Russia announced it halted gas supplies to Poland and Bulgaria and said it repaid the Eurobonds before the end of the grace period. Brazilian consumer price inflation rose less than expected. The Chinese politburo sent a strong message of support for the economy. Chile’s President Boric’s approval rates stabilised last week. Colombia hiked rates by 100bps as three board members favoured 150bps. Hungary wages surged more than 30% yoy. Mexico remittances from overseas workers increased. Philippines had record fiscal deficit ahead of next week’s presidential elections. Inflation surprised to the upside in Poland, South Korea and Peru and South Africa.

Emerging markets

Russia-Ukraine

Russia announced it was halting gas supplies to Poland and Bulgaria as both countries did not pay Gazprombank under the new pricing mechanism whereby buyers make the payment in EUR, but the transaction is only settled once Gazprombank converts the EUR into RUB via the Russian Central Bank, bypassing EU sanctions. Bloomberg reported that four EU countries have already made payments under the new system and ten EU companies opened accounts at Gazprombank as the next wave of payments are due on 15 May. Gas flow through EU pipelines has oscillated in recent days, but Germany is still receiving gas from Russia through both Ukraine and Nord Stream 1 pipelines. Germany said it is prepared to phase out oil imports by the end of the year, contingent on finding alternative sources. The deadline could be longer for countries more reliant on Russian energy such as Hungary, Austria, Slovakia, and Czech Republic. Last year Germany received USD 104bn from oil imports to Europe and the UK, compared to USD 45bn from gas. Poland, which continues to receive gas via reverse flows from Germany, is pressuring the EU to seize assets from sanctioned individuals to fund the rebuilding of Ukraine.

In other news, the conflict remains in a stalemate with Russia struggling to make progress both in expanding its control over Donbas and taking over the remainder of the Ukrainian coastline on the Black Sea. Tensions continued to build in Transnistria, the strip of land between Moldova and Ukraine where explosions were reported.

Russia: Russia said it had repaid the remaining USD 650m of its 4 April 2022 Eurobond before the end of the grace period, implying a higher willingness to service the debt as the country would have to deploy fresh funds from current exports (foreign exchange reserves remain frozen) to settle the transaction. The central bank cut its policy rate by 300bps to 14.0%, below consensus. Governor Elvira Nabiullina said pegging the RUB to gold is not under discussion. Economic data suggests the impact from sanctions was more gradual than expected with Bloomberg nowcast suggesting a 2% drop in GDP vis-à-vis February. The yoy rate of retail sales declined to 2.2% in March from 5.7% yoy level in February, as industrial production declined by 330bps to 3.0% yoy in March, both significantly above consensus as the unemployment rate was unchanged at 4.1% in March and real wages increased by 2.6% yoy in February (from 1.9% yoy in January and above 0.7% consensus).

Brazil: The yoy rate of CPI inflation rose to 12.0% in April from 10.8% yoy in the first half of March but came in 10bps below consensus, whilst PPI inflation rose to 15.0% yoy from 14.8% yoy in April, slightly above consensus. Tax collection rose to BRL 164bn in March from BRL 149bn in February, the highest level on record for the month of March allowing the budget deficit to narrow to BRL 6.3bn from BRL 20.6bn while the unemployment rate declined 0.1% to 11.1% over the same period.

China: The Politburo met last week, and President Xi Jinping pledged to stick to its zero-covid strategy whilst improving its control methods and coordinating virus control with economic growth. Importantly, the Politburo announced specific measures to support the healthy development of the (internet) platform economy as well as supporting local governments to optimise the supervision of developers’ pre-sales. Several provinces eased restrictions on housing purchases. The Politburo announcements triggered a strong rebound in Chinese stocks with the Shanghai Composite Index down only 1.3% and the Hang Seng (H-shares) index up 4.7% over the last five business days, both outperforming global stocks. In economic news, the current account surplus slowed to USD 89.5bn in Q1 2022 from USD 118.4bn in Q4 2021 as the yoy rate of industrial profits rose to 8.5% in March from 5.0% yoy in February. The manufacturing PMI dropped 2.1 points to 47.4 in April and non-manufacturing PMI declined by 6.5 to 41.9 over the same period due to lockdowns in Shanghai and other cities. Beijing announced mass testing in 12 districts, but unlike Shanghai has not imposed mass mobility restrictions.

Chile: A poll by Cadem showed President Gabriel Boric’s approval and disapproval rate stabilising at 35% and 53% respectively. The same poll showed 46% of respondents were against the new constitution with 36% being in favour. Economic data improved as the yoy rate of manufacturing production rose to 3.3% in March from -2.2% yoy in February and industrial production bounced to +0.8% yoy from -3.0% yoy and commercial activity rose to 8.4% yoy from 4.8% yoy over the same period. Retail sales rose 20bps to 11.2% yoy in March and copper production recovered to 462 tons in March from 400 tons in February, thus bouncing back to the average of the last five years. Overall, economic activity rose 1.6% mom in March from -0.7% mom in February, even though unemployment rate increased 30bps to 7.8% in March.

Colombia: The national unemployment rate dropped 80bps to 12.1% in March despite urban unemployment rate declining only 10bps to 12.6%. The central bank hiked its policy rate by 100bps to 6.0%, in line with consensus, but three out of seven members voted for a 150bps hike, signalling policy rate is likely to increase to at least 8.0% over the next few meetings.

Hungary: The average gross wages increased by 31.7% in February from 13.7% in January, more than twice the consensus expectation, led by a 20% increase in minimum wage as unemployment rate dropped 20bps to 3.6% in March. The National Bank of Hungary hiked its policy rate by 100bps to 5.4% and the effective 1-week repo rate by 30bps to 6.45%, both in line with consensus. In other news, the trade deficit widened to USD 117m in February from 91m in January, the worst level since 2004.

Mexico: Foreign exchange remittances from Mexicans living abroad accelerated to USD 4.7bn in March from USD 3.9bn in February, the highest level for the month since the beginning of the survey. The yoy rate of retail sales rose to 6.4% in February, 30bps below January but 70bps above consensus as economic activity improved by 70bps to 2.5% yoy over the same period. The unemployment rate dropped 70bps to 3.0% in March, which is close to the 20-year low at 2.8% in 2005.

Philippines: The fiscal deficit increased to PHP 188bn in March from PHP 106bn in February, the largest deficit in 20 years as the government gears up for presidential elections next Monday the 9 May. Bongbong Marcos, the son of former President Marcus Ferdinand, is the frontrunner with around 55% of vote intentions thanks to a solid social media platform and current vice president Leni Robredo running as an independent candidate in second position with slightly more than 20%. It is uncertain whether either candidate would change economic policies. Sara Duterte, the daughter of incumbent President Rodrigo Duterte is likely to win the race for vice president.

Poland: The yoy rate of CPI inflation rose 130bps to 12.3% in April, 90bps above consensus as the budget deficit rose to PLN 270m in the first quarter, better than the average deficit of PLN 9,373m over the last 10 years. The central bank is considering ways to support mortgage debt, the majority of which is indexed to the 3m Warsaw interbank offered rate (Wibor), which rose from 0.15% in October 2021 to 5.95% last week.

South Korea: The yoy rate of CPI inflation rose 70bps to 4.8% in April, versus 40bps consensus as core inflation rose 30bps to 3.6% yoy driven by higher utility prices. The yoy rate of real GDP growth declined 110bps to 3.1% in Q1 2022, in line with consensus as industrial production rose 1.3% mom in March from 0.3% mom in February, significantly above consensus and the yoy rate of retail sales accelerated to 7.1% from 4.7% yoy over the same period. The trade deficit widened to USD 2.7bn in April from USD 0.1bn deficit in March as imports rose by a yoy rate of 18.6% while exports rose only by 12.6% yoy.

Snippets

- Argentina: Shopping malls sales rose by a yoy rate of 32.9% in February, from 23.2% yoy in January while supermarket sales rose 6.6% yoy from 4.3% yoy over the same period.

- Czech Republic: The business confidence index rose 4.9 to 16.7 in April, but consumer confidence dropped 1.0 to -26.0 over the same period as real GDP growth expanded by a yoy rate of 4.6% in Q1 2022 from 3.6% yoy in Q4 2021, 30bps above consensus.

- Peru: The yoy rate of CPI inflation rose 120bps to 8.0% in April in Lima, 20bps ahead of consensus. Lawmakers from the ruling party turned on President Pedro Castillo, presenting a bill that cut his term from five to two years. If approved, it would be a novel way of removing the president from power.

- Pakistan: Saudi Arabia announced a USD 8bn support package for Pakistan, including the roll-over of an existing USD 3bn deposit with the central bank. The Saudi support follows Finance Minister Miftah Ismail’s request for an extension of its USD 6bn IMF programme until June 2023.

- Romania: The unemployment rate was unchanged at 5.7% in March.

- South Africa: The yoy rate of PPI inflation rose 1.4% to 11.9% in March, more than 100bps above consensus. The trade surplus improved to ZAR 45.9bn in March from ZAR 11.5bn in February, the highest level in 20-years except for 2021, but the budget deficit increased to ZAR 37.2bn in March from ZAR 3.4bn in February, the widest levels in 15-years except for 2020.

- Taiwan: The yoy rate of real GDP growth declined to 3.1% in Q1 2022 from 4.9% yoy in the previous quarter, almost 30bps above consensus.

- Thailand: The yoy rate of export and import growth accelerated to 18.9% and 16.7% respectively lifting the trade surplus to USD 5.2bn in March from USD 3.4bn in February, the highest levels for the month of March since the inception of the series in 1991.

- Turkey: The current account surplus narrowed to USD 0.9bn in March from USD 2.8bn in February, in line with seasonal patterns, thanks to the continuing recovery in foreign tourism as 2.15m people arrived in Turkey in Q1-2022 (the second highest historical level after 2018-19) while the trade deficit widened by USD 0.2bn to USD 8.2bn over the same period.

Global backdrop

United States: The annualised qoq rate of GDP growth fell to -1.4% in Q1 2022, from 6.9% qoq in Q4 2021. Good consumption and capital investment numbers were drowned out by a sharp increase in net imports. The annualised qoq rate of core personal consumption index (PCE), which includes all households and non-profit institution serving households, rose by 5.2% in Q1 2022 from 5.0% annualised qoq in Q4 2022, slightly better than consensus, as the employment cost index rose by 1.4% qoq (4.5% yoy), 30bps above consensus and the fastest pace in 20 years. Durable goods orders increased 0.8% mom in March after dropping 1.7% mom in February. The ISM manufacturing survey dropped 1.7 to 55.4 and the University of Michigan sentiment survey dropped another 0.5 to 65.2 points

Europe: The yoy rate of CPI inflation was unchanged at 7.5% in the Euro Area in April, but core CPI rose 60bps to 3.5% yoy over the same period. PPI inflation rose more than 500bps to 46.5% yoy in Italy and 26.5% yoy in France and by Economic confidence declined 1.7 to 105.0 in April as consumer confidence dropped 5.1 to -22.0 over the same period. In Germany the IFO expectations survey recovered only 1.8 points to 86.7 in April, consistent with the 20% decline in the DAX over the last 12 months while the EU-harmonised CPI rose 20bps to 7.8% yoy, the highest level in more than 30 years. In policy news, the ECB Vice President De Guindos said asset purchases will end in July, in line with consensus.

Australia: The Reserve Bank of Australia hiked its policy rate by 25bps to 0.35%, 10bps ahead of consensus and said it does not plan to reinvest the proceeds of maturing bonds, thus starting quantitative tightening (QT), a sharp shift from its policy to control the yield curve which was in place until H2 2021. The yoy rate of CPI inflation rose to 5.1% in Q1 2022 from 3.5% yoy in Q4 2022, 50bps above consensus as PPI inflation rose 120bps to 4.9% yoy over the same period. Export prices accelerated to 18.0% yoy in Q1 2022 from 3.5% yoy in Q4 2021 while import prices rose 5.1% yoy from 3.5% yoy over the same period.

Commodities: Commodity prices rose in April, but industrial metals underperformed with aluminium, iron ore, and silver down while energy outperformed, led by natural gas and gasoline prices.

This week: The Bank of England and the Federal Reserve of the United States both hold their monetary policy committee meetings this week. Consensus expectations are for BoE and the Fed to hike policy rates by 25bps and 50bps respectively, both taking their policy rates to 1.00%. The key question will be whether the current tightening in financial conditions (S&P500 -12.4%, Nasdaq -19.7%, long bonds -19.8%) is enough for the Fed to soften its very hawkish rhetoric year-to-date. Powell will attempt to deliver the rate hikes that are currently priced in (250bps by December) without pushing the economy into recession. Our sense is that both rates and equities sell-offs are overextended. Over the last 30 years we never had 200bps increases in 10-year rates without a significant impact on the economy and financial leverage has only increased over the years.

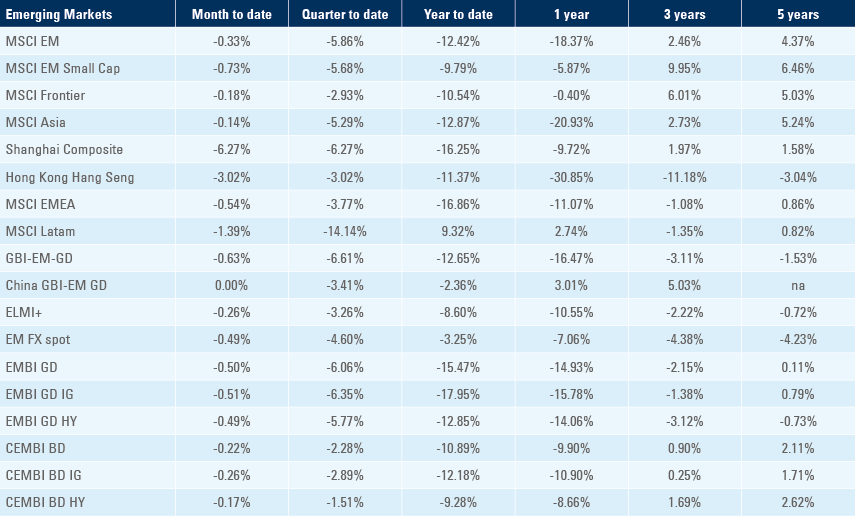

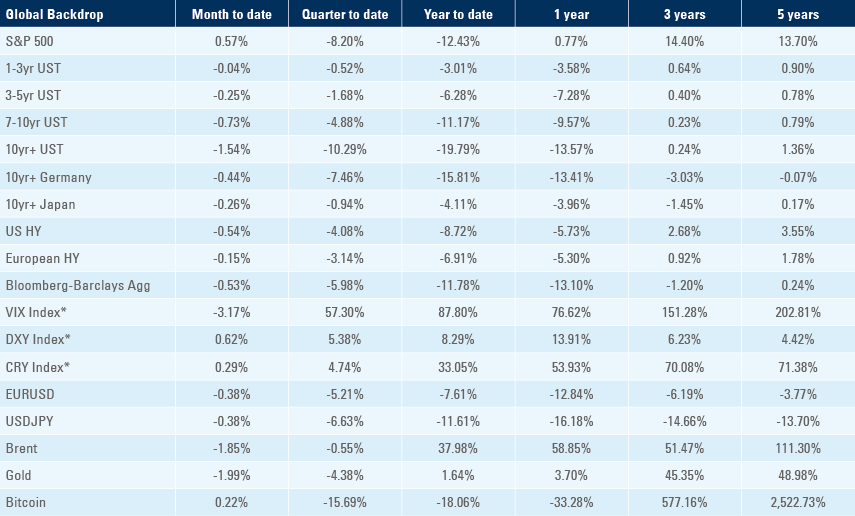

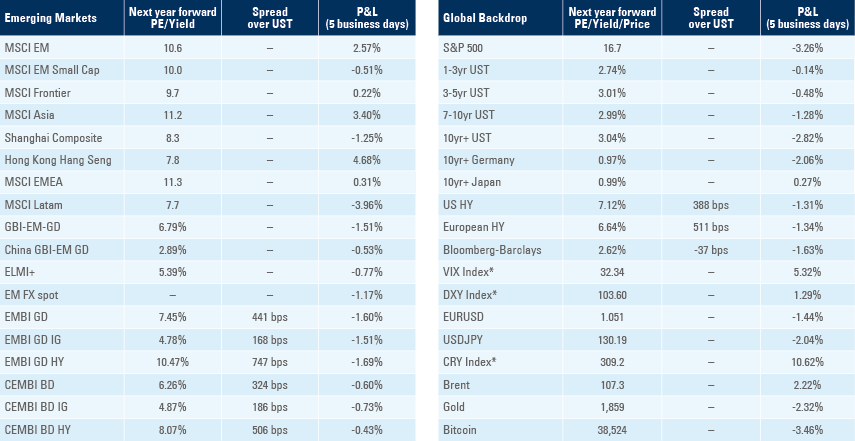

Benchmark performance