The World Bank and IMF Spring meetings get started amid a cautious outlook for growth, but softer inflation data.

Inflation data is coming in below expectations in Asia. The World Bank and International Monetary Fund (IMF) updated their growth forecasts. Amid its standoff with Taiwan, China tries to soften a defiant European bloc. Japan’s new central bank Governor elected a reassuringly dovish message in his maiden speech. Brazil’s Congress will start reviewing the government's new fiscal framework this week. Peru’s political instability is subsiding. Pakistan gets nearer to an IMF deal.

Global Macro

Softer inflation in Asia: a number of inflation reports from Asia were on the low side. In China, Consumer Price Index (CPI) inflation declined to 0.7% year-on-year (yoy) in March from 1.0% February (consensus 1.0%). Producer Price Index (PPI) inflation fell to -2.5% yoy from -1.4%, in line with consensus. In South Korea, CPI inflation rose 0.2% month-on-month (mom) in March from 0.3% in February and the yoy rate declined 60 basis points (bps) to 4.2% (4.3% expected). The Bank of Korea (BOK) kept its policy rate unchanged at 3.5% on 11 April, as expected. The decision was unanimous, unlike the previous one, and may mark the official end of the BOK’s hiking cycle. In Thailand, CPI inflation declined for the second consecutive month in March to -0.3% mom (+0.1% expected), bringing the yoy rate of inflation down 90bps to 2.8%, while core CPI declined 20bps to 1.75% yoy. In the Philippines, the yoy rate of CPI inflation dropped 100bps to 7.6%, 40bps below consensus, driven by lower food price inflation. However, core inflation rose to 8.0% from 7.8% in February, so the central bank (BSP) is expected to continue hiking interest rates.

In the United States (US), the two-year Treasury yield declined to 3.65% last week, a full 135bps below the Fed Funds rate, after disappointing Institute of Supply Management (ISM) Purchasing Manager’s Index (PMI) survey data, but the solid March payroll report pushed the yield back up to 4.0% to close the week roughly unchanged. The two-year vs. Fed Funds has been inverted by more than 90bps five times over the last 40 years. The inversion preceded an economic recession in 1989 (the Savings and Loans crisis), 2000 (dot-com bubble), 2007 (housing market and banking crisis) and 2019 (Covid-19). The only time when such curve inversion did not lead to a recession was in 1998, when the Federal Reserve (Fed) corralled the banking system to bail out the hedge fund LTCM.

Despite the US government’s efforts to restore confidence in the banking system, US regional banks have remained under pressure. An index of US regional banking stocks fell below the March lows last week. The index is down 26.4% year-to-date and down 32.5% over the past 12 months. With earnings releases for the sector forthcoming in the next few weeks, market reports highlight investors buying options to protect against expected volatility, amid market chatter about US small banks’ large exposure to at-risk commercial real estate loans. That said, stress in money markets and the outflow of deposits have subsided: according to Fed data released on 7 April, commercial bank deposits in the US increased by USD 43bn in the week ending 29 March, compared to a decrease of USD 179bn in the prior week. Deposits at small US banks, which had experienced significant outflows in the wake of recent bank failures, increased by USD 26bn in the week ending 29 March (vs. a USD 185bn drop the week of the Silicon Valley Bank failure).

Silver and gold are breaking out. The weaker DXY, lower rates and central bank buying are the main factors spurring the precious metals rally. Gold and silver perform well in periods of both stagflation and booms, which are the most likely regimes over the next few years. Global gold reserves increased by 52 tonnes in February, the 11th consecutive monthly increase, according to the World Gold Council. In January, central banks bought 74 tonnes of gold following a record 1,136 tonnes purchased in 2022. Precious metals have sold off during recessions over the last 40 years, but silver and gold rallied during the 1973 Yom Kippur War and had their steepest rally after the Iranian Revolution. Gold is trading close to its historical highs in nominal terms, and 35% below its highs in inflation-adjusted terms (US CPI). Silver arguably trades at a larger discount than gold: although it is trading close to its long-term average in real terms, it would need to rise by 3x to re-test its 2009 highs, adjusted for inflation.

Coming up this week

The IMF and the World Bank Spring meetings are kicking off this week in Washington, DC. In advance of the meetings, World Bank President David Malpass announced an increase in its 2023 global growth outlook from 1.7% to a still measly 2.0%, reflecting an improvement in the outlook for China’s recovery from its Covid lockdowns (the World Bank is now forecasting 5.1% growth in China, up 60bps from the January outlook).

As we go to press the IMF just released Chapter 1 of its April update of the World Economic Outlook, where it forecasts world output to grow by 2.8% in 2023, down from 3.4% in 2022, and down from 2.9% when they last published their forecast in January. However, Emerging and Developing economies (EM) are forecast to grow by 3.9%, compared with 1.3% for advanced economies. The ‘EM growth premium’ over advanced economies is thus set to double to 2.6% from 1.3% in 2022.

The main economic data release this week is the US CPI inflation report for March. The consensus forecast for headline CPI is 0.2% mom, down from 0.4% last month, and 5.1% yoy, from 6.0%.

Geopolitics

French President Emmanuel Macron and European Commission President Ursula von der Leyen met with China’s President Xi Jinping in China. Macron was given a lavish welcome, as commentators speculated whether Xi was trying to build allies within the European Union (EU) to counter the role of the US. US Speaker of the House of Representatives Kevin McCarthy met with Taiwan’s President Tsai Ing-wen during her stopover in California, defying warnings from Beijing. In response, China’s military simulated strikes against Taiwan during three days of military exercises around the island and imposed further sanctions on Taiwan’s de facto ambassador to the US. Over the weekend, dozens of Chinese aircraft crossed the Taiwan Strait’s median line, in a carefully-weighted warning message towards Taiwan following the McCarthy-Tsai meeting. China’s show of force was less incendiary than after former US Speaker Nancy Pelosi visited Tsai in Taiwan last year. At that time, China reacted aggressively with its navy and air force engineering a blockade around the island in what has become the most important commercial sea lane in the world.

Emerging Markets

China: New home sales rose by 56% mom in March after rising by 32% in February according to the China Index Academy survey in 14 cities. Sales rose the most in Tier 1 cities (+73%) and Tier 2 cities (+55%), where wealth is concentrated, but also did well in Tier 3 cities (+29%) as the easing of restrictive policies and the lowest mortgage rates on record led to a pick-up in demand. Another survey showed new home prices in 100 cities rose last month at the fastest pace since June 2022.

Brazil: The manufacturing PMI declined 2.2 points to 47.0 in March and the services PMI rose 2.0 points to 51.8. President Luis Inácio Lula da Silva praised his Finance Minister’s fiscal reform plan over the weekend. He dismissed the criticisms aired by opposition parties, and expressed confidence that the plan will pass through Congress. The plan will be sent to Congress this week, together with the annual budget bill that must be filed every year before 15 April. The plan aims to introduce a limit on the pace of spending growth and targets to eliminate the primary deficit by 2024. In other news, this week President Lula is in China for a four-day visit, where talks will include using the Yuan for bilateral trade settlements, and possibly of Brazil joining China’s Belt and Road initiative.

Peru: Congress rejected the impeachment motion against President Dina Boluarte, introduced on grounds of permanent moral incapacity following the deaths of too many protesters, with 64 votes against, 37 in favour and 10 abstentions. This follows failed attempts to get Congress to approve early elections, so the base case is for president Boluarte to serve out the rest of her term until 2026. Large-scale protests have stopped across the country. Economic activities, including all mining activities, have fully resumed, and local sentiment has significantly improved. Peru's central bank (BCRP) conveys its monetary policy meeting this week on 13 April, when it will likely keep its policy rate on hold. The market is pricing 20bps of cumulative cuts over the next six months.

Pakistan: The central bank hiked its policy rate by 100bps to 21.0%. On orders of the Prime Minister, due to the political situation Finance Minister Ishaq Dar cancelled his trip to Washington to attend the Spring meeting of the IMF. Dar added that Pakistan has completed all of the IMF’s requirements for the release of a much-needed USD 1.1bn in funding, subject to confirmation of additional bilateral support. The odds of a deal improved last week after Saudi Arabia assured the IMF it will provide a USD 2bn loan to Pakistan. The agreement with the IMF still rests on a similar commitment from the United Arab Emirates for a USD 1bn loan, according to Pakistan’s Ministry of Finance.

Snippets

- Chile: The central bank kept its policy rate unchanged at 11.25%, in line with consensus, but the accompanying statement kept a more hawkish tone, flagging the inflation adjustment had been “slower than expected” in the face of a “stronger backdrop for consumption.” The market was pricing more than 300bps of cuts before the policy decision.

- Colombia: CPI inflation rose 1.1% mom in March, down from 1.7% mom in February and 13.3% yoy, broadly in line with consensus. Core CPI rose 1.1% mom and 11.4% yoy, still too elevated for the central bank to even contemplate the timing of policy rate cuts. The Davivienda manufacturing PMI proxy rose 1.7 points to 51.5.

- Egypt: The Central Bank of Egypt (CBE) hiked its overnight interest rate by 200bps and set the lending rate at 19.25% and deposit rate at 18.25%. Still to be determined is the timing of the IMF review of Egypt’s adherence to the terms of the USD 3bn Extended Fund Facility put in place in December.

- India: Service sector PMI softened 1.6 points but remained robust at 57.8; The Reserve Bank of India (RBI) surprised the market at its last Monetary Policy Committee meeting by keeping its repo rate at 6.5% and ‘pausing’ its hiking cycle. The decision was unanimous. The RBI lowered its Financial Year FY2024 inflation forecast to 5.2% from 5.3%.

- Israel: The central bank hiked its policy rate by 25bps to 4.5%, moderating the pace of hikes in its ninth consecutive hike, in line with consensus. Governor Amir Yaron highlighted that the ongoing governance crisis “could impact substantially on the economic and financial developments in the short term and in the longer term, and therefore on the monetary policy that will be required”.

- Mexico: CPI inflation declined to 0.3% mom in March from 0.6% in February, bringing the yoy rate down by 70bps to 6.9% yoy, but core CPI declined only 20bps to 8.1% yoy, all broadly in line with consensus. The manufacturing PMI was unchanged at 51.0.

- Poland: The central bank kept its policy rate unchanged at 6.75%, in line with consensus.

- Romania: The central bank kept its policy rate unchanged at 7.0%, in line with consensus. The PPI posted a deflation of 0.3% mom in February after 1.4% in January, as the yoy rate of inflation declined by 230bps to 21.6%.

- Saudi Arabia: Ratings agency Fitch upgraded Saudi’s sovereign debt rating by one notch to ‘A+’ due to efforts to diversify its economy away from oil sales as well as holding large reserve balances.

- Sri Lanka: The central bank kept its policy rate unchanged at 16.5%, in line with consensus.

- Uruguay: CPI inflation was unchanged at 0.9% mom in March, driving the yoy rate down by 20bps to 7.3% over the same period.

Developed Markets

United States: The Bureau of Statistics reported 9.9m job openings in February, down from 10.6m in January and below 10.5m consensus. Factory orders dropped 0.7% mom in February after dropping 2.1% in January, while durable goods orders declined another 1.0% mom in February, as in January. The ADP National Employment Report was weaker with 145k jobs created in March from 261k in February, below the 3m moving average at 171k. For comparison, the average ADP report from 2011 to 2019 was 217k. The Labor Department released March payroll data showing 236,000 jobs added, while the unemployment rate dropped to 3.5%, near the half-century low of 3.4%. Hiring slowed, providing evidence that the Fed’s interest rate decisions may be having the desired effect of slowing the economy. Manufacturing PMI was unchanged at 49.2 and the ISM manufacturing declined 1.4 points to 46.3, with Prices Paid moving below 50 and New Orders dropping 3.7 points to 44.3. ISM services declined 3.9 points to 51.2, as Prices Paid dropped 6.1 to 59.5 (and 83.7 in February 2022), and New Orders fell 10.4 to 52.2. The trade deficit widened more than expected to USD 70.5bn in February, staying firmly in the ‘overheating’ zone. In other news, the Cleveland Fed President Loretta Mester said rates should rise above 5% and stay there for some time to reduce inflation, adding that the “exact level” depends on how quickly price pressures ease, but that for now it should move “somewhat into restrictive territory”.

Europe: The PPI dropped by 0.5% mom in February after declining 2.8% in January, bringing the yoy rate of PPI inflation down 190bps to 13.2% over the same period. The Eurozone Services sector PMI was down 0.60 to 55.0, but core countries underperformed: services PMI in France declined 1.6 points to 53.9 and Germany was down 0.2 to 53.7. However, some peripheral countries were booming: Spain was up 2.7 points to 59.4, while Italy surged 4.1 points to 55.7. The EU manufacturing PMI rose 0.2 to 47.3, again with core countries underperforming peripheral countries.

Japan: New Bank of Japan (BOJ) governor Kazuo Ueda took office on 9 April. At his inaugural press conference on Monday, he was in no rush to signal any changes to the BOJ’s easy monetary policy stance, including the so-called yield curve control (YCC) programme. Ueda reiterated his commitment to the BOJ’s stable and sustainable 2% inflation target, which has not been reached in his view, and recognised that above that mark any changes in policy would need to be significant. The first BOJ meeting chaired by Ueda will be held on 27-28 April, and the odds of a change in policy later this month have diminished after his talk.

Australia: The Reserve Bank of Australia kept its policy rate unchanged at 3.6% after ten consecutive hikes, in line with consensus, but stood ready to increase the policy rate further should inflation fail to converge towards its target.

New Zealand: The Reserve Bank of New Zealand hiked its policy rate by 50bps to 5.25%, 25bps above consensus expectations.

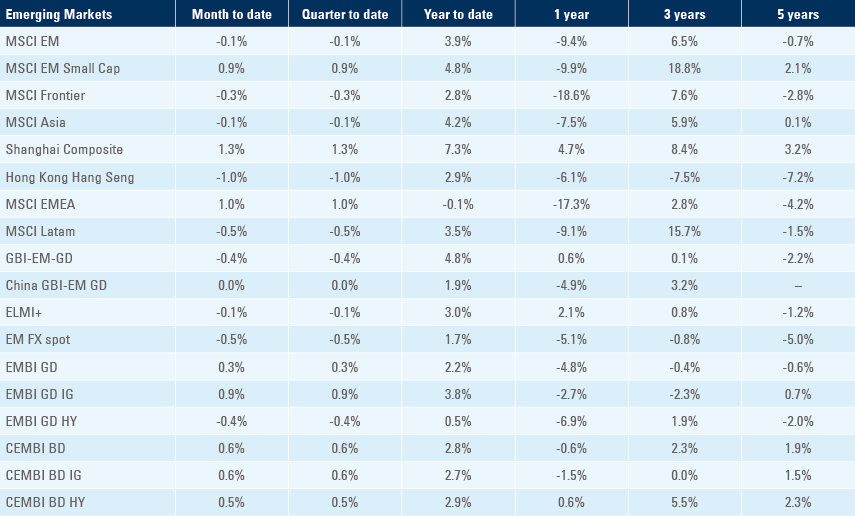

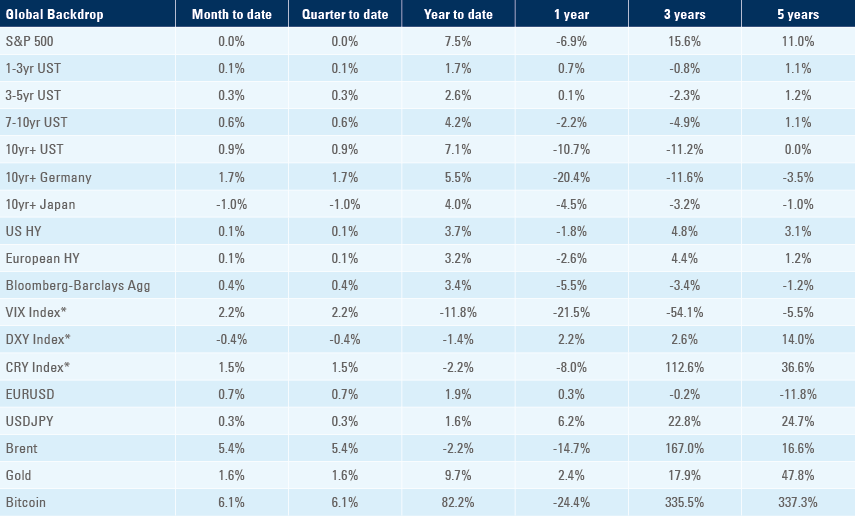

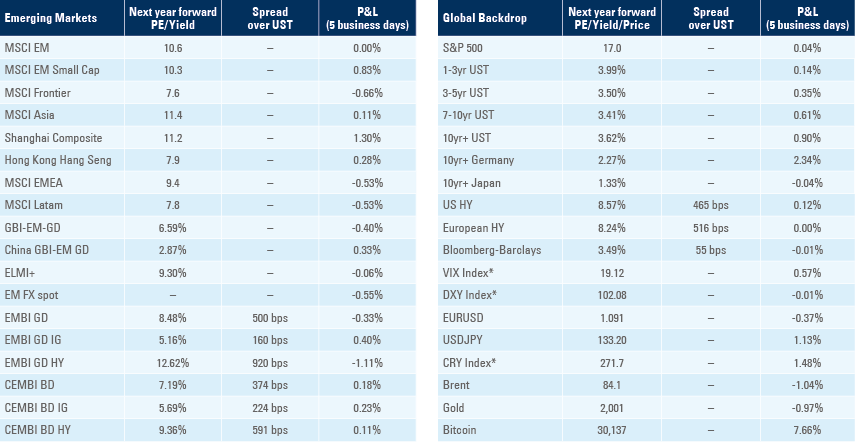

Benchmark performance