- The Federal Reserve cut policy rates by 25bps last week, in line with consensus.

- The FOMC is in data-dependent mode, likely to ease further over the next two meetings.

- The White House announced a USD 100k fee to new H-1B visa applications.

- Donald Trump and Xi Jinping spoke on the phone on Friday, may meet in South Korea in October.

- The British, Canadian, and Australian governments recognised Palestine as an independent state

- Argentina’s central bank propped up the peso for the first time since April’s trading band was implemented.

- Brazil’s central bank held the Selic at 15.00% in a unanimous decision.

- Moody’s affirmed Romania’s ‘Baa3’ rating with a negative outlook.

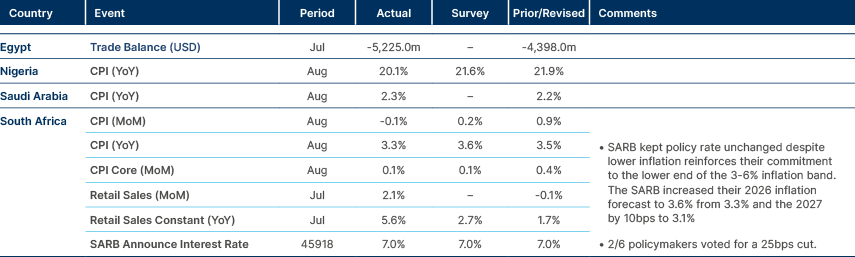

- Nigeria’s inflation surprised to the downside again, falling from 21.9% to 20.1% in August.

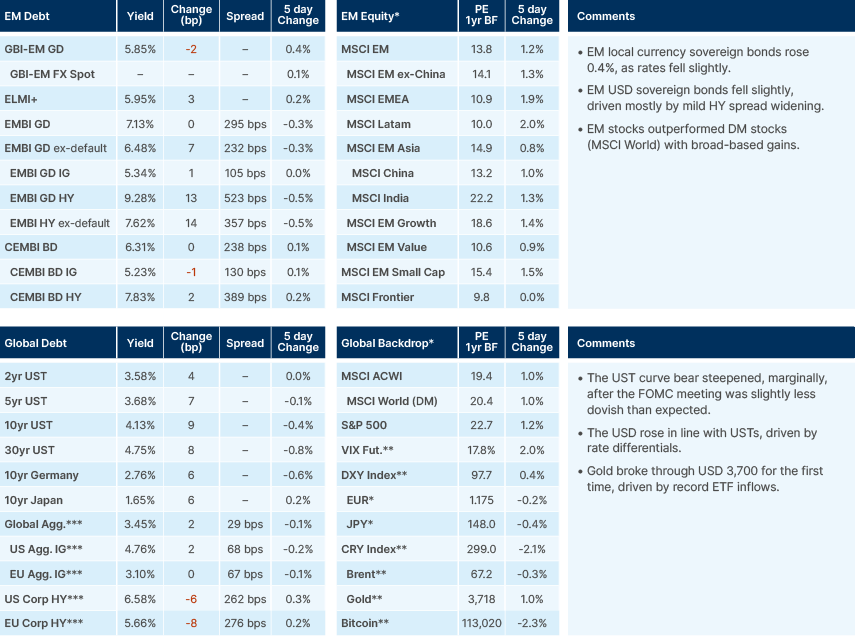

Last week performance and comments

Global Macro

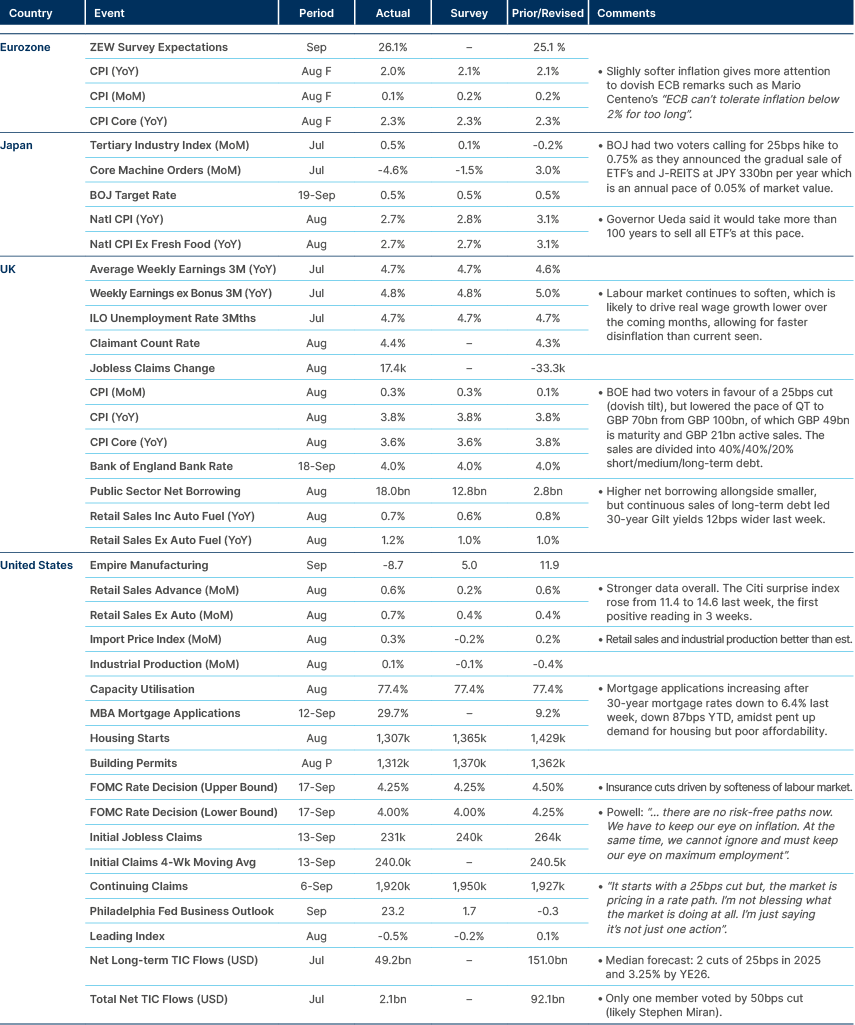

The US Federal Reserve (Fed) cut policy rates by 25 basis points (bps) last week, in line with consensus. Only one Federal Open Market Committee (FOMC) member dissented, by voting for a 50bps cut, suggesting governors Christopher Waller and Michelle Bowman voted with Chair Jerome Powell, boding well for concerns over Fed independence. The median FOMC board member (10/19) sees another 50bps cut this year and a final one in 2026, while six members see no cuts in 2025. This path matches the median street forecast on Bloomberg. The Fed’s growth and inflation forecasts rose at the margin as the unemployment rate declined by 10bps to 4.5% in both 2025 and 2026.

Overall, the FOMC is in data-dependent mode, but with a clear bias to ease further over the next two meetings. Powell described the policy intervention as “insurance cuts” driven by the soft labour market. A few of his quotes from his press conference captured the gist of the decision/views:

- “… there are no risk-free paths now. We have to keep our eye on inflation. At the same time, we cannot ignore and must keep our eye on maximum employment.”

- “Kids coming out of college and minorities are having a hard time finding jobs. The job finding rate is very low. However, the layoff rate is also very low.”

- “It starts with a 25bps cut but, the market is also pricing in a rate path. I'm not blessing what the market is doing at all. I'm just saying it's not just one action.”

The US labour market has been softening – led by college-graduated young individuals and minorities. That these dynamics are not observed in other economies like Japan, Europe or the UK, suggests a hiring freeze in the US, rather than a more structural AI-driven change in labour market dynamics.

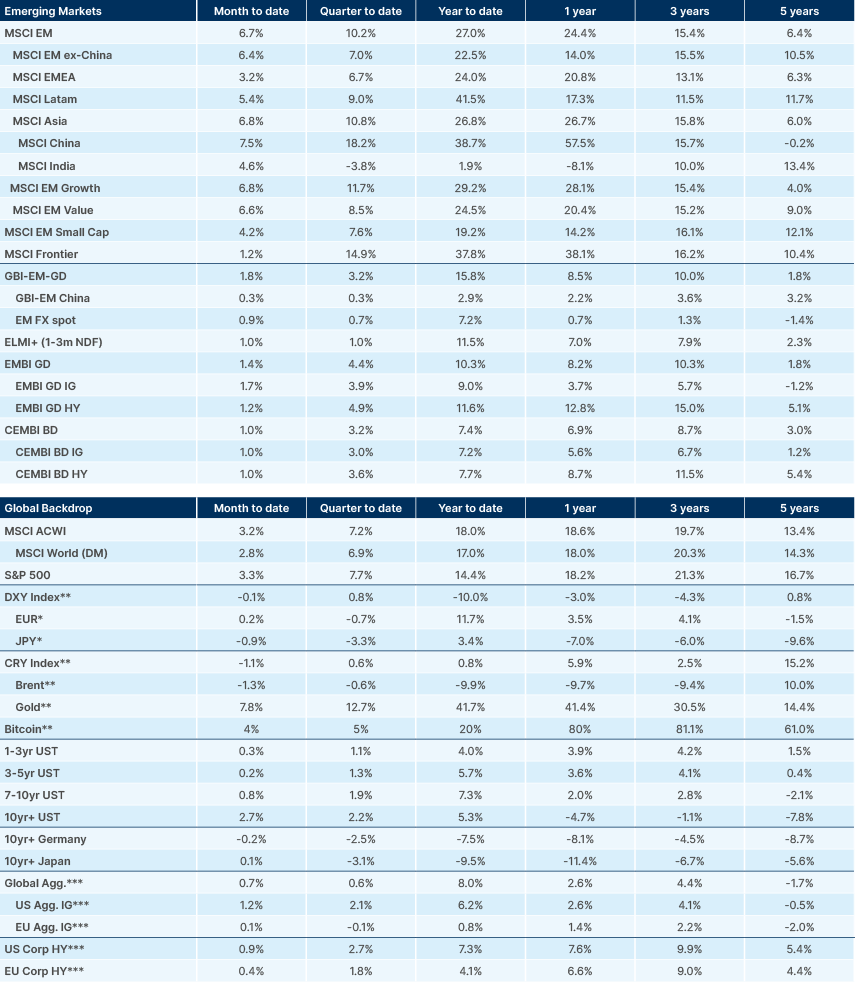

Historically (since 1980) easing cycles that do not coincide with a US economic recession have led to the outperformance of emerging market (EM) stocks and bonds over their developed market (DM) counterparts.

At current price levels, the market is pricing minimal odds of recession and higher odds of a re-acceleration of the economy, boding well for EM assets.

Several analysts, including Bank of America and UBS, now see the risk of a bubble inflating into 2026. Not only is the Fed cutting policy rates with the MSCI All Countries World Index at record highs, but the equity market breadth is also narrow, credit spreads are historically tight, and retail participation has been increasing at the end of a structural bull market, driven by a “this time is different” (AI) narrative.

The Bank of England (BoE) kept its policy rate unchanged at 4.0% as two out of nine Monetary Policy Committee (MPC) members voted for a 25bps cut. The BoE cut the pace of its quantitative tightening (QT) by GBP 30bn to GBP 70bn from October. This means the BoE will actively sell only GBP 21bn over the next 12 months, of which 20% will be long-end bonds. Some analysts were expecting the BOE to stop actively selling bonds, particularly at the long end. The QT decision, together with worst-than-expected fiscal data, added renewed pressure onto long-dated Gilts.

The sell off in long-end Gilts and Japanese bonds have been pressuring long-end US Treasuries year-to-date. The Gilts pressure may be exaggerated by poor technical and sentiment. We see the UK labour market showing signs of weakness, which could prompt the BoE to cut rates by more than the current c. 35bps priced over the next year.

The Trump Administration on Friday announced a new US$100,000 fee for H-1B visas, initially framed as applying to all new applications. Early confusion spurred a sell-off in Indian IT shares before clarifications from the White House. Press Secretary Karoline Leavitt confirmed the levy is a one-time fee that applies only to new H-1B applicants. Existing visa holders, renewals, and 2025 winners of H-1B visas are not affected. Even so, the proposal underscores renewed U.S. scrutiny of skilled-worker inflows just as an Indian delegation arrives in Washington for trade talks.

The move matters disproportionately for India, whose nationals account for over 70% of H-1B beneficiaries and whose IT firms derive more than half their revenues from the U.S. These firms use a “global delivery model”: most coding is done offshore in India, but a critical share of staff work on-site in the U.S. on H-1Bs to meet client demands, handle sensitive systems, and bridge between U.S. managers and offshore teams. Hiring local Americans for those roles would be far more expensive, so the visa pipeline is central to protecting margins.

Separately, a Congressional bill proposes a 25% tax on outsourcing payments, which, if advanced, would materially alter offshoring economics. Together, these initiatives point to a structurally higher cost of accessing U.S. talent from abroad.

Geopolitics

Presidents Trump and Xi held a phone call last Friday, which Trump called “productive.” The main outcome seems to have been Xi’s approval of a deal which would see TikTok’s US business sold to US investors. Trump also said the two “made progress” on trade issues. Both are scheduled to attend the Asia Pacific Economic Cooperation (APEC) summit at the beginning of October in South Korea. A group of senior US House representatives, led by Democrat and former House Armed Services Committee chairman Adam Smith, arrived in China on 21 September for talks with President Xi Jinping’s government — the first such official visit in six years.

The governments of UK, Canada, and Australia recognised Palestine as an independent state. The UK and Canada are the first G7 states to recognise Palestine, but 150 United Nations countries have already done so. Some 165 states recognise Israel. France and other European countries are expected to follow.

While symbolic, the move is a blow to Israeli Prime Minister Benjamin Netanyahu’s aggressive campaign against Hamas in Gaza and pressure on Palestinians living in the West Bank. It is also significant because the UK played a key role in creating the Israeli state, with Palestine being a British controlled territory after the fall of the Ottoman Empire in World War I. It started with the ‘Balfour Declaration’ in 1917, which said Britain supported the establishment of "a national home for the Jewish people" in Palestine.

China slammed the US for blocking a UN Security Council resolution calling for an immediate ceasefire in Gaza. Washington said the resolution, backed by all 14 other Security Council members, failed to adequately condemn Hamas. Meanwhile, with the war intensifying and its standing in the international community continuing to deteriorate, Israel’s economy and businesses are bracing for further strain.

Despite all the talk this year, there is still little indication that Russia and Ukraine are anywhere closer to reaching a mutually acceptable set of conditions for a ceasefire. A Kyiv International Institute of Sociology (KIIS) poll showed 62% of Ukrainians willing to endure a long war, and only 14% supporting negotiating with Russia on its conditions. Reports suggest Ukrainian President Zelenskyy is expected to meet with Trump on the sidelines of this week’s UN General Assembly meeting in New York. The UN Security Council will meet on Monday at Estonia’s request to discuss Friday’s violation of the Baltic country’s airspace by Russian fighter jets.

Ukraine’s Ministry of Finance released budget forecasts for 2026, projecting a budget deficit of 18.8% of GDP with foreign financing of USD 46.5bn. EU defence and security commissioner, Andrius Kubilius, said that the USD 330bn in immobilised Russian Central Bank (CBR) assets would be used to fund reparation loans to Ukraine. The German government, under Chancellor Olaf Scholz’s Merz-led administration is reportedly supporting the creative use of immobilised CBR assets, to help fill the financing gap left by a retreating US.

Emerging Markets

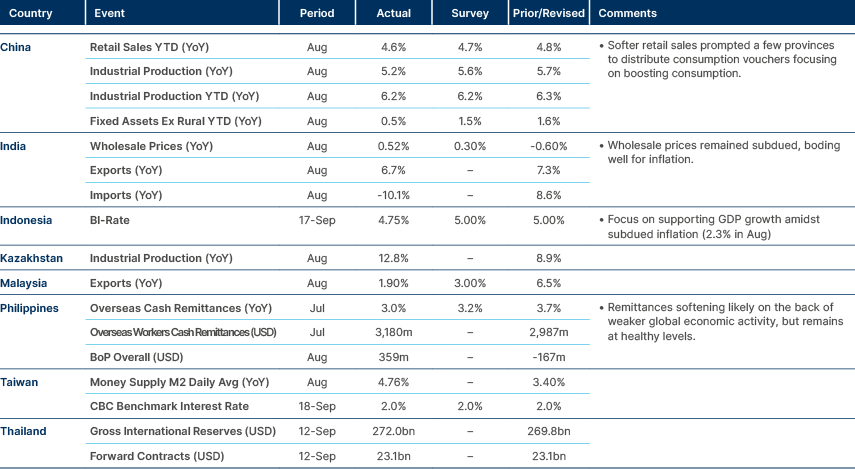

Asia

Bank Indonesia cut policy rates below 5%.

China: The People’s Bank of China (PBoC) left one- and five-year loan prime rates unchanged at 3.0% and 3.5%, respectively. However, the central bank conducted a RMB 300bn 14-day open market operation to provide liquidity to the money market.

Defence Minister Dong Jun opened Beijing’s flagship Xiangshan security forum on Thursday repeating a warning against “external interference” over Taiwan, while delivering a sharp critique of “bullying” in a veiled swipe at Washington. “We must keep in mind historical lessons, see through disguised hegemonic logic and bullying acts and stand against them” he said after blaming “hegemonic expansion” as a root cause of World War II. “We will never allow any separatist attempts for Taiwan independence to succeed.” While Taiwan functions as an independent state, only around 12 countries recognise it formally, and China views Taiwan as a breakaway province that eventually must be reunified. At international forums, Chinese officials repeat this stance and frame outside support for Taiwan (such as US arms sales or diplomatic visits) as “external interference”.

India: The government is considering raising capital expenditure above the budgeted INR 11.2trn for FY26, to drive consumption, sustain infrastructure-led growth and counter sluggish private investment. The proposals being discussed include plans to target urban infrastructure and sunrise industries.

While news flow suggests India’s relationship with the US continues to deteriorate, the European Union (EU) seeks closer ties with India across defence, technology, trade and energy. However, the EU shares US concerns over India’s ties with Moscow. India’s unemployment rate declined to 5.1%, with the improvement driven by rural job creation and increased female workforce participation.

Indonesia: Both monetary and fiscal policy are now pushing for higher growth. New Finance Minister, Purbaya Yudhi Sadewa, increased the 2026 fiscal deficit target to 2.7%. This follows IDR 200trn bank liquidity placements by the Bank of Indonesia, and recent fiscal stimulus with the ‘8+4+5’ package. This consists of eight acceleration agendas for the rest of 2025, four follow-up agendas in 2026, and five special programmes to absorb excess labour supply. Sovereign wealth fund Danantara is also looking to raise IDR 100trn, or roughly 0.4% of GDP, via bank loans and ‘patriot bonds’ for priority projects in off-budget financing.

President Prabowo Subianto reshuffled his cabinet, further surrounding himself with former military personnel. Most notably, former military officer Agus Chaniago will serve as Chief Political and Legal Minister. Chaniago replaced Prabowo in military roles earlier in his career.

Pakistan: Saudi Arabia and Pakistan signed a historic defence package, declaring an attack on either nation will be considered an act of aggression against both. Questions remain over whether Pakistan will extend its nuclear umbrella and the implications of Saudi-India ties.

In other news, the Pakistani current account deficit rose to USD 245m in August due to a rise in imports of both goods and services and higher primary income deficit. The central bank kept rates unchanged at 11.00% while it weighs flood-induced inflation and growth risks.

Philippines: Thousands joined marches in Manila and other areas of the country on Sunday, protesting what organisers say is widespread corruption in the government. The largely peaceful rallies were the biggest since President Ferdinand Marcos Jr. said in July that many government flood control projects had become a source of kickbacks.

South Korea: Local media reported that Samsung’s 12-layer HBM3E high performance memory chip product recently passed Nvidia’s qualification test. It means these components can be used in accelerators essential to the training of AI models. This would finally allow Samsung to compete with SK Hynix in higher-end products.

Exports declined 10.6% yoy in the first 20 days of September in business days-adjusted terms. The decline has been due to the US tariffs, and companies’ front-loaded shipments ahead of the Chuseok holiday last year. Exports rose 13.5% yoy in non-adjusted business days terms. Also, last year’s holiday fell in September, pulling exports forward and leaving a high base that makes this year’s daily average look smaller in comparison. Chip exports +27.0% yoy; autos rose 15% yoy. Exports to China rose +1.6%, US +6.1%, India rose 28.3%, and Taiwan c. 23%. 20-day imports also rose 9.9% yoy, leaving the trade surplus for the period at USD 1.894bn.

Sri Lanka: S&P Global upgraded Sri Lanka to ‘CCC+’, from selective default (SD) with a stable outlook. The ratings agency said, “The upgrade reflects Sri Lanka’s recent efforts to complete the restructuring of its remaining commercial debt, including government-guaranteed SriLankan Airlines’ bonds.”

President Anura Kumara Dissanayake has remained committed to the International Monetary Fund (IMF) programme, despite coming to power last year promising to change the terms of the bailout.

Thailand: Prime Minister Anutin Charnvirakul’s cabinet line-up received royal endorsement; the final step is delivering a policy statement to the parliament before the members can assume their duties. The Bank of Thailand and Finance Ministry are discussing ways to tax gold purchases and sales via online channels and settled in baht.

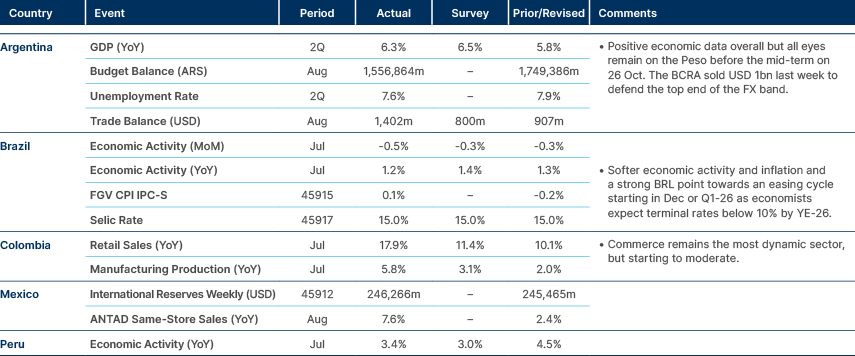

Latin America

Economic data solid in Argentina, but FX outflows clouding the fundamentals.

Argentina: The Argentinian Central Bank (BCRA) propped up the peso for the first time since it implemented a trading band in April. It sold USD 1.2bn at the upper end of the band from Wednesday to Friday last week. Economy Minister Luis Caputo said “We trust the program and we’re not going to move away from it. We are going to sell up till the last dollar at the ceiling of the band — the program was designed like that.” Donald Trump is scheduled to meet President Javier Milei on Wednesday. Just before the publication of this report, US Treasury Secretary Scott Bessent posted on “X”: “Argentina is a systemically important U.S. ally in Latin America, and the US Treasury stands ready to do what is needed within its mandate to support Argentina. All options for stabilization are on the table.”1

Brazil: The Brazilian Central Bank (BCB) kept its commitment to a "significantly contractionary policy for a prolonged period". Commentary around the decision to keep the Selic at 15% signalled readiness to resume hikes if needed. Inflation forecasts were cut for 2025-26, but the 2027 projection stayed at 3.4%. It is likely the BCB revised its output gap measure to the upside, despite the growth slowdown. Even more than before, focus turns to the behaviour of labour markets ahead. Bank of America expects a 50bps cut in December and terminal rate at 11.25% by year-end 2026. Morgan Stanley sees cuts starting in Q1 2026 and the Selic rate at 11.5% by year-end 2026.

Colombia: The economic monitoring index (ISE) rose 4.3% yoy in July, comfortably above expectations. Industrial output also expanded 2.95% yoy, supported by manufacturing and retail activity, while mining contracted by 8.0%. Retail sales were particularly strong, up 17.9% yoy, led by the automotive sector. On the fiscal side, the central government deficit widened to 4.3% of GDP in January–July, reflecting still high spending pressures.

Costa Rica: The Central Bank of Costa Rica (BCCR) cut its monetary policy rate by 25bps, citing inflation risks that remain tilted to the downside. Consumer prices fell 0.9% yoy in August, leaving inflation in negative territory and well below the 3% target. Policymakers indicated scope for further easing if disinflation persists.

Ecuador: President Daniel Noboa announced the end of the diesel subsidy, raising prices from USD 1.80 to USD 2.80 per gallon. The move sparked immediate protests and roadblocks, prompting the government to impose a curfew in areas affected by riots. The United Workers’ Front, led by Edwin Bedoya, has threatened to escalate to a national strike if the measure is not reversed. The reform is aimed at reducing fiscal costs but risks prolonged social unrest.

Peru: Congress approved a bill authorising workers to withdraw USD 7.5bn from private pension funds, the eighth such withdrawal since the pandemic. The measure, passed with over 110 votes in favour, follows public backlash against earlier reforms that tightened withdrawal rules. Cumulative pension withdrawals now amount to around PEN 115bn (about 12% of GDP), according to Peru’s financial regulator, the SBS, undermining long-term savings.

Mexico: Manufacturing employment fell 2.3% yoy in July, marking the 24th consecutive monthly decline. Despite job losses, real average wages rose 7.5% yoy, accelerating from 4.4% in June, suggesting resilience in household incomes. The labour market thus remains bifurcated, with structural weakness in employment offset by solid wage growth.

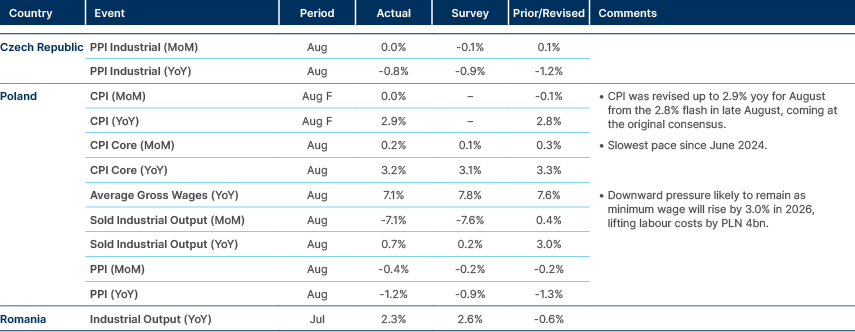

Central and Eastern Europe

Romania: Moody’s affirmed Romania’s ‘Baa3’ rating with a negative outlook, citing the high risk of slippage in fiscal consolidation. Labour market conditions improved in Q2, with the ILO jobless rate falling to 6% and total employment up 0.6% quarter on quarter. On the funding side, the Treasury raised RON 824m via T-bills at lower yields, and the Finance Ministry announced plans for a Samurai bond issue to diversify its investor base.

Türkiye: The court has postponed the hearing on a case challenging the annulment of the Republican People’s Party (CHP) congress until 24 October, prolonging the political uncertainty. On the fiscal side, the government posted a TRY 276.4bn surplus in August, driven by an 86.5% yoy revenue increase, partly reflecting base effects from deferred corporate tax payments.

Middle East and Africa

Hawkish South Africa Reserve Bank (SARB). Nigeria disinflation accelerates.

Egypt: The government is preparing to raise fuel prices in early October, consistent with its pledge to the IMF to fully eliminate petrol subsidies by end -2025. It also plans to sell stakes in four state-owned companies before the end of FY25/26, targeting USD 1.9bn in proceeds as part of its privatisation programme.

Morocco: Authorities approved six green hydrogen projects worth USD 31bn under the ‘Morocco Offer’ strategy. The projects underscore Morocco’s ambition to position itself as a global hub for renewable hydrogen production and export.

Nigeria: August disinflation has been driven mainly by easing food price pressures, with restaurants and transport also contributing. The trade surplus widened in Q2, helped by a 55.2% yoy surge in non-oil exports. Revenues were boosted by the first petrol cargo from the Dangote refinery to the US, marking a milestone for Nigeria’s diversification strategy.

Developed Markets

Central bank-heavy week with a tad more hawkish BoE and BoJ; balanced Fed.

Italy: Fitch upgraded Italy’s sovereign rating from ‘BBB’ to ‘BBB+’, bringing it in line with S&P, while Moody’s maintained a lower ‘Baa3’ with a positive outlook. Fitch highlighted stronger confidence in Italy’s fiscal path, crediting prudent budgeting and commitment to the new EU fiscal rules. Finance Minister Giancarlo Giorgetti welcomed the move, saying the government’s “serious and discrete” work had put Italy back on the right path. The upgrade reduces the gap with core peers and should help narrow spreads, though medium-term challenges around growth and high debt remain.

France: Protesters took to the streets ahead of Prime Minister François Bayrou’s budget proposal, increasing pressure on a fragile coalition reliant on socialist and centrist support. Left-wing lawmakers are pushing for a wealth tax on fortunes above EUR 100m, applying a minimum 2% levy on assets including companies, shares, and unrealised gains. Critics warn this could create liquidity strains and erode wealth accumulation over time, with cumulative taxes approaching 95% on a portfolio growing 5% annually. The proposal underscores ideological divides that complicate fiscal consolidation.

Japan: The Bank of Japan (BoJ) held policy rates at 0.5% in a 7–2 vote, with dissenters favouring a hike, and reiterated that further tightening remains possible this year. It also announced the first-ever plan to unwind its JPY 75trn stockpile of exchange-traded funds, starting sales at JPY 620bn annually. At this pace, full divestment would take over a century, but the symbolic step spooked equity markets. Governor Kazuo Ueda framed the move as part of gradual policy normalisation after years of ultra-easy policy. Separately, Sanae Takaishi, the prominent Japanese lawmaker and member of the ruling Liberal Democratic Party (LDP), called for tax cuts to strengthen Japan’s competitiveness, linking them to his leadership ambitions.

Norway: Norges Bank left rates unchanged at 4.0%, as expected, while signalling scope for multiple cuts next year if inflation continues to ease and growth stabilises. The stance reflects cautious optimism after a rapid tightening cycle.

Benchmark Performance

Source and notations for all tables in this document:

Source: Bloomberg, JP Morgan, Barclays, Merrill Lynch, Chicago Board Options Exchange, Thomson Reuters, MSCI. Latest data available on publication date.

* Price only. Does not include carry. ** Global Indices from Bloomberg. Price to Earnings: 12m blended-forward

Index Definitions:

VIX Index = Chicago Board Options Exchange SPX Volatility Index. DXY Index = The Dollar Index. CRY Index = Thomson Reuters/CoreCommodity CRM Commodity Index.

Figures for more than one year are annualised other than in the case of currencies, commodities and the VIX, DXY and CRY which are shown as percentage change.

1. See https://x.com/SecScottBessent/status/1970108240311587014