- EM assets performed well in February in the face of tariffs and geopolitical uncertainties.

- Odds of a ceasefire in Ukraine increased after the US hawkish stance against its traditional EU allies drove real change.

- Good economic and fiscal numbers from India.

- Malaysia moved ahead with fiscal consolidation, while questions remained in Indonesia.

- Argentina’s short-term debt rollover increased, signalling tighter policy to boost FX reserves.

- Costa Rica positive outlook, Mexico announced reforms at Pemex.

- Hungary sought to slow food inflation as Romania announced large external borrowing plans.

- Angola to issue Eurobonds, Lebanon government confirmed in parliament.

- The Kurdish PKK group declared a ceasefire in the war with Türkiye.

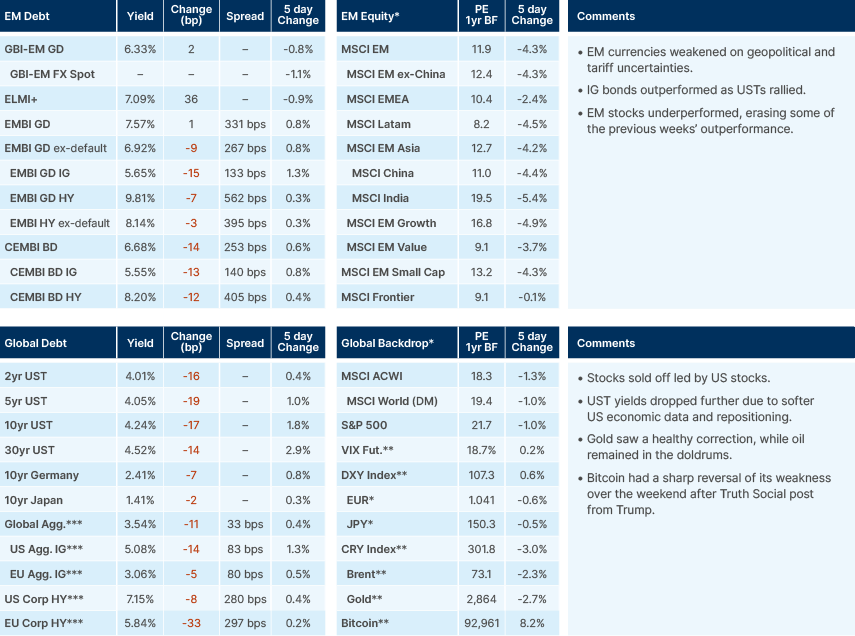

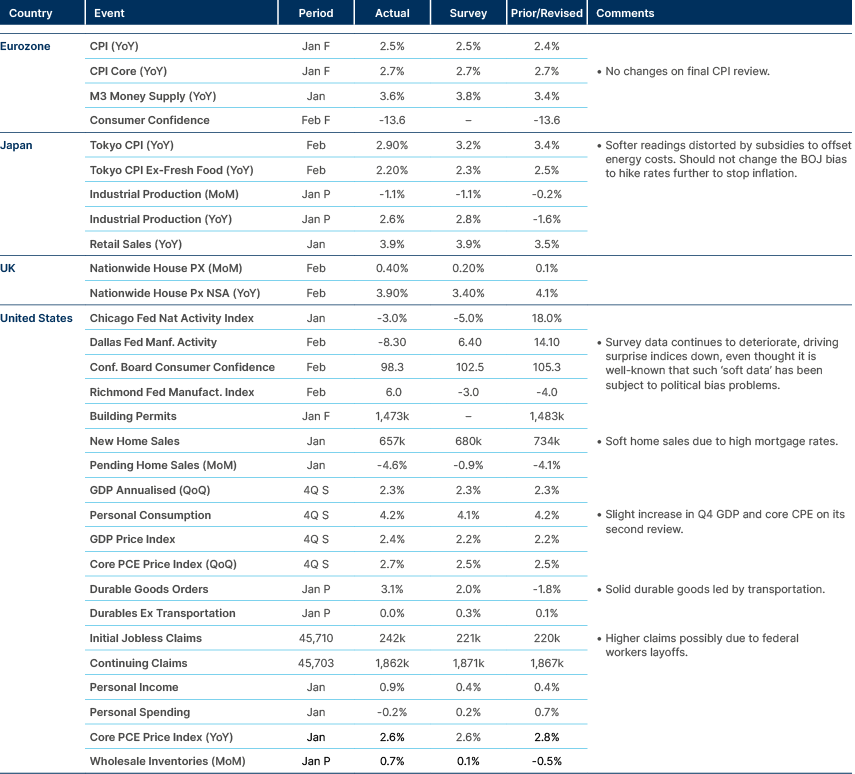

Last week performance and comments

Global Macro

Global equity and fixed income markets continue to be shaped by a confluence of tariff policy, monetary policy recalibrations, and evolving geopolitical risks. The US administration’s intention to impose reciprocal tariffs is not priced, as most investors have been discounting tariff policy as noise.

While we remain of the view that significant and long-lasting tariffs against Mexico and Canada are unlikely, we may see tariffs implemented for leverage purposes. US Secretary of Commerce Howard Lutnick said tariffs will be implemented tomorrow (4 March), but the magnitude is unclear. The 10% additional tariff against China, and reciprocal tariffs targeting Europe, are far more likely to stick in the short-term, in our view. Treasury Secretary Scott Bessent said Canada should follow Mexico in considering increasing tariffs on Chinese goods to stop re-exports from China hitting the US. We still believe an 8-12% increase in tariffs with a larger weight on primary and intermediate goods (i.e., steel and aluminium) is likely as a means of increasing tax revenues.

Europe could respond to reciprocal tariffs with more policy stimulus, led by the European Central Bank (ECB). Bloomberg’s dynamic stochastic general equilibrium (DSGE) model suggests that a 10% tariff could depress Euro area gross domestic product (GDP) growth by 70 basis points (bps) to only 0.3% yoy in Q4 2025, inflation would drop by 20bps to 1.5% and the ECB would cut its policy rate by 50bps more than on a baseline scenario to 1.65% (100bps cut from today). On the other hand, Reuters reported economists have advised the German government on a USD 400bn fund for defence and a EUR 400-500bn for infrastructure, presumably focused on energy. This leaves us with a defensive stance on the EUR in the short-term due to tariff risk, but a more constructive stance on European assets (including the EUR) over the medium term, as defence and infrastructure capex are likely to stimulate the economy and to support higher equilibrium interest rates.

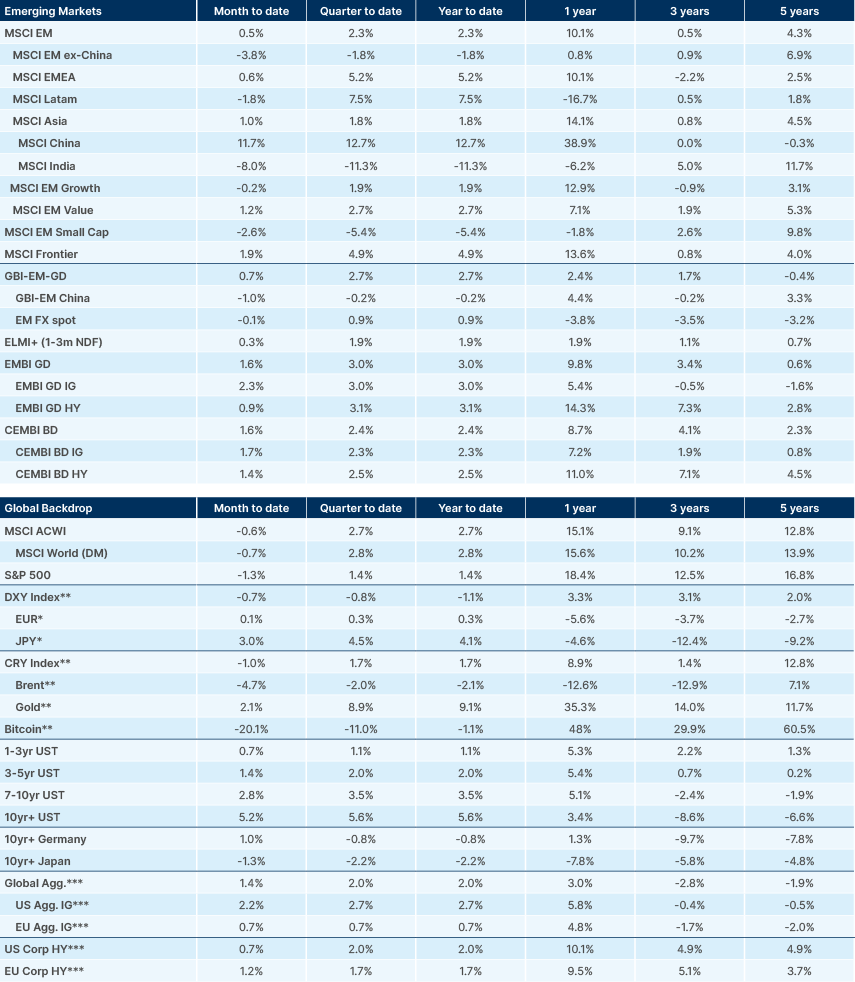

Economic activity has been consistently surprising to the downside in the US, which alongside with expectation of significant fiscal adjustments from the Department of Government Efficiency (DOGE), is leading yields on US Treasuries lower. In our view, this move is likely to have more legs as the uncertainty surrounding tariff disruptions and geopolitics weighs on US asset prices, which started the year at very elevated levels. Some surveys are now showing an extraordinarily negative sentiment to equities, which usually coincides with a major drawdown (contrarian indicator) rather than the small correction we have had so far. Cash levels from fund managers are very low and retail positioning in stocks is quite elevated. We remain of the view that US stocks have much more left tail asymmetry, while stocks in the rest of the world have more upside. The price action year-to-date has corroborated this view, with European and emerging market (EM) stocks outperforming the US, despite the poor performance of EM Asia ex-China and Latin America in February.

EM debt has also outperformed year-to-date, with sovereign, local currency and corporate bonds up 3.0%, 2.7% and 2.4%, respectively, against the Bloomberg Global Agg up 2.0% and EU and US high yield (HY) up 1.7% and 2.0%, respectively.

Geopolitics

The disastrous meeting between Ukraine President Volodymyr Zelenskyy, US President Donald Trump and Vice-President JD Vance left analysts with the impression that the US will indeed seek to disengage from European geopolitics, siding with Russia to force an end to the conflict. In the short term, the Munich Security Conference and the meeting on Friday have been a key catalyst for more European unity on security and infrastructure matters. Overall, despite the uncertainties, the likelihood of a ceasefire in Ukraine is increasing. It is also very likely that the balance of power in Europe will change for good. It is also still possible that a more ambiguous American attitude encourages the Europeans into action while keeping the Russians from attacking after a ceasefire in Ukraine. A more permanent peace deal in Ukraine is harder to imagine now, as there will be many unanswered questions and uncertainties, but it is hard to dismiss the much higher ceasefire odds that are priced into several assets, including European stocks and Ukrainian bonds.

Emerging Markets

Asia

Korean exports soften. Korea and Thailand cut policy rates.

India: The fiscal deficit widened by 6.1% yoy to INR 11.7trn between April and January of FY25. The government primarily financed this shortfall through domestic borrowing, securing INR 11.4trn from the local market. Tax receipts overall rose modestly by 1.3% to INR 19trn despite a 0.6% yoy decline in corporate tax collections, as personal income tax receipts rose 21.9% to INR 9.1trn.

Total expenditure rose 6.4% yoy to INR 35.7trn as the government ramped up capital expenditure in the second half of the fiscal year, pushing total capex to INR 7.5 trillion, a 5% yoy increase. Revenue expenditure also saw a 6.8% rise to INR 28.1trn, indicating an overall acceleration in government spending. The government remains on track to meet its fiscal deficit target of 4.6% of GDP for FY25, a revision from the earlier 4.9%.

The economy showed renewed momentum in Q3 FY25, with GDP expanding by 6.2% yoy, rebounding from the previous quarter’s two-year low of 5.4%. This resurgence was primarily driven by increased government spending, improved manufacturing output, and strong agricultural growth. Private consumption also showed signs of recovery, buoyed by robust rural demand. The latest figures align closely with market expectations, reinforcing optimism about India’s economic trajectory.

Indonesia: The state power utility PLN confirmed that the electricity tariff discount for low-consumption households will end in March, bringing tariffs back to December 2024 levels. The government had introduced a 50% tariff cut in January and February to cushion the impact of a 1% VAT hike on 1 January. The temporary measure had significantly lowered inflation, with consumer price index (CPI) inflation falling to 0.8% yoy in January and -0.1% in February as utility prices dropped.

Meanwhile, President Prabowo Subianto vowed to act on the corruption case involving state oil company Pertamina. Speaking at the Democratic Party's annual conference, he reaffirmed his commitment to upholding the law. The Attorney General recently charged seven individuals—four executives from Pertamina subsidiaries and three private businessmen—in a USD 12.3bn corruption case linked to crude oil trading at unfavourable prices and export losses. Separately, trade unions are planning protests on Friday, not only against the Pertamina scandal, but also to demand stronger worker protections against layoffs. Despite the pressures, it is unlikely the government will reverse its labour market reforms enacted by Jokowi on the omnibus law on investment.

Malaysia: The federal fiscal deficit narrowed by 5.2% yoy to MYR 8.5bn in January, as revenue growth (6.0% yoy to MYR 24.1bn) outpaced expenditure (up 2.8% yoy to MYR 32.5bn). The government remains focused on reducing the budget gap to 3.8% of GDP in 2025 from 4.1% in 2024.

South Korea: A Gallup Korea poll conducted between 25-27 February showed that 62% of moderates want the opposition to win the next presidential election, with 70% supporting President Yoon Suk Yeol’s impeachment. Moderates, who make up 42% of the electorate, are key to election outcomes. Nationally, 59% back impeachment and 51% favour a change in government, while conservative voters remain loyal to Yoon.

Party ratings remain close, with the opposition Democratic Party (DP) at 38% and the ruling People Power Party (PPP) at 36%, within the 3% margin of error. However, DP leader Lee Jae-myung is the clear frontrunner for the presidency, polling at 35% against 10% for the leading PPP candidate, Kim Moon-soo. Even with all conservative candidates combined, their support stands at just 23%.

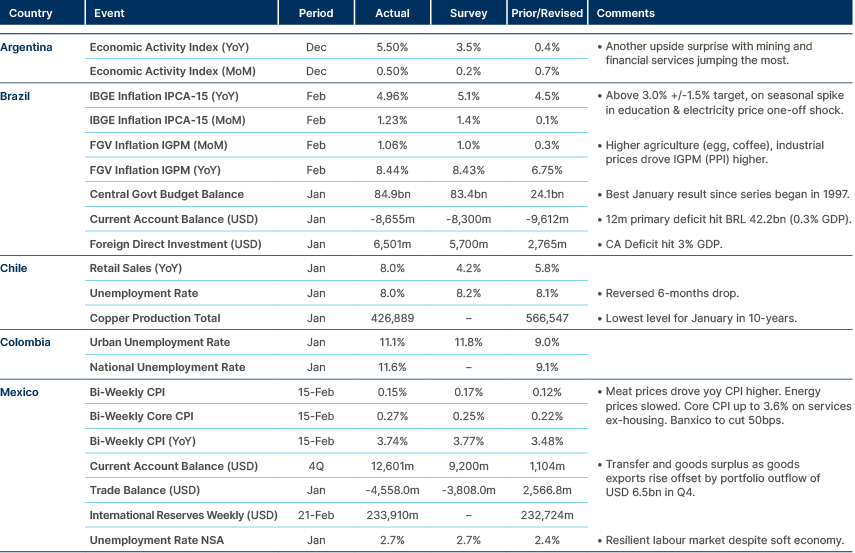

Latin America

Mixed inflation data. Argentina economy jumped in December.

Argentina: The Supreme Court controversy increased as Manuel García-Mansilla was sworn in through a secretive presidential decree bypassing constitutional procedures. His appointment, alongside Ariel Lijo’s upcoming swearing-in, shifts the Court’s balance of power back to Ricardo Lorenzetti after a decade of independent progressive control. While legal experts debate whether the Senate can reverse these appointments, Milei’s move risks setting a dangerous precedent, allowing future administrations to reshape the court via executive decree when Congress is in recess.

Meanwhile, Rio Tinto submitted a USD 2.7bn lithium project for Argentina’s Large Investments Regime (RIGI), aiming to extract 60k tons of battery-grade lithium per year from the Rincon salt flat. The company plans to use water-conserving direct lithium extraction and targets first production by 2028. Only one project has been approved under RIGI so far. The programme offers tax benefits, regulatory stability, and special foreign exchange (FX) access, shielding investors from capital controls.

On the monetary front, Argentina’s economy ministry secured 165% T-bill rollover by paying above-market rates, with short-term yields now exceeding inflation by 5% annually. This move absorbs liquidity while enticing agriculture exporters to sell dollars ahead of schedule. The government’s strategy aims to balance monetary control, a 1% mom crawling peg, and FX reserve accumulation.

Brazil: The central government posted a record BRL 84.9bn primary surplus in January, bringing the one-year deficit to BRL 42.2bn (0.3% of GDP). Rising tax revenues, particularly from imports and corporate taxes, drove the surplus, while spending rebounded after two declines. The government’s 2025 fiscal target remains a zero deficit, but uncertainty persists over revenue assumptions and potential spending cuts. Pressure on Finance Minister Fernando Haddad is mounting as President Lula’s approval rating declines, increasing political risks ahead of 2026.

Haddad reiterated that a balanced 2025 budget would support inflation control and lower interest rates. He expects FX appreciation and a record harvest to ease price pressures from March onward but admitted that compensating for expanded income tax exemptions will be difficult. The 2025 budget vote in March will provide clarity on fiscal measures, but structural reforms to curb debt remain unlikely, as Lula’s government prioritises short-term economic sentiment over long-term fiscal stability.

Chile: BHP will submit a USD 2bn project to optimise its Escondida copper concentrator, as part of a USD 10bn investment plan. Finance Minister Mario Marcel urged more foreign firms to reinvest. The finance ministry raised its 2025 deficit forecast to 1.7% of GDP, citing weak revenue. Spending cuts were pledged, with details due in April, but major reductions seem unlikely in an election year.

Colombia:

President Gustavo Petro’s approval fell to 32% in February, with disapproval rising to 63%, as opposition to his policies grows. Support among young and low-income voters has collapsed, with youth approval dropping to 44% and lower-income support to 33%. Facing a governing crisis, corruption scandals, and stalled reforms, Petro has reshuffled his cabinet, but prospects for his agenda remain bleak.

Costa Rica: Fitch reaffirmed Costa Rica’s BB rating and upgraded its outlook to ‘positive’, citing strong growth, a better external position, declining debt, and fiscal surpluses. GDP is forecast to grow 3.8% in 2025, with inflation rising to 1.7%, aligning with the central bank’s target. Despite a wider 2024 deficit (3.8% of GDP), fiscal consolidation is expected to be gradual, driven by lower interest costs and a shrinking wage bill. Debt fell below 60% of GDP, improving fiscal space. Fitch sees no major financing risks, but warns that political gridlock and election uncertainty could hinder reforms.

El Salvador: The International Monetary Fund (IMF) approved a USD 1.4bn ( agreement for El Salvador unlocking an immediate USD 113mn disbursement and paving the way for USD 3.5bn in additional multilateral funding. Strong remittances, tourism, and improved security are driving growth, while Bitcoin-related risks have been addressed, resolving a key IMF concern. The deal requires a 3.5% GDP fiscal adjustment over three years, with spending cuts already underway.

Mexico: Congress lowered Pemex’s tax burden, setting a 30% fixed tax rate for hydrocarbons. The reform eases the firm’s liquidity crisis, and simplifies its tax structure, aiding private-sector partnerships. The opposition claims this will squeeze public finances, with an estimated MXN 50bn revenue loss. The squeeze may well be offset by lower government capital injections, which became a norm in recent years, but highlights the need for a broader tax reform the government has yet to address.

In other news, Mexico extradited 29 drug lords, including Rafael Caro Quintero, wanted for the 1985 murder of a Drug Enforcement Administration (DEA) agent. The move, a win for the US, comes amid tariff threats from Washington. The move may be seen as politically low risk for President Claudia Sheinbaum, but it could fuel violence, especially in Sinaloa, where cartel tensions are already high.

Panama: President José Raúl Mulino will delay a decision on the Cobre Panama copper mine until pension reform is settled, mine supplier Abel Oliveros told local media. With no clear government strategy, the issue remains tied to political and legal battles. The pension reform, delayed since December, may pass by Q1’s end, while arbitration with First Quantum Minerals is pushed to February 2026. The mine’s fate hinges on environmental audits expected in 2025.

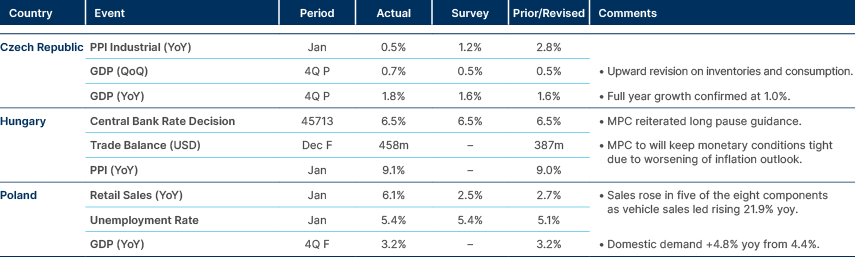

Central and Eastern Europe

Hawkish statement by Hungary’s MPC. Poland data was solid.

Czech Republic: The central government debt rose by CZK 31.3bn in Q4 2024, reaching CZK 3.37tn (42% of GDP). Debt grew 8.2% in 2024, mainly through long-term securities and loans. A total of 47.2% of debt matures within five years, but external exposure remains low at 6.4%. The government continues to prioritise long-term bonds as borrowing costs stay elevated.

Hungary: Concerns grow over fiscal slippage ahead of elections as PM Office head Gergely Gulyás said the government is preparing an action plan to curb food inflation, including market protection, profit restrictions, and bureaucracy cuts. If ineffective, price caps could be introduced by April. VAT refunds for pensioners will roll out in H2 2025. The government insists its 3.7% deficit target for 2025 is sustainable, though 2026’s deficit is now projected at 3.5%, above earlier plans to stay below 3%.

Kazakhstan: The VAT hike will slow GDP growth by 0.4% in 2026 but will have only a short-term impact, according to the economy ministry. The reform is expected to raise inflation by 2.5-3% by end-2026, with officials insisting it will stabilise by 2027. The government plans to offset the slowdown with state investment, but businesses worry of a longer-lasting downturn.

Romania: Romania’s no-confidence motion against Prime Minister Marcel Ciolacu failed, with only 147 votes, fewer than the nationalist parties hold. The ruling coalition remains solid, while nationalists appear divided after the vote. The move seems aimed at keeping anti-establishment sentiment alive ahead of the elections re-run. The finance ministry plans to borrow RON 150bn and EUR 17bn in 2025. Foreign borrowing will include EUR 13bn in Eurobonds, EUR 3bn from the EU recovery fund, and EUR 1bn from international financial institutions).

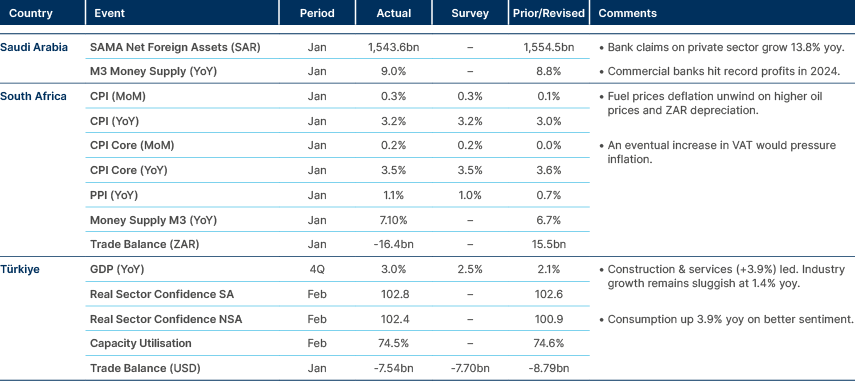

Central Asia, Middle East, and Africa

South Africa inflation stays low. Türkiye’s growth accelerates.

Angola: President João Lourenço approved a USD 4bn sovereign debt issuance for 2025, including USD 3bn in Eurobonds and USD 1bn in Japanese bonds, doubling initial plans. The government aims to raise USD 7.6bn in external funding this year. In December, Angola issued USD 2bn in Eurobonds to secure a USD 1bn JP Morgan loan at 11% yield, maturing in 2030.

Egypt: The country reportedly rejected an Israeli proposal to administer Gaza for 15 years in exchange for debt relief, reaffirming support for a two-state solution with Gaza under Palestinian control.

Ivory Coast: Ivory Coast’s budget deficit fell to 4.0% of GDP in 2024, down from 5.3% in 2023, aligning with IMF targets. The government expects a further drop to 3% in 2025. Revenue and spending were both below projections, with capital expenditure under-executed but offset by higher interest payments, subsidies, and transfers. Tax revenue missed targets, while non-tax revenue exceeded expectations.

Jordan: King Abdullah met Syria’s new leader, Ahmed al-Sharaa, in Amman, marking Sharaa’s third official foreign trip. Talks focused on trade, energy, water cooperation, and reconstruction. Jordan also condemned Israeli airstrikes on Syria. The leaders also agreed to strengthen border security and combat arms and drug smuggling, with Jordan previously accusing pro-Iranian militias of involvement.

Lebanon: The new cabinet led by Prime Minister Nawaf Salam won a confidence vote with 95 out of 128 MPs in favour, including Hezbollah, Amal, and major Christian parties. The cabinet is tasked with economic reforms and securing an IMF bailout to address the country’s crisis. In other news, inflation eased to 16.1% yoy in January, down from 18.1% in December.

Türkiye: The Kurdish PKK Group declared a ceasefire in its war with Türkiye after imprisoned leader Abdullah Öcalan asked it to lay down arms and called for the PKK’s dissolution and full political integration. The PKK has agreed to convene a congress to disarm and disband, but only if Öcalan is allowed to personally guide and conduct the meeting. Doubts about political motives remain amid ongoing government crackdowns on Kurdish politicians. The ruling AKP’s mixed approach – courting Kurdish votes while repressing pro-Kurdish figures – fuels scepticism of a longer truce. Öcalan’s influence over PKK factions also remains uncertain, as some militants are likely to resist disarmament.

Developed Markets

France: Ratings agency S&P downgraded France’s outlook to ‘negative’, citing “rising government debt amid weak political consensus for tackling large underlying budget deficits, against a backdrop of more uncertain economic growth prospects”.

Benchmark Performance

Source and notations for all tables in this document:

Source: Bloomberg, JP Morgan, Barclays, Merrill Lynch, Chicago Board Options Exchange, Thomson Reuters, MSCI. Latest data available on publication date.

* Price only. Does not include carry. ** Global Indices from Bloomberg. Price to Earnings: 12m blended-forward

Index Definitions:

VIX Index = Chicago Board Options Exchange SPX Volatility Index. DXY Index = The Dollar Index. CRY Index = Thomson Reuters/CoreCommodity CRM Commodity Index.

Figures for more than one year are annualised other than in the case of currencies, commodities and the VIX, DXY and CRY which are shown as percentage change.