- Geopolitical uncertainties abound after G-10 central banks start a tentative easing cycle.

- The US and global economies remain very imbalanced.

- China announced a monetary policy framework overhaul.

- Argentina delivered on fiscal consolidation and reforms…

- …While Brazil and Colombia debated how to close much smaller fiscal deficit gaps.

- Ghana announced an agreement in principle to restructure its Eurobond debt.

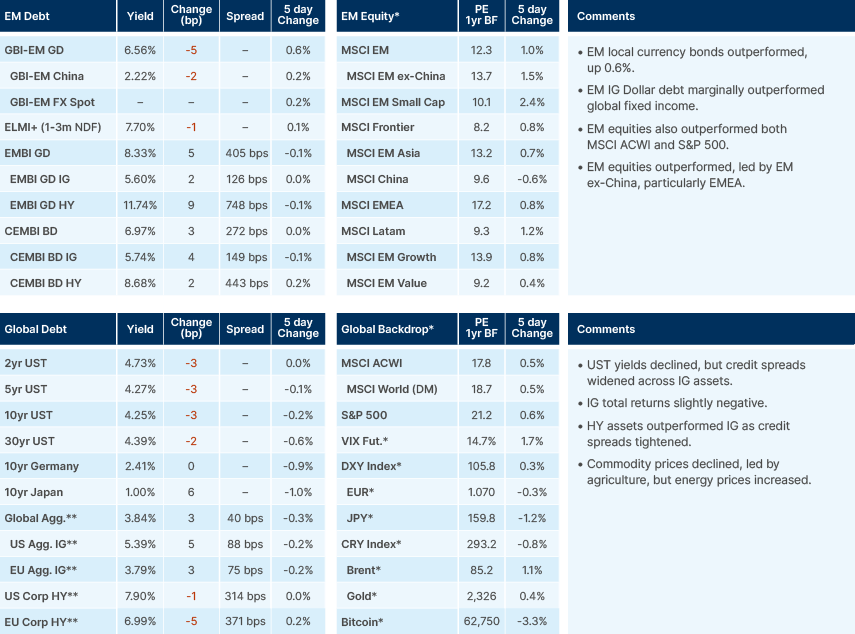

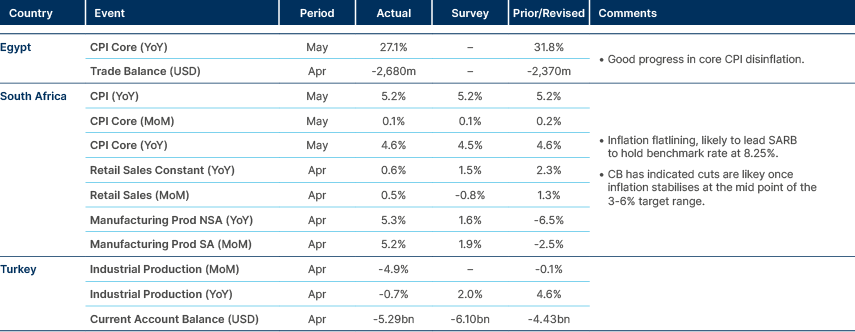

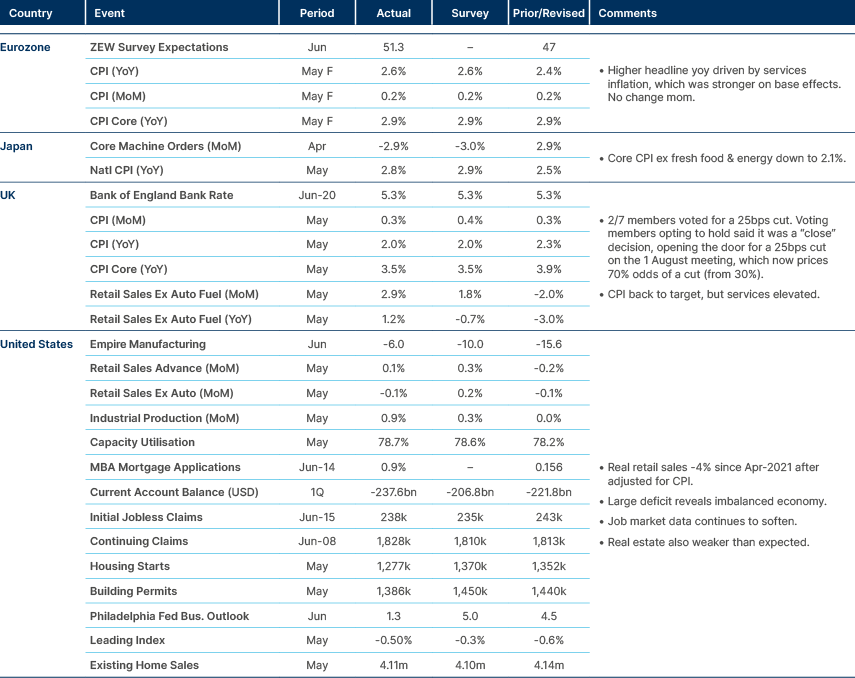

Last week performance and comments

Global Macro

G-10 monetary policy has turned dovish, with the European Central Bank (ECB), Bank of Canada (BOC), Riksbank (Sweden), and the Swiss National Bank (SNB) all now having cut rates. The Bank of England (BOE) and the US Federal Reserve (Fed) are likely to follow suit in August and September, respectively. While these cuts are bullish for risk assets, multiple negative catalysts lie ahead. The first US Presidential and UK General Election debates take place this week. The first round of the French election takes place on Sunday, and the second round on 7 July is fraught with risk. The latest poll of polls at the weekend suggested the far-right National Rally party support edging up towards 33%, versus 27% for the far-left New Popular Front (NPF) and 20% for Macron’s Renaissance Party. The two-round system across 577 sub-districts makes the number of seats very hard to predict. A victory for the right-wing coalition party with an outright majority is likely to be negative for asset prices, but some of it is already priced, considering they have diluted their most aggressive policies. A more disruptive left-wing victory would likely send shockwaves across European markets. Rising tension between Israel and Hezbollah is amplifying risks of regional escalation in the Middle East, which has started to increase oil prices risk premium. Furthermore, US stock market valuations have been stretched further, driven by a slim subset of AI-driven technology companies.

Against this backdrop, the recent softness of economic data, particularly in the US, is taking place when the US labour market is reaching an inflection point. The number of job openings is now consistent with the current 4% inflation rate, and a further decline in the supply of jobs is likely to be met by a sharper increase in unemployment rates. On the other hand, the service sector of the US (and global) economy remains very strong. Here lies a contradiction. The 40% wealthier part of the US population is responsible for close to two-thirds of all consumption, and this cohort still has significantly higher savings than during the pandemic, savings that are enjoying more than 5% returns on cash. At the same time, those at and below the fourth quintile of the income group is struggling to make ends meet, working several jobs and have accumulated very expensive consumer, auto loans, and other forms of debt, now showing in the form of higher delinquencies. The US corporate sector has the same two-tier problem, with small caps ailing with a 2% return on equity and much higher indebtedness than large and mega-cap companies that are as profitable and cash-rich as ever.

Ironically, there is a case to be made that high interest rates are fuelling service sector growth while the Fed remains cautious on inflation based on a lagging indicator – owners equivalent rents. That makes the ‘higher-for-longer’ regime much more unstable than usual, as it promotes consumption, giving the illusion of a super strong economy, but keeps battering the weaker links, increasing the chance of a larger accident.

Geopolitics

Following Russian President Vladimir Putin's visit to North Korea, Pyongyang expressed unwavering support for Russia's offensive in Ukraine, highlighting their close ties. Putin's subsequent trip to Vietnam aimed to maintain Russia's traditional alliance with the Communist state, despite Vietnam's efforts to balance relations with both Russia and Ukraine. Meanwhile, South Korea, reacting to these events, is reportedly considering indirect support for Ukraine through potential sales of advanced weaponry to Poland, which borders Ukraine. These moves reflect a strategic dance among nations to navigate alliances and interests amid the ongoing conflict in Ukraine.

Israel’s Prime Minister Benjamin Netanyahu disbanded his War Cabinet on Monday, consolidating his influence over the Israel-Hamas war and likely diminishing the odds of a ceasefire in the Gaza Strip. Major war policies will now be solely approved by Netanyahu’s Security Cabinet, a larger body dominated by hard-liners who oppose the US-backed ceasefire proposal. Israel’s military has reportedly approved plans for an offensive into southern Lebanon, with a decision on escalation imminent. On Wednesday, Hassan Nasrallah, the leader of Hezbollah, stated that the group does not want a "total war." However, he warned that if Israel launches a large-scale offensive on its northern border, "no place" in Israel "will be spared from our rockets." He added that Cyprus would also be in the firing line if Israel uses the island’s airports and facilities for logistics.

Leading Indicators

There were three leading indicators worth highlighting last week:

- The OECD G-20 leading indicator (a regression-based indicator comprised mostly of coincident data) rose by 0.08 to 100.43 in May. Readings above 100 and increasing suggest the global economy remains in the expansion phase.

- The June flash (preview) purchasing managers indices (PMIs) point to an uneven economic activity familiar pattern:

- European manufacturing dropped 1.7 points to 45.6 driving its composite PMI down 1.4 to 50.8.

- US services up 0.3 to 55.1, keeping its composite PMI at 54.6.

- India’s composite PMI up 0.4 to 60.9, with manufacturing up one point to 58.5.

- The Citibank Surprise Index showed the overall US economic data (hard and surveys) down another 5.7 points to -25.6, as Europe inflected sharply lower from +25.4 to -9.8 while EM improved marginally to +9.9.

It is likely that the unexpected snap French election has already contaminated both the manufacturing PMI and other survey-based data, explaining the drop in the Citibank Surprise Index.

Emerging Markets

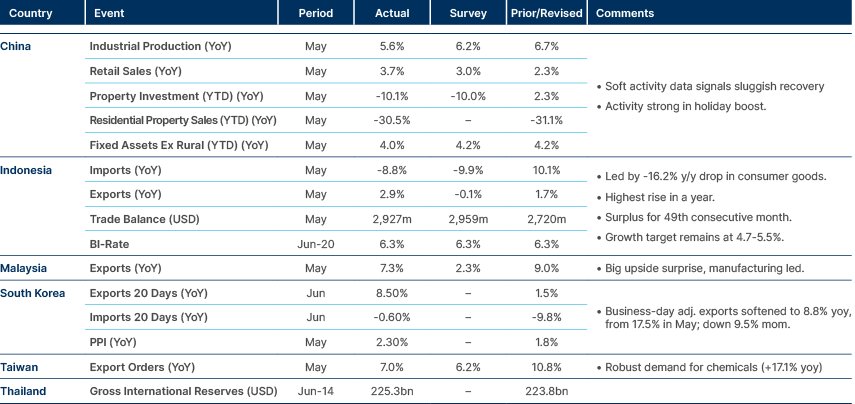

EM Asia

Data: China’s activity remains weak. Indonesia policy steady. Korean exports softened.

China: Home prices fell 0.7% mom in May, marking the 11th consecutive month of falling property prices despite ongoing government stimulus. In the first five months of 2024 property investments have fallen 10% yoy. The People’s Bank of China’s (PBoC) Governor Pan Gongsheng announced it will revamp the institution’s monetary policy framework. He said the quantity-based policy framework focusing on monetary aggregates as M2 and total social financing no longer suits the Chinese economy, which is undergoing rapid structural changes with housing and local government finance vehicles ongoing deleverage. The PBoC is likely to focus on its seven-day reverse repo as the key policy rate and the corresponding interest rates corridor (akin to the Fed Fund target range) needs to be narrowed for better communication of the policy stance. The PBoC said it will keep guidance on long-dated CGB yield aimed at reining-in liquidity mismatch risks among smaller banks and non-bank financial institutions, a lesson learned from the SVB event.

Thailand: Former Prime Minister Thaksin Shinawatra was granted bail by a Thai Court on lese majeste trial for remarks made in a 2015 interview that were perceived as critical of the monarchy. The specific statements that led to these charges are not widely disclosed due to Thailand's strict lese majeste laws, which prohibit the discussion and dissemination of content related to defaming, insulting, or threatening the monarchy. Thaksin remains a highly influential figure in Thai politics and has strong ties to the Pheu Thai Party, which is a key part of Prime Minister Srettha Thavisin’s coalition government. The PM faces his own charges of ethics violations, with senators alleging he breached the constitution in appointing a cabinet member once convicted for attempting to bribe members of the Supreme Court. If convicted, he could be removed from office. The rise in political risk in the country following these developments has led to large portfolio outflows from the country, with the stock index declining to a four-year low on Monday.

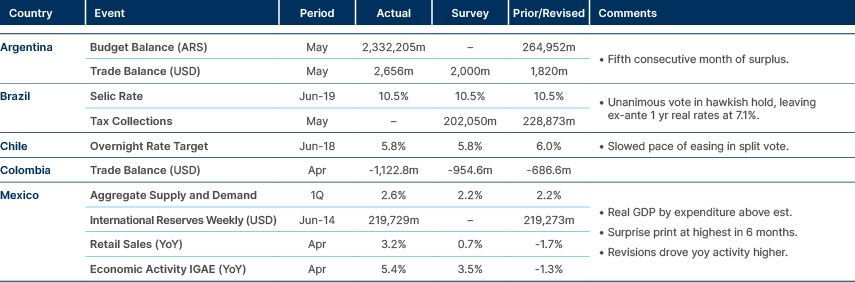

Latin America

Economic Data: Argentina had its fifth consecutive surplus. Brazil kept policy unchanged in a unanimous vote. Mexican activity stronger than expected.

Argentina: Under International Monetary Fund (IMF) guidance, Argentina is pursuing measures to stabilise its economy and bolster foreign exchange (FX) reserves. This includes raising real interest rates to positive levels and eliminating currency controls. As part of these reforms, the government plans to phase out a mechanism allowing exporters to sell 20% of their dollars at higher exchange rates by the end of the month. However, inflation remains a significant challenge, projected to stay high at 69% over the next 12 months. This situation may require interest rate hikes from the current 40% levels. President Milei's fiscal austerity measures have shown promising results, with monthly inflation reduced for five consecutive months to 4.2% in May, down from a peak above 25%. President Milei is seeking additional IMF funding to facilitate the removal of currency controls and capital restrictions. This move aims to reintegrate Argentina into international debt markets following its recent debt restructuring in 2020.

Brazil: Finance Minister Fernando Haddad met with President Lula to discuss the evolution of public expenditures and tax waivers, aiming to design a budget that ensures rights guarantees and promotes investment. Haddad emphasised the need for increased efforts to balance the budget, highlighting concerns over fiscal stability. So far, the government has focused on raising revenue rather than cutting expenses, but such measures have been insufficient for the achievement of the 0% primary fiscal deficit targeted for 2024 in the new fiscal framework approved last year.

Petrobras has agreed to pay BRL 19.8bn (c. USD 3.5bn) in back taxes, supporting President Lula's efforts to balance the budget. The payment includes 8bn reais from judicial deposits and fiscal credits, with the remainder to be paid in instalments. This arrangement reduces fines for Petrobras and potentially boosts government revenue through additional dividends in the future.

Colombia: Congress approved the revised debt ceiling to USD 17.6bn, in line with expected. The vote comes amid concerns about the state of the Andean country's fiscal needs and after Petro said last month that Colombia could stop paying its debts or enter an economic emergency if the ceiling was not increased, comments later softened by Finance Minister Ricardo Bonilla. A recent slump in tax collection has led to concerns over how authorities will cover a budget shortfall estimated by analysts at about USD 7bn this year. The government has already said it will cut spending by some USD 5bn as previously reported – a positive signal.

Mexico: This week, Claudia Sheinbaum announced the first six members of her cabinet. Mexican assets responded positively to the cabinet picks, which are viewed as market-friendly. Marcelo Ebrard was announced to lead the Economic Ministry; known for his experience in negotiating with the US and possessing a moderate political profile. Finance Minister Rogelio Ramirez de la O will continue in his current role. Sheinbaum will announce more cabinet picks next week.

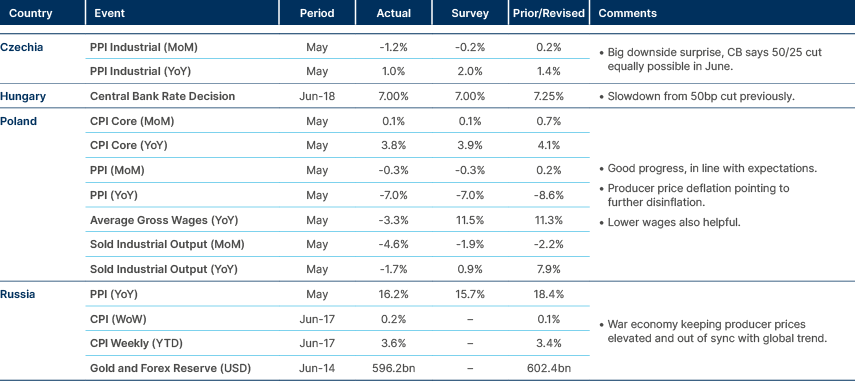

Central and Eastern Europe

Economic Data: Weak activity in Czechia. A hawkish cut in Hungary. Polish inflation still declining.

Central Asia, Middle East, and Africa

Economic Data: Good progress on core consumer price index (CPI) disinflation in Egypt. Inflation in South Africa remains subdued, but not yet low enough to warrant a rate cut, according to the Reserve Bank. This may change after the recent strength on the ZAR post elections.

Ghana: The Ministry of Finance reached an Agreement in Principle with bondholders to restructure USD 13bn of government debt.1 The deal involves a haircut of up to 37% on principal and a lengthening of maturity. The bonds rallied after Reuters published a report on the agreement, with the 2027 bond rally to its highest level since 2022. The West African gold and cocoa-producing nation defaulted on most of its USD 30bn of international debt in 2022, as the strain of the COVID-19 pandemic, war in Ukraine, and higher global interest rates tipped it into crisis after years of overspending.

Saudi Arabia: Saudi surpassed China as the largest issuer of international debt among Emerging Markets, ending Beijing’s 12-year streak at the top. Global fixed income investors are increasingly supporting Crown Prince Mohammed bin Salman’s Vision 2030 plan, which aims to diversify the Saudi economy. In contrast, Chinese borrowers are experiencing a surge in demand for local-currency bonds but have significantly reduced their issuance of international debt. This shift marks one of the slowest paces of international bond issuance by Chinese entities in recent years.

Mozambique: The IMF reached a staff-level agreement on the fourth review of the Extended Credit Facility (ECF) last week. The agreement includes reforms aimed at strengthening tax compliance, protecting spending for the most vulnerable populations, and improving the management of state-owned enterprises (SOEs). These measures are crucial for enhancing fiscal stability and governance in Mozambique's economy.

Developed Markets

Economic Data: US economic data, including employment, softened further. UK disinflation likely allowing the BOE to cut its policy rates in August.

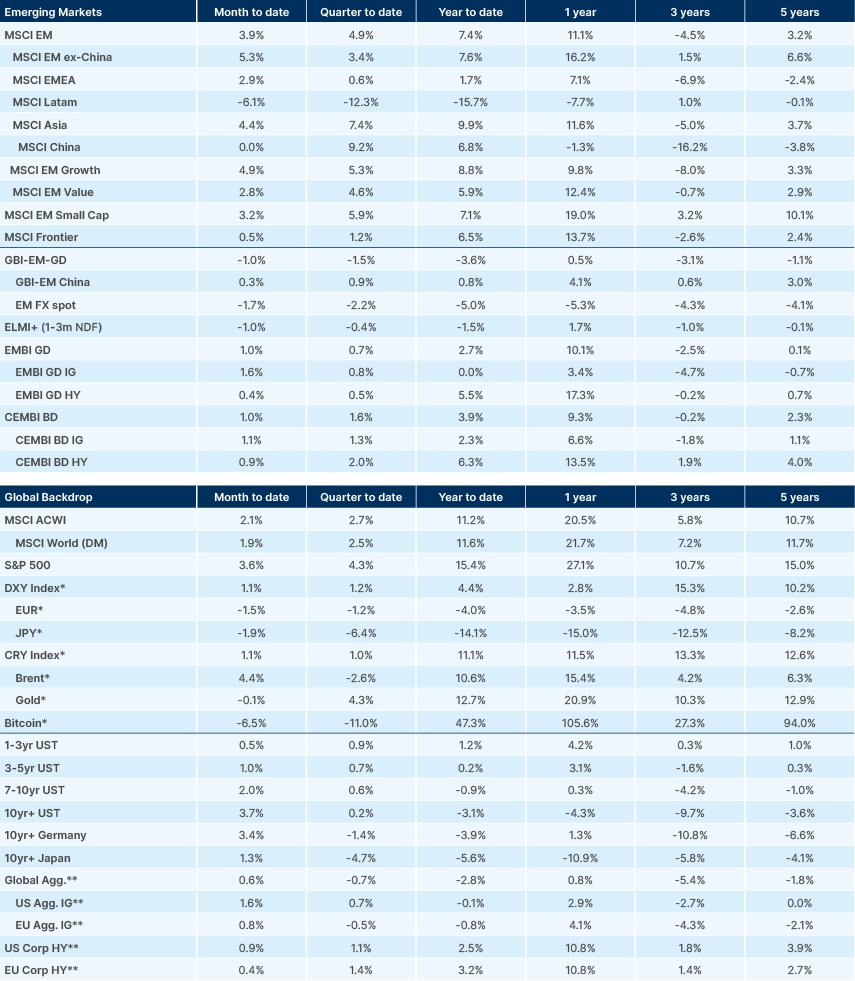

Benchmark performance

Source and notations for all tables in this document:

Source: Bloomberg, JP Morgan, Barclays, Merrill Lynch, Chicago Board Options Exchange, Thomson Reuters, MSCI. Latest data available on publication date.

* Price only. Does not include carry. ** Global Indices from Bloomberg. Price to Earnings: 12m blended-forward

Index Definitions:

VIX Index = Chicago Board Options Exchange SPX Volatility Index. DXY Index = The Dollar Index. CRY Index = Thomson Reuters/CoreCommodity CRM Commodity Index.

Figures for more than one year are annualised other than in the case of currencies, commodities and the VIX, DXY and CRY which are shown as percentage change.

1. See – https://www.prnewswire.com/news-releases/the-government-of-the-republic-of-ghana-and-representatives-of-bondholders-reach-an-agreement-in-principle-on-the-terms-of-the-eurobonds-restructuring-302179981.html