Central banks in the United States (US) and United Kingdom (UK) hiked their policy rates, but framed their forward guidance as data-dependent, mostly due to risks of a significant deterioration in credit conditions. The flash Purchasing Manager Indices (PMIs) suggested both services and manufacturing would recover further in April. The International Monetary Fund (IMF) approved loan programmes to Sri Lanka and Ukraine. Argentina mandated local pension plans to swap Eurobond holdings for local currency debt. Inflation across most Emerging Market (EM) countries either stabilised or declined.

Global Macro

European and UK banking regulators moved quickly to differentiate their approach from Swiss regulators on Additional Tier 1 (AT1) bonds (aka contingent convertible ‘CoCo’ bonds), issuing a joint statement that highlighted: “Common equity instruments are the first ones to absorb losses, and only after their full use would Additional Tier One be required to be written down”. Tensions in the banking sector increased again towards the end of last week. The US Federal Reserve (Fed) and Bank of England (BOE) hiked their policy rates by 25 basis points (bps) to 5.0% and 4.25% respectively, with the Fed insisting it had different tools to deal with financial stability and inflation. Fears over US regional banks increased after US Treasury Secretary Janet Yellen dismissed the possibility of a large increase in deposit guarantees, but acknowledged similar situations to Silicon Valley Bank (SVB) and Signature Bank were possible. The market is carefully monitoring any signs of bank run, including bank deposits and any increase in the size of the Fed’s emergency lending for financial institutions. Deposits declined by USD 98.4bn in the week ending 15 March to USD 17.5trn, as money market fund inflows increased by USD 117.4bn in the week ending 22 March to USD 5.1trn. The Federal Deposit Insurance Corporation (FDIC) bridge loans rose by USD 37.0bn to USD 179.8bn, the Fed’s Bank Term Funding Program (BTFP) rose by USD 41.8bn to USD 53.7bn from USD 11.9bn, while the discount window declined by 42.7bn to USD 110.2bn. Foreign central banks also tapped into their swap lines with the Fed. Europeans are also speculating on the next weak link in the banking sector, buying protection against the default of Deutsche Bank as its five-year credit default swaps (CDS) rose to 237bps last Friday from 81bps two weeks ago, even though bank sector specialists consider Deutsche Bank to be in a very different situation than Credit Suisse, generating healthy profits and having rebuilt its capital base with ample reserve buffers.

Against that backdrop, the flash PMIs for April came in better than expected, with the manufacturing sector recovering very close to 50 from around 46 at the end of 2022, while the service sector PMI rebounded to around 55 from below 50 just a few months ago. In the manufacturing sector, S&P Global reported the recovery was mostly driven by improving supply (backlogs declining) rather than a more fundamental increase in demand as new orders declined for the four largest economies for the tenth consecutive month.

Geopolitics

China’s President Xi Jinping concluded a three-day visit to Russia. He said China was willing to continue to play a constructive role in facilitating a political resolution of the war in Ukraine. Russian President Vladimir Putin responded by saying: “We will discuss all these issues, including China's initiatives, which we unconditionally respect". Like with Iran, China’s interests lie in keeping Putin in power, as a regime change could be destabilising for the region and threatens the Chinese alliance built with Russia.

Brazilian President Luis Inácio Lula da Silva postponed a visit to China after contracting flu and pneumonia. Lula has been advocating for a ceasefire in Ukraine. Such a ceasefire is an underappreciated possibility by financial market participants, in our view, as two-thirds of fund managers expect the war to rage throughout 2023. However, this assumes the West can keep supplying weapons to Ukraine, which is not guaranteed considering the low levels of military investment in the past years. Moreover, Ukraine risks losing further positions at a point that war fatigue ought to be building up across its population, should China start providing weapons to Russia, something left unsaid by Xi Jinping, but considered a distinct risk by US Secretary of State Anthony Blinken. Russia will also struggle to keep fighting a long war of attrition with severe casualties and heavy weaponry deployed.

Ukrainian President Volodymyr Zelenskiy said he was “waiting” for a phone call from China. Last week, Japanese Prime Minister Fumio Kishida visited Kyiv after stopping in India, where he condemned Russia’s invasion and sought to pressure Indian Prime Minister Narendra Modi to distance his country from Moscow over the war.

Over the weekend, protests in Israel intensified after Prime Minister Benjamin Netanyahu fired his defence minister for supporting a delay in the judiciary system reforms due to “tangible threats” to the country’s security. President Isaac Herzog also asked the government to suspend the judiciary overhaul after the country’s largest unions announced strikes. The protests are another layer of instability in the region, and alongside the turmoil in Iran, Lebanon and Syria, we believe this leads to increased risks of international conflicts that could distract public opinion from local politics.

Emerging Markets

Argentina: Ratings agency Fitch downgraded the foreign currency rating to ‘C’ from ‘CCC-‘ after an executive decree forcing domestic public sector entities (most notably its social security agency) to swap their Eurobonds into local law bonds that settle in pesos, thereby forcing the pension funds to sell their Eurobonds in the secondary market and acquire local bonds instead. The trade deficit was virtually unchanged at USD 484m in February against the consensus for a USD 182m surplus. The government agreed with the IMF to delay a USD 2.6bn payment, not marking a credit default, but highlighting the low level of international reserves as exporters have little incentive to repatriate funds due to an overvalued official exchange. The unemployment rate declined to 6.3% in Q4 2022 from 7.1% in Q3 2022, but the yoy rate of real gross domestic product (GDP) growth slowed to 1.9% from 5.9% over the same period. Real GDP growth rose 1.9% in yoy terms in Q4 2022, 20bps ahead of consensus, from 5.9% yoy in Q3 2022.

Brazil: The Brazilian Central Bank kept its policy rate unchanged at 13.75%, in line with consensus, but came under renewed pressure from the executive to cut policy rates. The Minister of Finance Fernando Haddad seems to be working hard behind the scenes to appoint two market-friendly members to the Central Bank’s monetary policy board and approve a bill to consolidate its fiscal accounts, but still faces resistance from President Lula and his own Workers Party. In economic news, the yoy rate of Consumer Price Index (CPI) inflation declined to 5.4% in the first two weeks of March from 5.6% yoy in February, in line with consensus.

Chile: The current account deficit narrowed to USD 5.0bn in Q4 2022 (consensus USD 2.7bn) from USD 7.5bn in Q3 2022 (revised from USD 9.4bn). Real GDP growth rose by 0.1% qoq in Q4 2022 (0.6% consensus) from -1.1% in Q3 2022, narrowly avoiding the fourth consecutive quarter of negative qoq growth. The producer price index (PPI) dropped 2.1% mom in February after remaining unchanged in January, bringing the yoy rate to deflationary levels at -1.6% from +3.0% yoy over the same period.

South Africa: CPI inflation rose 0.7% mom in February from -0.1% in January, taking the yoy rate 10bps higher to 7.0% yoy, 20bps above consensus. Core CPI increased by 0.8% mom in February after 0.2% mom in January, or 5.2% yoy, which was 20bps above consensus and 30bps above January’s core inflation. Consumer confidence plunged to -23 in Q1 2023 from -8 in Q4 2022, two standard deviations below the mean and close to the -36 lows in Q2 2020.

Sri Lanka: The IMF approved a USD 3bn loan programme for Sri Lanka with a duration of 48 months, including an immediate disbursement of about USD 333m. The program is focused on restoring macroeconomic stability, advancing revenue-based fiscal consolidation and debt sustainability.

Ukraine: The IMF approved a USD 15.6bn loan to Ukraine, its first loan to a country at war.

Snippets

- China: The People’s Bank of China kept its one-year and five-year prime loan rates unchanged at 3.65% and 4.30% respectively, in line with consensus. Air passenger traffic declined 13.2% yoy in the first two months of 2023, but rebounded in February after a softer January.

- Hungary: The unemployment rate rose by 0.1% to 4.0% in February, in line with consensus. Business and consumer confidence improved but remained at very depressed levels.

- Malaysia: The yoy rate of CPI inflation in February was unchanged at 3.7%.

- Mexico: CPI inflation rose by 0.15% mom (0.26% consensus) and 7.1% yoy in the first 15 days of March and core CPI increased by 0.3% mom and 8.2% yoy, both as expected. The yoy rate of retail sales rose to 5.3% in January, 210bps ahead of consensus, from 2.5% yoy in December.

- Nigeria: The central bank increased its policy rate by 50bps to 18.0%, in line with consensus.

- Philippines: The central bank hiked its policy rate by 25bps to 6.25%, in line with consensus.

- Poland: The yoy rate of PPI inflation dropped 170bps to 18.4% in February, nevertheless still 70bps above consensus expectations.

- South Korea: Exports per working day fell 4.8% mom (-23.1% yoy) in the first 20 days of March after rising 1.5% in February as exports to China remained soft. The yoy rate of PPI inflation declined 30bps to 4.8% in February.

- Taiwan: The central bank hiked its policy rate by 12.5 bps to 1.875%, against consensus for policy to remain unchanged.

- Thailand: General elections will take place on the 14 May.

- Turkey: The central bank kept its policy rate unchanged at 8.5%, in line with consensus. The TRY came under intense pressure from short sellers, and the implied yield on TRY forwards increased from 22.6% on 14 March to 50.0% last Friday.1

Developed Markets

United States: US Treasury Secretary testimony to Congress was the most important event last week. Janet Yellen said it was not considering a broad increase in deposit insurance, while at the same time mentioning that “situations like the run on Silicon Valley Bank may more readily happen in the future”, and that “regulations may need re-thinking”. The Federal Monetary Open Committee hiked its policy rates by 25bps to 4.75% to 5.0%, in line with consensus, despite mounting issues in the banking system. Fed Chair Jerome Powell stuck to the playbook already brought up by the European Central Bank and tried to argue that policymakers have different tools to control inflation and prevent bank runs. In our view, this was like saying the two wheels of a bicycle can spin in different directions smoothly and without causing a crash. Powell also didn’t discard the possibility of hiking rates further this year, if necessary. Existing home sales rose to 4.6m in February from 4.0m in January, one standard deviation below the average since 1999 at 5.3m (low 3.5m in July 2010; high 7.3m Sep 2005), while new home sales were unchanged at 640k in February, still close to the lowest levels since 2016. The Philadelphia Fed non-manufacturing activity survey dropped to -12.8 in March from 3.2 in February. Since 2011, the highest level for the Philly survey was 60.0 in June 2021 and the low was -99.9 in April 2020. Durable goods orders declined 1.0% mom in February, 120bps below consensus, after dropping 5.0% in January. Jobless claims remained subdued at 191k for the week ending 18 March, with continuing claims up only 14k to 1.694m in the prior week. The current account deficit improved marginally to USD 206.8bn in Q4 2022 from USD 219.0bn in Q3 2022.

United Kingdom: The BOE hiked its policy rate by 25bps to 4.25%, in line with consensus, with two members of the Monetary Policy Committee voting for no increase in policy rates. The BOE signalled an end to the hiking cycle, unless the persistence of inflation surprised to the upside, a very high bar considering large disinflationary pressures from commodity prices. CPI inflation rose 1.1% mom in February after declining 0.6% in January, bringing the yoy rate up by 30bps to 10.4%, -50bps above consensus.

Norway: Norges Bank hiked its policy rate by 25bps to 3.0%, in line with consensus, and signalled another 50bps of hikes by the summer to 3.5% as Governor Ida Wolden Bache said: “There is considerable uncertainty about future economic developments, but if developments turn out as we now expect, the policy rate will be raised further in May”.

Switzerland: The Swiss National Bank (SNB) hiked its policy rate by 50bps to 1.5%, in line with consensus, with Governor Thomas Jordan stating: “It cannot be ruled out that additional rises in the SNB policy rate will be necessary to ensure price stability over the medium term”. Jordan highlighted the SNB will keep playing an active role in currency intervention and commented on the bailout of Credit Suisse, as bankruptcy would have had “serious consequences for national and international financial stability” and that “Taking this risk would have been irresponsible”.

Australia: The Reserve Bank of Australia will consider pausing its policy tightening cycle next month given rates are already restrictive and the economic outlook remains uncertain, minutes of its March meeting showed.

1. Measured by the average of one-month, two-month and three-month non-deliverable forward rates calculated by the JP Morgan Emerging Local Markets Index Plus (ELMI+) Index.

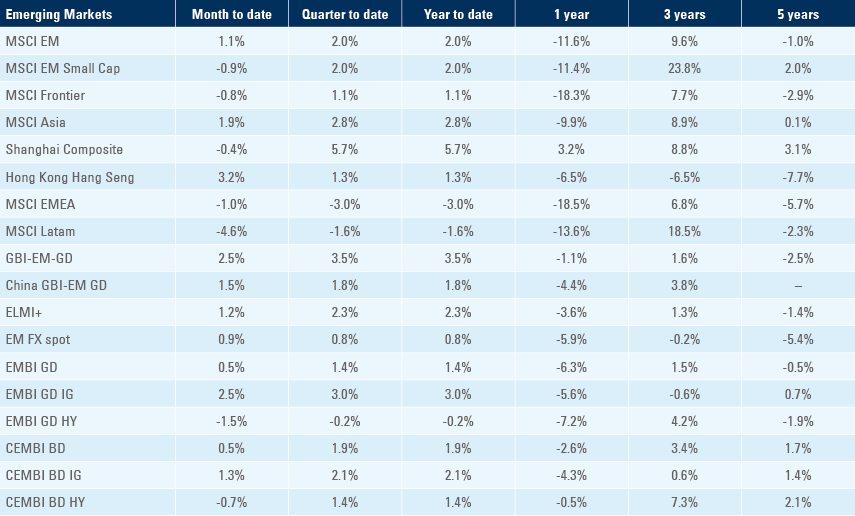

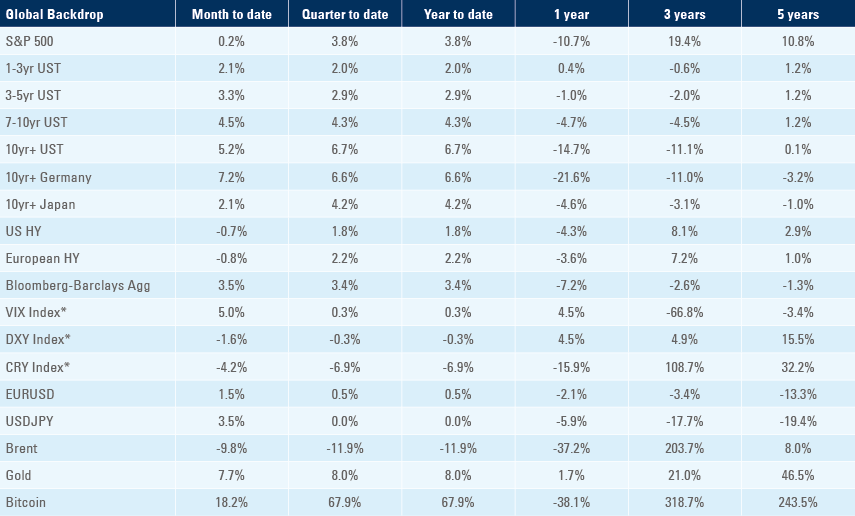

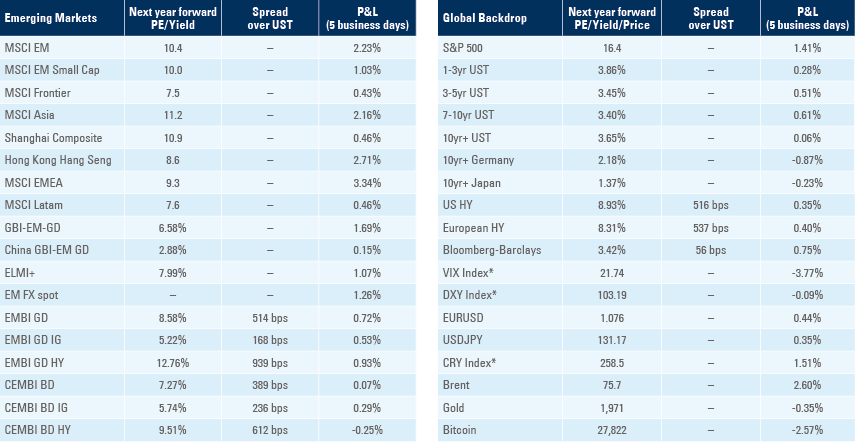

Benchmark performance