The Peronist Party suffered a historic defeat in Argentina; Xi Jinping approves historical resolution document in China

Argentina’s government coalition received only one-third of the votes in mid-term nationwide elections. Inflation rose further in Brazil as the current political-economic juncture rhymes with 2002. Chile’s Senate voted against a fourth withdrawal of its pension fund. China’s Xi Jinping approved a landmark document providing policy prescriptions to the Communist Party and setting the stage for a third term. CPI inflation surprised to the upside across most EM countries, as Central Banks in Mexico, Peru, Romania and Uruguay tightened monetary policy further. South Africa kept its fiscal consolidation guidance unchanged.

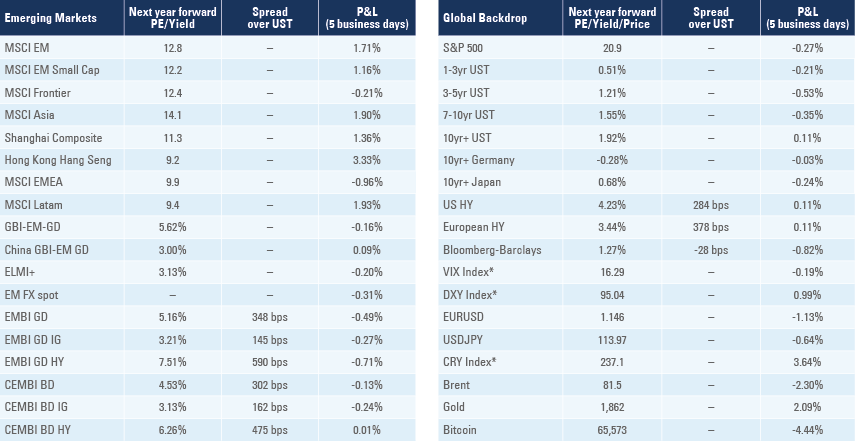

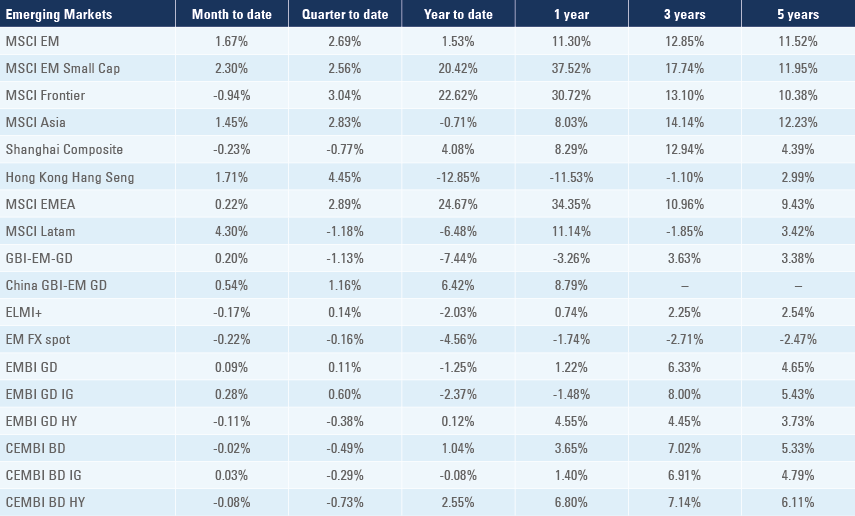

Emerging Markets

Argentina: The government coalition Frente de Todos received only 33.4% in the mid-term elections yesterday while the opposition coalition Juntos por Cambio received 42.1% of the votes.1 With the result, the Peronist Party lost the majority in the Senate for the first time since 1983 – a historic defeat for Cristina Kirchner resulting from the government’s heterodox policies failing to lift the population’s living standards. The government now has higher incentives to agree a deal with the IMF, in order to avoid another popularity blow that would result from further economic damage following an IMF default. In other news, CPI inflation was unchanged at 3.5% in October and wages rose by 4.0% in September from 3.2% in August.

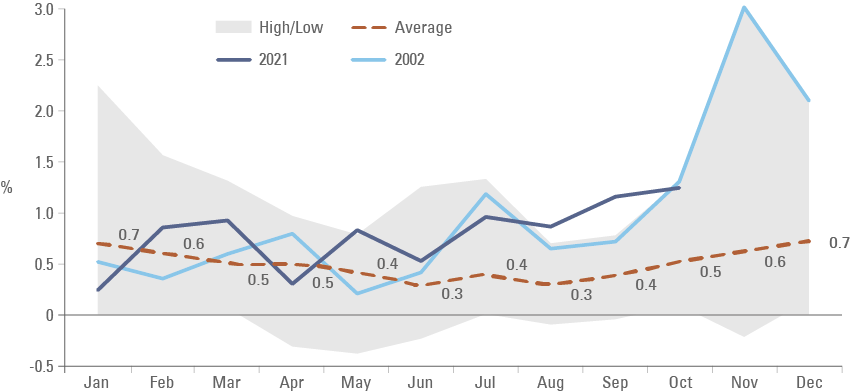

Brazil: CPI inflation rose to 1.3% mom in October, 0.2% above consensus and the highest number for the month since 2002 (10.7% yoy). Transport and energy costs were the main culprits led by higher energy prices due to international price pressures, a drought and a weaker BRL. The episode echos the 2001-2002 period (Figure 1), also marked by an overlap between election uncertainties and supply shocks (a severe drought led to energy rationing during 2001), which led to severe BRL depreciation. In 2002 the political uncertainties only dissipated once the leading presidential candidate Luis Inacio Lula da Silva published a “letter to the nation” pledging to uphold the fiscal responsibility law enshrined in the constitution by the previous government. Lula’s initial two presidential terms were marked by the strongest fiscal consolidation period in the country’s recent history, as sound economic policies were aided by high commodity prices. History does not repeat itself, but it often rhymes: last week Lula approached the former Governor of the Sao Paulo state – Geraldo Alckmin – to be his running mate in the 2022 elections. Ironically, Alckmin disputed the presidential election against Lula in 2006 and against another PT candidate in 2018 when he was a member of the social democrat party PSDB. While it is hard to believe Alckmin would accept the invitation, the fact that Lula is probing the possibility and Alckmin did not deny the conversations, suggests Lula’s strategy is – like in the 2002 election – to move the party away from its far-left political roots towards the centre. After all, Alckmin has the reputation of being a good manager and he is unlikely, in our view, to vouch for populist fiscal policies.

In other political news, last week the Lower House of Congress approved the second round of the constitutional amendment (PEC) that allows the government to implement its boosted social programme, Auxilio Brasil, as well as postponing the repayment of court-mandated liabilities (precatórios). The PEC would backtrack an important budgetary provision (ceiling on government expenditures) for the sustainability of the public debt (set in the constitution by the Michel Temer administration), but market participants have been hailing its approval as good news, since the alternative could be potentially even more disruptive. The PEC needs approval by the Senate in two votes before becoming law. Rejecting the PEC would be good news, in our view. Albeit it would bring short-term instability, maintaining the fiscal expenditure ceiling would allow the next administration to focus on other key reforms such as tax and administrative reforms. In other news, retail sales dropped 1.3% in September (0.7% consensus) after declining 4.3% in August (revised from -3.1%).

Figure 1: Brazil monthly CPI seasonal chart [area 2001-2020]:

Chile: The trade balance moved to a USD 352m deficit in October from a USD 79m surplus in September as imports rose to USD 8.12bn (from USD 7.35bn) while exports rose to USD 7.77bn (from USD 7.43bn). The yoy rate of CPI inflation rose 0.7% to 6.0% in October, 0.4% above consensus. Inflation expectations for one and two years climbed to 4.8% and 3.5% respectively (from 4.5% and 3.3% in October). In political news, the Senate rejected the fourth pension fund withdrawal. The bill goes back to discussion by a mixed Congress committee, but the process is likely to end only after the presidential elections, reducing the pressure to vote in favour of the bill.

China: The Chinese Communist Party (CCP) passed the historical resolution document proposed by Xi Jinping, setting the stage for a sweeping leadership reshuffle next year and securing a third five-year term for Xi as the party general secretary in 2022. President Xi was the third leader issuing the landmark document alongside Mao Zedong and Deng Xiaoping. The document covers the party’s historical achievements and prescribes its future course with a focus on promoting common prosperity policy and self-reliance in science and technology. In other news, Xi Jinping will hold a virtual summit today with US President Joe Biden after the US and China signed a historic climate agreement last week.

In economic news, the yoy rate of CPI inflation rose 0.8% to 1.5% in October, close to consensus while PPI inflation rose 2.8% to 13.5% yoy over the same period, 1.2% above consensus. Higher PPI inflation is likely to keep pressure on global tradable goods. Total aggregate financing declined to CNY 1.6trn in October, the largest result for the month, from CNY 2.9trn in September and new loans declined to CNY 0.8trn in October (also a record for the month) from CNY 1.7trn in the prior month. The yoy rate of retail sales and industrial production (IP) recovered more than expected at 4.9% and 3.5% (consensus 3.7% and 3.0%), while fixed asset investment and property investment declined slightly more than expected at 6.1% and 7.2%, respectively (consensus 6.2% and 7.8%). In real estate news, the pre-sales of property increased by 7% in October across large property developers (rising to 76% of the monthly target from 68% in September), according to data from BNP Paribas, a bank. The Development Research Centre of the State Council held a meeting with large property developers where they discussed the possibility of loosening conditions for real estate enterprises to issue domestic bonds, with devexlopers expected to issue debt in the interbank market. The People’s Bank of China is also considering loosening borrowing limits set by the “three red lines” to large state-owned developers in order to enable acquisitions of assets from developers with liquidity issues, according to sources heard by the Wall Street Journal.2 The rating agency S&P cut Shimao Group Holdings to BB+, one notch below investment grade, and kept a negative outlook on the rating. In other policy news, China plans to issue dozens of licences to companies like Gaotu Techedu and Tencent-backed Yuanfudao to offer after-school tutoring on a not-for-profit basis.

Colombia: The yoy rate of retail sales declined to 15.3% in September from 32.0% yoy in August while manufacturing production declined to 15.5% yoy from 22.9% yoy and IP to 13.7% yoy from 15.5% yoy over the same period. The consumer confidence survey by Fedesarrollo rose 1.7 but remained at a very subdued -1.3 level. In political news, the latest presidential election poll by CNC gives leftist candidate Gustavo Petro 22% of vote intentions with centre candidates accumulating 18% (Galán, Gaviria and Fajardo 5% each and la Calle 3%) of vote intentions and centre right candidates adding 13% (Hernandez 6%, Cabal 4% and Federico 3%).3

India: The yoy rate of CPI inflation rose 0.1% to 4.5% in October, slightly above consensus mostly due to higher vegetable prices, while core CPI was unchanged at 5.9% yoy. Higher vegetable and fuel prices drove the yoy rate of wholesale inflation index (WPI) inflation rose to 12.5% in October (consensus 11.1%) from 10.7% yoy in September. In other news, the yoy rate of IP declined to 3.1% in September from 12.0% in August, mostly due to supply bottlenecks and base effects.

Mexico: The central bank hiked its policy rate by 25bps to 5.0%, in line with consensus. The yoy rate of CPI inflation rose 0.2% to 6.2% in October, in line with consensus, but CPI accelerated to 6.4% in the second half of the month, suggesting further pressures ahead. The yoy growth rate of IP dropped to 1.6% in September, lower than both 3.9% yoy consensus and 5.5% yoy in August.

Peru: The central bank hiked its policy rate by 50bps to 2.0%. In political news, the Defence Minister Walter Ayala resigned after a scandal over changes in military leadership. Former commanders from the army and air force said President Pedro Castillo dismissed them after they refused to promote government-appointed officers. Business sentiment improved in October to 51 points, from 45 points in September. The improvement in sentiment coincides with the resignation of far-left Prime Minister Guido Bellindo.

Romania: The central bank hiked its policy rate by 50bps to 2.0%, 25bps above consensus as the yoy rate of CPI inflation rose to 7.9% in October, significantly above both 7.1% yoy consensus and 6.3% yoy in September. The yoy rate of industrial output contracted 3.2% in September from 0.2% in August, below consensus. In another signal of the need for further monetary policy tightening, the trade deficit widened to USD 2.1bn in September from USD 1.7bn in August and remains at the lowest levels in 15 years. In political news, the Liberal Party started discussions with its multi-year rival Social Democratic Party to form a new government.

South Africa: The Medium Term Budget Policy statement projected the fiscal deficit to narrow to 6.0% of GDP in the 2022 fiscal year (FY) and 5.3% in FY 2023 (from -6.6% in FY 2021 and -9.0% budgeted for the FY 2022). The deficit before interest payments narrowed to -0.3% in FY 2022 and moves to a small surplus in FY 2023. In other news, the yoy rate of manufacturing production slowed to 1.3% in September from 1.9% yoy in August, but beat consensus for a 1.3% yoy drop. Mining production dropped 3.7% mom in September after declining 2.0% in August

Snippets

Czech Republic: The yoy rate of CPI inflation rose 0.9% to 5.8%, slightly above consensus. The yoy rate of industrial output dropped by 4.0% in September from +1.4% yoy in August and the trade deficit narrowed to CZK 13.3bn in October from CZK 27.7bn in September, remaining at the widest deficit in 20 years for the second consecutive month.

Ecuador: Foreign exchange reserves rose to USD 7.6bn in October from USD 6.3bn in September according to the central bank.

Egypt: The yoy rate of CPI inflation declined 0.3% to 6.3% in October as core CPI rose 0.4% to 5.2% yoy. Egypt has bucked the higher global inflation trend (inflation is close to its lowest levels in 15 years) thanks to a stable currency and higher production of natural gas supporting the country’s terms of trade.

Hungary: The yoy rate of CPI inflation rose 1.0% to 6.5% in October, 0.3% above consensus as the consolidated fiscal balance accumulated a HUF 2.9trn deficit year-to-date until October, the biggest deficit in the 25 years since the inception of the series.

Indonesia: Consumer confidence rose to 113.4 in October from 95.5 in September, but local auto sales declined to 75.5k in October from 84.1k in September. The trade surplus surged to USD 5.7bn in October from USD 4.4bn in September as exports rose by a yoy rate of 53.4% (from 47.6%) and imports at 51.1% (from 40.3%).

Kenya: The yoy rate of real GDP growth rose to 10.1% in Q2 2021 from 0.7% in Q1 2021, almost twice the level of consensus expectations compiled by Bloomberg.

Malaysia: Real GDP growth contracted 3.6% in Q3 2021 after contracting 1.9% qoq in Q2 2021, bringing the yoy rate to -4.5% in Q3 2021 from +16.1% yoy in Q2 2021. However, the yoy rate of manufacturing sales and IP rose by 11.6% and 2.5% respectively in September, significantly above August data.

Nicaragua: The Organisation of American States (OAS) issued a resolution criticising Nicaragua’s presidential election after Daniel Ortega was re-elected for the 4th consecutive election with 76% of the votes after his government jailed most of the potential opposition candidates.

Philippines: Real GDP growth surged 3.8% qoq in Q3 2021 from -1.4% qoq in Q2 2021, significantly above consensus at 1.4% qoq. The yoy rate declined to 7.1% from 12.0% over the period.

Poland: The yoy rate of GDP growth slowed to 5.1% in Q3 2021 from 11.2% yoy in Q2 2021, beating consensus.

Russia: The trade surplus rose to USD 20.0bn in September from USD 17.1bn in August, the highest number for the month in 30 years, while the yoy rate of light vehicle car sales declined 18.1% in October from 22.6% yoy in September, both better than consensus expectations.

Saudi Arabia: The yoy rate of real GDP growth accelerated to 6.8% in Q3 2021 from 1.9% yoy in Q2 2021.

South Korea: Unemployment rate rose 0.2% to 3.2% in October due to a large increase in the labour force participation. Import prices accelerated 4.8% mom in October (35.8% yoy) from 2.3% mom in September while export prices rose 1.6% mom (25.3% yoy) from 1.2% mom over the same period.

Taiwan: The trade surplus narrowed to USD 6.1bn in October from USD 6.5bn in September, as the yoy rate of export growth declined 4.6% to 24.6% while imports declined 3.2% to 37.2% yoy in October.

Thailand: The Bank of Thailand kept its policy rate unchanged at 0.5%, in line with consensus.

Uruguay: The central bank hiked its policy rate by 50bps to 5.75%, as the statement highlighted the slowdown in the convergence of CPI and core CPI inflation to its target after rising to 7.9% and 8.3% respectively.

Global backdrop

Covid-19: The evolution of therapeutic drugs is likely to improve the outlook for global mobility. Last week Regeneron Pharmaceuticals said its antibody cocktail reduced the risk of contracting covid-19 by 82% for up to eight months according to a company-sponsored study. Merck and Pfizer are developing pills that showed promising results in patients early in the course of disease.

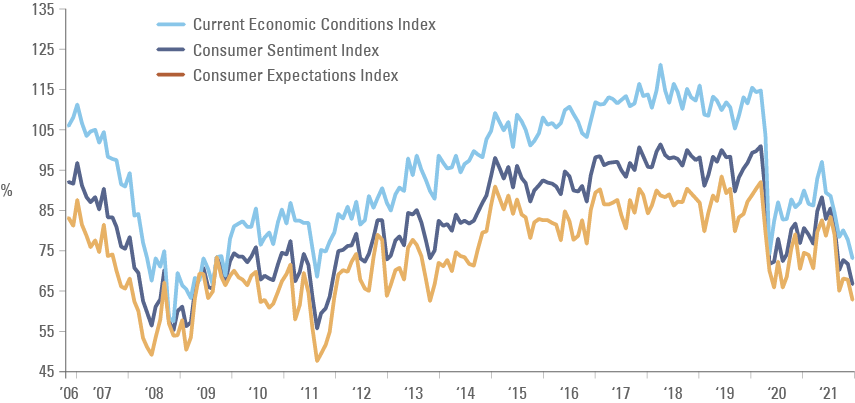

United States (US): CPI inflation rose to 0.9% mom in October from 0.4% in September (0.6% consensus), taking the yoy rate of CPI inflation to 6.2%. The yoy rate of CPI ex-food and energy rose 0.6% to 4.6% as other measures of core inflation also illustrated widespread pressures much beyond transitory elements. The yoy rate of PPI inflation was unchanged at 8.6% in October. After the higher than expected inflation data, Senator Joe Manchin said the threat posed by record inflation is not transitory and that politicians cannot ignore the pain of inflation while Joe Biden said reversing inflation is a top priority. The University of Michigan sentiment survey dropped to the lowest levels since 2011 (between 62 and 73), signalling US consumers are feeling the effect of higher inflation eroding their purchasing power despite higher wages.

Figure 2: University of Michigan consumer sentiment survey (Nov-2021):

Europe: The yoy rate of IP rose 0.3% to 5.2% in September, 1.1% above consensus. European imbalances are building up again: the German trade surplus rose to EUR 16.2bn in September from EUR 10.7bn in August while the French trade deficit widened marginally to EUR 6.8bm from EUR 6.7bn prior over the same period.

Japan: The current account surplus declined to JPY 1.0trn in September from JPY 1.5trn in August, in line with consensus. The yoy rate of PPI inflation rose 1.6% to 8.0% in October (7.0% yoy consensus)

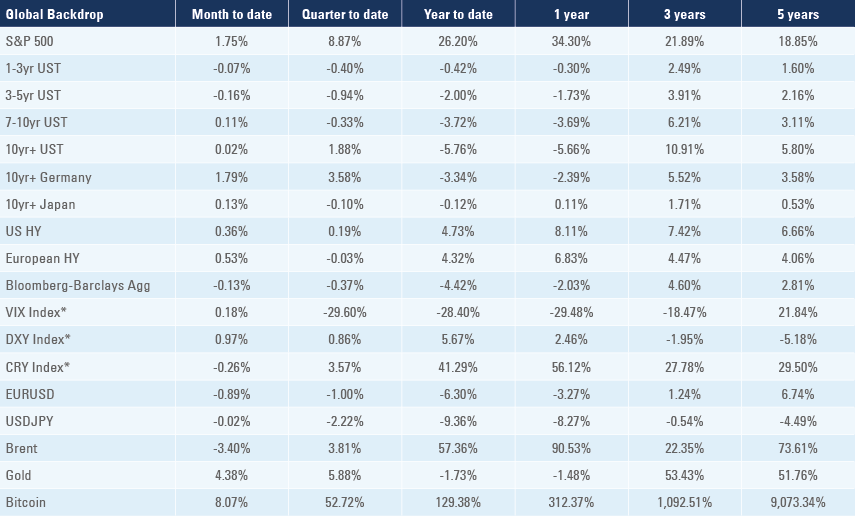

*VIX Index = Chicago Board Options Exchange SPX Volatility Index. *DXY Index = The Dollar Index. *CRY Index = Thomson Reuters / CoreCommodity CRM Commodity Index.

Source: Bloomberg, JP Morgan, Barclays, Merrill Lynch, Chicago Board Options Exchange, Thomson Reuters, MSCI, total returns.

Figures for more than one year are annualised other than in the case of currencies, commodities and the VIX, DXY and CRY which are shown as percentage change.

1. 97% of the votes counted

2. See https://www.wsj.com/articles/china-weighs-moderating-property-curbs-to-help-troubled-developers-unload-assets-11636572669

3. See https://www.valoraanalitik.com/2021/11/13/petro-puntea-nueva-encuesta-indecisos-siguen-siendo-el-mayor-porcentaje/