A clear result in the Kazakh election contrasts with the hung parliament in Malaysia. The Indonesian Central Bank hiked its policy rate by 50bps to 5.25% - another move fostering macroeconomic stability. China economic data was soft and zero-covid took a step back. Soft trade numbers from South Korea and Taiwan suggests the global economy is likely to remain weak during the last months of the year. Ilan Goldfajn was appointed as President of the IDB and former Brazilian Finance Minister Guido Mantega resigned from President-elect Lula’s transition team.

Emerging markets

Kazakhstan: Incumbent President Kassym-Jomart Tokayev was re-elected with 6.46m votes, or 81.3% of the total. Turnout reached 69.4% nationwide, but only 48.6% in Astana and 28.7% in Almaty – the two largest cities in the country. A total of 641 international observers from 10 international organizations and 35 foreign countries were accredited to observe the election. Tokayev will be in power until 2029 after he amended the constitution in June, extending the presidential term from five to seven years, but limiting the President to a single period in office. Tokayev was first appointed president in 2019 – appointed by former President Nazarbayev – and survived widespread protests in 2021, partially thanks to the support of Russian troops sent to Kazakhstan. With the election, Tokayev will be keen to break with his former political patron and will have to tread carefully in the relationship with Russia as a pipeline linked to the Russian port of Novorossiysk transports c. 80% of Kazakh oil exports. Tokayev has already been playing a difficult balancing act – he has criticised the Russian invasion and has not recognised the referendum transferring regions of Ukraine to Russia, but stopped short of following the European Union and has not levied sanctions against Russia.

Malaysia: Parliamentary elections resulted in a hung parliament with the Perikatan Nasional (PN), led by former prime minister Muhyddin Yassin, gaining 41 seats to 73, while the Pakatan Harapan (PH) led by opposition Anwar Ibrahim lost 17 seats to 83 and the Barisan National (BN), led by current Prime Minister Ismail Sabri Yaakob, lost 13 seats to 30 in the 220-seat parliament. The election may lead to a longer than usual negotiation for government formation. The PN said it brought to the King sworn declarations of more than 112 lawmakers to support Muhyiddin Yassin as prime minister, albeit it was not clear which groups were supporting the bid. In economic news, the trade surplus narrowed to MYR 18.1bn in October from MYR 31.7bn in September, significantly lower than expected as exports of palm oil slowed to negative levels and electronic products slowed (while petroleum and natural gas exports remained elevated).

Indonesia: Bank Indonesia hiked its policy rate by 50bps to 5.25%, in line with consensus, as the authority reiterated its objective to ensure core inflation remains within the 2.0% to 4.0% target band in 2023 (current 3.3%). The current account surplus improved by USD 0.4bn to USD 4.4bn in Q3 2022 as the trade surplus rose to USD 5.7bn in October from USD 5.0bn in September, as exports were unchanged at USD 24.8bn (+12.3% yoy) and imports declined by USD 0.7bn to USD 19.1bn (+17.4% yoy) over the same period.

China: Economic activity was softer than expected in October with the yoy rate of industrial production declining 130bps to 5.0%, retail sales were down 300bps to -0.5% and fixed asset investment slowed by 10bps to 5.8% yoy. Residential property sales declined 28.2% from January to October 2022 versus the same period of 2021. The People’s Bank of China kept its 1-year and 5-year loan prime rates unchanged at 3.65% and 4.30% respectively. Covid-19 cases rose to around 24k-26k per day over the weekend, the highest level since April. The capital of Hebei Province (Shijiazhuang) went into full lockdown after cases increased. China is balancing a broader policy shift with near term containment pressures due to rapidly rising caseloads. Whilst the direction of travel is reopening, there will be back and forth this winter.

South Korea: Trade data disappointed with exports declining 16.7% on a yoy basis in the first 20 days of November, or -11.3% yoy after adjusting for business days. Imports declined 5.5% yoy in the first 20 days of November as the trade deficit narrowed to USD 4.4bn from USD 5.0bn over the period.

Taiwan: Export orders declined by a yoy rate of 6.3% in October from -3.1% yoy in September, below consensus expectations.

Brazil: Economic activity rose 0.1% mom in September after dropping 1.1% in August, bringing the yoy rate down 100bps to 4.0%. The former President of the Brazilian Central Bank Ilan Goldfajn was elected President of the Inter-American Development Bank president. His election is a victory for moderate Vice President Geraldo Alckmin over Worker`s Party radicals who wanted the IDB election postponed, stopping an appointee from outgoing President Jair Bolsonaro taking the post. Former Finance Minister Guido Mantega, who sent a letter to the US Treasury Secretary as well as Colombia and Chile requesting a postponement of the IDB election, resigned from Lula’s transition team.

Snippets

- Argentina: CPI inflation rose to 6.3% mom in October from 6.2% in September, bringing the yoy rate up 500bps to 88.0%.

- Chile: The economy contracted by 1.2% qoq in Q3 2022 after growing 0.1% qoq in Q2 2022, leading to a strong 530bps slowdown in the yoy rate of GDP growth to only 0.3% over the same period, led by a slump in domestic demand (personal services) driven by tighter monetary and fiscal policies as well as lower mining output and lower imports. Despite the weaker economy, the current account deficit widened to a record USD 9.4bn in Q3 2022 (USD 2.1bn worse than consensus) from 7.9bn in Q2 2022.

- Colombia: GDP growth rose to 1.6% qoq in Q3 2022 from 1.3% qoq in Q2 2022 as the yoy rate slowed to 7.0%, which was 40bps better than consensus. Domestic demand remains the main driver of economic growth, as private consumption slowed sequentially (but remained the main contributor) and investment increased sequentially. The trade deficit narrowed to USD 1.4bn in September from USD 2.2bn in August as imports declined by USD 0.6bn to USD 6.7bn over the same period.

- Czechia: PPI inflation slowed to 0.6% mom in October from 1.2% in September allowing for a 170bps decline in the yoy rate to 24.1%

- Hungary: GDP growth declined 0.4% qoq in Q3 2022 after rising 0.8% in Q2 2022, bringing the yoy rate of growth down 250bps to 4.0% over the same period. The state news service MTI reported Prime Minister Viktor Orban will still reject a proposal for joint EU financing for Ukraine, asking member states to transfer funds on a bilateral basis.

- India: The trade deficit widened to USD 26.9bn in October from USD 25.7bn in September as imports declined by USD 4.5bn to USD 56.7bn (+5.7% yoy) and exports dropped by USD 5.7bn to USD 29.8bn (-16.6% yoy) over the same period.

- Nigeria: The yoy rate of CPI inflation increased 30bps to 21.1% in October, broadly in line with consensus.

- Peru: The unemployment rate declined by 50bps to 7.2% in Lima in October as the yoy rate of economic activity was unchanged at 7.7%.

- Philippines: The central bank hiked its deposit and lending policy rates by 75bps to 4.5% and 5.0% respectively, in line with signals by Governor Felipe Medalla, as forecasts for the yoy rate of inflation increased by 20bps to 4.3% in 2023 and by 10bps to 3.1% in 2024.

- Poland: GDP growth improved to 0.9% qoq in seasonally-adjusted terms in Q3 2022 from -2.3% qoq in Q2 2022, but the yoy rate declined by 120bps to 4.4% over the same period as the economy continues to suffer from a combination of higher interest rates slowing down the mortgage sector and cost of living increases led by higher energy and food prices. The current account deficit narrowed to EUR 1.6bn in September from EUR 3.3bn in August as the trade deficit narrowed by EUR 0.5bn to EUR 2.1bn over the same period.

- Romania: The economy expanded by 1.3% in qoq terms in Q3 2022 after 1.8% in Q2 2022, taking the yoy rate of growth down 110bps to 4.0%. Higher energy prices and a drought weighted on economic activity over the last quarter, but the economy is likely to remain supported in 2023 thanks to large EU fund transfers boosting consumption and infrastructure investment.

- Saudi Arabia: The yoy rate of CPI inflation declined 10bps to 3.0% in October.

Developed markets

United States: St. Louis Fed Governor James Bullard did a presentation entitled “Getting into the Zone” in which he shows a chart with the most well-known monetary policy rule devised by John Taylor (Taylor rule”), suggesting the Fed Fund rate would have to increase to 5-7% to get into restrictive levels.1 It is remarkable how Bullard is not afraid of showing the well-known chart empirically highlighting the US Federal Reserve has been behind the curve since at least Q2 2021 while calling inflation “transitory.” Around this time, John Taylor himself was saying the Fed was making a policy mistake, as serious EM Central Bankers like Roberto Campos Neto in Brazil and Elvira Nabiullina in Russia were already increasing rates, pointing to demand-led inflation after the over-stimulation of the economies in the previous 12-months.

The more hawkish tone was accompanied by Governor Christopher Waller’s opinion that “policy is barely in restrictive territory." Both were in contrast with the more “dovish” tone by Fed Vice Chair Lael Brainard and Boston Fed Raphael Bostic, who pledged to slow down and end the hiking cycle soon, to understand the impact of the current moves. This week, FOMC voting members Loretta Mester, Esther George and John Williams will speak. Mester will speak about wages and inflation one day before the release of the minutes or the latest FOMC, a topic meriting a hawkish tone considering wage inflation remains elevated. Fed Chairman Jerome Powell will speak about “The economic outlook and the labour market” at the Brookings Institute on 30 November.2

In economic news, PPI inflation ex-food and energy dropped to 0.0% mom in October from 0.2% in September, bringing the yoy rate down 40bps to 6.7%, or 50bps below consensus. Retail sales increased 1.3% mom in October (1.0% consensus) and industrial production declined -0.1% (+0.1% consensus) over the same period. The NAHB housing market index dropped another 5 points in November to 33 as existing home sales declined to 4.43m in October from 4.71m in September, rapidly approaching levels like 2008-2011 and the Covid-19 shock in 2020, while housing starts slowed to 1,425k in October from 1,488k in September. Jobless claims remained low at 222k in the week ending on 12 November and the Philadelphia Fed Business outlook dropped to -19.4 in November from -8.7 in October.

Europe: The ZEW survey of finance professionals showed expectations for economic activity rebounded to -38.7 in November from -59.7 in October, a level that is still at the most depressed levels since the beginning of the survey and consistent with an economic recession. The trade deficit narrowed by EUR 10bn to EUR 37.7bn in September, slightly better than consensus and GDP growth was unchanged at 0.2% qoq and 2.1% yoy in Q3 2022, in line with consensus. The German PPI inflation declined 4.2% mom in October after rising 2.3% in September, bringing the yoy rate down 11.3% to 34.5%, more than 1,000bps below consensus. European Central Bank President Christine Lagarde said the risk of a recession had increased, but the recession would not necessarily bring down inflation, a tone that would justify more hikes by the ECB. The tone of speeches by influential board members such as Villeroy de Galhau, Klass Knot and Joachim Nagel suggested a 50bps hike would be more appropriate for the upcoming meeting.

United Kingdom: CPI inflation rose 2.0% mom in October from 0.5% in September, taking the yoy rate up 100bps to 11.1% as core CPI was unchanged at 6.5% yoy over the same period. The Chancellor of the Exchequer issued a hawkish budget statement with progressive tax hikes in an attempt to contain the rise in government debt.

Japan: The yoy rate of both CPI and core CPI inflation rose by 70bps to 3.7% and 2.5% respectively, 10bps above consensus, as a weaker JPY hits sentiment. GDP contracted by 0.3% qoq in seasonally adjusted terms in Q3 2022 after growing 1.1% in Q2 2022, taking the non-seasonally adjusted yoy rate up 10bps to 1.8%

1. See https://www.stlouisfed.org/news-releases/2022/11/17/bullard-presents-getting-into-the-zone

2. See https://www.brookings.edu/events/federal-reserve-chair-jerome-powell-the-economic-outlook-and-the-labor-market/

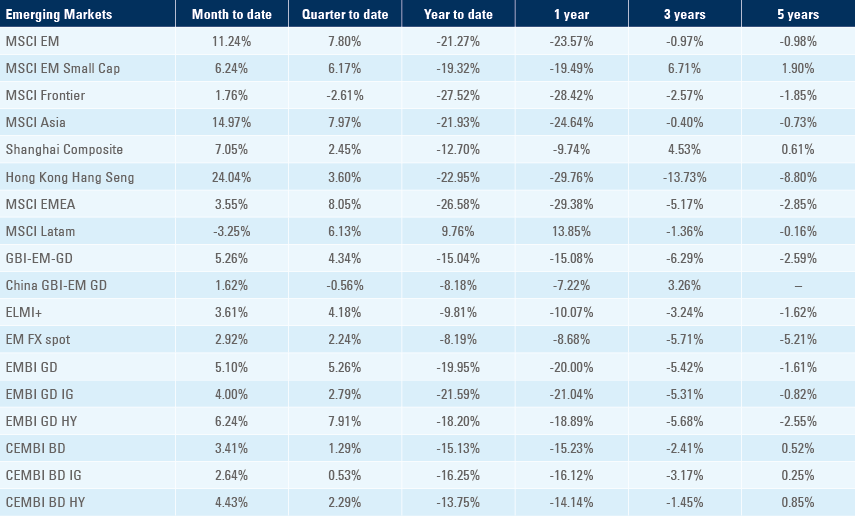

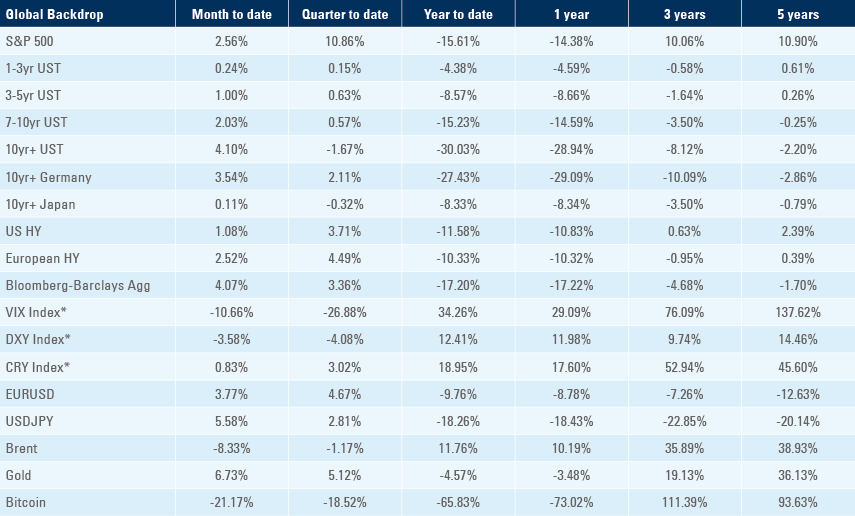

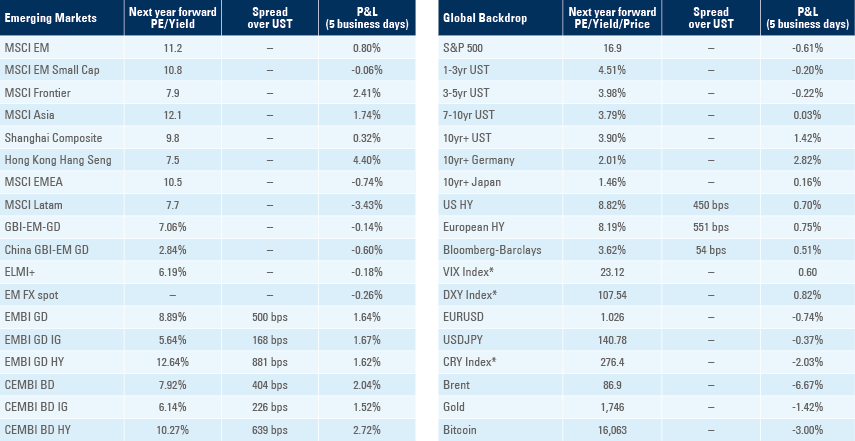

Benchmark performance