The war of attrition grinds on in Ukraine as Europe tries to normalise gas flows and open ports for grains. China’s challenges were compounded by boycotts on mortgages for unfinished projects. Argentina’s finance minister announced its new economic plans. Brazil approved a social assistance package that threatens the expenditure cap. Colombia’s economic activity surprised to the upside again. The Philippines and Hungary hiked policy rates in unscheduled meetings. The Taiwan Semiconductor Manufacturing Company announced better than expected Q2-2022 results.

Emerging markets

Russia-Ukraine: The situation on the ground remains complex, making any educated prediction extremely hard. The best description remains a long, protracted war of attrition that is now almost 5 months long (invasion 24 February 2022).

Russian forces achieved narrow territorial gains by using sheer artillery that forced the Ukrainian army to retreat, particularly since giving up on taking Kyiv and focusing on Donbass. However, these territories remain exposed due to thin Russian infantry forces and targeted assassination campaigns by Ukrainian intelligence to avoid Russian proxies to impose their regime in the newly conquered Ukrainian cities.

By retreating and forming a new defensive line in new cities where urban warfare favours defence, Ukrainian forces allow the Russians to take territory at the expense of severe attrition. This strategy is costly, from a human and capital perspective, but is the only way for Ukraine to exhaust the Russian offensive in terms of manpower and weaponry, allowing the Ukrainian army to be in a better position to counterattack and reclaim territory – sheer artillery vs. sheer attrition.

The Ukrainian position maybe be greatly enhanced by new artillery weapons shipped from NATO countries, including GPS guided artillery in new howitzers. Hence, there is some expectation that Ukraine will be able to regain significant territory over the next couple of months as NATO weapons arrive at larger scale. There are three key practical challenges to Ukraine:

- NATO is not shipping a uniform system of weapons to Ukraine, forcing the Ukrainian army to learn and operate different systems across different frontlines and coordinate different logistical needs.

- Ukraine remains dependent on western produced ammunition, and NATO simply does not produce ammunition in sufficient quantities for a long war of attrition.

- The Ukrainian defence strategy has inflicted severe losses to the Ukrainian army as well, which lowers the morale of the existing troops and forces

- The Ukrainian army to recruit both older and younger personnel with little training. Hence the efforts by NATO countries (including Britain) to train Ukraine’s personnel.

This complex situation explains why both parties may gain the upper hand over the next weeks and why NATO Secretary General Jens Stoltenberg suggested the fighting might last for years. This is particularly the case considering the alternative scenario – negotiated peace – seems to be impossible for the Ukrainian leadership under Russian conditions.

In other news, Gazprom mentioned it may not be able to resume flowing gas via Nord Stream 1 pipeline without the return of the turbine, which is yet to be delivered by Siemens Canada. Without the NS1, gas flows to Europe have been limited to the pipeline systems from Belarus and Ukraine. Despite soft gas flows, European inventories increased to around two-thirds of capacity on the 17 July.

At the same time, European diplomats are working to cut a deal between Russia and Ukraine to allow oversight for safe passage of cargo ships through the Black Sea, allowing grains to flow from Odesa and other Ukrainian ports. Around two-thirds of the Ukraine winter grain harvest (22m tons according to the agriculture minister) remains stuck in the country, shipping close to 2.0m tons of grain monthly, compared to 6-7m tons pre-invasion.

In a minor positive development, Lithuania allowed the transport of goods from Russia to Kaliningrad exclave. The flow of basic goods had been halted by European sanctions, which were allowed for an exception to avoid a conflict situation between Russia and Lithuania.

China: Last week several property buyers boycotted mortgage payments from flats where the construction is delayed in more than 100 unfinished projects across 50 cities according to Bloomberg, despite the risk of tarnishing their credit risk. Mortgages to new constructions is a small part of the market, measured around RMB 800bn (0.2% of total system loans), and the boycotted loans a fraction of that number. The risk is that non-repayment of new unfinished buildings hits price and sentiment the broader real estate market, thus causing a systemic risk. This is a considerable risk since a much larger share of savings is parked in properties, which has had a lower volatility than stocks and significant price appreciation over the last years. Regulators were fast to acknowledge the seriousness of the problem have been discussing measures to make sure buyers that borrowed money to buy a property under construction receive their payments, including tightening up the rules on individual projects escrow accounts, and ring-fencing and injecting new capital in projects where the developer diverted down payments to other purposes. In economic news, aggregate financing surged to RMB 5.2trn in June from RMB 2.8trn in May as new loans rose by RMB 0.9tn to RMB 2.8trn. The trade surplus surged to USD 98bn in June from USD 79bn in May as exports rose by a yoy rate of 17.9% and imports rose by only 1.0% yoy. GDP dropped 2.6% qoq in Q2 2022 from 1.3% in Q1 2022, bringing the yoy growth rate down to only 0.4% from 4.8% over the same period. Economic activity recovered in June as the yoy rate of industrial production rose 320bps to 3.9%, retail sales rose to 3.1% yoy after dropping 6.7% yoy in May, and fixed asset investments declined only 10bps to 6.1% yoy. However, the yoy rate of property investment declined to -5.4% in June from -4.0% yoy in May, below consensus.

Argentina: Finance Minister Silvina Batakis pledged to move forward with energy price hikes, an important step to improve the country’s fiscal accounts policy but pledged to keep subsidies to poorer households. Silvina also pledged to accelerate fiscal consolidation via gaining control over spending across all government agencies, shift the reporting period to monthly (from quarterly) and increase revenues from wealth taxes by marking the assets at current market valuations (today the tax is levied in historical valuations). The new minister also said the country needs to have positive real interest rates to incentivise Argentinians to keep their savings in ARS instead of converting to USD. In economic news, CPI inflation rose 5.5% mom in June from 4.8% in May, bringing the yoy rate up 90bps to 68.4%.

Brazil: Congress approved a USD 7.6 billion social assistance programme designed to help poorer households deal with high inflation rate, allowing the government to bypass the constitutional spending caps. The economic activity proxy declined 0.1% mom in May after dropping 0.6% in April, but the yoy rate rose to 3.7% from 2.1% over the same period due to base effects. Retail sales rose 0.1% mom in May after 0.8% in April, 90bps below consensus, bringing the yoy change to -0.2% from +4.5% over the same period.

Colombia: Economic activity surprised to the upside again as the yoy rates of retail sales, industrial and manufacturing production soared to 34.8%, 29.9% and 46.2% in May respectively, significantly above both April numbers (9.2%, 23.3% and 13.5% respectively) and consensus expectations. Consumer confidence jumped to 2.9 in June from -14.6 in May, the highest level since 2018 and significantly higher than consensus.

Philippines: The central bank hiked its policy rate by 75bps to 3.25% in an unscheduled policy committee meeting justified by higher inflationary pressures and higher currency volatility. Overseas cash remittances was unchanged at USD 2.4bn in May and the trade deficit widened to USD 5.7bn in May form USD 5.4bn in April as imports rose to USD 12bn (from 11.5bn) and exports rose to USD 6.3bn (from USD 6.1bn) over the period=.

Taiwan: The Taiwan Semiconductor Manufacturing Company (TSMC) reported better than expected results for Q2-2022 as end-demand is holding up. Revenues rose by +44% yoy, +2% higher than consensus as net income rose 76% yoy or 8% ahead of consensus. Guidance for the full year 2022 was even better than previously bullish guidance, but the company now expect an inventory correction like 2015 or 2019 (but not like 2008) from Q4 2022 lasting until mid-2023. As a result, the company trimmed down capital expenditure commitments by a small amount.

Snippets

- Chile: The Central Bank of Chile hiked its policy rate by 75bps to 9.75%, 25bps more than expected by the median economist reporting their expectation on Bloomberg, but 25bps less than implied by market prices.

- Croatia: The ratings agency Fitch upgraded Croatia sovereign credit rating to 'BBB+' with a stable outlook.

- Czechia: The yoy rate of retail sales ex-autos dropped 6.9% in May from 5.7% in April and CPI inflation rose 1.6% mom in June after increasing by 1.8% in May, taking the yoy rate to 17.2%.

- Hungary: The National Bank of Hungary hiked its policy rate by 200bps to 9.75% on a unscheduled decision, bringing it in line with the 1-week repo rate, signaling tighter monetary policy will remain in place for longer.

- India: The yoy rate of industrial production rose to 19.6% in May from 6.7% yoy in April, slightly below consensus, while the yoy rate of CPI inflation was unchanged at 7.0% in June, in line with consensus, but wholesale prices slowed 70bps to 15.2% yoy over the same period. The trade deficit widened to USD 26.2bn in June from USD 24.3bn in May.

- Indonesia: The trade surplus rose to USD 5.1bn in June from USD 2.9bn in May, significantly higher than consensus as exports rose by a yoy rate of 40.7% (from 27.0%) and imports by 22.0% (from 30.7%).

- Mexico: Manufacturing production rose by a yoy rate of 6.1% in May from 3.9% in April and industrial production rose 60bps to 3.3% yoy over the same period, both coming above consensus.

- Peru: The yoy rate of economic activity proxy slowed to 2.3% in May from 3.7% in April, but the unemployment rate in the city of Lima declined 40bps to 6.8%.

- Poland: The current account deficit narrowed to USD 1.9bn in May from USD 3.5bn in April, led by a lower trade deficit at USD 1.2bn from USD 2.6bn over the same period as exports improved USD 1.2bn to USD 28.1bn and imports declined USD 0.1bn to USD 29.3bn.

- Romania: CPI inflation dropped to 0.8% mom in June from 1.2% in May, driving the yoy rate 60bps wider increase in the yoy rate to 15.1%. Industrial output dropped 0.1% mom in May after rising 0.3% in April (revised from +0.7%) and the trade deficit narrowed to USD 2.7bn in May from USD 2.8bn in April.

- Russia: The current account surplus rose to USD 70bn in Q2 2022 from USD 68.4bn in Q1 2022 as higher commodity prices compensated for marginally lower volumes.

- Saudi Arabia: The yoy rate of CPI inflation rose only 10bps to 2.3% in June. US President Joe Biden went to Saudi Arabia to ask for an increase in oil production, but heard a consistent message that the Kingdom and the OPEC+ follow the market situation and will supply energy as needed.

- South Africa: The yoy rate of manufacturing production dropped 0.2% mom in May after dropping 5.7% in April and retail sales dropped 1.0% mom in May after rising 0.6% in April (revised from -0.2%). Mining production declined by a yoy rate of 7.8% in May from -14.8% in April, slightly better than consensus.

- South Korea: The Bank of Korea hiked its policy rate by 50bps to 2.25%, in line with consensus.

- Sri Lanka: Gotabaya Rajapaksa resigned from the presidential post after fleeing the country, initially to Maldives, then to Singapore. A new president is expected to be elected through parliament this week

- Turkey: Fitch downgraded Turkey’s foreign debt rating to `B` from `B+`, the second downgrade in 2022 and kept the negative outlook citing soaring inflation rates, low foreign exchange reserves and looming presidential elections.

Global backdrop

United States: June inflation increased by more than expected across measures. CPI inflation rose by 1.3% mom in June, 20bps above consensus, bringing the yoy rate to 9.1%, the highest level since 1981. Energy prices surged 7.5% mom, with used cars and trucks increasing 1.6% mom. The CPI ex-food and energy increased to 0.7% mom and 5.9% yoy, also 20bps above consensus as shelter prices rose 0.6%. High inflation led the average weekly earnings to drop by a yoy rate of 4.4%, the sharpest decline since the inception of the series in 2007. PPI final demand rose 1.1% mom in June (from 0.9% in May) or 11.3% yoy (from 10.9%), significantly above consensus, but PPI ex-food and energy declined 30bps to 8.2% yoy (in line).

The money market priced a 75% chance of the Fed hiking policy rate by 100bps last Thursday (before declining to c. 20% odds last Friday), even though the economy has been slowing and inflation is likely to decline over the 2H 2022. For the fourth straight week, the nation’s average gas price has fallen, declining 12.8 cents from a week ago to USD 4.66 per gallon according to GasBuddy.1 The national average price of diesel has declined 8.5 cents in the last week and stands at $5.65 per gallon. Last week the CRY commodity price index declined another 3.5%, leading to a cumulative drop of 15.8% from its highest levels. Higher inventories, higher cost of funding for housing and private sector capex contrast with a fast decline in economic activity momentum. Anecdotally, nearly 60k home sales fell through in June due to higher mortgage rates, according to an analysis by Redfin Corp, equivalent to 15% of transactions that went into contract that month, the highest share of cancellations since April 2020, when early Covid lockdowns froze the housing market.

Forward looking surveys improved only marginally as the New York Fed Empire Manufacturing survey improved to 11.1 in July from -1.2 in June and the University of Michigan Sentiment survey improved 1,1 to 51.1 in July, led by current conditions. All indicators, notably expectation of future activity remained depressed and 5-10-year inflation expectations dropped 30bps to 2.8%. Other coincident indicators were mixed as retail sales rose 1.0% mom in June recovering from -0.1% in May, but industrial production dropped 0.2% mom in June (flat in May).

Japan: PPI inflation rose by 0.7% mom, bringing the yoy rate to 9.2% in June, significantly higher than most Asian countries, including China. Import prices are up more than 46.3%, the highest level since 1980. The large gap between import prices and PPI and between PPI and CPI means that companies and/or the government are absorbing part of the cost increases.

United Kingdom: The contest for the leadership of the Conservative Party advanced with several candidates pledged to cut taxes, a popular measure within the party, but unsustainable from a fiscal point of view. A first vote took place where Rishi Sunak, Liz Truss and Penny Mordaunt emerged as the favourites to win, but several other candidates are still in the running. In other news, industrial and manufacturing production rose 0.9% mom and 1.4% mom respectively in May significantly above consensus as construction output rose 1.5% mom (from 0.3% in April), but the trade deficit was unchanged at GBP 9.8bn in May.

Europe: The ZEW survey of expectations of financial professions across Europe tumbled to -51.1 in July from -28.0. New car registrations dropped 15.4% on a yoy basis in June, reaching the lowest level to the period in since the inception of the survey in 2003. Industrial production rose 0.8% mom in May from 0.5% in April. The European Central Bank holds a monetary policy committee meeting next week and are expected to hiked policy rate by 25bps to -0.25% and commit to a 50bps hike in September. Prime Minister Mario Draghi asked to resign after the Five Star Movement, part of the unity government, refused to back him in a confidence vote, but the Italian president rejected his resignation.

Canada: The central bank hiked its policy rate by 100bps to 2.5%, 25bps more than consensus.

Australia: The unemployment rate declined 40bps to 3.5% in June, 30bps lower than consensus.

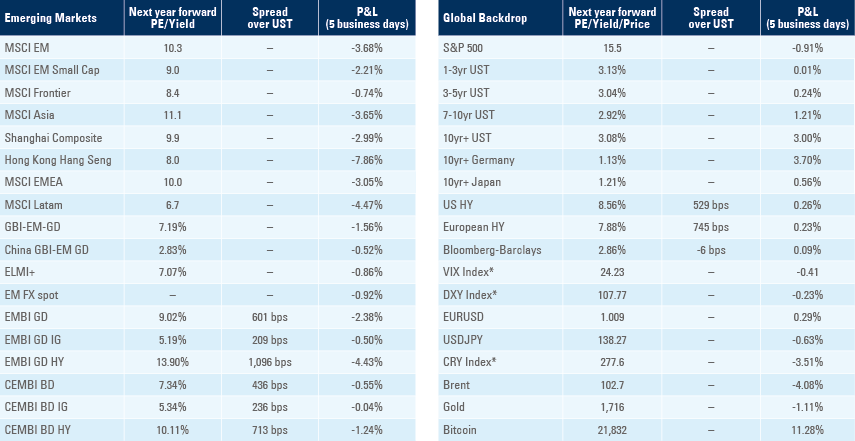

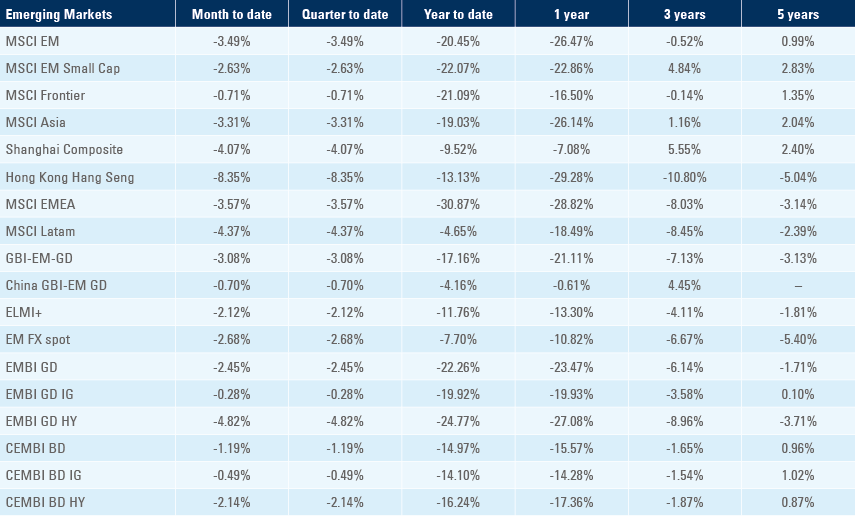

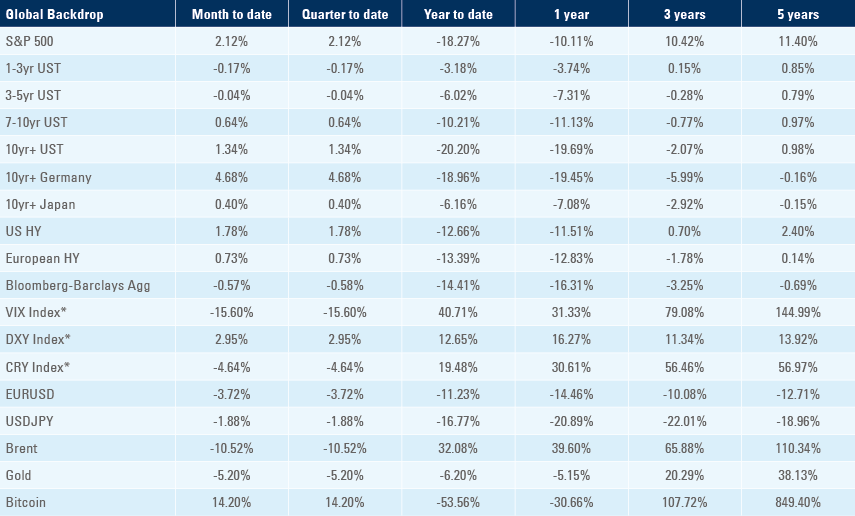

Benchmark performance

1. Data compiled from more than 11 million individual price reports covering over 150,000 gas stations across the country