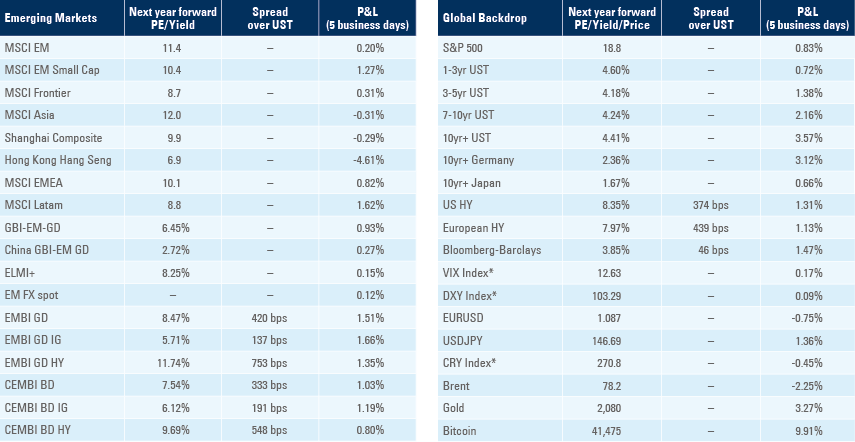

Benchmark performance