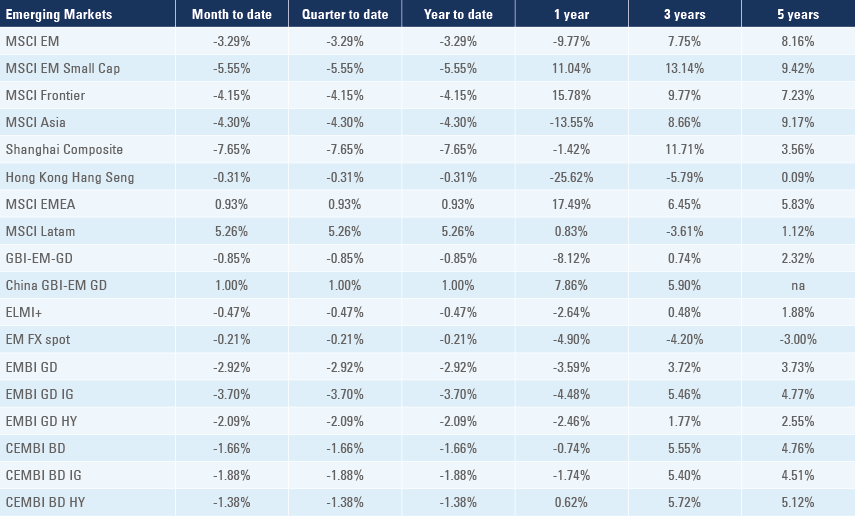

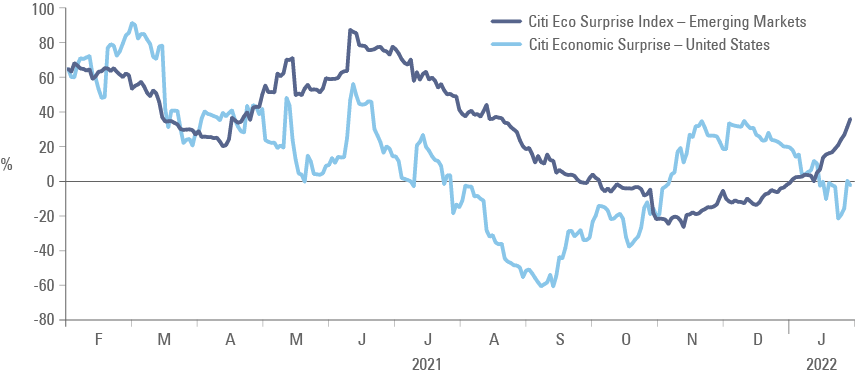

High frequency data in Emerging Markets (EM) surprised to the upside, leading to a strong increase in the Citibank Surprise Index. Argentina reached a preliminary agreement with the IMF. Chile and Colombia hiked policy rates by 150bps and 100bps (25bps ahead of consensus) while South Africa hiked 25bps (in line). Chinese economic growth was softer than expected. President Erdogan fired the head of the Turkish statistical bureau. The OECD said it will open accession discussions for six EM countries.

Emerging markets

Citibank Surprise Index: The dispersion between the US and EM economic surprise indices increased further as the US surprise index was broadly unchanged at -2.7 while the EM surprise index increased 17 points to 36.2 over the last week as per Figure 1.

Economic growth and fiscal numbers mostly surprised to the upside across EM countries. The strong divergence in favour of EM economic data is likely to lead to an outperformance of EM asset prices vis-à-vis US assets, in our view.

Figure 1: Citibank Surprise Index: US vs. EM

Argentina: President Alberto Fernandez said Argentina reached a preliminary agreement for a USD 44.5bn deal with the IMF that includes USD 4.5bn of new disbursements. Finance Minister Martin Guzman said the fiscal adjustment will be gradual with a primary fiscal deficit target of 2.5% of GDP in 2022, 1.9% in 2023 and 0.9% in 2024 alongside a gradual reduction of monetary finance to 1.0% of GDP in 2022, 0.6% in 2023 and 0% in 2024. The deal needs approval from the Argentine parliament and the IMF board. If approved, Argentina’s 2022 external funding needs (mostly IMF repayments) will be mostly covered. However, the agreement does little to support a rebound in confidence from local and foreign investors, a necessary condition for a true recovery in economic growth and to ensure medium term macro-economic stabilisation. In economic news, the economic activity index rose 1.7% in November from -0.8% in October and 0.9% consensus, bringing the yoy number to 9.3% from 6.7% yoy over the same period.

Chile: The central bank hiked its policy rate by 150bps to 5.5%, 25bps more than consensus and kept a hawkish rhetoric in the statement the signalling policy rate would reach 6.5% to 7.0% by the end of the cycle, which implies another 100-150bps hike in the March meeting. CPI inflation reached 7.2% yoy in December, the highest level since 2008 and the forecast for 2022 inflation increased to 6.0% yoy from 4.9% yoy in the prior survey. The Chilean treasury issued USD 4bn of Eurobonds under its sustainable programme comprising of USD 1.5bn 5yr bond at UST +110bps (2.76%); USD 1.5bn 12yr at UST + 170bps (3.51%); and USD 1.0bn 30-yr at UST +195bps (4.06%). The demand books added up to USD 19bn.

Colombia: The central bank hiked its policy rate by 100bps to 4.0%, 25bps more than consensus, with two out of seven policymakers voting for a 75bps hike. The central bank acknowledged that policy remained in expansionist territory as the staff revised its 2022 inflation forecast to 4.3%-4.5%, from 3.7% in the December meeting. The policy rate will likely rise to at least 5.5%, in our view, to contain inflation expectations.

South Africa: The Reserve Bank of South Africa hiked its policy rate by 25bps to 4.0%, in line with consensus. Inflation remained elevated as the yoy rate of PPI inflation rose 1.2% to 10.8% in December (10.2% yoy consensus), but the fiscal balance improved to a ZAR 41.9bn surplus in December from a ZAR 21.8bn deficit in November.

China: The Markit Manufacturing PMI declined by 1.8 to 49.1 in January, while the official Manufacturing PMI dropped by 0.2 to 50.1 and non-manufacturing PMI was down 1.6 to 51.1 over the same period. Soft external demand and labour markets were the main culprits for the slowdown in Chinese PMIs. Economic activity is likely to remain soft in Q1 2022 as industries dependent on high energy consumption such as steel, glass, cement and oil had multiple production curbs (by as much as 70% or even totally shut down from Nov 2021 until Mar 2022). The curbs will affect provinces neighbouring Beijing (Hebei, Henan, Shanxi and Shandong) to ensure good air quality and clear skies during the Winter Olympic Games starting Friday. Similar production curbs led to 1.0% - 1.9% yoy drop in industrial production growth during the year. The number of covid-19 cases continued to increase in Beijing ahead of the Games, calling into question the sustainability of China’s zero covid-19 policy.

Turkey: In another step to destroy economic credibility, President Recep Tayyip Erdogan fired the head of the Turkish Statistical Institute, responsible for calculating and posting official economic data, including inflation. The group of independent analysts at the Inflation Research Group said that December annual inflation reached 82.8%. After forcing the central bank to cut policy rates by 500bps to 14.0%, President Erdogan seems to be inclined to force the official bureau to reduce reported inflation to prove his flawed thesis that lower rates lead to a drop in inflation. In other news, economic confidence improved to 100.8 in January from 98.2 in December.

Organisation for Economic Cooperation and Development (OECD): The OECD said it would hold accession discussions with six countries, including Brazil, Argentina, Peru, Bulgaria, Croatia and Romania. The countries will be scrutinised by more than twenty committees to assess whether the candidates are aligned with the standards, policies and practices of the OECD.

Snippets

- Brazil: The yoy rate of CPI inflation declined to 10.2% in the first 15 days of January from 10.4% yoy over the same period in December, slightly above 10.1% yoy consensus. The yoy rate of PPI inflation declined 0.9% to 16.9% in January, 0.2% below consensus. The current account deficit improved to USD 5.9bn in December from USD 6.4bn in November, but foreign direct investment swung to a USD 3.9bn outflow after a USD 4.6bn inflow in November.

- Czech Republic: The business confidence survey improved 3.6 to 11.0 while consumer confidence declined another 2.5 to -16.8.

- Ecuador: President Guillermo Lasso announced Ecuador will sign a free trade agreement with China and formally requested to join the Pacific Alliance between Colombia, Peru, Mexico and Chile. Economy Minister Simon Cueva said the country will borrow USD 330m less than expected, thanks to the tax reform and higher oil prices, as the fiscal deficit will decline to USD 2.3bn (USD 1.4bn less than expected)

- Egypt: Tourism revenues rose above USD 13bn in 2021, returning to pre-pandemic levels and significantly above the government target of USD 6-9bn.

- Honduras: President Xiomara Castro said in her inaugural speech she would seek to restructure debt saying, “it is practically impossible to meet debt maturities”, including USD 7.2bn of domestic and USD 6.4bn of external debt under “an agreement with public and private creditors”. The new Economy Minister Pedro Barquero said Castro meant re-profile, not restructure the debt. Honduras debt stands at 56% of GDP, interest expenses are manageable around and the first bond maturity of USD 500m is not until 2024. Castro also proposed electricity and fuel subsidies and ordered the central bank to reduce interest rates to favoured sectors.

- Hungary: The central bank hiked its effective policy rate, the 1-week deposit rate, by 30bps to 4.3% while increasing its base rate by 50bps to 2.9%. Gross wages rose to 10.1% yoy in November and the unemployment rate was unchanged at 3.7% in December.

- Malaysia: The trade surplus rose to MYR 31bn in December from MYR 19bn in November, significantly above consensus.

- Mexico: The yoy rate of CPI inflation declined to 7.1% in the first 15 days of January from 7.3% yoy over the same period in December. The economic activity index published by the Indicador Global de la Actividad Económica rose to 1.7% yoy in November from -0.6% yoy in October as retail sales rose 0.9% in November from 0.3% in October. The trade balance moved to a USD 590m surplus in December from a USD 112m deficit in November while the fiscal deficit widened to MXN 758bn from MXN 450bn over the same period.

- Namibia: The energy company Shell announced a major oil and gas discovery in an offshore well in Namibia. The discovery could unleash significant energy investment across the country1. Several African countries are likely to become net exporters of oil over the next years, including Ivory Coast, Mozambique and Senegal.

- Nigeria: The central bank kept its policy rate unchanged at 11.5%, in line with consensus.

- Pakistan: The central bank kept its policy rate unchanged at 9.75%, in line with consensus, as Governor Reza Baqir sees inflation remaining elevated due to elevated energy prices and base effects, but not rising significantly. The parliament approved a bill seeking more autonomy for the central bank, a key IMF condition for the extension of its deal.

- Peru: Finance Minister Pedro Francke said the fiscal deficit dropped to 2.6% in 2021 from 8.7% in 2020 and significantly lower than consensus expectations of a deficit around 4.2%.

- Philippines: The balance of payments improved to a USD 991m surplus in December from a USD 123m deficit in November despite the trade deficit widening to USD 5.2bn from USD 4.7bn over the same period. The yoy rate of real GDP growth rose to 7.7% in Q4 2021 from 6.9% yoy in Q3 2021 (consensus 6.3% yoy), taking the 2021 cumulative GDP growth to 5.6% (consensus 5.1%) after a 9.6% contraction in 2020.

- Poland: Retail sales jumped 14.9% mom in December after dropping 1.0% in November while the unemployment rate was unchanged at 5.4% over the same period.

- Russia: The yoy rate of PPI inflation dropped 0.7% to 28.5% in December, slightly below consensus. A Bloomberg survey with 33 economists showed 2022 CPI forecast rose to 6.4% vs. 5.9% in the previous survey.

- South Korea: The yoy rate of real GDP growth rose 0.1% to 4.1% in Q4 2021, taking the full year GDP growth to 4.0% in 2021 from -0.9% in 2020. Consumer confidence improved 0.5 to 104.4 in January while the yoy rate of retail sales growth rose 2.0% to 11.6% in December and industrials production was unchanged at 6.2% yoy (consensus 1.8% yoy).

- Taiwan: The yoy rate of industrial production declined 1.4% to 10.0% in December, 0.5% above consensus while real GDP growth rose 4.9% yoy in Q4 2021 from 3.7% yoy in Q3 2021, taking the full year expansion to 6.3% in 2021 after +3.0% in 2020.

- Thailand: Car sales improved to 86k in December from 72k in November, 14k below the average of the previous five and 10 years.

- Ukraine: President Volodymir Zelensky asked the US and other countries to stop the continuous warmongering in Western press as the headlines are affecting confidence and economic performance. Zelensky said the risk of a war with Russia was not larger than at the same time last year. In the meantime, Russia continued to say it does not want a war, but will defend its interests. A bilateral deal between Russia and the US to avoid further deployment of weapons near the Russian border could lead to a de-escalation of tensions.

Global backdrop

United States (US)

The US Federal Reserve kept its Fed fund rates unchanged, confirmed it will end quantitative easing (QE) and is likely to start hiking policy rates in March, in line with consensus expectations ahead of the meeting. However, the press conference held a much more hawkish tone with Governor Jerome Powell not answering any questions in regards to future hawkish surprises directly, including the possibility of 50bps hikes, more hikes than priced, or faster balance sheet unwind.

Powell maintained that balance sheet reduction is a secondary tool from rate hikes, but he reiterated the Fed holds much more assets (c. $9trn) than at the peak of the previous QE programme (c. 4.5trn). The shorter duration profile of its assets also supports a faster passive unwind. The Fed’s principles on QE unwind suggest the aim is to shrink the balance sheet mostly via not reinvesting maturities rather than selling bonds and the Fed would be able to sell USD 1.8trn to USD 2.0trn if they start the run-off in May with a USD 100bn cap per month. Powell also admitted the Fed does not know the impact of balance sheet reductions on financial conditions.

The more passive approach to QT led to more hikes priced in. The market is now pricing five hikes during 2022 as the median consensus by sell-side economists moved from 2-4 hikes of 25bps in 2022 to 4-6 hikes. Nomura forecasts a front loaded cycle with 50bps hike in March and another four hikes of 25bps during the rest of the year, while Bank of America expects seven hikes (across all meetings) in 2022.

In economic news, the Markit Manufacturing PMI declined 2.7 to 55.0 in January (1.7 below consensus) while services PMI plunged 6.7 to 50.9 (4.5 below consensus) over the same period. December new home sales rose 11.9% mom after an 11.7% mom increase in November, but pending home sales dropped 3.8% mom after a 2.3% mom drop over the same period. Initial jobless claims dropped to 260k in the week ending on 22 January from 290k in the previous week while continuing claims rose 1.68m in the week ending on 15 January from 1.63m in the previous week. Durable goods orders dropped 0.9% in December after rising 3.2% in November, but GDP growth surged to a 6.9% annualised qoq rate in Q4 2021 from 2.3% annualised qoq in Q3 2021. Core PCE inflation rose 0.3% to 4.9% yoy in Q4 2021, in line with expectations and significantly above the Fed’s target. The Employment Cost Index declined to 1.0% in Q4 2021 from 1.3% in Q3 2021, remaining at elevated levels. Lastly, the University of Michigan sentiment survey dropped another 1.6 to 67.2 with current conditions down 1.2 to 72.0 and expectations down 1.8 to 64.1, the lowest levels in 10 years.

Eurozone: The Euro Area Markit manufacturing PMI rose 1.0 to 59.0 in January, 1.5 above consensus, but services PMI dropped 1.9 to 51.2, or 0.8 below consensus. The German IFO business climate improved 1.0 to 95.7 and expectations increased 2.6 to 95.2 while current assessment dropped 0.8 to 96.1.

Japan: The yoy rate of core CPI inflation in Tokyo dropped to 0.2% in January from 0.5% yoy in December. Industrial production dropped 1.0% mom in December after rising 7.0% mom in November while retail sales dropped 1.0% in December after rising 1.3% in November.

Australia: The yoy rate of CPI inflation rose to 3.5% in Q4 2021 (3.2% consensus) from 3.0% yoy in Q3 2022, while PPI inflation rose by 0.8% to 3.7% yoy over the same period.

Canada: The bank of Canada kept its policy rate unchanged at 0.25%, in line with consensus. Prime Minister Justin Trudeau is on the defensive as truck drivers organised a massive 70km Freedom Convoy to the Capital Ottawa sparked by a vaccine mandate for truckers crossing the US-Canada border. Trudeau denounced the convoy and its conservative supporters as a “small fringe minority”.

Commodities: Commodity prices rose another 1.8% last week and are up by 8.8% over the year, buoyed by higher energy, industrial metals and agriculture prices. Iron ore prices rose 4.5% last week while energy prices rose 7.5% led by higher coal and natural gas prices. Oil prices may be close to a cyclical short-term peak ahead of the OPEC+ meeting this week. Brent prices are testing USD 90 per barrel and are sitting at overbought levels due to geopolitical risks. The likelihood of a deal with Iran also does not seem to be priced in oil prices.