Scott Bessent pick boosts bonds, Brazil’s fiscal reforms disappoint.

- Bond yields moved sharply lower as markets priced in Scott Bessent’s sound economic plans.

- Mexican peso and Canadian dollar recovered after brief selloff, after tariff rhetoric from Trump was met with signs of cooperation from USMCA partners.

- Ceasefire agreement reached between Hezbollah and Israel. Implementation is key.

- Zelensky shed new light on potential ceasefire conditions.

- India’s GDP growth missed expectations.

- The Bank of Korea cut rates 25bp to 3.0%.

- Sri Lanka’s debt restructuring shows upside potential, with upgrade to ‘Caa1.’

- Brazil’s fiscal reforms disappointed, with tax cuts leading to BRL sell-off.

- El Salvador received a Moody’s upgrade to B3 as IMF support is likely, easing debt pressures.

- Protests in Georgia after the government delayed EU membership talks until 2029.

- Moody’s changed Angola’s outlook from positive to stable citing debt profile challenges.

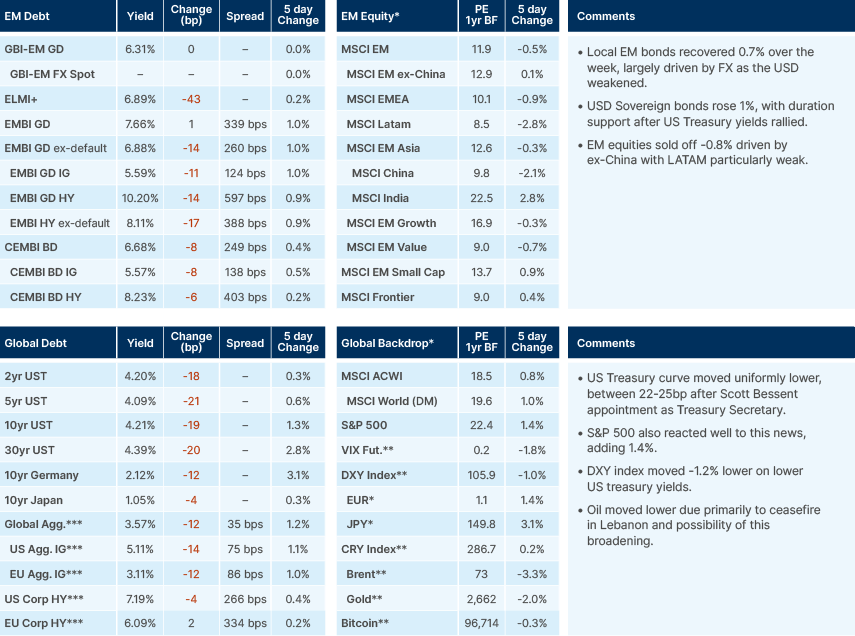

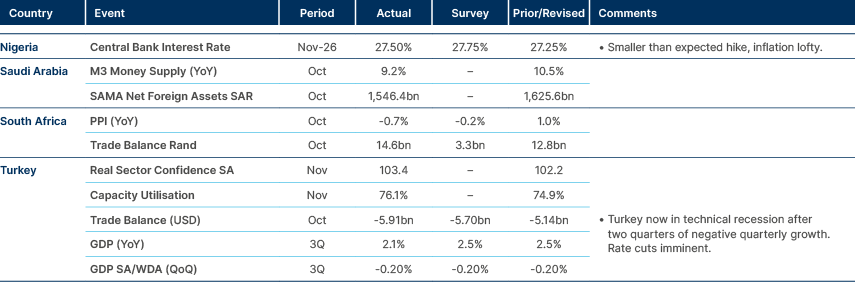

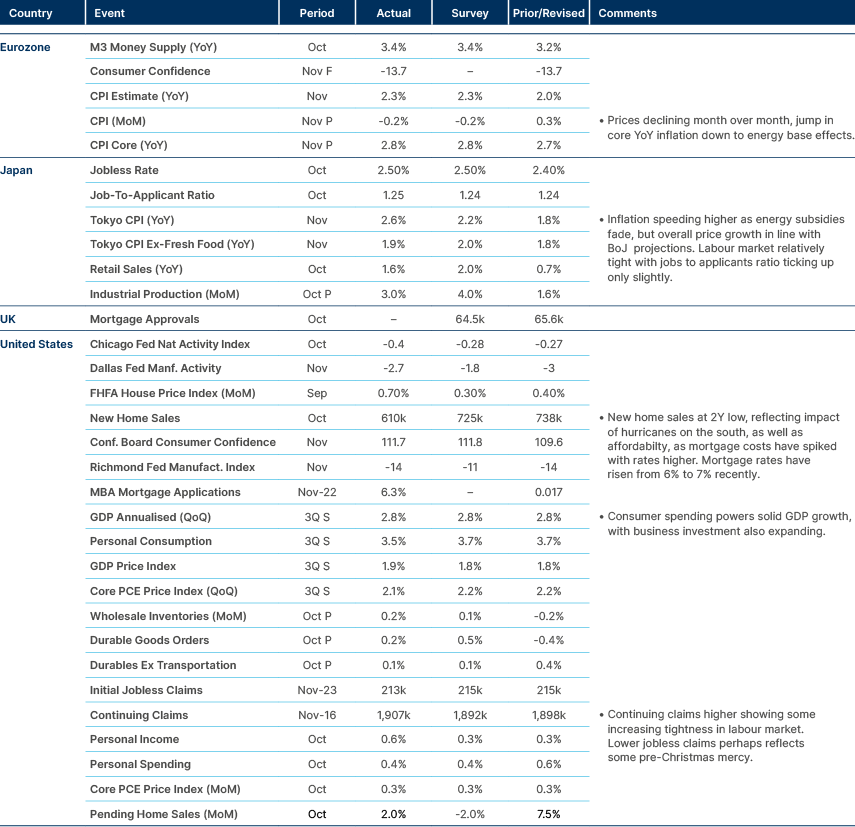

Last week performance and comments

Global Macro

Price action in currency markets last week showed that markets are taking Trump’s ongoing rhetoric, (for now, on Truth Social rather than from the White House), about tariffs with a pinch of salt. After his comments on imposing a 25% tariff on all goods from Canada and Mexico last weekend caused a brief sell-off in the CAD and MXN, the exchange rates recovered in just two days. Both Sheinbaum and Trudeau both spoke to Trump last week. After a phone conversation, Sheinbaum commented that she was confident there will be ‘no potential tariff war’ between Mexico and the US, although they did not discuss tariffs with Trump directly. Trump’s reaction on Truth Social to the conversation indicated willingness from Sheinbaum to work with the US to limit illegal immigration through Mexico. Trudeau went one step further and flew to Mar-a-Lago, promising Trump him to increase surveillance over the long joint border according to a senior Canadian official. Trump said the meeting was ‘very productive.’ Trudeau posted on X "Thanks for dinner last night, President Trump. I look forward to the work we can do together, again.” The tone certainly sounds conciliatory.

During the week, long dollar positioning also began to unwind with the DXY index moving down from 107.5 on Friday the 22nd of November to 105.7 last Friday, as treasury yields fell across the curve. We think that the dollar may have more downside in the short-term. FOMC minutes now suggest that another cut in December is happening, with futures markets now pricing a 65% probability of a 25bp cut. Furthermore, an influential ECB member, Isabel Schnabel pushed back against a 50bp cut in the short term. The BOJ is likely to hike at the December meeting after Tokyo CPI came in hot in November and wage negotiations are skewed in favour of employees. A lower interest rate differential between the dollar and the two other major reserve currencies, the Euro and the Yen, will put pressure on the USD in the short term.

Trump had more to say this weekend on Truth Social: “The idea that the BRICS Countries are trying to move away from the dollar while we stand-by and watch is OVER. We require a commitment from these countries that they will neither create a new BRICS currency, nor back any other ccy to replace the mighty U.S. dollar or, they will face 100% tariffs and should expect to say goodbye to selling into the wonderful U.S. Economy.”

The dollar hegemony matter is complex and the practical implications of the post ambiguous, in our view. One of the key reasons that the dollar has the ‘exorbitant privilege’ of being the world’s reserve currency is because mercantilist countries have large surpluses with the US, and these surpluses are recycled largely into the US Treasury market. As Michael Pettis neatly put it: “Reducing the trade deficit would benefit American businesses, workers and middle-class savers. Increasing USD dominance would benefit Wall Street and the sanctioning power of the US government. The US must decide which constituency is more important”.1 Furthermore, the dollar has been losing market share both in terms of global foreign exchange reserves and as a percentage of trade settlement. Nevertheless, the dollar rose over the last decade. Losing more market share or even a change in the trend to a depreciating greenback doesn’t mean the dollar will lose its hegemony. The hegemony is associated with the soundness of the US capital markets and the US military strength. The best way of preserving both would be implementing thoughtful policies as prescribed by Scott Bessent, which may well drive the dollar weaker by design.2

Geopolitics

Donald Trump named Kash Patel, a loyalist and “Deep State” critic, to lead the FBI, with plans to dismiss Chris Wray before his term ends in 2027. Trump declared, “For too long, the partisan Department of Justice has been weaponized against me and other Republicans — not anymore.”3

Israel has entered a 60-day ceasefire with Hezbollah, though the situation remains fragile. Both sides have accused the other of violations of the ceasefire. Lindsey Graham indicated Trump is pushing for a Gaza ceasefire before his inauguration, tied to the release of 101 hostages.4

Russia/Ukraine developments include North Korean troops reportedly integrating with Russian units in Ukraine. Meanwhile, Vladimir Putin praised Trump as “a smart and experienced politician.” Ukrainian President Volodymyr Zelenskyy suggested a ceasefire deal could be possible if territory under his control is brought "under the NATO umbrella," allowing for diplomatic negotiations over the rest later.

Syria faces a power vacuum in Aleppo as Syrian rebel forces move in, taking advantage of Israel’s strikes into Iran and Hezbollah, as well as Russia’s focus in Ukraine.

French politics remains volatile. National Rally leader Jordan Bardella threatening to activate a censure vote against Prime Minister Michel Barnier unless concessions are made.

Australia has passed a law banning children under 16 from using social media.

Emerging Markets

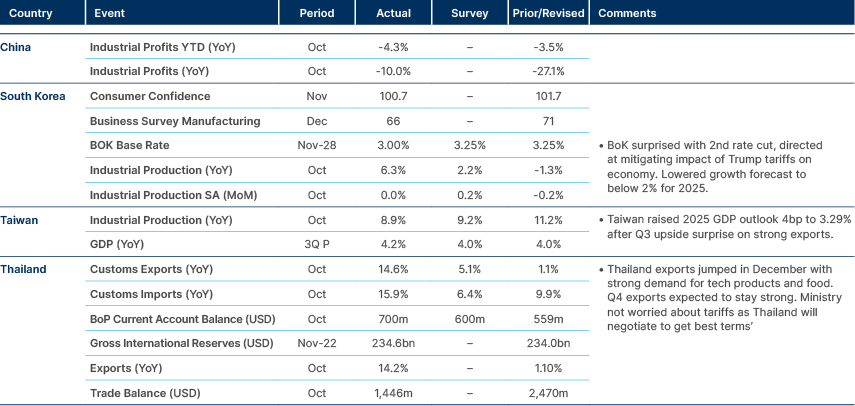

Asia

Surprise second rate cut in Korea, strong exports in Thailand continue.

India

GDP growth fell short of expectations, registering a year-on-year expansion of 5.4% compared to the anticipated 6.5%. The undershoot was primarily driven by weaker performance in agriculture, mining, and manufacturing sectors. The data reinforces the case for the Reserve Bank of India (RBI) to adopt a looser monetary stance, potentially allowing some currency depreciation to support economic recovery.

South Korea

The Bank of Korea responded to growth concerns by cutting its policy rate by 25 basis points to 3.0%. The decision, however, revealed a split among the board, with two of the six members advocating for no change. This highlights ongoing uncertainty about the economic outlook and the extent of required monetary easing, particularly with possibility of US tariffs.

Sri Lanka

Moody’s assigned a ‘Caa1’ credit rating to the restructured bonds and placed them under review for an upgrade, though they remain categorized as Selective Default (SD) and Restricted Default (RD) by S&P and Fitch, respectively.

The Central Bank of Sri Lanka has simplified its monetary policy framework by moving to a single interest rate mechanism. The newly introduced Overnight Policy Rate has been set at 8%, marking a 50-basis-point reduction from the previous average weighted call money rate. HSBC expects further rate cuts in the near term as the central bank continues its efforts to stabilize the economy and stimulate growth.

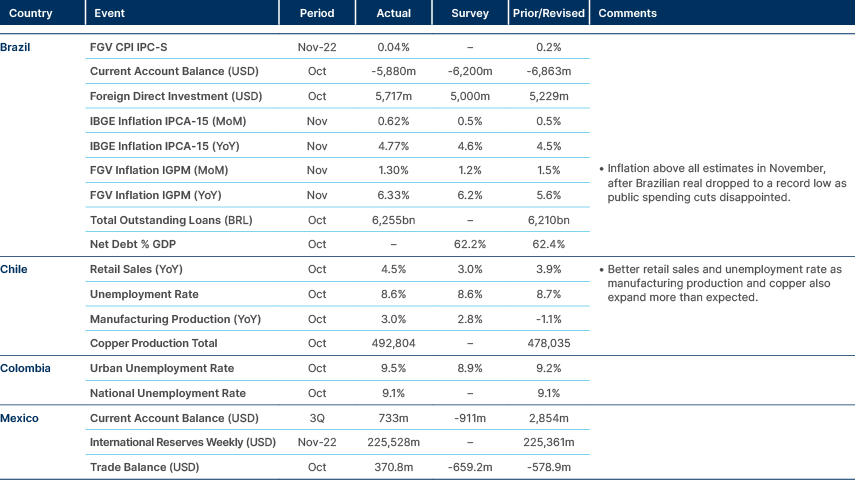

Latin America

Brazil fiscal soap opera.

Argentina

Economic activity has been recovering at an annualized pace of 9.7% since April, according to JP Morgan. Key growth sectors include manufacturing (+6.3%), construction (+5.2%), commerce (+4.3%), hospitality (+4.9%), and financial intermediation (+11.3%). Growth projections for 2024 and 2025 have been revised to -3.0% year-on-year and +5.2%, respectively, with forecast risks for 2025 skewed to the upside, reflecting optimism about continued economic recovery.

Brazil

Finance Minister Fernando Haddad announced a long-awaited fiscal consolidation program to sustain its fiscal deficit framework. The markets took this as a negative surprise. The BRL 70 billion adjustment announced was expected, with BRL 30 billion planned for 2025 and BRL 40 billion for 2026. Haddad proposed exempting workers earning less than BRL 5,000 per month from income tax, offset partially by tax increases for those earning more than BRL 50,000. However, the math does not add up. The proposed exemption would reduce the number of regular taxpayers by a third and cut annual tax collection by approximately BRL 35 billion (0.3% of GDP). Given that the top 0.5% of the economically active population earns more than BRL 50,000 per month, even a substantial tax hike on this group would fail to offset the loss. Brazil’s tax system remains highly regressive, with a heavier reliance on consumption taxes than income tax. Encouragingly, the leaders of both houses of Congress issued statements saying they would not back the new tax measures if they would result in a decline in tax revenues. It is time Brazilian Congress takes back the fiscal reigns, before its too late.

El Salvador

Moody’s upgraded El Salvador’s sovereign rating to B3, aligning with S&P and one notch above Fitch’s CCC+ rating. Recent debt management operations have significantly eased the country’s payment schedule, with bond prices nearing par value across the yield curve. Moody’s noted that external bond amortizations through 2029 are now low and manageable due to recent buybacks, reinforcing favourable market sentiment. Bloomberg reported a strong likelihood of a staff-level agreement with the IMF for approximately $1.4 billion, potentially enhancing fiscal stability further.

Panama

S&P downgraded Panama’s sovereign rating to BBB-, bringing it in line with Moody’s Baa3 and one notch above Fitch’s BB+ rating. The downgrade reflects reduced fiscal flexibility and heightened vulnerability to economic challenges. S&P’s stable outlook anticipates gradual fiscal consolidation under Panama’s new government, supported by growth rates higher than peers. Moody’s, however, lowered Panama’s outlook to negative, citing a larger-than-expected fiscal deficit above 6% of GDP in 2024 and rising debt-to-GDP nearing 61%. These developments underline significant hurdles to rapid fiscal consolidation and economic resilience.

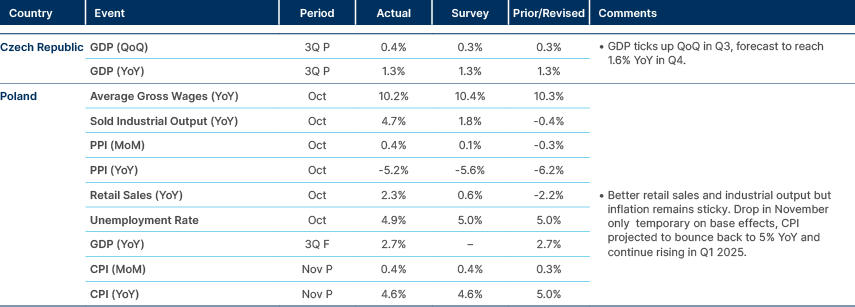

Central and Eastern Europe

Georgia

Protests broke out in Tbilisi after Prime Minister Irakli Kobakhidze announced that the government would not pursue EU membership talks before 2029. The statement, made shortly after Parliament confirmed a new cabinet, drew sharp criticism from President Salome Zourabichvili. Georgia had applied for EU membership in 2022, but the bloc has not formally agreed to open negotiations for the years-long process.

Hungary

Moody’s affirmed the ‘BBB’ sovereign credit rating but changed the outlook to negative citing downward risk to growth, debt prospects and institutional risks.

Romania

Last week’s presidential election results are under scrutiny as the Constitutional Court investigates claims of external interference. The controversy centres on one candidate allegedly receiving massive exposure and preferential treatment on TikTok, violating electoral law. A recount could alter the outcome, potentially advancing a Social Democratic Party (PSD) candidate to the second round, increasing political uncertainty. In parallel, legislative elections brought a fragmented parliament, as expected, but with more than 50% of seats allocated to centre-left parties. With 99% of the votes counted, the chamber of elections voting split was:

- PSD 22.3% (socialist)

- AUR 17.9% (far-right)

- PNL 13.4% (liberals)

- USR 12.2% (progressive)

- SOS-7.2% (far-right)

- UDMR 6.4% (Hungarian minority party)

- POT - 6.3% (far-right)

Central Asia, Middle East, and Africa

Angola

President Biden is scheduled to visit Angola today and tomorrow, marking his first and final trip to the African continent during his tenure. He is set to meet with President João Lourenço, a meeting that had been postponed since October. Moody's has adjusted Angola's credit rating outlook from positive to stable, citing a slower pace of fiscal consolidation than previously anticipated. The agency now forecasts modest fiscal deficits in the coming years, with debt-to-GDP stabilizing slightly below 60%. While refinancing risks have diminished, Moody's notes that Angola continues to face a challenging debt profile.

Senegal

S&P has affirmed Senegal's credit rating at B+ but revised the outlook from stable to negative. This decision, made on October 18, 2024, reflects concerns over fiscal slippage and potential economic challenges. The agency is likely awaiting the results of a national audit, expected later this month, before considering further rating actions. Previously, on October 18, S&P had downgraded the outlook from stable to negative, indicating apprehensions about the country's fiscal trajectory.

Developed Markets

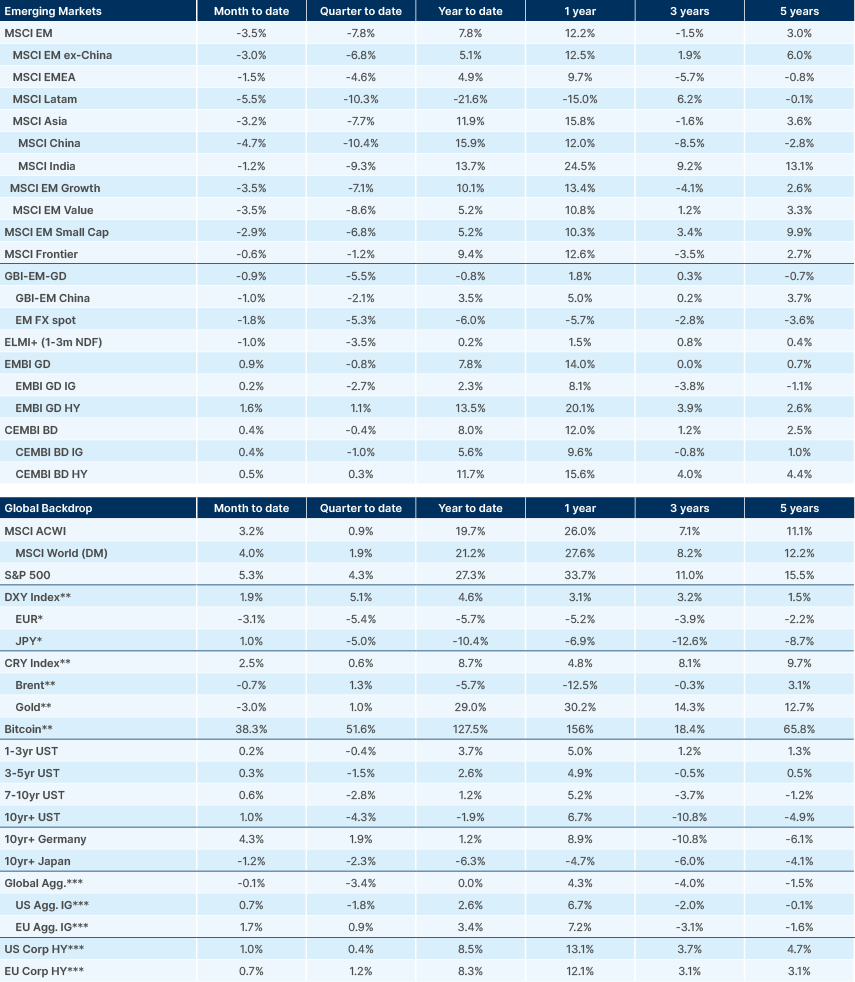

Benchmark performance

Source and notations for all tables in this document:

Source: Bloomberg, JP Morgan, Barclays, Merrill Lynch, Chicago Board Options Exchange, Thomson Reuters, MSCI. Latest data available on publication date.

* Price only. Does not include carry. ** Global Indices from Bloomberg. Price to Earnings: 12m blended-forward

Index Definitions:

VIX Index = Chicago Board Options Exchange SPX Volatility Index. DXY Index = The Dollar Index. CRY Index = Thomson Reuters/CoreCommodity CRM Commodity Index.

Figures for more than one year are annualised other than in the case of currencies, commodities and the VIX, DXY and CRY which are shown as percentage change.

1. See – https://x.com/michaelxpettis/status/1863079259746492856

2. See – ‘Trump 2.0: Implications for Emerging Markets', Market Commentary, 12 November 2024.

3. See – https://www.axios.com/2024/11/30/trump-staff-investigation-fbi-doj

4. See – https://www.axios.com/2024/11/29/trump-gaza-ceasefire-hostage-deal