OPEC+ cut oil production. Brazil unveiled guidelines for fiscal consolidation.

OPEC+ members announced a surprise oil production cut. The Brazilian government presented a guideline to consolidate its fiscal accounts. China announced high profile agreements to settle trade in RMB. Saudi Arabia agreed on two strategic investments in refineries in China. Argentina was found liable in a court case seeking larger compensation for the nationalisation of oil company YPF during former President Cristina Kirchner’s term. Ecuador’s impeachment of President Guillermo Lasso proceeded to Parliament. Egypt and South Africa hiked their policy rates by more than expected as hikes from Mexico, Thailand and Colombia were in line with consensus, and Vietnam maintained its rate cutting programme to support its economy.

Global Macro

OPEC+ members agreed to cut oil production by 1.16m barrels, with Russia and Saudi Arabia cutting production by 500k barrels each. The cut was a surprise since it was announced outside of a formal OPEC+ meeting. It is possible Russia’s production would decline in any event given the challenges posed by sanctions in the industry. There are at least four theories on why Saudi decided to join in with the cuts:

- It presents an opportunity to squeeze short sellers after net long oil positions have collapsed .

- Saudi may be worried about softer demand due to banking sector liquidity issues.

- The United States (US) did not hold its promise to buy oil at $70 per barrel (pb) to replenish its strategic oil reserves.

- To strengthen its alliance with Russia.

- All of the above.

Whatever the reasons, the OPEC+ announcement was a clear signal its members care about controlling oil prices and have changed the dynamics for oil prices, at least in the short term. At the time of writing, Brent crude prices were 5.6% higher than Friday’s price levels at USD 84.2, in line with oil price levels at the beginning of 2023, 20% higher than the USD 70.1 lows on 20 March, and 30% above pre-Covid levels in January 2020. The resumption of the bullish trend from the USD 16 low in April 2020 could be very destabilising to the global economy. If oil prices were to surge above USD 100 pb in the short term, as some are speculating, that could well trigger a recession. As usual, any recession caused (or accelerated) by higher oil prices would impact oil importers to a larger extent than exporters.

More broadly, OPEC+ cuts happened one week after Saudi Arabia announced two strategic investments in the Chinese petrochemical industry (more below) and the peace agreement between Saudi Arabia and Iran mediated by China. All these news suggests a significant rebalance of power in the region is taking place as the US loses influence in lieu of countries seeking more arm’s length, pragmatic relationships that benefit their own economies.

Emerging Markets

Brazil: Finance Minister Fernando Haddad announced a new fiscal guideline intended to achieve a primary balance in 2024 and a primary surplus of 0.5% of gross domestic product (GDP) in 2025 and 1.0% in 2026. The rule links expenditure growth to 70% of the increase in government revenues and determines a real expenditure increase of 0.6% should revenues disappoint (a countercyclical trigger). If the government misses the target by more than 0.25%, expenditure growth of the following year would be limited to 50% of revenues. The announcement represents a victory for the pragmatists in the government, as it reduces uncertainties and establishes a fiscal consolidation path and commitment. However, the targeted fiscal consolidation is unlikely to stabilise debt/GDP, unless GDP growth surprises to the upside over the next few years and demands a net increase in taxation is achieved1. Some members of the opposition have expressed concerns that the rule is too lax on the fiscal side, but the government intends to present the guidelines as a common law, rather than a legally binding constitutional amendment. This means only a simple majority is necessary in both houses of Congress. Tax increases are also very unpopular in Congress, but the government intends to present a tax reform introducing a federal value add tax (VAT) regime to replace the current complicated set of state tax rules . The government also intends to increase taxes for the population.

In economic news, the current account deficit narrowed to USD 2.8bn in February from USD 9.1bn in January (consensus: USD 5bn deficit) and foreign direct investment declined only marginally to USD 6.5bn from USD 6.9bn over the same period. Net debt to GDP rose 50bps to 56.6%, less than expected, as the fiscal account moved to a deficit, but broadly in line with consensus. A total of 242k jobs were created in February, 72k more than consensus and above 85k in January. The producer price index (PPI) of inflation rose 0.1% month-on-month (mom) in March after declining 0.1% in February, but the year-on-year (yoy) rate declined by 170bps to 0.2%, the lowest level in five years. The PPI is very often a key leading indicator for the consumer price index (CPI) of inflation.

China: Two pieces of news increased the standing of the Chinese currency (RMB) internationally. French multinational Total Energy agreed to sell liquified natural gas (LNG) in RMB and Brazil agreed to use RMB to settle bilateral trade.2 3However, there is an important caveat: even if most of a commodity is settled in RMB, its price may still be denominated and traded against the USD, which is a much harder change to enact. Having said that, an increasingly larger amount of settlement in RMB will force central banks, banks, and corporate treasures to consider their exposure to the Chinese currency, which should increase the trading and circulation of RMB. In corporate news, Alibaba announced it will break its massive conglomerate down into six different companies, leading to a 17% surge on its share price. Other Chinese corporations are likely to follow in Alibaba footsteps, in our view.

In economic news, the National Bureau of Statistics (NBS), China’s official non-manufacturing Purchasing Manager’s Index (PMI) rose by 1.9 points to 58.2 in March, with the retail sub-sector above 60 highlighting the strength of the consumer rebound. The NBS manufacturing PMI declined 0.7 points to 51.9, slightly ahead of consensus as 13 out of 21 industries improved. New domestic orders at 54.6 and new orders at 53.6 were both robust, while new export orders dropped two points to 50.4. However, the Caixin PMI (run by S&P Global) declined 1.6 points to 50.0.

Saudi Arabia: The national oil company Saudi Aramco acquired a 10% stake in Rongsheng Petrochemical at RMB 24.3 per share, or USD 3.6bn, a 103% premium to the stock price. The deal will help increase downstream exposure to China and secure shipments of 480k barrels of crude oil per day. The large premium over public markets shows the strong intention to build ties between the countries. Aramco also recently agreed to a 30% stake in a new USD 12bn refining and petrochemical plant in China’s Liaoning Province, suppling 210k barrels per day of crude. The USD 3.6bn stake will bring its Chinese investment pledges to circa USD 7bn. Aramco pledged to convert 4m barrels of oil per day into petrochemicals by the end of the decade, as it expects demand for products such as plastics and paint to keep rising over the coming decades, even after electric vehicles potentially lower gasoline and diesel consumption. In other news, the current account surplus narrowed to USD 19.8bn in Q4 2022 from USD 19.2bn in Q3 2022, as the unemployment rate declined by 190bps to 8.0%.

Argentina: A US judge ruled against Argentina on claims the country failed to pay fair value to shareholders in the nationalisation of oil and gas company YPF in 2012. The judge did not fix the value of compensation, but newspaper La Nación estimates Argentina would have to pay between USD 7bn to USD 20bn after interest. This case is likely to take a few years as the government will appeal, unless the government agrees on a settlement, like the agreement with Repsol. In political news, Mauricio Macri announced he will not be a presidential candidate in this year’s election, lowering the odds of Cristina Kirchner running and strengthening the cohesion in the opposition Juntos por Cambio. In economic news, the current account moved to a USD 1.7bn surplus in Q4 2022 from a USD 3.2bn deficit in the previous quarter. The economic activity index rose 0.3% mom in January after declining 0.9% in December, bringing the yoy rate up 390bps to 2.9% over the same period.

Ecuador: The constitutional court approved the impeachment motion against President Guillermo Lasso. The process will now move to the National Assembly, where two-thirds of the votes are needed to impeach the president. If President Lasso is impeached, he has the option of calling early elections in parliament (“muerte cruzada”), which could keep Lasso in power while the next elections take place. If Lasso does not dissolve parliament, his Vice President Alfredo Borrero, the former CEO of the largest private hospital in Ecuador, would assume power and likely run a consensus government.

Egypt: The Central Bank of Egypt (CBE) hiked its policy rate by 200bps, setting its deposit rate at 18.25% and deposit rate to 19.25%, in line with consensus. The CBE is still struggling to stabilise financial conditions after large outflows and the need for large refinancing forced it to let the EGP depreciate, driving inflation sharply higher. The trade deficit widened to USD 2.5bn in January from USD 1.9bn in December.

Hungary: The central bank kept its policy rate unchanged at 13.0%, in line with consensus. The PPI had the second consecutive month of deflation at -2.2% mom in February after -0.2% in January, bringing the yoy rate down by 450bps to 29.0%, and average wage growth declined to 16.3% in January from 18.1% yoy in December. Consumer and business confidence improved marginally.

Israel: Prime Minister Benjamin Netanyahu agreed to delay the vote for the legal overhaul taking authority away from the Supreme Court after intense protests paralysed more than one-quarter of the country early last week. Netanyahu is likely to try to approve the bill in the future as he has burned bridges with most opposition parties, and he cannot afford to look weak in the eyes of his far-right coalition supporting the government.

Kenya: Protesters took to the streets in Nairobi and other cities to protest high living costs and President William Ruto after opposition leader Raila Odinga called for protests. The police reported 24 officers were injured in the clashes. The Central Bank hiked its policy rate by 50bps to 9.5%.

Mexico: The central bank hiked its policy rate by 25bps to 11.25%, in line with consensus as the unemployment rate declined another 30bps to 2.7%, the lowest level since the inception of the series. The trade deficit narrowed to USD 1.8bn in February from USD 4.1bn in January, worse than consensus for a USD 1.1bn surplus.

South Africa: The Reserve Bank of South Africa hiked its policy rate by 50bps to 7.75%, in a split vote where two out of five members voted for a 25bps hike, which was also consensus. PPI inflation rose 0.6% mom in February after -0.6% in January, but declined by 50bps to 12.2% in yoy terms due to base effects. The trade balance improved to a ZAR 16.1bn surplus in February after a 22.7bn deficit in January, significantly better than 14.6bn deficit consensus.

South Korea: Lawmakers are working to approve a bill to boost semiconductor investments by increasing the tax credit from 8% to 15% for large firms and from 16% to 25% for small companies. In economic news, industrial production dropped 3.2% in February after rising 2.4% in January, but the yoy rate declined by a lesser extent, increasing 490bps to -8.1% due to base effects. The manufacturing PMI declined 0.9 points to 47.6.

Vietnam: The central bank announced it will cut its refinancing rate by 50bps to 5.5% at its 3 meeting April to support the economy. Economic data and inflation disappointed as the yoy rate of real GDP growth dropped to 3.3% in Q1 2023 from 5.9% in Q4 2022, and the yoy rate of CPI inflation declined by 90bps to 3.4% in March. Industrial production dropped by a yoy rate of 1.6% in March after +3.6% yoy in February. The manufacturing PMI dropped 3.5 points to 47.7, the largest drop in Asia with textile orders down quite dramatically on yoy terms.

Snippets

- Chile: The unemployment rate rose by 40bps to 8.4% in February, 30bps above consensus as manufacturing and industrial production dropped by a yoy rate of 3.6% and 1.1% respectively, both much lower than consensus.

- Colombia: The central bank hiked its policy rate by 25bps to 13.0%, in line with consensus. The urban unemployment rate declined 300bps to 11.5% and the national unemployment rate declined 230bps to 11.4%

- Czech Republic: The central bank kept its policy rate unchanged at 7.0%, in line with consensus.

- Ghana: The Bank of Ghana hiked its policy rate by 150bps to 29.5% (consensus unchanged) to fight inflation that peaked at 54.1% yoy in December 2022 from 12.6% one year earlier and is forecasted to decline to 29.0% by the end of 2023.

- India: The manufacturing PMI rose by 1.1 point to 56.4, still the best performing country in Asia.

- Indonesia: The yoy rate of CPI inflation dropped to 5.0% in March from 5.5% in February as core CPI dropped by 15bps to 2.9%, both below consensus. The manufacturing PMI increased 0.7 points to 51.9 in March.

- Malaysia: Manufacturing PMI rose 0.4 points to 48.8 in March.

- Philippines: Manufacturing PMI dropped 0.2 points to 52.5 in March.

- Poland: CPI inflation rose 1.1% mom in March after 1.2% in February, but base effects brought the yoy rate down 220bps to 16.2%.

- Qatar: Ratings agency Fitch revised Qatar's AA- sovereign rating outlook to positive.

- Romania: The unemployment rate declined 10bps to 5.5% in February.

- Taiwan: US Treasury Secretary Yellen said the US will consider eliminating the double taxation burden for Taiwanese companies, a move to bolster chipmakers’ investments in the US.

- Thailand: The Bank of Thailand hiked its policy rate by 25bps to 1.75%, in line with consensus. The trade balance moved to a USD 1.3bn surplus in February from a USD 2.7bn deficit in January, as exports rose by USD 20bn to USD 22.4bn and imports declined by 20bps to USD 21.1bn.

Developed Markets

United States: The annualised quarter-on-quarter (qoq) rate of real GDP growth slowed by 10bps to 2.6% in Q4 2022, as personal consumption increased by 1.0% qoq in Q4 2022 from 1.4% in Q3 2022 and core personal consumption expenditures (PCE) increased 10bps to 4.4% yoy over the same period. The core PCE deflator rose by 0.3% mom in February (4.6% yoy), 10bps below consensus. Initial jobless claims rose by 7k to 198k on the week of 25 March as continuing claims rose to 1.7m in the previous week. The University of Michigan Sentiment Survey declined 1.4 points to 62 as inflation expectations one year ahead declined 20bps to 3.6%. The Dallas Fed Manufacturing Outlook Survey showed activity declined another 2.2 points to -15.7 but the Richmond Fed rose by 11 points to -5 and Conference Board Consumer Confidence improved marginally to 104.2.

Europe: CPI inflation rose 0.9% mom in March, 20bps below consensus, from 0.8% mom in February, but the yoy rate declined by 160bps to 6.9% due to base effects, 20bps below consensus. Core CPI inflation rose 10bps to 5.7%, in line with consensus. The unemployment rate was unchanged at 6.6%.

Japan: CPI inflation declined by 10bps to a yoy rate of 3.3% in the city of Tokyo in March, but CPI ex-food and energy rose 30bps to 3.4% over the same period. Economic activity surprised positively with retail sales and industrial production at higher-than-expected levels. The Bank of Japan announced it will buy JPY 100bn to JPY 500bn of 10–25-year bonds in Q2 2023 compared with a range of JPY 200bn to JPY 400bn in Q1 2022 after ten-year government bonds declined significantly below the 0.5% yield cap on the ten-year bond at 0.35% at the end of last week.

Australia: The yoy rate of CPI inflation declined 60bps to 6.8% in February, 40bps below consensus and 160bps below its peak in December.

1. Consensus forecasts for real GDP growth is 0.9% in 2023, 1.7% in 2024 and 1.8% in 2025.

2. See https://www.nasdaq.com/articles/china-completes-first-yuan-settled-lng-trade

3. See https://www.chinadaily.com.cn/a/202303/30/WS64252413a31057c47ebb76f7.html

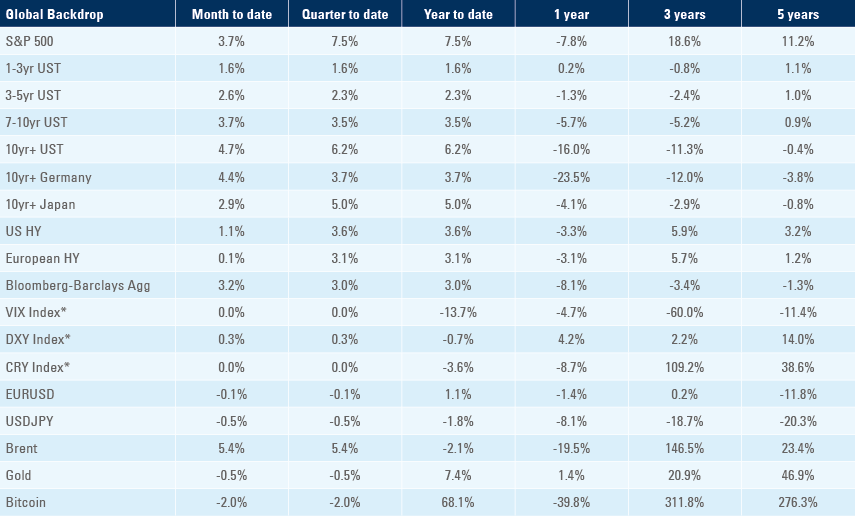

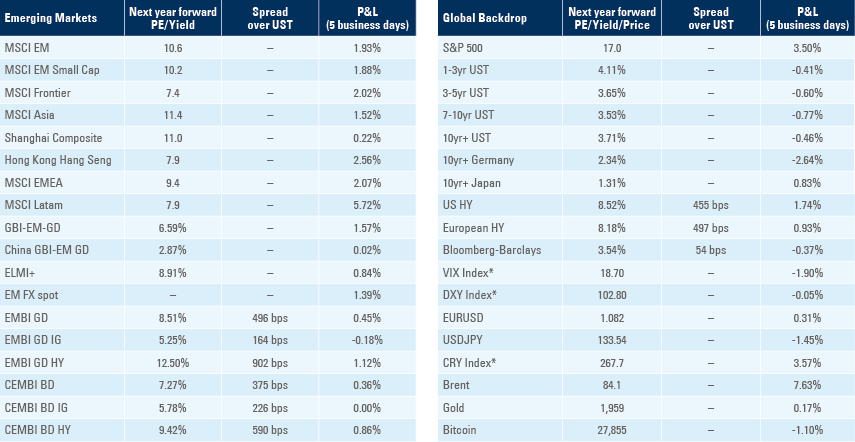

Benchmark performance