- Stocks struggled and the US yield curve steepened as markets took back post-US election gains on higher inflation expectations.

- Trump’s choices for foreign policy positions were hawkish and have raised geopolitical risk at the margin. Attention now turns to his economic appointees.

- Fitch upgraded Argentina to CCC with a positive outlook

- S&P upgraded Türkiye to BB- with a positive outlook.

- Croatia and Barbados were also upgraded.

- Moody moved Mexico’s outlook to negative, primarily due to its judiciary reforms.

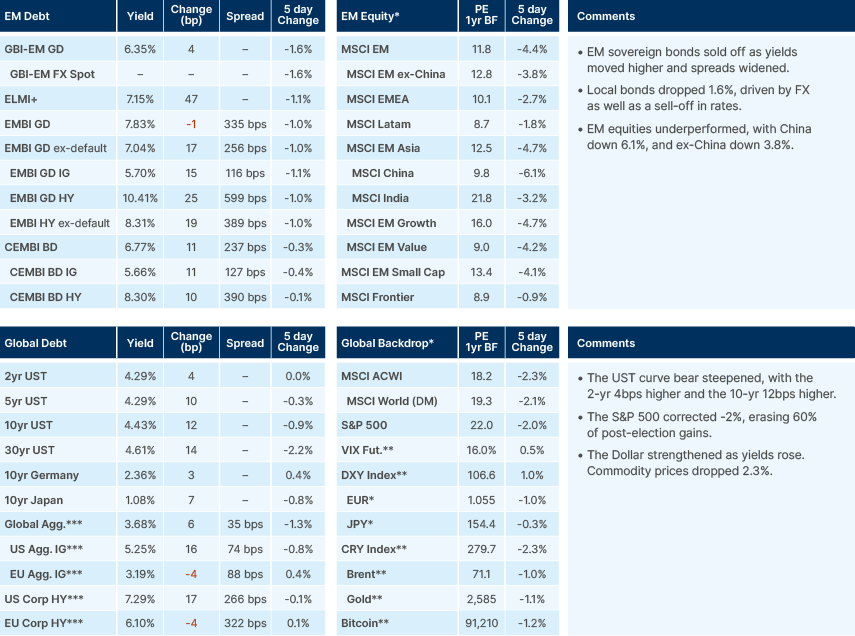

Last week performance and comments

Global Macro

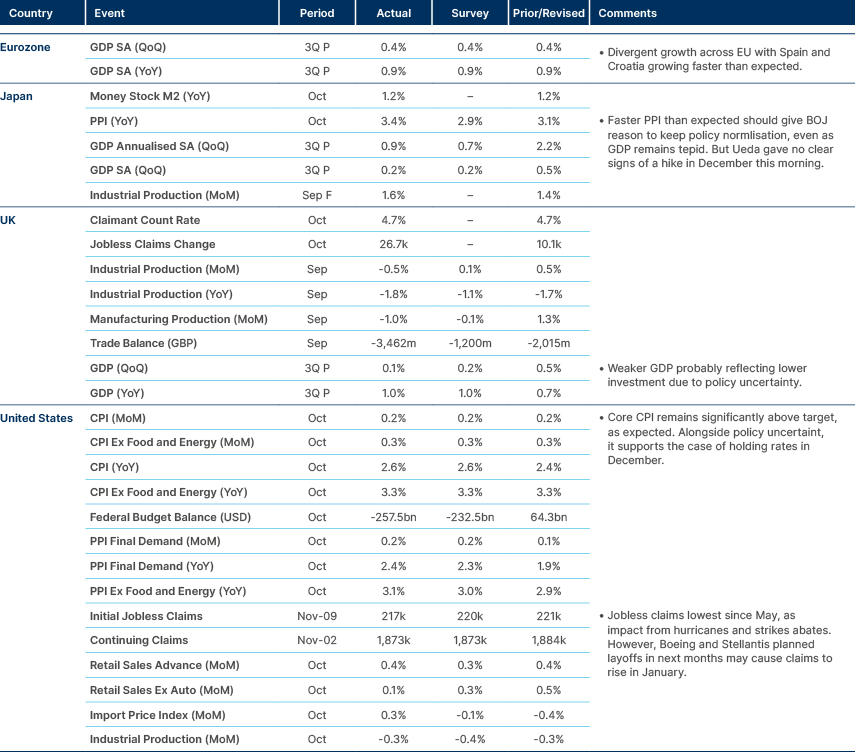

Following the US election result, there were record inflows into stocks, driven by bets on a ‘US risk-on’ rally leading up to Inauguration Day. But last week, expectations of higher for longer interest rates due to persistent core inflation and policy uncertainty led to a significant correction. The S&P 500 fell 2.1%, erasing 60% of the gains made in the post-election rally. Semiconductor stocks (SOX) dropped 8.6%, and small-cap stocks declined 4.0%, driven by the disappointment that Trump did not nominate Scott Bessent as US Treasury Secretary and amid rising interest rates. Bitcoin rose significantly (17.1%), while gold fell 4.5%, and oil declined 3.8%.

Higher inflation expectations are now tightening financial conditions. Federal Reserve (Fed) Chair Jerome Powell said there is "no hurry" to lower interest rates in a commentary last week, noting that the economy is "not sending any signals that we need to be in a hurry to lower rates." This caused the odds of a December rate cut to drop to 48%, down from 82% the day before his speech. The 10-year US Treasury yield reached a four-month high at 4.5%, and US initial jobless claims fell to 217k, the lowest level since May.

Geopolitics

Chinese President Xi Jinping, in response to continued and growing pressure from the US, outlined “four red lines” during a meeting with President Biden last week. These include China’s firm stance on Taiwan, the protection of its right to development, and human rights. Xi also said China will reject policies that use national security as a pretext for anti-China actions. ‘National security’ is the pretext for certain tariffs implemented at the executive level in the US.

President Biden has authorised Ukraine to use US-made long-range missiles to strike Russian targets. Additionally, Bloomberg reported that up to 100k North Korean troops may be deployed to Ukraine, which would be a major escalation in international involvement in the war, and probably bolster Putin’s hand at the negotiation table should a deal be struck in the coming months.

Trump’s cabinet appointments

The search for a Treasury Secretary in Trump’s cabinet has reportedly been expanded, according to the Financial Times. Elon Musk has been involved, having spoken to Scott Bessent following his public endorsement of Howard Lutnick. While Bessent and Lutnick are still considered the leading candidates, other names under consideration include Kevin Warsh, Marc Rowan (CEO of Apollo), Bill Hagerty, and Robert Lighthizer.

In foreign policy, Trump’s appointments appear to adopt a more hawkish stance than his own, with a strong emphasis on being overtly pro-Israel and anti-China. This approach is driven by ideological convictions rather than a purely trade-focused perspective. Such choices challenge the notion that Trump’s policies will become more balanced once he assumes office, although economic policy constraints remain intact.

Cabinet appointments so far

| Position | Nominee | Comments |

|---|---|---|

| Secretary of State | Senator Marco Rubio |

|

| Secretary of Defence | Pete Hegseth |

|

| Attorney General | Former Rep. Matt Gaetz |

|

| Secretary of the Interior | Governor Doug Burgum |

|

| Secretary of Health and Human Services | Robert F. Kennedy Jr. |

|

| Secretary of Veterans Affairs | Former Rep. Doug Collins |

|

| Secretary of Homeland Security | Governor Kristi Noem |

|

Other key appointments

| Position | Nominee | Comments |

|---|---|---|

| ‘Border czar’ | Tom Homan Former Immigration and Customs Enforcement (ICE) Director |

|

| Director of National Intelligence | Former Rep. Tulsi Gabbard |

|

| Federal Communications Commission (FCC) | Brendan Carr |

|

| Director of the Central Intelligence Agency (CIA) | John Ratcliffe |

|

| Administrator of the Environmental Protection Agency (EPA) | Former Rep. Lee Zeldin |

|

| US Ambassador to the United Nations (UN) | Representative Elise Stefanik |

|

| National Security Advisor | Representative Mike Waltz |

|

Emerging Markets

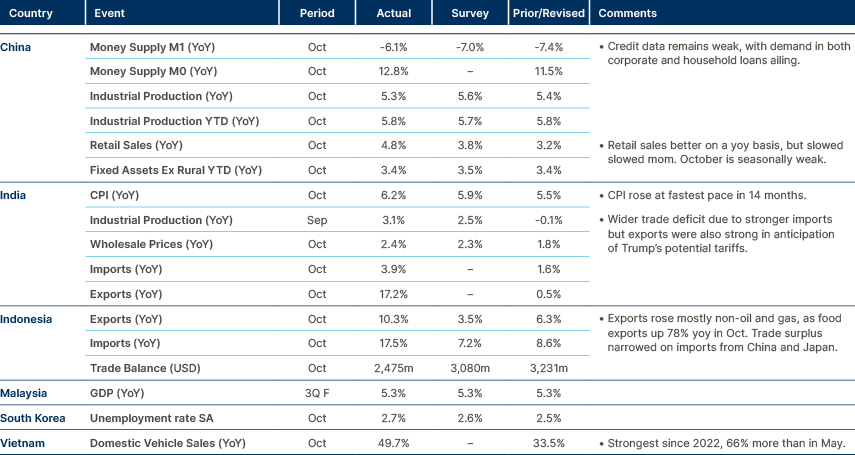

Asia

Better retail sales in China, India CPI faster. Strong trade numbers a Trump effect

China

The government has extended both the May Day and Spring Festival public holidays in 2025 by an extra day, a measure likely to boost domestic consumption indirectly. The stimulus already in place is driving results. Retail sales grew at their fastest pace in eight months during October, exceeding all forecasts. Subsidies for purchases of home appliances and cars have been effective so far, with home appliance sales 39% higher than the same period last year, marking the fastest growth since 2010. Sentiment among manufacturers and service providers has climbed to its highest level in two years, reflecting broader optimism in the economy. Lastly, property sales improved to -2% yoy from -11% in September, as secondary property prices increased sequentially in Tier 1 cities. The recovery remains mild, however, and will probably require additional fiscal measures to build momentum.

Chinese companies reported earnings with very healthy growth across most large names. Tencent reported 36% earnings growth (15x P/E) and JD.com reported 30% growth (8x P/E). Things improving sequentially in September and October. Stock market performance suggests the market does not want to believe in the consumption recovery story.

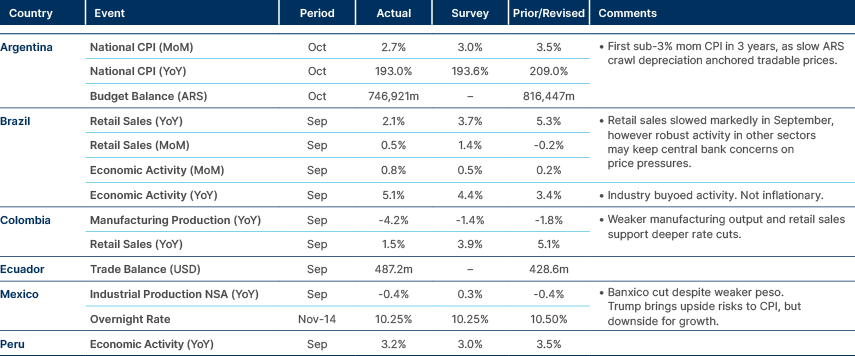

Latin America

Inflation milestones in Argentina, Mexico cut 25bps.

Argentina

Fitch upgraded Argentina’s sovereign credit rating from CC to CCC and maintained it under positive watch. This reflects growing confidence in the government’s ability to meet upcoming foreign-currency bond payments without needing restructuring or relief. The recent tax amnesty programme brought over USD 20bn into the economy, boosting reserves by USD 3.6bn since July. However, Argentina faces significant debt obligations in 2025, with USD 4.3bn due in January and July, alongside USD 2.3bn in foreign exchange (FX) bond payments by the central bank and USD 2.7bn by provincial governments. While the authorities are exploring several external financing options, none has been finalised yet.

In other news, President Javier Milei has withdrawn Argentina from COP29 in Baku, signalling an end to its participation in UN climate negotiations. This decision has intensified concerns about the influence of right-wing leaders on global climate efforts, particularly with Donald Trump poised to re-enter the international stage, possibly withdrawing the US from the Paris Agreement again. Milei has previously dismissed the climate crisis as “a socialist lie.”

Barbados

S&P upgraded the sovereign credit rating to B, positioning it one notch below Fitch’s rating and one notch above Moody’s.

Brazil

President Lula is increasingly looking to Beijing to invest in domestic infrastructure projects. Despite past warnings from the Biden administration against aligning with China’s Belt and Road Initiative, Lula is reportedly seeking Chinese participation in four key areas: domestic infrastructure, regional integration, clean energy, and industrial modernization. Between 2007 and 2022, China invested USD 96bn in the Mercosur trade bloc, comprising Brazil, Argentina, Uruguay, Paraguay, and Bolivia, and aims to raise that figure to USD 250bn by 2025. China has been Brazil’s top trade partner for years, with imports of Chinese products surpassing those from the US during the 2010s. While Brazil maintains a small trade surplus with the US, it is unlikely to face major tariff pressures.

Mexico

Moody’s revised Mexico’s Baa2 sovereign credit outlook from stable to negative, citing risks from recent constitutional changes that could undermine checks and balances within the judiciary. According to the agency, this shift poses potential harm to the country’s economic and fiscal stability. A downgrade would still leave the country in investment grade territory. Mexico is rated BBB by S&P and BBB- by Fitch.

The finance minister posted the 2025 budget with an expected deficit reduction from 5.9% to 3.9% of GDP. Public debt is projected at 51.4% of GDP. Growth is expected at 2-3% and inflation at 3.5%. The budget has a conservative oil price of USD 58 per barrel and foresees a USD 5.7bn support for state oil company Pemex. There are no signs of a tax reform, however, it can be proposed later by the Morena and allies’ parliamentary group.

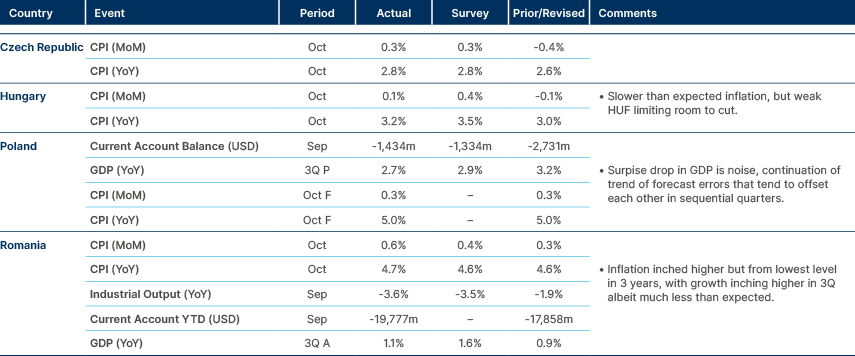

Central and Eastern Europe

Croatia

Moody’s upgraded the sovereign to A3, matching S&P and Fitch ratings.

Central Asia, Middle East, and Africa

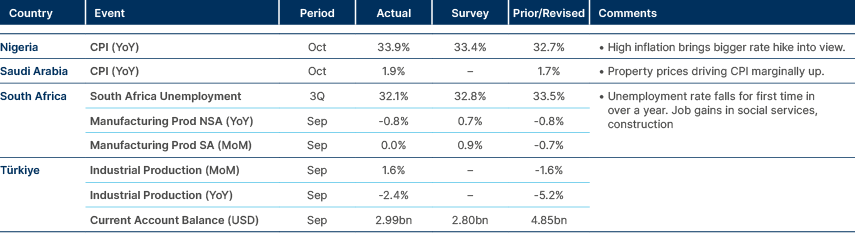

Inflation hot in Nigeria, unemployment falls in South Africa.

Egypt

Fitch upgraded Egypt’s sovereign credit rating to B, placing it one notch above S&P and two notches above Moody’s. The upgrade reflects reduced external risk and adjustments to monetary policy. Public finance risks have been moderately alleviated through measures aimed at curbing off-budget public investment and broadening the tax base. These changes are expected to lead to a notable reduction in the domestic debt interest burden.

Since March, Egypt has unlocked significant international financing, including an augmented USD 8bn Extended Fund Facility (EFF) from the International Monetary Fund (IMF) and EUR 7.4bn in three-year European Union support. Foreign direct investment (FDI) is projected to average USD 16.5bn annually for the fiscal years ending June 2025 (FY25) and FY26, supported by new investments from Saudi Arabia and developments in Ras El-Hekma.

Nigeria

Nigeria is planning to issue a USD 1.7bn Eurobond and a USD 500m sukuk as part of its financing efforts.

Tükiye

S&P upgraded Türkiye’s sovereign credit rating to BB- while maintaining a positive watch. This aligns S&P’s rating with Fitch and places it one notch above Moody’s B1 rating.

South Africa

The S&P on Friday evening, in a surprise move, upgraded its ratings outlook for SA from stable to positive. The possibility of ratings upgrades could see SA eventually added back to the WGBI which could see offshore holdings increase significantly.

Developed Markets

Core consumer price index (CPI) inflation remains above target in the US, jobless claims lowest since May.

Benchmark performance

Source and notations for all tables in this document:

Source: Bloomberg, JP Morgan, Barclays, Merrill Lynch, Chicago Board Options Exchange, Thomson Reuters, MSCI. Latest data available on publication date.

* Price only. Does not include carry. ** Global Indices from Bloomberg. Price to Earnings: 12m blended-forward

Index Definitions:

VIX Index = Chicago Board Options Exchange SPX Volatility Index. DXY Index = The Dollar Index. CRY Index = Thomson Reuters/CoreCommodity CRM Commodity Index.

Figures for more than one year are annualised other than in the case of currencies, commodities and the VIX, DXY and CRY which are shown as percentage change.

1. See https://www.bbc.co.uk/news/articles/c977njnvq2do and https://static.project2025.org/2025_MandateForLeadership_FULL.pdf