Mexican judiciary reform clears another hurdle, but more remain

- Soft US economic data set the tone for asset prices.

- Oil prices hit yearly lows and kept plunging.

- Frontier stocks continue to outperform, illustrating their diversification benefits.

- Chinese monetary intervention supporting yuan.

- Mexican judiciary reform passed through lower congress and will be voted on in the Senate this week.

- Türkiye upgraded by Fitch to `BB-`.

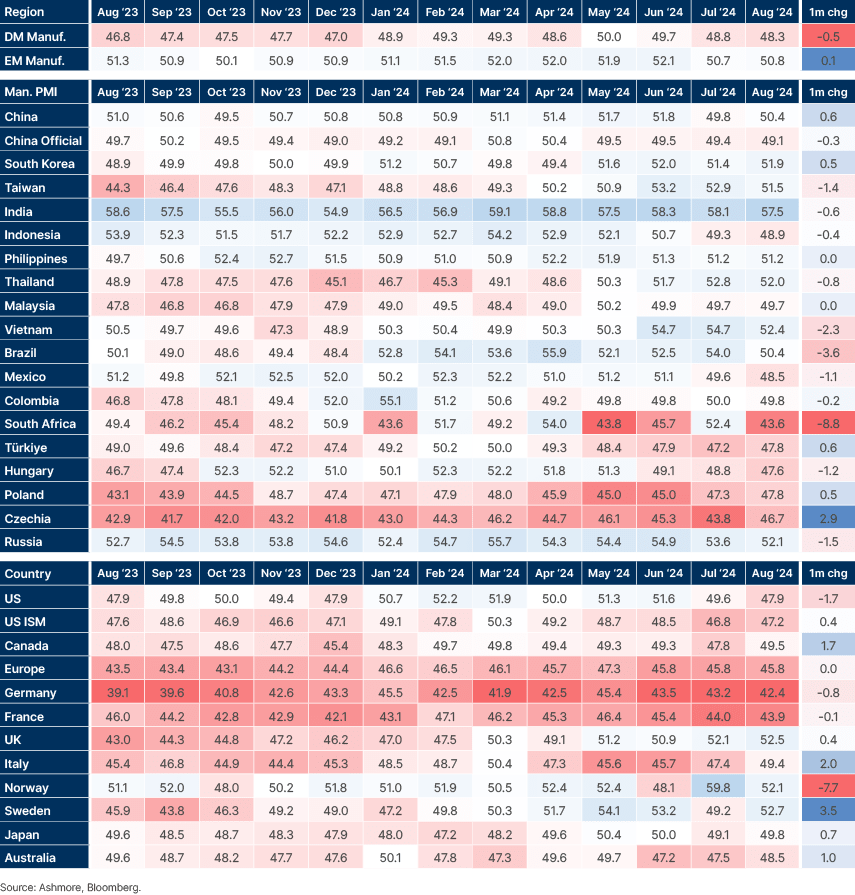

Last week performance and comments

Global Macro

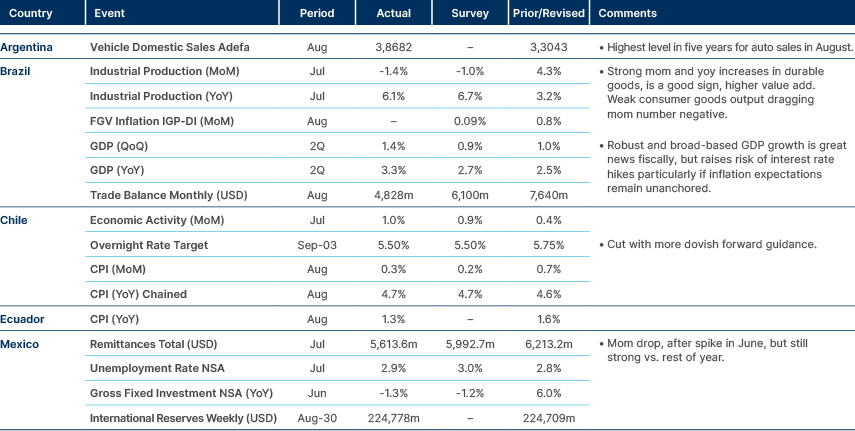

Softer US Institute for Supply Management (ISM) manufacturing data and payroll reports set the tone for asset prices last week. The payroll report indicated a marginal deterioration in number of jobs created, albeit the unemployment rate and average wages improved. The equity market sell-off has been driven by a positioning unwind, particularly amidst elevated earnings-per-share (EPS) growth expectations in the US. Semiconductor stocks, a high-beta proxy for investor sentiment these days, are nearing the dip levels seen in August. Despite the downwards move in stocks, bond yields are still declining across global fixed income indices (both DM and EM), which suggests that financial conditions are not tightening excessively, yet.

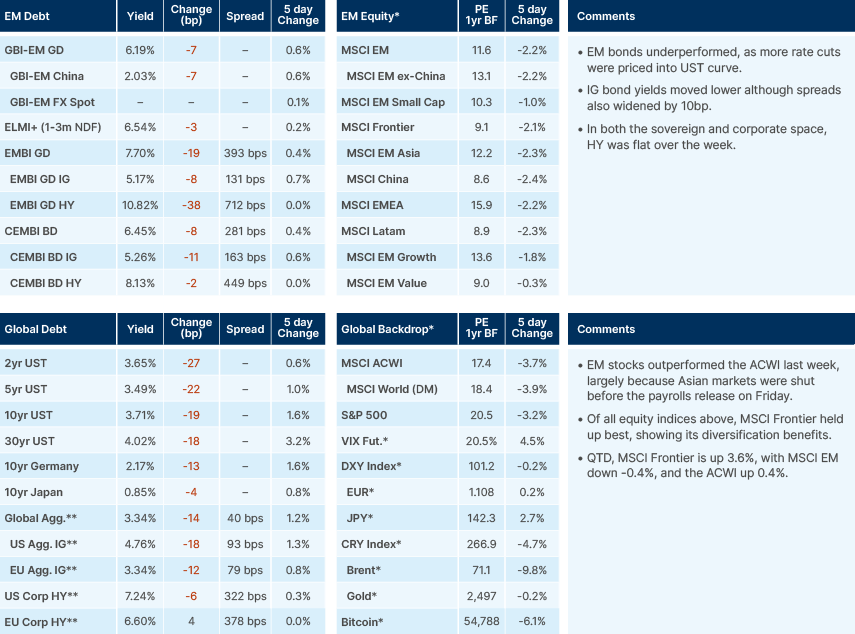

Along with soft ISM data, new orders/inventories in the US continue to move sharply lower, indicating a buildup of supply amidst weak demand.

Fig 1: US, ISM vs. Orders / Inventories

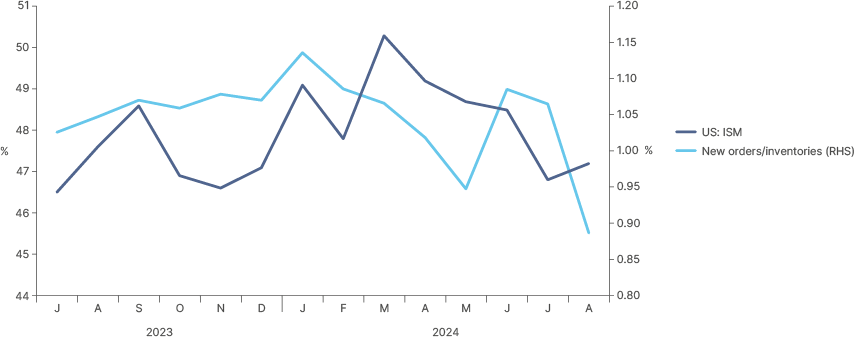

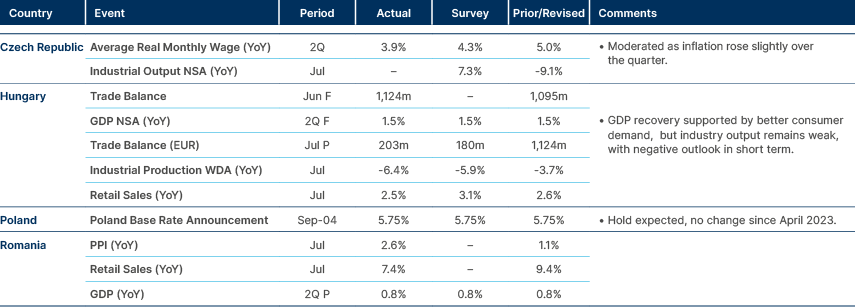

Global Manufacturing Purchasing Managers’ Index (PMI’s)

EM aggregate PMI remains expansionary, while DM moves deeper into contraction.

Fig 2: Global Manufacturing PMI data

Commodities

Oil prices hit yearly lows of nearly USD70 during the week, due to a poor demand outlook and soft economic data from the US and China. From a technical standpoint, oil prices seem to be a victim of position unwinding as the net non-commercial position in Brent and WTI futures hit the lowest level since the inception of the data-series on Bloomberg, in 2011.With prices falling, OPEC+ members secured a deal to delay an oil output hike for two months. Plans had originally been in place to raise output by 180k barrels per day in October and 540k barrels per day overall by the end of the year, with the increase primarily coming from Saudi Arabia, Russia, and the United Arab Emirates.

Brent futures spiked on the news but later declined to USD 71 a barrel following the payroll report. The oil market is pricing in a subdued demand environment in the medium term, which is overshadowing the withdrawal of OPEC supply for a few extra months. World surpluses are expected to swell further in 2025, as fuel consumption growth will likely remain subdued while output from non-OPEC nations, such as Brazil, Guyana, Argentina, and the US, will continue to expand. In this context, OPEC may have limited scope to add barrels.

Emerging Markets

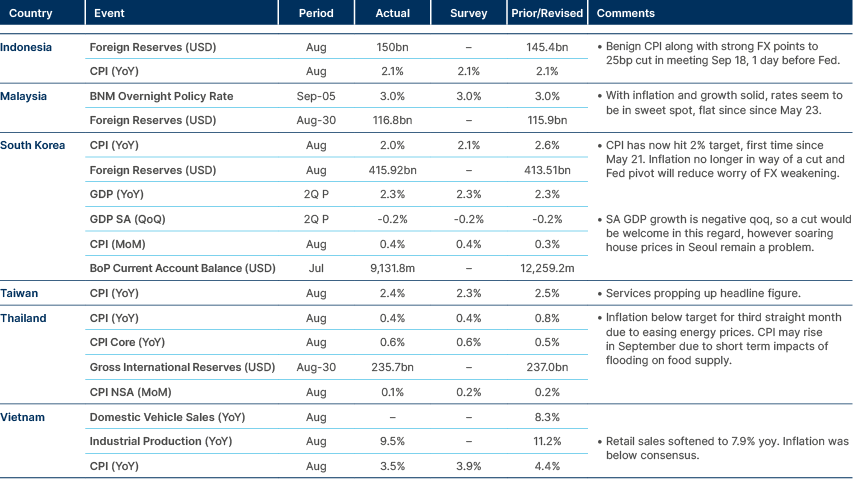

Asia

CPI remains subdued across Asia.

China

The onshore yuan is set for the seventh straight weekly advance, its hottest streak since 2020 amid JPY strength. Chinese state-owned banks have been seen selling large amounts of dollars in the markets, according to traders, adding to the yuan strength. China’s sovereign yield curve is also steepening, as the threat of further intervention from the People’s Bank of China (PBOC) causes investors to slow purchases of longer-term bonds.

The FT reported that the cost of renting cloud services using Nvidia’s leading artificial intelligence chips is lower in China than in the US, a sign that the advanced processors are easily reaching the Chinese market despite Washington’s export restrictions.

Latin America

Economic activity surprised to the upside across the region.

Mexico

Despite major protests and strikes, President Andrés Manuel López Obrador’s (AMLO’s)judiciary reform was passed on Tuesday in the Lower House of Congress, where the Morena party holds a significant supermajority. It is now widely expected to be approved in the Senate, where Morena and its allies are only one seat away from a supermajority.

If the reform package is approved, nearly all the country’s judges, including those on the Supreme Court, will be required to resign within the next three years. Mexican voters will then choose new judges from candidates nominated by the presidency, Congress, and the judicial branch. The goal is to reduce corruption and ensure that judges are "working for the people." However, with Morena in partial control of the nomination process, many new judges are likely to be sympathetic to the party, potentially weakening the judiciary's important role as a check on executive power.

The minimum requirement for judges to be nominated for a position, even one in the Supreme Court, will be a law degree and five years of relevant experience. This is considered very low compared to current standards. Critics are concerned that less experienced, politically motivated judges could be more susceptible to influence from either the Morena party or criminal cartels. Additionally, certain independent watchdog agencies, which monitor the judiciary and executive branch, will be dissolved, with more oversight transferred to the executive.

In the short term, Senate approval of this reform will create uncertainty and negatively impact investor sentiment. But the bigger question is what its impact might be on US trade relations and the nearshoring trend in Mexico. The US ambassador warned last week that the reform could weaken efforts toward North American economic integration, although no direct violation of the all-important United States-Mexico-Canada (USMCA) trade agreement has been identified, with the next review of the agreement not until July 2026.

Furthermore, the reform will still face many hurdles even after its senate approval. It’s implementation will be gradual, and likely take place over the course of Claudia Sheinbaum’s term in government. If the reform passes the Senate, it will still have to be voted for and approved by a simple majority in at least 17 of 32 state legislatures. Then, the constitutional amendment will have to be implemented via complementary laws - which do not yet exist - to detail the procedures and regulations for the new election process. The reform also proposes the creation of new judicial administration bodies, whose functions still need clear definitions. Judges and staff will also need training on the new processes and systems to ensure a smooth transition and maintain the quality of decisions.

So, while the reform is negative for markets at the margin, attributing it to a long-term derailment of nearshoring foreign direct investment (FDI) into Mexico seems overly pessimistic. The judiciary has faced significant challenges for many years, and the country’s crime and corruption problems are largely factored into asset prices. Markets have extended this risk pricing over the summer, with the MSCI Mexico down over 20% since May and the Mexican peso exceeding 20 for the first time since Q4 2022.

Irrespective of the judicial reforms, weaker economic performance is expected for the rest of this year and next, as elevated real interest rates and slowing domestic and US demand weigh on growth.

Venezuela

Opposition presidential candidate Edmundo Gonzáles fled to Spain on Sunday, as part of a negotiated deal with the government after receiving an arrest order last week. Attorney General Tarek William Saab, a staunch Maduro ally, accused Gonzáles of sharing “forged voting records” online, to undermine the National Electoral Council. “My departure from Caracas was surrounded by acts of pressure, coercion and threats,” Gonzáles said. “I trust that we will soon continue our fight to achieve our freedom and the restoration of Venezuela's democracy.” Gonzálesis considered by many to be the legitimate winner of the 28 July presidential elections.

Central and Eastern Europe

Poland CB Governor Glapinski struck a less hawkish tone.

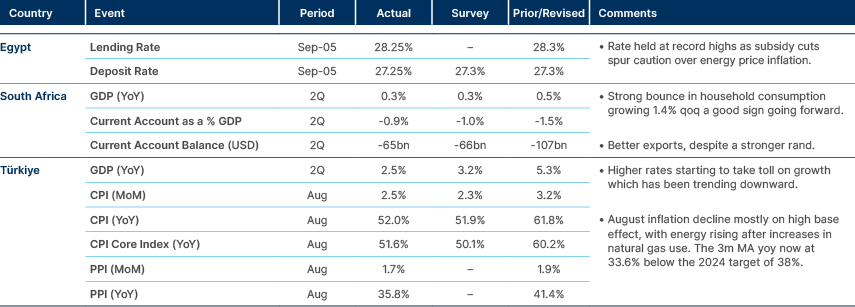

Central Asia, Middle East, and Africa

Egypt kept its policy rate unchanged. Türkiye making progress on inflation.

Türkiye

Fitch upgraded Türkiye’s credit rating to “BB-”, the first of the three major rating agencies to do so. The outlook was maintained as stable. Fitch cited improved foreign exchange (FX) reserves as the most important factor for the upgrade, supported by reduced dollarisation, better capital inflows and increased access to external borrowing. Positive real interest rates and low current account deficits are expected to continue to improve these external buffers, while helping to reduce inflation.

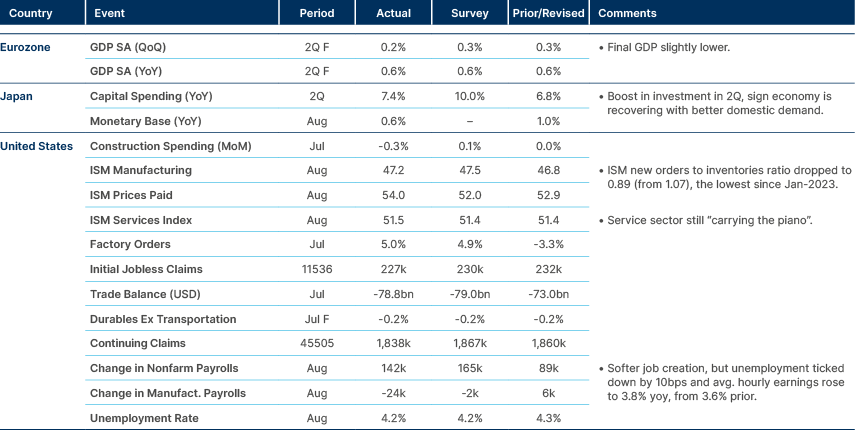

Developed Markets

Softer ISM manufacturing and payrolls set the tone for asset prices.

Canada

The Bank of Canada (BOC) cut rates by 25 basis points (bps) for the third month running. The benchmark rate is now 4.25%. While inflation remains 50bps above the target rate of 2%, it is trending downwards. BOC Governor Tiff Macklem indicated further cuts if this trend continues.

Growth has been weak in Canada for the last three quarters, with unemployment now at 6.4%, 2% higher than the record low set in summer 2022. High housing costs is the most politically charged issue in Canada today, so further rate cuts will be a relief for Prime Minister Justin Trudeau and homeowners alike, one year out from the next election.

United States

US stocks extended their declines and government bonds rallied after Tuesday’s closely watched ISM manufacturing figures came in slightly softer than expected. These directional trends continued through the week as Wednesday’s US JOLTS (Job Openings and Labor Turnover Survey) report showed the labour market was weakening faster than previously thought, falling to a three-and-a-half year low in July. The ratio of job openings per unemployed individuals fell back to 1.07, beneath its pre-Covid levels in 2019, backing up Federal Reserve (Fed) Chair Jerome Powell’s claim that “labour market conditions are now less tight than just before the pandemic in 2019.”

After the weak JOLTS report, investors dialled up the chance that the Fed would cut by 50bps in September, and futures were giving that a 44% probability by the close (up +7pps). Friday’s change in the non-farm payroll (NFP) number was the big datapoint of the week. 140k was benign, although lower than median expectations. However, July payrolls were revised downwards from 114k to 89k, which lowers the moving average quite significantly, highlighted the deteriorating trend. Treasuries pushed higher after the NFP release number, and the probability of a 50bps cut moved to 47%, the highest since the volatility spike in early August.

France

French President Emmanuel Macron appointed Michel Barnier as the new Prime Minister, following two months of political deadlock after legislative elections resulted in no clear majority. Barnier, 73, a conservative and former European Union Brexit negotiator, is tasked with leading a divided parliament and addressing key challenges like education, security, and financial debt. His appointment sparked criticism from the left, with opposition leaders claiming the decision deepened the political crisis. Barnier must now form a government and navigate potential no-confidence motions in the highly polarised Assemblée Nationale.

Next Week’s events

- Monday: Japan GDP, China CPI

- Tuesday: Germany CPI, UK unemployment data, China trade. US small biz optimism. 3yr UST auction $58bn

- Wednesday: US CPI, 10yr UST $39bn auction; UK GDP.

- Thursday: India CPI; ECB; US PPI, claims; 30yr UST $22bn auction.

- Friday: France/Poland CPI, Eurozone IP.

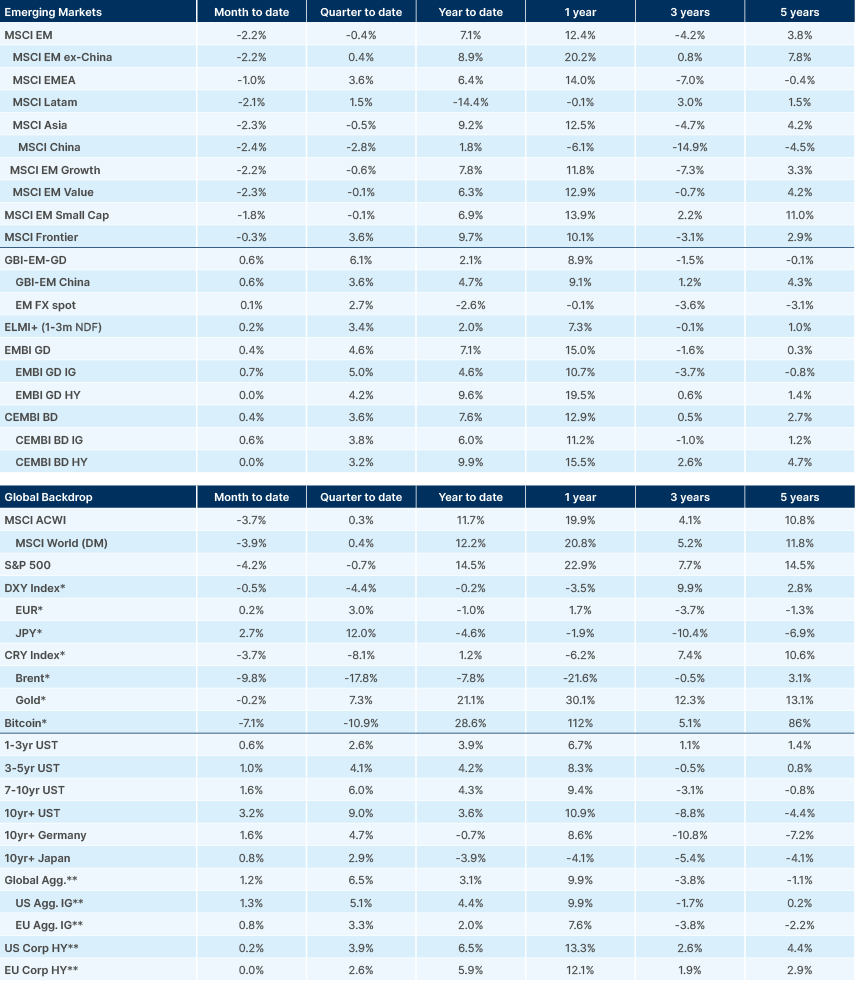

Benchmark Performance

Source and notations for all tables in this document:

Source: Bloomberg, JP Morgan, Barclays, Merrill Lynch, Chicago Board Options Exchange, Thomson Reuters, MSCI. Latest data available on publication date.

* Price only. Does not include carry. ** Global Indices from Bloomberg. Price to Earnings: 12m blended-forward

Index Definitions:

VIX Index = Chicago Board Options Exchange SPX Volatility Index. DXY Index = The Dollar Index. CRY Index = Thomson Reuters/CoreCommodity CRM Commodity Index.

Figures for more than one year are annualised other than in the case of currencies, commodities and the VIX, DXY and CRY which are shown as percentage change.