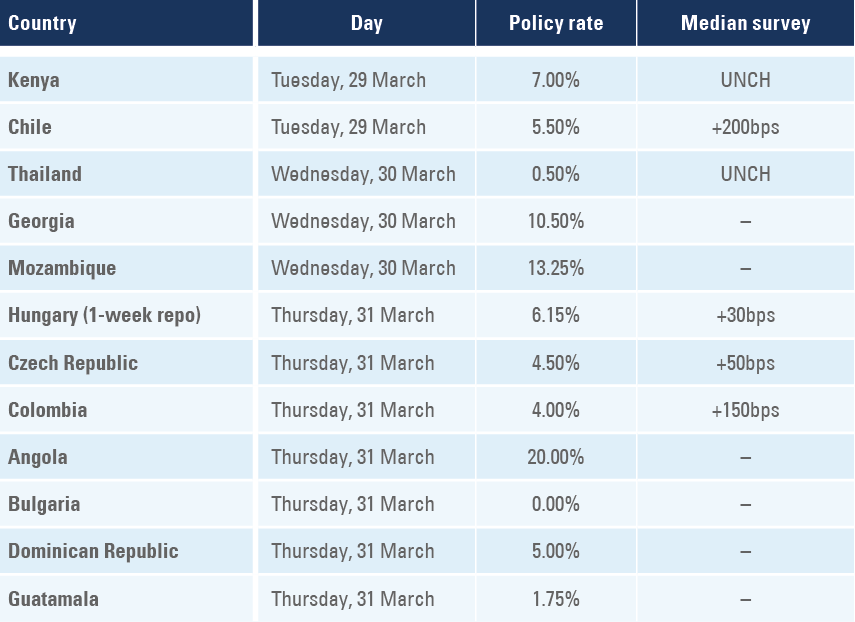

The war in Ukraine and the war against inflation charted a parallel course last week

President Biden and Chairman Powell both hardened calls for decisive action, which is not without risks.

Despite unhelpful remarks by President Biden on a visit to Poland, Ukrainian President Zelensky is keeping the door open to a cease-fire in Ukraine. Eastern European countries announced transactions to permit the conversion of refugees’ UAH to the currencies of their destination countries. The central banks of Brazil, Egypt and Hungary all hiked their policy rates by 100bps to 11.75%, 9.25% and 4.4% respectively, and Mexico hiked by 50bps to 6.0%. Argentina and Ghana raised policy rates by 200bps and 250bps to 44.5% and 17.0% respectively. A number of EM central banks are likely to increase their rates further next week. China’s Alibaba increased its share buyback programme. Chile revised its current account data. The Ecuadorian National Assembly rejected an investment reform bill while Uruguayans upheld a number of structural reforms in a referendum.

Emerging markets

Russia-Ukraine

During a speech delivered from Poland where he visited US troops, President Joe Biden seemed to veer off-script when he said of his Russian counterpart that “this man cannot remain in power”. Secretary of State Antony Blinken, Biden himself and NATO leaders subsequently had to walk back this message by saying that there is no strategy of regime change in Russia. The confrontational language risked reaching a cease-fire agreement in Ukraine more difficult, many thought. However, Ukraine President Volodymir Zelensky signalled that he may be willing to accept one of Russia’s conditions for cease-fire, saying that he wanted Russia to move its troops to the “compromise territories” of Donetsk and Luhansk and saying “I understand that forcing Russia to liberate this territory completely is impossible as it would lead to WWIII.” Interfax reported that Luhansk People’s Republic leader Leonid Pasechnik plans to hold a referendum on becoming part of Russia. Ukrainian and Russian delegations will meet in Turkey from 28 to 30 March for further discussions on a possible cease-fire.

Central and Eastern Europe

A key problem facing Ukrainian refugees is how to convert their savings in Hryvnia (UAH) to currencies they need in their new destination. Since Ukraine suspended currency trading and froze the official exchange rate for the UAH at pre-war levels, it has become impossible for commercial banks to clear their UAH transactions, leading to a large premium in the black market. The Central Bank of Poland announced a USD 1.0bn swap line whereby it agreed to take up to UAH 10k (c. EUR 300) per refugee at the official exchange against Zloty, in effect nationalising the losses once the Hryvnia starts trading again. Bulgaria and Romania announced a similar commitment. In the meantime, the European Central Bank did not provide a Euro Area swap line to cater for Ukrainian refugees as the monetisation of currency losses would cause a loss to the European taxpayer and the ECB does not have authorisation to monetise debt without compensation from the Treasuries of its member-states.

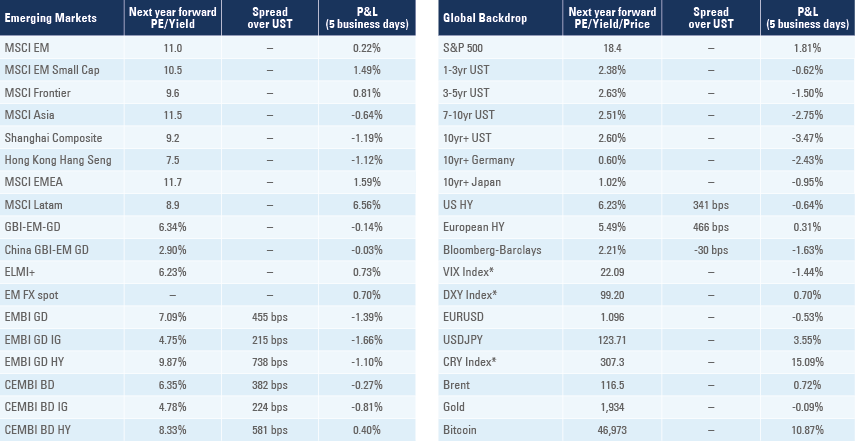

Monetary policy committee decisions next week

Twelve EM central banks will hold monetary policy committee meetings next week, with Chile and Colombia likely to hike their policy rates by more than 100bps. Several frontier economies will be under pressure to adjust their policy rate after the central banks of Egypt, Argentina and Ghana hiked last week. Overall, EM central banks are sticking to a very orthodox monetary policy stance, in sharp contrast to DM central banks that remain mostly behind the curve.

Fig 1: EM policy rates decisions this week

Brazil: The minutes of the latest monetary policy committee meeting had a more dovish tilt, signalling a final 100bps hike over the next meeting to 12.75% before declining to 8.75% in 2023, as the energy shock from last year’s drought and the war dissipates. The next hike is already more than priced in by the market. The central bank also brought its inflation forecast down to 7.1% in 2022 and 3.4% in 2023. The minutes highlighted good monetary policy practices and suggested the central bank should react only to the secondary inflationary effects of further oil price shocks, as the shocks themselves hit aggregate demand. In economic news, the yoy rate of CPI inflation was unchanged at 10.8% in the first half of March, 10bps above consensus.

Egypt: The central bank hiked its deposit and lending policy rates by 100bps to 9.25% and 10.25% in an unscheduled monetary policy meeting and allowed the EGP to depreciate, which will preserve Egypt’s competitiveness and safeguard macroeconomic stability. The country’s local debt saw USD 15bn of outflows over the last 3-4 weeks. The rate hike and currency devaluation are likely to bring Egypt closer to a deal with the International Monetary Fund (IMF). The IMF confirmed Egypt has requested support to implement its comprehensive economic programme. Egypt already has USD 19bn in debt with the IMF. Abu Dhabi’s state holding company ADQ said it is looking to buy an 18% stake in Commercial International Bank and three other listed firms in deals totalling USD 2bn.

Hungary: The National Bank of Hungary hiked its policy rate by 100bps to 4.4% at its regular meeting, below the effective policy rate, which is the 1-week deposit rate of 5.85%. The NBH revised the 2022 CPI inflation expectations range to 7.5% to 9.8% and signalled more policy rate hikes ahead to contain rising inflation expectations.

Mexico: The Central Bank (Banxico) hiked its policy rate by 50bps to 6.0% and set a hawkish tone for upcoming meetings, suggesting additional 50bps hikes at its next meetings. The yoy rate of CPI inflation was unchanged at 7.3% in the first 15 days of March and core CPI was unchanged at 6.7% yoy, slightly below both consensus, but still the highest level since 2001. The median expectation for 2022 CPI inflation rose by 40bps to 4.7% while core CPI rose 30bps to 4.6%. The yoy rate of retail sales rose by 1.8% to 6.7% yoy in January, while real GDP growth rose to 1.1% yoy in Q4 2021, bringing the full year real GDP growth to 4.8% in 2021 from -8.2% in 2020.

Argentina: The central bank hiked its policy rate by 200bps to 44.5%, equivalent to an effective annual rate (EAR) of 54.9%, from 51.9%, and the 180-day Leliq rate rose to 49.5% (or 55.7% EAR). The unemployment rate dropped 1.2% to 7.0% in Q4 2021 while the trade surplus rose to USD 800m in February from USD 300m in January.

Ghana: The Bank of Ghana hiked its policy rate by 250bps to 17.0% due to tighter global financing conditions and the sharp pressure on the GHS, as well as elevated inflation posing policy challenges. CPI inflation rose to 15.7% yoy in February, the highest level in six years and above the 6%-10% inflation target band. Finance Minister Ken Ofori-Ata announced an additional 10% cut to discretionary spending, taking the total budget cuts to 30% in order to achieve the 7.4% fiscal deficit target for 2022.

China: Owing to the rise in Covid cases more cities are being put in lockdown, most notably Shanghai, which started a process of partial, rolling lockdowns on 28 March, expected to last until 5 April. The e-commerce giant Alibaba increased its share buyback programme by USD 10bn to USD 25bn in order to support the company’s share price and boost investors’ confidence. Alibaba’s share price rallied more than 40% from its lows two weeks ago after Liu He said China was close to ending big tech platforms’ “rectifications.” Alibaba traded at a price/earnings multiple of 12x and one quarter of its market value is in cash and short-term investments. In other corporate news, Evergrande set a target to send its restructuring proposal by end-July after saying it will delay its financial results from its 31 March deadline in order to complete audit work, as a property services unit is investigating how banks seized USD 2.1bn of deposits pledged as security for third-party guarantees.

Chile: The central bank revised Chile’s current account numbers for the period from 2013 to 2021, implying deficits USD 24.5bn higher than originally reported and pushing the 2021 current account deficit to 6.4% of GDP. The 2019 and 2020 deficits were revised to USD 14.5bn and USD 4.3bn respectively, from the prior USD 10.5bn deficit and USD 3.3bn surplus respectively. Higher copper prices last year failed to attract new investment, as the private sector is becoming a net exporter of long-term capital. This in turn brings the government to rely on foreign finance via portfolio flows.

Ecuador: Congress rejected President Guillermo Lasso’s investment bill by a wide margin. The rejection has a relatively small economic impact, but is a sign of the challenges Lasso will face in approving structural reforms, including labour and social security reforms, over the rest of his mandate. Lasso has the option to dissolve Parliament and call for early parliamentary and presidential elections, but with an approval rate below 40%, half the mid-2021 level he reached after boosting the vaccination rates of Ecuadorians, Lasso’s chances would appear uncertain.

Uruguay: The population voted in a referendum on the government’s Law of Urgent Consideration (LUC in Spanish), opting to retain the 135 articles of President Lacalle Pou’s reform proposal, with 49.8% votes to keep and 48.8% votes to repeal, with 96% of the votes counted at the time of writing. The referendum was an important political test in determining the ability of President Lacalle Pou to implement his post-referendum reform agenda, including social security and labour market reforms, as well as negotiations for a free- trade agreement with China. In economic news, the yoy rate of real GDP growth rose 5.9% in Q4 2021 from 6.2% in Q3 2022 – the strong activity in 2H 2022 leaves a large 3.6% statistical carry-over for 2022.

Snippets

- Colombia: Leftist presidential candidate Gustavo Petro has named Afro-Colombian environmental activist Francia Marquez as his vice presidential running mate. Marquez’s selection caused the Liberal Party’s Cesar Gaviria to withhold its endorsement of Petro.

- Malaysia: The yoy rate of CPI inflation fell by 10bps to 2.2% in February, 20bps below consensus.

- Nigeria: The Central Bank of Nigeria kept its policy rate unchanged at 11.5%.

- Poland: The government said it wanted to exclude defence expenditures from the debt rule. The Polish Central Bank extended a USD 1bn swap line to Ukraine.

- Philippines: The central bank kept its policy rate unchanged at 2.0%, in line with consensus, but increased the 2022 CPI inflation forecast by 0.6% to 4.3%, above the 2.0- 4.0% target band, possibly signalling the beginning of a hiking cycle.

- Russia: The yoy rate of industrial production dropped 2.3% to 6.3% in February, 1.3% below consensus.

- Singapore: The yoy rate of CPI inflation rose by 30bps to 4.3% in February while core CPI dropped 0.2% to 2.2% yoy, slightly lower than consensus.

- South Africa: The Reserve Bank of South Africa hiked its policy rate by 25bps to 4.25%, in line with consensus. CPI inflation was unchanged at 5.7% yoy and core CPI was unchanged at 3.5% yoy, both 10bps below consensus.

- Taiwan: Export orders rose by a yoy rate of 21.2% in February, from 11.7% yoy in January, the 24th straight month of expansion, led by electronic and information & communication products.

- Thailand: The current account deficit narrowed to USD 1.8bn (c. 0.4% of GDP) in 2022.

Global backdrop

United States: The Chairman of the Federal Reserve Jay Powell said the Fed could hike by more than 25bps at each FOMC meeting if necessary and committed to hiking policy rates above neutral rates if necessary. Several Fed Directors, including more dovish members such as San Francisco’s Mary Daly, hinted at increasing the pace of increase to 50bps over the upcoming meetings as the market prices 86bps of hikes between May and June. In economic news, the Markit manufacturing PMI rose 1.2 points to 58.5 and services PMI rose 2.9 points to 58.9, both significantly above expectations, but the University of Michigan survey was down 0.3 to 59.4, the lowest levels since 2008/09, while 1-year and long-term inflation expectations remained at 5.4% and 3.0%. New home sales declined 2.0% mom in February after dropping 8.4% in January. House affordability has declined as 30-year mortgage rates rose by 150bps from their lows to 4.5% just as house prices increased. Durable goods orders dropped 2.2% mom in February after rising 1.6% in January. Initial jobless claims dropped to 187k in the week ending on 19 March from 215k in the previous week.

Europe: Der Spiegel released a poll showing 48% of Germans are in favour of sanctioning oil imports from Russia (42% against), and 59% want an embargo on coal purchases (34% against); only 42% are in favour (48% against) of stopping the purchase of natural gas. The Eurozone Markit manufacturing PMI dropped 1.2 points to 57.0, and the service PMI dropped 0.7 points to 54.8, leaving the composite PMI better than consensus and at relatively elevated levels despite the Ukrainian conflict. The German IFO business climate survey dropped 7.7 to 90.8, while business expectations dropped 13.3 to 85.1, both at the lowest levels since July-2020.

United Kingdom: The yoy rate of CPI inflation rose 70bps to 6.2% in February while core CPI rose 80bps to 5.2% yoy, both 20bps above consensus expectations.

Japan: In contrast to other large central banks the BoJ has been doubling down on QE to pin nominal bond yields down, and has offered to buy unlimited amounts of JGBs over the next few days. This has led to a sharp depreciation in the JPY, which is down by more than 8% against US dollar since the start of the month. In economic news, Tokyo CPI inflation rose 30bps to a yoy rate of 1.3% in March, 10bps above consensus.

Commodities: Crude oil and gasoline inventories declined by 2.5m and 3.0m respectively, significantly above consensus, pushing oil prices higher. Despite pressure from president Zelensky and domestic popular opinion, Germany and the EU Commission declined to cut off oil and gas imports from Russia immediately, citing the enormous impact on the European economy. Rather, the US and the EU issued a much less ambitious ‘Joint Statement on European Energy Security’, which affirms the joint resolve to terminate EU dependence on Russian fossil fuels by 2027, and secures the supply of 15 bcm (billion cubic metre) in LNG from the US this year – with plans to ramp this up to 50 bcm by 2030.