- ‘Risk-off’ and higher rates after US Fed meeting caused a cross asset sell-off last week, including in EM.

- Ukraine assassinate Russian commander inside Moscow.

- Erdogan urges foreign countries to withdraw support for Kurdish fighters in Syria.

- European tariffs on Chinese electric vehicles taking effect.

- China holds rates, a waiting game for clarity on US trade policy before easing can continue?

- Sri Lanka upgraded “from Restricted Default” by Moody’s and Fitch.

- Brazil’s Senate passed a weakened version of a spending cut package.

- Ruling party in Romania withdrew from coalition talks.

- IMF complete fourth review of Zambia and disburse loan.

- Ambitious infrastructure plans in Morocco pre–World Cup 2030.

- While the US Fed turn more hawkish, European Central Bank tilts dovish.

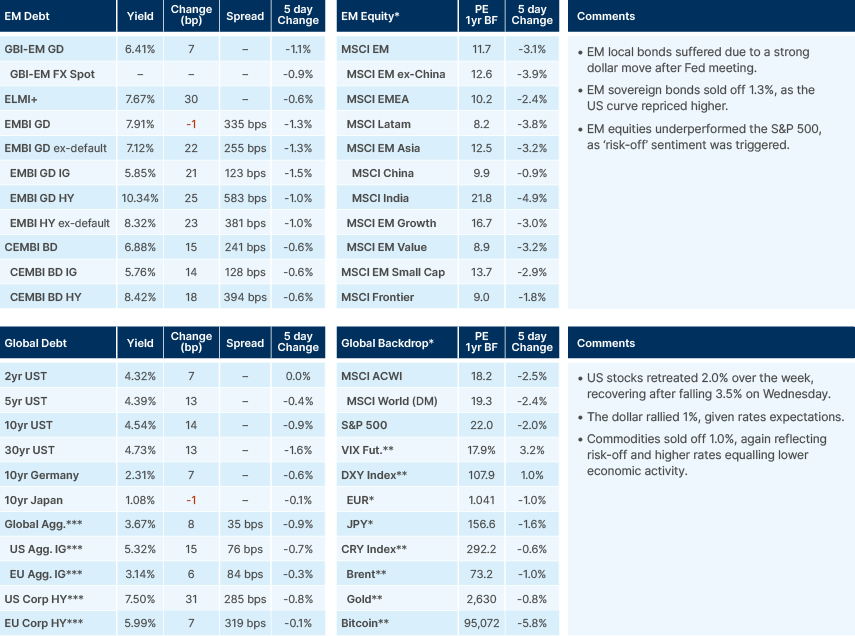

Last week performance and comments

Global Macro

The US Federal Reserve cut interest rates by 25 basis points (bps) but accompanied the move with hawkish forward guidance. It signalled fewer rate cuts in 2025 than previously anticipated and projected a higher terminal rate. As a result, markets are now pricing in just 1.5 rate cuts for 2025, with the Fed expected to hold rates steady at its January meeting. Fed Chair Jerome Powell emphasised that the current policy stance remains "meaningfully restrictive."

In the 61 trading days since the Fed implemented a 50bps rate cut, the 10-year US Treasury yield has risen by 90bps, the DXY has strengthened 8%, the S&P 500 has gained 4%, the NYSE Composite is down 1%, SPW (S&P 500 Equal Weight) has declined 1%, and investment grade bonds have dropped 4%. These moves do not indicate a material ‘loosening of financial conditions.’ Rather, the combination of a hawkish pivot from the Fed, despite core consumer price index (CPI) inflation remaining at 3.5%, and a strong consensus for further stock market gains has led to increased market nervousness and volatility.

Emerging Market (EM) assets and currencies have also felt the impact of these developments keenly. Since the end of summer, rising US yields and a stronger dollar has exerted pressure on EM currencies, making it more expensive for these economies to borrow, service their dollar-denominated debt, and reducing their international purchasing power. The strength of the US dollar, currently being driven by high rates, has given less space for EM central banks to cut rates and boost their economies, for fears of currency depreciation. These tighter conditions have contributed to EM equity markets lagging, as well as the dominant performance of US mega-cap stocks.

While ‘economic exceptionalism’ has become an axiom this quarter, a significant divergence is emerging within US equity markets. The S&P 500 has risen 23% year-to-date, compared to just 8% growth for the index excluding its 12 largest constituents. The equal weighted index has declined consistently since the start of December, down 6.4% month-to-date, versus -1.68% for the market-weighted index. This disparity shows the broader market is experiencing a significant correction, masked by the outsized performance of a few winners now trading at record valuations. The S&P 500's market capitalisation is now USD 50trn, while the S&P 500 excluding the "Magnificent 7" stocks has a market capitalisation of just USD 32trn.

Geopolitics

Representatives from Iran, the UK, France, and Germany are set to meet next month for high-level discussions on pressing regional and international issues, including the nuclear issue. The timing of this meeting is particularly significant as it comes just ahead of Donald Trump’s inauguration as US President, raising questions about the potential impact of his administration’s policies on ongoing diplomatic efforts.

The President of Türkiye, Recep Tayyip Erdoğan, has stated the time has come to neutralise terror groups operating in Syria. In a strongly-worded address, Erdogan highlighted the growing threat posed by these groups to both regional stability and Türkiye’s national security. He called for swift and decisive action, emphasising Türkiye would take necessary measures to eliminate these threats, even if it requires unilateral action. Erdogan also called on international allies to support efforts to stabilise Syria and prevent further expansion of militant networks.

General Igor Kirillov, the head of Russia’s nuclear defence forces, was killed in a bomb attack in Moscow. The explosive device, which was remotely detonated, marked a significant escalation in targeted attacks. Ukrainian special forces claimed responsibility for the assassination, as a consequence for Kirillov’s war crimes related to the usage of illegal chemical weapons.

Emerging Markets

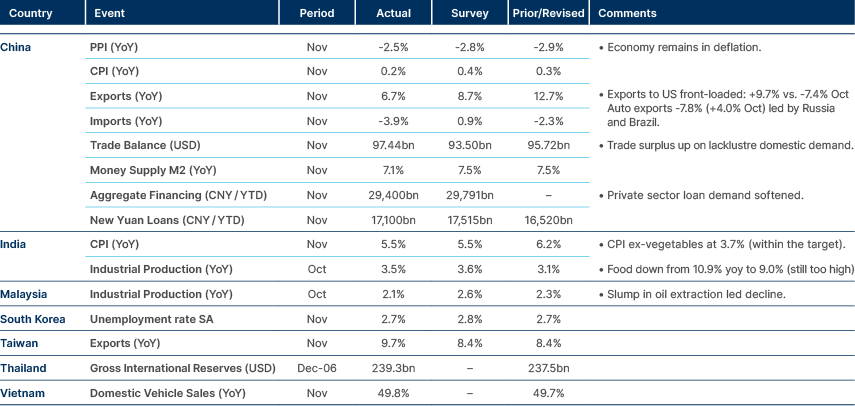

Asia

China

Chinese automakers have captured their smallest share of the European electric vehicle (EV) market in eight months, following the introduction of new tariffs. These tariffs have increased the cost of importing cars to the region by as much as 35%. As a result, their market share has dropped significantly, falling from around 12% earlier this year to just 7%. This decline highlights the impact of trade barriers on Chinese automakers' competitiveness in Europe’s growing EV market.

Sri Lanka

Sri Lanka received credit rating upgrades from Moody’s and Fitch, reflecting improved financial stability following the completion of a major bond restructuring. Moody’s upgraded the country’s rating to Caa1, while Fitch raised its rating from Restricted Default to CCC+. These upgrades come after 98% of creditors participated in the restructuring, helping to normalise relations with most lenders.

Fitch also upgraded Sri Lanka’s local currency rating from CCC- to CCC+, citing better macroeconomic prospects. The upgrades mark a turning point for the country, signalling increased confidence in its ability to manage debt and foster economic recovery.

Latin America

Brazil

Congress approved a watered-down version of Brazil’s spending cut proposals this week. President Lula said the government would ‘remain vigilant’ about ‘further measures’ to cut spending, but this was not enough to stop further volatility in Brazilian assets. Finance Minister Fernando Haddad told reporters before the final vote that the lower house had only slightly reduced the impact of the 70 billion-real ($11.5 billion) saving plan, with a cut of just 1 billion reais (approximately $171 million). This was far less than the government had initially feared, which was a more substantial dilution of the bill.

However, forecasts by XP Investments, predict a much larger reduction of 8 billion reais (approximately $1.37 billion) due to changes in the plan. XP already forecasted the bill’s savings to be BRL 52bn, so the revision would lower the estimated savings from the government’s original projection, reducing it to 44.3 billion reais (about $7.5 billion) over the next two years. Furthermore, XP predicts an even more significant decrease in long-term savings, revising the government’s projected 294.2 billion reais (roughly $50 billion) in savings to j232.2 billion reais (around $39.5 billion).

Lula also said the next leader of the Central Bank, Gabriel Galipolo, will be ‘the governor with the most autonomy it has ever had.’

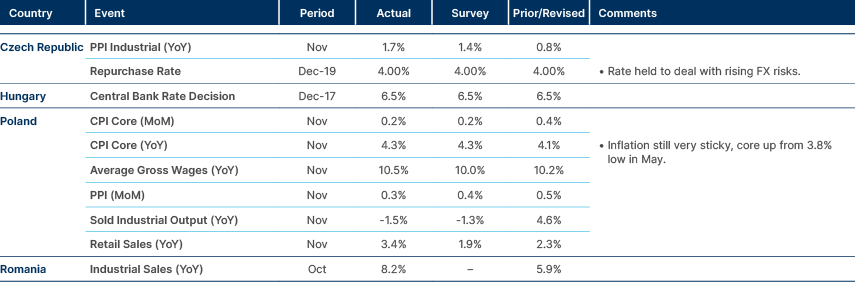

Central and Eastern Europe

Romania

The ruling leftist Social Democrat Party (PSD) has withdrawn from government coalition talks following clashes with three other parties over reform plans and cost-cutting measures. Romania currently has the European Union’s widest budget deficit, necessitating tough fiscal consolidation efforts.

As a result of the PSD's withdrawal, the remaining parties: PNL, USR, and UDMR, may form a minority government, which the PSD has signalled it might support indirectly. Despite winning the largest share of votes in recent parliamentary elections, the PSD appears reluctant to be directly associated with the unpopular spending cuts required to address the budget deficit, particularly with the presidential election looming between March and May.

Complicating matters further, the centrist USR party withdrew from coalition talks yesterday, citing concerns that fiscal consolidation discussions were not being taken seriously. The situation underscores the political challenges Romania faces as it seeks to balance economic reforms with electoral pressures.

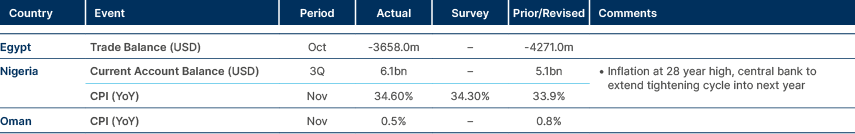

Central Asia, Middle East, and Africa

Zambia

The Executive Board of the International Monetary Fund (IMF) completed its fourth review of Zambia’s economic programme, resulting in the disbursement of USD 184m. The IMF described Zambia’s performance under the programme as “satisfactory,” noting progress in managing public debt. While Zambia’s public debt is now considered “sustainable,” the country remains at a “high risk” of overall external debt distress. However, the risk level is expected to improve to moderate over the medium term, reflecting optimism about Zambia's fiscal and economic trajectory.

Morocco

Moroccan Prime Minister Aziz Akhannouch announced ambitious infrastructure and technology plans as part of the country's preparations for co-hosting the 2030 FIFA World Cup. He stated that airport capacity will be doubled by 2030 to accommodate the anticipated influx of visitors. Additionally, a nationwide rollout of 5G networks is set to begin in early 2026, enhancing the country’s digital infrastructure. The USD 1.2bn Nador West Med Port is also slated to open within the first few months of next year, further boosting Morocco's logistical and trade capabilities.

Developed Markets

European Union

European Central Bank (ECB) President Christine Lagarde reinforced the dovish tone from the previous week’s press conference, stating the central bank aims to implement an “appropriate” policy stance. She added, “If the incoming data continue to align with our baseline, the path forward is clear, and we anticipate further reductions in interest rates.”

Meanwhile, Isabel Schnabel, one of the ECB’s more hawkish members, said that “gradually lowering policy rates towards a neutral level is the most prudent course of action,” subtly signalling caution against the possibility of taking rates below neutral. This suggests some divergence within the ECB on the extent of future rate cuts.

Benchmark performance

Source and notations for all tables in this document:

Source: Bloomberg, JP Morgan, Barclays, Merrill Lynch, Chicago Board Options Exchange, Thomson Reuters, MSCI. Latest data available on publication date.

* Price only. Does not include carry. ** Global Indices from Bloomberg. Price to Earnings: 12m blended-forward

Index Definitions:

VIX Index = Chicago Board Options Exchange SPX Volatility Index. DXY Index = The Dollar Index. CRY Index = Thomson Reuters/CoreCommodity CRM Commodity Index.

Figures for more than one year are annualised other than in the case of currencies, commodities and the VIX, DXY and CRY which are shown as percentage change.