Emerging Markets (EM) manufacturing Purchasing Managers’ Index (PMI) declined 0.7 to 51.3 in June. The Chinese monetary policy committee signalled monetary policy should remain accommodative. Ratings agency Fitch downgraded Colombia’s credit rating to below investment grade (IG). The Brazilian energy regulator hiked electricity prices by 52% and people took to the streets to protest against corruption. India announced a 2.8% of GDP fiscal stimulus. Economic activity was strong in Chile. South Korea submitted a proposal to parliament for additional spending of 1.6% of GDP. The central banks in Mexico and South Africa indicated future rate hikes. Inflation remained subdued in Indonesia. Turkey increased reserve requirements for foreign exchange (FX) deposits in order to encourage investors to buy more local currency.

| Emerging Markets | Next year forward PE/Yield | Spread over UST | P&L (5 business days) |

|---|---|---|---|

| MSCI EM | 13.2 | – | -1.66% |

| MSCI EM Small Cap | 12.1 | – | -0.08% |

| MSCI Frontier | 11.9 | – | 1.24% |

| MSCI Asia | 14.5 | – | -1.83% |

| Shanghai Composite | 11.6 | – | -2.31% |

| Hong Kong Hang Seng | 9.6 | – | -2.19% |

| MSCI EMEA | 10.2 | – | -0.38% |

| MSCI Latam | 10.4 | – | -1.69% |

| GBI-EM-GD | 5.00% | – | -0.75% |

| China GBI-EM GD | 3.18% | – | -0.43% |

| ELMI+ | 2.91% | – | -0.72% |

| EM FX spot | – | – | -0.91% |

| EMBI GD | 4.92% | 343 bps | 0.02% |

| EMBI GD IG | 3.17% | 163 bps | 0.25% |

| EMBI GD HY | 7.20% | 576 bps | -0.23% |

| CEMBI BD | 4.26% | 298 bps | 0.23% |

| CEMBI BD IG | 3.00% | 174 bps | 0.27% |

| CEMBI BD HY | 5.87% | 458 bps | 0.17% |

| Emerging Markets | Next year forward PE/Yield | Spread over UST | P&L (5 business days) |

|---|---|---|---|

| MSCI EM | 13.2 | – | -1.66% |

| MSCI EM Small Cap | 12.1 | – | -0.08% |

| MSCI Frontier | 11.9 | – | 1.24% |

| MSCI Asia | 14.5 | – | -1.83% |

| Shanghai Composite | 11.6 | – | -2.31% |

| Hong Kong Hang Seng | 9.6 | – | -2.19% |

| MSCI EMEA | 10.2 | – | -0.38% |

| MSCI Latam | 10.4 | – | -1.69% |

| GBI-EM-GD | 5.00% | – | -0.75% |

| China GBI-EM GD | 3.18% | – | -0.43% |

| ELMI+ | 2.91% | – | -0.72% |

| EM FX spot | – | – | -0.91% |

| EMBI GD | 4.92% | 343 bps | 0.02% |

| EMBI GD IG | 3.17% | 163 bps | 0.25% |

| EMBI GD HY | 7.20% | 576 bps | -0.23% |

| CEMBI BD | 4.26% | 298 bps | 0.23% |

| CEMBI BD IG | 3.00% | 174 bps | 0.27% |

| CEMBI BD HY | 5.87% | 458 bps | 0.17% |

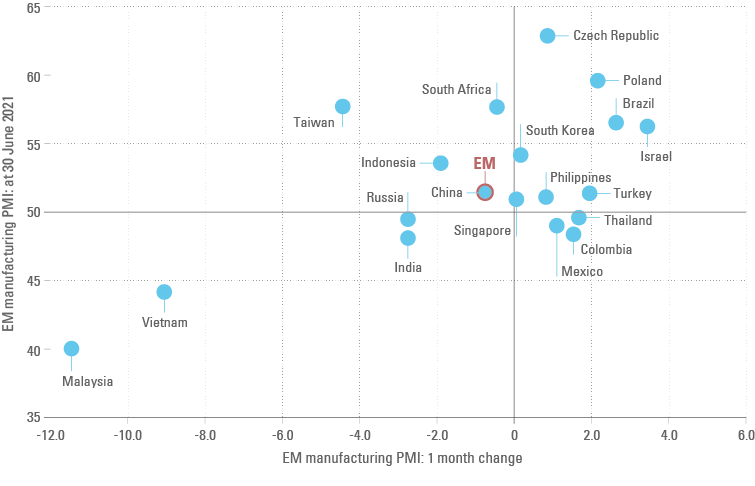

EM IHS Markit manufacturing PMIs: EM manufacturing PMIs declined 0.7 to 51.3 in June with significant dispersion across countries as illustrated in Figure 1. In Malaysia, Vietnam, Taiwan, Russia, and India PMIs declined more than 2.0 points, while they rose more than 2.0 points or more in Israel, South Africa, Brazil, Poland, and Turkey. Most EM countries (13 out of 21) remain above 50, a level associated with economic expansion, while Malaysia, Vietnam, India, Russia, Mexico, Colombia, and Thailand PMIs are below 50. China’s manufacturing PMI was down 0.7 to 51.3, in line with the broader EM manufacturing PMI index.

The modest pullback in EM PMIs is likely to be temporary, while mobility continues to improve across most of EM, a few countries adopted more stringent lockdowns in June including Indonesia, Malaysia, Philippines, Singapore, South Africa, South Korea, Taiwan, Thailand and Vietnam.

The pace of vaccinations in EM is now faster than in developed economies, which will soon enable the permanent removal of mobility restrictions, which should lead to a resurgence in PMIs across EM, in our view.1

Fig 1: EM manufacturing PMIs: most recent number versus 1 month change

China: The monetary policy committee of the People’s Bank of China (PBOC) stated that monetary policy should be flexible to take into account the uneven nature of the economic recovery and that the economy may need further strengthening. In other words, the central bank stands ready to ease policy if necessary. The International Monetary Fund (IMF) invited China’s PBOC Deputy Governor Li Bo to assume the Deputy Managing Director position, replacing Zhang Tao from 23 August. In economic news, the NBS manufacturing PMI declined 0.1 to 50.9, mostly due to a strong drop in purchasing prices (-11.6 to 61.2) as well as producer prices (-9.2 to 51.4). The Caixin services PMI declined to 50.3 in June from 55.1 in May. The sharp drop was led by a slowdown in small business activity in coastal regions following a small increase in Covid-19 cases and associated restrictions. In other news, the State Administration for Market Regulation proposed to fine companies up to 0.5% of annual sales for illegal e-commerce practices such as bid-data price discrimination, which is a practice by which companies set different prices for different consumers of the same product.

Colombia: Ratings agency Fitch downgraded Colombia’s sovereign credit rating to ‘BB+’. This was the second downgrade to sub-IG status by the big global credit agencies, which triggers Colombia’s exclusion from IG-only bond funds and associated outflows from passive investors. However, the downgrade was largely expected, so flows are expected to be modest, also offset by active investors purchases. The central bank kept the policy rate unchanged at 1.75%, in line with consensus expectations. The statement following the rate decision did not suggest that hikes are forthcoming, although the central bank did flag fiscal policy risks and increased their GDP growth outlook following a better than expected economic performance in spite of mobility restrictions. In other news, the unemployment rate rose 0.5% to 15.6% in May.

Brazil: The weekly central bank survey of market expectations showed that investors now expect 2021 real GDP growth of 5.1% (from 5.0%) and consumer prices index (CPI) inflation of 6.0% (from 5.9%). Inflation expectations are likely to increase further over the next weeks as the National Electricity Agency raised tariffs by 52%. The electricity system is heavily dependent on hydroelectric power. The worst drought in 111 years has forced energy companies to turn to more expensive thermoelectric generation, thus sparking the increase in prices. However, higher energy prices are likely to only have a temporary effect on inflation as prices are expected to decline again once the drought is over. Besides, higher prices should lead to lower consumption and less energy waste, thus helping to contain the crisis. In economic news, formal job creation rose by 281k in May from 121k in April (the consensus expectation was 151k). The latest number brings the 6-month moving average to 223k, which is the fastest pace since the inception of the series in 2003, underscoring the broad economic recovery underway in Brazil. The trade surplus rose to 10.4bn in June from USD 9.3bn in May, in line with consensus expectations. Industrial production (IP) rose 1.4% in May after declining 1.5% in April, also in line with consensus expectations.

The ratio of net debt to GDP improved to 59.7% in May from 60.5% in April. This was a whole 1% of GDP better than the consensus expectations as tax collections surprised to the upside. The May primary deficit of BRL 15.5bn was better than expected (BRL 18.5bn). In political news, thousands of people took to the streets across the country to demand the impeachment of President Jair Bolsonaro whose government stands accused of corruption in the purchase of Covid-19 vaccines from India.

India: The government announced another fiscal stimulus package targeting the worst hit sectors, particularly low-income households. At INR 6.3trn (2.8% of GDP), the fiscal package is large, but the net cash outflow is only INR 1.3m (0.6% of GDP) as the bulk of the support is in the form of credit guarantees. India’s fiscal deficit declined to INR 445bn in May from 787bn in April, thanks mainly to better tax receipts. In other economic news, the current account deficit widened to USD 8.1bn in Q1 2021 from USD 2.2bn in Q4 2020. This was slightly wider than the consensus expectation. The trade deficit widened to USD 9.4bn in June from USD 6.3bn in May. The services PMI contracted to 41.2 in June from 46.3 in May.

Chile: The yoy rate of economic activity accelerated to 18.1% in May from 14.1% in April, while retail sales surged 72.1% yoy from 44% yoy over the same period (22% higher than May 2019). The yoy rate of manufacturing production rose 8.9% in May from 5.9% in April and the unemployment rate declined 0.2% to 10.0% over the same period.

South Korea: The government put forward an additional fiscal stimulus of KRW 33trn (1.6% of GDP), funded by excess tax revenue. The stimulus targets education, vaccine purchases, preventative measures, employment support measures as well as direct payments to individuals in the bottom 80% of the income distribution. In economic news, the yoy rate of export growth declined to a still very solid 39.7% in June from 45.6% yoy in May, better than consensus expectations. IP disappointed by declining 0.7% mom in May after declining 1.6% in April, mainly due to slower auto production. The yoy rate of CPI inflation declined to 2.4% in June from 2.6% yoy in May, while the core rate of CPI inflation was unchanged at 1.5% yoy.

Mexico: The Central Bank of Mexico (Banxico) Deputy Governor Jonathan Heath said he would consider raising the policy rate further if inflation does not slow to near 5% in H2 2021. The statement increases the chances of further rate hikes as inflation is likely to remain high, in our view. Remittances from abroad rose to USD 4.5bn in May from USD 4.1bn in April, equivalent to a yoy growth rate of 31.0%. The trade surplus narrowed to USD 0.3bn in May from USD 1.5bn in April.

South Africa: The South Africa Reserve Bank (SARB) Deputy Governor Kuben Naidoo signalled rate hikes ahead saying, “There is no contradiction between hiking rates and having accommodative monetary policy. At the moment rates on a forward-looking basis are quite highly negative – even if we hike by 50bps, they remain negative. We can’t keep interest rates at 3.5% forever”.

Indonesia: The yoy rate of CPI inflation declined to 1.3% in June from 1.5% yoy in May, surprising consensus expectations to the downside, while the yoy rate of core CPI inflation rose to 1.5% compared to 1.4% in May. The Indonesian government placed Java and Bali under the strictest mobility restrictions in order to control a recent surge in Covid-19 cases.

Turkey: The Central Bank of Turkey (CBT) increased the reserve requirement ratio (RRR) for FX deposits across all maturity brackets by 200bps to an average of 19.2%. At the same time, the CBT increased the remuneration for banks that convert FX deposits to TRY. The policies are intended to support the currency by incentivising banks to offer higher deposit rates in TRY and lower deposit rates in USD, currently at 18.8% and 1.2% respectively. However, inflation remains elevated, which may lead to further expectation of FX depreciation. June’s yoy CPI inflation print was 17.5% versus 16.8% expected. In other news, the energy market regulator announced a 15% increase in electricity tariffs due to higher input costs.

Snippets

Angola: The central bank hiked its policy rate to 20.0% from 15.5%.

Belarus: Ratings agency S&P affirmed Belarus’ sovereign rating at ‘B’.

Ecuador: The United States (US) agreed to donate 2 milion doses of Pfizer vaccine to Ecuador as part of a plan to donate 14 million doses to Latin America. Ecuador has sourced another 2.1 million doses from other sources, which means that Ecuador now has vaccines to cover 97% of the population.

Malaysia: The trade surplus narrowed to MYR 13.7bn in May from MYR 26.7bn in April, below consensus expectations. The smaller surplus suggests the impact of the second lockdown was not as severe as expected with imports holding up.

Peru: The yoy rate of CPI inflation in Lima reached 3.3% in June from 2.5% yoy in May with food prices accounting for more than 2/3 of the inflationary pressures. The yoy rate of core CPI inflation rose by a more modest 20bps to 1.9% in June.

Russia: Household inflation expectations rose to a yoy rate of 11.9% in June from 11.3% yoy in May. The Central Bank of Russia (CRB) Governor Elvira Nabiullina maintained a hawkish tone, stating CBR will consider a further 25bps to 100bps of rate hikes at the next meeting scheduled for 23 July.

Thailand: IP surged to a yoy rate of 25.8% in May from 18.0% in April. The yoy rate of CPI inflation declined to 1.3% in June from 2.4% yoy in May, while the rate of core CPI inflation was unchanged at 0.5% yoy.

Uruguay: The government submitted a budget proposal with a primary deficit of 0.4% of GDP for 2022 and revised the 2021 primary fiscal deficit target to 2.2% of GDP from the previous target at 0.9% of GDP. The government expects real GDP growth of 3.5% in 2021 and 2.9% in 2022.

Global backdrop

Global taxation: A group of 130 countries agreed to introduce a global effective minimum tax rate for corporations of at least 15% from 2023. The main objective of the global tax is to counter the practice by multinational corporations of registering valuable intellectual property, copyright, or trademarks in low tax jurisdictions.

ESG: The European Union (EU) is discussing new proposals for the revamp of the EU emission trading system (ETS), which could result in higher costs for greenhouse gas emitters over the next decade. The aim is to help the EU achieve its target of cutting emissions by at least 55% by 2030, relative to 1990 emission levels. The changes, which are likely to be applied in 2026, include cutting the emissions cap and then further accelerating the cut in the cap every year going forward. The reform is also likely to increase the number of sectors within the emission trading system as well as a reduction in the number of free emission permits. The precise scale and time frame for the cuts in the emission cap are likely to be announced on 14 July.

In China, the Tsinghua University Professor Zhang Xiliang, a climate change expert, said the Chinese carbon market expansion would cover eight industries over the next five years. Next year the cement and electrolytic aluminium industries will be added. China’s steel and chemicals industries are likely to be included.

Trading of carbon and other greenhouse gas emissions is the single most important instrument for achieving the net-zero emissions goal by 2050, in our view. Important stakeholders in the industry share this view, including Exxon CEO Darren Woods who wrote in a blog post “We believe a price on carbon emissions is essential to achieving net zero emissions”.

Commodities: Data from the Organisation of Petroleum Exporting Countries (OPEC) showed that demand currently exceeds supply by some 1.9 million barrels of oil per day (bpd). United Arab Emirates (UAE) blocked an OPEC+ deal brokered between Saudi Arabia and Russia to increase output. UAE is demanding better terms, including increased output from its current production cap of 3.2 million bpd. Last week, crude oil prices rose above USD 75 per barrel for the first time in three years, a sign that market players still believe a new OPEC agreement may keep the oil market tight until the end of 2022.2

United States: Richmond Fed President Barkin – a centrist within the Federal Open Markets Committee (FOMC) – reiterated that the FOMC would remain data dependent. Hence, “if the numbers hit, great. If they don’t, we’ve got time.” On inflation, he said, “when the supply-chain shortages and prices are going to come down, I think there’s going to be a period where the numbers actually go backwards rather than forward.”

In economic news, the US June non-farm payroll number was 850k, up from 583k in May and exceeding consensus expectations by 70k. Furthermore, initial jobless claims declined to 364k on 26 June from 415k in the previous week. However, the US unemployment rate rose to 5.9% in June from 5.8% in May and fell significantly short of expectations (5.6%). Average hourly earnings rose at a yoy rate of 3.6% in June from 1.9% in May, in line with consensus. Future activity surveys improved as the Conference Board’s consumer confidence index rose to 127.3 from 120.0, which is the highest level since December 2019. However, ISM manufacturing declined 0.6 to 60.6 in spite of prices paid rising 4.1 in June to a record high of 92.1. Housing data was mixed, with pending home sales rising 8.0% in May after declining 4.4% in April, but mortgage applications declined 6.9% in the week ending on 25 June. Factory orders and durable goods orders rose 1.7% and 2.3% respectively in May, in line with consensus expectations. Credit card spending data from Bank of America rose 19% on a 2-year basis in the week ending in 26 June, mostly due to a surge in spending on services, consistent with the observed lifting of lockdown restrictions.

Europe: The yoy rate of core CPI inflation declined 0.1% to 0.9% in June, while retail sales rebounded 4.2% in May after declining 6.8% in April, supported by economic reopening.

United Kingdom: The number of Covid-19 cases increased to 360 cases per million on a 7-day rolling average basis, which is the same magnitude as at the peak of the third wave in November 2020. This latest peak is due to the spread of the more contagious delta variant. However, the number of deaths remains low, confirming the effectiveness of vaccines.

1. See http://www.ashmoregroup.com/insights/research/another-week-hawkish-surprises-and-faster-vaccinations-em

2. See https://corporate.exxonmobil.com/News/Newsroom/News-releases/Statements/Our-position-on-climate-policy-and-carbon-pricing

Benchmark performance

| Emerging Markets | Month to date | Quarter to date | Year to date | 1 year | 3 years | 5 years |

|---|---|---|---|---|---|---|

| MSCI EM | -1.37% | -1.37% | 5.96% | 35.25% | 11.46% | 12.97% |

| MSCI EM Small Cap | -0.45% | -0.45% | 19.33% | 59.24% | 12.85% | 11.90% |

| MSCI Frontier | 0.34% | 0.34% | 15.38% | 38.62% | 9.36% | 9.44% |

| MSCI Asia | -1.67% | -1.67% | 4.58% | 33.67% | 12.13% | 14.32% |

| Shanghai Composite | -2.00% | -2.00% | 2.34% | 16.33% | 10.79% | 6.09% |

| Hong Kong Hang Seng | -2.32% | -2.32% | -1.67% | 6.17% | 1.76% | 7.31% |

| MSCI EMEA | 0.26% | 0.26% | 16.48% | 34.85% | 6.55% | 7.51% |

| MSCI Latam | -0.09% | -0.09% | 8.94% | 39.58% | 6.12% | 6.05% |

| GBI-EM-GD | -0.38% | -0.38% | -3.74% | 5.17% | 4.32% | 3.09% |

| China GBI-EM GD | -0.35% | -0.35% | 2.74% | 10.72% | na | na |

| ELMI+ | -0.37% | -0.37% | -0.98% | 5.82% | 2.22% | 2.23% |

| EM FX spot | -0.35% | -0.35% | -1.92% | 3.49% | -2.72% | -2.93% |

| EMBI GD | -0.05% | -0.05% | -0.71% | 6.59% | 6.71% | 4.73% |

| EMBI GD IG | -0.04% | -0.04% | -2.49% | 2.28% | 7.86% | 4.94% |

| EMBI GD HY | -0.06% | -0.06% | 1.36% | 11.87% | 5.35% | 4.45% |

| CEMBI BD | 0.07% | 0.07% | 1.35% | 8.54% | 7.53% | 5.72% |

| CEMBI BD IG | 0.07% | 0.07% | -0.07% | 5.21% | 7.07% | 4.83% |

| CEMBI BD HY | 0.08% | 0.08% | 3.28% | 13.24% | 8.10% | 7.06% |

| Global Backdrop | Month to date | Quarter to date | Year to date | 1 year | 3 years | 5 years |

|---|---|---|---|---|---|---|

| S&P 500 | 1.30% | 1.30% | 16.73% | 41.21% | 19.03% | 17.87% |

| 1-3yr UST | 0.02% | 0.02% | -0.07% | 0.09% | 2.73% | 1.60% |

| 3-5yr UST | 0.08% | 0.08% | -0.96% | -0.78% | 4.24% | 2.06% |

| 7-10yr UST | 0.23% | 0.23% | -3.16% | -4.03% | 5.98% | 2.28% |

| 10yr+ UST | 0.46% | 0.46% | -7.50% | -9.86% | 8.19% | 2.98% |

| 10yr+ Germany | 0.40% | 0.40% | -6.42% | -3.38% | 4.29% | 1.35% |

| 10yr+ Japan | 0.39% | 0.39% | 0.08% | 0.89% | 1.06% | -0.61% |

| US HY | 0.20% | 0.20% | 3.82% | 14.76% | 7.59% | 7.43% |

| European HY | 0.06% | 0.06% | 3.53% | 11.91% | 4.58% | 4.69% |

| Bloomberg-Barclays Agg | 0.03% | 0.03% | -3.18% | 2.55% | 4.31% | 2.29% |

| VIX Index* | -4.80% | -4.80% | -33.76% | -45.56% | 0.67% | -3.27% |

| DXY Index* | -0.11% | -0.11% | 2.66% | -4.98% | -2.18% | -3.99% |

| CRY Index* | 0.74% | 0.74% | 28.10% | 52.89% | 9.56% | 13.34% |

| EURUSD | 0.00% | 0.00% | -2.94% | 4.85% | 1.43% | 7.06% |

| USDJPY | 0.01% | 0.01% | 7.62% | 3.51% | 0.43% | 9.22% |

| Brent | 1.20% | 1.20% | 46.78% | 77.64% | -1.76% | 58.53% |

| Gold | 0.97% | 0.97% | -5.86% | 0.14% | 42.08% | 31.77% |

| Bitcoin | -1.23% | -1.23% | 17.81% | 278.98% | 424.93% | 4999.08% |

*VIX Index = Chicago Board Options Exchange SPX Volatility Index. *DXY Index = The Dollar Index. *CRY Index = Thomson Reuters / CoreCommodity CRM Commodity Index.

Source: Bloomberg, JP Morgan, Barclays, Merrill Lynch, Chicago Board Options Exchange, Thomson Reuters, MSCI, total returns.

Figures for more than one year are annualised other than in the case of currencies, commodities and the VIX, DXY and CRY which are shown as percentage change.