The Chinese politburo is now tightly controlled by Xi Jinping. Argentina fiscal and external numbers were better than expected. Incumbent Brazilian President Jair Bolsonaro is rising in polls for the runoff next Sunday 30 October. Colombian Finance Minister Ocampo tries to boost confidence. Ecuador fiscal numbers were better than expected in 1H 2022. Indonesia hiked policy rate by 50bps underpinning macro stability. Mexico starts its 2023 oil hedging programme. Pakistan seeks resources after devastating floods. Peruvian political instability contrasts with macro stability. Turkey cuts rates again to 10.5%. Uruguay issued a novel sustainability bond that could become benchmark for Emerging Market sovereign bond issuance, in our view.

Emerging markets

China: Xi Jinping managed to appoint key allies in the Chinese Communist Party politburo, side-lining any faction within the party that antagonised him. Former President Hu Jintao was removed from the ceremony, apparently for health issues and against his own will, by two security guards in a scene reminiscent of a political purge. Several members of the politburo have experience only in regional or administrative government, and therefore will be much more dependent on Xi Jinping, who will have full autonomy in military, political and economic decisions.

The other six members of the politburo standing committee does not seem to include any clear successor to Xi Jinping. The committee members are:

- Li Qiang: current Shanghai party chief and former top secretary when Xi was Zheijang Party Secretary in the mid-2000s;

- Zhao Leji, likely the next Chairman of the National People’s Congress, in charge of legislating. Connected to Xi via their fathers, both revolutionary comrades from Shaanxi;

- Wang Huning, the only member of the politburo who worked for Hu Jintao, but believed to be a key architect of the Xi Jinping philosophy, including political concepts and a more assertive foreign policy;1

- Cai Qi, who worked closely with Xi in Fujian and Zheijang;

- Ding Xuexiang, current Xi Jinping chief-of-staff; and

- Li Xi, former governor of Liaoning province, likely the next anti-corruption watchdog.

Xi Jinping also broke the age limit with relatively young members of the politburo retired. Li Qiang is in line to become premier when Li Keqiang retires in March 2023. The Governor of the People’s Bank of China, Yi Gang, is likely to step down next March after he was not named as full or alternate member of the party's Central Committee. Also excluded were outgoing Premier Li Keqiang, Liu He, and central bank party chief Guo Shuqing. Another notable absence was the reformist from Guangdong, Wang Yang.

More power concentration in the politburo suggests decisions and policy will be more centralised in the hands of Xi Jinping. This may lead to better execution of policies coming from the top, with the downside of having with fewer checks and balances than the prior government where the politburo reflected different political factions and economic views.

There were no indications of a reversal of the zero Covid-19 strategy, although there was a suggestion of relaxation of quarantine policies for inbound travellers to mainland China, which is at odds with the stringent mobility restrictions in China. The fact that Xi Jinping will be travelling to Indonesia for the G-20 meeting also suggests a more open approach.

In economic news, GDP growth accelerated to a yoy rate of 3.9% in Q3 2022 from 0.4% in Q2 2022, significantly above consensus at 3.3%. Industrial production rose 6.3% yoy in September from 4.2% in August and 4.8% consensus, but retail sales rose only 2.5% yoy (3.0% consensus and 5.4% in August) and fixed asset investment rose 10bps to 5.9% (slightly below consensus) as property investment contracted 8.0% yoy (-7.5% consensus, -7.4% in August). The trade surplus increased by USD 5.4bn to USD 84.7bn in September as exports rose 5.7% yoy (consensus 4.0%) and imports rose 0.3% yoy (consensus 0.0%). Lastly, the urban unemployment rose by 20bps to 5.5% in September. The People’s Bank of China kept its 1-year and 5-year loan prime rates unchanged at 3.65% and 4.30%, in line with consensus.

Argentina: The fiscal account moved to an ARS 80.6bn surplus in September after a ARS 210bn deficit in August. The country recorded a USD 414m trade surplus in September after a USD 300m deficit in August as imports dropped by USD 0.8bn to USD 7.0bn and exports were down only USD 0.1bn to USD 7.4bn over the same period. Economic activity improved 0.4% mom in August, taking the yoy rate up 50bps to 6.4%, significantly above consensus expectations at 4.0%. Vehicle exports rose to 35.4k units in September from 32.5k in August and domestic sales improved to 34.6k from 29.2k over the same period, despite production declining by 1.8k to 52.2k.

Brazil: President Jair Bolsonaro’s vote intentions rose to 46.9% on 19 October from 46.5% on 14 October while Lula declined by 1.0% to 45.9% over the same period according to a poll by Modal/Futura – a pollster that had a more accurate prediction of votes in the first round of presidential elections. Brazilian assets are likely to outperform if Bolsonaro is re-elected, as he is likely to keep Paulo Guedes as Finance Minister and keep the current direction of reducing the size of the state, including the ambitious objective to privatise more state-owned companies, including Petrobras, making state-owned companies candidates for outperformance if he wins the election. Economic activity declined 1.1% mom in August after rising 1.7% in July, taking the yoy rate up 90bps to 4.9%, 40bps below consensus.

Colombia: Finance Minister Ocampo tried to calm market participants concerned about recent heterodox tweets by President Gustavo Petro. Ocampo pledged to honour the fiscal rule, said there would be no capital control and pledged to diversify exports, but said they were working to keep exports of oil and gas at decent levels. Ocampo also pledged not to intervene in the Colombian Peso to preserve foreign exchange reserves. The approval rate of President Petro declined by 10% to 46% while his disapproval rate increased by 12% to 40%, a similar trend to his predecessor, Ivan Duque, and which has been observed in Peru and Chile over the recent elections. Colombian assets have underperformed since Petro’s election. The country’s main macroeconomic issue lies in a large current account deficit, equivalent to 6% of GDP over the past four quarters, due to poor fiscal numbers. A frontloaded fiscal consolidation and higher interest rates will be required to rein in the external deficit and stabilised markets. In economic news, the trade deficit widened to USD 2.2bn in August from USD 0.5bn in July, USD 0.3bn below consensus as imports rose by USD 0.4bn to USD 7.2bn.

Ecuador: The fiscal surplus rose to USD 1.8bn in 1H 2022, significantly higher than USD 0.2bn in 1H 2021, thanks to measures that allowed increased tax collections and lower government expenditures. Vice Minister of Economy Leonardo Sánchez said gasoline subsidies segmentation agreed with indigenous groups would save between USD 150m and USD 250m per year (c. 0.2% of GDP) at current oil prices. Individuals with income above USD 41k per year or owners of large engine vehicles, or three or more vehicles, will pay the full cost of gasoline. Torino, a broker-dealer, estimates the country’s finance needs will reach USD 4.3bn in 2023, of which USD 2.6bn will be funded by international financial institutions.

Indonesia: Bank Indonesia (BI) hiked its policy rate by 50bps to 4.75%, in line with consensus, to anchor inflation expectations, saying the hike is “front loaded, pre-emptive, and forward looking”. Unlike several developed economies’ central banks, the BI has been extremely successful at anchoring financial stability and inflation. The BI expects GDP growth to come at the higher end of its 4.5% - 5.3% estimate range and has revised the current account surplus equivalent to 0.4% to 1.2% of GDP in 2022, up from -0.5% to +0.3% of GDP. The trade surplus narrowed by USD 0.8bn to USD 4.9bn in September as the yoy rate of imports rose by 33.4% yoy from 32.8% and exports slowed to 28.6% yoy from 30.0% over the same period.

Mexico: Retail sales declined 0.4% mom in August after rising 0.9% in July, taking the yoy rate down 30bps to 4.7%, 100bps lower than consensus, over the same period. Sources said the government began its oil hedging process for 2023 aiming to hedge 200-300m barrels of oil at USD 75 per barrel for H1 2023 at an estimated cost of USD 1bn. Banxico’s Deputy Governor Geraldo Esquivel said Mexico is in a better position than the United States to facilitate inflation converge to its target.

Pakistan: The country will seek billions in new loans after devastating floods last month, costing an estimated USD 30bn, equivalent to c. 12% of Pakistan’s gross domestic product. The environmental disaster begs the question if developed world countries should compensate frontier markets that are victims of global warming caused by deforestation and large greenhouse gas (GHG) emissions in the atmosphere.

Peru: Economic activity was unchanged at 1.4% in August and the unemployment rate increased by 20bps to 7.5% in the capital city of Lima. The rating agency Fitch downgraded the rating outlook to negative from stable due to political uncertainties but kept the `BBB` rating unchanged. The finance minister said, "the negative outlook requires urgent measures and consensus building to avoid the deterioration of the country's credit rating". Macroeconomic fundamentals remain solid despite political “noise” as the fiscal deficit narrowed to 1.1% of GDP in September (primary surplus +0.5% of GDP) leading the government to review the 2022 headline fiscal deficit to -1.7% of GDP and keeping the 2023 deficit at a low -2.5% of GDP. Congress leader Jose Williams said there are three ways to oust President Pedro Castillo and to exit the political crisis: vacancy, suspension, and procedure of the constitutional accusation. Williams said, “Personally, I believe that the vacancy is within the constitution, but we need 87 votes”. In other news, university students clashed with police officers when trying to block a railway line used by Southern Copper to transport minerals in the city of Moquegua.

Turkey: The Central Bank of Turkey (CBT) cut its policy rate by 150bps to 10.5%, 50bps more than consensus. House prices rose by a yoy rate of 184.6% in August from 173.9% yoy in July as individuals borrow money significantly below inflation to purchase an asset that often holds its real value (after adjusting for inflation).

Uruguay: The Ministry of Finance issued a USD 1bn Sovereign Sustainability Linked Bond (SSLB) due in October 2034 with three equal principal payments on October 2032, 2033, and 2034 at 5.94% yield, equivalent to US Treasury + 170bps with step-up and step-down interests contingent on four sustainability targets:

- Achieve a reduction of at least 50% in aggregate GHG emissions intensity by 2025

- Achieve a reduction of more than 52% in aggregate gross GHG emissions intensity by 2025

- Maintain at least 100% of the native forest area by 2025

- Increase native forest by 3% or more by 2025

The interest payment will increase by 15bps in October 2027 if the country misses each of the targets 1 or 3 and will decline by 15bps if the country achieves targets 2 or 4. The bond was 4x oversubscribed with 20% of orders from first-time participants in Uruguay's primary market operations, many of which were ESG-focused. The novel structure is an astute way of setting up tangible incentives for countries to achieve their emission targets and can be replicated across EM countries. Uruguay has simultaneously issued a tender offer for USD 673m of bonds expiring in August 2024, USD 1,527m bonds expiring in October 2027 and USD 2,441m of bonds expiring in January 2031.

Snippets

- Czechia: PPI inflation rose 1.2% mom in September after declining 0.1% in August, taking the yoy rate up 60bps to 25.8% - 50bps above consensus.

- Malaysia: The yoy rate of CPI inflation declined 10bps to 4.6% in September, 10bps above consensus. The trade surplus was unchanged at MYR 17.4bn in September as both exports and imports decelerated. Foreign exchange reserves declined by USD 1.6bn to USD 104.5bn on 14 October.

- Nigeria: The yoy rate of CPI inflation rose 50bps to 21.0% in September, slightly above consensus.

- Philippines: The balance of payments deficit widened to USD 2.4bn in September from USD 0.6bn in August and remittances from workers living overseas declined by USD 150m to USD 2.7bn in the previous month.

- Poland: Retail sales were unchanged at a yoy rate of 21.5% in September but the rate of growth of sold industrial output declined by 210bps to 8.8% yoy. The yoy rate of PPI inflation was unchanged at 25.5% (90bps above consensus) while core CPI rose by 80bps to 10.7% yoy in September (in line with consensus). The yoy rate of gross wages rose by 70bps to 13.4% in September, 90bps below consensus.

- South Africa: CPI inflation rose by 0.1% mom in September and the yoy rate was unchanged at 7.6% as core CPI rose by 0.5% mom taking the yoy rate up 30bps to 4.7%, both in line with consensus. Retail sales rose 0.4% mom in August after declining 0.1% in July, significantly better than consensus for a 1.8% mom decline.

- South Korea: The trade deficit widened to USD 5.0bn in the first 20-days of October from USD 4.1bn over the same period in September as exports declined at a yoy rate of 5.5% and imports rose by 1.9% yoy.

- Taiwan: The yoy rate of export orders dropped to a 3.1% contraction in September from +2.0% in August.

- Thailand: Car sales increased to 74k in September from 68k in August.

Developed markets

United States: The probability of the Republican Party assuming control of the Lower House of Congress improved to 80% and the Senate is close to a toss-up according to data scientist Nate Silver from Fivethirtyeight. Mid-term elections take place on the 8 November and the odds of the Republicans taking both houses increased to 41% while the probability of a split Congress is 38% and a Democratic Party sweep only 21% (status quo).2

In monetary policy news, several Federal Reserve Governors spoke at various events. The overall message was hawkish, but towards the end of the week, the Wall Street Journal’s Nick Timiraos (often seen as a mouthpiece for the Fed) said some officials are considering reducing the pace of hikes after November, when the policy rate is likely to reach 4.0%, suggesting terminal rates may peak below the 4.9% priced in today. The Fed Governor Lisa Cook warned that inflation ‘likely will require ongoing rate hikes and then keeping policy restrictive for some time,’ adding that the risk with prices is skewed to the upside and 2023 voting member Philadelphia Governor Patrick Harker said the Fed is likely to increase the Fed Funds rate ‘well above’ 4.0% this year and hold it there for a prolonged period.

Second tier economic data is consistent with softer housing markets, but a resilient labour market. Building permits rose to at 1.56m in September from 1.54m in August, but housing starts declined to 1.39m from 1.56m over the same period. Existing home sales dropped 2.1% in September after declining 0.8% in August and mortgage applications dropped another 4.5% in the week of 14 October. Foreign investors purchased a record USD 275.6bn of US bonds in August after USD 154bn in July. The empire manufacturing survey plunged to -9.1 in October from -1.5 in September as the Philadelphia Fed business outlook recovered 1.2 points to still depressed -8.7. Jobless claims remained at low levels. Industrial production rose 0.1% mom in September from -0.1% mom in August.

United Kingdom: Liz Truss resigned after only 45 days in power, the shortest ever tenure in Britain. Rishi Sunak is the new Prime Minister after predicting a crash in UK assets resulting from Truss’ economic policies. Importantly, Jeremy Hunt said he would stay as Chancellor of the Exchequer after implementing a decisive “U-turn” in fiscal policies with austerity instead of tax expansion as defended by Sunak. We believe that the UK economy grew dependent on foreign inflows to unproductive assets (i.e. houses) to fund its large current account deficit, resulting from overconsumption and now needs to create the conditions for higher savings rates to allow productive investment without depending on external capital, implying a long period of economic austerity and higher interest rates.

Europe: The European Central Bank is likely to hike its policy rate by another 75bps to 1.5%, keeping an aggressive path of hiking as CPI inflation rose to 10.0% yoy in September (revised 10bps higher). Consumer confidence improved by 1.2 points to -27.6 in October and the ZEW survey of expectations (responded by bankers) improved 1.0 to -59.7, both remaining at extremely low levels. Giorgia Meloni was sworn in as Prime Minister in Italy, but Italian assets are not underperforming thanks to reassurances by Meloni that she will remain close to the European Union and her intention to appoint an orthodox Finance Minister, despite noise from the leaders of coalition parties Silvio Berlusconi and Mateo Salvini.

Japan: The Bank of Japan intervened in the currency market selling an undisclosed amount but likely to be a few dozens of billions of USD, considering the sharp increase in volume on Friday afternoon, leading the JPY retracement from 151.9 to below 147 before closing at 147.7. The intervention is likely to have a short-lived impact on JPY unless either US Treasury yields stop increasing or the Bank of Japan is forced to change its negative interest rate policy (policy rate at -0.1%) and the yield cap on 10-year Japanese Government bond current at 0.25%, a set of policies designed to weaken the currency, which is the opposite of what Japan needs today, in our view. The Bank of Japan meets next Friday.

Canada: The yoy rate of CPI inflation declined by 10bps to 6.9%, 20bps above consensus. Core measures were also elevated as core CPI common rose 30bps to 6.0% yoy, core trimmed was unchanged at 5.2% yoy, and core CPI median declined 10bps to 4.7% yoy.

Commodities: A record number of LNG tankers are waiting off the European coast to offload due to the lack of regasification capacity after utilities rushed to fill gas storage facilities ahead of winter. The cost of chartering vessels to transport LNG surged to record levels.

1. See https://www.washingtonpost.com/opinions/2021/12/16/china-wang-huning-is-man-see/

2. See https://fivethirtyeight.com/features/the-senate-is-a-toss-up/

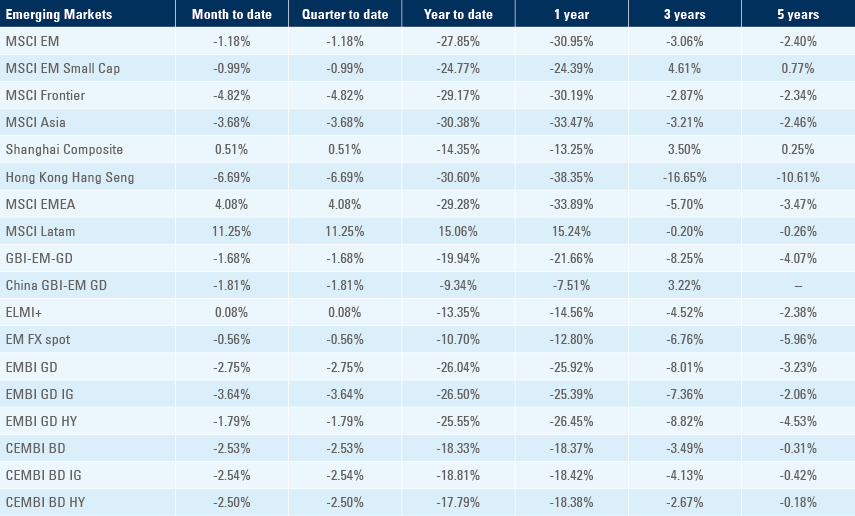

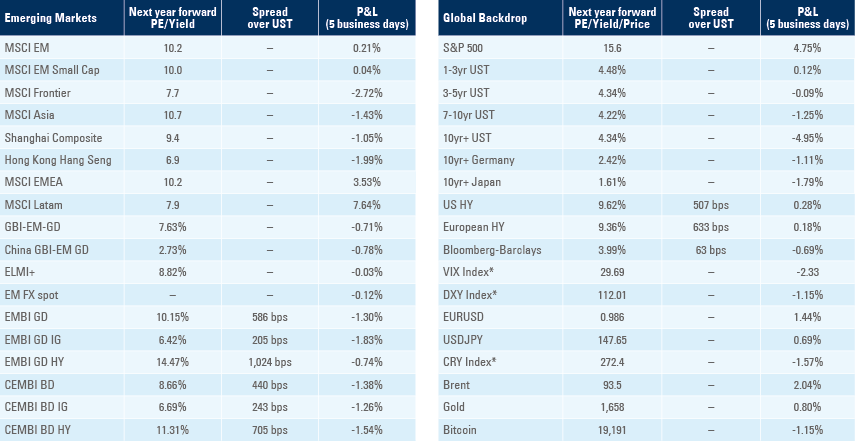

Benchmark performance