Former President Luiz Inácio ‘Lula’ da Silva pulled a trick, winning the presidential election for third time with 50.9% of valid votes, despite losing the elections in four out of five regions. Developed world central banks are handling threats in the format of forward guidance towards less intense hikes, despite elevated inflation. Russia pulled out of the deal allowing safe passage of grains in the Black Sea and intensified missile strikes in Ukraine after drone attacks hit its Black Sea fleet hard. Argentina was downgraded by Fitch to `CCC-` with a negative outlook, despite better political outlook for 2023. Egypt has a new IMF programme, but its external financing needs are likely to remain elevated over the coming years.

DM monetary policy

The Central Bank of Canada hiked policy rates by 50bps to 3.75%, 25bps less than consensus, while the European Central Bank (ECB) hiked its deposit and lending rates by 75bps to 1.50% and 2.25% but signalled a reduction in the pace of hikes ahead. The slower pace of hikes by Australia and Canada, and the signalling of a reduction in the pace by the ECB, led investors to speculate the US Federal Reserve would reduce the pace of hikes as well after the November Federal Open Market Committee (FOMC).

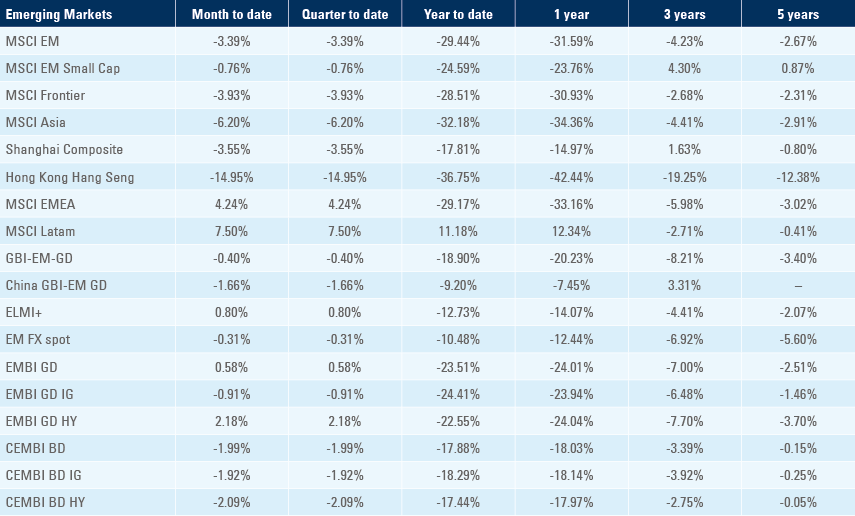

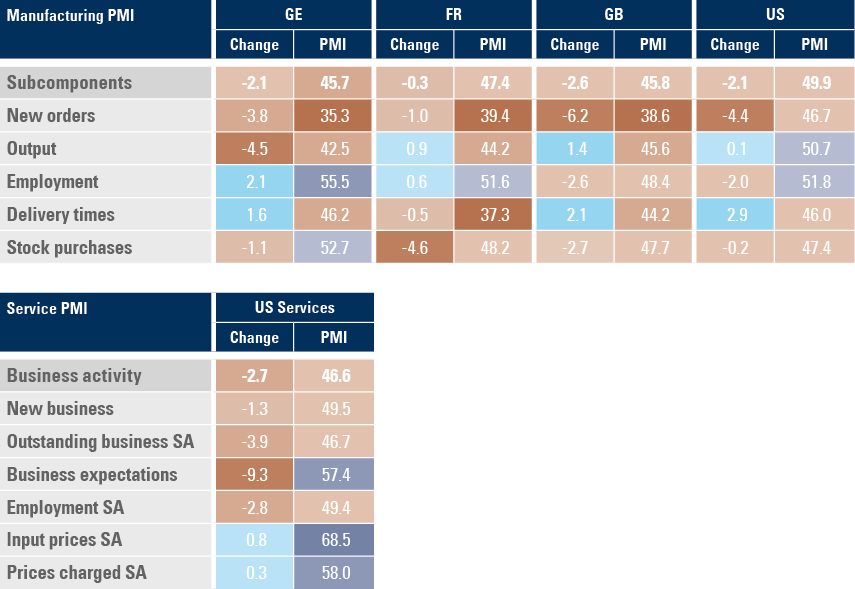

The more cautious approach by the European, Canadian, and Australian policymakers is justified by structural fragilities in these regions. Australian and Canadian household debt to GDP are above 100%, exposing the vulnerability of their housing market to higher interest rates. In the Eurozone, the flash Purchasing Managers Index new orders subcomponent declined below 40 across Germany, France, and the United Kingdom. New orders declined 4.4 points to 46.7 in the United States where the services PMI slowed 2.7 points to 46.6 as per figure 1.

Figure 1: Selected DM Markit Flash PMIs – October 2022

The first week of November has an important macro calendar with monetary policy committee meetings by the Reserve Bank of Australia (Tuesday), the US Federal Reserve meets Wednesday and the Bank of England on Thursday. The RBA is expected to hike its policy rate by 25bps to 2.85%, while consensus expectations are for the Fed and the BOE to hike rates by 75bps to 4.0% and 3.0% respectively. It will be significant if Chairman Jerome Powell signals less aggressive hikes in December and Q1 2023, like the BOC and ECB did last week. The overnight interest rate swaps pricing is split between 50bps and 75bps in December and a terminal rate of 4.9% by the end of Q1 2023. On the economic data front are: S&P Markit PMIs across EM and DM, October inflation data in Europe, as well as the key non-farm payroll data in the US.

Geopolitics

Wheat prices jumped 6% to USD 877 per contract after Russia pulled out of the grain-export deal with Turkey and Ukraine after accusing Kyiv of strikes against its Black Sea fleet in Sevastopol, Crimea. Russia also accused British navy specialists of helping Ukraine to prepare the attack.1 Ukraine, Turkey, and the UN are testing Putin’s willingness to stop grain exports after they agreed to have vessels carrying food from Ukrainian ports sail on Monday. Russia also retaliated with a barrage of missile attacks in Kyiv, Kharkiv, Zaporizhzhia and other cities across Ukraine. Air defence mechanisms were active in Kyiv with several missiles shot down according to liveuamap.com.2

Emerging markets

Argentina: Fitch downgraded Argentina’s credit rating to `CCC-` with a negative outlook justified by "deep macroeconomic imbalances and a highly constrained external liquidity position" expected to "increasingly undermine repayment capacity as foreign-currency debt service ramps up in the coming years". Argentina’s bonded debt repayments are only USD 1.9bn in 2023; USD 3.65bn in 2024 but increase to around USD 6.5bn from 2025 to 2027 and USD 8.5bn from 2028 to 2030. Overall, those are manageable numbers should the country take advantage of its abundant natural resources and implement a front-loaded fiscal consolidation at the beginning of the next administration. The main issue is the IMF repayments amounting to USD 14.5bn in 2023 and USD 4.0bn in 2024 before declining to between USD 0.5bn and USD 2.0bn per year until 2030. The IMF is likely to have to term out its lending to Argentina to avoid a country default. Importantly, all leading candidates for the October 2023 elections, Javier Milei (Libertarian Party, supportive of the Austrian School), Patricia Bullrich (former minister of security under Mauricio Macri) and Horacio Rodriguez Laretta (Buenos Aires Mayor and leader of Juntos por el Cambio) are between centre to far right, defending what appear to be sound macroeconomic policies. Vice President Cristina Fernandez de Kirchner will not be on the ticket, bringing the odds of President Alberto Fernandez to near nil.

Brazil: Lula pledged to re-unite the country after winning the presidential elections with less than 2% difference to the incumbent Bolsonaro – the tightest margin since the re-democratisation of the country in 1988. Bolsonaro still did not acknowledge defeat at the time of writing. Albeit the election may feel very unfair, with four out of five regions choosing Bolsonaro for a second term (except for the Northeast), the electronic vote process is sound as most Brazilian voters chose the return of Lula. There is a risk of social protests paralysing the country, particularly if truck drivers decide to strike in favour of Bolsonaro, but the result is unlikely to be reversed. It is likely that any social discontent will be settled within weeks as Lula has proven to be a skilful negotiator across his political career. After that, all eyes will turn to Lula’s economic team. He has mentioned he would prefer to have a politician as Finance Minister, but he is very likely to have senior pragmatic technocrats as advisers, including former central bankers such as Henrique Meirelles, Arminio Fraga, and the `father of the Real plan` Persio Arida, amongst others. The economic team will have the challenge to raise the spending cap limit to enable more spending alongside a tax reform to permanently increase revenue and simplify the tax system. The fragmented Congress, with Bolsonaro’s party commanding the larger minority, demands centrist policies from Lula, which are likely to be delivered, in our view. Furthermore, Lula is likely to champion progressive environmental policies, which could bring Brazil back to benefit from its position of an environmental and agricultural powerhouse.

In economic news, the current account deficit widened to USD 5.7bn in September from USD 5.4bn in August, but foreign direct investment rose to USD 9.2bn from USD 8.9bn over the same period. CPI inflation rose 0.2% mom in the first 15 days of October from -0.4% in September, as the yoy rate declined another 110bps to 6.9%, only 10bps above consensus. PPI inflation declined another 1.0% mom in October, taking the yoy down by 180bps to 6.5%. The central bank kept the Selic policy rate unchanged at 13.75%, in line with consensus, but kept a cautious hawkish tone, preserving the ability to hike policy rates should the fiscal accounts deteriorate.

Egypt: The IMF approved a USD 3bn Extended Funding Facility (EFF) and a USD 1bn Resistance and Sustainability Facility (RSF) alongside a USD 5bn commitment from bilateral partners for further funding. On the same day, the central bank allowed the EGP to depreciate by 18.5% to 24.15 – a cumulative 35% year-to-date – and said the currency would be allowed to float freely to market forces, and at the same time hiked both borrowing and lending policy rates by 200bps to 13.25% and 14.25%. In our view the central bank will have to hike policy rates further and the EGP is likely to depreciate more to attract foreign and local investors to refinance local currency instruments. Importantly, it is not clear whether the USD 11.6bn of repayments from 2016 and 2020 IMF loans, due between 2023 and 2025, will be postponed. If not, the country’s financing needs will remain elevated, keeping the pressure on the currency unless the country implements a large and frontloaded fiscal consolidation allowing for a sizeable primary surplus on the fiscal accounts.

Snippets

- Chile: Unemployment rate increased by 10bps to 8.0% in September, in line with consensus, and retail sales declined by a yoy rate of 14.3% over the same period, from -13.2% in the previous year.

- China: The official manufacturing PMI declined 0.9 points to 49.2 in October (49.8 consensus) and the non-manufacturing PMI dropped 1.9 to 48.7 (50.1 consensus) as mobility restrictions continue to impair economic growth.

- Colombia: The central bank hiked its policy rate by 100bps to 11.0%, in line with consensus, in a unanimous vote.

- Ecuador: Ecuadorian 2030 Eurobond rallied USD 11c last week to USD 55c after President Guillermo Lasso said Ecuador is considering repurchasing part of the bond. Any buyback at current market pricing would be very intelligent as the country would guarantee close to 50% discount on the debt repayment.

- El Salvador: The Western Hemisphere IMF Director, Ilan Goldfajn, said that a financing agreement with El Salvador is far from being approved, indicating the adoption of Bitcoin as legal tender and governance issues pose significant challenges for an agreement.

- Mexico: The yoy rate of CPI inflation declined 10bps to 8.5% in the first 15 days of October, but core CPI rose 10bps to 8.4% over the same period. Economic activity rose 1.0% mom in August from 0.4% in July, pushing the yoy rate to 5.7% from 1.3% over the same period. The trade deficit narrowed to USD 0.9bn in September from USD 5.5bn in August, significantly lower than consensus for a USD 4.5bn deficit as exports rose USD 1.6bn to USD 52.3bn and imports slowed USD 3.0bn to USD 53.3bn.

- Peru: The ratings agency S&P affirmed Peru’s `BBB` rating, with a stable outlook.

- Poland: The unemployment rate rose 30bps to 5.1% in September.

- South Korea: The yoy rate of real GDP growth accelerated to 3.1% in Q3 2022 from 2.9% in Q2 2022, slightly better than consensus.

- Taiwan: Real GDP growth rose to a yoy rate of 4.1% in Q3 2022 from 3.1% in Q2 2022.

- Thailand: The trade deficit narrowed to USD 0.9bn in September from USD 4.2bn in August.

Developed markets

United States: The housing market softened further as new home sales dropped 10.9% to 603k in September and pending home sales dropped 10.2%. Real GDP growth rose 2.6% in Q3 2022 from -0.6% in Q2 2022, but most of the improvement came from net exports as personal consumption slowed to 1.4% yoy from 2.0% over the same period. Core PCE inflation slowed 20bps to 4.5% in Q3 2022 and the core PCE deflator rose 20bp to 5.1% in September, slightly better than consensus. The University of Michigan sentiment was unchanged at 59.9 as 1-year and 5-year inflation remained at 5.0% and 2.9% respectively.

Europe: The yoy rate of CPI inflation (EU harmonised) increased by 340bps to 12.8% in Italy, by 10bps to 11.6% in Germany and by 90bps to 7.2% in France.

Japan: The Bank of Japan kept its policy rate unchanged at -0.1% and the yield curve control on the 10-year bonds at 0.25%, in line with consensus, justifying its stance on downside risks to economic activity, despite an upside bias for prices. Governor Harukiro Kuroda kept its ultra-dovish stance saying yield curve control is a method of easing, not designed to weaken the JPY and that Japan needs to stimulate the economy with policy easing. In our view, the BOJ is aligning itself with other global central banks by keeping monetary policy easy for an irresponsibly long period of time to bring inflation above the level of interest rates and erode its debt levels. Apropos, the yoy rate of CPI inflation rose by 70bps to 3.5% and CPI ex-food and energy rose 50bps to 2.2%. These dynamics are a veiled tax across the population, hitting the poorer the most in favour of debtors (mostly the government, but also Japanese corporations). The BOJ is likely to change its ultra-loose monetary policy after Kuroda retires in April 2023.

Australia: The yoy rate of CPI inflation rose 120bps to 7.3% in September, 20bps above consensus and core CPI increased to 6.8%

1. See https://www.bbc.co.uk/news/world-europe-63437212

2. See https://liveuamap.com/en/2022/31-october-several-missiles-were-shot-down-near-kyiv

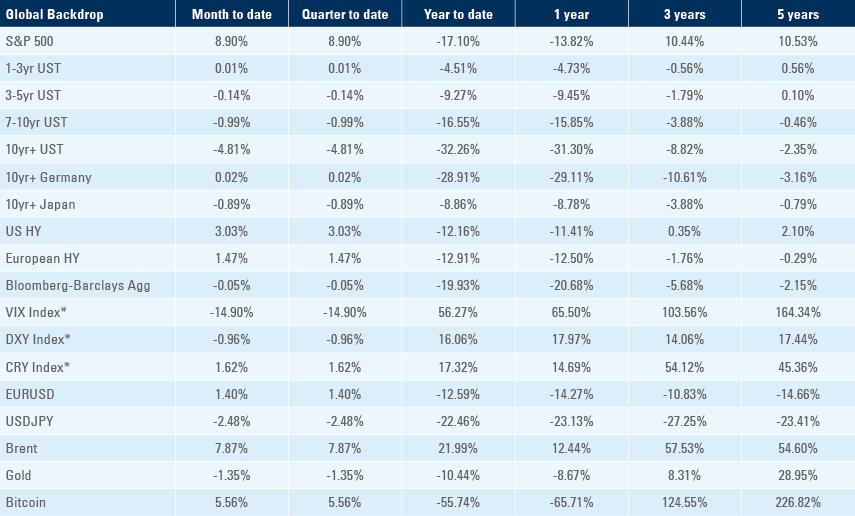

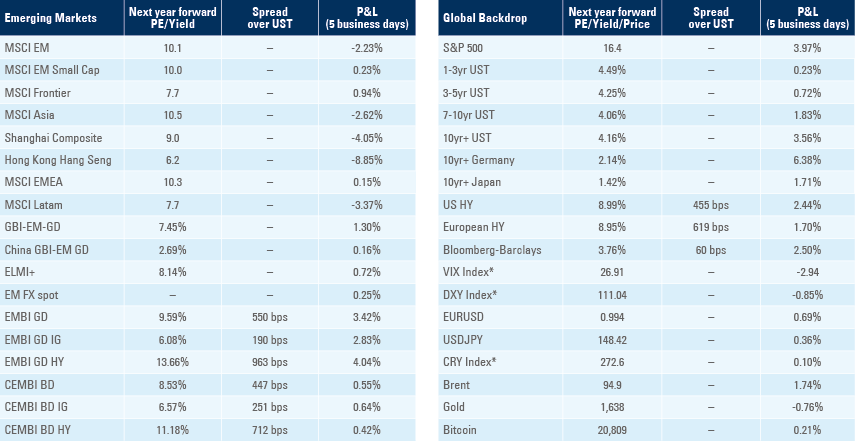

Benchmark performance