Russian orthodox policy response contrasts with Turkey's heterodoxy

The Central Bank of Russia hiked its policy rate by more than expected as Governor Elvira Nabiullina prioritised anchoring inflation expectations, leading to a strong performance across Russian assets. On the other hand, fears of a deterioration of fiscal policy in Brazil and further monetary policy heterodoxy in Turkey led to a strong sell-off across the two countries. Investors over-reacted to fears of an evolution of the fiscal accounts over the next years in Brazil, in our view. In Turkey, the Central Bank cut policy rates by 200bps after all but one of the former CB directors were fired. President Erdogan created another crisis with the United States and Europe as he threatened to fire 10 ambassadors from Istanbul. In China, the central bank added liquidity overnight while property developer Evergrande said it repaid the coupon on two Eurobonds ahead of the end of the grace period on 23 October.

Emerging Markets

Argentina: The fiscal balance swung to a ARS 291.4m primary surplus in September from a ARS 124.8m deficit in August, with the year-to-date primary deficit accumulating 1.5% of GDP. However, after excluding the one-off impacts of the wealth tax and the IMF SDR injection, the adjusted YTD primary deficit adds up to 3.1% of GDP, a much slower consolidation than suggested by the headline numbers. The trade surplus narrowed to USD 1.7bn in September from USD 2.3bn in August.

Brazil: The Treasury Secretary Bruno Funchal and three other technocrats resigned after President Bolsonaro pressured for the constitutional expenditure cap to be “softened” in order to allow for an expanded income transfer social program from 2022. A constitutional amendment bill was proposed by the Lower House of Congress retroactively changing the inflation adjustment (from previous-year June CPI to December), which in practice increases the 2022 expenditure ceiling to BRL 1.66trn (from BRL 1.61trn). If approved, the higher expenditure ceiling will allow the government to expand the current monthly stipend from 14m families to 17m and to increase its value to BRL 400 from BRL 187 today, as well as carving out BRL 15bn for vaccines and socio-economic emergencies. The government also announced a temporary monthly BRL 400 to 700k-850k truck drivers (estimated total cost of BRL 4bn) to alleviate the impact of higher fuel prices and avoid having to interfere in fuel prices. Lastly, the annual payment of court-ordered debts (precatorios) was limited to the 2016 value (adjusted for inflation) (around BRL 40bn). The above-cap expenditures could increase the 2022 primary fiscal deficit by BRL 75bn (or 0.5% of GDP) to 1.2% of GDP according to Itau, a local bank.

The deterioration in the government`s fiscal discipline led to a sharp sell-off in 10yr local bonds, which widened 137bps to 12.43%, and the MSCI Brazil dropped 11.4%, now trading around 7.0x 12-months earnings – the lowest levels since 2008. In our view, the economic policy mistakes are likely to bring the private sector to support an alternative candidate to Bolsonaro and former president Lula. The main risk is that as a large number of candidates launch themselves as alternatives to the polarisation, thus splitting the votes from the share of the population not interested in voting either Lula or Bolsonaro. The other unknown factor contributing to higher uncertainty is whether former President Lula will be a good steward of sound macroeconomic policies as he was during the majority of his tenure or will move to a more heterodox/populist framework, should he win the 2022 presidential elections. At current levels, local assets are close to pricing in a very poor political outcome next year, providing interesting upside for the medium term, in our opinion.

In economic news, the current account moved to a USD 1.7bn deficit in September from a USD 1.8bn surplus in August, only slightly worse than expected, while foreign direct investment was unchanged at USD 4.5bn over the same period.

China: Vice Premier Liu He said risks on the property market are under control, adding that developers’ reasonable funding needs are being met and the property market’s healthy development trend remains unchanged. The People’s Bank of China (PBoC) governor Yi Gang said the central bank will avoid any contagion risk from individual property developers to the overall sector and financial markets. Xu Shanchang, an official at China`s top economic regulator said the regulatory tightening on the internet platform monopoly and disorderly expansion of capital was not targeting specific companies or the private sector. Xu said the authorities would support small businesses that are currently under pressure due to rising costs of raw materials and covid-19 resurgence.

In corporate news, the property developer Evergrande said it had paid a USD 83m coupon on Eurobonds before the end of the grace period on 23 October (Saturday). However, Evergrande terminated a deal to sell 51% of a stake in its property management company to Hopson Development Holdings. The deal would raise HKD 20bn (USD 2.6bn) for Evergrande.

El Salvador: The ratings agency S&P kept El Salvador sovereign rating at B-, but downgraded the outlook to negative, aligning itself with Fitch while Moody`s rating which is already Caa1 (negative outlook). The IMF reiterated its ongoing dialogue for an Article IV and a possible extended funding facility loan.

Russia: President Putin said Russia could increase gas exports to Europe by 10% as soon as it gets regulatory approval, as the first Nord Stream 2 gas pipeline “is filled with gas”. The first line can deliver 17.5bn cubic meters of gas while the combined capacity of both pipes can reach 55bn.1 The Central Bank of Russia (CBR) hiked its policy rate by 75bps to 7.5% (consensus 25bps) and said further rate hikes are possible over the next meetings. The hawkish stance was justified by higher than expected inflation as expectations for end of 2022 remained at 4.0% - 4.5% (slightly above the 4.0% target).

South Africa: The yoy rate of CPI inflation rose 0.1% to 5.0%, in line with consensus as core CPI rose 0.1% to 3.2% yoy. Central Bank Governor Lesetja Kganyago said price pressures are so far transitory. The central bank will avoid “too early” monetary policy tightening killing nascent economic growth but is ready to react to any signs of inflation persistence.

South Korea: The yoy rate of export growth rose 25.7% in the first 20 days of October down from 31.3% yoy over the same period in September. Higher imports on the back of higher energy prices drove the trade balance to a USD 2.5bn deficit in the first 20 days of October from USD 1.1bn surplus in September. The yoy rate of PPI inflation rose 0.1% to 7.5% in September.

Turkey: The Central Bank of Turkey (CBT) cut its key policy rate by 200bps to 16.0% (consensus 100bps), which is now 3.6% below CPI inflation and 1.0% below core CPI. The CBT said “supply-side transitory factors” leave limited room for further cuts, suggesting further cuts of smaller magnitude are forthcoming. The TRY depreciated another 3.8% accumulating a 22.7% decline year-to-date, the worst performing currency across major EM and DM currencies. Over the weekend, President Erdogan said he would repeal the ambassadors of 10 countries, including US, Germany and France, after their coordinated announcement to release Osman Kavala, a businessperson, from jail. If confirmed, the countries affected may retaliate by also expelling their Turkish ambassadors, leading to further deterioration in Turkey`s key economic and geopolitical relationships.

Zambia: The Ministry of Finance published the full list of government creditors. Chinese creditors account for nearly one-third of the total USD 13.4bn central government external debt stock in 2H 2021, in line with expectations. The total public debt stock was around USD 26.3bn (95% of GDP), down from 115% of GDP in 2019 as higher nominal GDP alongside the Kwacha appreciation is allowing for a steady improvement in debt metrics.2

Index matters: The United Arab Emirates will join the JP Morgan EMBI GD with an estimated 0.2% weight at the end of the month following the issuance of 2031, 2041 and 2061 bonds. On the other hand Slovakia will drop out of the index as its single 2022 Dollar-denominated Eurobond is now shorter than 1-year, thus no longer eligible for index inclusion.

Snippets

Colombia: The trade deficit widened to USD 1.6bn in August from USD 1.2bn in July.

Hungary: The central bank hiked its policy rate 15bps to 1.80%, in line with consensus.

Indonesia: Bank Indonesia kept its policy rate unchanged at 3.5%, in line with consensus.

Malaysia: The yoy rate of CPI inflation rose 0.2% to 2.2% in September, remaining at the lower bound of Bank Negara Malaysia inflation target range of 2.0% to 3.0%.

Mexico: The yoy rate of CPI inflation was unchanged at 6.1% in the first 15 days of October, but core CPI rose 0.2% to 5.1% yoy over the same period. Retail sales was flat in August, leading the yoy rate down 2.7% to 7.2%, slightly better than consensus.

Paraguay: The central bank hiked its policy rate by 125bps to 2.75%, significantly higher than the 25bps consensus expectations.

Poland: The yoy rate of industrial output declined 4.4% to 8.8% in September, while retail sales rose 0.4% to 11.1% yoy. The yoy rate of core CPI inflation rose 0.3% to 4.2% yoy in September as average gross wages moderated 0.8% to 8.5% yoy

Taiwan: The yoy rate of export orders rose to 25.7% in September from 17.6% in August, significantly above consensus as the unemployment rate dropped 0.2% to 3.9% in September.

Ukraine: The IMF staff agreed to restart disbursements of a USD 5bn loan that was frozen for one year due to lack of compliance with the fund`s conditions. The board of directors needs to approve the loan.

Global backdrop

ESG: The European Union (EU) postponed the classification of natural gas and nuclear energy in the EU taxonomy framework. The EU taxonomy will classify activities considered sustainable to industries and investors and avoid “greenwashing”. Several countries, including France and Germany, have been investing in nuclear and gas power plants as an alternative to coal. Some environmental groups believe these activities are not truly sustainable, potentially questioning the credibility of the EU taxonomy. The taxonomy framework will guide asset allocation decisions by banks and asset management companies under pressure to improve their contribution to global environmental solutions. In other ESG news, China announced new guidelines targeting a plateau of oil consumption between 2026 and 2030 and aiming at generating more than 80% of the country`s total energy from renewable sources by 2060.

United States (US): Economic data was mixed as the Citibank economic surprise index recovered 1.8 to -32.6. The flash Markit manufacturing PMI dropped 1.5 to 59.2 in October, but services PMI rose 3.3 to 58.2. The Philadelphia Fed business outlook dropped to 23.8 in October from 30.7 in September. Jobless claims declined 6k to 290k in the week ending in 16 October, while continuing claims dropped 120k to 2.48m in the previous week. Existing home sales rose 0.4m to 6.3m in September, but housing starts dropped 25k to 1.56m and building permits dropped 130k to 1.59m.

Fed Chairman Powell acknowledged that inflation could stay at high levels for longer, but added that although the Fed will start its tapering process in November, rate hikes are not on the cards in the short term.

Eurozone: October flash PMIs were softer than expected. The Eurozone services PMI dropped 1.7 to 54.7 while manufacturing PMI was 0.1 lower at 58.5. Within manufacturing, the employment index rose 2.6 to 90.2 while output rose 0.6 to 56.1. The Germany manufacturing output index declined 3.1 to 51.1, the lowest level in 16 months. The current account surplus dropped to EUR 13.4bn in August from EUR 22.6bn in July.

Japan: The yoy rate of CPI inflation rose 0.6% to 0.2% in September mostly due to higher food prices while CPI ex-food and energy was unchanged at -0.5% yoy over the same period.

United Kingdom: The yoy rate of CPI inflation softened 0.1% to 3.1% in September.

Australia: The Reserve Bank of Australia announced AUD 1bn of purchases 2024 bonds, driving yields down 6bps to 0.11% (just above the 0.1% target).

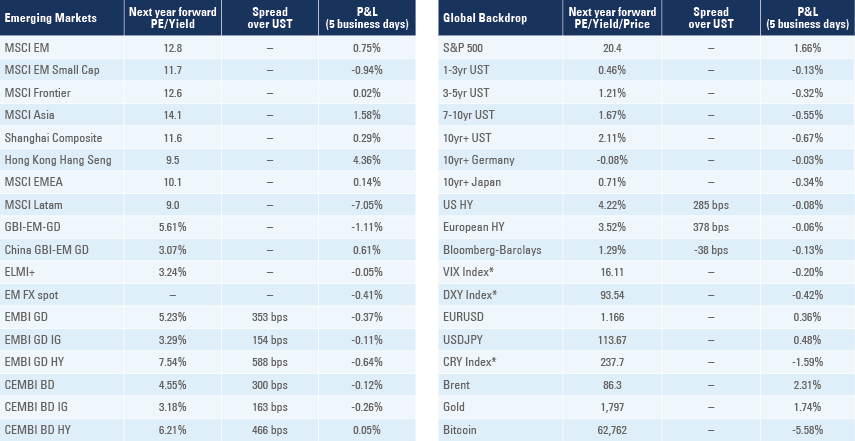

*VIX Index = Chicago Board Options Exchange SPX Volatility Index. *DXY Index = The Dollar Index. *CRY Index = Thomson Reuters / CoreCommodity CRM Commodity Index.

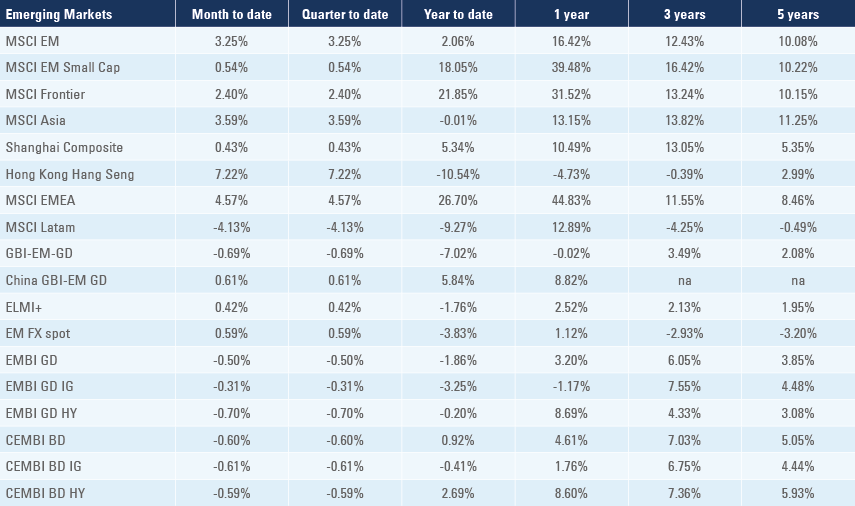

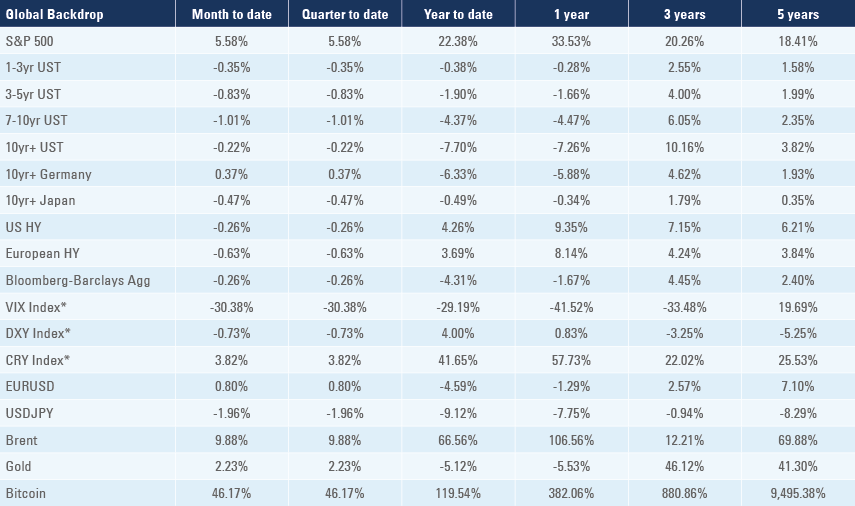

Source: Bloomberg, JP Morgan, Barclays, Merrill Lynch, Chicago Board Options Exchange, Thomson Reuters, MSCI, total returns.

Figures for more than one year are annualised other than in the case of currencies, commodities and the VIX, DXY and CRY which are shown as percentage change.

1. See https://www.bnef.com/news/974027?e=News%20Watch:sailthru

2. See https://www.lusakatimes.com/2021/10/22/government-publishes-full-list-of-creditors/