The US Federal Reserve (Fed) and the European Central Bank (ECB) hiked policy rates by 25 basis points (bps), in line with consensus. Bank Negara Malaysia also hiked by 25bps, but its track record suggests a much better management of macro stability than most of its peers, less focused on what could be thought of as meaningless targets and considering financial stability. Lending standards tightened significantly in the United States (US), but not as much as feared. Brazil kept its policy rate at 13.75% as inflation expectations declined for the first time since October 2022. China’s trade balance was surprisingly positive, led by lower imports. Meanwhile Mexican economic data remained very strong.

Global Macro

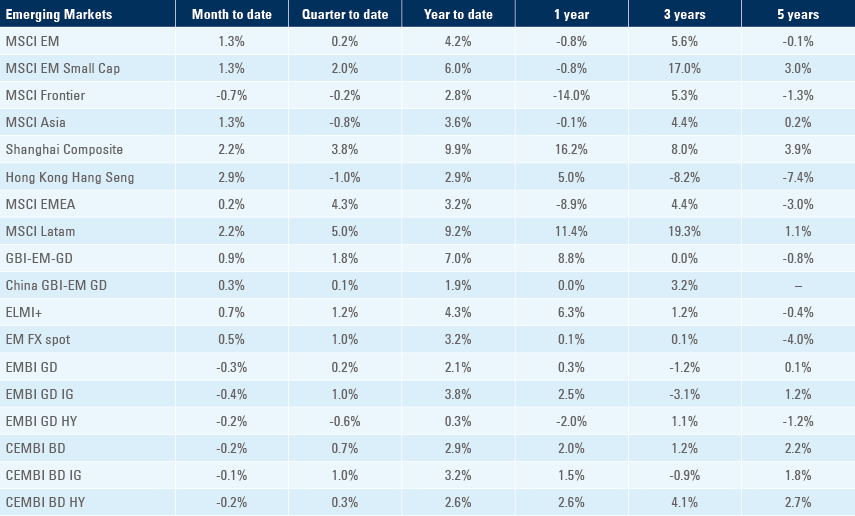

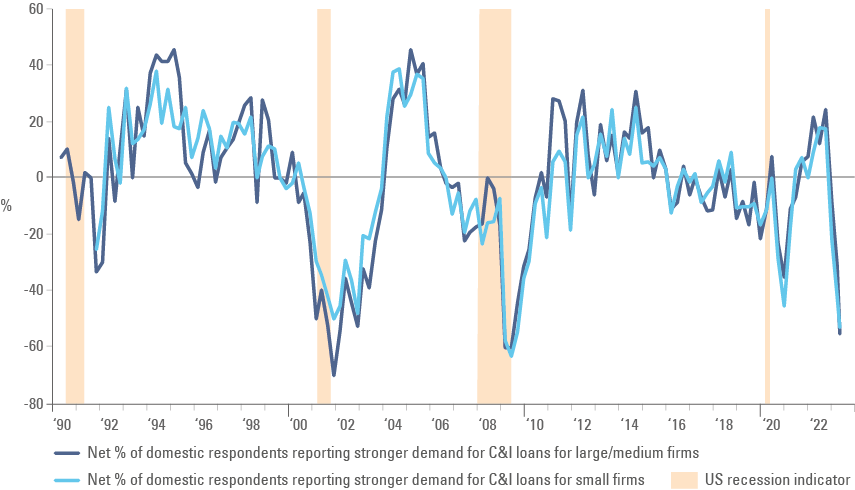

The Fed’s Senior Loan Officer Opinion Survey (SLOOS) reported tighter lending standards and wider credit spreads for industrial, commercial loans and commercial real estate. The tightening was likened pre-recession levels in 1991, 2000, 2007 and 2020, as demand for loans softened by a similar magnitude. Lending standards for residential mortgages and consumer loans tightened by a lesser extent, leading to a lower (but still pronounced) decline in demand for consumer loans as residential mortgage demand rose from all-time lows, but still in line with previous lows in 1994, 2000 and 2007-08.

Figure 1: Federal Reserve Senior Loan Officer Opinion Survey

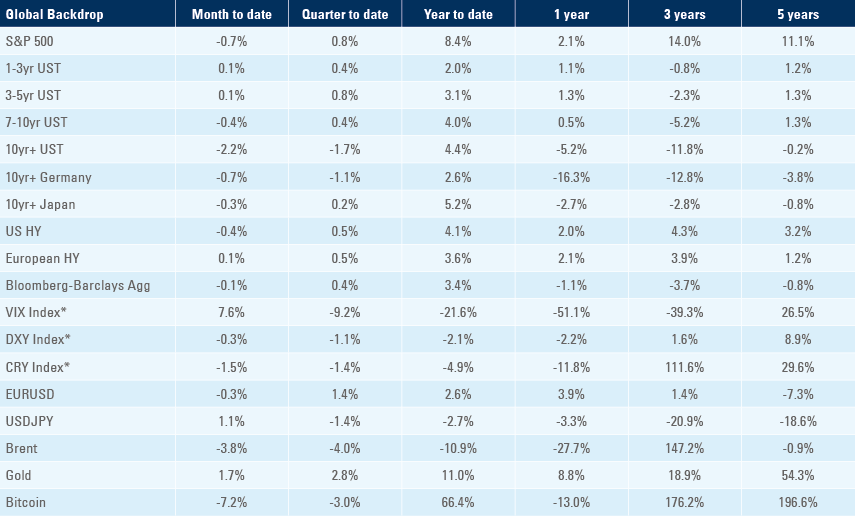

Historically, these (weak) levels of demand for credit have only happened during or immediately after recessions. What is incredible is the pace of credit demand collapse over this cycle:

Figure 2: Previous credit cycles versus today, measured by small company demand for commercial and industrial loans

Nevertheless, just as with Q1 earnings, the report was not as bad as expected. Only two out of 60 banks reported lending conditions had tightened considerably. Interestingly, only 60 banks report their lending standards, meaning we don't know how much worse loan conditions for the bulk of the regional banks presumably are.

The SLOOS data was certainly not a catalyst for the recovery on regional banks stocks, which bounced 14% from the lowest levels last Friday on rumours of a short-selling ban and ahead of the SLOOS report, but declined 4.8% yesterday after. After declining 40%, regional banks trade at 0.68x their book value, close to 0.60x book in March 2020 and 0.51x book in March 2009. The key question for regional banks is not only whether they are in a default situation today, but how their business will cope with a trifecta of higher defaults (commercial real estate), higher cost of funding, and tighter regulations, all of which are very likely to follow. Equity holders therefore have a tough path ahead and are likely to be sellers on rips rather than buyers of dips, unless there is sufficient regulatory forbearance and changes in market structures that would allow these banks to survive, even in a challenging environment.

In the early 1980s, following the massive increase in interest rates by then-Fed Chair Paul Volcker, the thrift (savings and loans) institutions were virtually defaulted. These institutions were forced by regulation to keep saving rates at lower levels, and the much higher interest rates led to deposit flights. A change in regulation that allowed them to pay higher deposit rates and invest in riskier assets led to a rush of speculative transactions, which coincided with the development of the primary market for high yield corporate credit; this was a period characterised by excessive risk taking and rampant scams, fraud, and swindles. Most thrift institutions still defaulted during the 1980s, as the cost of bailing out depositors were far higher than if the de-regulation would not have taken place. It is unlikely the Biden administration will repeat the playbook of Ronald Regan. If anything, most likely it will go in the opposite direction.

Emerging Markets

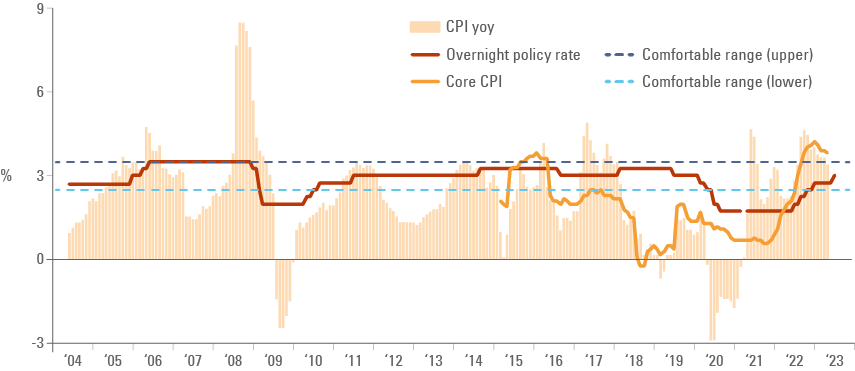

Malaysia: Bank Negara Malaysia hiked its policy rate by 25bps to 3.0%, against consensus for unchanged. We believe that Bank Negara is one of the most prudent and long-term thinking institutions in the world, managing to keep its mandate to price stability while keeping policy range in a tight 1.75% to 3.5% range over the last two decades, as per Figure 3. The central bank does not have a specific target regime but stablised 2.5% to 3.5% as its “comfortable range”. The lack of a rigid target and prudent attention to price conditions, economic activity and financial stability, allowed the institution to avoid excessively reacting to overshoots or undershoots in the headline inflation as core consumer price index (CPI) ex-fresh food and administered prices averaged 1.9% since the inception of the index in 2015, an enviable track record of fostering financial and price stability. In other news, the manufacturing purchasing managers’ index (PMI) was unchanged at 48.8.

Figure 3: Bank Negara Malaysia policy rate, inflation, and core inflation since May 2004

Brazil: The Brazilian Central Bank kept the Selic rate unchanged at 13.75%, in line with consensus, but pointed to more two-sided risks for the inflation outlook, suggesting the odds of an earlier policy rate cut have increased, in our view. The Focus market survey showed market participants expects CPI inflation for 2023 and 2024 at 6.02% and 4.16%, both slightly lower than one week before – the first decline in expectations since Q4 2022. In economic news, the services sector PMI rose by 2.7 points to 54.5 and the trade surplus narrowed to USD 8.2bn in April from USD 10.9bn in March, as exports dropped USD 5.6bn to USD 27.4bn and imports declined by USD 3.0bn to 19.2bn. Vehicle production dropped to 179k in April from 222k in March while sales declined by 38k to 161k over the same period.

China: The services PMI declined by 1.4 points to 56.4 in April, slightly below consensus and suggesting the service sector remains robust. The trade surplus increased by USD 2.0bn to USD 90.2bn in April as the year-on-year (yoy) rate of import growth declined by 7.9% (from -1.4%) while exports rose by 8.5% yoy (from 14.8%).

Mexico: Manufacturing PMI was virtually unchanged at 51.1 in April. Remittances rose to USD 5.2bn in March from 4.4bn in February, 10.7% higher than March 2022. The unemployment rate dropped by 30bps to 2.4% in March, the lowest level since the inception of the series as total capital investment rose to 12.7% yoy in February from 7.8% yoy in January. This was the highest level since 2012 excluding the “noisy” data during the Covid-19 pandemic in 2020- 2021.

Snippets

- Argentina: Vehicle sales declined to 34k in April from 38k in March, exports dropped by 1.5k to 31k and production declined by 7k to 54k over the same period.

- Chile: Nominal wage growth was unchanged at 11.2% yoy in March, but economic activity declined by 0.1% month-on-month (mom) in March after dropping 0.4% in February, bringing the yoy rate down by 160bps to 2.1%. Vehicle sales slumped to 19.5k vehicles in April from 37.5k in March. The trade surplus narrowed to USD 1.2bn in April from USD 2.9bn in March, as exports slowed by USD 2.2bn to USD 7.6bn and imports declined only 0.4bn to USD6.4bn.

- Colombia: CPI inflation dropped to 0.8% mom in April from 1.1% mom in March, allowing the yoy rate to decline by 50bps to 12.8%, 10bps below consensus as core CPI inflation slowed to 1.0% mom from 1.1% mom over the same period and the yoy rate rose 10bps to 11.5%. The Davivienda Composite (whole economy) PMI improved by 1.1 points to 52.6 in April.

- Czechia: The central bank kept its policy rate unchanged at 7.0%, but one committee member voted for a hike as inflation remains stubbornly elevated. The whole economy PMI declined 1.5 points to 42.8 in April, against a consensus for a 0.2-point increase, while the yoy rate of retail sales (ex-auto) declined further to -8.1% in March from -6.8% yoy in February.

- Hungary: Producer price index (PPI) inflation dropped by 1.2% mom in March after a 2.2% mom decline in February, bringing the yoy rate down 730bps to 21.7%. The manufacturing PMI surged 5.9 points to 61.9 in April, significantly above consensus for a 2.3 points slowdown. Retail sales and industrial production contracted further in April, supporting further deflationary pressures.

- India: The services sector PMI rose 4.2 points to 62.0 in April, significantly above consensus.

- Indonesia: The yoy rate of real gross domestic product (GDP) growth was unchanged at 5.0% in Q1 2023. Consumer confidence rose to 126.1 in April from 123.3 in March, remaining close to the highest levels since the start of the survey 20 years ago.

- Philippines: The manufacturing PMI declined 1.1 points to 51.4 in April and the yoy rate of CPI inflation declined by 100bps to 6.6% over the same period, but core CPI decelerated by only 10bps to 7.9% over the same period.

- Poland: The manufacturing PMI declined by 1.7 points to 46.6 in April.

- Romania: PPI inflation was unchanged in March after declining 0.3% mom in February, but base effects led to an 800bps plunge in the yoy rate to 13.6% over the same period. The unemployment rate declined 10bps to 5.4% and retail sales rose 2.9% mom in March (6.7% yoy) from 0.4% mom in February (4.2% yoy).

- South Africa: The Absa manufacturing PMI rose by 1.7 points to 49.8 in April, significantly better than consensus for a stable PMI. The yoy rate of electricity production declined by 5.6% in March, better than the 9.7% yoy decline in February, allowing for consumption to improve to -4.5% yoy from -8.7% over the same period.

- South Korea: CPI inflation rose 0.2% mom in April, the same pace as in March, but base effects led to a 50bps decline in the yoy rate to 3.7%, while core CPI declined by only 20bps to 4.6% yoy. The manufacturing PMI rose by 0.5 point to 48.1 in April, remaining in contractionary levels.

- Taiwan: The yoy rate of CPI inflation was unchanged at 2.4% in April, 20bps above consensus, while core CPI rose 20bps to 2.7%, but PPI moved to a 2.0% yoy deflation over the same period.

- Thailand: CPI inflation rose by 0.2% mom in April after declining 0.3% mom in March, as the yoy rate slid another 10bps to 1.7%, and core CPI dropped 15bps to 2.7%.

- Turkey: CPI inflation rose by 2.4% mom in April from 2.3% mom in March as base effects brought the yoy rate down 680bps to 43.7%, PPI dropped by 1,030bps to 52.1% but core CPI declined only 190bps to 45.5% yoy over the same period.

Developed Markets

United States: A dovish hike or a hawkish pause? The Federal Open Market Committee (FOMC) hiked the Fed funds rate by 25bps to 5.25%, in line with consensus, with no dissent, bringing the policy rate back to the 2006 peak. Fed Chair Jay Powell highlighted that policy is now very tight, so it can "have the luxury" to watch the data, signalling a strong preference to pause the hiking cycle as he highlighted at the press conference that “we’re getting close [to the end] or maybe even there”, a bias also expressed in the statement.

The ISM Services index rose 0.7-points to 51.9 as prices paid was unchanged at 59.6, employment declined marginally to 50.8 and new orders rose 4 points to 56.1.

Labour market data continues to indicate a tight market. Some signs of cooling showed on job openings, which declined to 9.6m in March from 10.0m in February and initial jobless claims rose to 242k on the week of 29 April from 229k in the previous week. Continuing claims declined to 1.81m from 1.84m in the previous week. However, other indicators did not confirm this coolness as non-farm payrolls were stronger than expected at 253k new jobs created in April in net terms, from 165k in March (revised from 236k), the unemployment rate declined by 10bps to 3.4% and average hourly earnings rose by 0.5% mom (consensus 0.3%) or 4.4% yoy (consensus 4.2%). The challenger job cut announcements aggregator reported a drop to 67k job cuts in April from 90k in March, 78k in February and 100k in January, nevertheless keeping the four, six and 12-month moving averages on an increasing trend.

Eurozone: The ECB hiked its deposit and refinancing policy rates by 25bps to 3.25% and 3.75% respectively, in line with consensus, but after some committee members voted for a 50bps hike. Governor Christine Lagarde maintained a hawkish stance, suggesting the ECB is very likely to increase its policy rate at least by another 50bps over the next two meetings. The Eurozone services PMI declined 0.4 points to 56.2, but retail sales contracted by 1.2% mom in March after dropping 0.2% mom in February, bringing the yoy rate down to 3.5%. The PPI posted a 1.6% deflation in mom terms in March after declining 0.4% mom in February, bringing the yoy rate down by 740bps to 5.9%.

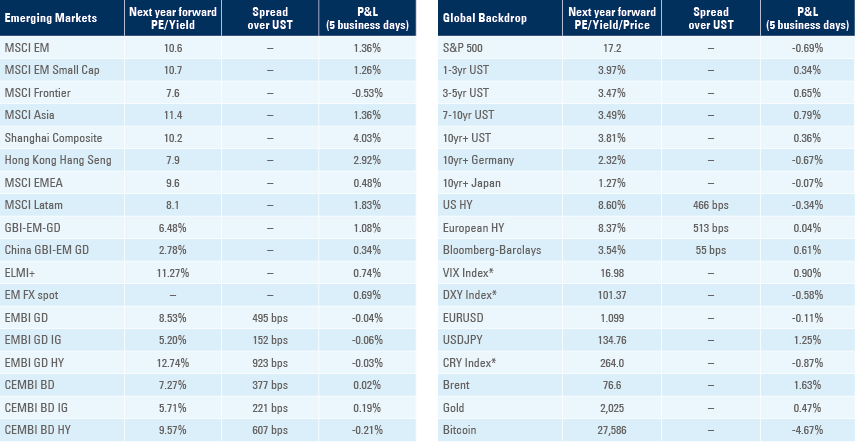

Benchmark performance