Lower inflation is the signal, random dots on a chart is noise.

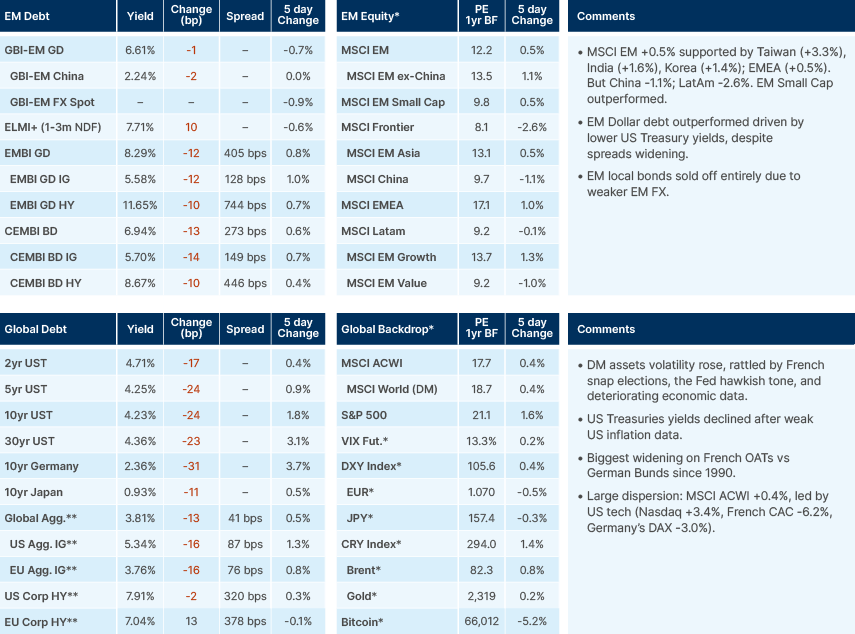

- Global stock volatility increased due to the French snap elections, the Fed’s hawkish tone, and deteriorating economic data. EM stocks were supported by Asia.

- Global bond yields declined after lower US inflation data.

- The EU announced tariffs on Chinese EV imports.

- Inflation softened further across EM and plunged in Argentina.

- Argentina’s Senate approved the omnibus bill reform.

- Mexico, Colombia, and Brazil underperformed amid fiscal and institutional concerns.

- Best-case scenario in South Africa with unity government coalition excluding far-left populists.

- Good developments across many FM economies, including Pakistan, Sri Lanka, and Ghana.

Last week performance and comments

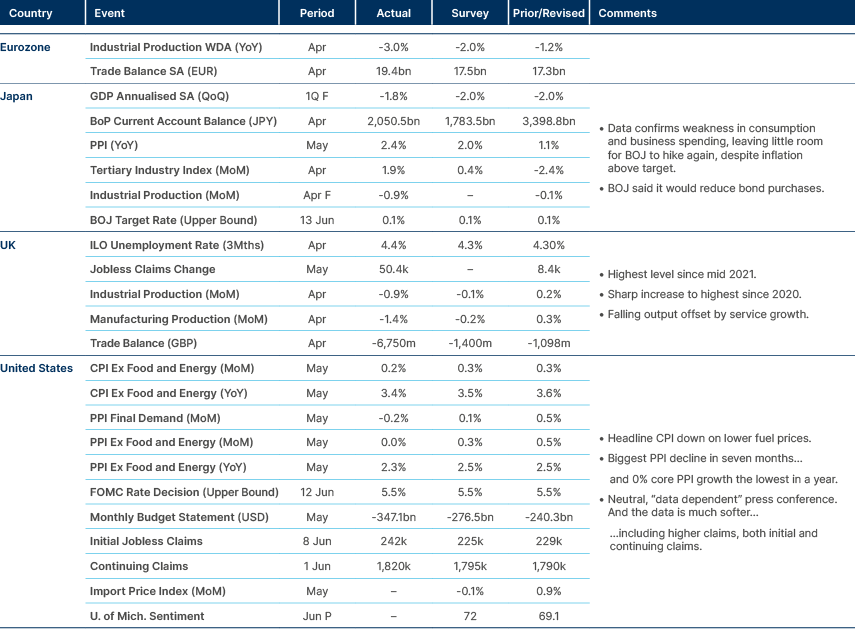

Global Macro

The Federal Open Market Committee (FOMC) kept its policy rates unchanged at 5.25% to 5.50%, and signalled it remains in data-dependent mode. There is a strong disconnect between guidance and the economy, in our view. US consumer price index (CPI) inflation is at the same level as in Europe, after adjusting for the different basket weights, and inflation posted a meaningful negative turn in May (CPI that was already available at the time of the FOMC meeting). Activity data has been softening since July 2023, except for a brief recovery from mid-January to early April.

Moreover, the dot-plot chart showed most FOMC participants believe one or two cuts would be appropriate, despite the US Federal Reserve (Fed)’s median estimate for the core personal consumption expenditures (PCE) inflation rate at year-end up to 2.8%, from 2.6% previously, the same level as in April. It is hard to justify how the median FOMC participants see one or two cuts if they expect core inflation to remain unchanged meaningfully above its inflation target. The US Treasury market took the signal from the softer data and interpreted the Fed’s communication as noise.

Both CPI and producer price index (PPI) inflation surprised to the downside in April. Lower gasoline prices drove much of this decline, but core CPI inflation (ex-food and energy) rose only 0.2% mom (3.4% yoy), 10 basis points (bps) less than expected, and PPI was at 0% mom, 30bps lower than both expected and prior month. Employment data following the Fed’s meeting on Wednesday also showed disinflationary signals. Initial jobless claims for the week came in at 242k, with 225k expected, while continuing claims rose to 1,820k from 1,790k the week prior. Alongside the softer Job Openings and Labor Turnover Survey (JOLTS) data, these readings suggest the US labour market is running out of steam. Hence, while there was a lot of noise in the Fed’s communication, the signals coming from the economy are weak.

A more hawkish tone from Fed Chair Jerome Powell and FOMC members may be justified by fears of igniting further “irrational exuberance” in the US stock market, which kept outperforming based on a narrow leadership. Powell’s dovish statement at the December FOMC meeting stoked a rally in yields and risk assets that loosened financial conditions, which coincided with a rebound in inflation in Q1 2024, exposing the Fed to criticism.

Last week was also dominated by fears over EU politics after Emmanuel Macron called for early elections following his Renaissance Party’s poor showing in the European Parliament election. The French political system is very fragmented and the short period for the formation of alliances and candidacies has led to a chaotic situation. A summary of the state of play of the key alliances is included at the end of the report, but the bottom line is that the populist National Rally (RN) party of Marine Le Pen is expected to have the most votes, based on the latest credible polls. It remains unclear if that will be enough for RN to form a government. It is unlikely that the RN will obtain a simple majority in Congress, forcing it either to come to the centre or form an unlikely alliance with the far left to govern. Macron said he would remain President even if his party loses the election, and Le Pen vowed to work with Macron. Moving her stance towards the centre may help her to get a broader number of politicians in a position to dispute seats in the different regions, likely yielding the RN a better result. It also means that the RN will shift its populist economic agenda, including unsustainable tax cuts, to the centre. Nevertheless, France’s fragile fiscal situation and political uncertainty is a recipe for elevated volatility until the second round of election on the 7 July.

Geopolitics

The European Commission (EC) announced it will impose additional tariffs on electric vehicles (EVs) imported from China, starting on 4 July, pending a final decision by EU member states. The decision was motivated by concerns over unfair trade practices and to level the playing field following a comprehensive investigation into subsidies provided to Chinese EV manufacturers. EC President Ursula von der Leyen qualified its objective was to “engage China and get Beijing to course-correct and address the problems at their root…” and “… create leverage for China to engage”.

The tariffs vary based on the level of cooperation with the EU's probe: SAIC Motor faces the highest additional duty of 38.1%, in addition to an existing 10% duty, while BYD Auto and Geely face levies of 17.4% and 20%, respectively. While these tariffs may not severely impede Chinese EV penetration into the EU market, they could increase prices for consumers and potentially spur greater domestic production within Europe.

China has threatened to challenge EV duties by filing a lawsuit with the World Trade Organization (WTO). Retaliations could further strain bilateral trade ties and potentially exacerbate divisions within the EU, particularly impacting countries like France and Germany, which have significant economic interests in both Chinese imports and the automotive sector. Both the EU and China are expected to proceed cautiously to avoid further escalation into a full-scale trade conflict, emphasising adherence to WTO rules, while safeguarding their respective economic interests and geopolitical strategies.

Israel/Hamas

Hamas has proposed “unworkable” changes following a UN ceasefire resolution, according to US Secretary of State Anthony Blinken who did not provide more details as to what Hamas requested. Hamas wants a permanent ceasefire, rather than the preliminary six-week ceasefire period proposed by the plan. But Israel wants to “finish” Hamas. The intensity of the war in Gaza will decline after all major areas of the Strip were destroyed. The risk is that Israel turns its focus against the Hezbollah.

Commodities

The latest annual update to the medium-term oil market outlook from the International Energy Agency (IEA) was published on Sunday. It sees a surplus supply starting in 2026 and growing until 2028, implying substantial downside risk for the oil price in the medium term. The IEA said a glut in oil supply, led by increasing production from America and other non-OPEC countries, could “upend the current OPEC+ market management strategy, and result in a lower price environment.”

Emerging Markets

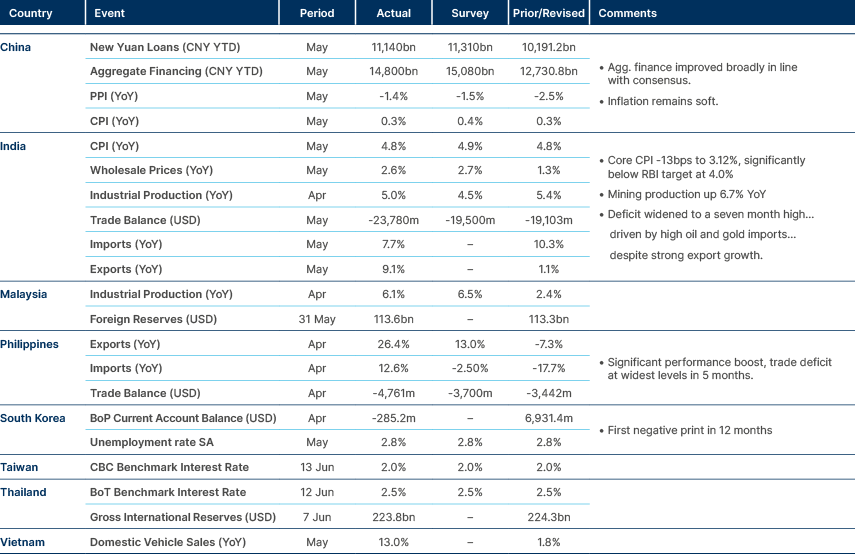

EM Asia

Data: China remains in deflation; weak aggregate financing.

India: Headline inflation slightly decreased to 4.75% yoy in May 2024, driven by stable food prices and subdued core CPI. Food inflation remained stable despite the heatwave, with specific items like eggs and cereals showing lower-than-expected price increases. Core CPI, excluding food, beverages, tobacco, and alcohol, dropped to a new low of 3.1% yoy in May 2024, indicating weak consumer demand. Potential future increases from sectors like telecoms may slow the pace of core CPI disinflation in the future. The Reserve Bank of India (RBI) is likely to have room to cut policy rates over the next months, influenced by these subdued inflation trends and uneven growth.

Indonesia: According to one of President-elect Prabowo Subianto’s senior aides, there are no plans to raise the country’s public debt to 50%, denying an article published on Bloomberg that caused volatility in the currency and bond markets, which are concerned about fiscal slippage under the new government. Since 1997’s financial crisis, Indonesia has contained fiscal deficits within a legal limit of 3%, except during the pandemic. The President-elect has no intention of widening this limit, according to the source. Despite this reassurance, the markets worry Prabowo’s government will lack the fiscal discipline of Jokowi’s. Indonesia’s debt/GDP is currently around 39%, lower than many Asian peers, however, Indonesia carries a higher interest burden, with debt service already accounting for 15% of revenues.

Pakistan: The central bank cut interest rate by 150bps to 20.50%, the first cut in four years. A sharp slowdown in inflation (11.8% in May, down from 17.3% in April and 38% in May 2023) gave it confidence to begin what will likely be a monetary easing cycle to support Pakistan’s targeted economic expansion of 3.6% in the upcoming fiscal year. Bloomberg economists expect another 250bps of cuts by year-end, taking rates to 18%.

A new International Monetary Fund (IMF) loan programme is being negotiated to bolster foreign reserves amid upcoming debt repayments totalling about USD 12bn. The newly-presented 2025 budget appears to be in line with IMF targets, which should support Pakistan's new programme negotiations. The consolidated budget targets a GDP deficit of 5.9%, equating to a primary surplus of some 2% of GDP, which marks a material increase from the expected 0.4% primary surplus in FY 2024 expected before the budget announcement. This should be sufficient to gain IMF support for the new programme, as further fiscal consolidation could be achieved in the following years.

Sri Lanka: The IMF's Executive Board completed its second review of Sri Lanka's 48-month extended fund facility arrangement, enabling the authorities to draw USD 336m from an overall USD 2.9bn package. This raises the total IMF financial support disbursed to date to USD 1bn. Sri Lanka has continued to perform well under its IMF programme and received staff-level approval for the second review in March. Post-restructuring, however, Sri Lanka will have to walk a tightrope to keep its debt on a sustainable path, with the IMF stating after the second review that the economy is “still vulnerable” and the path to debt sustainability remains “knife-edged”.

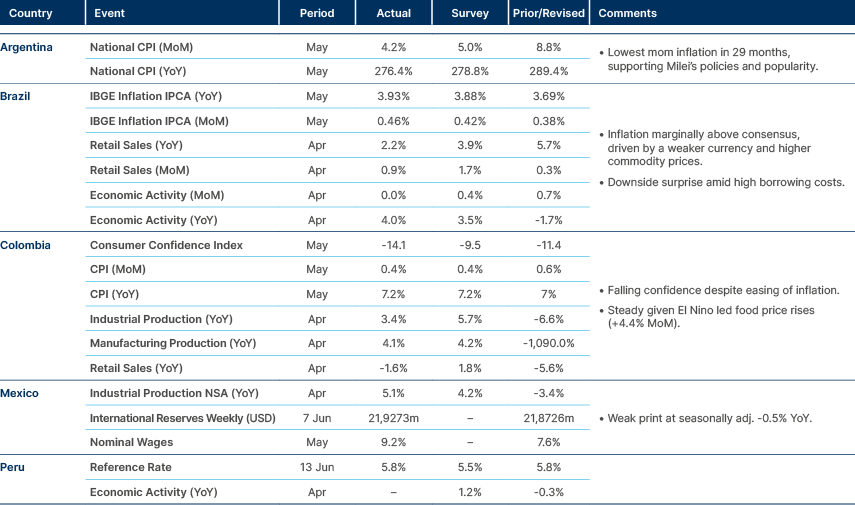

Latin America

Economic Data: Argentina’s CPI below all forecasts. Colombia’s activity looking recessionary.

Argentina: The Senate approved President Javier Milei's first set of austerity measures with a narrow vote of 37 to 36. The measures still require approval from the Lower House before becoming law. Since taking power, Milei’s government's weakness in Congress and opposition to pension reform has hindered the implementation of his market-friendly reform agenda. The omnibus bill approval will be an important milestone, proving the government can negotiate despite its relative weak position in the legislature. The government remains committed to its fiscal consolidation agenda, targeting a zero fiscal balance for 2024. The recent plunge in inflation should help support Milei’s popularity for longer. Milei needs investments to boost GDP growth and employment before mid-term elections in mid-2025.

Colombia: Despite a large expenditure contingency plan announced last week, which included COP 20trn (1.3% GDP) in budget cuts, the COP sold off nearly 10% in the week. This was likely driven by negative headlines from rating agencies, as Fitch changed its outlook to negative and Moody’s said it sees Colombia posting a wider fiscal deficit in 2024 than in 2023, despite planned budget cuts. Weaker economic activity is the main fundamental issue, as lower confidence has led to lower investments, which lowers growth in a negative feedback loop. Cutting expenditures will slow down the fundamental deterioration in the fiscal accounts, but also weighs on GDP growth. The government confirmed this situation on Friday, saying it will target a 2024 deficit of 5.6% of GDP this year, 30bp higher than its previous target. Nevertheless, the commitment to the fiscal framework and the large cut in expenditures are positive signals, in our view, particularly considering Colombian assets already trade at relatively attractive levels. Petro also announced on Friday that there will be a reshuffle in his cabinet, to be detailed before the 20th of July. It has been confirmed that these changes will not affect the Finance Minister, Ricardo Bonilla, or the rest of the economic team, another positive signal.

Mexico: The Peso sold off nearly 2% on Tuesday and Wednesday, after President-elect Claudia Sheinbaum said a proposed reform of the Mexican judicial system would be among the first items to be discussed in Congress. Investors worry the reforms will erode checks on the ruling party. The Peso has dropped by nearly 10% since the election results on 3 June.

Peru: The Central Bank left reference rate unchanged at 5.75%, which was unexpected given headline inflation reached the target midpoint of 2% last month. However, policymakers are more worried about core inflation, which rose from 3.0% to 3.1% in May. They cited that the decline in headline inflation was mainly driven by fading supply shocks on food prices.

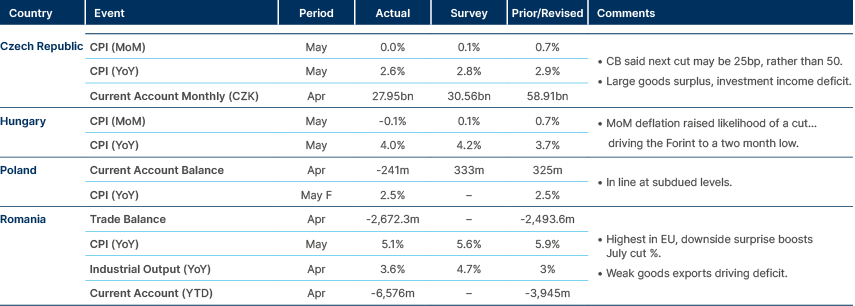

Central and Eastern Europe

Economic Data: Inflation still softening across Eastern Europe.

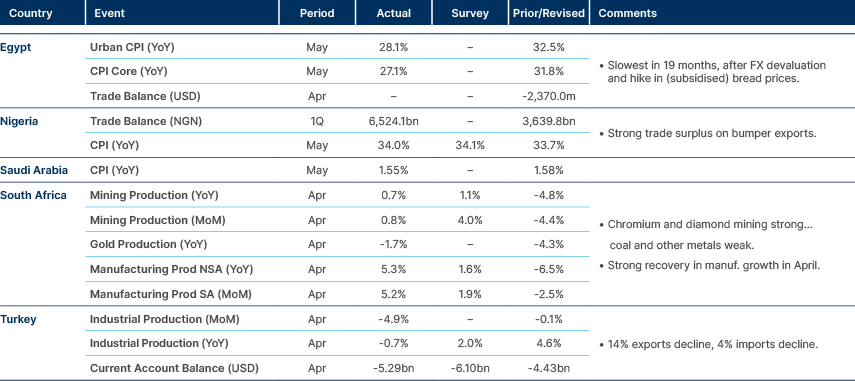

Central Asia, Middle East, and Africa

Economic Data: Egypt’s inflation has plunged.

Ghana: Ghana reached a finalised debt agreement with official creditors, formalising plans agreed in January. The agreement paves the way for a second review of a USD 3bn loan package and the release of a USD 360m disbursement from the IMF, according to Ghana’s Finance Ministry.The financial terms of the agreement provide significant debt service relief that allows the redirection of financial resources toward critical areas such as infrastructure, healthcare, and education. Declining inflation and improving confidence post-debt restructuring may lift the IMF's 2024 growth projection of 2.8% higher.

South Africa: Cyril Ramaphosa was re-elected president, as a ‘Government of National Unity’ (GNU) was formed combining the African National Congress (ANC), which won 40% of the vote, the Democratic Alliance (DA) with 22%, and smaller parties including the Inkatha Freedom Party (IFP) and the Patriotic Alliance (PA), which won 4% and 2% of votes, respectively. This was the best possible outcome as an alliance between the two centrist parties (ANC and DA) is likely the most stabilising option for South Africa’s economy.

Despite several ANC factions preferring a government with former president Jacob Zuma’s MK Party and EFF involvement, MK said it would not work with the ANC while Ramaphosa was in power, while the far-left EFF said it would not join a government with the ‘neo-colonial’ DA. The leader of the EFF, Julius Malema, said the EFF will now have to work with the MK Party to form a robust opposition to the ANC and DA coalition. These parties won 15% and 10% of the national vote, respectively.

The MK Party failed to win a majority to govern KwaZulu-Natal (KZN), a province where it won 45.6% of the votes. KZN’s provincial legislature elected IFP member Thami Ntuli as its premier with 41 votes (supported by GNU votes), over MK’s Zuma, who reached 39 votes. This raises the possibility of riots in a state where a large part of the population is loyal to its ethnic-tribal roots.

Developed Markets

Economic Data: US inflation posts big downside surprise. Components show favourable path ahead. UK jobless claims posted sharpest increase since 2020.

France: A summary of the state of play of alliances

Far-right: National Rally and Reconquête (Reconquest)

- RN: Marine Le Pen (parliamentary party leader) and Jordan Bardella (party president). Bardella is a young (28), soft-spoken leader using social media to galvanise support, likely PM if RN wins.

- Reconquête: Éric Zemmour (Leader and controversial far-right figure) and Marion Maréchal (the leading candidate for Reconquête at European elections).

Some members of Reconquête have publicly supported RN. Maréchal expressed her support for the right single list (with RN). Zemmour refused and expelled her from the party. Hence, there is no alliance agreement in place yet across the far-right. This could have implications on the first round if Reconquête can take votes away from RN.

Left to Far-left: Front Populaire (former NUPES) left-wing alliance (from Communist to Social Democrats)

- Includes the Communist Party (PFC) led by Fabien Roussel, LFI (Jean-Luc Mélenchon, Greens (Marine Tondelier), Socialists (Olivier Faure), and smaller, left-leaning parties (i.e., Place Publique of Raphaël Glucksman).

LFI Deputy Éric Coquerel said an agreement would only be possible based on a “platform of rupture” including the rollback of the retirement age to 60, rise of minimum wage and pension, reform of the tax system and recognition of a Palestinian state. Mélenchon ruled out as a potential leader, citing the need for a ‘consensus’ candidate.

Different political views between the parties within the leftist alliance, will breed more division. There must be further negotiations between the parties to agree which candidates will run in each of the 577 legislative districts.

Centre: L’Arc Republican (Republican Arc) centrist coalition created by Macron (65% disapproval rate)

- Parties include Renaissance (Emmanuel Macron), Modem (Democratic Movement) of François Bayrou and Horizon (Édouard Phillipe, former PM).

In disarray with people close to Macron blindsided by the gambit.

Centre-Right: Republicans (LR)

Party very divided after its leader, Éric Ciotti, announced a surprise alliance with RN. This prompted the rest of the party’s leadership to vote him out twice, last week, but Ciotti has insisted he is still the conservative party’s leader.

Likely to have some candidates join RN and L’Arc Republican. Bardella has claimed that 70 RN candidates will run jointly with LR, although the figures are disputed by LR. Already, some non-contest pacts in West Paris (some LR candidates will not run against Macron).

Most likely scenario: RN will have a partial majority; it will not have the assembly, making it very difficult to pass anything (e.g., what is happening now with Macron forcing him to use art. 49.3 to bypass voting on key legislation). Latest IFOP poll: Marine Le Pen (RN) 35%, Left-Wing Alliance 25% and Macron 16%.

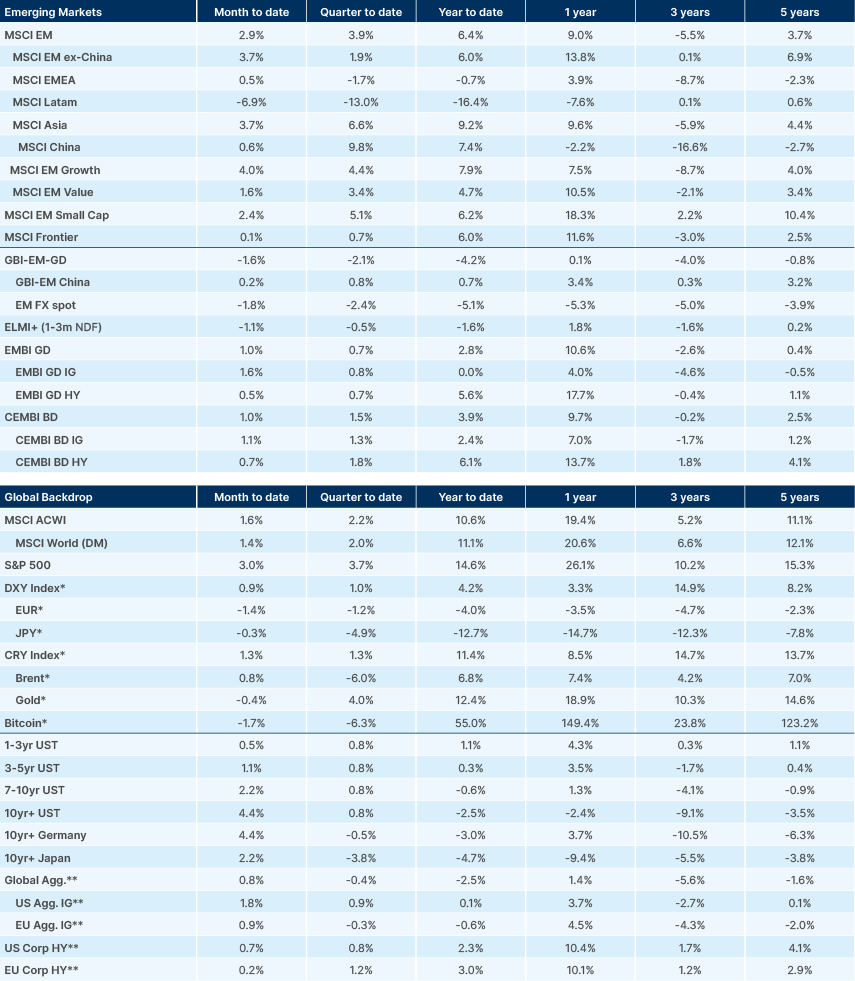

Benchmark performance

Source and notations for all tables in this document:

Source: Bloomberg, JP Morgan, Barclays, Merrill Lynch, Chicago Board Options Exchange, Thomson Reuters, MSCI. Latest data available on publication date.

* Price only. Does not include carry. ** Global Indices from Bloomberg. Price to Earnings: 12m blended-forward

Index Definitions:

VIX Index = Chicago Board Options Exchange SPX Volatility Index. DXY Index = The Dollar Index. CRY Index = Thomson Reuters/CoreCommodity CRM Commodity Index.

Figures for more than one year are annualised other than in the case of currencies, commodities and the VIX, DXY and CRY which are shown as percentage change.