US investment narratives converging around AI highlight emerging market diversity

- The AI narrative got jittery, but macro conditions remain conducive to the performance of risk assets.

- EM cross-asset outperformance was extended.

- Diversity of macroeconomic, thematic and valuation exposures in EM stock universe helped investors sleep at night.

- China advised its citizens to avoid travelling to Japan following remarks by Prime Minister Sanae Takaichi on Taiwan.

- Chile’s first-round general election results put right-wing candidate José Kast in pole position for a run-off with Jeannette Jara on 14th December.

- Colombia plans to continue buybacks of international bonds.

- Ghana’s 2026 budget plan was broadly in line with IMF programme targets.

- S&P upgraded Nigeria’s credit outlook to positive, South Africa’s credit rating to ‘BB.’ Senegal was downgraded.

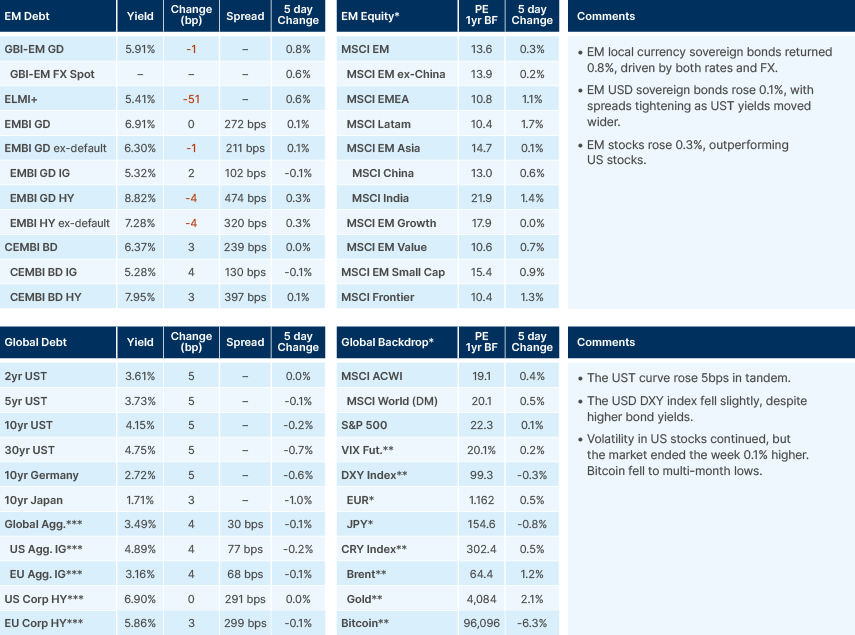

Last week performance and comments

Global Macro

As we head into what is normally a strong season for risk assets, markets are jittery. Media noise around an artificial intelligence (AI) bubble is louder than ever, with newsflow that hyperscalers will begin to use more leverage to fund capex driving a new wall of worry. This has led to some credit spread widening in select names, such as Oracle. Contagion to other credit spreads in the space has been limited and has not spread to wider investment grade corporate bonds yet. Is this an indicator of things to come? Perhaps. But evidence this is more than an idiosyncratic move is limited. The US earnings season has been very positive, with 82% of companies beating expectations so far. Earning growth yoy for the index currently stands at 13%. AI-related earnings were generally strong and datacentre capex plans were expanded. All indicators showing the AI story has no sign of slowing down.

More important for markets, in our view, than the current form of tech-related paranoia, is the lack of key US economic data for the past six weeks. The longest-ever government shutdown (now over) has clouded the picture over future rate cuts, with CPI and payroll data for September and October still not published. Through the fog has come some decidedly hawkish commentary from various members of the Federal Reserve (Fed), including Chair Jerome Powell, aimed at tempering expectations of consecutive cuts at future meetings.

As a result, the forward market implied probability of the Fed cutting rates in December has dropped to below 50%. Both US nominal and real yields have trended higher too, in recent weeks. Part of this move was due to rising risks to tariff revenues. The Supreme Court is yet to decide on the legality of Trump’s executive order IEEPEA tariffs. If they are deemed illegal, he would need to pay the revenue back – a cost estimated in the hundreds of billions.

It is expected the tariffs would be resurrected through another route. However, risks to tariff revenues now also come from US President Donald Trump’s deal flow. In recent weeks various trade deals have been announced, such as with Switzerland over the weekend, whose tariff was cut from 39 to 15%. Most importantly, tariffs to China were cut by 10% following a meeting between Trump and Xi Jinping, which sets the stage for a softening of trade tensions between the two global superpowers next year. But political pressure around affordability in the US is also driving Trump to make further concessions, most recently for food products from Latin America. With midterm elections in 2026 now an important consideration, this trend persisting may lead to a meaningful reduction in tariff revenues in 2026.

The expectation of lower Fed fund rates next year, and the decline in US bond yields this year in anticipation, are important pillars of this bull market. September’s non-farm payroll data will be released this Thursday, but it is unlikely we will return to full data normality until January, particularly for inflation. As yields have risen, month-to-date (MTD), the S&P 500 is down 1.5%.

As the backdrop for risk assets gets choppier, EM stocks continue to outperform US stocks, with the MSCI EM down 1.1% MTD. EM stocks are now up 31% ytd, versus 16% for the S&P 500. Some outperformance has come from China, up 1% this month given the boost from the improved trade outlook with the US. Goldman Sachs has gone as far as to upgrade its 2026 China gross domestic product (GDP) growth target from 4.3% to 4.8% on the back of Premier Xi Jinping and Trump’s successful meeting, and the Fourth Plenum meeting. This indicated that over the next five years authorities would double down on high-tech manufacturing investment, which, if trade lanes stay open, could widen China’s trade surplus even further.

Further expansion in Chinese exports brings risks to manufacturing growth in Asia-ex China and Europe. However, importing disinflation will provide scope for central banks to cut further – a powerful mitigating factor for capex-intensive industries that would also likely provide upside for local currency bond investors. EM local currency bonds, as measured by the J.P Morgan GBI-EM-GD index, are up 17% ytd.

Indian equities (MSCI India) are up 0.9% on the month, as macroeconomic indicators look increasingly positive for next year after a cyclical slowdown in 2025. MSCI LATAM continues its positive year, (+51% year-to-date), up 4.3% MTD. Brazil’s falling inflation expectations opens the door for the Central Bank of Brazil to cut rates next year, which can give the rally in Brazilian stocks more legs. Mexico is in a cyclical downturn, but rate cuts may drive a broad-based economic recovery next year, and a successful review of the USMCA trade agreement can reduce uncertainty and drive a resurgence in manufacturing capex and foreign direct investment (FDI).

At a time when global investors can hardly get through a sentence without saying “AI” – the macroeconomic, thematic, and valuation diversity within emerging markets (EM) becomes more relevant than ever. This dynamic is perhaps even more prevalent in frontier markets (FM), which normally exhibit low correlations with global stocks. News flow from Africa just this week is a clear example, Nigeria has been upgraded by S&P to a positive outlook. South Africa’s credit rating was upgraded by S&P to ‘BB’ on an improving growth and fiscal trajectory, with a positive outlook maintained. These are just two examples of a range of improving idiosyncratic stories across EM, which continue to drive strong investment returns in equity and fixed income markets. Sometimes it might not seem like it, but there is more to life than AI.

Still, the key swing factor for risk for the rest of the month will probably be NVIDIA reporting its Q3 results on Wednesday. These are almost certain to be strong; however, the focus may be more on NVIDIA’s narrative management, with many investors sitting on big profits and looking for a reason to sell.

Will we get a ‘Santa Rally’? Or will investors be left with some coal in their stocking come Christmas? Only time will tell. But in our view, rising concerns of a major drawdown in global markets are currently overblown. Yes, markets have had another good year. Volatility is now rising, and certain leading indicators of risk, such as crypto, are struggling. This will likely lead to some profit taking. But ultimately, the macro backdrop remains supportive. The Fed is cutting rates, and most other central banks globally also have a cutting bias. Currency volatility remains low, the USD is still soft, and bonds remain mostly well-behaved. Low credit spreads mean liquidity conditions are still good. This is not to say we would be surprised to see a correction in stocks this side of Christmas. It may even be healthy for markets to get rid of some froth before 2026 begins. But there are various canaries in the coalmine that would be singing louder if the time to worry was now. And if investors are concerned about valuations, then increasing portfolio diversification, as always, is the best medicine for a better night’s sleep.

Geopolitics

Japan’s government strongly protested after China advised its citizens to avoid travelling to Japan following remarks on Taiwan by Prime Minister Sanae Takaichi. Takaichi suggested that military force in a Taiwan conflict could be a “survival-threatening situation” justifying Japan’s intervention.

Tokyo says the move runs counter to prior leadership agreements on advancing a mutually beneficial strategic relationship and called for “multi-layered communication” between the two countries. Party policy chief Takayuki Kobayashi urged calm and continued dialogue to maintain a constructive bilateral relationship. In August 2025, in 2024, according to CNBC almost 20% of international visitors to Japan came from China, around 7 million people.

Emerging Markets

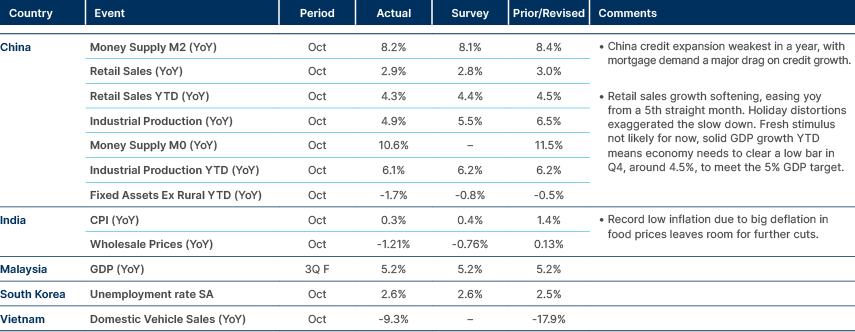

Asia

Malaysia: Malaysia’s labour market remains one of the strongest in the region, with unemployment holding at its lowest level in a decade at 3.0%. Youth unemployment has fallen to its lowest point since 2020. This reinforces the narrative of a resilient domestic economy despite a slowing global backdrop.

Pakistan: Tensions between Pakistan and Afghanistan escalated after peace negotiations collapsed due to Kabul’s refusal to formalise a counter-terrorism commitment. Although a ceasefire persists, cross-border relations remain fragile, and the risk of renewed hostilities cannot be discounted. Türkiye’s ongoing mediation effort is expected to play a central role in managing the next steps.

South Korea: China’s suspension of sanctions on Korean shipbuilding affiliates for one year marks a modest easing of bilateral trade frictions following the recent US-China de-escalation. This temporary reprieve is positive for Korean heavy industry, but structural reliance on Chinese inputs and regulatory exposure remains a key medium-term risk for the sector.

Thailand: The Article IV review by the International Monetary Fund (IMF) signalled a more subdued macroeconomic outlook for Thailand, projecting growth to slow to 2.1% in 2025 and 1.6% in 2026, against a backdrop of weak private investment and soft external demand. The IMF recommends targeted fiscal support and notes room for additional monetary easing. On the political front, a NIDA poll in the northern region shows elevated voter indecision, though the opposition People’s Party currently leads among those expressing a preference.

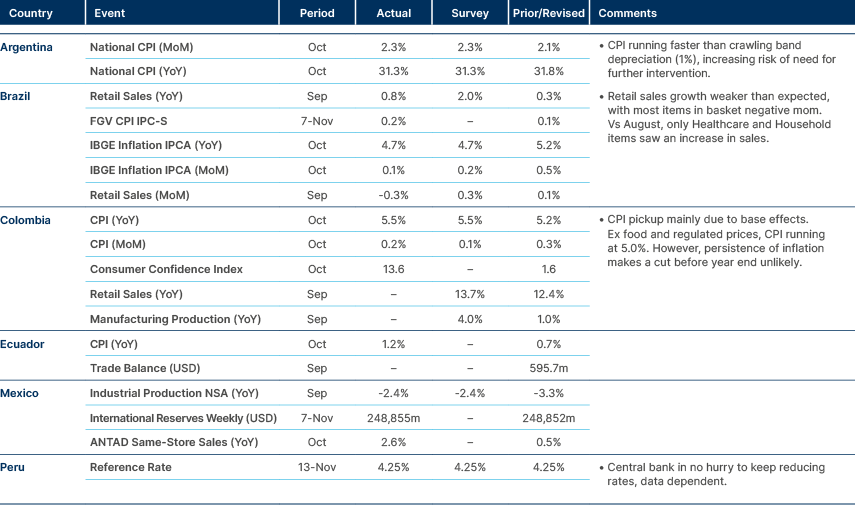

Latin America

Argentina: An economic team is preparing a set of measures centred on FX reserve accumulation, a potential debt buyback programme targeting 2029s and 2030s, and the introduction of a debt-for-education instrument. While market speculation has pointed to a faster adjustment of the FX band, the Economy Ministry has publicly denied any accelerated timetable. Policy signals are likely to remain closely scrutinised given the fragile macro backdrop.

Brazil: Polling data shows President Lula’s advantage in hypothetical second-round matchups narrowing, driven largely by public security concerns following a high-profile Rio police operation. Rising rejection rates for both Lula and the Bolsonaro family highlight ongoing polarisation, while support for centrist positioning is increasing as undecided voters expand.

Chile: Results from the first round of Chile’s general election put right-wing candidate José Kast in pole position for a run-off against Communist Party candidate Jeannette Jara on 14 December. Kast received 24% of the vote with Jara on 27%. However, right wing/centrist voters are now very likely to rally around Kast, with Jara the sole representative of the far left on the ballot.

Colombia: The government will buy back more of its outstanding global bonds, its second such operation this year as the government moves to diversify public debt and reduce financing costs. The government seeks to repurchase global notes across the curve, including EUR-denominated bonds due in 2026 and global Peso notes due in 2027. The government expects to retire more than USD 4bn in global USD bonds with coupons above 7% “as a strategic measure to reduce debt costs and improve liquidity at different points on the new euro yield curve,” public credit director Javier Cuellar said in the statement.

Mexico: The agricultural sector faces mounting pressure as farmer groups call for a nationwide strike demanding higher guaranteed prices. The planned mobilisation raises the possibility of disruptions to key highways and border crossings, with potential spill-over effects on trade flows and broader economic activity. Mexico’s Supreme Court supported a case of USD 1.8bn in tax claims against companies owned by billionaire Ricardo Salinas Pliego. The conglomerate is likely to dispute the “fair and correct” amount owed in local and international courts.

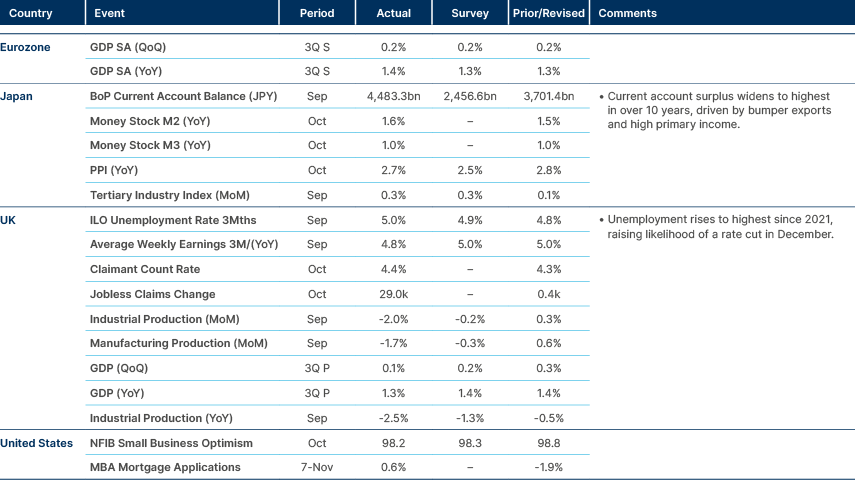

Central and Eastern Europe

Hungary: Hungary has secured long-term exemptions from US sanctions on Russian oil and nuclear cooperation, with deepening bilateral economic, energy and defence ties with Washington after Orban visited the White House last week Orbán also said Trump had offered a “financial shield” to Hungary that could be worth up to USD 20bn if funding was cut from the European Union. During the same meeting, Hungary had committed to buying US liquefied natural gas (LNG) valued at USD 600m and pledged to spend USD 700m on US military supplies. After Orbán went public with the terms of the deal, the Trump administration quickly clarified that the deal was just a verbal agreement, and it was just for one year.

Türkiye: Foreign relations with Israel deteriorated further after Istanbul prosecutors issued arrest warrants for 37 Israeli officials on allegations of genocide tied to a prior flotilla incident. The move reinforces Ankara’s increasingly confrontational diplomatic posture and is likely to exacerbate already heightened regional tensions.

Middle East, and Africa

Angola: Ties with India deepened after it granted Angola a USD 200m credit line and cooperation in defence, agriculture and medical training. In parallel, discussions with Botswana on diamond-sector cooperation underscore intensifying regional competition for upstream assets, particularly amid rival bids for De Beers.

Ghana: The 2026 budget plan was broadly in line with IMF programme targets. Finance Minister Cassiel Ato Forson noted public debt fell from 62% of GDP in 2024 to 45% in 2025, aided by strong FX valuation effects (the Cedi has risen c. 25% since April). Key 2026 budget projections: Overall Balance: -2.2% of GDP, Primary Balance: 1.5% of GDP, Revenue: 16.8% of GDP, Total Expenditures: 18.9% of GDP.

Provisional data for FY2025 shows a primary balance surplus of 1.8% of GDP in 2025 from a deficit of 3.0% of GDP in 2024 (2025 IMF target of 1.5%). Expenditure declined to 17.8% of GDP in 2025 from 23.2% in 2024, while revenues edged up to 16% of GDP in 2025 from 15.9% in 2024. Revenue to rise 0.8% to 16.8% of GDP in 2026, despite proposals to cut effective tax rates through improved tax collection.

Kenya: Parliament finally lifted a seven-year moratorium on new power purchase agreements (PPAs), introducing tariff caps and permitting both USD- and KES-denominated PPAs to alleviate supply constraints. The government also advanced an extensive restructuring of state-owned enterprises (SEOs), converting 67 parastatals into PLCs. At the same time, the Treasury created a dedicated fiscal risk unit to improve oversight, prompted by a rise in SOE loan arrears to KES 154bn.

Nigeria: S&P Global Ratings revised its outlook on Nigeria from stable to positive, while affirming a 'B-' long-term foreign rating. The positive outlook reflects an improving external, economic, fiscal, and monetary environment. Authorities are taking steps to improve the economy’s growth prospects, and macroeconomic resilience, despite low GDP per capita, a weak, albeit improving, fiscal revenue base, high debt servicing costs as a percentage of revenues, and challenges in compiling national statistics.

Morocco: Morocco’s draft 2026 budget emphasises continued fiscal consolidation, targeting a reduction of the deficit to 3% of GDP through more robust revenue mobilisation and a controlled pace of current expenditure. Despite this consolidation agenda, the government has maintained an ambitious public investment envelope of MAD 380bn, alongside ongoing expansion of social protection programmes.

Saudi Arabia: Saudi crude exports are facing a near-term headwind from China, where independent refiners are expected to reduce liftings for a second consecutive month due to quota limitations. While softer Chinese demand poses a challenge, the impact may be partly offset by stronger Indian refinery interest, reflecting the ongoing diversification of Saudi crude outlets across Asia. Indeed, Saudi has increased plans for oil exports to Asia.

Senegal: S&P downgraded Senegal’s foreign-currency sovereign rating to CCC+ (from B–), highlighting a sharp deterioration in fiscal sustainability. Public finances have become highly precarious as gross financing needs for 2026 are expected to reach roughly 26% of GDP, driven by a still-wide fiscal deficit and heavy amortisation of XOF 4.3 trillion. S&P’s own deficit forecast—8.1% of GDP once arrears are included—is materially higher than the government’s target and would push financing needs closer to 29% of GDP. The suspension of the USD 1.8bn IMF programme last year, following revelations of hidden debt and fiscal misreporting, has severely restricted access to concessional funding. The rating agency warned that without a credible fiscal repair plan and restored multilateral support; debt-servicing pressures will continue to intensify.

South Africa: S&P upgraded South Africa’s sovereign credit rating from ‘BB-’ to ‘BB’, citing an improving growth and fiscal trajectory. It also maintained a positive outlook on the rating in a positive surprise to market expectations. Given that S&P’s fiscal forecasts remain conservative, there is scope for credit metrics to outperform S&P’s expectations and therefore to prompt an upgrade to ‘BB+’ within the next year, in our view. This would imply that significant further outperformance is likely for South African credit and local currency bonds.

Developed Markets

United States: Former Fed Governor Adriana Kugler’s abrupt resignation in the summer came after Chair Powell declined to grant her a waiver to resolve financial holdings that breached the central bank’s ethics rules, a Fed official said. Newly released documents showed Kugler’s 2024 disclosures were not certified by Fed ethics staff or the Office of Government Ethics and were referred to the Inspector General. The filings revealed previously undisclosed trades in individual stocks — including Materialise, Southwest Airlines, Cava, Apple and Caterpillar — which Fed officials and their families are banned from trading. Some trades also occurred during blackout periods around policy meetings, compounding the violations

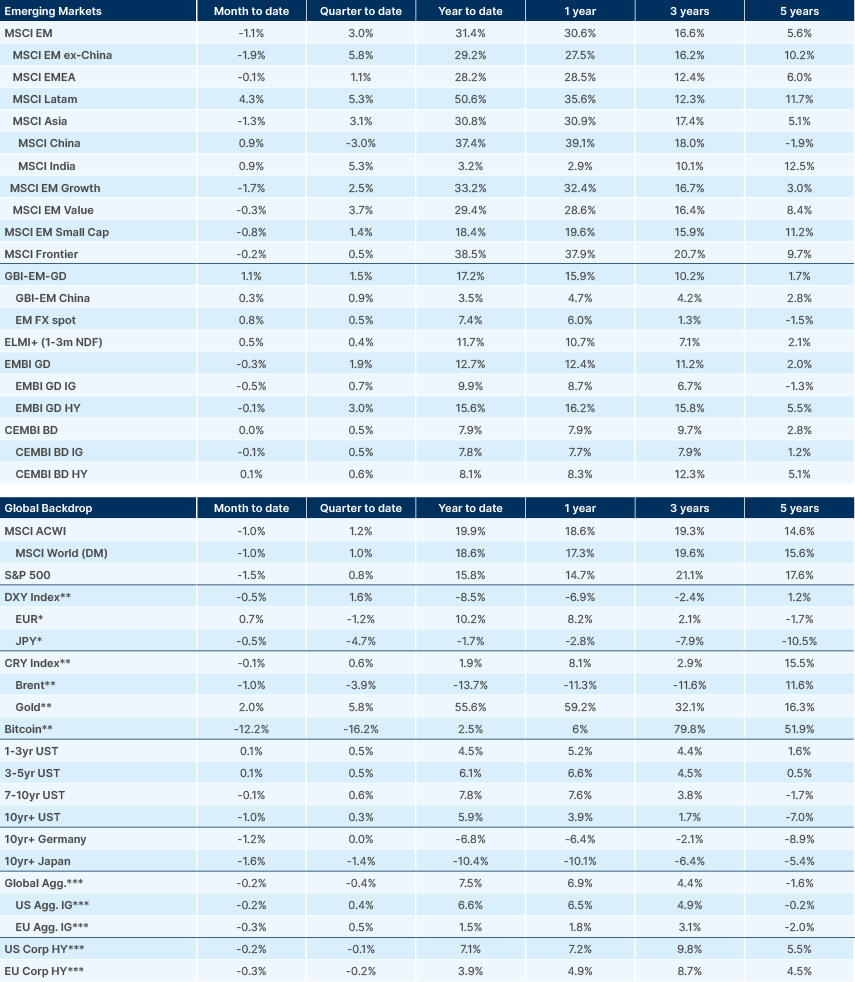

Benchmark Performance

Source and notations for all tables in this document:

Source: Bloomberg, JP Morgan, Barclays, Merrill Lynch, Chicago Board Options Exchange, Thomson Reuters, MSCI. Latest data available on publication date.

* Price only. Does not include carry. ** Global Indices from Bloomberg. Price to Earnings: 12m blended-forward

Index Definitions:

VIX Index = Chicago Board Options Exchange SPX Volatility Index. DXY Index = The Dollar Index. CRY Index = Thomson Reuters/CoreCommodity CRM Commodity Index.

Figures for more than one year are annualised other than in the case of currencies, commodities and the VIX, DXY and CRY which are shown as percentage change.