Market price action signals the end of United States (US) stock market exceptionalism. Russia held cordial and constructive conversations with the US with the aim to de-escalate tensions on the Ukrainian border. Last week the CSTO forces left Kazakhstan after security was re-stablished. China announced important measures to ease liquidity in the property sector and cut policy rates. Chile’s President elect Gabriel Boric appointed a market-friendly Finance Minister and a balanced cabinet.

Global macro

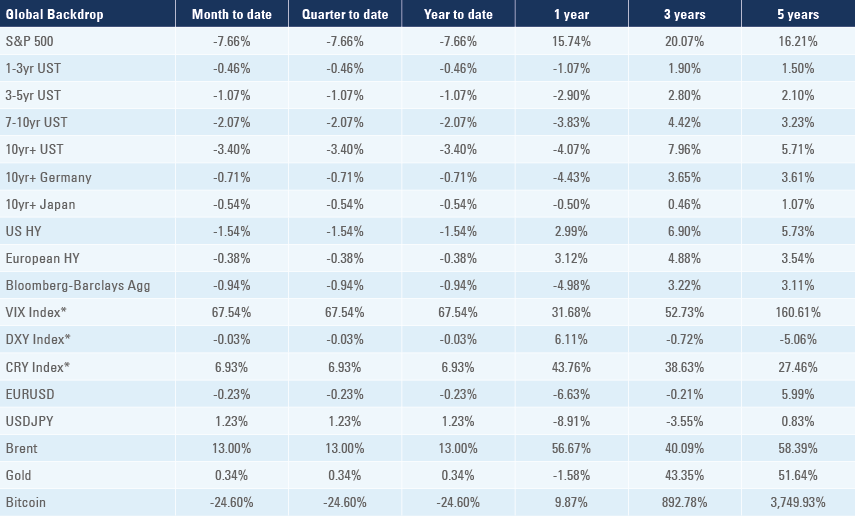

Yields on 10-year US Treasuries hit 1.9% before closing the week down 3bps at 1.76%, while 5y5y real interest rates closed at -0.08% (+39bps year to date) after reaching +0.07% during the week and 10-year German Bunds closed the week at -0.07% after hitting +0.02% (from -0.18% on 31 December).

The yields on US Treasuries tested new highs last week just as the US economy started to show signs it is slowing down, illustrated by the negative levels of the Citibank US economic surprise index and declining leading indicators such as PMIs and other sentiment surveys. After ignoring higher inflation and activity for all of 2021, “bond vigilantes” are focused on the Fed's narrative shift from "inflation is transitory" to "the economy is on solid footing", which seems to be again at odds with the reality in economic data. On top of the decline in leading indicators for economic activity, the ongoing sell-off in stocks that benefited from the pandemic rally (meme stocks, non-profitable tech, etc) as well as crypto assets is likely to lead to a negative wealth effect due to the steep losses these moves are causing to retail investors.

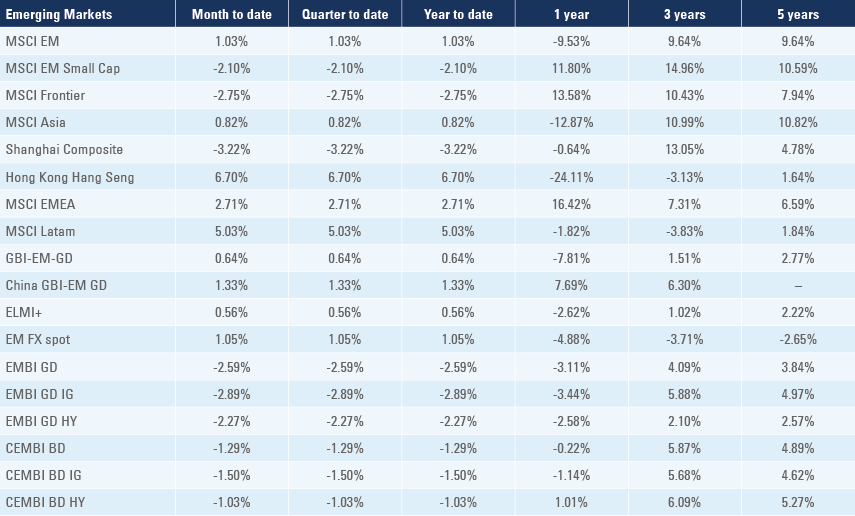

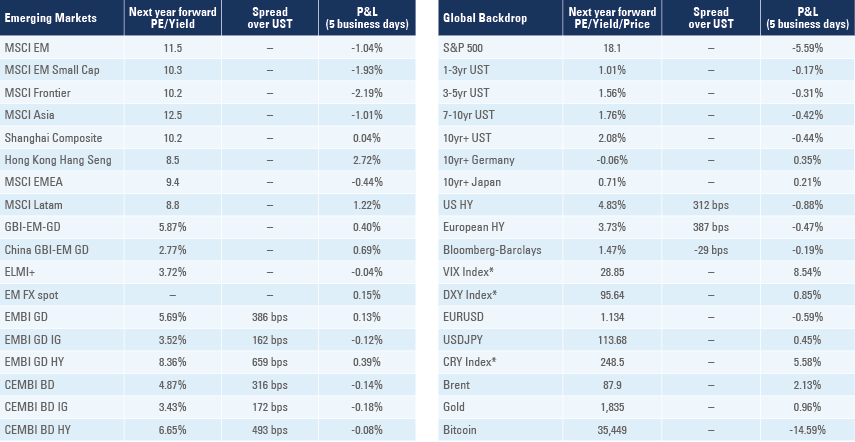

Crypto currencies lost almost half of their market value, reaching USD 1.6trn on 22 January 2022 from USD 3.0trn on 10 November 2021. Bitcoin has fallen 25% year to date and 50% from its November highs.1 Furthermore, the valuation of the large technology stocks in the US (NYFANG index) declined by USD 1.6trn (more than 10%) since its peak on 31 December. Higher US rates affected primarily US asset valuations, which did not stop declining even after rates retraced. Last week the S&P500 and the NASDAQ dropped 5.6% and 6.8% respectively, while the MSCI World declined 4.7% and the MSCI Emerging Markets (EM) only -1.0%. EM stocks are up 1.0% in 2022, outperforming the MSCI World, S&P500 and NASDAQ, which are down 6.4%, 7.7% and 11.5% respectively.

Despite the strong intraweek retracement, the rates market is still pricing the Fed fund rates to increase four times (25bps each) by the end of 2022. This seems excessive, in our view; particularly considering the Fed is inclined to start reducing the size of its balance sheet during the year. If the Fed hikes less than its currently priced to, this will likely to add downward pressure on the Dollar.

The US Dollar is flat over the year and EM currencies are up 1.1%. This is at odds with the common perception that the USD should strengthen during risk-off environments and during periods when US rates rise faster than the rest of the world, both attracting investors to perceived safe US Treasury bonds. The Dollar underperformance is explained by the huge amount of foreign investor exposure to US stocks. Data from the US Treasury shows foreign investors held USD 13.5trn worth of US stocks at the end of September 2021, more than twice the amount foreign investors had in US Treasuries (USD 6.6trn).

In our view, US stock market exceptionalism was mostly a function of five years of pro-cyclical fiscal expansion (Donald Trump corporate tax cuts in 2017 and Joe Biden’s overly generous stimulus in 2021) as well as more than 10 years of quantitative easing, which benefited primarily US stocks. Both pro-cyclical fiscal stimulus and quantitative easing will end in 2022 as the US government seeks to consolidate its fiscal accounts and US politicians urge the Fed to focus on inflation.

This will allow for the reversal of US stocks outperformance, a trend that is now almost 10-years old. The massive discrepancy in valuations of US stocks to the rest of the world is likely to make this a sustainable long-lasting trend, starting in 2022, in our view. In contrast, despite the recent outperformance, EM stocks remain extremely undervalued and are likely to outperform going forward

Emerging markets

Russia: Foreign Minister Sergey Lavrov met with his US counterparty Anthony Blinken last Friday to discuss the situation in Ukraine and the US-Russia bilateral relationship after a conference call between them earlier in the week. The meeting and following statements had a cordial tone. Lavrov reiterated Russia is not planning to attack Ukraine and that it was expecting a formal written response from the US in regards to demands laid earlier in the year, mostly related to taming the expansion of North Atlantic Treaty Organisation (NATO) on Russia’s western border. Blinken said he laid out several ideas to increase security on the eastern European border with Russia and that there is room for further conversations. Importantly, Blinken said the US will not support the return to an open door policy for NATO and that the US can facilitate the resumption of a Normandy Format talks involving Germany, France, Russia and Ukraine. Blinken also said that Russia shares the US sense of urgency in regards to reaching a non-proliferation of nuclear facilities deal with Iran.

Kazakhstan: The last four planes with CSTO troops left Kazakhstan last week. A number of family members of former president President Nursultan Nazarbayev resigned from their posts over the last days. Last week, Timur Kulibayev, the husband of Nazarbayev’s second daughter, resigned from the Atameken business association, which unites most of Kazakhstan’s industrial groups. Despite the high-profile resignations, Nazarbayev said last week he never left the country, contrary to rumours, and that President Tokayev will soon lead the Nur Otan Party and there was no conflict between the country’s elite.

Belarus: President Alexander Lukashenko set a constitutional referendum for the 27 February, giving legitimacy to the All-Belarussian People’s Assembly, which was created by Lukashenko, but has no constitutional powers. The referendum will also re-instate a two-term limit for president (cancelled by Lukashenko in 2004) but only from the referendum date, allowing the president to remain in power until 2035.

China: China is drafting nationwide rules to facilitate developers accessing funds from down payments on flats held in escrow accounts. Local authorities’ clampdown on escrow accounts could release as much as RMB 3.6trn (USD 570bn) to complete projects and pay suppliers. In other property news, the government will accelerate public affordable housing development, targeting 1.9m units in 2022 from 0.9m in 2021. The PBoC cut its 1-year and 5-years benchmark lending rates by 10 basis points to 3.7% and 4.6% respectively. The share of CNY transactions on the global payment Swift system rose to 2.7% in December from 0.7% in December 2020, the highest level since 2015, overtaking the JPY as the fourth largest currency in the system. The share of the USD rose to 40.5% from 38.7% one year ago, EUR was stable at 36.7%, GBP declined 0.6% to 5.9% and JPY dropped 1.0% to 2.6%.

Chile: President elect Gabriel Boric appointed the current Central Bank of Chile (BCCh) Governor Mario Marcel to the position of Minister of Finance. Marcel was BCCh governor since 2016 and was the director of the budget in the Ministry of Finance in 2000-2006 during the centre left government of Ricardo Lagos. Boric stressed the importance of maintaining fiscal responsibility, saying that each new permanent spend has to be matched with new permanent tax revenue. Boric’s 24 ministers feature a diverse and young team, incorporating more names from the centre-left parties outside Boric’s coalition than expected – a step to increase governability given the split congress.

Indonesia: The Bank Indonesia (BI) kept its policy rate unchanged at 3.5%, in line with consensus, but signalled it will hike the reserve requirement ratio by 150bps in March to 5.0%, followed by another 100bps hike in June and 50bps in September to remove excess liquidity in the banking system created by BI government bond purchases. The trade surplus dropped to USD 1.0bn in December from USD 3.5bn in November, as the yoy rate of export growth declined 15% to 35% yoy while import growth was down by 5% to 48% yoy.

Ghana: Fitch downgraded Ghana’s credit rating to ‘B-‘ from ‘B’ and kept a negative outlook citing the country’s loss of access to international capital markets in 2H 2021. The Finance Minister held calls with investors last week and pledged to cut spending by up to 20% if revenue targets are not met in 2022. Ghanaian bonds have underperformed on fears of the inability of the country to balance large debt stock and debt repayments with ongoing large fiscal deficits.

Snippets

- Angola: The rating agency Fitch upgraded Angola’s sovereign rating to ‘B-‘ with a stable outlook.

- Argentina: The trade surplus declined to USD 371m in December from USD 397m in November as both exports and imports rose by USD 0.5bn to USD 6.6bn and USD 6.2bn respectively, leading to a cumulative surplus of USD 14.8bn in 2021. The fiscal deficit narrowed to ARS 496bn in December from ARS 135bn in November.

- Brazil: Labour Party and former president Luis Inacio Lula da Silva confirmed he would like to have former Sao Paulo Governor Geraldo Alckmin – today a member of the Social Democrat (PSDB) Party – as his running mate. In economic news, economic activity rose 0.7% in November after declining 0.3% in October, in line with consensus.

- Bolivia: The central bank lent USD 6.2bn to seven state-owned companies, including USD2.9bn for the state electricity company and USD 1.5bn for the oil company to “promote the State’s objectives”.

- Colombia: The trade deficit widened to USD 2.0bn in November from USD 1.5bn in October as economic activity improved 0.3% to a yoy rate of 9.6% over the same period.

- Czech Republic: The yoy rate of PPI inflation declined 0.3% to 13.2% in December, 0.7% below consensus.

- Ecuador: Oil production normalised after pipeline disruptions lead to a temporary halt in December.

- Hungary: The central bank kept its 1-week deposit rate unchanged at 4.0%, in line with consensus.

- Malaysia: Bank Negara Malaysia kept its policy rate unchanged at 1.75%, in line with consensus. The yoy rate of CPI inflation dropped 0.1% to 3.2% in December.

- Mexico: The unemployment rate dropped 0.2% to 3.5% in December, slightly above consensus at 3.4%.

- Nigeria: The yoy rate of CPI inflation rose 0.2% to 15.6% in December, 0.8% above consensus.

- Poland: The yoy rate of core CPI inflation rose 0.6% to 5.3% (consensus 5.2% yoy) while PPI inflation rose 0.6% to 14.2% yoy (consensus 13.5% yoy) and average gross wages rose by 1.4% to 11.2% yoy. Governor Adam Glapinski said the National Bank of Poland is ready to raise rates more than the market predicts.

- Russia: The trade surplus rose to USD 21.1bn in November from USD 19.8bn in October as exports rose 2.4bn to USD 49.0bn while imports rose 1.1bn to USD 27.9bn. The fiscal surplus dropped to RUB 515bn in December from RUB 2,338bn in November, in line with consensus and the best December result in 10 years except for 2018 and 2019.

- South Africa: The yoy rate of CPI inflation rose 0.4% to 5.9% in December while core CPI rose 0.1% to 3.4% yoy over the same period. Mining production rose by 5.2% on a yoy basis in November from 2.2% yoy in October and retail sales increased by 1.9% mom from -1.3% mom over the same period.

- South Korea: The yoy rate of PPI inflation dropped 0.8% to 9.0% in December. January’s first 20-days of exports rose 22.0% on a yoy basis in from 22.0% yoy in December while imports dropped to 38.4% yoy from 42.1% yoy over the same period.

- Sri Lanka: The central bank hiked its deposit and lending policy rates by 50bps to 5.5% and 6.5%.

- Taiwan: Export orders rose by 12.1% yoy in December from 13.4% yoy in November, almost 5% above consensus as the unemployment rate was unchanged at 3.7%.

- Thailand: The trade balance moved to a USD 354m deficit in December from a USD 1.019m surplus in November, significantly below consensus as imports surged to 33.4% on a yoy basis (19.9% prior, 18.2% consensus) while exports rose by 24.2% yoy (24.9% prior, 16.4% consensus).

- Turkey: The Central Bank of Turkey kept its policy rate unchanged at 14.0%, in line with consensus. House prices rose by 50.3% yoy in November from 40.2% yoy in October and the fiscal balance moved to a TRY 145.7bn deficit in December from a TRY 32bn surplus in November, the worst monthly result in 16 years (since the inception of the series on Bloomberg).

- Uganda: The Head of the Bank of Uganda, Emmanuel Tumusiime Mutebile, died aged 72 after more than two decades in his position. Mubebile previously occupied important posts in the Finance Ministry and was a key architect of structural reforms in collaboration with the International Monetary Fund.

- Venezuela: The Spain-Venezuela Chamber of Industry and Commerce organised a phone call between foreign investors and Venezuela’s representative Patricio Rivera, which presented potential deals in the oil and tourism sectors and discussed new economic growth data.

Global backdrop

United States (US): Initial jobless claims rose to 286k in the week ending on 15 January from 231k in the previous week and mortgage applications rose 2.3% from 1.4% over the same period. Continuing claims rose to 1.64m in the week ending on 8 January from 1.55m in the previous weeks. Housing starts were unchanged at 1.7m in December while existing home sales dropped 0.3m to 6.2m over the same period. The NY state empire manufacturing survey dropped to -0.7 in January from 31.9 in December, but the Philadelphia Fed business survey rose to 23.2 from 15.4 over the same period.

Eurozone: The ECB Governor Christine Lagarde said her institution stands ready to respond to inflation if data requires and the ECB has reasons not to act as quickly as the Fed. The yoy rate of new car registrations dropped 22.8% in December from 20.5% yoy in November. The current account surplus jumped to EUR 23.6bn in November from EUR 19.4bn in October while construction output dropped 0.2% mom from +0.6% over the same period.

United Kingdom: The yoy rate of CPI inflation rose 0.3% to 5.4% in December, 0.2% above consensus as core CPI rose 0.2% to 4.2% yoy, or 0.3% above consensus. The unemployment rate dropped 0.1% to 4.1% in November while retail sales dropped 3.7% in December from 1.0% in November.

Japan: The Bank of Japan kept its overnight policy rate and 10-year yield target unchanged at -0.1% and 0.0% respectively, in line with consensus. The yoy rate of CPI inflation rose 0.2% to 0.8% while CPI ex-food and energy was unchanged at 0.5% yoy. The trade deficit narrowed to JPY 582bn in December from JPY 956bn in November.

Australia: The unemployment rate dropped 0.4% to 4.2% in December, lower than consensus as the labour force participation was unchanged at 66.1% of the population (66.2% consensus).

Canada: The yoy rate of CPI inflation rose 0.1% to 4.8% in December, in line with consensus.