More rate hikes as inflation peaks across many EM countries while China focuses on growth

Brazil hiked its policy rate by 150bps to 9.25%. Inflation declined in sequential terms across most EM countries, including Brazil, Russia and Central Europe, but remained under pressure in Mexico. The Chinese politburo signalled a shift in focus towards economic growth. Ecuador’s fiscal accounts improved further in November. Mexico’s Pemex received a USD 3.5bn capital injection from the government and issued a USD 1bn (10yr) Eurobond ahead of a buyback exercise. Peru hiked policy rate by 50bps to 2.5% as the impeachment motion against President Castillo failed. Russia showed a path to de-escalate military tensions in Ukraine. Sri Lanka’s Finance Minister shunned the IMF again. Turkey’s inflation expectations deteriorated, but the current account improved. This week the Federal Reserve is likely to confirm an accelerated pace of quantitative easing tapering, broadly in line with market expectations.

Emerging Markets (EM)

Brazil: The Brazilian Central Bank (BCB) hiked its policy rate by 150bps to 9.25%. In the statement, the BCB policy committee considers it appropriate to tighten policy “significantly into restrictive territory” until the disinflation process consolidates and re-anchors inflation expectations around its targets. In political news, former president Luiz Inacio Lula da Silva said he is keen to form an alliance with the former governor of the state of Sao Paulo, Geraldo Alckmin. In economic news, consumer price index (CPI) inflation dropped to 1.0% mom in November from 1.3% mom in October, as yoy rate was unchanged at 10.7% (consensus 10.9% yoy). Lower food and healthcare prices were the main factors for softer inflation while transportation remains the main villain, accounting for more than 70% of the price increase in November. Core CPI rose 0.4% to 6.7% yoy but the diffusion index dropped to 63.1% from 66.8% over the same period. In other economic news, retail sales dropped 0.1% mom in October (+0.6% consensus) after falling 1.1% in September, but vehicle production rose 27k to 206k in November and sales rose 10k to 173k.

China: The annual Central Economic Work Conference (CEWC) of the Chinese Communist Party (CCP) ended on the 10 December, confirming Beijing has shifted its focus to economic growth as stability was mentioned 25x in the memo. The CEWC defined common prosperity, as “a long-term historical process and China should move toward this goal in a steady way”. The CEWC memo highlighted the need to acknowledge that coal remains a major energy source as the government should push for an “optimised mix of coal and renewable energy” rather than achieving carbon neutrality “all of a sudden”. The CEWC called for city specific policies in the property market, and suggested that China will retain its zero tolerance to covid-19 for longer. The CEWC memo confirms Beijing’s shift to focus on economic growth: last week the central bank cut the reserve requirement ratio (RRR) by 50bps, easing liquidity to the banking sector, but hiked the RRR on FX deposits by 2% to 9%, reducing USD liquidity onshore making it harder to speculate for RMB strength.

In economic news, inflation measures were slightly below consensus as coal and metal prices eased. The yoy rate of core CPI inflation dropped 0.1% to 1.2% in November and producer price index (PPI) inflation slowed 0.6% to 12.9% yoy while CPI inflation rose 0.8% to 2.3% yoy over the same period. The trade surplus narrowed to USD 71.7bn in November from USD 84.5bn in October, as imports rose faster than expected due to the extraordinary efforts to resolve the power shortage. Imports of machines and electronics also accelerated in a sign that capital investment is healthy. Aggregate financing rose to CNY 2.6trn from CNY 1.6trn, as expected.

Ecuador: The central government posted a primary surplus of USD 1.1bn (1.0% of GDP) in the January to November 2021 period from a deficit of USD 2.3bn (2.3% of GDP) over the same period in 2020. The adjustment also has a high-quality composition as tax revenues rose by almost USD 1bn and oil revenues rose USD 1.5bn while current expenditure dropped close to USD 1bn allowing for investment to increase by more than USD 1 bn. The government is also continuously cutting arrears. In other news, the Development Bank of Latin America (CAF) granted Ecuador two loans totaling USD 325m: USD 75m for the acquisition and distribution of vaccines and USD 250m for public debt and reactivation of production.

Mexico: The oil and gas company Pemex issued USD 1bn via a new 2032 Eurobond at 6.7% yield after the government announced a USD 3.5bn capital injection to the company as part of a liability management where the company will buy bonds with maturities from 2024 to 2030 and 2044 to 2060. On top of the USD 3.5bn capital injection, the government remained committed to repay the c. USD 4bn of bonds maturing over the next two years. In economic news, CPI inflation rose to 1.1% mom in November from 0.8% in October, taking the yoy rate up 1.2% to 7.4% as inflation rose sequentially in the second week of November. Industrial production rose 0.6% mom in October (0.8% consensus) after dropping 1.1% in September (revised from 1.4%) while vehicle production declined 9k to 249k in November but vehicle exports rose 15k to 240k over the same period.

Peru: The Central Bank of Peru hiked its policy rate by 50bps to 2.5% as the authority sees inflation returning to its target range in 2H 2022. In political news, Congress rejected an impeachment motion against President Pedro Castillo after the president gathered support from leftist and centrist parties. Opposition parties gathered 46 votes, slightly short of the 52 threshold in the 130-member Congress. A poll by Datum revealed 45% of the population supports an impeachment against Castillo, higher than his own approval rate at 32% (-8% from last poll) as Congress disapproval rate jumped 5% to 76% in December.

Russia: The foreign ministry proposed the renewal of regular defence dialogue with the United States and the North Atlantic Treaty Organisation (NATO) where it proposed to agree safe distances between warships and airplanes, especially in the Baltic and Black seas. Earlier in the week, Ukrainian President Volodymyr Zelenskiy said he favors Normandy-peace talks between Ukraine, Russia, France and Germany, even though he said in the same interview that joining NATO is a choice of the Ukrainian people. Russian President Putin made it clear that Ukraine joining NATO was a key red-line that could lead to military escalation. In economic news, CPI inflation dropped to 1.0% mom in November from 1.1% in October as the yoy rate rose 0.3% to 8.4%, but core CPI rose to 1.1% mom from 0.9% taking the yoy rate 0.7% higher to 8.7% over the same period. The Central Bank Governor Elvira Nabiulina said that another 100bps hike in the policy rate is on the cards. The trade surplus was unchanged at USD 20bn in October.

Sri Lanka: Foreign exchange reserves declined faster than expected by USD 0.7bn to US$1.6bn in November. The International Monetary Fund (IMF) sent a delegation to Colombo to write the 2021 Article IV consultation – a document accessing the country’s macroeconomic environment as well as debt situation. The Finance Minister said he met with the IMF and listened to long speeches from its directors, but has no confidence in the institution.

Turkey: Inflation expectations for one-year ahead rose sharply to 21.4% in December from 15.6% in the previous month, the highest value since June 2003. The current account surplus improved to USD 3.2bn in October from USD 1.7bn in September, significantly better than consensus at USD 2.5bn.

Snippets

Argentina: Sergio Massa, a moderate politician from the ruling coalition Frente de Todos, was reelected as President of the Chamber of Deputies. Massa called for "dialogue and hard work so that we can build trust", which will be essential in drafting the 2022 budget and the negotiation with the IMF.

Chile: CPI inflation declined to 0.5% in November from 1.3% in October, as the yoy rate rose 0.7% to 6.7%, the highest level since 2008. The trade balance improved to a USD 834m surplus in November from a USD 352m deficit in October as exports rose to USD 8.4bn and imports declined to USD 7.6bn.

Colombia: Consumer confidence declined 0.1 to -1.4.

Czech Republic: The yoy rate of retail sales rose 0.3% in October (or +5.6% yoy ex-auto) from 0.6% yoy in September (from +3.7% yoy ex-auto) while industrial output dropped 7.4% yoy in October from -4.0% yoy in September. The yoy rate of CPI inflation rose 0.2% to 6.0% in November, in line with consensus.

Egypt: The yoy rate of CPI inflation dropped 0.7% to 5.6% in November while core CPI inflation rose 0.6% to 5.8%.

El Salvador: The US government sanctioned a number of officials from President Najib Bukele’s government for links to corruption cases in El Salvador.

Hungary: CPI inflation dropped to 0.7% in November from 1.1% in October, as yoy rate rose 0.9% to 7.4% over the same period. The National Bank of Hungary hiked the 1-week deposit rate by 20bps to 3.3%, 150bps higher from one month ago. The trade deficit widened to USD 355m in October from USD 128m in September

India: The Reserve Bank of India kept its reverse repo and repo rates unchanged at 3.35% and 4.0%, in line with consensus. The yoy rate of industrial production oscillated to 3.2% in October (consensus 3.7%) from 3.3% yoy in September as mining rose to 11.4% yoy (from 8.6% yoy), electricity output increased 3.1% yoy (from 0.9% yoy), but manufacturing slowed to 2.0% yoy (from 3.0% yoy), led by lower consumer durables and capital goods.

Indonesia: Consumer confidence rose 5.1 to 118.5, the highest level since January 2020.

Malaysia: The yoy rate of industrial production rose to 5.5% in October (consensus 3.7%) from 2.5% yoy in September as manufacturing sales value rose by 15.3% yoy from 11.6% yoy over the same period.

Philippines: The yoy rate of CPI inflation declined 0.4% to 4.2% in November while the unemployment rate declined 1.5% to 7.4% in October. The trade deficit was unchanged at USD 4.0bn in October as both exports and imports dropped by a small magnitude.

Poland: The National Bank of Poland increased its policy rate by 50bps to 1.75% in line with consensus.

Romania: CPI inflation was unchanged in November from 1.8% mom in October, bringing the yoy rate of inflation down to 7.8% (consensus 8.2%) from 7.9%). The trade deficit widened to EUR 2.5bn in October from EUR 2.1bn in September, the worst deficit for the month since the inception of the series in 2003.

South Africa: Real GDP contracted 1.5% in Q3 2021 (-1.0% consensus) after growing 1.1% in Q2 2021, taking the yoy rate to 2.9% from 19.1% yoy over the same period. The current account surplus narrowed to 3.6% of GDP in Q3 2021 from 5.1% of GDP in Q2 2021 due to a narrowing of the trade surplus.

South Korea: The current account surplus dropped to USD 7.0bn in October from USD 10.0bn in September as the trade surplus narrowed USD 3.8bn to USD 5.7bn

Taiwan: The yoy rate of CPI inflation rose 0.3% to 2.8% in November as core CPI rose only 0.1% to 1.5% yoy, both slightly higher than expected while wholesale price index (WPI) dropped 0.9% to 14.2% yoy over the same period. The trade surplus narrowed to USD 5.7bn in November from USD 6.1bn in October as the yoy rate of exports and imports rose above 30%.

Thailand: Consumer confidence rose 1.0 to 44.9 in November.

Global backdrop

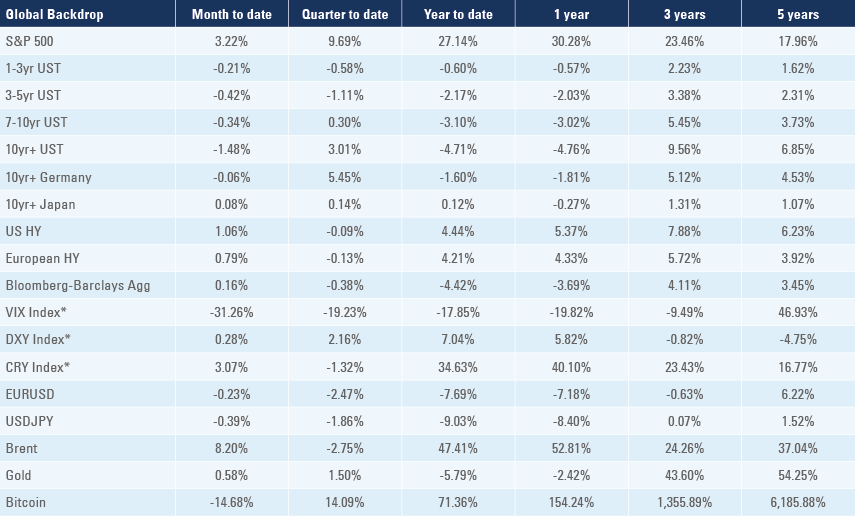

Commodities: The CRY commodity price index rose 5.3% last week with Brent prices moving 4.5% higher to USD 76.4. Oil price stabilising between USD 65 and USD 80 would be the sweet spot allowing a small disinflation from the USD 85 peak in late October to consumers, while remaining at a level where producers will harvest higher profits in 2022. Rig count rose by 23 to 467, a significant recovery from the 180 low in July 2020, but still much below the 888 high in November 2018 (when oil prices were at similar levels to today). Oil production rose to 11.7k barrels per day in the week ending on 3 December from a low of 10.5k barrels per day (3m moving average) in November 2020.

United States (US): Initial jobless claims dropped to 184k in the week ending on 4 December, from 227k in the previous week, the softest level since the 1960s. The number of job openings rose to 11.0m in October from 10.6m in September. CPI inflation dropped to 0.8% mom (0.7% consensus) in November from 0.9% in October, as the yoy rate rose 0.6% to 6.8%, the highest level in 40 years while CPI ex-food and energy rose 0.3% to 4.9% yoy, the highest level in 30 years. The University of Michigan sentiment rose 3.0 to 70.4 in December as 1yr and 5-10yr inflation expectations remained unchanged at 4.9% yoy and 3.0% yoy respectively in the same survey.

This week the Federal Reserve (Fed) is likely to announce an accelerated pace of tapering of its asset purchasing programme, ending by Q1 2022, but is likely to try pushing back on the three hikes priced in 2022, in order to keep some policy flexibility depending on the economic data. Inflation is likely to decline in sequential terms, particularly if energy and commodity prices fails to break new highs.

Europe: Germany factory orders declined 6.9% mom in October from 1.8% in the previous month while industrial production rose 2.8% in October from -0.5% in September. The French current account deficit narrowed EUR 0.2bn to EUR 2.6bn in October despite a wider trade deficit at EUR 7.5bn over the same period.

Australia: The Reserve Bank of Australia kept its policy rate unchanged at 0.1%, in line with consensus.