There was no breakthrough from Russia during victory day and no significant sanctions on Russia following the G7 meeting. Brazil hiked policy rate by 100bps to 12.75%, Czech and Poland hiked 75bps to 5.75% and 5.25% respectively while India hiked 40bps to 4.4% in an unscheduled policy meeting. Lockdowns remained in place in Shanghai and areas of Beijing despite the number of covid cases stabilising. Colombian tax collections remained strong, thanks to solid economic performance. Inflation surprised to the upside in Hungary and South Korea and hit hyperinflation levels in Turkey.

Emerging markets

Russia-Ukraine: Russian victory day celebrating the World War 2 victory had the usual military parade. President Vladimir Putin’s victory day speech did not bring any major escalation signals, as Putin aimed to re-ignite the morale of Russian troops, potentially preparing for a long conflict. Putin also tried to de-legitimise the Ukrainian regime in the eyes of the Russian population, claimed Russia was under attack as well, and said the West threatened to use nuclear weapons against Russia.

The leaders of the G7 agreed to “commit to phase out our dependency on Russian energy, including by phasing out or banning the import of Russian oil”. The statement left plenty of flexibility regarding timing adding: “We will ensure that we do so in a timely and orderly fashion, and in ways that provide time for the world to secure alternative supplies”.

However, Japan rejected an embargo on Russian oil, which still accounts for around 4% of Japanese energy needs as Premier Kishida said a phase out of Russian oil is desired but will take some time. European sanctions imposed on financial transactions kick in on the 15 May making it harder for traders to sell Russian oil in Europe.

President Olaf Scholz held a televised address to the nation to clarify Germany’s position on the conflict stating it would continue to provide Ukraine with heavy weapons but would not take steps that sacrifice its own security. Hungary is still blocking a proposal by the European Union to ban oil imports

The Russian Deputy Prime Minister Marat Khusnullin visited Mariupol, pledging to help the seized territories rebuild and provide humanitarian support. Khusnullin is responsible for infrastructure and construction.

Brazil: The central bank hiked its policy rate by 100bps to 12.75%, in line with consensus. In economic news, the yoy rate of PPI inflation by Fundação Getulio Vargas dropped to 13.5% in April from 15.6% yoy in March. The trade surplus rose to USD 8.2bn in April from USD 7.4bn in March with both imports and exports declining marginally and industrial production rose 0.3% mom in March from 0.7% mom in February.

Poland: The National Bank of Poland (NBP) hiked its policy rate by 75bps to 5.25% while consensus expected a 100bps hike. The NBP stated that economic activity remains solid and it expects conditions to remain favourable in the coming quarters, whilst the war in Ukraine continues to deteriorate the inflation outlook and increasing economic uncertainty globally means CPI inflation is likely to get close to 13% in June 2022.

Czech Republic: The Czech National Bank hiked its policy rate by 75bps to 5.75%, 25bps above consensus.

India: The Reserve Bank of India hiked its reverse repo policy rates by 40bps to 4.4% in an unscheduled monetary policy meeting, a more hawkish reaction than expected by market participants. Manufacturing and service PMI surprised to the upside in April.

China: Lockdowns remained in Shanghai and parts of Beijing even though the number of covid-19 cases have stabilised at a relatively low level. The trade surplus rose to USD 51.1bn in April from USD 47.4bn in March, but both exports (+3.9% yoy) and imports (flat) slowed by less than expected. The largest impact of the lockdowns will be felt by small and micro business in the Shanghai area which have been unable to operate for a more than one month. In other news, the e-commerce company JD.com announced the first dividend payment since its initial public offering, a signal of more confidence that regulatory headwinds are behind us.

Colombia: Tax collections increased by 35.5% in the first four months of the year, confirming strong economic performance. Tax collections were also boosted by higher prices as the yoy rate of CPI inflation rose by 70bps to 9.2% in April, 40bps ahead of consensus as core CPI rose by 60bps to 5.9% over the same period. Exports rose to USD 5.0bn in March from USD 4.2bn in February, also above consensus due to higher energy prices.

Hungary: The economy has further signs of overheating following record wage inflation last week as the yoy rate of PPI inflation rose by 350bps to 25.9% in April, retail sales rose by a yoy rate of 16.2% in March from 9.8% in February and the trade deficit widened to USD 117m in February from 91m in January. The National Bank of Hungary kept its 1-week policy rate at 6.45%, in line with consensus.

South Korea: The yoy rate of CPI inflation rose by 70bps to 4.8% in April, 40bps above consensus and core CPI rose by 30bps to 3.6% yoy. The yoy rate of export growth decelerated to 12.6% in April from 18.2% yoy in March while imports slowed to 18.6% yoy from 27.9% yoy, resulting in an increase in the trade deficit to USD 2.7bn from USD 0.1bn over the same period.

Turkey: The combination of loose monetary policy, currency depreciation and an exogenous commodity price shock is now leading Turkey to hyperinflation dynamics. CPI inflation rose 7.3% on a month-over-month basis in April, from 5.5% mom in March, translating into a yoy rate of 70.0% (from 61.1%) as core CPI rose by 4.0% to 52.4% yoy over the same period. PPI inflation reached 121.8% yoy in April from 115.0% yoy in March.

Snippets

- Argentina: The yoy rate of industrial production slowed to 3.6% in March from 8.7% yoy in February as construction activity dropped to 1.9% yoy from 7.3% yoy over the same period.

- Chile: The yoy rate of CPI inflation rose 110bps to 10.5% in April – 40bps ahead of consensus, prompting the Central Bank of Chile to hike its policy rate by 125bps to 8.25%, which was 25bps above consensus. Economic activity expanded by a yoy rate of 7.2% in March, 40bps above February levels.

- Peru: The yoy rate of CPI inflation rose 120bps to 8.0% in the capital city of Lima during April, 20bps above consensus.

- Philippines: The trade deficit widened to USD 5.0bn in March from USD 4.2bn in February, above consensus as imports rose USD 1.8bn to USD 12.2bn and exports rose by USD 1.0bn to USD 7.2bn.

- Romania: The yoy rate of PPI inflation surged to 51.7% in March from 43.8% yoy in February and 4.9% yoy in March 2021. The unemployment rate was unchanged at 5.7% and retail sales decelerated to 5.5% yoy from 8.8% yoy over the same period.

- Saudi Arabia: The yoy rate of constant prices real GDP growth rose 9.6% in Q1 2022 from 6.7% yoy in Q4 2021 as high oil prices and increasing bank lending buoyed the economy to the fastest annual expansion pace in 11 years.

- Taiwan: The yoy rate of CPI inflation rose by 0.1% to 3.4% in April and core CPI was unchanged at 2.5% yoy, both slightly above consensus.

- Thailand: The yoy rate of CPI inflation dropped 1.0% to 4.7% in April and core CPI was unchanged at 2.0% yoy, both slightly below consensus.

Global backdrop

United States: The FOMC hiked its policy rate by 50bps to 1.0% and announced it would start reducing its balance sheet by USD 47.5bn per month starting in June and would increase the pace of reduction to USD 95.0bn by September, in line with consensus. Chairman Jay Powell said the committee is not considering 75bps as 50bps is the likely pace until inflation starts declining. Powell said they would not hesitate to hike policy rates above neutral level (a mere concept, currently estimated at 2% to 3%) but will monitor the impact on the economy and financial conditions. Even though the economy remains supported by the tight labour market, the stress in financial conditions is already palpable: year-to-date the Nasdaq is down 22% and the S&P500 -13.5% while governments, corporates and households have significantly higher borrowing costs as the yield on the Barclays Global Agg. Index rose 158bps to 2.76%, US Agg Corporate yields rose 216bps to 4.45% and 30-year mortgage rates rose 227bps to 5.55%, all reaching the highest levels in more than 10 years.

Economic data was softer than previous weeks as the Citibank Surprise Index dropped to 20.3 on the 6 May from 39.4 and 67.1 over the previous two weeks. Nonfarm payrolls rose by 428k in April, unchanged from March as the unemployment rate was unchanged at 3.6% (labour force participation dropped 0.2% to 62.2%) and the yoy change of average hourly earnings declined 0.1% to 5.5%, all broadly in line with consensus. Construction spending slowed to 0.1% mom in March from 0.5% in February, but durable goods orders rose 1.1% mom from 0.8% and factory orders rose 2.2% mom from 0.1% over the same period. The trade deficit widened to USD 109.8bn in March (3x the average deficit over the previous 30 years) from USD 89.8bn in February. Leading indicators were also mixed: the ISM manufacturing dropped 1.7 to 55.4 and ISM services dropped 1.2 to 57.1 in April, while the US services PMI rose 0.9 to 55.6.

United Kingdom: The Bank of England (BoE) hiked its policy rate by 25bps to 1.0% and said the bank staff will work on a strategy to start the sale of UK government bonds. Three out of nine members preferred a 50bps hike despite the BoE warning of “signs that retail spending and consumer confidence are declining due to a sharp decline in real disposable incomes” which is likely to get worse as the BoE expects inflation reaching over 9.0% yoy in Q2 2022 and 10% yoy in Q4 2022 (from 7.0% yoy in March). Unemployment rate is expected to rise to 5.5% in three years after a sharp slowdown in demand growth, allowing inflation to drop to around 2.0% in two years. The candid negative outlook for the economy weighed on 2-year UK rates which declined 4bps last week, while G-10 2-year rates rose 3-10bps, leading to GBP underperformance (-1.8% to 1.234 as the USD Index rose only 0.3%). Despite significant differences in the structure of the economies, the UK is often a leading indicator to the US.

Europe: Economic activity was lower than expected with the Citibank surprise index dropping to 27.9 in 6 May from 53.1 in the previous week. Retail sales dropped 0.4% mom in March after rising 0.4% in February and consumer confidence dropped further into negative levels at -22.0 in April from -16.9 in March. Weaker activity is caused mostly by higher energy prices as the yoy rate of PPI inflation rose by 530bps to 36.8% in March.

Japan: The yoy rate of CPI inflation rose to 2.5% in city of Tokyo in April from 1.3% yoy in March as CPI ex-fresh food doubled to 1.9% yoy over the same period and vehicle sales declined by a yoy rate of 15.0% in April (-14.8% yoy in March).

Commodities: Saudi Aramco cut oil prices for Asian buyers as Covid-19 lockdowns led to weaker demand. June’s shipments of Arab Light crude to Asia will command a USD 4.40 per barrel premium over the benchmark, down from the record level of USD 9.35 in May. Mike Muller, the Head of Vitol in Asia, said the Chinese situation is “terrible for citizens of Shanghai and parts of Beijing… but it has not spiralled into something really dramatic. Therefore, people have not worsened their demand-loss projections from China.” Muller said Russia’s exports of crude and oil products “probably” dropped by around 1m barrels, to 6.5m after the Ukraine invasion in late February. He added there would be significant bottlenecks for dealing with Russian oil from 15 May when EU sanctions kick-in, demanding an entire segment of the shipping market to be dedicated to re-routing Russian oil exports, leading to higher shipping freight costs and larger Russian Ural oil discounts.1

This week: Monetary policy committees in Romania (consensus +50bps to 3.5%), Malaysia (consensus unchanged at 1.75%), Serbia (no estimates), Mexico (consensus +50bps to 7.0%) and Peru (consensus 50bps to 5.0%). Romania may follow Czech and hike by 75bps or even 100bps, considering it remains significantly behind the curve, while Mexico is likely to follow the Fed with a 50bps hike.

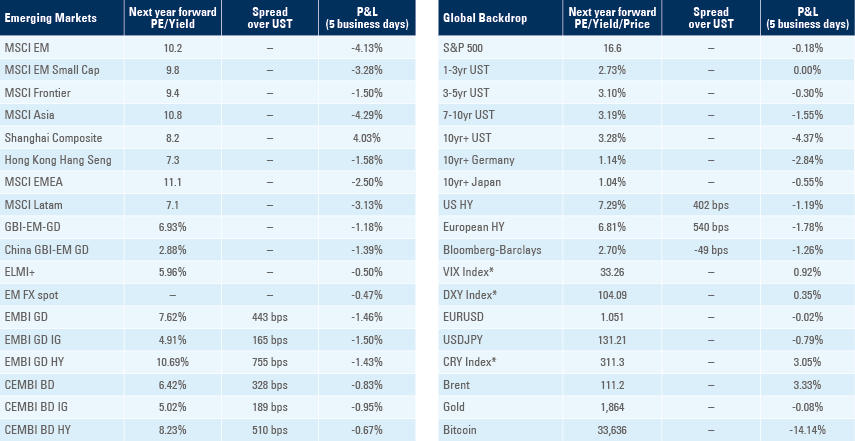

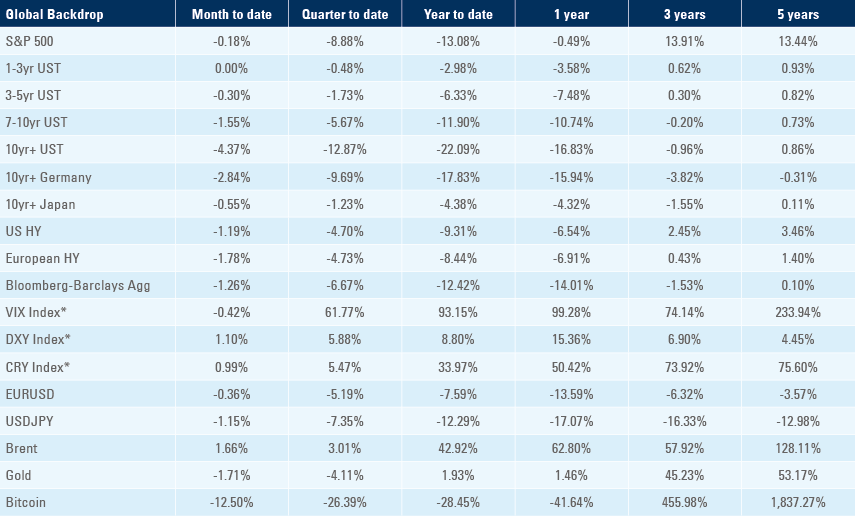

Benchmark performance

1. Source: Gulf Intelligence podcast