- US economic growth has surprised to the downside, inflation to the upside.

- A helicopter crash killed Iranian President Raisi. Israel’s Netanyahu faced more pressure from his cabinet.

- The US announced 100% tariffs on imports of Chinese electric vehicles.

- China announced sweeping measures to support the housing market.

- Indonesia’s President-elect to increase expenditures to boost growth.

- IMF staff approved the eighth review of the Argentinian programme.

- The Brazilian Central Bank minutes quelled political interpretations of dissent from committee members at its last meeting.

- Mexico’s presidential front-runner Sheinbaum said consumption is likely to remain strong as she vowed to increase infrastructure investments.

- Georgia’s President Zourabichvili vetoed the controversial ‘Foreign Agent’ law, but parliament may overrule her.

- Türkiye received record foreign investment in local bonds last week.

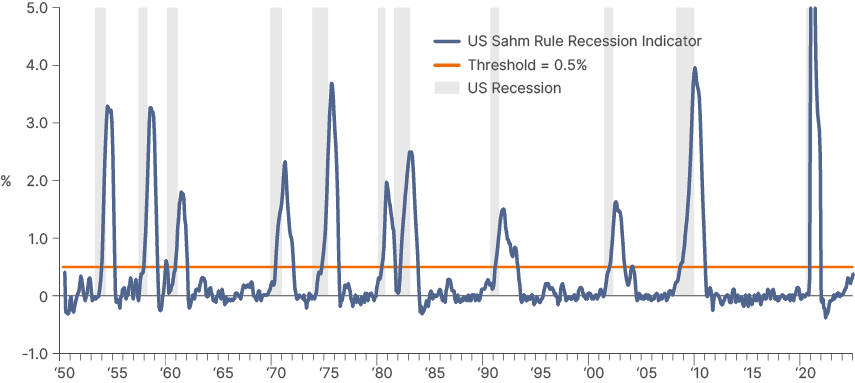

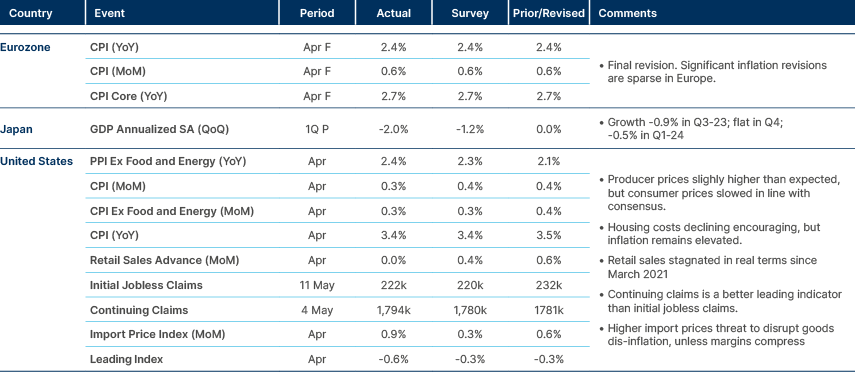

Last week performance and comments

Global Macro

At the latest Federal Open Market Committee press conference, Federal Reserve (Fed) Chairman Jerome Powell responded to a question on ‘stagflation’ by saying, “I don’t see the ‘stag’ or the ‘-flation’, actually”, as economic activity remained robust and inflation surprises were concentrated on a few items that are likely to decline. While it is true the US economy has remained more resilient than expected, the evolution of the data shows a clear trend where activity has surprised to the downside and inflation to the upside. It is increasingly obvious to us that US exceptionalism was a matter of inflating nominal gross domestic product (GDP) with inflationary fiscal policies.

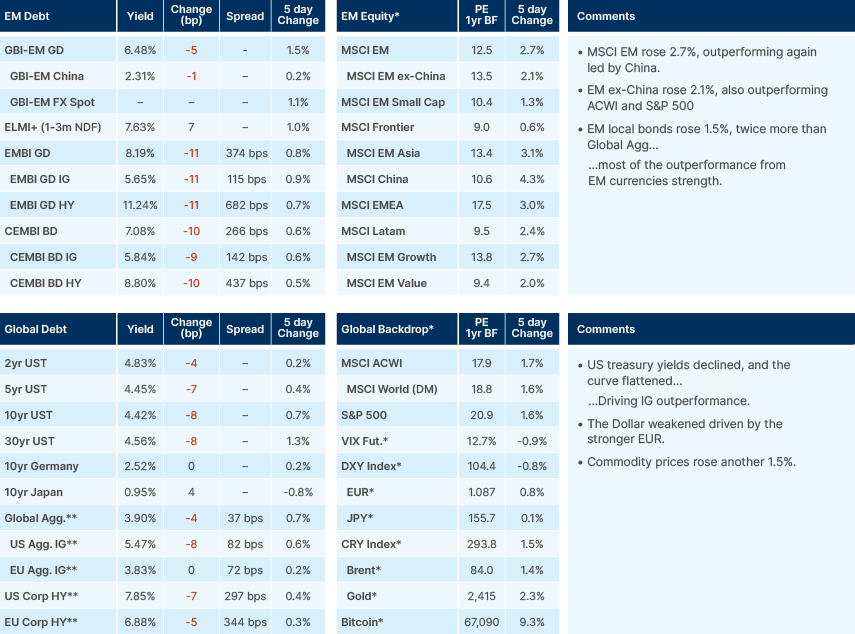

For instance, the Bloomberg Surprise Indexes of inflation (containing 33 indicators) and growth (66 indicators) have posted a large and rare divergence since February. Inflation surprises moved from zero in early February to +1 last week, while growth surprises declined from +0.2 to -0.4 over the same period, as per Fig. 1. It is very unusual for inflation and activity to diverge, and indeed have diverged to the same magnitude only during the pandemic:

Fig. 1: Bloomberg Surprise Index: Growth vs. Inflation

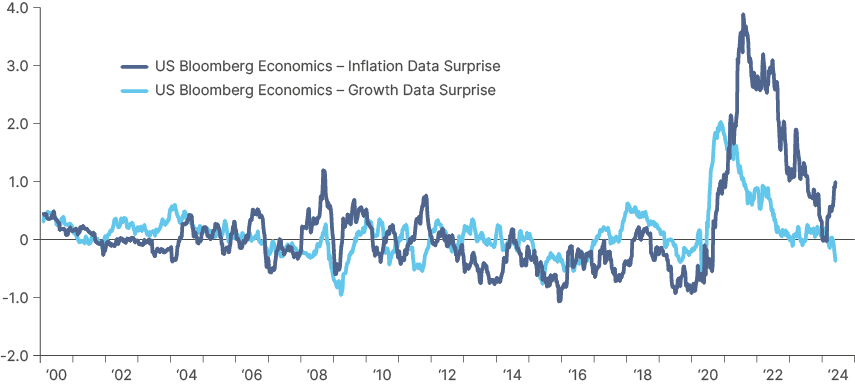

Another element suggesting inflation has been the main factor supporting the US exceptionalism, is retail sales. A first look shows a robust picture, with retail sales nearly 40% above pre-pandemic levels and more than 15% higher than April 2021. However, after adjusting for inflation, retail sales are up only c. 10% above pre-pandemic levels and have declined over the last three years, as per Fig. 2:

Fig 2: Retail and Food Services Sales

Seasonally Adjusted – nominal terms and adjusted for inflation

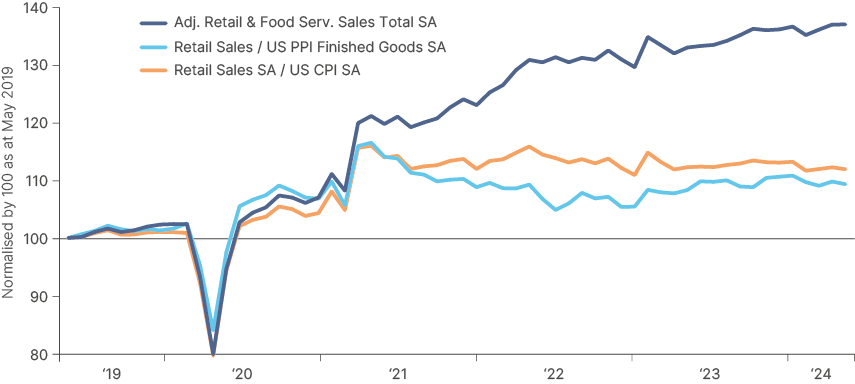

Further, small business confidence remains at very weak levels, the level of defaults on credit card and consumer loans continues to increase and the labour market has been softening. The Sahm Rule, a simple indicator comparing the three-month moving average (MA) of the unemployment rate against its lows is close to breaching the 0.5% level that signals a recession.

Fig 3: Sahm Rule

Against this backdrop, Fed officials Loretta Mester, John Williams and Neel Kashkari have noted that price deceleration is slower than expected, partly due to limited supply chain improvements. Mester stated that “Incoming economic information indicates that it will take longer to gain confidence for cuts" and that "maintaining our restrictive stance for longer is prudent as we gain clarity about inflation.”

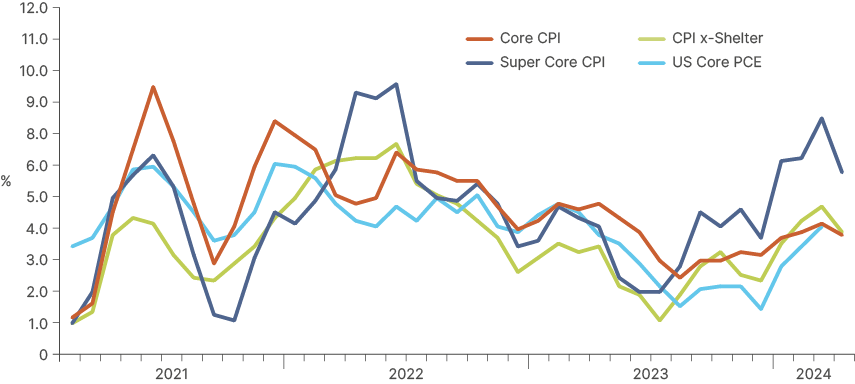

Indeed, the consumer price index (CPI) of inflation was revised lower in March, compensating for the higher-than-expected inflation in April. However, the super core CPI (services excluding housing) remains high at 0.4% month-over-month. While the three-month moving average of core CPI inflation may have declined, it remains on an upward trend that started in August 2023. The three-month MA of both super core and CPI ex-shelter are at very elevated levels at 6.3% and 4.2%, respectively as per Fig. 4. The six-month MAs are all rising, with core CPI up to 4.1% yoy from 3.9% in March, super core CPI having risen to 6.5% (from 6.1%) and CPI ex-shelter up 20bps to 4.0%.

Fig. 4: CPI and Core CPI measures: 3-month moving average

On the other hand, European Central Bank (ECB) officials are signalling a 25 basis points (bps) cut at the 6 June meeting as certain. The market expects three more 25bps cuts over five meetings in 2024, or one every other meeting, barring a significant slowdown in economic data. Such monetary policy divergence has been well-telegraphed and priced in recent weeks. Indeed, the weaker US activity and Powell’s dovish statement capping the two-year rates at 5.0% worked against the Dollar last week.

Geopolitics

Iranian President Ebrahim Raisi and Foreign Minister Hossein Amirabdollahian died in a helicopter crash in mountainous terrain in heavy fog after a visit to the border in Azerbaijan. The accident led to speculation of a US or Israeli plot to assassinate the president. Presidents hold little power in Iran, but Raisi was a frontrunner to replace the Supreme Leader Ayatollah Ali Khamenei. More important than whether the US/Israel killed the president is whether Iran chooses to blame foreign powers with the intention of retaliating. Tehran has been careful to avoid a meaningful escalation that would pose a threat to the regime.

In Gaza, Israeli forces have taken control of the Rafah crossing, with Israel and Egypt blaming each other for its continued closure amid a worsening humanitarian crisis. Israeli Defence Minister Yoav Gallant stated that politicians will not allow the military to devise a post-war plan for Gaza. The next day, war cabinet member Benny Gantz threatened to leave the government unless Netanyahu agreed on six conditions, including establishing an international task force to manage Gaza after the war. This political bickering is unlikely to fracture the coalition, in our view. Netanyahu is likely to retain the majority in parliament even if Gantz exits the government. The US plans to send an additional USD 1bn in weapons and ammunition to Israel, with delivery details yet to be released.1 The EU is urging an end to the Rafah operation, warning it threatens already deteriorating ties.2

President Biden has accused China of “cheating” on trade and announced tariffs on products accounting for USD 18bn in annual imports.3 Tariffs on electric vehicles (EVs) will rise to 100%. The measure is largely political and has little impact on bilateral trade, as the US does not import many EVs from China. Levies of 25% to 50% will target semiconductors, batteries, solar cells, critical minerals, and medical supplies, adding to previously increased tariffs on steel, aluminium, and EVs, but some tariffs will rise only in 2025 and 2026, allowing time for the industries to adapt.

Amid growing trade tensions, the EU is taking a different approach to Chinese imports. Despite joining the US in accusing China of overproducing EVs and other renewable energy products, the EU is much more dependent on international trade. Europe has been relying on an export-led growth model, supported by Russian energy, since 2011. Thus, it is very challenging for Europe to decouple from China and Russia at the same time, in our view. Stellantis announced a joint venture with Chinese EV startup Leapmotor to start selling electric cars in nine European countries later this year.4

President Vladimir Putin visited Beijing to meet with President Xi Jinping on his first post-inauguration foreign trip. They agreed to enhance cooperation, which Putin described as “one of the main stabilising factors in the international arena.” Notably, 90% of trade between Russia and China is now conducted in Rubles or Yuan, which Putin claims protects their trade and investments from third-country influences.

Emerging Markets

EM Asia

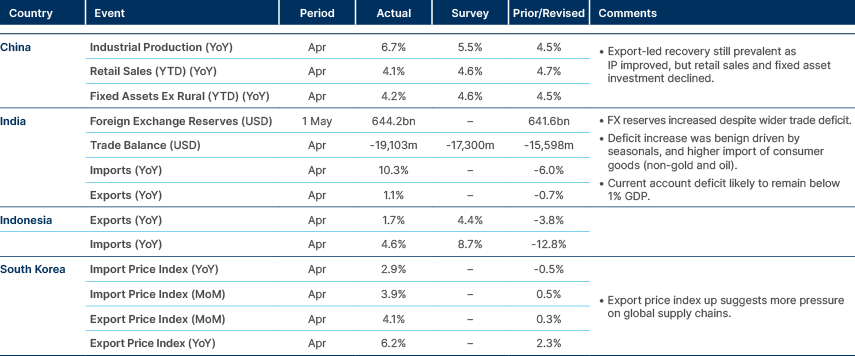

Data: Weak Chinese data. Indian trade not as bad as it seems. Korean export prices increasing.

China: The People's Bank of China scrapped the nationwide minimum mortgage interest rate and reduced the minimum down payment ratio to 15% for first-time buyers and 25% for second homes. These significant policy changes aim to revitalise the country's struggling real estate sector. Additionally, local state-owned enterprises will receive support to purchase built and unsold homes that meet certain criteria for working-class basic needs (affordable housing). The companies purchasing the homes should not be financed by local government financing vehicles or be involved in local government “hidden debt”. The cabinet aims to formalise the draft plan by June. In other news, Bloomberg reported China has sold a record USD 53.3bn in US Treasury bonds. We would be cautious in making political inferences from the data, noting it is challenging to establish China’s Treasuries positions, as its holdings are often held by global custodians that do not disclose the ownership origin.5 It would be reasonable to expect China and its state-owned banks to be selling US Treasuries as China has been intervening to defend the RMB.

Indonesia: President-elect Prabowo Subianto urged the government to adopt a more aggressive spending approach to stimulate the economy. He said the current 3.0% legal limit on the budget deficit is arbitrary and expressed confidence in achieving 8% GDP growth within the next two to three years, aiming to position the country as the fastest-growing major economy globally. Economic Minister Airlangga Hartarto announced government support for projects aimed at leveraging the world's largest nickel reserves to attract foreign investment.

Thailand: Finance Minister Pichai Chunhavajira and Bank of Thailand Governor Sethaput Suthiwartnarueput met to ease tensions between the government and the central bank over strategies to “rejuvenate” the nation's economy, particularly regarding the inflation target. In their first meeting since taking office, Pichai emphasised that “Providing access to lending is more important than the level of interest rate.”

Latin America

Argentina: The International Monetary Fund (IMF) have approved the eighth review of Argentina's USD 44bn loan agreement, paving the way for c. USD 800m in loans for the country. President Javier Milei said the nation is on the brink of lifting foreign exchange controls and emphasised the government's eagerness to do so swiftly.

Brazil: President Lula removed Petrobras CEO Jean Paul Prates following a prolonged dispute over dividend payments. Prates, along with CFO Sergio Caetano Leite, was officially ousted during a board meeting, leading to a sharp decline in the oil giant's share price. The new CEO is a technocrat with a good reputation and plenty of experience in the sector and with Petrobras. Central Bank Governor Roberto Campos Neto emphasised that most monetary policy committee members recognised the need for a change in response to significant developments, including a deteriorating inflation outlook, following last week's rate cut by 25bps to 10.5%. The minutes of the monetary policy committee, where four directors appointed by Lula dissented in favour of a larger 50bps cut, stated the disagreements were about breaking the previous forward guidance, rather than the substance of (a more cautious stance to) monetary policy.

Colombia: President Gustavo Petro criticised the central bank, asserting that the current interest rate “strangles the economy”. The government has persistently advocated for a swifter reduction in the policy rate, despite the country having one of Latin America's highest inflation rates.

Mexico: Presidential candidate Claudia Sheinbaum predicted that despite a potential US economic slowdown, Mexico's robust domestic consumption will fuel economic growth through 2025. She emphasised plans to construct one million homes and undertake significant infrastructure projects as additional drivers of economic expansion. These assertions coincide with Mexico's record-breaking foreign direct investment (FDI) of USD 20.3bn in Q1, indicating the nation's advantageous position to capitalise on global trade tensions amidst escalating US-China conflicts.

Central and Eastern Europe

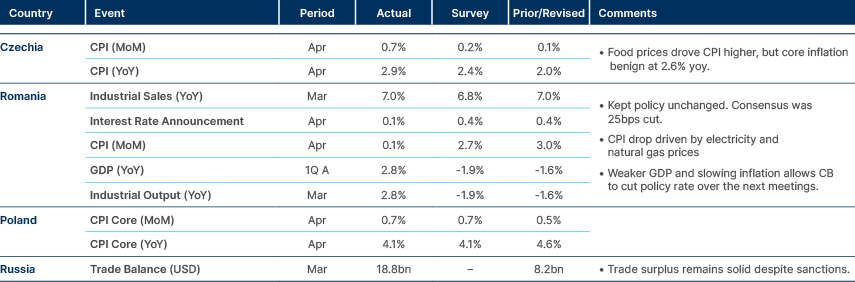

Economic Data: Inflation still softening.

Georgia: President Salome Zourabichvili vetoed the ‘Foreign Agent’ bill passed by parliament last week, saying the law “in its essence and spirit, is fundamentally Russian” and an obstacle to Georgia's path to EU membership. Georgia was granted EU candidate status in December 2023, but both the EU and US criticised the bill. Parliament can vote to override her veto with a simple majority. The legislation would require organisations receiving more than 20% of their funding from abroad to register as “agents of foreign influence” or face a fine, a similar law passed in Russia in 2012. Russia and Georgia have had no formal relations since Russia invaded Georgia in 2008, but Russians are allowed to live and work in Georgia with lax visa requirements, and the number of Russian expats increased significantly post-Russian invasion of Ukraine.

Central Asia, Middle East, and Africa

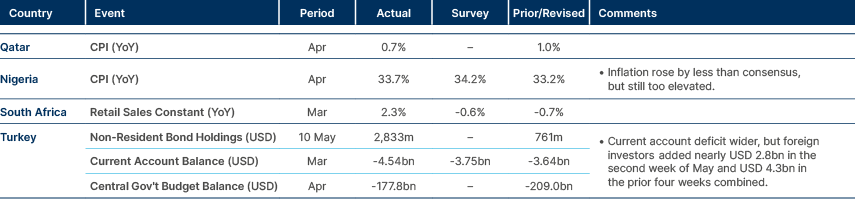

Economic Data: Türkiye’s foreign investor inflows to bonds surged in the week of 10 May.

Egypt: The country has received the second USD 14.0bn tranche from the United Arab Emirates (UAE) deal, coinciding with the commencement of exchanging a USD 6.0bn UAE deposit into Egyptian pounds.6

Developed Markets

Economic Data: US inflation in line, but elevated. Activity weaker.

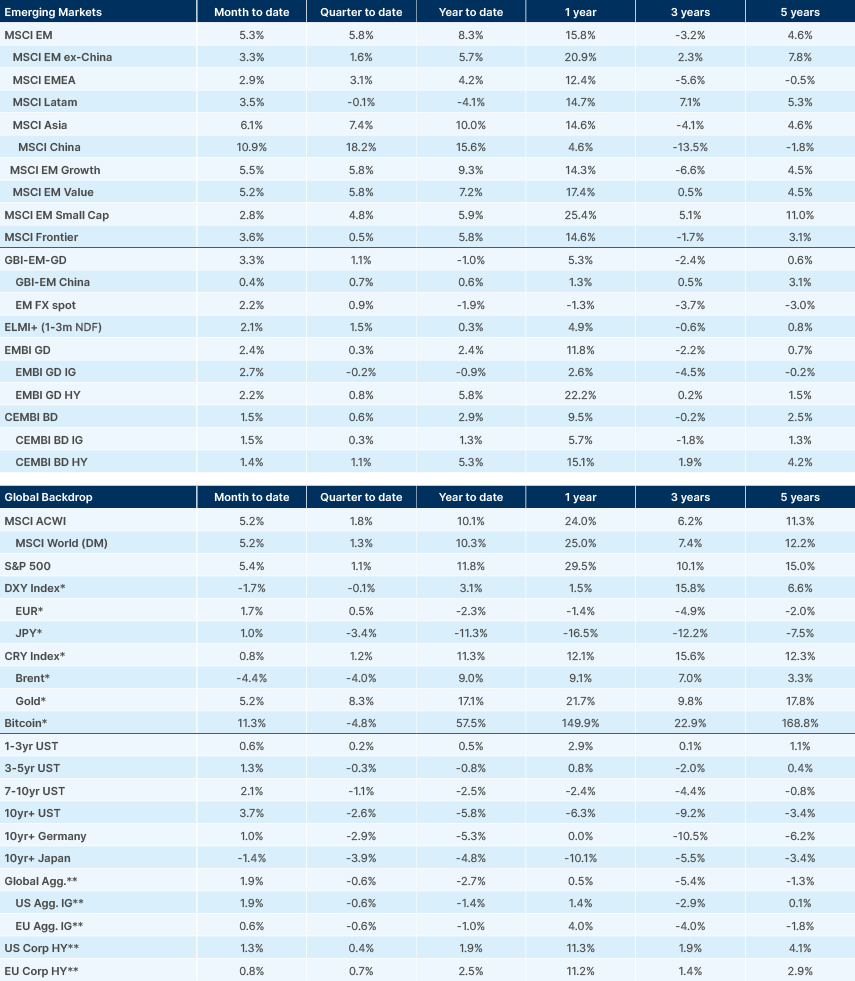

Benchmark performance

Source and notations for all tables in this document:

Source: Bloomberg, JP Morgan, Barclays, Merrill Lynch, Chicago Board Options Exchange, Thomson Reuters, MSCI. Latest data available on publication date.

* Price only. Does not include carry. ** Global Indices from Bloomberg. Price to Earnings: 12m blended-forward

Index Definitions:

VIX Index = Chicago Board Options Exchange SPX Volatility Index. DXY Index = The Dollar Index. CRY Index = Thomson Reuters/CoreCommodity CRM Commodity Index.

Figures for more than one year are annualised other than in the case of currencies, commodities and the VIX, DXY and CRY which are shown as percentage change.

1. See – https://apnews.com/article/us-israel-arms-gaza-ebe971ca8878ff430ce6458c04151585

2. See – https://www.washingtonpost.com/world/2024/05/15/israel-hamas-war-news-gaza-palestine-rafah

3. See – https://blinks.bloomberg.com/news/stories/SDHEBZT1UM0W

4. See – https://www.euronews.com/business/2024/05/15/stellantis-and-leapmotor-to-sell-electric-cars-in-europe-from-september

5. See – https://x.com/Brad_Setser/status/1792364812141470142

6. See – 'The big picture behind Egypt’s big deal', The Emerging View, 20 March 2024