Rising policy uncertainty. Georgieva should stay, Powell may go

A number of senior politicians had their financial affairs exposed by the release of the Pandora Papers, while the managing director of the IMF, Kristalina Georgieva, is under pressure after a report unveiled minor irregularities in the drafting of a World Bank report under her supervision. The Federal Reserve leadership is also under scrutiny after active portfolio trading by monetary committee members was disclosed, leading to the resignation of two members while the Chairman and Vice-Chairman remain in the spotlight.

China is increasing coal production and liberalised energy prices, but property sales declined more than expected and tensions in the Taiwan Strait increased. Two large centrist political parties merged in Brazil, forming a strong platform for the 2022 elections. Czech Prime Minister Babis was unseated after his party’s poor performance versus centrist parties in Sunday’s general elections. India kept policy rate unchanged and reported coal inventories at a bare minimum. The Mexican president sent a utility bill reform weakening private sector position to Congress. Poland’s constitutional court ruled its constitution has priority over EU treaty articles. The central banks of Peru, Poland, Romania and Uruguay hiked their policy rates last week.

Geopolitics

Global policy developments: Policy uncertainty has increased over the last few weeks. The release of the Pandora Papers exposed several global leaders in both Developed Markets (DM) and Emerging Markets (EM).

The IMF and Fed leaderships are also under pressure while brinkmanship reigns in the US Congress. These events are likely to motivate politicians in Western Democracies to enact policies that lower inequality as voters favour centrist parties that support policies driving income and wealth redistribution. The new Japan Finance Minister and the British Prime Minister have explicitly said lowering inequality is a priority while Austria cut taxes to the middle class after introducing a carbon tax in mid-2022.

Pandora Papers: Some of the world’s most powerful individuals were exposed by the biggest leak of offshore data in history, the Pandora Papers, with 12 million files from offshore companies and trusts in tax havens such as Panama, Dubai, Monaco, Switzerland and the Cayman Islands. In total, the leaked documents exposed 35 world leaders between current and former presidents and prime ministers as well as 300 other public officials such as ministers, judges, mayors and military generals in more than 90 countries. The International Consortium of Investigative Journalists with 600 journalists from major news outlets assembled the documents. Ecuador’s president Lasso, who was also included, issued a statement saying all taxes were paid and the monies were declared. In the Czech Republic, the ruling party lost Sunday’s general election after Prime Minister Andrej Babis was cited in the Pandora Papers for a purchase of a EUR 15m property on the French Riviera.

International Monetary Fund (IMF): The law firm Wilmer Hale published a retrospective report from 2017, accusing Kristalina Georgieva of manipulating the World Bank’s (WB) Ease of Doing Business (EDB) report in order to avoid a downgrade of China’s position in the ranking.1 During that period, the Obama appointees to the WB and the International Monetary Fund (IMF) worked hard behind the scenes to keep the US funding of both the Bretton-Woods multilateral financial organisations.

The biggest interference at the EDB report was to cease its publication in August 2020, allegedly, after China’s ranking rose by five positions according to the technical criteria.2 The fact that the current anti-China leadership of the World Bank commissioned the investigation belatedly speaks volumes. In our view, Kristalina Georgieva is an apt CEO committed to defend multilateral global relationships and should not become the victim of a political power play led by anti-China actors within the institutions. If Kristalina is forced to resign, the current fragile relationship between US, China and Europe will come under renewed pressure.

Aside from the global minimum tax agreement within the G-20, the Biden administration has succumbed to populism in other relevant foreign policy matters. The Trump-imposed tariffs on China remain in place despite the burden of imported products arising from severe supply shortages. At the same time, the sanctions blocking Chinese access to high-technology semiconductors remains in place, increasing the risks of instability in the Taiwan Strait. Biden’s unilateral decision to exit Syria and the recent military alliance with the UK and Australia worked to alienate its European partners. In the meantime, Russia and China are benefiting from pragmatic foreign policy. Both Trump and Biden tried to convince Europe to give up on the Nord Stream 2 gas pipeline from Russia, which is now proving to be key to lower energy supply risks.

Biden has an opportunity to return to a fully-fledged multilateralism that he championed as Vice President by supporting Kristalina Georgieva as Managing Director of the IMF. Furthermore, Biden should soften the US anti-China stance to avoid further escalation of tensions that could lead to a second, more concerning Cold War.

United States Federal Reserve: The Chairman of the Federal Reserve (Fed) Jerome Powell and Vice Chairman Richard Clarida are under scrutiny for holding or actively trading public securities during their tenures. Eric Rosengreen and Robert Kaplan resigned from their positions for similar (albeit large and more active) activities.3 Last week President Joe Biden expressed support for the Fed Chairman hours after senior Senator Elizabeth Warren called Powell a “dangerous man” that “failed as a leader”. In our view, central bank directors should follow Former Fed Chair Alan Greenspan and invest their personal wealth in arms-length (blind) trusts, or money market deposits during the duration of their mandates, in order to avoid any conflict of interest.

Lael Brainard and Raphael Bostic are the leading contenders in case Powell is not reappointed in January. Brainard is viewed as a more ‘dovish’ Fed member and Bostic has been one of the leading proponents of adopting economic metrics with social filters such as unemployment rates across Latin Americans and African American populations.

Emerging Markets

China: Several coal-producing provinces pledged to increase long-term coal supply by a total of 145m tons in Q4 2021 (c. 3.8% of China’s annual production) in order to alleviate energy shortages. Premier Li Keqiang announced an increase in the floating range of market-based electricity prices to a 20% band around the retail price in order to ease the cost pressure on power plants and alleviate energy shortages. Property sales from the largest 100 developers declined 36.2% on a yoy basis in September (or -18.0% vs. the same period in 2019), from -20.7% yoy in August, according to China Real Estate Information Corp. Shanghai property sales declined 45% yoy while Beijing, Shenzen and Guangzhou saw a 30% yoy drop. The luxury property developer Fantasia Holdings failed to repay USD 206m in dollar bonds that matured on 4 October. On the other hand, local provinces have started to ease financing conditions for the property markets and Chinese authorities have recently increased the pace of investment in water and environmental infrastructure in order to soften the impact of the property slowdown in the economy. In economic news, the Caixin Services PMI rose to 53.4 in September from 46.7 in August as new orders improved following the containment of the recent covid-19 flare-ups.

Brazil: The Democrats and Social Liberal Party agreed to merge, forming the new United Brazil party with 82 seats in the Lower House, a strong centrist-platform against President Jair Bolsonaro in 2022. The Services PMI declined 0.5 to 54.6 in September while CPI inflation rose 0.7% to 10.3%, slightly below consensus. The yoy rate of industrial production (IP) declined 0.7% in August, after rising 1.2% yoy in July while retail sales declined by 4.1% yoy from 5.7% yoy over the same period. Vehicle production rose to 173k in September (from 164k in August) while sales declined to 155k (from 173k).

Czech Republic: Prime Minister Andrej Babis lost the general election to the opposition party Spolu that is now working on a coalition government with the Pirates/Mayors (Stan) alliance that will control 108 of the 200 seats in Congress. The ruling ANO party defeat came one week after Babis was mentioned in the Pandora Papers leak for the purchase of a EUR 15m property on the French Riviera.4 The new government announcement may take some time as President Milos Zeman, was taken into intensive care unit for an old condition. In economic news, the yoy rate of CPI inflation rose 0.8% to 4.9% in September.

India: The Reserve Bank of India (RBI) kept its reverse repo and repo rates unchanged at 3.35% and 4.00% respectively, in line with consensus. The RBI kept its growth forecasts for 2022 and 2023 fiscal years (FY) unchanged at 9.5% and 7.8% respectively while CPI forecasts declined to 5.3% in FY 2022 (from 5.7%) and 4.5% to 5.2% range in FY 2023. The Markit services PMI slowed 1.5 points to 55.2 in September. The country reported its coal inventories are at critical levels, equivalent to four days of consumption. Despite the massive investment in renewable energy, coal power plants still generates slightly over 50% of India’s energy.

Mexico: President Andres Manuel Lopez Obrador (AMLO) called on opposition parties to vote in favour of the energy reform lifting the market share of state-owned utility enterprise, Comisión Federal de Electricidad (CFE) in the electricity sector to 54%. The reform proposes CFE to have monopoly over lithium exploration; reaffirms the price caps on propane-butane gas; extinguishes CFE subsidiaries in charge of energy regulation; and eliminates self-service energy supply contracts. The constitutional amendment is unlikely to be approved, as it requires a two-thirds majority in both houses of Congress while the government holds only a simple majority. In other political news, AMLO called for an investigation into more than 3,000 Mexicans involved in the Pandora Papers, including one of his ministers and prominent Mexican business leaders. In economic news, the yoy rate of CPI inflation rose 0.4% to 6.0% in September. Vehicle production declined to 208k in September from 237k in August, bringing vehicle exports down to 17k to 195k over the same period.

Peru: The central bank hiked its policy rate by 50bps to 1.5%, in line with consensus. President Pedro Castillo reshuffled his cabinet, replacing several radical to more moderate left-wing politicians. Former head of Congress Mirtha Vasquez was appointed as Prime Minister after Guido Bellindo resignation. Importantly, the market-friendly Economy Minister Pedro Francke retained his role and Julio Velarde will remain as central bank governor for another term. Last week Castillo submitted a letter to the OECD expressing the intention to join the organisation.

Poland: The National Bank of Poland hiked its policy rate by 40bps to 0.50% (surprising consensus expectations for no change) in a bid to anchor inflation expectations. In political news, the constitutional tribunal ruled that certain articles of the EU treaty are incompatible with the Polish constitution and impede the country’s sovereignty, intensifying a conflict over democratic backsliding that questions Poland’s access to both the EU pandemic aid and its membership in the EU.

Romania: The Central Bank hiked its policy rate by 25bps to 1.5%, against unchanged consensus as the yoy rate of retail sales rose 11.7% in August from 9.2% yoy in July.

Uruguay: The Central Bank hiked the monetary policy by 25bps to 5.25% (consensus was for a second 50bps increase). The yoy rate of CPI inflation slowed 0.2% to 7.4% in September, matching consensus while the unemployment rate declined 0.9% to 9.5% in August.

Snippets:

- Argentina: President Alberto Fernández said the country has closed a deal with the IMF allowing for a postponement of interest payments to the institution during 2022. Vehicle production rose 5k to 44k in September while vehicle exports were unchanged at 25k over the same period. The yoy rate of IP rose 0.8% to 13.8% in August.

- Costa Rica: The current account deficit widened to 4.0% of GDP in Q2 2021 from 3.3% of GDP in Q1 2021. Mostly due to wider deficit on the income account. The services surplus (5.0% of GDP) remain subdued.

- Colombia: The yoy rate of CPI inflation rose 0.1% to 4.5% in September, in line with consensus, while core CPI declined 0.1% to 3.0% yoy. The consumer confidence index improved to -3.0 in September from -8.2 in August.

- Chile: Vehicle sales rose 5k to 43k in September. The yoy rate of CPI inflation rose 0.5% to 5.3% in September, higher than consensus, with most price pressures from transportation, food and clothing. The monetary policy committee is likely to deliver at least another 75bps policy rate hike to 2.25%.

- El Salvador: Tax revenues rose by a yoy rate of 27.1% from January to September 2021, led by a 37.8% yoy increase in VAT, higher than expected at the beginning of the year thanks to a strong GDP recovery.

- Egypt: The yoy rate of CPI inflation rose 0.9% to 6.6% in September as core CPI rose 0.3% to 4.8% yoy over the same period.

- Hungary: The yoy rate of CPI inflation rose 0.6% to 5.5% in September, in line with consensus as the yoy rate of retail sales rose to 4.1% in August from 3.0% in July, but IP dropped 2.7% mom from -0.6% mom over the same period.

- Pakistan: The trade deficit narrowed to USD 4.1bn in September from USD 4.3bn in August.

- Philippines: The yoy rate of CPI inflation declined 0.1% to 4.8% in September (0.3% below consensus), mostly due to a moderation in transport costs, while core CPI was unchanged at 3.3% yoy.

- Russia: The yoy rate of CPI inflation rose to 7.4% in September from 6.7% yoy in August and core CPI rose 0.5% to 7.6% yoy, both higher than consensus. The Markit Services PMI rose 1.2 to 50.5 in September.

- Rwanda: The yoy rate of CPI inflation dropped to 4.5% in September from 6.9% in August.

- Saudi Arabia: The Markit PMI rose 4.5 to 48.9.

- South Korea: Samsung Electronics negotiation with Unions (first ever) demands of a 51% increase in average salaries. The yoy rate of CPI inflation declined 0.1% to 2.5% in September while core CPI rose 0.1% to 1.9% yoy.

- Sri Lanka: Foreign exchange (FX) reserves declined by USD 1.0bn to USD 2.6bn in September, a steeper drop than expected given the absence of large FX liabilities during the month.

- Thailand: The yoy rate of CPI inflation jumped to 1.7% in September (consensus 0.5%) from 0.0% yoy in August but core CPI rose only 0.1% to 0.2% yoy over the same period

- Turkey: The current account moved to a USD 0.5bn surplus in August from a USD 0.9bn deficit in July. The yoy rate of CPI inflation rose 0.3% to 19.6% in September, in line with consensus, while core CPI rose 0.2% to 17.0% yoy and the yoy rate of PPI inflation declined 1.5% to 44.0%.

Global backdrop

Commodities: Oil prices rose further after the OPEC+ decided to add only the pre-planned 400k barrels of oil per day in November, despite global shortages of coal and gas. Higher energy prices are already reducing real household incomes in the US by 1.5%, but pent-up demand due to higher overall disposable incomes is likely to keep commodity prices under pressure.

United States (US): The Senate approved a ‘band-aid’ temporary increase in the debt ceiling by USD 480bn until 3 December 2021, postponing the risk of a debt default. The last-minute compromise drove Democrats and Republicans to accuse each other of failing to reach a permanent agreement, which doesn’t bode well for the permanent increase (or abolition) of the debt ceiling in December.

In economic news, non-farm payrolls disappointed with 194k new jobs created in September from 366k in August; significantly lower than 500k median consensus expectations. However, the unemployment rate declined 0.4 to 4.8% in September and the underemployment rate dropped 0.3% to 8.5%, significantly below consensus as average hourly earnings rose 0.6% mom in September (from 0.4% in August) equivalent to a yoy rate of 4.6%. Durable goods orders was unchanged at +1.8% in August as factory orders rose 1.2% in August from 0.7% in July (above consensus). The trade deficit widened to USD 73.3bn in August from USD 70.3bn in July. The ISM Services rose 0.2 to 61.9 and the Markit Services PMI rose 0.5 to 54.9. The Markit PMI has a much broader participation, including many small and medium enterprises while the ISM Manufacturing is more representative of larger corporations that have purchasing manager to answer the questionnaire.

Eurozone: Austria proposed a new carbon tax plan involving a EUR 30 per ton of carbon from July 2022, increasing to EUR 55 per ton by 2025, while at the same time dropping the income tax for individuals earning between EUR 18k to 60k per year. Germany, France and Netherlands are also introducing carbon tax at similar rates. The scientific journal Nature estimates a EUR 120 per ton tax by 2030 is consistent with lower emissions to net zero by 2050.5 In economic news, Germany factory orders dropped 7.7% in August after rising 4.9% in July (supply chain shortages). The Eurozone Services PMI rose 0.1 to 56.4 in September. The yoy rate of PPI inflation rose 1.0% to 13.4%.

Japan: The new government pledged to tackle inequality. Japan’s new Finance Minister, Shunichi Suzuki said Prime Minister Fumio Kishida would aim to “bring about a new form of capitalism that creates a virtuous cycle of growth and wider wealth distribution”. A few days later, Kishida pledged not to increase income tax or impose a dividend tax “for the time being”. In economic news, the Tokyo CPI rose to a yoy rate of 0.3% in September from -0.4% yoy in August, above consensus.

New Zealand: The Reserve Bank of New Zealand hiked its policy rate by 25bps to 0.5%, in line with consensus, as the committee highlighted “further removal of monetary policy stimulus is expected over time”, signalling

policy rates rising over 1.0% during 2022.

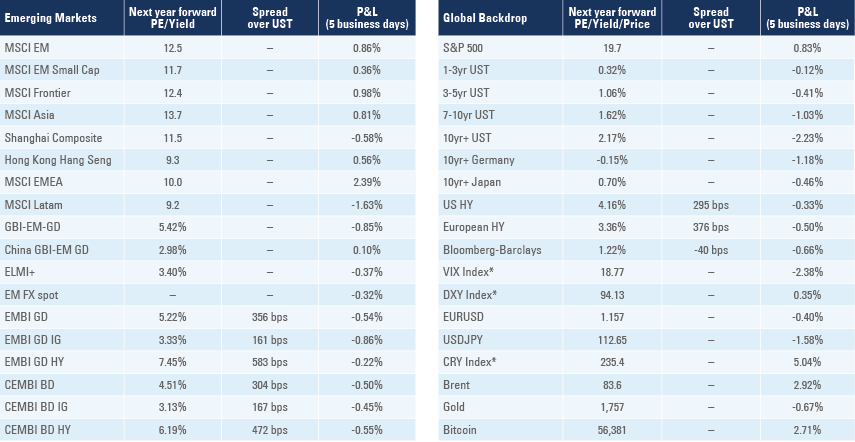

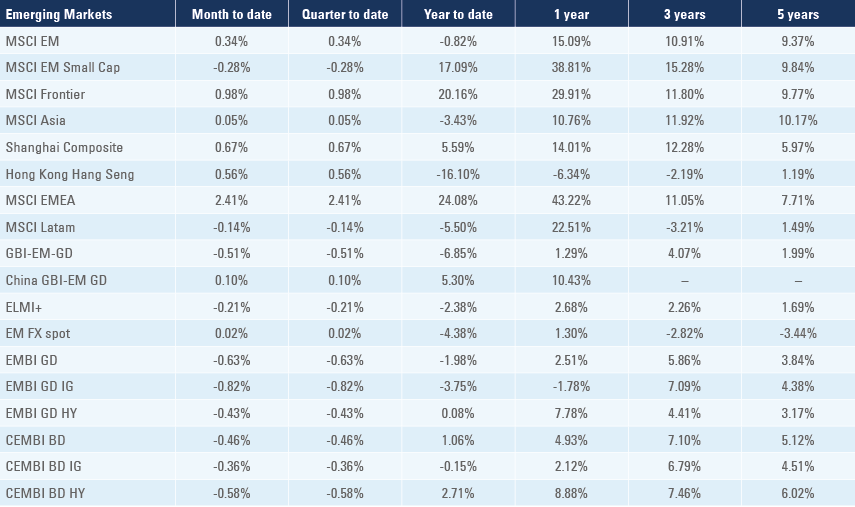

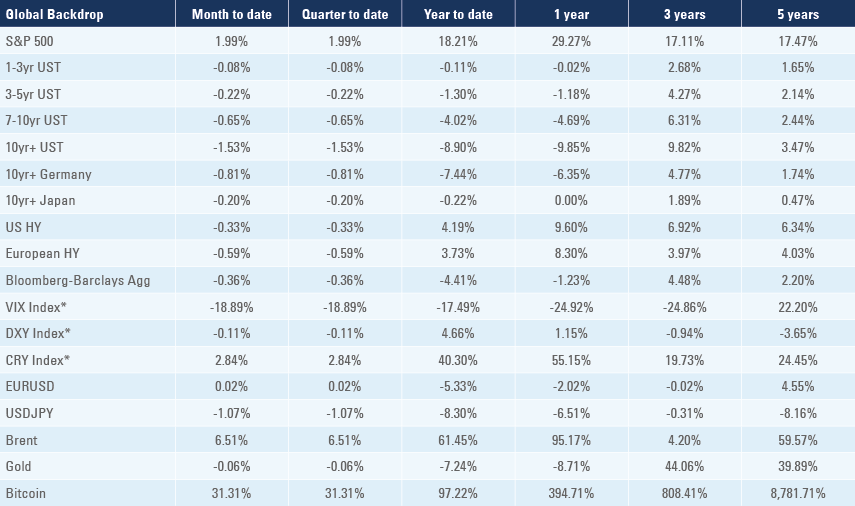

Benchmark performance

*VIX Index = Chicago Board Options Exchange SPX Volatility Index. *DXY Index = The Dollar Index. *CRY Index = Thomson Reuters / CoreCommodity CRM Commodity Index.

Source: Bloomberg, JP Morgan, Barclays, Merrill Lynch, Chicago Board Options Exchange, Thomson Reuters, MSCI, total returns.

Figures for more than one year are annualised other than in the case of currencies, commodities and the VIX, DXY and CRY which are shown as percentage change.

3. See https://www.wsj.com/articles/boston-fed-leader-rosengren-to-retire-early-from-bank-11632747033