Monetary policy turned more cautious across the US and several Emerging Market (EM) countries, improving the risk-reward dynamics for bonds. Oil and gold prices increased as geopolitical risks remained elevated. EM manufacturing sentiment improved further in March. The US and the European Union (EU) were worried about China’s export surplus. TSMC’s operations were unaffected after Taiwan’s strongest earthquake in 25 years. Elon Musk challenged the president of Brazil’s Supreme Court over the blocking of accounts on social media platform X. Poland, Romania, Kenya, and India kept their policy rates unchanged. Türkiye’s President Erdogan accepted defeat in local elections. Oil and gold prices rallied on the back of fears over the Middle East.

Global Macro

Monetary Policy

US Federal Reserve (Fed) Chair Jerome Powell said on Wednesday 3 April that the Fed is “not done yet” with bringing down inflation and that it would need “greater confidence” of easing price pressures before cutting interest rates. However, Powell said the strong labour market data did not “materially change the overall picture”, associating some of the strength with a positive supply shock and that “it is too soon to say whether the recent (inflation) readings represent more than just a bump”. However, other members of the Federal Open Market Committee (FOMC), including Governor Christopher Waller, suggested pushing out rate cuts, or delivering fewer rate cuts in 2024, leaving the market with a mixed message. The weighted probability of a 25bps policy rate cut in the June FOMC meeting dropped to 48% on overnight index swap (OIS) rates. The same market prices only 2.5 cuts of 25bps until December from 6.7 three months ago. In other words, the market moved from pricing almost one cut per meeting in 2024 to pricing only two or three cuts, moving from one tail of the scenario to another in less than three months. At current levels, the risk-reward favours increased allocation to investment grade bonds, in our view.

Geopolitics

NATO Secretary General Jens Stoltenberg said it is discussing how its support to Ukraine can be “institutionalised, predictable and robust”. A USD 100bn five-year military aid programme is being planned, where NATO will take over management of the Ramstein Group, originally set up by the US to coordinate military supplies to Kyiv.1

The airstrike on Iran’s embassy in Syria last Monday has renewed fears of regional spillovers of the Israeli-Palestinian conflict. The strike killed Mohammad Reza Zahedi, a top commander of Iran’s Quds force in Syria and Lebanon, as well as six other military officials. Tehran has warned of a “serious response” and Hezbollah has reportedly planned to retaliate against Israel. Pundits still argue that, even if Iran responds, a second full-blown war is not guaranteed. For Israel, risks of domestic disunity and lack of full support from the US make a multi-front war risky. From Iran’s perspective, restraint may extract concessions from the US through a lax application of sanctions on Iran’s oil exports. Risks remain in place: Israel’s unwillingness to agree to a ceasefire and Hamas still holding hostages. The Israeli government led by Benjamin Netanyahu has been dependent on the ultra-orthodox Jewish constituency ralling against any temporary ceasefire and may see any Iranian response as an opportunity to re-impose Israeli military hegemony in the region. Furthermore, international sympathy for Palestinians in Gaza continues to grow.

Meanwhile, US Defence Secretary Lloyd Austin rebuked Israel over killing United Nations (UN) aid workers in Gaza. This was the first time a Western official has highlighted a link between the strike on the World Central Kitchen convoy and Israel’s plan to attack Rafah, a town where more than one million civilians are taking shelter.2 The Israeli government said it was open to allowing humanitarian aid into Gaza as a negotiation team returned to Cairo to discuss a new hostage deal proposal. However, last night, Israel said it had withdrawn troops from southern Gaza to prepare for future military operations in Rafah, with the objective of destroying Hamas’s Rafah Brigade and to “finalise the dismantling of Hamas as a military authority in Gaza”.

Crude oil prices rallied due to the heightened geopolitical risk in the Middle East, tighter supply from Mexico and continued strong demand. Brent crude hit a seven-month high last Friday, rising to USD 91.2 per barrel. A ministerial committee of the Organisation of the Petroleum Exporting Countries (OPEC+) kept its oil supply policy unchanged, contributing to this spike in oil prices.3 Gold also surged to a new high, reaching USD 2,330 last week as China and India kept increasing their gold reserve positions.

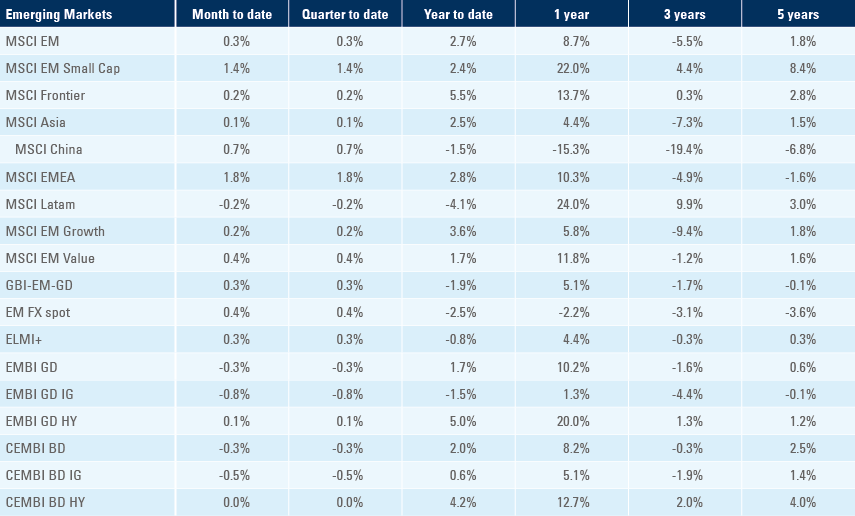

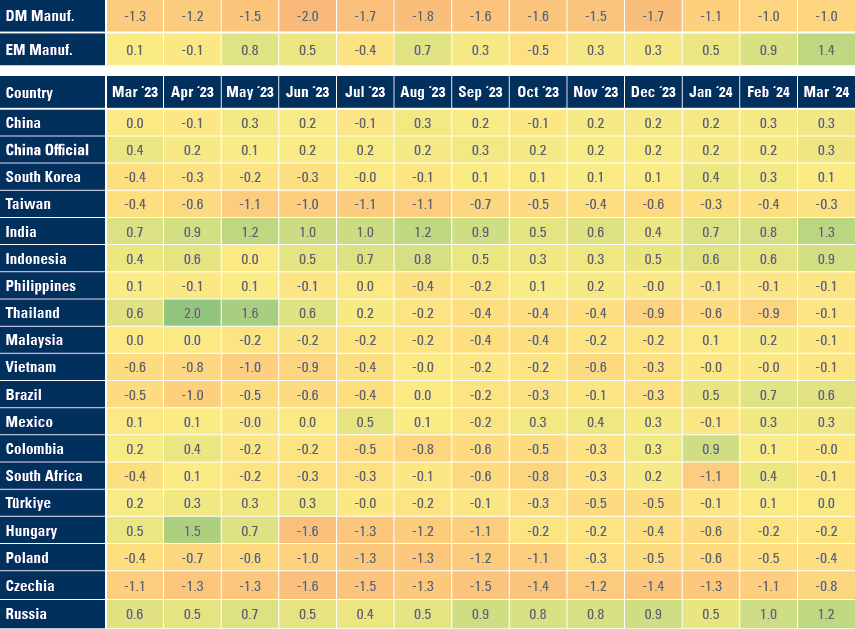

Global Manufacturing PMI

The global manufacturing purchasing managers index (PMI) rose 0.3 to 50.6 in March with the EM manufacturing PMI rising 0.5 to 52.0 and the Developed Markets (DM) PMI unchanged at 49.3. Within EM, China, India, Indonesia, Thailand, Czechia, and Russia led the improvement in manufacturing as per the z-score table on Fig. 1. In DM, the improvements on the manufacturing PMI in the UK, Italy, Sweden, and Japan were compensated by sharp drops in Germany, France, Norway, and Australia.

Fig. 1: Manufacturing PMI: Z-Scores

Emerging Markets

EM Asia

China: Economic data was stronger than expected in China. The Caixin manufacturing PMI rose to 51.1 in March from 50.9 in February and 51.0 in estimates. In geopolitics, US President Joe Biden voiced concerns to President Xi Jinping about the ownership of TikTok during a phone call, in the interest of protecting data security. In a visit to China, US Treasury Secretary Janet Yellen stressed that Chinese companies supplying Russia’s war effort risked “significant consequences” and voiced concerns over China’s excess manufacturing capacity impacting the global economy: “Overcapacity isn’t a new problem, but it has intensified, and we’re seeing emerging risks in new sectors”. Last week, the EU launched two investigations into Chinese solar panel manufacturers, arguing that China has benefited from market-distorting subsidies. “The two new in-depth investigations on foreign subsidies in the solar panel sector aim to preserve Europe’s economic security and competitiveness by ensuring that companies in our single market are truly competitive and play fair”, said the EU’s Internal Market Commissioner Thierry Breton. The investigation will focus on a German subsidiary of Longi Green Energy Technology and two European subsidiaries of Chinese state-backed power company Shanghai Electric. The EU will assess the evidence of alleged unfair practices and will draft a plan due to be signed by EU energy ministers and industry groups on 15 April.4

Taiwan: Taiwan Semiconductor Manufacturing Company (TSMC) evacuated a factory due to the strongest earthquake in 25 years. The 7.4 magnitude quake hit 25km south-east of Hualien on 3 April. TSMC restarted production and maintained its full-year revenue guidance of low-to-mid-20% after stating only a few production lines were affected. This morning, Bloomberg reported TSMC received USD 11.6bn in grants and loans from the US government for three chip plants.

Indonesia: Consumer price index (CPI) inflation increased to 3.1% yoy in March, from 2.8% in February and higher than estimates of 2.9%. Sequentially, inflation rose 0.5% mom in March from 0.4% in February. The pick-up in prices is probably due to a stronger demand after elections and the start of the Ramadan period.

Malaysia: Foreign exchange (FX) reserves increased slightly to USD 113.8bn as of 29 March, from USD 113.4bn as of 15 March.

South Korea: CPI inflation was up 0.1% mom in March from 0.5% in February, in line with estimates. Prices went up by 3.1% on a yoy basis, unchanged from the previous month and slightly higher than estimates of 3.0%. CPI inflation excluding food and energy was in line with estimates at 2.4% yoy in March, from 2.5% in February. The current account surplus jumped to USD 6.9bn in February, from USD 3.0bn in January. Foreign travel spending rose 3.2% in February to USD 1.0bn yoy, and the number of visitors rose by 115% to 1 million in March compared with February.

Thailand: CPI inflation declined 0.5% yoy in March from -0.8% in February, the sixth straight month of deflation. The decline was driven by fresh food, energy, electricity, and the high base in March last year. Gross international reserves stood at USD 223.4bn for the week ended 29 March, from USD 223.6bn in the prior period.

Latin America

Argentina: The government’s tax revenue increased to ARS 7,726bn in March from ARS 7,249bn in February.

Brazil: Elon Musk accused the Supreme Court Leader Alexandre de Moraes of making unlawful demands to social media company X, formerly called Twitter, going as far as asking for the judge’s impeachment.5 Moraes retaliated by opening an inquiry into whether Musk obstructed justice, accusing him of starting a “disinformation campaign” and suggesting X is abusing its economic power to “illegally influence public opinion”. Countries are struggling to strike the fine balance between regulating social media while avoiding impairing free speech. The matter became highly political in Brazil (and other countries) after former President Jair Bolsonaro’s meteoric rise thanks to a social media campaign from hordes of political influencers.

Economic data was mixed. Industrial production decreased 0.3% mom in February compared with a decrease of 1.6% in January, differing from estimates of a 0.2% increase. The current account deficit tightened to USD 4.4bn in February from a deficit of USD 5.1bn in January, but was still wider than estimates of USD 3.5bn. Foreign direct investment (FDI) was USD 5.0bn in February, lower than the USD 8.7bn in the prior month and USD 6.6bn estimates. Brazil’s trade surplus widened by USD 7.0bn in March, exceeding estimates. The surplus increased to USD 7.5bn from USD 5.3bn in February. Exports increased by USD 4.5bn to USD 2.8bn, and imports increased by USD 2.3bn to USD 2.0bn over the same period. Government net debt to GDP rose to 60.9% in February, compared with the estimate of 60.1% in January.

Colombia: Colombia’s exports rose less than economists expected in February. Exports stood at USD 3.8bn in February compared with USD 4.0bn estimated, but increased from USD 3.7bn in January.

Chile: Chile’s central bank cut its key rate from 7.25% to 6.5%, in line with consensus.

Ecuador: CPI inflation was 0.3% mom in March, an increase from 0.1% mom in February. The yoy rate of inflation increased to 1.7% from 1.4% in February.

Mexico: Gross fixed investment grew by 15.3% yoy in January compared with 13.4% in the prior month and estimates of 17.9%. Private consumption increased by 2.9% yoy in January, which was lower than the 4.4% increase in December and the 3.7% estimate. Vehicle production fell to 301,976 in March from 318,736 in February, while vehicle exports rose to 286,002 from 284,602 in February.

Central and Eastern Europe

Czechia: The budget balance stood at a deficit of CZK 105bn in March, from CZK 102.5bn in February. S&P’s Global manufacturing PMI for Czechia was 48.0 in March, increasing from 47.9 in February and above estimates of 47.9.

Hungary: The trade surplus rose to EUR 1.7bn in February, from EUR 0.6bn in January. Exports increased by EUR 1.1bn to EUR 12.6bn, and imports were unchanged at EUR 10.9bn. Industrial Production rose to 1.4% yoy in February, from -4.1% in January and above consensus at -3.0%, led by higher car production. However, retail sales were lower than expected at 1.1% yoy in February compared with estimates of 2.3%, albeit still an increase from 0.6% in January.

Poland: The National Bank of Poland left its key interest rate unchanged at 5.75%. This decision was expected as Monetary Policy Council member Iwona Duda said on 27 March that the central bank did not see “room for interest rate cuts this year”. Governor Adam Glapiński also signalled that interest rates would likely stay unchanged for the rest of the year due to concerns of inflation flaring up again as the government restores higher taxes on food and plans to lift some energy price caps.

Romania: The National Bank of Romania kept its policy rate unchanged at 7.0%, in line with consensus. Governor Mugur Isǎrescu said the “most recent data show that inflation will continue to decline in the coming months but on a slightly higher path compared with the February forecast” and that “economic growth in the first quarter will be stronger than previously envisaged”. While price growth is expected to ease to 4.7% at the end of this year, the central bank remains worried about the inflation outlook given fiscal measures aimed at underpinning the budget consolidation process remained in place. Romania faces four rounds of elections, growing demands for higher wages and a budget deficit forecast of 5.0% of GDP this year. In economic news, retail sales rose by 7.1% in yoy terms in February, up from 5.9% in January.

Central Asia, Middle East, and Africa

Kenya: The central bank kept its benchmark interest rate unchanged at 13%, a 12-year high. Governor Kamau Thugge said, “The current monetary policy stance will ensure that overall inflation continues to decline towards the 5% midpoint of the target range”. CPI inflation slowed to a yoy rate of 5.7% in March from 6.3% in February.

Angola: Real GDP growth was unchanged at 1.4% yoy in Q4 2023, in line with consensus. FX reserves increased to USD 14.3bn in March, from USD 14.1bn in February.

Pakistan: CPI inflation declined to 20.7% yoy in March from 23.1% in February, slightly higher than estimates of 20.4%. Pakistan’s trade deficit widened to USD 2.2bn in March from USD 1.7bn in February, largely driven by an increase of imports by USD 0.4bn to USD 4.7bn as exports were unchanged at USD 2.6bn.

India: The Reserve Bank of India stuck to its hawkish policy tone and maintained its benchmark rate at 6.5%, in line with consensus. This was the last rate decision before elections start in two weeks’ time. Governor Shaktikanta Das said that the central bank is “unwaveringly focus[ed] on price stability”.

South Africa: The Absa Manufacturing PMI declined to 49.2 in March, from 51.7 in February and lower than estimates of 51.3. Sentiment declined due to logistical challenges at state-owned Transnet.

Türkiye: In political news, President Erdogan vowed not to interfere with the outcome of the local elections on 31 March, accepting the defeat of his Justice and Development Party (AKP) to the opposition Republican People’s Party (CHP) lead by Ekrem Imamoğlu. This was AKP’s first-ever defeat in a nationwide vote share, after receiving 35.5% of votes against CHP’s 37.7%. There is a consensus within the AKP that the defeat was due to Türkiye’s troubled economy. The subdued turnout of 78% suggested traditional AKP voters sat out of the polls and that AKP underestimated losing voters to the small Islamist-leaning New Welfare Party (YRP).6 Despite the defeat, there were few signs of any change on the orthodox line adopted post-presidential elections. In last week’s data, CPI inflation slowed to 3.2% mom in March, from 4.5% in February, 30bps below consensus. The yoy rate of CPI inflation declined by 60bps to 68.5%. Core CPI inflation rose by 330bps to 75.2% yoy in March, in line with consensus. The central bank’s latest projections forecast inflation ending this year at 36% with an upper band of 42%. Finance Minister Mehmet Simsek said the fiscal deficit will be lowered through control over government spending, excluding costs related to the earthquake last year. Coupled with monetary policy tightening, he stated that inflation expectations will be anchored, and policies will “contribute to the disinflation process”. The cash budget deficit declined to TRY166.8bn in March, from TRY 198.3bn in February, remaining at the lowest level for 20 years.

Developed Markets

United States: Non-farm payrolls data last Friday (5 April) advanced to 303k in March, significantly higher than estimates and last month’s revised figure of 270k. Average hourly earnings declined by 20bps to 4.1%, and the unemployment rate dropped 10bps to 3.8%, both in line with consensus. Last week, the yield on the 10-year US Treasury rose 20bps to 4.41%. In other news, the ISM manufacturing PMI survey rose by 2.5 points to 50.3 as the S&P manufacturing PMI declined by 0.6 to 51.9. The trade balance widened to USD 68.9bn in February from USD 67.4bn prior. The value of imports rose to USD 332bn, while exports increased to USD 263bn. The US trade deficit with China narrowed to USD 21.9bn, the smallest decline in three months, whereas the goods shortfall with Mexico widened to USD 15.3bn due to record-high imports.

Europe: The first estimate Eurozone CPI inflation declined by 20bps to 2.4% in March, as core CPI also declined by 20bps to 2.9%, bolstering hopes for interest-rate cuts by the European Central Bank (ECB) in June, as signalled by ECB President Christine Lagarde. The ECB’s hawkish Chief Economist Philip Lane insisted that wage increases must retreat before the central bank would consider rate cuts, as salaries have continued to increase by more than 4.0%. Lagarde has made clear that the ECB will not commit to a particular rate path after the first rate cut. The unemployment rate rose by 10bps to 6.5% in February, against a 6.4% consensus.

Japan: The monetary base was 1.6% yoy in March, from 2.5% in February. The Tankan showed an improvement in sentiment for the services sector, with an increase in consumer spending for construction and real estate.

1. See – https://www.ft.com/content/27e012a7-87cf-4d3d-88f9-06fdcb39118e

2. See – https://www.ft.com/content/725b3176-1bdc-4dae-a8ed-d21ba7158500

3. See – https://www.reuters.com/business/energy/opec-ministers-keep-oil-output-policy-steady-sources-say-2024-04-03

4. See – https://www.ft.com/content/5e677032-82c6-4761-9053-a441ef1a71c4

5. See – https://twitter.com/elonmusk/status/1776989005848207503

6. See – https://www.ft.com/content/0deeaad7-d98f-46a3-aac9-a4e18086e8b1

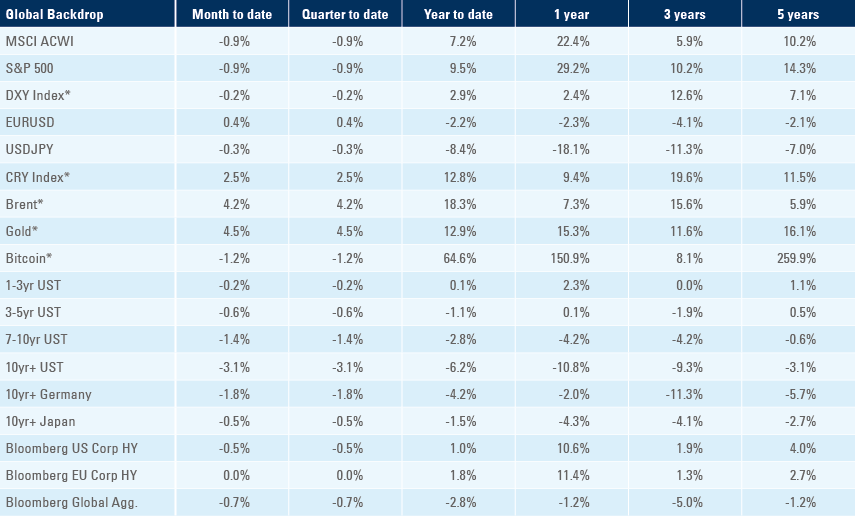

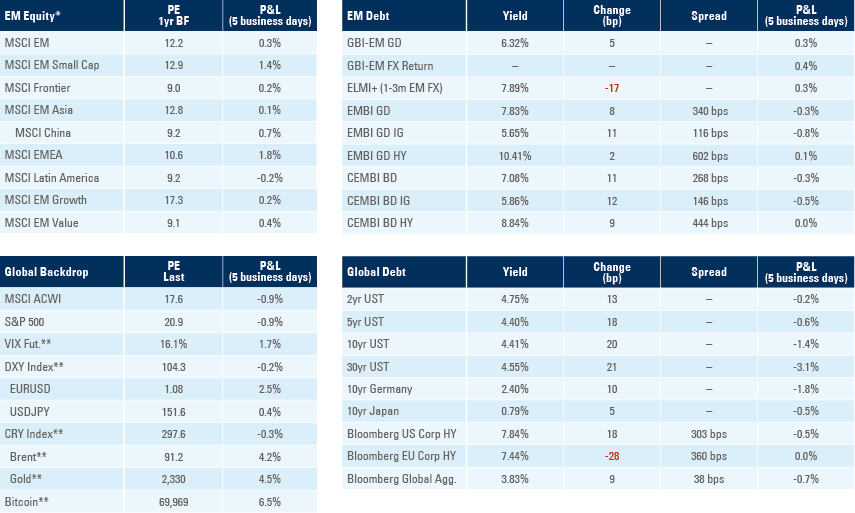

Benchmark performance