“There are decades where nothing happens, and weeks where decades happen.”

- A seismic shift in German economic policy on the horizon, raising German bond yields.

- Confusion over US trade and fiscal policies is damaging sentiment in US stocks.

- Trump threatens higher tariffs on Russia

- Mark Carney won the election within Canada’s liberal party by landslide

- OPEC+ to go ahead with production increases in April.

- China confirms increase in fiscal deficit from 3% to 4% this year in NPC.

- Argentina’s Milei said an IMF deal is weeks away

- Mexico Finance Minister resigned, will be replaced by his deputy, Edgar Amador.

- Hungary opposition party now leading polls

- Armenia issued USD750mn bond to strong demand.

- Türkiye’s Erdogan said the EU should resume accession talks immediately.

- Zambia continues to deliver solid fiscal consolidation.

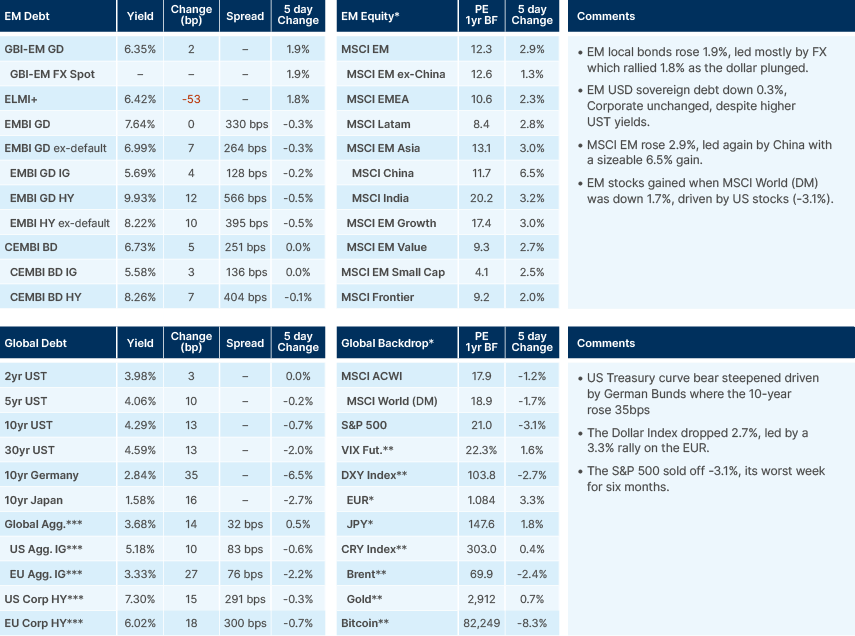

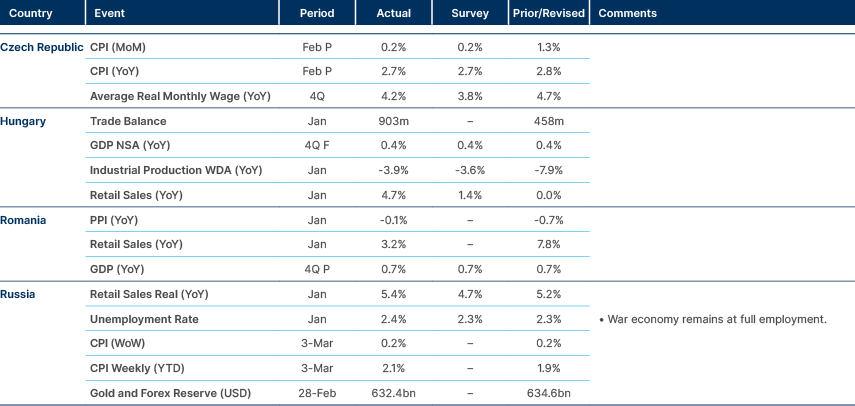

Last week performance and comments

Global Macro

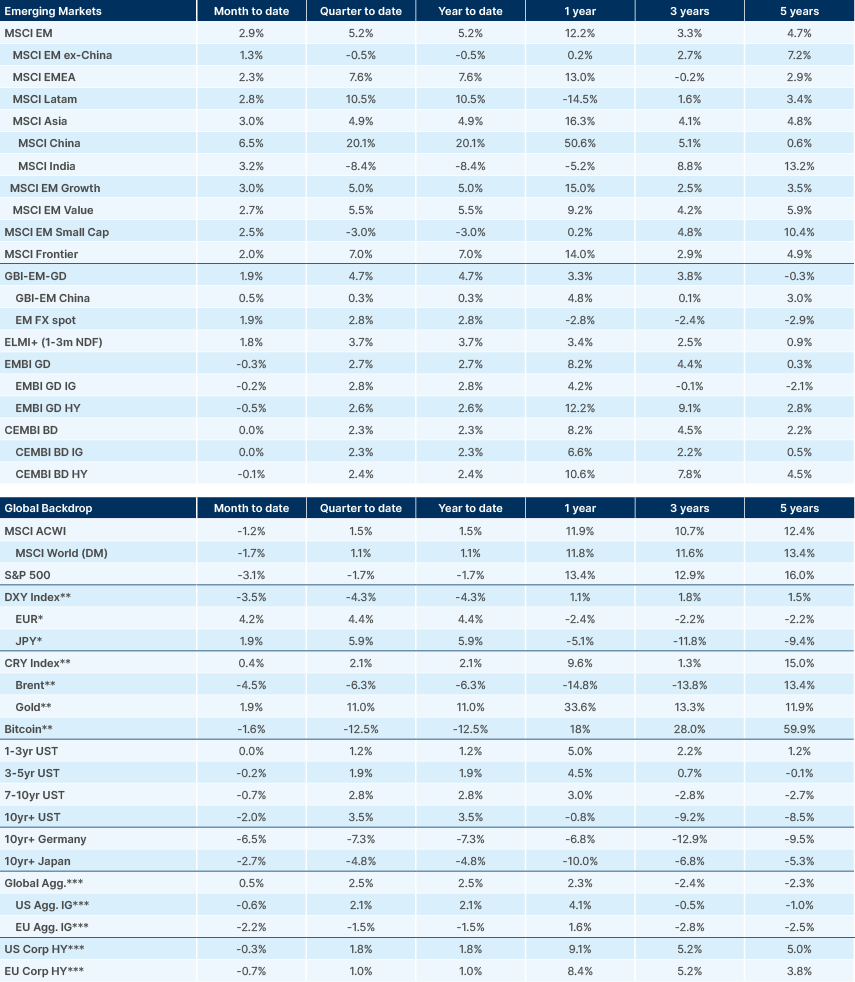

With confusion around economic policies extinguishing American animal spirits, US exceptionalism now looks to be in retreat. The trade weighted dollar index (DXY) is now back to 103.5 from 110 at its peak in January, despite Donald Trump and his team proving more hawkish with tariffs than many investors expected. At the margin, higher tariffs should make the dollar stronger, but fears of weaker growth and capital outflows are now directing the dollar’s momentum. US stocks have wiped out all their post-election gains, with the S&P 500 down -3% year-to-date (ytd).

But the negative sentiment to US did not preclude a more positive environment for emerging markets and Europe. The MSCI EM is up 5% ytd, led by China with Chinese H-shares are up 23% ytd, spearheaded by a significant repricing of Chinese tech stocks after the DeepSeek launch.

The rally in European stocks, up +12% ytd (EU 50), was a trade few investors were positioned for, with widespread pessimism over European growth at the end of 2024. However, the promise of more supportive German fiscal policy under Friedrich Merz now looks likely to materialise. Last week, Merz announced historical shifts for Germany’s fiscal policy with implications for the European Union (EU) and geopolitics. The first was exempting defence from the fiscal rule that limits the structural fiscal deficit at 0.35% of gross domestic product (GDP). The second was the creation of a Special Purpose Vehicle (SPV) worth EUR 500bn (c 11.5% of 2024’s GDP) for a 10-year infrastructure investment programme. Lastly, the federal states will be allowed to run fiscal deficits of up to 0.35% of GDP (from zero today). On top of that, the EU announced a EUR 150bn defence fund with allocated, but unspent proceeds from the pandemic and will lift defence spending from the 3% Maastricht rule.

The announcement is truly historic, as the magnitude of the prospective fiscal expansion is reminiscent of German reunification. The yield on German bunds widened by 31 basis points (bps) in a day, trading at 2.8% at the end of the week, from 2.4% before it started - the largest intraday move since reunification. It is fair to say that the inflammatory JD Vance speech at the Munich Conference and the US policy shift on Ukraine have been important catalysts for change in Europe. Encouragingly, several members of parliament have been talking about implementing the Mario Draghi plan. The large investment, if well executed, increases the likelihood that the mainstream parties will remain in power for longer.

Nevertheless, the fiscal measures require a supermajority to change the constitution to be presented early this week. Merz is looking to approve the measures before the inauguration of the new parliament on 25 March, when the ruling coalition seats will decline to just under the two-thirds supermajority needed for constitutional reforms. The new coalition is looking to develop a proposal for a lasting reform to the ‘debt brake’, which was introduced in 2009, by the end of 2025. The plans do little to change the outlook in the short term but will probably lead to a fiscal injection of 2-3% of GDP from 2026-2027 onwards, shifting GDP growth and neutral interest rates structurally higher.

Vladimir Lenin famous quote seems very appropriate for the current juncture: “There are decades when nothing happens, and weeks when decade happens.”

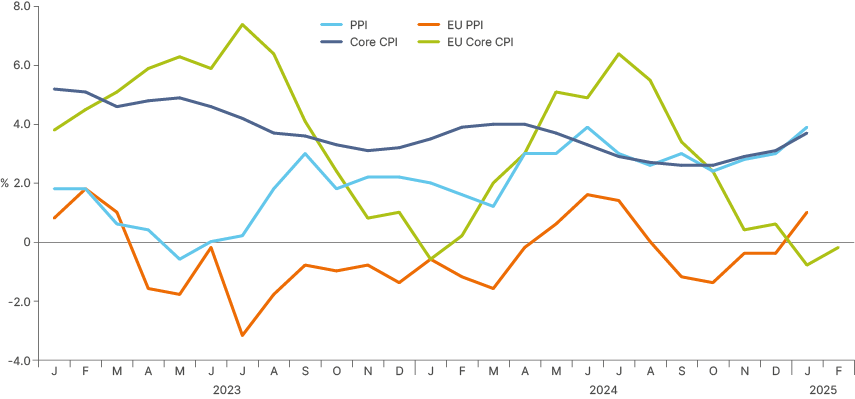

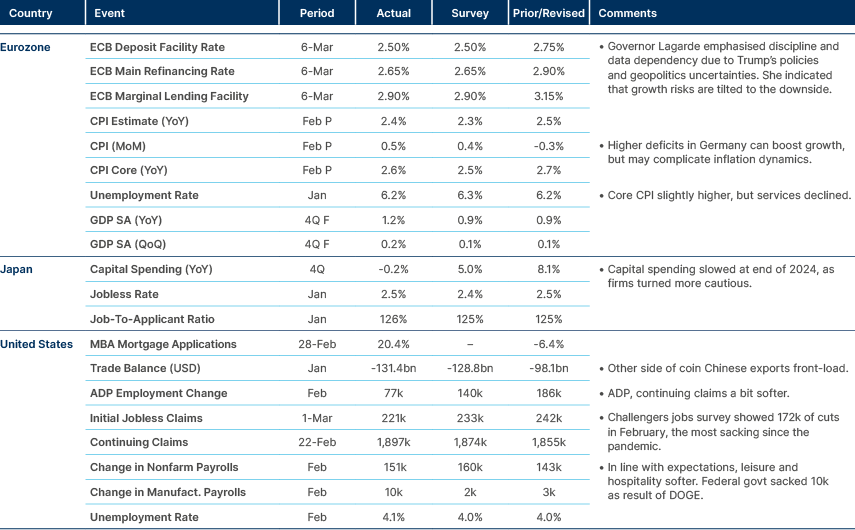

If approved, the fiscal change should have severe implications for monetary policy as well. Swap curves are still pricing two cuts by the ECB to 2.0% this year, and three cuts by the Fed to 3.75%. What justifies the structurally higher rates in the US are the divergence in inflation dynamics (Fig. 1). Europe’s are much more benign than in the US. But if Europe is moving to a loose fiscal stance as the US fiscal stance is tightening (higher taxes from tariffs and lower spending via DOGE), rates should converge, in our view. The labour market is tight in both sides of the Atlantic with the EU unemployment rate is at all-time low (ATL) at 6.2% while in the US it’s at 4.0% (ATL 3.4%).

Fig 1: Annualised 6m moving average Core CPI and PPI in US and EU

Indeed, last week, the ECB abdicated from forward guidance as Christine Lagarde said monetary policy had become “meaningfully less restrictive.” Back across the pond, the US Federal Reserve have retained a more dovish bias, as Trump hikes tariffs and cuts spending. Fed Board Member Christopher Waller said he is not thinking about a rate cut at the Fed’s March meeting, and that it needs to wait to see whether the soft data continues. Waller thinks there is nothing wrong with forecasting two or possibly three 25bps cuts for this year. He also said 2018/19 tariffs are not a good benchmark for the current situation. The reality is that both central banks are now data and policy dependent.

The structurally higher rates in the US are justified by the divergence in inflation dynamics, with Europe’s much more benign than in the US. The labour market also has structural problems in Europe. The unemployment rate is at a record low of 6.2%, while in the US it is at 4.0% (ATL 3.4%).

Geopolitics

Trump said he is “strongly considering” fresh banking sanctions and tariffs on Russia over its continued attacks on Ukraine, ramping up pressure ahead of negotiations in Saudi Arabia. He also said the suspension of US intelligence sharing with Ukraine has now “largely” been lifted, ahead of diplomatic meetings with Ukrainian and American delegates in Riyadh today.

Trump wants to link the minerals deal between Ukraine and the US to demands for Kyiv to commit to a quick ceasefire with Russia. He indicated he is ready to finalise the deal this week.

Canada: Further backlash against Trump as Mark Carney won the election within Canada’s Liberal party by a landslide (nearly 86% of vote). The transfer of power from Justin Trudeau to Carney is expected to take place within days, and it is possible he will call a national election soon after.

Commodities

OPEC+ will go ahead with increasing oil production from April due to “healthy market fundamentals”. Production can increase by 2.2m barrels/day by 2026. But OPEC+ stated “the gradual increase can be paused or reversed, if necessary.”

Emerging Markets

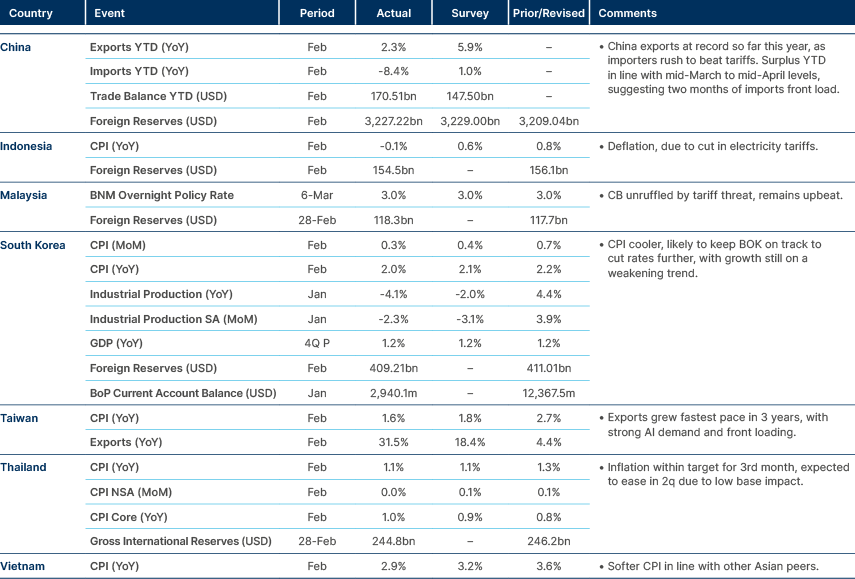

Asia

Inflation still declining across the board as China frontloads exports

China: There were a few surprises at China’s National People’s Conference (NPC) last week. Highlights included Premier Li Keqiang saying it will be “hard to achieve” the reinstated growth target of 5.0%. The fiscal deficit rose from 3% to 4% and the inflation target was lowered from 3% to 2%.

A further RMB 500bn of special Chinese Government Bond (CGB) issuance was announced to help recapitalise state banks. Issuance of ultra-long-term special treasury bonds in 2025 is to reach RMB 1.3trn. The consumer trade-in programme for white goods will be RMB 300bn this year. Local government can tap RMB4.4 trn in special bonds for land and inventory purchases.

In our view, the most important actions to lower saving rates and boost consumption will be boosting pension payments to the less privileged. The marginal propensity to consume for lower income groups in China is higher, particularly in rural areas. Currently there are 173m elderly people in China who do not receive formal retirement payments. In this regard, Beijing’s steps so far have not been particularly decisive.

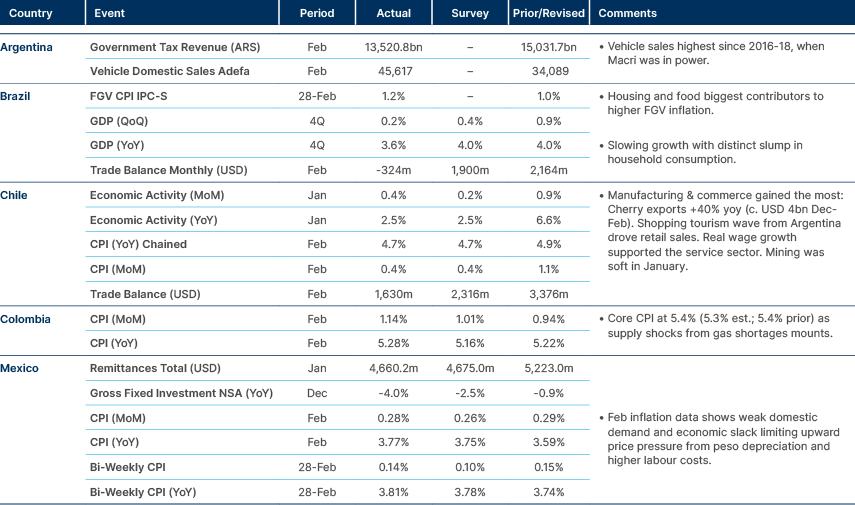

Latin America

Argentinians spend their savings (record vehicle sales); Brazil growth softens

Argentina: President Javier Milei opened a meeting of Congress with a speech focused on the achievements of the first year of his administration. He said that the International Monetary Fund (IMF) deal will go to Congress in days, which will help allow for a freer foreign exchange (FX) regime. Milei also proposed a broad fiscal reform of a mandatory zero-deficit budget for all states. He introduced a target to reduce public spending to 25% of GDP by 2027, and a reform to cut the number of national taxes by 90% to just six in total. Milei celebrated that his government was able to put an end to pickets and roadblocks in a single year and reduce crime rates significantly in the country's most dangerous cities. To keep advancing, Milei said the government will push for a reform to lower the age of crime responsibility, increase the penalties for every crime in the criminal code, and fill all the courts and prosecution offices, which are currently working with an overall vacancy rate of 40%.

Brazil: President Lula chose Worker’s Party (PT) head Gleisi Hoffmann to be the new Minister of Institutional Relations. This is a very influential role, with the responsibility of managing the governments’ political dialogue with Congress. Hoffmann will replace Alexandre Padilha, who was appointed Health Minister. She is a critic of Finance Minister Haddad's fiscal adjustment. The 2025 budget discussion will start on 11 March and be voted on during the week of 17 March. The key will be how legislators incorporate the fiscal package approved late last year and the spending pressures, like the cooking gas subsidy programme, into the budget.

Mexico: Finance Minister Rogelio Ramirez de la O resigned for personal reasons. He will be replaced by his Deputy Edgar Amador. Amador, who previously served as a Mexico City official and as an adviser to central bank chief Victoria Rodriguez, has been in his current position since last year. Amador has often attended public events in Ramirez de la O’s place and is perceived by analysts as likely to maintain the outgoing minister’s policy approach.

Central and Eastern Europe

Inflation subdued with softening activity in region

Belarus: President Aleksander Lukashenko gave an interview to online journalist Mario Nawfal and said the use of nuclear weapons was a measure of last resort for Russia and Belarus. Lukashenko praised Trump’s efforts to end the war in Ukraine but warned against excessive use of pressure against Ukraine President Volodymyr Zelenskyy, and urged negotiations, suggesting Minsk as a convenient location to hold them.

Hungary: The opposition Tisza Party leads with 37% among voters, compared to Fidesz with 33%, according to a large-sample survey by the Compass pollster over a three-month period. The survey shows the support for Fidesz is concentrated on the elderly and uneducated. It has only 35% of vote intentions among 18- to 29-year-olds and 23% among 30- to 39-year-olds, but has 47% among pensioners. The Fidesz leads the Tisza Party by 27% among lower-earning households with monthly income below HUF 200k. This explains the ruling party’s focus on inflation, which hits pensioners and the poorest the hardest.

Ukraine: The National Bank of Ukraine (NBU) raised its policy rate by 100bps to +15.5%, in line with consensus expectations.

Central Asia, Middle East, and Africa

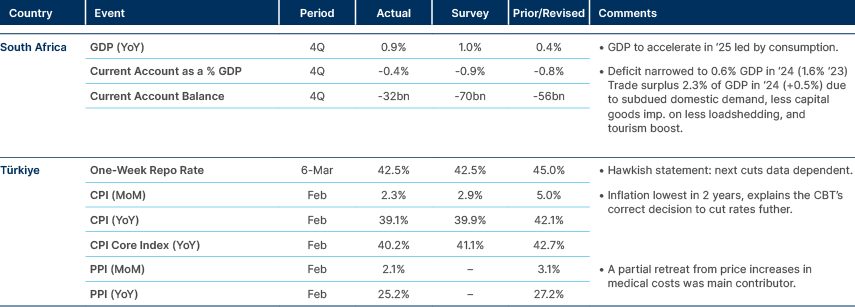

Inflation softens in Türkiye. SOAF growth to accelerate.

Armenia: Armenia issued USD 750m of 10-year unsecured note at 97.5% of face value, offering a yield of 7.1%. The stabilisation period ended without any intervention, with the issue receiving strong demand with orders exceeding USD 2bn. This allowed the yield to be revised downward from an initial 7.5%. The bond is rated in line with Armenia’s sovereign rating of Ba3/Bb-/BB-.

Azerbaijan: President Ilham Aliyev met with leaders of Russia's Tatneft, Kazakhstan's KazMunayGas, and Uzbekistan's Uzbekneftegaz to discuss multilateral cooperation between energy companies. This includes joint production, dealing with emergencies, optimising work in digital technology, joint procurement and industry development.

Egypt: Arab leaders gathered in Cairo to endorse a Gaza reconstruction plan unveiled by Egyptian President Abel Fattah El-Sisi. The plan counters Trump’s proposal and envisions multiple reconstruction phases costing c. USD 50bn. It faces major hurdles including the political and military future of Hamas.

Romania: Prime Minister Marcel Ciolacu wants to use EU defence funding to revitalise the local defence industry. Polish defence spending was 2.3% of GDP in 2024, more than 1.6% in 2023, but less than 2.5% committed.

Saudi Arabia: Saudi took advantage of (still) bargain EUR rates and issued EUR2.25bn 7y green & 12y at 3.458% and 3.871%, respectively. The books were skewed to green instruments.

Türkiye: President Erdogan said the EU should revive Türkiye’s accession talks immediately and that his country is ready to contribute to EU defence. Continuing to block Türkiye’s participation in the EU's defence initiatives for political reasons would be a grave mistake. In this period of heightened security concerns in Europe, Türkiye's full participation in the EU’s defence efforts is crucial for Europe to be a global actor.

Zambia: The fiscal deficit narrowed to 3.9% of GDP in 2024 on above-expected revenues and grants as well as lower than projected expenditures. The result is significantly better than the IMF forecast of 6.1% of GDP, and the country targets a fiscal deficit of 3.1% of GDP in 2025.

Developed Markets

ECB turns more hawkish, Fed more dovish tilt.

Benchmark Performance

Source and notations for all tables in this document:

Source: Bloomberg, JP Morgan, Barclays, Merrill Lynch, Chicago Board Options Exchange, Thomson Reuters, MSCI. Latest data available on publication date.

* Price only. Does not include carry. ** Global Indices from Bloomberg. Price to Earnings: 12m blended-forward

Index Definitions:

VIX Index = Chicago Board Options Exchange SPX Volatility Index. DXY Index = The Dollar Index. CRY Index = Thomson Reuters/CoreCommodity CRM Commodity Index.

Figures for more than one year are annualised other than in the case of currencies, commodities and the VIX, DXY and CRY which are shown as percentage change.