The European Central Bank (ECB), US Federal Reserve (Fed), and the Bank of England (BoE) statements suggested they are all getting ready to cut policy rates in June. The central banks of Türkiye and Taiwan unexpectedly hiked policy rates, while Switzerland cut its policy rate by 25bps. The Bank of Japan (BoJ) exited its negative interest rate and yield curve control policies but kept a relatively dovish forward guidance path. The war between Russia and Ukraine intensified, and no ceasefire was agreed in Gaza. In Emerging Markets (EM) Asia, Chinese investors increased their exposure to Hong Kong stocks. Malaysia intervened on the ringgit. Korean exports confirmed the rebound in global manufacturing led by semiconductors. Latin America’s positive policy momentum continued: Argentina posted exceptional fiscal and external account results, and Brazil, Colombia, and Mexico cut rates as expected. Moody’s upgraded Nicaragua and Uruguay's sovereign ratings, while S&P lifted the outlook for Egypt’s rating. Senegal and Slovakia elections brought surprising results.

Global Macro

The messages from the ECB, Fed, and the BOE suggest all of them are getting close to cut policy rates this June. Inflation has already been hovering below the 2% target in Europe, and deflation is entrenched in producer prices across major economies, thanks to lower energy costs. Lower energy prices and softer economic activity suggests to us that inflation is also likely to decline below 2% in the UK by the spring. In the US, sticky rental prices are keeping inflation above target, but Powell’s speech suggests the Fed is getting ready to ease regardless of slightly higher than expected inflation.

Federal Open Market Committee (FOMC)

The FOMC kept policy rates unchanged at 5.25% to 5.5%, in line with forward guidance. The dot plot chart marking the forecast of the Fed Funds (FF) rate by participant did move higher, albeit the median remained at three cuts. Nine members expect FF rates at 4.875% (two cuts) or less, the same number of participants that expect three cuts. Most participants now expect FF rates at 3.625% to 3.875% at the end of 2025, implying two to three cuts this year, followed by three cuts next year. The FOMC’s economic expectations are remarkably stable, with growth around 2% and unemployment at close to 4% for the next three years.

The key message from Fed Chair Jerome Powell’s press conference was that “the Fed stands ready to cut policy rates if the labour market softens faster than expected.” It sees the unemployment rate at 4.0% (in line with the median forecast) at the end of the year. That appears to be a low bar. The unemployment rate just increased from 3.5% in March 2023 to 3.9%. Stocks rose after Powell dismissed the question that financial conditions became too loose after the increase in equity prices. The culprit for Powell’s easing bias may be in the banking sector. In a testimony to Congress a few weeks back, Powell said he expects more banks to struggle due to their exposure to commercial real estate. On the balance sheet, Powell signalled the Fed will start reducing the quantitative tightening (QT) pace in May/June, again, as expected. He is monitoring money markets to make sure liquidity moves down from “abundant” to “ample”.

Geopolitics

The war in Ukraine intensified one week after the expected re-election of Vladimir Putin in Russia. Last week, Russia launched a large-scale missile attack on Ukraine’s largest hydroelectric power plant.1 Russia’s defence ministry said the assault was part of a series of retaliations against Kyiv’s earlier inclusion in Russia’s territory. Over the last few weeks, Ukraine has been attacking several refineries and petrochemical facilities in Russia. The attacks on energy infrastructure are part of the reason for the recent build-up in speculative positions in gasoline and oil prices. The Financial Times reported the US had “urged” Ukraine to halt attacks on Russia’s energy infrastructure, as the drone strikes are driving energy prices higher.2

Oil prices are up about 18% from the lows in December and 4% higher versus the average of 2023, but gasoline prices rose 38.5% from mid-December and are 9.3% higher than last year’s average. The International Energy Agency (IEA) has revised up its oil demand forecast due to the longer routes ships must now take between Asia and Europe due to the dangers around the Red Sea. Elevated oil prices could have an impact on the United States (US) elections, with voters dissatisfied with overall prices significantly eroding their purchasing power.

Russia and China vetoed a ceasefire proposal between Israel and Hamas submitted by the US to the United Nations Security Council. The expected ceasefire remains elusive as Israel’s Prime Minister Netanyahu remains determined to “finish the job”, attacking Rafah despite the threat of a humanitarian disaster in Gaza.3 Nevertheless, a ceasefire is still under negotiation.

Over the weekend, a terrorist attack in the outskirts of Moscow left more than 150 casualties. Russia initially implied Ukraine was involved, but Islamic State (IS) claimed responsibility. Four suspects from Tajikistan appeared in court after being arrested and tortured. Russia has long struggled with Islamic terrorism owing to its occupation of Afghanistan, its military presence in Tajikistan, and the war in Chechnya.

Emerging Markets

Asia

China: The People’s Bank of China (PBoC) kept its one- and five-year loan prime rates unchanged at 3.45% and 3.95%, respectively, in line with consensus. Foreign direct investment (FDI) was down by 19.9% in yoy terms in February, but from a high base in 2022/23. The cumulative FDI in January and February is slightly above the average over the last 10 years. In equity market news, Chinese mainland investors have bought shares in Hong Kong (H-shares) for the last 27 days, adding up to HKD 110.2bn or USD 14.1bn. In the past, the so-called Southbound flows have led to favourable performance on H-shares. In currency news, the Renminbi (RMB) depreciated last Friday after the PBoC allowed the fixing to settle below 7.10, and banks did not sell dollars to contain the 7.20 psychological level. The CNY has depreciated by around 10% against the USD but is up by 1% against its main trading partners as the JPY depreciated by 28%, while the ringgit and the Korean won depreciated by 13% and 16%, respectively. This morning, the PBoC set the fixing above 7.10 again. Last week’s cautious BoJ hike driving the JPY lower may have weighed on China’s decision to signal its currency may also depreciate, should external conditions change meaningfully.

Malaysia: The trade surplus widened to MYR 10.9bn in February from MYR 10.2bn in January. Exports declined by 0.8% in yoy terms (+2.4% yoy consensus) and imports rose by 8.4% yoy (7.5% expected). Despite the healthy surplus, foreign exchange (FX) reserves dropped by USD 0.9bn to USD 113.4bn on 15 March. The central bank may have intervened in the market as it mentioned the currency was too weak over previous weeks. The government has reportedly asked Petronas to repatriate dollars and the government-owned Employees’ Pension Fund to stop buying USD. Other exporters are hoarding dollars which gives them a higher carry and hedge against depreciating JPY and RMB.

India: The flash manufacturing purchasing managers’ index (PMI) rose by 2.3 to 59.2, while services PMI rose by 0.7 to 61.3 in March.

Indonesia: Bank Indonesia kept its policy rate unchanged at 6.0%, in line with consensus.

South Korea: Exports rose by 11.2% in yoy terms in the first 20 days of March, from -7.8% yoy in February. Chip exports surged 46.5% as exports to the US and China rose by 18.2% and 7.5%, respectively. The result confirmed the solid momentum of the semiconductor industry. Imports declined by 6.3% yoy in the first 20 days of March from -19.2% yoy in February. In other news, producer price index (PPI) inflation rose by 20bps to 1.5% yoy in February.

Taiwan: The central bank hiked its policy rate by 12.5bps to 2.0%, surprising consensus that expected policy to remain unchanged. Inflation is unlikely to ease, in our view, as the government considers increasing electricity prices to help stem losses at the government-owned Taiwan Power Co. due to higher fuel prices. In other news, February export orders declined by 10.4% in yoy terms (1.2% est.) from 1.9% prior.4

Thailand: FX reserves declined by USD 1.6bn to USD 223.8bn on 15 March.

Latin America

Argentina: The fiscal and external adjustments marched on in February. Argentina achieved its second consecutive month of fiscal surplus (before interest expenses) of 0.3% of GDP in February, accumulating +0.8% of GDP year-to-date (ytd). The nominal surplus added to 0.2% of GDP ytd. The result marked the first nominal surplus for the period since 2011. On top of the fiscal adjustment, the trade surplus rose to USD 1.4bn in February from USD 0.8bn prior, the best result for the month in recent history. Exports rose by USD 100m to USD 5.5bn, and imports declined by USD 500m to USD 4.1bn. In other news, Q4 2023 GDP contracted by 1.4% yoy (-1.5% est.) from -0.8% in Q3, but the unemployment rate was unchanged at 5.7%.

Brazil: The central bank cut its policy rate by 50bps to 10.75%, but struck a more cautious tone in its statement, highlighting domestic and external environments are more uncertain. The committee is likely to keep to the same 50bps pace next meeting: “if the scenario evolves as expected”. The statement also brought some vague guidance regarding the magnitude of cuts: “…the total magnitude of the cycle… will depend on inflation dynamics, especially the components that are more sensitive to monetary policy and economic activity, in particular the longer-term ones, on its inflation projections, the output gap and on the balance of risks.” In other news, tax collection slowed to BRL 186.5bn (184.5bn est.) from BRL 280.1bn, in line with seasonality.

Chile: The current account deficit narrowed to USD 3.7bn in Q4 2023 (est. USD 2.7bn) from USD 5.3bn in Q3. Real GDP slowed to 0.1% qoq and 0.4% yoy in Q4 2023 (0.2% yoy est.) from 0.9% qoq in Q3 24. PPI inflation rose to 2.9% yoy in February from 0.8% yoy prior.

Colombia: The central bank cut its policy rate by 50bps to 12.25%, in line with consensus. Two members dissented in favour of 75bps and 100bps cuts. In economic news, the trade deficit widened to USD 960m in January (USD 900m est.) from USD 550m in December. Economic activity accelerated to 1.6% yoy (-0.4% est.) in January, from 0.1% yoy in December.

Mexico: The Bank of Mexico (Banxico) cut its policy rate by 25bps to 11.0%, in line with consensus. The “hawkish” board member Irene Espinosa voted to keep it unchanged as expected. The statement kept a careful guidance, acknowledging disinflation progress, but not signalling a change of approach if inflation surprises to the upside. The current inflation level and trend gives room for Banxico to cut policy rates over the next meetings. In our view, there is good value in Mexican rates, with two- and 10-year MXN bonds pricing very little in terms of easing at 9.95% and 9.25%. In other news, retail sales declined by 0.8% in yoy terms in January, below consensus at +1.2% yoy. CPI inflation came at 0.3% mom and 4.5% yoy in the first 15 days of March, and core CPI at 4.7% yoy, both 5bps above consensus.

Nicaragua: Ratings agency Moody’s raised Nicaragua’s sovereign credit rating to ‘B1’ from ‘B2’.

Paraguay: The central bank cut its policy rate by 25bps to 6.0%, marking the sixth consecutive cut since July, totalling 250bps. CPI inflation at 2.9% yoy down from 3.5% in July 2023 and 11.5% in June 2022.

Uruguay: Moody’s upgraded Uruguay’s sovereign rating to ‘Baa1’, two notches above the minimum investment grade rating of ‘Baa3’.

Central and Eastern Europe

Czechia: The Czech National Bank cut its policy rate by 50bps to 5.75%, in line with consensus. PPI industrial inflation declined by 0.9% in yoy terms in February, rising from -1.8% prior.

Poland: Core CPI rose by 0.5% mom and 5.4% yoy (both in line) in February, down from 6.2% in January. PPI deflation at -10.1% yoy in February (-8.7% est.) from -10.6% in January. Average gross wages rose by 12.9% yoy in February (11.3% est.) from 11.8% in January. Retail sales +6.7% yoy in Feb (7.4% est.) from +4.6% yoy in January due to base effects.

Russia: The central bank kept its policy rate unchanged at 16%. Governor Elvira Nabiullina said it was concerned about precedents of seizing investors’ shares purchased on exchanges. It is asking the regulator to study possible steps.

Slovakia: The former European Union (EU) diplomat Ivan Korčok won the first round of presidential elections with 42.5% of the votes, followed by House Speaker Peter Pellegrini, who received 37.0% of votes. The Russian-leaning former supreme court chief, Stefan Harabin, got 11.8%. Pellegrini is a key ally of Prime Minister Robert Fico, the leftist Prime Minister pledging to halt military aid to Ukraine and support people hit by price surges. Nevertheless, Pellegrini said Slovakia will remain anchored in the EU and NATO. Presidents do not wield many executive powers, but have a role in government and judicial appointments, can veto laws, and shape public debate.

Middle East and Africa

Egypt: The trade deficit narrowed to USD 2.1bn in January from USD 3.0bn in December 2023. Ratings agency S&P moved the outlook for Egypt’s ‘B-‘ sovereign credit rating to positive.

Qatar: Ratings agency Fitch upgraded Qatar’s sovereign credit rating by one notch to ‘AA’ with a stable outlook.

Senegal: People took to the streets to celebrate early results of presidential elections showing opposition leader Bassirou Diomaye Faye ahead. Former prime minister and incumbent coalition candidate Amadou Ba said celebrations were premature and is confident in a run-off next Sunday in the “worst-case scenario”. It is unclear how many ballots were counted on the early results. Turnout was c. 71%. Around 7.3m people were registered to vote (18m population). Economic activity is set to accelerate as oil and gas production increases sharply on H2 2024, helping to close very large external deficits and relatively elevated fiscal deficits. The opposition has campaigned on anti-corruption and prioritise economic sovereignty. They hold more heterodox views on monetary reforms, such as exiting the Swiss African franc (CFA), renegotiating with the International Monetary Fund (IMF) and reviewing the oil and gas contracts. Nevertheless, any changes will be hard to implement as the opposition needs a coalition to govern.

South Africa: CPI inflation rose to 5.6% yoy in February (5.5% est.) from 5.3% prior. Core CPI rose by 40bps to 5.0% yoy (4.9% est.) Retail sales dropped by 2.1% yoy in January (+0.9% est.) after +3.2% in December.

Türkiye: The Central Bank of Türkiye (CBRT) hiked its one-week repo rate by 500bps to 50%. Consensus expected no change in policy. Furthermore, the rate corridor band around the policy rate widened to +/-300bps from +/- 150 bps. Hence, the effective funding rate can increase to 53%. The Turkish lira rallied more than 1% on the day. The hike came after CBRT FX reserves declined by around USD 16bn – about half the amount it had accumulated since the orthodox shift. The culprit for lower reserves was locals buying foreign currency ahead of the municipal elections, fearing a change of economic policy in case President Recep Erdoğan underperformed. The hike took place one week before the municipal elections this coming weekend and is a very strong message that the economic team led by Minister of Finance Mehmet Şimşek has full support from Erdogan, in our view. The five-year credit default swap (CDS) dropped 30bps to 315. In other news, tourism arrivals rose by 22.7% yoy to 2.3m visitors, the most in history for the month.

Developed Markets

United States: The US housing market showed signs of strength last week. Existing home sales rose by 9.5% mom to 4.38m (3.95m est.), housing starts were up 10.7% mom to 1.52m in February (1.44m est.), and building permits increased 1.9% mom to 1.52m in February (1.5m est.). The flash manufacturing PMI rose 0.3 to 52.5 in March (51.8 est.), and the services PMI declined 0.6 to 51.7 (52.0 est.). Labour markets indicators were also solid, with initial claims at 210k (213k est.) and continuing claims at 1,807k (1,820k est.). The current account deficit declined to USD 195bn (USD 209bn est.) in Q4 2023 from USD 196bn in Q3 2023. Next week, the main data point will be the core personal consumption expenditures (PCE) inflation index towards the end of the week.

Japan: The BoJ hiked its deposit rate by 10bps to 0%, the first hike since 2007, exiting its negative interest rate policy (NIRP) after eight years. Yield curve control was also scrapped, but the BoJ will keep buying bonds at a similar pace and would respond to a sharp increase in long-term yields. It also signalled it would only hike again if inflation remained elevated, keeping real interest rates at deep negative levels. In economic news, CPI inflation rose to 2.8% yoy in February (2.9% est.) from 2.2% in January. Core CPI (ex-food and energy) declined by 30bps to 3.2% (3.3% est.) in February. The flash manufacturing PMI increased by one point to 48.2 while services increased two points to 54.9.

United Kingdom: The BoE kept its policy rate unchanged at 5.25%, in line with consensus. The Monetary Policy Committee voted 8-1, with one member pushing for a cut. Two hawkish dissenting voters moved to keep the policy rate unchanged. Inflation was 10bps below consensus in February as CPI inflation declined by 60bps to 3.4% (3.5% est.), core CPI dropped by 60bps to 4.5% (4.6% est.), and PPI input deflation at 2.7% in February (in line) from -2.8% prior. The flash manufacturing PMI rose 2.4 to 49.9 in March, while services declined 0.4 to 53.4. Retail sales ex-fuel rose 0.2% mom in February (-0.1% est.).

Eurozone: The Eurozone flash manufacturing PMI declined 0.8 to 45.7 (47.0 est.), services increased +0.9 to 51.1 (50.5 est.). Eurozone labour costs declined to 3.4% yoy in Q4 2023 from 5.2% yoy in Q2 2023. The seasonally-adjusted trade surplus rose to EUR 28.1bn in January from EUR 14.3bn in December. The current account surplus rose to EUR 39.4bn in January from EUR 31.9bn in December. ZEW survey of banking professionals said expectations increased to 33.5 in March from +25 in February. In Germany, PPI inflation was 4.1% lower in February (-3.8% est.) after -4.4% in January.

Other DMs

- The Swiss National Bank cut rates by 25bps to 1.5% (1.75% est.)

- The Reserve Bank of Australia left rates unchanged at 4.35% (in line)

- The Central Bank of Norway left rates unchanged at 4.5%

1. See – https://www.bbc.co.uk/news/world-europe-68634444

2. See – https://www.ft.com/sic%20content/98f15b60-bc4d-4d3c-9e57-cbdde122ac0c

3. See – https://www.redcross.org.uk/stories/disasters-and-emergencies/world/whats-happening-in-gaza-humanitarian-crisis-grows and https://www.euronews.com/2024/03/13/we-will-finish-the-job-in-rafah-israeli-prime-minister-netanyahu#:~:text=%22We%20will%20finish%20the%20job,AIPAC%20organization%20in%20Washington%2C%20D.C.

4. See – *est. = Consensus

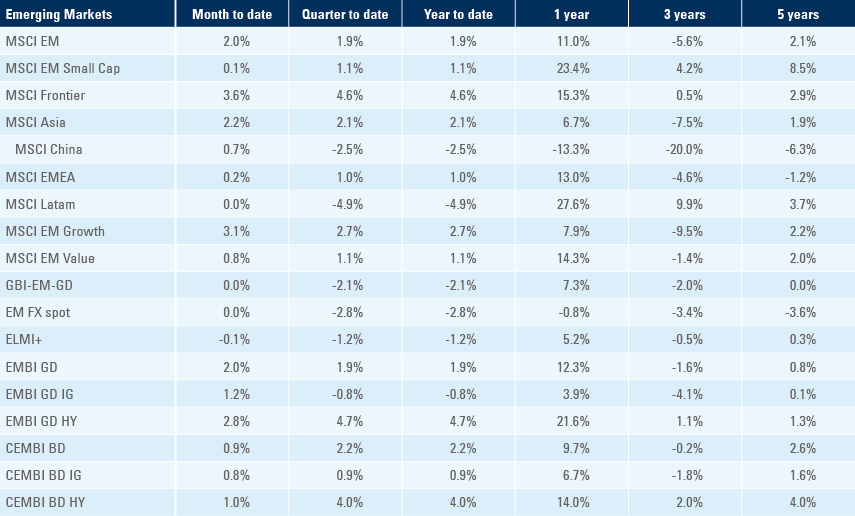

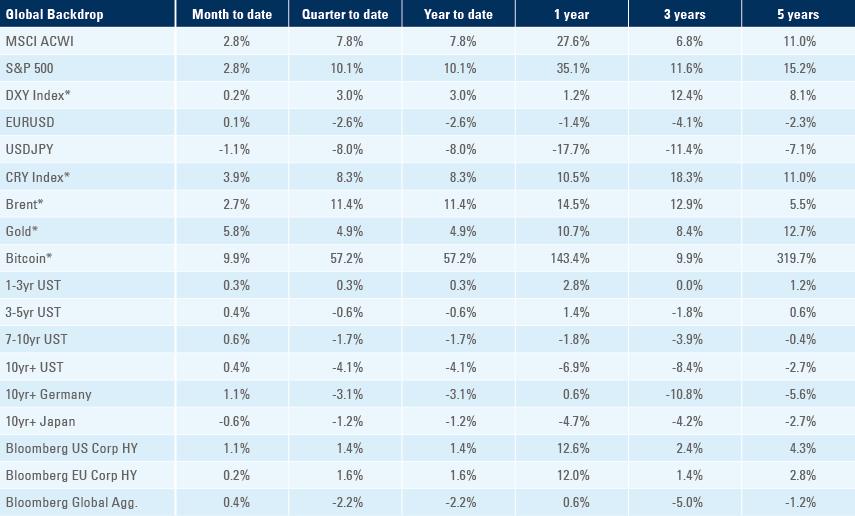

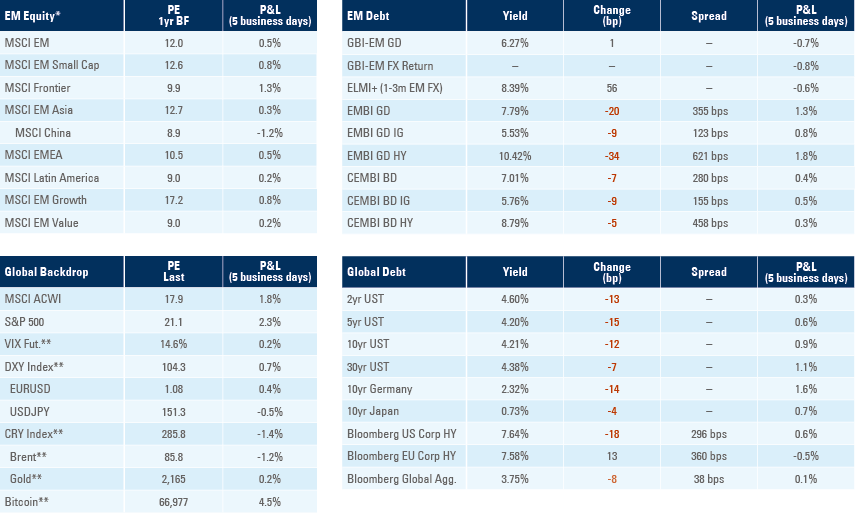

Benchmark performance