Shanghai remains in lockdown as the Ukrainian war enters its second phase

Risk-off mode as US rates hit cyclical highs, China’s lockdowns persist, and the Ukrainian war enters its second phase. Colombia’s presidential candidate Gustavo Petro promised not to expropriate private property. South Korean exports slowed but remain at elevated levels. The Mexican Congress approved a bill nationalising lithium reserves. Peruvian farmers blocked roads asking for social reforms. Polish inflation accelerated further, prompting a more hawkish tone by the central bank.

Emerging markets

China: The People`s Bank of China (PBoC) kept its 1-yr and 5-yr loan prime rates unchanged at 3.7% and 4.6% respectively against consensus for a 5-10bps cut. Chinese stocks came under renewed selling pressure due to fears over declining demand and lower GDP growth as Shanghai remains in lockdown and areas of Beijing reported mobility restrictions after 21 covid-19 cases were reported last Sunday. The RMB declined 3.1% against the USD due to growth concerns and lower differential between US and Chinese rates. Despite all the negative headlines, in our view it is unlikely that China will allow its economy to enter a recession, which means either the lockdowns become effective in preventing higher cases, or that China will have to relax its strict mobility rules. In other news, US Treasury Secretary Janet Yellen said the US was carefully re-examining the trade strategy on China, a sign that reducing import tariffs are not off the table. Yellen noted China is not undermining sanctions on Russia, reminding that the US has not sanctioned China’s trading with Russia.

Russia-Ukraine: The Russian President Vladimir Putin said Mariupol was taken by Russia after taking control of the entire city excluding the giant Azovstal steel plant. Interfax reported that Russia plans to take full control of Donbas and Southern Ukraine as part of the second phase of its military operation. Speaking at a defence industry meeting in Ekaterinburg, Major General Rustam Minnekayev said the objective of the second phase is “to establish full control over Donbas and southern Ukraine, to ensure a land bridge to Crimea as well as influence key aspects of the Ukrainian economy, Black Sea ports through which agricultural and metallurgical exports go to other countries”.

Mykolaiv and Odesa are the major cities standing in the way of Russia's ambitions. Both are complicated targets to capture and control while Russia is still bogged down on several fronts, including resistance at the Mariupol Azovstal steel plant as the Donbas front seems to be in a stalemate. Russia has lost important assets, including the Moskva warship, and personnel. Some analysts are saying that given the loss of resources, this is Russia's last opportunity to take territory.1 If true, this implies the next offensive could be even more aggressive, while, at the same time, the next round of negotiations, stand a better chance of an agreement than the last one.

There was plenty of foreign policy activity last week as the Spanish and Danish PMs visited Kyiv. The likelihood of European sanctions on Russian energy continues to rise. Italy's Energy Minister said “In my opinion we should soon halt gas imports from Russia, also for ethical reasons”. On the other hand the Turkish Foreign Minister Mevlut Cavusoglu said in an interview with CNN Turkey that "Some NATO members want the war in Ukraine to continue in order to weaken Russia, without much concern for the impact on Ukraine itself". He had met with Russia’s Foreign Secretary Sergei Lavrov earlier. Turkey’s importance as a “pivot” between the West and East will increase, should Russia take control of the Black Sea. Indonesia’s ambassador to Australia defended the decision to invite Putin to the November G-20 meeting in Bali, saying it was important to pursue the group’s economic agenda. The US Foreign Secretary announced the return of diplomats to Ukraine and the nomination of a new ambassador to Ukraine. The Austrian Foreign Minister Schallenberg said he was against Ukraine joining the EU. In other news, Chinese state-owned oil companies are negotiating the purchase of Shell’s stake in Liquified Natural Gas assets in Russia.

Ukraine war effort and reconstruction costs: The International Monetary Fund (IMF) asked nations to provide grants and donations to fill a USD 5bn monthly financing gap for Ukraine, which was close to Zelensky’s USD 7bn per month figure mentioned a few weeks ago. The IMF approved last month a USD 1.4bn emergency loan. War bonds issued by local and foreign investors provided USD 1.5bn and the World Bank provided USD 1bn according to Ukraine.

Ukraine said rebuilding the country will cost USD 600bn. To put the figure into perspective, a blogpost by the Council of Foreign Relations estimated that US had spent USD 208bn to “rebuild” Iraq and Afghanistan until 2017, while the USD 13.2bn spent by the United States during the Marshal plan to rebuild Europe would be the equivalent of USD 135bn today.2 The number of displaced Ukrainians rose above 10m with around 5m Ukrainians fleeing the country.3

Colombia: A poll by CNC showed Gustavo Petro leading second round vote intentions with 38.0% of the votes against 23.8% of former Mayor of Medellin Federico Gutierrez (known locally as FICO), 9.6% by Rodolfo Hernandez and Sergio Farrardo with 7.2%.4 Another poll released last week but conducted in late March shows FICO leading an eventual run-off against Petro. Last week, Petro swore an oath pledging not to expropriate Colombian private property in a bid to gain the more moderate voters, while his brother was involved in a scandal after recently visiting a prison to meet former officials convicted of corruption charges. The first round of presidential elections takes place on the 29 May. In economic news, the trade deficit narrowed to USD 1.1bn in February from USD 1.7bn in January, in line with consensus.

South Korea: Exports rose by +16.9% yoy in the first 20 days of April from 10.1% yoy in March, but average daily exports declined on a sequential basis to USD 2.3bn in April from USD 2.8bn in March. Imports rose by a yoy rate of 25.5% from 18.9% yoy over the same period. In other news, the yoy rate of PPI inflation rose by 30bps to 8.8% in March.

Mexico: One day after the Senate rejected AMLO’s bad energy reform, congress passed a bill nationalising all inventories of lithium and Mexico’s other strategic metals. If approved, the bill will make Mexico less competitive in becoming a global hub for electric vehicles, an area where Indonesia excels. In economic news, the yoy rate of CPI inflation rose 10bps to 7.7% in the first 15 days of April, slightly above consensus. The Bank of Mexico is likely to keep hiking policy rates, now at 6.5%, by at least another 200bps as 2-year MXN rates rose to 8.79%, the highest level in 17 years, a level consistent with positive real interest rates. In other news, the state-owned oil company Pemex said it would resume debt amortisations with its own resources this year, a change in the agreement whereby the Mexican government would repay Pemex debt during the entire year of 2022.

Peru: Farmers have blocked roads across the country requesting the dissolution of Congress, the end of monopolies and for an agrarian reform promised by President Pedro Castillo as well as a Constituent Assembly. During a televised ministers cabinet meeting in Cusco, Castillo pledged to send a bill to Congress calling for a referendum to change the constitution. A state of emergency was declared near Cuajone mine after protesters disrupted 20% of national copper output. Southern Copper claimed the situation was normalised after the military intervened, but output in the Las Bambas mine, controlled by Chinese mining company MMG, remained disrupted by locals that request more investment in its community.

Poland: Inflation continues to rise faster than expected, forcing the National Bank of Poland’s belated shift to a more hawkish tone. The yoy rate of PPI inflation surged to 20.0% in March from 16.1% yoy in February as core CPI rose to 6.9% yoy from 6.7% yoy over the same period. Retail sales rose by 22.0% yoy from 16.5% in February while average gross wages rose 12.4% yoy from 11.7% yoy over the same period, both signalling monetary policy remains too stimulative.

Snippets

- Argentina: The economic activity index rose 1.8% in February after declining 0.7% in January. The fiscal deficit deteriorated to ARS 99.8bn in March from ARS 76.3bn in February and the trade surplus narrowed to USD 279m from USD 809m over the same period.

- Bolivia: The Minister of Planning Gabriela Mendoza denied the government debt is above 80% of GDP – a figure mentioned by the World Bank – saying external debt is below 30% of GDP.

- Brazil: The Brazilian Central Bank intervened in the foreign exchange market last Friday selling USD 571m when the BRL sold-off nearly 5% before closing -3.8%. Despite the retracement, the BRL is still up 16.3% year-to-date, the best performing across major currencies as the lack of geopolitical risks trumped political risks.

- Czech Republic: The yoy rate of PPI inflation rose 340bps to 24.7%, more than 100bps above consensus.

- Ecuador: The Chief of Staff Francisco Jiménez met with the head of legislative to improve the relationship and mediate the approval of a new Investment Law, under negotiation with congress, as well as labour and security reforms.

- Egypt: The trade deficit widened to USD 2.7bn in February from USD 2.4bn in January, ahead of the full impact of the Russia-Ukraine war on its external accounts.

- Indonesia: Bank Indonesia kept its policy rate unchanged at 3.5%, in line with consensus.

- Malaysia: The yoy rate of CPI inflation was unchanged at 2.2% in March, 10bps below consensus, as core inflation rose 20bps to 2.0% yoy over the same period as energy subsidies cushion the impact of higher costs to the economy.

- Pakistan: The new Finance Minister Miftah Ismail went to Washington DC for the IMF semi-annual gathering and pledged to cut expenditures in an attempt to revive the USD 6bn programme with the IMF, of which only 50% was disbursed.

- Russia: The yoy rate of PPI inflation rose by 320bps to 26.7% in March, more than 1% below consensus as the weekly CPI in the 2nd week of April rose to 11.1% yoy from 10.8% in the same period in March.

- South Africa: The yoy rate of CPI inflation rose 20bps to 5.9% while core CPI rose 30bpst to 3.8%, both around consensus.

- Taiwan: Export orders rose by a yoy rate of 16.8% in March down from 21.1% yoy in February, but 130bps above consensus.

- Venezuela: President Nicolas Maduro proposed the creation of a basket of currencies including Dollars, Euros, Roubles, Renminbi, Rupees and Bitcoin to “feed the country’s wealth accumulation and distribution centre”. Argentina and Ecuador said it was time for Latin America to resume diplomatic ties with Venezuela.

Global backdrop

Commodities: Commodity prices declined 7.7% last week with oil prices down 8.8% trading close to USD 100 in early London trading hours. Fears of lower demand due to lockdowns in China coupled with the highest level of interest rates in the US in years as well as hopes that the conflict in Ukraine may be entering its final phase led to the correction. However, it is unlikely that China will allow its economy to enter a recession and the conflict in Ukraine could be far from a conclusion, in our view, therefore suggesting more volatility in commodity prices is likely.

United States: Despite St Louis Governor Jim Bullard’s calling for a 75bps hike, most of the Fed board, including Chairman Jay Powell, Atlanta Fed Raphael Bostic and Chicago’s Charles Evans have signalled a 50bps hike in the next meeting on 4 May, in line with current market pricing. Evans now believes that the Fed should reach neutral this year and move beyond neutral in 2023, with two 50bp hikes this year making sense (on 7 April he had said the Fed would only need to hike to neutral). Bostic also changed his tone saying that the Fed should move to neutral 'as expeditiously as possible' – compared with his previous 'measured way'. When asked regarding a 75bp hike, Evans believed there was no need for it and Bostic said it was 'not on the radar'.

In economic news, the weekly MBA mortgage applications declined another 5% in the week ending on 15 April, with the index dropping by 62% to 374 (from 981) since January 2021 as 30-year mortgage rates rose to a 12-year high. Existing home sales dropped to 5.77m in March from 5.93m in February and housing starts rose 5k to 1793k over the same period. The S&P Global manufacturing PMI rose 0.9 points to 59.7 in April, 1.7 above consensus, but the service PMI dropped 3.3 points to 54.7 in April (consensus 58.0).

Europe: Emmanuel Macron won the French presidential election run-off with 58.6% of the votes, against 41.4% for of Marine Le Pen. Macron’s lead was slightly higher than expected, but Le Pen’s party, the ‘Rassemblement National’ nevertheless increased its 2017 score of 33.9% of the votes despite its association with Putin’s regime, a result of the general dissatisfaction in France with higher costs of living notably. Notwithstanding the far-right performance, Macron’s political achievement is impressive, becoming the first president to be re-elected since Jacques Chirac in 2002 and the first to do so while retaining a majority in parliament since Charles de Gaulle in 1965. In that regard, the parliamentary elections on the 12 and 19 June will be key to monitor. Regardless of the outcome of the parliamentary elections, Macron’s election helps ensure that the European Union presents a somewhat unified front against Russia, which in economic terms means more European integration, more expenditure on security and energy independence. In monetary policy news, the European Central Bank may raise interest rates as soon as July amid “significant” inflation risks that will probably require further tightening later in the year, according to Governing Council member Martins Kazaks. The Euro Area manufacturing PMI rose to 55.3 (54.9 consensus), while the services PMI rose to 57.7 (55.0 consensus). In other economic news, new car registrations dropped by a yoy rate of 20.5% in March from -6.7% yoy in February.

Japan: The trade deficit improved by less than consensus to JPY 412bn in March from JPY 668bn in February, as the yoy rate of export growth dropped to 14.7% from 19.1% and imports dropped to 31.2% from 34.0% over the same period. The yoy rate of CPI inflation rose to 1.2% in March (in line with consensus) from 0.9% yoy in February.

United Kingdom: Retail sales dropped by 1.4% mom in March after declining another 0.5% in February, significantly below consensus, leading to a steep drop in the GBP against its main trading partners.

Canada: The yoy rate of CPI inflation rose by 100bps to 6.7%.

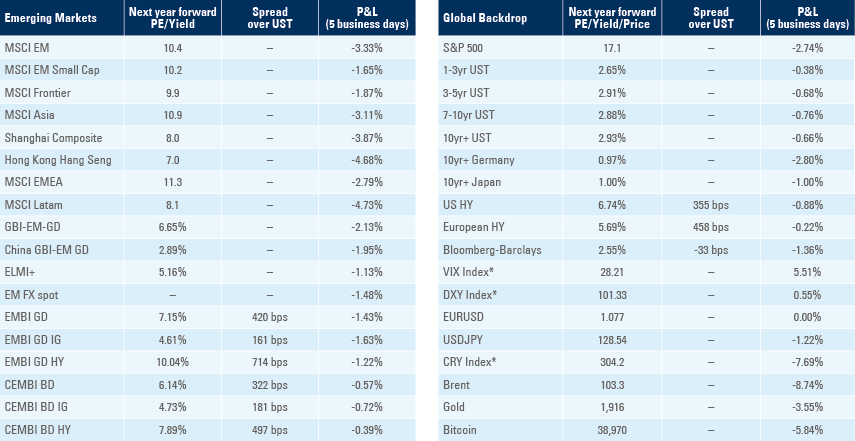

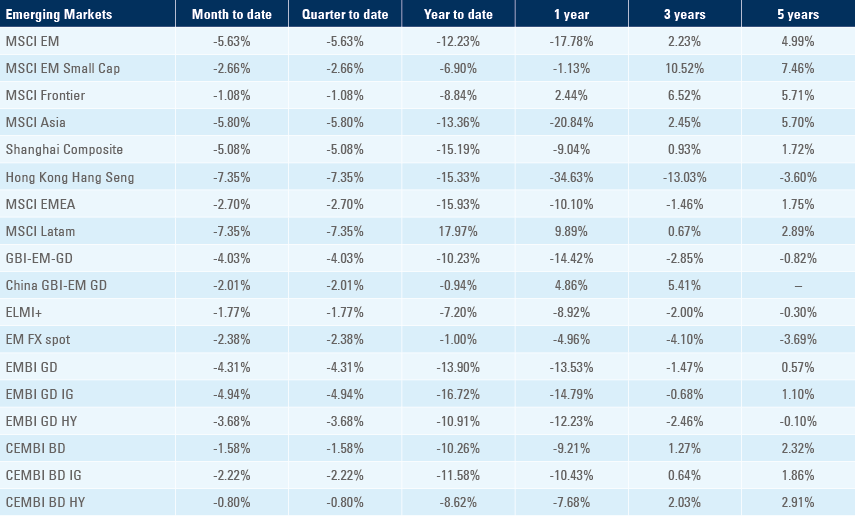

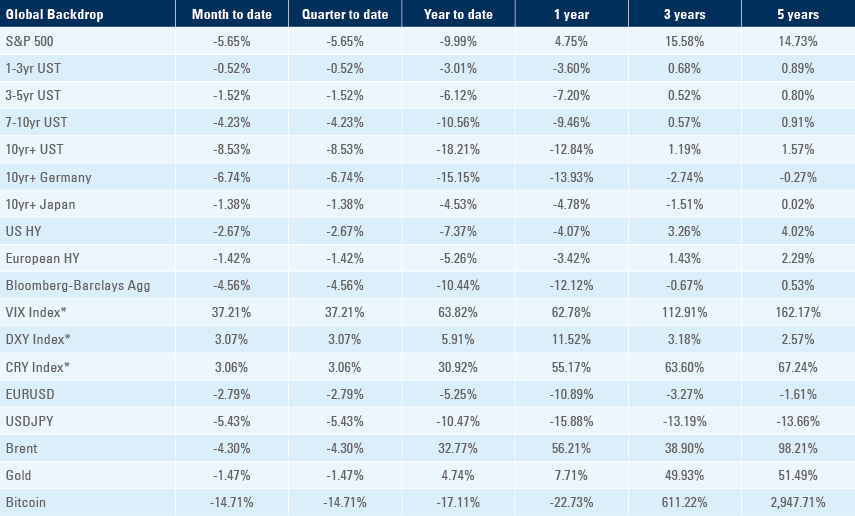

Benchmark performance

1. See : https://twitter.com/KofmanMichael/status/1517463774189469696

2. See https://www.cfr.org/blog/it-takes-more-money-make-marshall-plan#:~:text=The%20Marshall%20Plan%2C%20the%20historic,%24135%20billion%20in%20today's%20money.

3. See https://data2.unhcr.org/en/situations/ukraine

4. See https://www.semana.com/nacion/articulo/atencion-gustavo-petro-consolida-su-ventaja-y-se-perfila-como-el-proximo-presidente-encuesta-del-cnc/202237/